false

0001463972

0001463972

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

May 9, 2024

VUZIX CORPORATION

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-35955 |

04-3392453 |

| (Commission File Number) |

(IRS Employer Identification No.) |

25

Hendrix Road, Suite A

West

Henrietta, New York 14586

(Address of principal executive offices)

(Zipcode)

(585) 359-5900

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered: |

| Common Stock, par value $0.001 |

|

VUZI |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Vuzix Corporation

(the “Company”) issued a press release announcing the Company’s financial results for the period ended March 31,

2024. The press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction

B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement

or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: May 14, 2024 |

VUZIX CORPORATION |

| |

|

|

| |

By: |

/s/

Grant Russell |

| |

|

Grant Russell

Chief Financial Officer |

Exhibit 99.1

| Press Release |

Vuzix Reports First Quarter 2024 Results

ROCHESTER, N.Y., May 9, 2024 - Vuzix®

Corporation (NASDAQ: VUZI) (“Vuzix” or the “Company”), a leading supplier of Smart Glasses and Augmented

Reality (AR) technologies and products, today reported its first quarter results for the three months ended March 31, 2024.

“In

Q1 2024, Vuzix continued to work toward expanding and deepening relationships within the enterprise, consumer, and defense markets. An

increasing number of potential customers are indicating they embrace the unique competitiveness of our solutions and our core technology

and have confirmed their interest in implementing solutions using our technologies. At the same time, we have implemented and are taking

further proactive measures to reduce our cost structure by up to 35% in the aggregate by the end of Q2 going forward, as measured against

our 2023 comparable operating expenses,” said Paul Travers, President and CEO of Vuzix. “Further investments in capital equipment

and licenses have been scaled back by more than 90% as compared to comparable spending levels in the 2023 and 2022 fiscal years.”

The following

table compares condensed elements of the Company’s unaudited summarized Consolidated Statements of Operations data for the three

months ended March 31, 2024 and 2023, respectively:

| | |

For Three Months Ended March 31 | |

| | |

($000s except per share amounts) | |

| | |

2024 | | |

2023 | |

| Sales: | |

| | | |

| | |

| Sales of Products | |

$ | 1,829 | | |

$ | 4,191 | |

| Sales of Engineering Services | |

| 175 | | |

| - | |

| Total Sales | |

| 2,004 | | |

| 4,191 | |

| | |

| | | |

| | |

| Total Cost of Sales | |

| 2,057 | | |

| 3,315 | |

| | |

| | | |

| | |

| Gross Profit (Loss) | |

| (53 | ) | |

| 876 | |

| Gross Profit (Loss) % | |

| (3 | )% | |

| 21 | % |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Research and Development | |

| 2,738 | | |

| 3,070 | |

| Selling and Marketing | |

| 2,221 | | |

| 2,540 | |

| General and Administrative | |

| 4,098 | | |

| 5,132 | |

| Depreciation and Amortization | |

| 970 | | |

| 964 | |

| Loss on Fixed Asset Disposal | |

| 11 | | |

| - | |

| Impairment of Patents and Trademarks | |

| - | | |

| 18 | |

| | |

| | | |

| | |

| Loss from Operations | |

| (10,092 | ) | |

| (10,847 | ) |

| | |

| | | |

| | |

| Total Other Income (Expense) | |

| 45 | | |

| 607 | |

| Net Loss | |

| (10,048 | ) | |

| (10,241 | ) |

| | |

| | | |

| | |

| Loss per Common Share | |

$ | (0.16 | ) | |

$ | (0.16 | ) |

First Quarter 2024 Financial Results

For the

three months ended March 31, 2024, total revenues decreased by 52% to $2.0 million versus $4.2 million for the comparable period

in 2023. The decrease in total revenues was due to lower product sales and specifically reduced unit sales of M400 smart glasses. Engineering

services revenues were $0.2 million for the three months ended March 31, 2024 as compared to nil in the prior year’s quarter.

There was

an overall gross loss of $0.1 million for the three months ended March 31, 2024 as compared to a gross profit of $0.9 million or

21% of revenue for the same period in 2023. The loss was the result of lower revenues to absorb many of our relatively fixed manufacturing

overhead costs as compared to the 2023 period.

Research

and Development expense was $2.7 million for the three months ended March 31, 2024, versus $3.1 million for the comparable 2023 period,

a decrease of approximately 11%. This decrease was primarily due to reduced salary and benefits expenses.

Selling

and Marketing expense was $2.2 million for the three months ended March 31, 2024, versus $2.5 million for the comparable 2023 period,

a decrease of approximately 13%. This decrease was primarily due to lower advertising and tradeshow spending and reduced salary and benefits

expenses.

General

and Administrative expense for the three months ended March 31, 2024 was $4.1 million versus $5.1 million for the comparable 2023

period, a decrease of approximately 20%. This decrease was primarily due to a drop in non-cash stock-based compensation and reduced investor

relations expenses, partially offset by an increase in legal expenses.

The net

loss decreased slightly for the three months ended March 31, 2024 to $10.0 million, or $0.16 cents per share versus a net loss of

$10.2 million, or $0.16 for the comparable period in 2023.

The cash

net loss, excluding working capital changes, a non-GAAP measure, was $6.5M for the first quarter of 2024 versus $5.4M for the comparable

2023 period. As of March 31, 2024, the Company maintained cash and cash equivalents of $16.5 million and an overall working capital

position of $29.2 million.

Management Outlook

“Our overall outlook for 2024 remains positive,

with good potential for top line improvements over the balance of this year. We have a well-defined book of business with identified

opportunities representing large potential deals with cornerstone customers for enterprise smart glasses products and solutions. We have

a number of enterprise accounts that are approaching a critical mass in their operations with our smart glasses, resulting in improved

productivity, lower onboarding times and fewer errors. Our OEM business opportunities continue to expand; we have a backlog of business

to deliver against and we expect at least one of our defense contractors and one of our commercial enterprise customers to move into production

later this year. Furthermore, we expect to soon conclude several new projects with new and existing defense and consumer product-focused

customers over the course of the year. At the same time, while we grow our business, we also remain vigilant in further lowering our operating

costs. Recent actions include a voluntary salary reduction program adopted by many company constituents that offers staff, directors and

management restricted stock or stock options in lieu of foregoing 10% to 50% of their base salaries, which will further extend our operational

runway and reduce our cash burn by more than $1.6 million over the next 12 months," said Mr. Travers.

Conference Call Information

Date: Thursday, May 9, 2024

Time: 4:30 p.m. Eastern Time (ET)

Dial-in Number for U.S. & Canadian Callers: 877-709-8150

Dial-in Number for International Callers (Outside of the U.S. &

Canada): 201-689-8354

A live and archived webcast of the conference

call will be available on the investor relations page of the Company's website at: https://ir.vuzix.com/

or directly at https://event.choruscall.com/mediaframe/webcast.html?webcastid=XlJ68qQN.

Participating on the call will be Vuzix’

Chief Executive Officer and President Paul Travers and Chief Financial Officer Grant Russell, who together will discuss operational and

financial highlights for the quarter ended March 31, 2024.

To join the live conference call, please dial

into the above referenced telephone numbers five to ten minutes prior to the scheduled conference call time.

A telephonic replay will be available for 30 days,

starting on May 9, 2024, at approximately 5:30 p.m. (ET). To access this replay, please dial 877-660-6853 within the U.S. or

Canada, or 201-612-7415 for international callers. The conference replay ID# is 13746319.

About Vuzix Corporation

Vuzix is a leading designer, manufacturer and

marketer of Smart Glasses and Augmented Reality (AR) technologies and products for the enterprise, medical, defense and consumer markets.

The Company’s products include head-mounted smart personal display and wearable computing devices that offer users a portable high-quality

viewing experience, provide solutions for mobility, wearable displays and augmented reality, as well OEM waveguide optical components

and display engines. Vuzix holds more than 375 patents and patents pending and numerous IP licenses in the fields of optics, head-mounted

displays, and augmented reality Video Eyewear field. Moviynt, an SAP Certified ERP SaaS logistics solution provider, is a Vuzix wholly

owned subsidiary. The Company has won Consumer Electronics Show (or CES) awards for innovation for the years 2005 to 2024 and several

wireless technology innovation awards among others. Founded in 1997, Vuzix is a public company (NASDAQ: VUZI) with offices in: Rochester,

NY; Munich, Germany; and Kyoto and Tokyo, Japan. For more information, visit the Vuzix website, Twitter

and Facebook pages.

Forward-Looking Statements Disclaimer

Certain statements contained in this news release

are "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Forward-looking statements contained in this release relate to, among other things, the timing of new product releases,

opportunities related to market disruptions regarding smart glasses demand, R&D project successes, smart glasses pilot to roll-out

conversion rates, existing and new engineering services and conversion to volume production OEM programs, future revenue and operating

results, the amount and impact of operating expense cash reductions, Atomistic MicroLED development, capabilities, and further development

timelines and the Company's leadership in the Smart Glasses and AR display industry. They are generally identified by words such as "believes,"

"may," "expects," "anticipates," "should" and similar expressions. Readers should not place undue

reliance on such forward-looking statements, which are based upon the Company's beliefs and assumptions as of the date of this release.

The Company's actual results could differ materially due to risk factors and other items described in more detail in the Company's Annual

Reports and other filings with the United States Securities and Exchange Commission and applicable Canadian securities regulators (copies

of which may be obtained at www.sedar.com or www.sec.gov).

Subsequent events and developments may cause these forward-looking statements to change. The Company specifically disclaims any obligation

or intention to update or revise these forward-looking statements as a result of changed events or circumstances that occur after the

date of this release, except as required by applicable law.

Investor Relations Contact

Ed McGregor, Director of Investor Relations

Vuzix Corporation

ed_mcgregor@vuzix.com

Tel: (585) 359-5985

Vuzix Corporation, 25 Hendrix Road, West Henrietta, NY 14586 USA,

Investor Information – IR@vuzix.com www.vuzix.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

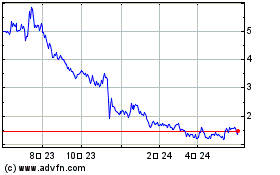

Vuzix (NASDAQ:VUZI)

過去 株価チャート

から 11 2024 まで 12 2024

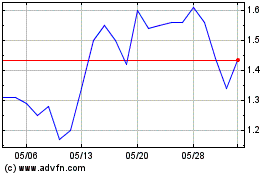

Vuzix (NASDAQ:VUZI)

過去 株価チャート

から 12 2023 まで 12 2024