false

0001295401

0001295401

2024-07-25

2024-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): July

25, 2024

The

Bancorp, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-51018

| Delaware |

|

23-3016517 |

| (State or other jurisdiction of |

|

(IRS Employer |

| incorporation) |

|

Identification No.) |

409

Silverside Road

Wilmington, DE

19809

(Address of principal executive offices, including

zip code)

302-385-5000

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value

$1.00 per share |

|

TBBK |

|

Nasdaq

Global Select |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

[_]

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [_]

Item 2.02. Results

of Operations and Financial Condition

On July 25, 2024, The Bancorp, Inc. (the "Company")

issued a press release regarding its earnings for the three and six months ended June 30, 2024. A copy of this press release is furnished

with this report as Exhibit 99.1.

Item 7.01. Regulation

FD Disclosure.

The Company hereby furnishes the information

set forth in the presentation attached hereto as Exhibit 99.2, which is incorporated herein by reference.

The information in this Current Report,

including the exhibits hereto, are being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report

shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as

amended.

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 25, 2024 |

The Bancorp, Inc. |

| |

|

|

| |

By: |

/s/ Paul Frenkiel |

| |

Name: |

Paul Frenkiel |

| |

Title: |

Chief Financial Officer and |

| |

|

Secretary |

Exhibit 99.1

The Bancorp, Inc. Reports Second Quarter Financial

Results

Wilmington, DE – July 25, 2024 – The Bancorp, Inc. ("The

Bancorp" “the Company” or “we” or “our”) (NASDAQ: TBBK), a financial holding company, today reported

financial results for the second quarter of 2024.

Recent Developments

The Company entered into a purchase and sale agreement

for an apartment property acquired by The Bancorp Bank through foreclosure in connection with a real estate bridge lending (“REBL”)

loan. At June 30, 2024, the related $39.4 million balance, comprised the majority of our other real estate owned. The purchaser made an

earnest money deposit of $125,000 in July 2024, with additional required deposits projected to total $500,000 prior to the December 31,

2024, closing deadline. The sales price is expected to cover the Company’s current other real estate owned balance plus the

forecasted cost of improvements to the property. There can be no assurance that the purchaser will consummate the sale of the property,

but if not consummated, earnest money deposits would accrue to the Company.

One of the accounting estimates as described in the notes to our

financial statements, is the allowance for credit losses (“ACL”), which is sensitive to a variety of inherent portfolio

and external factors. REBL may be one of the more sensitive portfolios to such factors. In the second quarter of 2024, REBL loans

classified as either special mention or substandard increased to $177.1 million from $165.2 million at March 31, 2024. Each

classified loan was evaluated for a potential increase in the ACL on the basis of third-party appraisals of related apartment

building collateral. On the basis of “as is” and “as stabilized” loan to values (“LTV’s”),

increases to the allowance for specific loans was not required. The respective weighted average “as is” and “as

stabilized” LTVs were 81% and 69%, based on third party appraisals, the majority of which were performed in 2024. The current

allowance for credit losses for REBL, is primarily based upon historical industry losses for multi-family loans, in the absence of

significant historical losses within the Company’s REBL portfolio. However, as a result of increasing amounts of loans

classified as special mention and substandard, the Company will evaluate potential related sensitivity of that factor for REBL. This

evaluation is inherently subjective as it requires material estimates that may be susceptible to change as more information becomes

available.

The Company has a single $12.6 million par value security

in its investment portfolio, which is the only security remaining from its securitization business, which was exited in 2020. As a result

of appraisals received from the servicer in the second quarter of 2024, the Company placed the security into non-accrual status, notwithstanding

that those appraisals, with lower values than prior appraisals, exceeded principal and accrued interest. The following table reflects

the related non-GAAP second quarter impact.

| |

Net Income (000’s) |

EPS |

| GAAP |

$53,686 |

$1.05 |

| Interest income impact of legacy security transferred to nonaccrual, net of tax |

1,009 |

0.02 |

| As adjusted, non-GAAP |

$54,695 |

$1.07 |

In the second quarter of 2024, the Company initiated

its measured entry into consumer fintech lending, by which the Company makes consumer loans with the marketing and servicing assistance

of its existing and planned new fintech relationships. While the $72.4 million of such loans at June 30, 2024 did not significantly impact

income during the quarter, such lending is expected to meaningfully impact both the balance sheet and income in the future. We expect

that impact will be reflected in a lower cost of funds for related deposits and increased transaction fees.

Highlights

| · | The Bancorp reported net income of $53.7 million, or $1.05 per diluted share (“EPS”), for the quarter ended June

30, 2024, compared to net income of $49.0 million, or $0.89 per diluted share, for the quarter ended June 30, 2023, or an EPS increase

of 18%. While net income increased 10% between these periods, outstanding shares were decreased as a result of common share repurchases

which were significantly increased in 2024. |

| · | Return on assets and equity for the quarter ended June 30, 2024, amounted to 2.8% and 27%, respectively, compared to 2.6% and 27%,

respectively, for the quarter ended June 30, 2023 (all percentages “annualized”). |

| · | Net interest income increased 8% to $93.8 million for the quarter ended June 30, 2024, compared to $87.2 million for the quarter ended

June 30, 2023. |

| · | Net interest margin amounted to 4.97% for the quarter ended June 30, 2024, compared to 4.83% for the quarter ended June 30, 2023,

and 5.15% for the quarter ended March 31, 2024. |

| · | Loans, net of deferred fees and costs were $5.61 billion at June 30, 2024, compared to $5.36 billion at December 31, 2023 and

$5.27 billion at June 30, 2023. Those changes reflected an increase of 3% quarter over linked quarter and an increase of 6% year over

year. |

| · | Gross dollar volume (“GDV”), representing the total amounts spent on prepaid and debit cards, increased $4.36 billion,

or 13%, to $37.14 billion for the quarter ended June 30, 2024, compared to the quarter ended June 30, 2023. The increase reflects continued

organic growth with existing partners and the impact of clients added within the past year. Total prepaid, debit card, ACH, and other

payment fees increased 13% to $27.8 million for the second quarter of 2024 compared to the second quarter of 2023. |

| · | Small business loans (“SBL”), including those held at fair value, amounted to $964.4 million at June 30, 2024, or

16% higher year over year, and 4% higher quarter over linked quarter, excluding the impact of $28.6 million of loans with related secured

borrowings. |

| · | Direct lease financing balances increased 8% year over year to $711.4 million at June 30, 2024, and 1% over March 31, 2024. |

| · | At June 30, 2024, real estate bridge loans of $2.12 billion had grown 1% compared to a $2.10 billion balance at March 31, 2024, and

16% compared to the June 30, 2023 balance of $1.83 billion. These real estate bridge loans consist entirely of rehabilitation loans for

apartment buildings. |

| · | Security backed lines of credit (“SBLOC”), insurance backed lines of credit (“IBLOC”), and investment advisor

financing loans collectively decreased 13% year over year and increased 1% quarter over linked quarter to $1.80 billion at June 30,

2024. |

| · | The average interest rate on $6.96 billion of average deposits and interest-bearing liabilities during the second quarter of

2024 was 2.50%. Average deposits of $6.72 billion for the second quarter of 2024 increased $213 million over first quarter 2024, while

historically, average deposits have tended to decrease between those periods, as tax refund related balances decline. |

| · | As of June 30, 2024, tier one capital to assets (leverage), tier one capital to risk-weighted assets, total capital to risk-weighted

assets and common equity-tier 1 to risk-weighted assets ratios were 10.07%, 14.13%, 14.68% and 14.13%, respectively, compared to well-capitalized

minimums of 5%, 8%, 10% and 6.5%, respectively. The Bancorp Bank, National Association, remains well capitalized under banking regulations. |

| · | Book value per common share at June 30, 2024 was $15.77 compared to $13.74 per common share at June 30,

2023, an increase of 15%. |

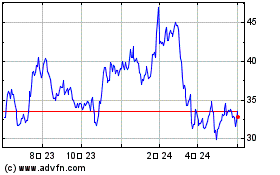

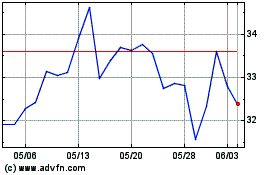

| · | The Bancorp repurchased 3,018,405 shares of its common stock at an average cost of $33.13

per share during the quarter ended June 30, 2024. As a result of the increase in the share repurchase in the second quarter of 2024, from

$50.0 million to $100.0 million, outstanding shares at June 30, 2024 amounted to 49.3 million, compared to 53.2 million shares at December

31, 2023, or a reduction of 7.4% |

| · | The Bancorp emphasizes safety and soundness and its balance sheet has a risk profile enhanced by the special nature of the collateral

supporting its loan niches, related underwriting, and the characteristics of its funding sources, including those highlighted in the bullets

below. Those loan niches and funding sources have contributed to increased earnings levels, even during periods in which markets have

experienced various economic stresses. |

| · | The vast majority of The Bancorp’s funding is comprised of FDIC-insured and/or small balance accounts, which adjust to only

a portion of changes in rates. The Bancorp also has lines of credit with U.S. government sponsored agencies totaling approximately $3.1

billion as of June 30, 2024, as well as access to other forms of liquidity. |

| · | In its real estate bridge lending portfolio, The Bancorp has minimal exposure to non-multifamily commercial real estate such as office

buildings, and instead has a portfolio largely comprised of rehabilitation bridge loans for apartment buildings. These loans generally

have three year terms with two one-year extensions to allow for the rehabilitation work to be completed and rentals stabilized for an

extended period, before being refinanced at lower rates through U.S. Government Sponsored Entities or other lenders. The rehabilitation

real estate lending portfolio consists primarily of workforce housing, which we consider to be working class apartments at more affordable

rental rates. Related collateral values should accordingly be more stable than higher rent properties, even in stressed economies. While

the macro-economic environment has challenged the multifamily bridge space, the stability of The Bancorp’s rehabilitation bridge

loan portfolio is evidenced by the estimated values of underlying collateral. The Bancorp’s $2.1 billion apartment |

bridge lending portfolio at June 30, 2024 has a weighted average

origination date “as is” LTV of 70%, based on third party appraisals. Further, the weighted average origination date

“as stabilized” LTV, which measures the estimated value of the apartments after the rehabilitation is complete may provide

even greater protection.

| · | As part of the underwriting process, The Bancorp reviews borrowers’ previous rehabilitation experience in addition to overall

financial wherewithal. These transactions also include significant borrower equity contributions with required performance metrics. Underwriting generally

includes, but is not limited to, assessment of local market information relating to vacancy and rental rates, review of post rehabilitation

rental rate assumptions against geo-specific affordability indices, negative news and lien searches, visitations by bank personnel and/or

designated engineers, and other information sources. |

| · | Rehabilitation progress is monitored through ongoing draw requests and financial reporting covenants. This generally allows

for early identification of potential issues, and expedited action to address on a timely basis. |

| · | Operations and ongoing loan evaluation are overseen by multiple levels of management, in addition to the real estate bridge lending

team’s experienced professional staff and third-party consultants utilized during the underwriting and asset management process.

This oversight includes a separate loan committee specific to real estate bridge lending, which is comprised of seasoned and experienced

lending professionals who do not directly report to anyone on the real estate bridge lending team. There is also a separate loan

review department, a surveillance committee and additional staff which evaluate potential losses under the current expected credit losses

methodology (“CECL”), all of which similarly do not report to anyone on the real estate bridge lending team. |

| · | SBLOC and IBLOC portfolios are respectively secured by marketable securities and the cash value of life insurance. The majority of

SBA 7(a) loans are government guaranteed, while SBA 504 loans are made with 50-60% LTV’s. |

| · | Additional details regarding our loan portfolios are included in the related tables in this press release, as is the summarization

of the earnings contributions of our payments businesses, which further enhances The Bancorp’s risk profile. The Company’s

risk profile inherent in its loan portfolios, funding and earnings levels, may present opportunities to further increase shareholder value,

while still prudently maintaining capital levels. Such opportunities include the recently increased planned stock repurchases noted above. |

| · | In the second quarter of 2024, the Company purchased approximately $900 million of fixed rate government sponsored entity backed commercial

and residential mortgage securities of varying maturities, with an approximate 5.11% weighted average yield, and estimated weighted average

lives of eight years, to reduce its exposure to lower levels of net interest income, should the Federal Reserve begin decreasing rates.

Such purchases would also reduce the additional net interest income which will result if the Federal Reserve increases rates. While there

are many variables and limitations to estimating exposure to changes in rates, such purchases and continuing fixed rate loan originations

are projected to reduce such exposure to modest levels. In prior years, The Bancorp deferred adding fixed rate securities when yields

were particularly low, which has afforded the flexibility to benefit from, and secure, more advantageous securities and loan rates. |

“The second quarter, which usually reflects greater tax refund related

runoff, instead showed continued broad based momentum in deposit volumes, and deposit stability,” said Damian Kozlowski CEO and

President of The Bancorp.” Growth trends and the reduction of shares through buybacks should support continued strong EPS growth

in 2024 and beyond. We are lifting our 2024 guidance to $4.35 a share from $4.25 a share without including the impact of $50 million of

quarterly share buybacks. We intend to issue preliminary 2025 guidance in our 3rd quarter press release.”

Conference Call Webcast

You may access the LIVE webcast of The Bancorp's Quarterly Earnings Conference

Call at 8:00 AM ET Friday, July 26, 2024 by clicking on the webcast link on The Bancorp's homepage at www.thebancorp.com. Or you may dial

1.800.225.9448, conference code BANCORP. You may listen to the replay of the webcast following the live call on The Bancorp's investor

relations website or telephonically until Friday, August 2, 2024, by dialing 1.800.934.5153.

About The Bancorp

The Bancorp, Inc. (NASDAQ: TBBK), headquartered in Wilmington, Delaware,

through its subsidiary, The Bancorp Bank, National Association, (or “The Bancorp Bank, N.A.”) provides non-bank financial

companies with the people, processes, and technology to meet their unique banking needs. Through its Fintech Solutions, Institutional

Banking, Commercial Lending, and Real Estate Bridge Lending businesses, The Bancorp provides partner-focused solutions paired with cutting-edge

technology for companies that range from entrepreneurial startups to Fortune 500 companies. With over 20 years of experience, The Bancorp

has become a leader in the

financial services industry, earning recognition as the #1 issuer of prepaid

cards in the U.S., a nationwide provider of bridge financing for real estate capital improvement plans, an SBA National Preferred Lender,

a leading provider of securities-backed lines of credit, with one of the few bank-owned commercial vehicle leasing groups. By its company-wide

commitment to excellence, The Bancorp has also been ranked as one of the 100 Fastest-Growing Companies by Fortune, a Top 50 Employer by

Equal Opportunity Magazine and was selected to be included in the S&P Small Cap 600. For more about The Bancorp, visit https://thebancorp.com/.

Forward-Looking Statements

Statements in this earnings release regarding The Bancorp’s business

which are not historical facts are "forward-looking statements." These statements may be identified by the use of forward-looking

terminology, including but not limited to the words “intend,” “may,” “believe,” “will,”

“expect,” “look,” “anticipate,” “plan,” “estimate,” “continue,”

or similar words, and are based on current expectations about important economic, political, and technological factors, among others,

and are subject to risks and uncertainties, which could cause the actual results, events or achievements to differ materially from those

set forth in or implied by the forward-looking statements and related assumptions. For further discussion of the risks and uncertainties

to which these forward-looking statements may be subject, see The Bancorp’s filings with the Securities and Exchange Commission,

including the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

sections of those filings. The forward-looking statements speak only as of the date of this press release. The Bancorp does not undertake

to publicly revise or update forward-looking statements in this press release to reflect events or circumstances that arise after the

date of this press release, except as may be required under applicable law.

The Bancorp, Inc. Contact

Andres Viroslav

Director, Investor Relations

215-861-7990

andres.viroslav@thebancorp.com

Source: The Bancorp, Inc.

The Bancorp, Inc.

Financial highlights

(unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, |

|

June 30, |

| Consolidated condensed income statements |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Dollars in thousands, except per share and share data) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

93,795 |

|

$ |

87,195 |

|

$ |

188,213 |

|

$ |

173,011 |

| Provision for credit losses on loans |

|

1,252 |

|

|

361 |

|

|

3,421 |

|

|

2,264 |

| Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

| ACH, card and other payment processing fees |

|

3,000 |

|

|

2,429 |

|

|

5,964 |

|

|

4,600 |

| Prepaid, debit card and related fees |

|

24,755 |

|

|

22,177 |

|

|

49,041 |

|

|

45,500 |

| Net realized and unrealized gains on commercial |

|

|

|

|

|

|

|

|

|

|

|

| loans, at fair value |

|

503 |

|

|

1,921 |

|

|

1,599 |

|

|

3,646 |

| Leasing related income |

|

1,429 |

|

|

1,511 |

|

|

1,817 |

|

|

3,001 |

| Consumer credit fintech fees |

|

140 |

|

|

— |

|

|

140 |

|

|

— |

| Other non-interest income |

|

895 |

|

|

1,298 |

|

|

1,543 |

|

|

1,578 |

| Total non-interest income |

|

30,722 |

|

|

29,336 |

|

|

60,104 |

|

|

58,325 |

| Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

33,863 |

|

|

33,167 |

|

|

64,143 |

|

|

62,952 |

| Data processing expense |

|

1,423 |

|

|

1,398 |

|

|

2,844 |

|

|

2,719 |

| Legal expense |

|

633 |

|

|

949 |

|

|

1,454 |

|

|

1,907 |

| FDIC insurance |

|

869 |

|

|

472 |

|

|

1,714 |

|

|

1,427 |

| Software |

|

4,637 |

|

|

4,317 |

|

|

9,126 |

|

|

8,554 |

| Other non-interest expense |

|

10,021 |

|

|

9,640 |

|

|

18,877 |

|

|

20,414 |

| Total non-interest expense |

|

51,446 |

|

|

49,943 |

|

|

98,158 |

|

|

97,973 |

| Income before income taxes |

|

71,819 |

|

|

66,227 |

|

|

146,738 |

|

|

131,099 |

| Income tax expense |

|

18,133 |

|

|

17,218 |

|

|

36,623 |

|

|

32,968 |

| Net income |

|

53,686 |

|

|

49,009 |

|

|

110,115 |

|

|

98,131 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income per share - basic |

$ |

1.05 |

|

$ |

0.89 |

|

$ |

2.12 |

|

$ |

1.78 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income per share - diluted |

$ |

1.05 |

|

$ |

0.89 |

|

$ |

2.10 |

|

$ |

1.76 |

| Weighted average shares - basic |

|

50,937,055 |

|

|

54,871,681 |

|

|

51,842,097 |

|

|

55,160,642 |

| Weighted average shares - diluted |

|

51,337,491 |

|

|

55,269,640 |

|

|

52,327,122 |

|

|

55,653,950 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Condensed consolidated balance sheets |

June 30, |

|

March 31, |

|

December 31, |

|

June 30, |

| |

2024 (unaudited) |

|

2024 (unaudited) |

|

2023 |

|

2023 (unaudited) |

| |

|

(Dollars in thousands, except share data) |

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

5,741 |

|

$ |

9,105 |

|

$ |

4,820 |

|

$ |

6,496 |

| Interest earning deposits at Federal Reserve Bank |

|

399,853 |

|

|

1,241,363 |

|

|

1,033,270 |

|

|

874,050 |

| Total cash and cash equivalents |

|

405,594 |

|

|

1,250,468 |

|

|

1,038,090 |

|

|

880,546 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Investment securities, available-for-sale, at fair value, net of $10.0 million allowance for credit loss effective December 31, 2023 |

|

1,581,006 |

|

|

718,247 |

|

|

747,534 |

|

|

776,410 |

| Commercial loans, at fair value |

|

265,193 |

|

|

282,998 |

|

|

332,766 |

|

|

396,581 |

| Loans, net of deferred fees and costs |

|

5,605,727 |

|

|

5,459,344 |

|

|

5,361,139 |

|

|

5,267,574 |

| Allowance for credit losses |

|

(28,575) |

|

|

(28,741) |

|

|

(27,378) |

|

|

(23,284) |

| Loans, net |

|

5,577,152 |

|

|

5,430,603 |

|

|

5,333,761 |

|

|

5,244,290 |

| Federal Home Loan Bank, Atlantic Central Bankers Bank, and Federal Reserve Bank stock |

|

15,642 |

|

|

15,642 |

|

|

15,591 |

|

|

20,157 |

| Premises and equipment, net |

|

28,038 |

|

|

27,482 |

|

|

27,474 |

|

|

26,408 |

| Accrued interest receivable |

|

43,720 |

|

|

37,861 |

|

|

37,534 |

|

|

34,062 |

| Intangible assets, net |

|

1,452 |

|

|

1,552 |

|

|

1,651 |

|

|

1,850 |

| Other real estate owned |

|

57,861 |

|

|

19,559 |

|

|

16,949 |

|

|

20,952 |

| Deferred tax asset, net |

|

20,556 |

|

|

21,764 |

|

|

21,219 |

|

|

19,215 |

| Other assets |

|

149,187 |

|

|

109,680 |

|

|

133,126 |

|

|

122,435 |

| Total assets |

$ |

8,145,401 |

|

$ |

7,915,856 |

|

$ |

7,705,695 |

|

$ |

7,542,906 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

| Demand and interest checking |

$ |

7,095,391 |

|

$ |

6,828,159 |

|

$ |

6,630,251 |

|

$ |

6,554,967 |

| Savings and money market |

|

60,297 |

|

|

62,597 |

|

|

50,659 |

|

|

68,084 |

| Total deposits |

|

7,155,688 |

|

|

6,890,756 |

|

|

6,680,910 |

|

|

6,623,051 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Securities sold under agreements to repurchase |

|

— |

|

|

— |

|

|

42 |

|

|

42 |

| Senior debt |

|

96,037 |

|

|

95,948 |

|

|

95,859 |

|

|

95,682 |

| Subordinated debenture |

|

13,401 |

|

|

13,401 |

|

|

13,401 |

|

|

13,401 |

| Other long-term borrowings |

|

38,283 |

|

|

38,407 |

|

|

38,561 |

|

|

9,917 |

| Other liabilities |

|

65,001 |

|

|

60,579 |

|

|

69,641 |

|

|

51,646 |

| Total liabilities |

$ |

7,368,410 |

|

$ |

7,099,091 |

|

$ |

6,898,414 |

|

$ |

6,793,739 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

| Common stock - authorized, 75,000,000 shares of $1.00 par value; 49,267,403 and 54,542,284 shares issued and outstanding at June 30, 2024 and 2023, respectively |

|

49,268 |

|

|

52,253 |

|

|

53,203 |

|

|

54,542 |

| Additional paid-in capital |

|

72,171 |

|

|

166,335 |

|

|

212,431 |

|

|

256,115 |

| Retained earnings |

|

671,730 |

|

|

618,044 |

|

|

561,615 |

|

|

467,450 |

| Accumulated other comprehensive loss |

|

(16,178) |

|

|

(19,867) |

|

|

(19,968) |

|

|

(28,940) |

| Total shareholders' equity |

|

776,991 |

|

|

816,765 |

|

|

807,281 |

|

|

749,167 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

8,145,401 |

|

$ |

7,915,856 |

|

$ |

7,705,695 |

|

$ |

7,542,906 |

| Average balance sheet and net interest income |

|

Three months ended June 30, 2024 |

|

|

Three months ended June 30, 2023 |

| |

|

(Dollars in thousands; unaudited) |

| |

|

Average |

|

|

|

|

|

Average |

|

|

Average |

|

|

|

|

Average |

| Assets: |

|

Balance |

|

|

Interest |

|

|

Rate |

|

|

Balance |

|

|

Interest |

|

Rate |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of deferred fees and costs(1) |

$ |

5,749,565 |

|

$ |

114,970 |

|

|

8.00% |

|

$ |

5,730,384 |

|

$ |

107,299 |

|

7.49% |

| Leases-bank qualified(2) |

|

4,621 |

|

|

117 |

|

|

10.13% |

|

|

3,801 |

|

|

100 |

|

10.52% |

| Investment securities-taxable |

|

1,454,393 |

|

|

17,520 |

|

|

4.82% |

|

|

778,100 |

|

|

9,873 |

|

5.08% |

| Investment securities-nontaxable(2) |

|

2,895 |

|

|

50 |

|

|

6.91% |

|

|

3,234 |

|

|

53 |

|

6.56% |

| Interest earning deposits at Federal Reserve Bank |

|

341,863 |

|

|

4,677 |

|

|

5.47% |

|

|

701,057 |

|

|

8,997 |

|

5.13% |

| Net interest earning assets |

|

7,553,337 |

|

|

137,334 |

|

|

7.27% |

|

|

7,216,576 |

|

|

126,322 |

|

7.00% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses |

|

(28,568) |

|

|

|

|

|

|

|

|

(23,895) |

|

|

|

|

|

| Other assets |

|

266,061 |

|

|

|

|

|

|

|

|

231,035 |

|

|

|

|

|

| |

$ |

7,790,830 |

|

|

|

|

|

|

|

$ |

7,423,716 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand and interest checking |

$ |

6,657,386 |

|

$ |

39,542 |

|

|

2.38% |

|

$ |

6,399,750 |

|

$ |

36,688 |

|

2.29% |

| Savings and money market |

|

60,212 |

|

|

457 |

|

|

3.04% |

|

|

78,252 |

|

|

728 |

|

3.72% |

| Total deposits |

|

6,717,598 |

|

|

39,999 |

|

|

2.38% |

|

|

6,478,002 |

|

|

37,416 |

|

2.31% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

92,412 |

|

|

1,295 |

|

|

5.61% |

|

|

— |

|

|

— |

|

— |

| Repurchase agreements |

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

— |

|

— |

| Long-term borrowings |

|

38,362 |

|

|

685 |

|

|

7.14% |

|

|

9,949 |

|

|

128 |

|

5.15% |

| Subordinated debentures |

|

13,401 |

|

|

291 |

|

|

8.69% |

|

|

13,401 |

|

|

271 |

|

8.09% |

| Senior debt |

|

95,984 |

|

|

1,234 |

|

|

5.14% |

|

|

96,890 |

|

|

1,280 |

|

5.28% |

| Total deposits and liabilities |

|

6,957,757 |

|

|

43,504 |

|

|

2.50% |

|

|

6,598,283 |

|

|

39,095 |

|

2.37% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

36,195 |

|

|

|

|

|

|

|

|

88,276 |

|

|

|

|

|

| Total liabilities |

|

6,993,952 |

|

|

|

|

|

|

|

|

6,686,559 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

796,878 |

|

|

|

|

|

|

|

|

737,157 |

|

|

|

|

|

| |

$ |

7,790,830 |

|

|

|

|

|

|

|

$ |

7,423,716 |

|

|

|

|

|

| Net interest income on tax equivalent basis(2) |

|

|

|

$ |

93,830 |

|

|

|

|

|

|

|

$ |

87,227 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax equivalent adjustment |

|

|

|

|

35 |

|

|

|

|

|

|

|

|

32 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

93,795 |

|

|

|

|

|

|

|

$ |

87,195 |

|

|

| Net interest margin(2) |

|

|

|

|

|

|

|

4.97% |

|

|

|

|

|

|

|

4.83% |

| |

| (1) Includes commercial loans, at fair value. All periods include non-accrual loans. |

| (2) Full taxable equivalent basis,

using 21% respective statutory federal tax rates in 2024 and 2023. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average balance sheet and net interest income |

Six months ended June 30, 2024 |

|

Six months ended June 30, 2023 |

| |

|

(Dollars in thousands; unaudited) |

| |

Average |

|

|

|

|

|

Average |

|

Average |

|

|

|

|

Average |

| Assets: |

Balance |

|

Interest |

|

|

Rate |

|

Balance |

|

Interest |

|

Rate |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of deferred fees and costs(1) |

$ |

5,733,413 |

|

$ |

229,130 |

|

|

7.99% |

|

$ |

5,858,040 |

|

$ |

213,503 |

|

7.29% |

| Leases-bank qualified(2) |

|

4,683 |

|

|

233 |

|

|

9.95% |

|

|

3,582 |

|

|

169 |

|

9.44% |

| Investment securities-taxable |

|

1,093,996 |

|

|

27,154 |

|

|

4.96% |

|

|

776,089 |

|

|

19,173 |

|

4.94% |

| Investment securities-nontaxable(2) |

|

2,895 |

|

|

100 |

|

|

6.91% |

|

|

3,288 |

|

|

94 |

|

5.72% |

| Interest earning deposits at Federal Reserve Bank |

|

607,968 |

|

|

16,561 |

|

|

5.45% |

|

|

640,864 |

|

|

15,582 |

|

4.86% |

| Net interest earning assets |

|

7,442,955 |

|

|

273,178 |

|

|

7.34% |

|

|

7,281,863 |

|

|

248,521 |

|

6.83% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses |

|

(27,862) |

|

|

|

|

|

|

|

|

(23,215) |

|

|

|

|

|

| Other assets |

|

323,244 |

|

|

|

|

|

|

|

|

234,037 |

|

|

|

|

|

| |

$ |

7,738,337 |

|

|

|

|

|

|

|

$ |

7,492,685 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand and interest checking |

$ |

6,553,107 |

|

$ |

78,256 |

|

|

2.39% |

|

$ |

6,401,678 |

|

$ |

69,071 |

|

2.16% |

| Savings and money market |

|

55,591 |

|

|

904 |

|

|

3.25% |

|

|

105,105 |

|

|

1,947 |

|

3.70% |

| Time deposits |

|

— |

|

|

— |

|

|

— |

|

|

41,933 |

|

|

858 |

|

4.09% |

| Total deposits |

|

6,608,698 |

|

|

79,160 |

|

|

2.40% |

|

|

6,548,716 |

|

|

71,876 |

|

2.20% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

46,892 |

|

|

1,314 |

|

|

5.60% |

|

|

10,193 |

|

|

234 |

|

4.59% |

| Repurchase agreements |

|

6 |

|

|

— |

|

|

— |

|

|

41 |

|

|

— |

|

— |

| Long-term borrowings |

|

38,439 |

|

|

1,371 |

|

|

7.13% |

|

|

9,973 |

|

|

254 |

|

5.09% |

| Subordinated debentures |

|

13,401 |

|

|

583 |

|

|

8.70% |

|

|

13,401 |

|

|

532 |

|

7.94% |

| Senior debt |

|

95,939 |

|

|

2,467 |

|

|

5.14% |

|

|

97,985 |

|

|

2,559 |

|

5.22% |

| Total deposits and liabilities |

|

6,803,375 |

|

|

84,895 |

|

|

2.50% |

|

|

6,680,309 |

|

|

75,455 |

|

2.26% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

142,826 |

|

|

|

|

|

|

|

|

90,777 |

|

|

|

|

|

| Total liabilities |

|

6,946,201 |

|

|

|

|

|

|

|

|

6,771,086 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

792,136 |

|

|

|

|

|

|

|

|

721,599 |

|

|

|

|

|

| |

$ |

7,738,337 |

|

|

|

|

|

|

|

$ |

7,492,685 |

|

|

|

|

|

| Net interest income on tax equivalent basis(2) |

|

|

|

$ |

188,283 |

|

|

|

|

|

|

|

$ |

173,066 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax equivalent adjustment |

|

|

|

|

70 |

|

|

|

|

|

|

|

|

55 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

188,213 |

|

|

|

|

|

|

|

$ |

173,011 |

|

|

| Net interest margin(2) |

|

|

|

|

|

|

|

5.06% |

|

|

|

|

|

|

|

4.75% |

| |

| (1) Includes commercial loans, at fair value. All periods include non-accrual loans. |

| (2) Full taxable equivalent basis, using 21% respective statutory federal tax rates in 2024 and 2023. |

| |

|

|

|

|

|

|

|

|

| Allowance for credit losses |

|

Six months ended |

|

Year ended |

| |

June 30, |

|

June 30, |

|

December 31, |

| |

2024 (unaudited) |

|

2023 (unaudited) |

|

2023 |

| |

(Dollars in thousands) |

| |

|

|

|

|

|

|

|

|

| Balance in the allowance for credit losses at beginning of period |

$ |

27,378 |

|

$ |

22,374 |

|

$ |

22,374 |

| |

|

|

|

|

|

|

|

|

| Loans charged-off: |

|

|

|

|

|

|

|

|

| SBA non-real estate |

|

417 |

|

|

871 |

|

|

871 |

| SBA commercial mortgage |

|

— |

|

|

— |

|

|

76 |

| Direct lease financing |

|

2,301 |

|

|

1,439 |

|

|

3,666 |

| IBLOC |

|

— |

|

|

— |

|

|

24 |

| Consumer - home equity |

|

10 |

|

|

— |

|

|

— |

| Other loans |

|

6 |

|

|

3 |

|

|

3 |

| Total |

|

2,734 |

|

|

2,313 |

|

|

4,640 |

| |

|

|

|

|

|

|

|

|

| Recoveries: |

|

|

|

|

|

|

|

|

| SBA non-real estate |

|

32 |

|

|

298 |

|

|

475 |

| SBA commercial mortgage |

|

— |

|

|

75 |

|

|

75 |

| Direct lease financing |

|

59 |

|

|

175 |

|

|

330 |

| Consumer - home equity |

|

— |

|

|

49 |

|

|

299 |

| Total |

|

91 |

|

|

597 |

|

|

1,179 |

| Net charge-offs |

|

2,643 |

|

|

1,716 |

|

|

3,461 |

| Provision for credit losses, excluding commitment provision |

|

3,840 |

|

|

2,626 |

|

|

8,465 |

| |

|

|

|

|

|

|

|

|

| Balance in allowance for credit losses at end of period |

$ |

28,575 |

|

$ |

23,284 |

|

$ |

27,378 |

| Net charge-offs/average loans |

|

0.05% |

|

|

0.03% |

|

|

0.07% |

| Net charge-offs/average assets |

|

0.03% |

|

|

0.02% |

|

|

0.05% |

| |

|

| Loan portfolio |

June 30, |

|

March 31, |

|

December 31, |

|

June 30, |

| |

2024 (unaudited) |

|

2024 (unaudited) |

|

2023 |

|

2023 (unaudited) |

| |

(Dollars in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

| SBL non-real estate |

$ |

171,893 |

|

$ |

140,956 |

|

$ |

137,752 |

|

$ |

117,621 |

| SBL commercial mortgage |

|

647,894 |

|

|

637,926 |

|

|

606,986 |

|

|

515,008 |

| SBL construction |

|

30,881 |

|

|

27,290 |

|

|

22,627 |

|

|

32,471 |

| Small business loans |

|

850,668 |

|

|

806,172 |

|

|

767,365 |

|

|

665,100 |

| Direct lease financing |

|

711,403 |

|

|

702,512 |

|

|

685,657 |

|

|

657,316 |

| SBLOC / IBLOC(1) |

|

1,558,095 |

|

|

1,550,313 |

|

|

1,627,285 |

|

|

1,883,607 |

| Advisor financing(2) |

|

238,831 |

|

|

232,206 |

|

|

221,612 |

|

|

173,376 |

| Real estate bridge loans |

|

2,119,324 |

|

|

2,101,896 |

|

|

1,999,782 |

|

|

1,826,227 |

| Consumer fintech(3) |

|

70,081 |

|

|

— |

|

|

— |

|

|

— |

| Other loans(4) |

|

46,592 |

|

|

56,163 |

|

|

50,638 |

|

|

55,644 |

| |

|

5,594,994 |

|

|

5,449,262 |

|

|

5,352,339 |

|

|

5,261,270 |

| Unamortized loan fees and costs |

|

10,733 |

|

|

10,082 |

|

|

8,800 |

|

|

6,304 |

| Total loans, including unamortized fees and costs |

$ |

5,605,727 |

|

$ |

5,459,344 |

|

$ |

5,361,139 |

|

$ |

5,267,574 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Small business portfolio |

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

June 30, |

| |

|

2024 (unaudited) |

|

|

2024 (unaudited) |

|

|

2023 |

|

|

2023 (unaudited) |

| |

|

(Dollars in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

| SBL, including unamortized fees and costs |

$ |

860,226 |

|

$ |

816,151 |

|

$ |

776,867 |

|

$ |

673,667 |

| SBL, included in loans, at fair value |

|

104,146 |

|

|

109,131 |

|

|

119,287 |

|

|

134,131 |

| Total small business loans(5) |

$ |

964,372 |

|

$ |

925,282 |

|

$ |

896,154 |

|

$ |

807,798 |

(1) SBLOC

are collateralized by marketable securities, while IBLOC are collateralized by the cash surrender value of insurance policies. At June

30, 2024 and December 31, 2023, IBLOC loans amounted to $582.8 million and $646.9 million, respectively.

(2) In

2020 The Bancorp began originating loans to investment advisors for purposes of debt refinancing, acquisition of another firm or internal

succession. Maximum loan amounts are subject to loan-to-value (“LTV”) ratios of 70% of the business enterprise value based

on a third-party valuation, but may be increased depending upon the debt service coverage ratio. Personal guarantees and blanket

business liens are obtained as appropriate.

(3) Consumer fintech loans consist primarily

of secured credit card loans.

(4) Includes

demand deposit overdrafts reclassified as loan balances totaling $279,000 and $1.7 million at June 30, 2024 and December 31, 2023, respectively.

Estimated overdraft charge-offs and recoveries are reflected in the allowance for credit losses and are immaterial.

(5) The

SBLs held at fair value are comprised of the government guaranteed portion of 7(a) Program loans at the dates indicated.

Small business loans as of June 30, 2024

| |

|

|

|

| |

|

|

|

| |

|

Loan principal |

| |

|

(Dollars in millions) |

| U.S. government guaranteed portion of SBA loans(1) |

|

$ |

400 |

| PPP loans(1) |

|

|

2 |

| Commercial mortgage SBA(2) |

|

|

336 |

| Construction SBA(3) |

|

|

14 |

| Non-guaranteed portion of U.S. government guaranteed 7(a) Program loans(4) |

|

|

117 |

| Non-SBA SBLs |

|

|

56 |

| Other(5) |

|

|

28 |

| Total principal |

|

$ |

953 |

| Unamortized fees and costs |

|

|

11 |

| Total SBLs |

|

$ |

964 |

(1) Includes

the portion of SBA 7(a) Program loans and PPP loans which have been guaranteed by the U.S. government, and therefore are assumed to have

no credit risk.

(2) Substantially

all these loans are made under the 504 Program, which dictates origination date LTV percentages, generally 50-60%, to which The Bancorp

adheres.

(3) Includes

$6 million in 504 Program first mortgages with an origination date LTV of 50-60%, and $8 million in SBA interim loans with an approved

SBA post-construction full takeout/payoff.

(4) Includes

the unguaranteed portion of 7(a) Program loans which are 70% or more guaranteed by the U.S. government. SBA 7(a) Program loans are not

made on the basis of real estate LTV; however, they are subject to SBA's "All Available Collateral" rule which mandates that

to the extent a borrower or its 20% or greater principals have available collateral (including personal residences), the collateral must

be pledged to fully collateralize the loan, after applying SBA-determined liquidation rates. In addition, all 7(a) Program loans and 504

Program loans require the personal guaranty of all 20% or greater owners.

(5) Comprised of $29 million of loans sold that do not qualify

for true sale accounting.

Small business loans by type as of June 30, 2024

(Excludes government guaranteed portion of SBA 7(a) Program and PPP loans)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SBL commercial mortgage(1) |

|

SBL construction(1) |

|

SBL non-real estate |

|

Total |

|

|

% Total |

| |

|

|

(Dollars in millions) |

| Hotels and motels |

|

$ |

76 |

|

$ |

— |

|

$ |

— |

|

$ |

76 |

|

|

15% |

| Funeral homes and funeral services |

|

|

22 |

|

|

— |

|

|

25 |

|

|

47 |

|

|

9% |

| Full-service restaurants |

|

|

29 |

|

|

5 |

|

|

2 |

|

|

36 |

|

|

7% |

| Child day care services |

|

|

23 |

|

|

1 |

|

|

2 |

|

|

26 |

|

|

5% |

| Car washes |

|

|

17 |

|

|

1 |

|

|

— |

|

|

18 |

|

|

3% |

| General line grocery merchant wholesalers |

|

|

17 |

|

|

— |

|

|

— |

|

|

17 |

|

|

3% |

| Homes for the elderly |

|

|

16 |

|

|

— |

|

|

— |

|

|

16 |

|

|

3% |

| Outpatient mental health and substance abuse centers |

|

|

15 |

|

|

— |

|

|

— |

|

|

15 |

|

|

3% |

| Gasoline stations with convenience stores |

|

|

15 |

|

|

— |

|

|

— |

|

|

15 |

|

|

3% |

| Fitness and recreational sports centers |

|

|

8 |

|

|

— |

|

|

2 |

|

|

10 |

|

|

2% |

| Nursing care facilities |

|

|

9 |

|

|

— |

|

|

— |

|

|

9 |

|

|

2% |

| Lawyer's office |

|

|

9 |

|

|

— |

|

|

— |

|

|

9 |

|

|

2% |

| Limited-service restaurants |

|

|

4 |

|

|

1 |

|

|

3 |

|

|

8 |

|

|

2% |

| Caterers |

|

|

7 |

|

|

— |

|

|

— |

|

|

7 |

|

|

1% |

| All other specialty trade contractors |

|

|

7 |

|

|

— |

|

|

— |

|

|

7 |

|

|

1% |

| General warehousing and storage |

|

|

6 |

|

|

— |

|

|

— |

|

|

6 |

|

|

1% |

| Plumbing, heating, and air-conditioning contractors |

|

|

5 |

|

|

— |

|

|

1 |

|

|

6 |

|

|

1% |

| Other accounting services |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| Offices of real estate agents and brokers |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| Other miscellaneous durable goods merchant |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| Other technical and trade schools |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| Packaged frozen food merchant wholesalers |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| Lessors of nonresidential buildings (except miniwarehouses) |

|

|

5 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1% |

| All other amusement and recreation industries |

|

|

4 |

|

|

— |

|

|

— |

|

|

4 |

|

|

1% |

| Other(2) |

|

|

122 |

|

|

10 |

|

|

29 |

|

|

161 |

|

|

30% |

| Total |

|

$ |

441 |

|

$ |

18 |

|

$ |

64 |

|

$ |

523 |

|

|

100% |

(1) Of the SBL

commercial mortgage and SBL construction loans, $109 million represents the total of the non-guaranteed portion of SBA 7(a) Program loans

and non-SBA loans. The balance of those categories represents SBA 504 Program loans with 50%-60% origination date LTVs. SBL Commercial

excludes $29 million of loans sold that do not qualify for true sale accounting.

(2) Loan

types of less than $4 million are spread over approximately one hundred different business types.

State diversification as of June 30, 2024

(Excludes government guaranteed portion of SBA 7(a) Program loans and PPP

loans)

| |

|

SBL commercial mortgage(1) |

|

SBL construction(1) |

|

SBL non-real estate |

|

Total |

|

|

% Total |

| |

|

|

(Dollars in millions) |

| California |

|

$ |

117 |

|

$ |

3 |

|

$ |

5 |

|

$ |

125 |

|

|

24% |

| Florida |

|

|

76 |

|

|

4 |

|

|

3 |

|

|

83 |

|

|

16% |

| North Carolina |

|

|

38 |

|

|

1 |

|

|

5 |

|

|

44 |

|

|

8% |

| Pennsylvania |

|

|

21 |

|

|

— |

|

|

14 |

|

|

35 |

|

|

7% |

| New York |

|

|

28 |

|

|

2 |

|

|

2 |

|

|

32 |

|

|

6% |

| Texas |

|

|

22 |

|

|

2 |

|

|

6 |

|

|

30 |

|

|

6% |

| Georgia |

|

|

26 |

|

|

1 |

|

|

1 |

|

|

28 |

|

|

5% |

| New Jersey |

|

|

21 |

|

|

3 |

|

|

3 |

|

|

27 |

|

|

5% |

| Other States |

|

|

92 |

|

|

2 |

|

|

25 |

|

|

119 |

|

|

23% |

| Total |

|

$ |

441 |

|

$ |

18 |

|

$ |

64 |

|

$ |

523 |

|

|

100% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Of the SBL commercial

mortgage and SBL construction loans, $109 million represents the total of the non-guaranteed

portion of SBA 7(a) Program loans and non-SBA loans. The balance of those categories represents SBA 504 Program loans with 50%-60% origination

date LTVs. SBL Commercial excludes $29 million of loans that do not qualify for true sale accounting.

Top 10 loans as of June 30, 2024

| |

|

|

|

|

|

|

|

| Type(1) |

|

State |

|

SBL commercial mortgage |

|

| |

|

|

(Dollars in millions) |

| General line grocery merchant wholesalers |

|

|

CA |

|

$ |

13 |

|

| Funeral homes and funeral services |

|

|

PA |

|

|

13 |

|

| Outpatient mental health and substance abuse center |

|

|

FL |

|

|

10 |

|

| Funeral homes and funeral services |

|

|

ME |

|

|

9 |

|

| Hotel |

|

|

FL |

|

|

8 |

|

| Lawyer's office |

|

|

CA |

|

|

8 |

|

| Hotel |

|

|

NC |

|

|

7 |

|

| General warehousing and storage |

|

|

PA |

|

|

6 |

|

| Hotel |

|

|

FL |

|

|

6 |

|

| Hotel |

|

|

NY |

|

|

6 |

|

| Total |

|

|

|

|

$ |

86 |

|

(1) The table above does

not include loans to the extent that they are U.S. government guaranteed.

Commercial real estate loans, excluding SBA loans, are as follows including

LTV at origination:

Type as of June 30, 2024

| |

|

|

|

|

|

|

|

|

|

|

| Type |

|

|

# Loans |

|

|

Balance |

|

Weighted average origination date LTV |

|

Weighted average interest rate |

| |

|

|

(Dollars in millions) |

| Real estate bridge loans (multifamily apartment loans recorded at amortized cost)(1) |

|

|

160 |

|

$ |

2,119 |

|

70% |

|

9.19% |

| |

|

|

|

|

|

|

|

|

|

|

| Non-SBA commercial real estate loans, at fair value: |

|

|

|

|

|

|

|

|

|

|

| Multifamily (apartment bridge loans)(1) |

|

|

7 |

|

$ |

116 |

|

76% |

|

9.20% |

| Hospitality (hotels and lodging) |

|

|

2 |

|

|

27 |

|

65% |

|

9.82% |

| Retail |

|

|

2 |

|

|

12 |

|

72% |

|

8.19% |

| Other |

|

|

2 |

|

|

9 |

|

73% |

|

5.10% |

| |

|

|

13 |

|

|

164 |

|

74% |

|

9.18% |

| Fair value adjustment |

|

|

|

|

|

(3) |

|

|

|

|

| Total non-SBA commercial real estate loans, at fair value |

|

|

|

|

|

161 |

|

|

|

|

| Total commercial real estate loans |

|

|

|

|

$ |

2,280 |

|

70% |

|

9.19% |

(1) In the third quarter

of 2021, we resumed the origination of bridge loans for multi-family apartment rehabilitation which comprise these categories. Such loans

held at fair value were originally intended for sale, but are now being retained on the balance sheet. In addition to “as is”

origination date appraisals, on which the weighted average origination date LTVs are based, third party appraisers also estimated “as

stabilized” values, which represents additional potential collateral value as rehabilitation progresses, and units are re-leased

at stabilized rental rates. The weighted average origination date “as stabilized” LTV was estimated at 61%.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| State diversification as of June 30, 2024 |

|

|

15 largest loans as of June 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| State |

|

|

Balance |

|

|

Origination date LTV |

|

|

State |

|

|

|

Balance |

|

Origination date LTV |

| (Dollars in millions) |

|

|

(Dollars in millions) |

| Texas |

|

$ |

778 |

|

|

71% |

|

|

Texas |

|

|

$ |

47 |

|

72% |

| Georgia |

|

|

259 |

|

|

69% |

|

|

Texas |

|

|

|

46 |

|

75% |

| Florida |

|

|

245 |

|

|

69% |

|

|

Tennessee |

|

|

|

40 |

|

72% |

| Michigan |

|

|

132 |

|

|

68% |

|

|

Michigan |

|

|

|

38 |

|

62% |

| Indiana |

|

|

105 |

|

|

70% |

|

|

Texas |

|

|

|

37 |

|

80% |

| Ohio |

|

|

73 |

|

|

67% |

|

|

Texas |

|

|

|

36 |

|

67% |

| New Jersey |

|

|

71 |

|

|

68% |

|

|

Florida |

|

|

|

35 |

|

72% |

| Other States each <$60 million |

|

|

617 |

|

|

71% |

|

|

Pennsylvania |

|

|

|

34 |

|

63% |

| Total |

|

$ |

2,280 |

|

|

70% |

|

|

Indiana |

|

|

|

34 |

|

76% |

| |

|

|

|

|

|

|

|

|

Texas |

|

|

|

33 |

|

62% |

| |

|

|

|

|

|

|

|

|

New Jersey |

|

|

|

32 |

|

62% |

| |

|

|

|

|

|

|

|

|

Michigan |

|

|

|

32 |

|

79% |

| |

|

|

|

|

|

|

|

|

Oklahoma |

|

|

|

31 |

|

78% |

| |

|

|

|

|

|

|

|

|

Texas |

|

|

|

31 |

|

77% |

| |

|

|

|

|

|

|

|

|

Michigan |

|

|

|

29 |

|

66% |

| |

|

|

|

|

|

|

|

|

15 largest commercial real estate loans |

|

|

$ |

535 |

|

71% |

Institutional banking loans outstanding at June 30, 2024

| |

|

|

|

|

| Type |

Principal |

|

% of total |

| |

|

(Dollars in millions) |

|

|

| SBLOC |

$ |

975 |

|

54% |

| IBLOC |

|

583 |

|

32% |

| Advisor financing |

|

239 |

|

14% |

| Total |

$ |

1,797 |

|

100% |

For SBLOC, we generally lend up to 50% of the value of equities and 80%

for investment grade securities. While the value of equities has fallen in excess of 30% in recent years, the reduction in collateral

value of brokerage accounts collateralizing SBLOCs generally has been less, for two reasons. First, many collateral accounts are “balanced”

and accordingly have a component of debt securities, which have either not decreased in value as much as equities, or in some cases may

have increased in value. Second, many of these accounts have the benefit of professional investment advisors who provided some protection

against market downturns, through diversification and other means. Additionally, borrowers often utilize only a portion of collateral

value, which lowers the percentage of principal to collateral.

Top 10 SBLOC loans at June 30, 2024

| |

|

|

|

|

| |

Principal amount |

|

% Principal to collateral |

| |

(Dollars in millions) |

| |

$ |

11 |

|

17% |

| |

|

9 |

|

48% |

| |

|

8 |

|

36% |

| |

|

8 |

|

68% |

| |

|

8 |

|

65% |

| |

|

8 |

|

80% |

| |

|

8 |

|

24% |

| |

|

8 |

|

34% |

| |

|

7 |

|

22% |

| |

|

7 |

|

44% |

| Total and weighted average |

$ |

82 |

|

43% |

Insurance backed lines of credit (IBLOC)

IBLOC loans are backed by the cash value of eligible life insurance policies

which have been assigned to us. We generally lend up to 95% of such cash value. Our underwriting standards require approval of the

insurance companies which carry the policies backing these loans. Currently, fifteen insurance companies have been approved and, as of

April 17, 2024, all were rated A- (Excellent) or better by AM BEST.