UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2024

Commission

File Number 001-41231

TC

BIOPHARM (HOLDINGS) PLC

(Translation

of registrant’s name into English)

| |

Maxim

1, 2 Parklands Way

Holytown,

Motherwell, ML1 4WR

Scotland,

United Kingdom

+44

(0) 141 433 7557 |

|

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒

Form 20-F ☐ Form 40-F

ADS

Ratio Change

As

previously announced, on July 31, 2024, TC BioPharm (Holdings) PLC (the “Company”) changed its ratio of its American Depositary

Shares (“ADSs”) to ordinary shares from one (1) ADS representing twenty (20) ordinary shares to one ADS representing two

hundred (200) ordinary shares (the “ADS Ratio Change”). The ADS Ratio Change became effective on August 5th, 2024 (the “Effective

Date”).

For

the ADS holders, the ADS Ratio Change has the same effect as a one-for-10 reverse ADS split. The ADS Ratio Change has no impact on the

Company’s underlying ordinary shares, and no ordinary shares will be issued or cancelled in connection with the ADS Ratio Change.

On

the Effective Date, holders of the ADSs were required to surrender and exchange every ten (10) ADSs then held for one (1) new ADS. The

Bank of New York Mellon, as the depositary bank for the Company’s ADS program (the “Depositary”), arranged for the

exchange. The ADSs continue to be traded on Nasdaq Capital Market under the symbol “TCBP.”

No

fractional new ADSs were issued in connection with the change in the ADS ratio. Instead, fractional entitlements to new ADSs were aggregated

and sold by the Depositary and the net cash proceeds from the sale of the fractional ADS entitlements (after deduction of fees, taxes

and expenses) will be distributed to the applicable ADS holders by the Depositary.

As

a result of the ADS Ratio Change, the ADS trading price is expected to increase proportionally, although the Company can give no assurance

that the ADS trading price after the ADS Ratio Change will be proportionally equal to or greater than the previous’ ADS trading

price prior to the change.

In

addition, the Companies public warrants (the “Warrants”), were amended in accordance with the terms of the Warrant Agreement,

whereby if the Company at any time while the Warrants are outstanding, enters into a ratio change, an adjustment is made to the exercise

price and the proportion of ADSs issued upon exercise of your Warrant in accordance with Section 5 of the Agency Agreement. As such,

upon the consummation of the ratio change, the exercise price of the Warrants shall be increased from $500.00 to $5,000.00 and the proportion

of ADSs issued upon exercise of each Warrant will be proportionally adjusted from one thousand Warrants for one ADS to ten thousand

Warrants for one ADS such that the aggregate Exercise Price of each Warrant shall remain unchanged. A copy of the Company’s

Warrant repricing notice to warrant holders is attached as Exhibit 99.1.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

TC

BIOPHARM (HOLDINGS) PLC |

| |

|

|

| |

By: |

/s/

Martin Thorp |

| |

Name: |

Martin

Thorp |

| |

Title: |

Chief

Financial Officer |

Date:

August 8, 2024

Exhibits

Exhibit

99.1

TC

BioPharm (Holdings) plc

Maxim

1,2 Parklands Way, Maxim Park, Eurocentral, ML1 4WR

Tel:

0141 433 7557 | Email: info@tcbiopharm.com

August

5, 2024

VIA

OVERNIGHT MAIL

The

Holders of Warrants to Purchase American Depositary Shares issued pursuant to the terms of that certain warrant agent agreement, dated

February 10, 2022 (collectively, the “Holders”):

To

Whom It May Concern:

You

are receiving this letter since you are a holder of record as of August 5, 2024 of certain warrants to purchase American Depositary Shares

(each a “Warrant” and collectively, the “Warrants”) of the Company which are publicly traded on the NASDAQ Capital

Market LLC under the symbol “TCBPW.” Reference is made to that certain warrant agent agreement, dated February 10, 2022 (the

“Agency Agreement”), between TC Biopharm (Holdings) plc (the “Company”) and Computershare, Inc. Capitalized terms

not otherwise defined herein shall have the meaning ascribed to them as set forth in the Agency Agreement

Section

4 of the Agency Agreement provides that the Exercise Price covered by each Warrant outstanding is subject to adjustment from time to

time as provided in Section 5 of the Warrant Certificate. Section 5(a)(iii) of the Warrant Certificate provides that if the Company at

any time while the Warrants are outstanding, enters into an agreement to combine (including by way of reverse stock split) outstanding

Ordinary Shares into a smaller number of shares, then with the consummation of such combination of the Ordinary Shares, the Exercise

Price shall be multiplied by a fraction of which the numerator shall be the number of Ordinary Shares and such other capital stock of

the Company (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number

of Ordinary Shares and such other capital stock of the Company (excluding treasury shares, if any) outstanding immediately after such

event, and the number of ADSs issuable upon exercise of this Warrant shall be proportionately adjusted such that the aggregate Exercise

Price of this Warrant shall remain unchanged. Any adjustment made pursuant to this Section 5(a) shall become effective immediately after

the record date for the determination of shareholders entitled to receive such dividend or distribution and shall become effective immediately

after the effective date in the case of a subdivision, combination or re-classification.

On

August 5, 2024, the Company changed the ratio of its American Depositary Shares (“ADSs”) to ordinary shares from one (1)

ADS representing twenty (20) ordinary share to one ADS representing two hundred (200) ordinary shares (the “ADS Ratio Change”).

As

a result of the ADS Ratio Change, an adjustment was made to the exercise price and the proportion of ADSs issued upon exercise of your

Warrant in accordance with Section 5 of the Agency Agreement.

Upon

completion of the ADS Ratio Change, the exercise price of your Warrants will increase from $500.00 to $5,000.00 and the proportion of

ADSs issued upon exercise of each Warrant will be proportionally adjusted from one thousand Warrants for one ADS to ten thousand Warrants

for one ADS such that the aggregate Exercise Price of each Warrant shall remain unchanged.

Please

attach this notice to your certificate representing Warrant to record the adjustment of the exercise price and the proportion of ADSs

issued upon exercise of your Warrant. Please note that no further action is required on your part as the books of the Company have been

adjusted to reflect the adjustments described in this notice.

| |

Very

truly yours, |

| |

|

|

| |

TC

BIOPHARM (HOLDINGS) PLC |

| |

|

| |

Name:

|

Martin

Thorp |

| |

Title:

|

CFO |

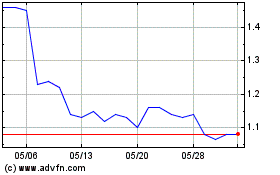

TC BioPharm (NASDAQ:TCBP)

過去 株価チャート

から 8 2024 まで 9 2024

TC BioPharm (NASDAQ:TCBP)

過去 株価チャート

から 9 2023 まで 9 2024