0001930021

false

00-0000000

0001930021

2023-11-29

2023-11-29

0001930021

PTHR:UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrant.Member

2023-11-29

2023-11-29

0001930021

PTHR:ClassOrdinaryShare0.0001ParValuePerShareMember

2023-11-29

2023-11-29

0001930021

PTHR:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember

2023-11-29

2023-11-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 29, 2023

PONO

CAPITAL THREE, INC.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41607 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

643

Ilalo Street, #102, Honolulu, Hawaii 96813

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (808) 892-6611

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Units,

each consisting of one Class A Ordinary Share, and one Redeemable Warrant. |

|

PTHRU |

|

The

Nasdaq Stock Market LLC |

| Class

A Ordinary Share, $0.0001 par value per share |

|

PTHR |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

PTHRW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

As

previously disclosed, on August 15, 2023, Pono Capital Three, Inc., a Cayman Islands exempted company (“Pono”), entered

into a Business Combination Agreement (the “Business Combination Agreement”), by and among Pono, Pono Three Merger

Acquisitions Corp., a British Columbia company and wholly-owned subsidiary of Pono (“Merger Sub”) and Robinson Aircraft

Ltd., d/b/a Horizon Aircraft (“Horizon”).

Pursuant

to the Business Combination Agreement, prior to the closing of the transactions contemplated by the Business Combination Agreement (the

“Closing”), Pono will redomesticate as a British Columbia company, and at the Closing, Merger Sub will amalgamate

(the “Amalgamation,” together with the other transactions contemplated by the Business Combination Agreement, the

“Business Combination”) with Horizon (the resulting company, “Amalco”), with Amalco being the wholly-owned

subsidiary of Pono.

Attached

as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is an investor presentation (“Investor

Presentation”) that will be used by Pono and Horizon in connection with the Business Combination.

The

Investor Presentation is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except as expressly set forth by specific reference in such filing. For the avoidance of doubt, Pono intends for

this Form 8-K, including Exhibit 99.1, to satisfy the requirements of Rule 165(b) and Rule 425(a) under the Securities Act. This Current

Report on Form 8-K will not be deemed an admission as to the materiality of any information in this Item 7.01, including Exhibit 99.1.

Forward

Looking Statements

The information in this Current

Report on Form 8-K contains certain “forward-looking statements” within the meaning of the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995 with respect to the Business Combination. These forward-looking statements generally

are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “aim,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Actual results may differ from their expectations, estimates

and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Many factors

could cause actual future events to differ materially from the forward-looking statements in this report, including but not limited to:

(i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of

Pono’s securities; (ii) the failure to satisfy the conditions to the consummation of the Business Combination, including the approval

of the definitive Business Combination agreement by the shareholders of Pono; (iii) the occurrence of any event, change or other circumstance

that could give rise to the termination of the Business Combination Agreement; (iv) the outcome of any legal proceedings that may be instituted

against any of the parties to the Business Combination Agreement following the announcement of the entry into the Business Combination

Agreement and Business Combination; (v) redemptions exceeding anticipated levels or the failure to meet The Nasdaq Market’s initial

listing standards in connection with the consummation of the Business Combination; (vi) the effect of the announcement or pendency of

the Business Combination on Horizon’s business relationships, operating results and business generally; (vii) risks that the Business

Combination disrupts the current plans of Horizon; (viii) changes in the markets in which Horizon competes, including with respect to

its competitive landscape, technology evolution or regulatory changes; (ix) the risk that Pono and Horizon will need to raise additional

capital to execute its business plans, which may not be available on acceptable terms or at all; (x) the ability of the parties to recognize

the benefits of the Business Combination Agreement and the Business Combination; (xi) the lack of useful financial information for an

accurate estimate of future capital expenditures and future revenue; (xii) statements regarding Horizon’s industry and market size;

(xiii) financial condition and performance of Horizon and Pono, including the anticipated benefits, the implied enterprise value, the

expected financial impacts of the Business Combination, potential level of redemptions of Pono’s public shareholders, the financial

condition, liquidity, results of operations, the products, the expected future performance and market opportunities of Horizon; and (xiv)

those factors discussed in Pono’s filings with the SEC and that that are contained in the registration statement on Form S-4 and

the related proxy statement relating to the Business Combination. You should carefully consider the foregoing factors and the other risks

and uncertainties that will be described in the “Risk Factors” section of the registration statement on Form S-4 and the related

proxy statement and other documents to be filed by Pono from time to time with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward- looking

statements, and while Horizon and Pono may elect to update these forward-looking statements at some point in the future, they assume no

obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, subject

to applicable law. None of Horizon or Pono gives any assurance that Horizon and Pono will achieve their respective expectations.

Additional

Information and Where to Find It

In connection with the Business

Combination Agreement and the Business Combination, Pono has filed materials with the SEC, including a registration statement on Form

S-4 (the “Form S-4”), which includes a preliminary proxy statement/prospectus of Pono, and will file other documents

regarding the Business Combination with the SEC. Pono will mail a final prospectus and definitive proxy statement and other relevant documents

after the SEC completes its review. Pono shareholders are urged to read the Form S-4 and the preliminary proxy statement/prospectus and

any amendments thereto, and when available, the final prospectus and definitive proxy statement in connection with the solicitation of

proxies for the special meeting to be held to approve the Business Combination, because these documents will contain important information

about Pono, Horizon, and the Business Combination. The final prospectus and definitive proxy statement will be mailed to shareholders

of Pono as of a record date to be established for voting on the Business Combination. Shareholders of Pono will also be able to obtain

a free copy of the proxy statement, as well as other filings containing information about Pono without charge, at the SEC’s website

(www.sec.gov) or by calling 1-800-SEC-0330. Copies of the proxy statement and Pono’s other filings with the SEC can also be obtained,

without charge, by directing a request to Pono Capital Three, Inc., 643 Ilalo St. #102, Honolulu, Hawaii 96813, (808) 892-6611. The information

contained in, or that can be accessed through, Horizon’s website is not incorporated by reference in, and is not part of, this report.

No

Offer or Solicitation

This current report on Form

8-K does not constitute (i) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Business

Combination, or (ii) an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

Participants

in the Solicitation

Horizon and Pono and their

respective directors and officers and other members of management and employees may be deemed participants in the solicitation of proxies

in connection with the Business Combination. Pono shareholders and other interested persons may obtain, without charge, more detailed

information regarding directors and officers of Pono in Pono’s initial public offering prospectus, which was declared effective

the SEC on February 9, 2023. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of

proxies from Pono’s shareholders in connection with the Business Combination will be included in the definitely proxy statement/prospectus

the Pono intends to file with the SEC.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits are being filed herewith:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PONO CAPITAL THREE, INC. |

| |

|

|

| Date: November 29, 2023 |

By: |

/s/ Davin

Kazama |

| |

Name: |

Davin Kazama |

| |

Title: |

Chief Executive Officer |

4

Exhibit 99.1

BUILDING THE FUTURE HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 PR I VAT E AN D CO N F I D E N T I A L HORIZON AIRCRAFT | A NEW TYPE OF AEROSPACE COMPANY RE N D E RI N G O F T H E X 7 O V E R A C I T Y

This document contains forward - looking statements regarding, among other things, the strategies of Robinson Aircraft Ltd . (“ Horizon Aircraft ” or “ we ” or “ our ”) which may constitute “forward - looking statements” within the meaning of the United States Securities Act of 1933 , as amended (the “ U . S . Securities Act ”) and the United States Securities Exchange Act of 1934 , as amended by the Private Securities Litigation Reform Act of 1995 , including but not limited to the ability of Horizon Aircraft to successfully complete testing and certification of its Cavorite X 7 eVTOL quickly and then to enter the market and service a broad spectrum of early use cases, including the targeted future production of Horizon’s Cavorite X 7 aircraft ; the ability of the Cavorite X 7 to takeoff and land like a helicopter and fly twice as fast ; the projected useful load, estimated maximum speed and projected range of the Cavorite X 7 aircraft ; the ability of the Cavorite X 7 to fly 98 % of its mission in a like a traditional aircraft ; the certification for flight into known icing ; and the ability of the Cavorite X 7 to be fast, versatile, and built for bad weather . Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward - looking statements . The forward - looking statements represent our current expectations, estimates, forecasts and assumptions, and are based on information available as of the date hereof and involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performances or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward - looking statements . Such risks and uncertainties include, but are not limited to : the size and growth of the regional air mobility market generally ; our ability to develop, certify and produce aircraft that meet our performance expectations, the competitive environment in which we plan to operate ; our present and future capital needs to achieve our goals ; our ability to adequately protect and enforce our intellectual property rights ; our ability to effectively respond to evolving regulations and standards relating to our planned aircraft ; and uncertainties related to our limited operating history and that we face significant challenges to develop, certify, and manufacture its aircraft . Although Horizon Aircraft believes that its plans, intentions and expectations reflected in or suggested by these forward - looking statements are reasonable, Horizon Aircraft cannot assure you that Horizon Aircraft will achieve or realize these plans, intentions or expectations . Forward - looking statements are not guarantees of performance . As such, you should not place undue reliance on these forward - looking statements and you should read this document completely and with the understanding that our actual future results may be materially different from what we expect . All forward - looking statements are qualified in their entirety by this cautionary statement . Horizon Aircraft undertakes no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results or circumstances, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . No securities regulatory authority has expressed an opinion about Horizon Aircraft securities and it is an offense to claim otherwise . CAUTIONARY NOTE ABOUT FORWARD - LOOKING STATEMENTS HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 2 2 PR I VAT E A N D C O N F I D E N T I A L

This document contains certain projections or future oriented financial information about prospective results of operations, financial position or cash flows, based on assumptions about future economic conditions and courses of action and that is not presented in the format of a historical balance sheet, income statement or cash flow statement . The projections or FOFI have been prepared by Horizon Aircraft’s management to provide an outlook of Horizon Aircraft’s activities, results and anticipated use of proceeds . The projections or FOFI have been prepared based on a number of assumptions, including assumptions with respect to the costs and expenditures to be incurred by Horizon Aircraft, capital expenditures and operating costs, taxation rates for Horizon Aircraft and general and administrative expenses . Management does not have firm commitments for all of the costs, expenditures, prices or other financial assumptions used to prepare the projections or FOFI or assurance that such operating results will be achieved and, accordingly, the complete financial effects of all of those costs, expenditures, prices and operating results are not objectively determinable . The actual results of operations of Horizon Aircraft and the resulting financial results will likely vary from the amounts set forth in the analysis presented in this document, and such variation may be material . Horizon Aircraft and its management believe that the projections or FOFI have been prepared on a reasonable basis, reflecting management’s best estimates and judgments . However, because this information is highly subjective and subject to numerous risks including the risks discussed above, it should not be relied on as necessarily indicative of future results . Except as otherwise required by applicable securities laws, Horizon Aircraft undertakes no obligation to update such projections or FOFI and forward - looking statements and information . DISCLAIMER This document is for informational purposes only and is being made available solely to enable prospective “accredited” and other qualified investors authorized by Horizon Aircraft to evaluate an investment in the securities of Horizon Aircraft (the “ Securities ”) . This document does not constitute an offer to sell or the solicitation of an offer to buy the Securities, nor shall there be any sale of Securities, in the United States, Canada, any state, any province or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . The Securities have not been and will not be registered under the U . S . Securities Act or any state securities laws and may not be offered or sold in the United States, or to or for the account or benefit of a U . S . Person (as defined in Regulation S under the U . S . Securities Act), except in compliance with the registration requirements of the U . S . Securities Act and applicable state securities laws or pursuant to an exemption therefrom . NO WARRANTIES The information contained in this document does not purport to be all - inclusive and neither Horizon Aircraft nor any other person makes any representation or warranty, express or implied, as to the completeness, accuracy or reliability of the information contained in this document . In particular, the general explanations included in this document cannot address, and are not intended to address, each prospective purchaser’s specific investment objectives, financial situations or financial needs . Accordingly, by accepting this document, each prospective purchaser confirms that such purchaser is not relying upon the information contained in this document to make any investment decision . Prospective purchasers should consult with their own counsel and tax and financial advisors as to legal and related matters concerning the matters described in this document . THIRD PARTY INFORMATION Certain information contained herein includes market and industry data that has been obtained from or is based upon estimates derived from third party sources, including industry publications, reports and websites . Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance or guarantee as to the accuracy or completeness of included data . Although the data is believed to be reliable, Horizon Aircraft has not independently verified the accuracy, currency or completeness of any of the information from third party sources referred to in this document or ascertained from the underlying economic assumptions relied upon by such sources . Horizon Aircraft hereby disclaims any responsibility or liability whatsoever in respect of any third - party sources of market and industry data or information . PROJECTIONS & FUTURE - ORIENTED FINANCIAL INFORMATION HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 3 3 PR I VAT E A N D C O N F I D E N T I A L

“We were humbled and excited to partner with the United States Air Force and USSOCOM. Together we developed our hybrid eVTOL platform towards providing capability to help service people around the world.” Brandon Robinson, CEO HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 COMPANY OVERVIEW MILITARY CONTRACTS Led by a CF - 18 Canadian Top Gun fighter pilot, the Cavorite X 7 was designed for the real operational world . This was recognized by the USAF and USSOCOM through the award of an AFWERX High Speed VTOL contract . The team worked closely with the USAF/USSOCOM and successfully completed the engagement . AN EXPERIENCED AEROSPACE TEAM Horizon Aircraft is a family . Founded and led by a father - son team with extensive operational flying experience, the team now has collected an elite group of aerospace engineers . It is a team that has designed, built, and flown new types of aircraft from clean sheet designs . THE CAVORITE X 7 Horizon Aircraft has developed an innovative new eVTOL aircraft, the Cavorite X 7 . Its patented fan - in - wing design allows for vertical takeoff and landing while flying enroute in an efficient configuration much like a traditional aircraft . PR I VAT E A N D C O N F I D E N T I A L HORIZON AIRCRAFT 4 FOUNDED IN 2013 TO ENABLE A BETTER WAY TO MOVE PEOPLE & GOODS GLOBALLY A patented vertical lift system enabling an eVTOL aircraft unlike any other in the industry

LEADING THE WAY Our team of industry trailblazers includes visionary entrepreneurs with high - growth startup expertise and aerospace engineers with military - proven leadership. THE TEAM 5 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 BRANDON ROBINSON CHIEF EXECUTIVE, FOUNDER • CF - 18 Fighter Pilot Top Gun grad • Mechanical Engineer & MBA • Major project directorship over $400M budget • Air Force commendations and awards for leadership and flight safety JASON O’NEILL CHIEF OPERATING OFFICER • 20 years of high growth start - up • Machine learning, software architecture & integration • Sr. Leadership, strategy and team building BRIAN ROBINSON CHIEF ENGINEER, FOUNDER • Experimental aircraft builder & pilot • Mechanical Engineer, P.Eng • 50 years of custom aviation engineering • Advanced manufacturing • Executive management PR I VAT E A N D C O N F I D E N T I A L

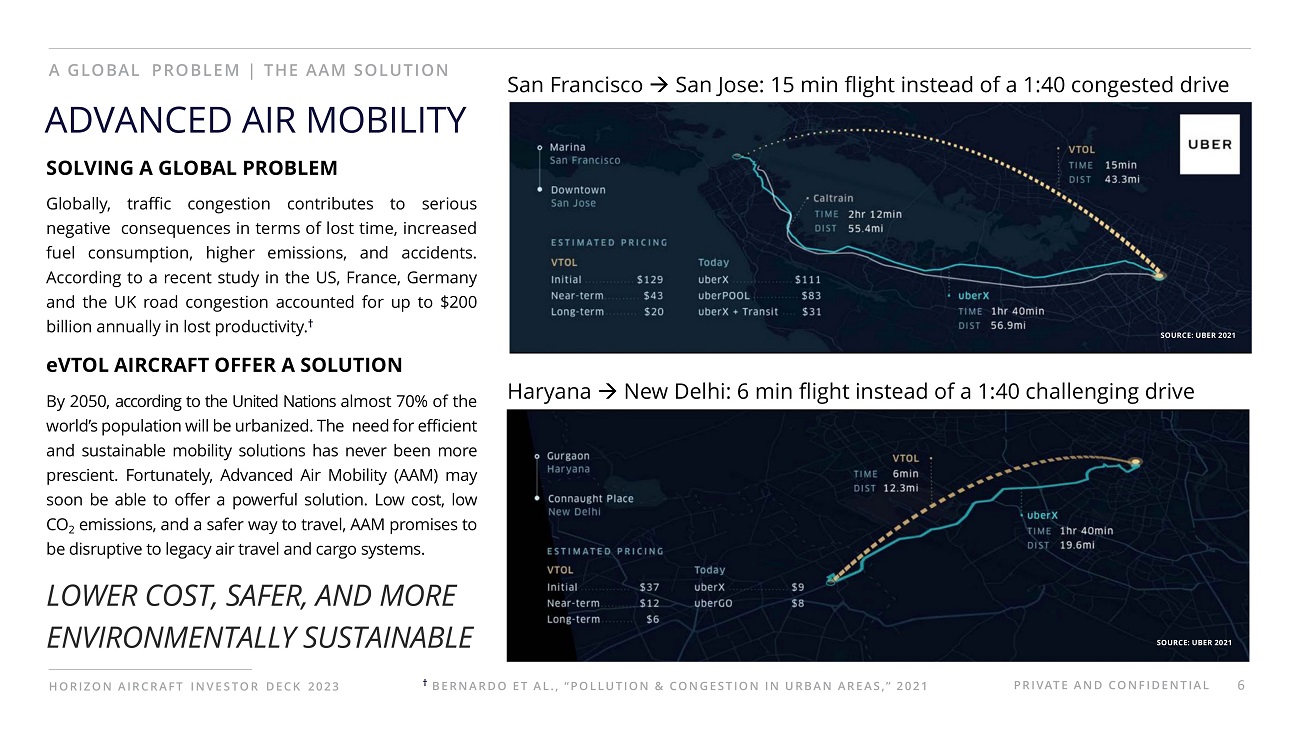

A GLOBAL PROBLEM | THE AAM SOLUTION ADVANCED AIR MOBILITY SOLVING A GLOBAL PROBLEM 6 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 PR I VAT E A N D C O N F I D E N T I A L Globally, traffic congestion contributes to serious negative consequences in terms of lost time, increased fuel consumption, higher emissions, and accidents . According to a recent study in the US, France, Germany and the UK road congestion accounted for up to $ 200 billion annually in lost productivity . † eVTOL AIRCRAFT OFFER A SOLUTION By 2050 , according to the United Nations almost 70 % of the world’s population will be urbanized . The need for efficient and sustainable mobility solutions has never been more prescient . Fortunately, Advanced Air Mobility (AAM) may soon be able to offer a powerful solution . Low cost, low CO 2 emissions, and a safer way to travel, AAM promises to be disruptive to legacy air travel and cargo systems . LOWER COST, SAFER, AND MORE ENVIRONMENTALLY SUSTAINABLE San Francisco San Jose: 15 min flight instead of a 1:40 congested drive Haryana New Delhi: 6 min flight instead of a 1:40 challenging drive † BE R N A R D O E T A L . , “ P O L L U T I O N & C O N G E S T I O N I N U R B A N A R E A S , ” 2 0 2 1 SOURCE: UBER 2021 SOURCE: UBER 2021

Horizon Aircraft is a company with a unique approach, patented technology & strong leadership represents significant potential in a rapidly growing new industry Morgan Stanley , Autonomous Aircraft, 2021 Transport & Logistics $517B Shared Mobility $457B Military, Defense $10B Total Addressable Market (by 2040) $1.0T A HUGE PROJECTED INDUSTRY THAT IS SET TO TAKE OFF $ 1 . 0 TRILLION PROJECTED TOTAL ADDRESSABLE MARKET BY 2040 TOTAL ADDRESSABLE MARKET 7 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 PR I VAT E A N D C O N F I D E N T I A L RE N D E RI N G O F T H E C AV O RI T E X 7 O V E R A M O U N TA I N RA N G E

OUR PATENTED SOLUTION HORIZON AIRCRAFT CAVORITE X7 A PR OTOT Y PE eVTOL DESI GNE D F OR LONGE R - RA NGE RE GI ONA L PA SSE NGE R, C A RG O, AN D SP E CI AL MI SSI ONS CleanTech, High Efficiency Hybrid 1500 lb Payload Patented Fan - in - Wing Design 500 mile Range 7 - Person Capacity 8 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 Low CapEx and OpEx PR I VAT E A N D C O N F I D E N T I A L TA K E OF F A ND L A ND L I K E A HE L I COP TE R AN D F LY AL MOST TWI CE AS FAST US NON - PR OV ISIO NA L UT I L I T Y PAT E NT S PR OT E C T IN G K E Y T E C H VERTICAL MODE **R E N D E R I N G O F T H E CAV O R I T E X 7 I N T H E VE R T I C A L F L I G H T M O D E

OUR PATENTED SOLUTION HORIZON AIRCRAFT CAVORITE X7 WI NGS CLO S E D FO R E NR OUT E FL IG HT, FLY IN G L IK E A NOR MA L A I R C R A F T. CleanTech, High Efficiency Hybrid 1500 lb Payload Patented Fan - in - Wing Design 500 mile Range 7 - Person Capacity 9 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 Low CapEx and OpEx PR I VAT E A N D C O N F I D E N T I A L FORWARD MODE FA ST, V E R SAT I L E , USE F UL . DE SI GNE D BY P I LOT S F OR R E A L - WOR L D OP E R AT I ONS. **R E N D E R I N G O F T H E CAV O R I T E X 7 I N T H E EN R O U T E F L I G H T M O D E

THE ADVANTAGE OF OUR DESIGN 10 PR I VAT E A N D C O N F I D E N T I A L TAKE OFF AND LAND LIKE A HELICOPTER BUT FLY ALMOST TWICE AS FAST WITH LOWER OPERATING COSTS Hybrid - electric power 450 km/h top speed † 680 kg useful load † 800+ km range †† DESIGNED TO BE ONE OF THE MOST EFFICIENT eVTOLS IN THE INDUSTRY The patented wing system allows the Cavorite X7 to fly enroute in a configuration exactly like a normal aircraft. Flying like a traditional aircraft for 98% of the mission has several advantages: Lower cost to own & operate Simple operation Fast AL L P E R F O R M AN CE B AS E D O N E N G I N E E R I N G AS S E S S M E N T ; † FLY I N G AT 1 0 , 0 0 0 FT AT M A X I M U M PO W E R ; †† MA X R A N G E B A S E D O N A ME D I U M PAY LO A D O F 8 0 0 L B S A N D 2 2 0 K T S C R U I S E

AN ALL - WEATHER eVTOL DESIGN Intent to certify the aircraft for flight into known icing Designed for bad weather operations Multi - mission capability HO RI Z ON A I R C R A F T IN V E S T O R D EC K 2023 PR I VAT E A N D C O N F I D E N T I A L 11 RE N D E RI N G O F T H E C AV O RI T E X 7 I N B A D W E AT H E R

Confidential | Horizon Aircraft | Building a Better Future | 2023 REAL - WORLD TESTING ON A SUB - SCALE PROTOTYPE The 50% - scale prototype has successfully demonstrated hover flight HOR I Z ON A I R C R A F T IN V E S T O R DE C K 2023 PR I VAT E A N D C O N F I D E N T I A L 12 PI C T U R E O F T H E 5 0 % - SC A L E A I RC RA FT D U RI N G H O V E R FL I G H T T E ST I N G

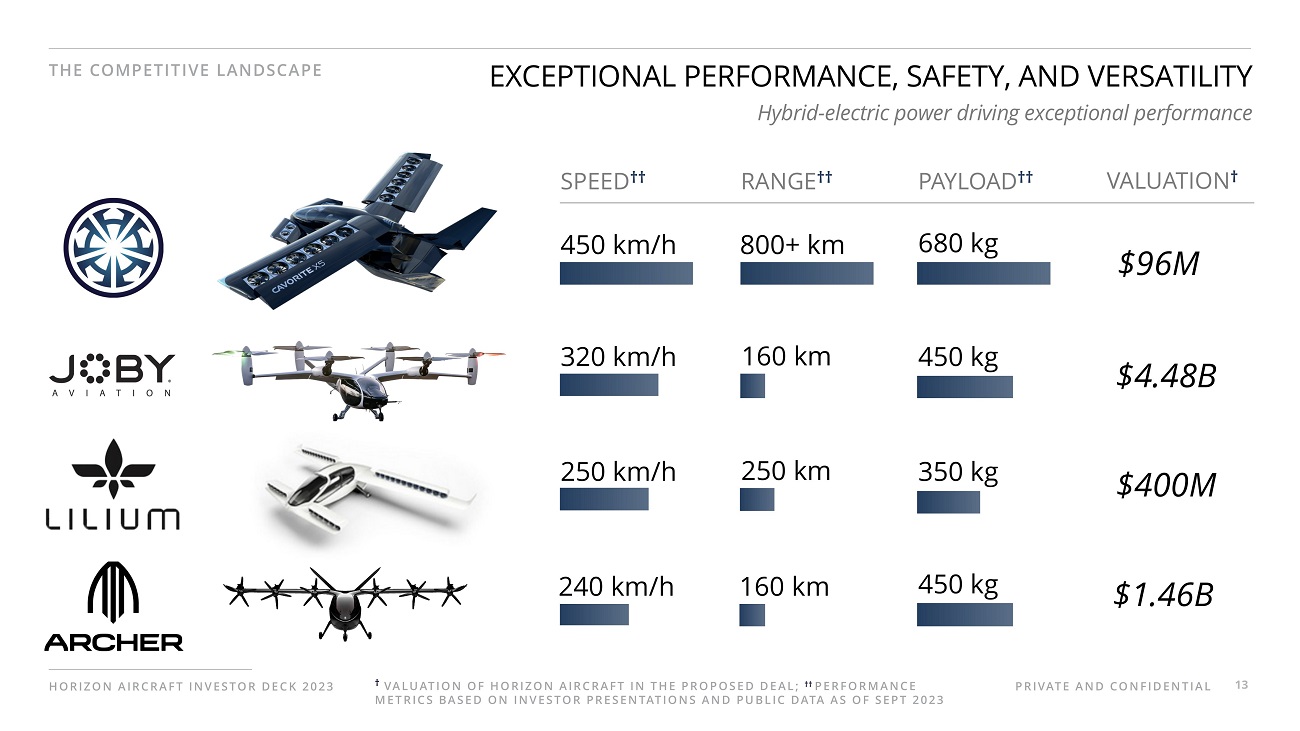

THE COMPETITIVE LANDSCAPE 13 HOR I Z ON A I R C R A F T I N V E S TOR D E C K 2 0 2 3 EXCEPTIONAL PERFORMANCE, SAFETY, AND VERSATILITY Hybrid - electric power driving exceptional performance PR I VAT E A N D C O N F I D E N T I A L 240 km/h 160 km PAYLOAD †† VALUATION † RANGE †† SPEED †† 680 kg $96M 800+ km 450 km/h 450 kg $4.48B 160 km 320 km/h 350 kg $400M 250 km 250 km/h 450 kg $1.46B † VA L U AT I O N O F H O R I Z O N A I R C R A F T I N T H E P R O P O S E D D E A L ; †† PE R F O R M A N C E ME T R I C S B A S E D O N I N V E S TO R P R E S E N TAT I O N S A N D P U B L I C D ATA A S O F S E P T 2 0 2 3

IN JANUARY OF 2022 AN AFWERX PHASE 1 CONTRACT WAS AWARDED FOR THE INNOVATIVE CAVORITE HIGH SPEED VTOL AIRCRAFT DESIGN UNITED STATES GOVERNMENT CONTRACT AWARD PHASE 1 US DOD HSVTOL CONTRACT AWARD The AFWERX Phase 1 award offered close to $ 400 K USD for Horizon Aircraft to demonstrate the viability of the Cavorite VTOL concept . In April of 2022 , the Horizon Aircraft team hosted the USAF and USSOCOM AFWERX teams at the primary assembly facility . FUTURE OPPORTUNITIES The US Military is very interested in Runway Independent Operations . The Horizon Aircraft team is confident that the winning Cavorite hybrid electric VTOL concept could offer many opportunities for partnership going forward . 14 HOR I Z ON A I R C R A F T IN V E S TO R D E C K 2 0 2 3 “The partnership with the USAF and USSOCOM through AFWERX allowed us to accelerate development and further explore important military applications for our innovative Cavorite VTOL technology platform.” - Brandon Robinson, CEO Horizon Aircraft PR I VAT E A N D C O N F I D E N T I A L USAF & USSOCOM PARTNERSHIP

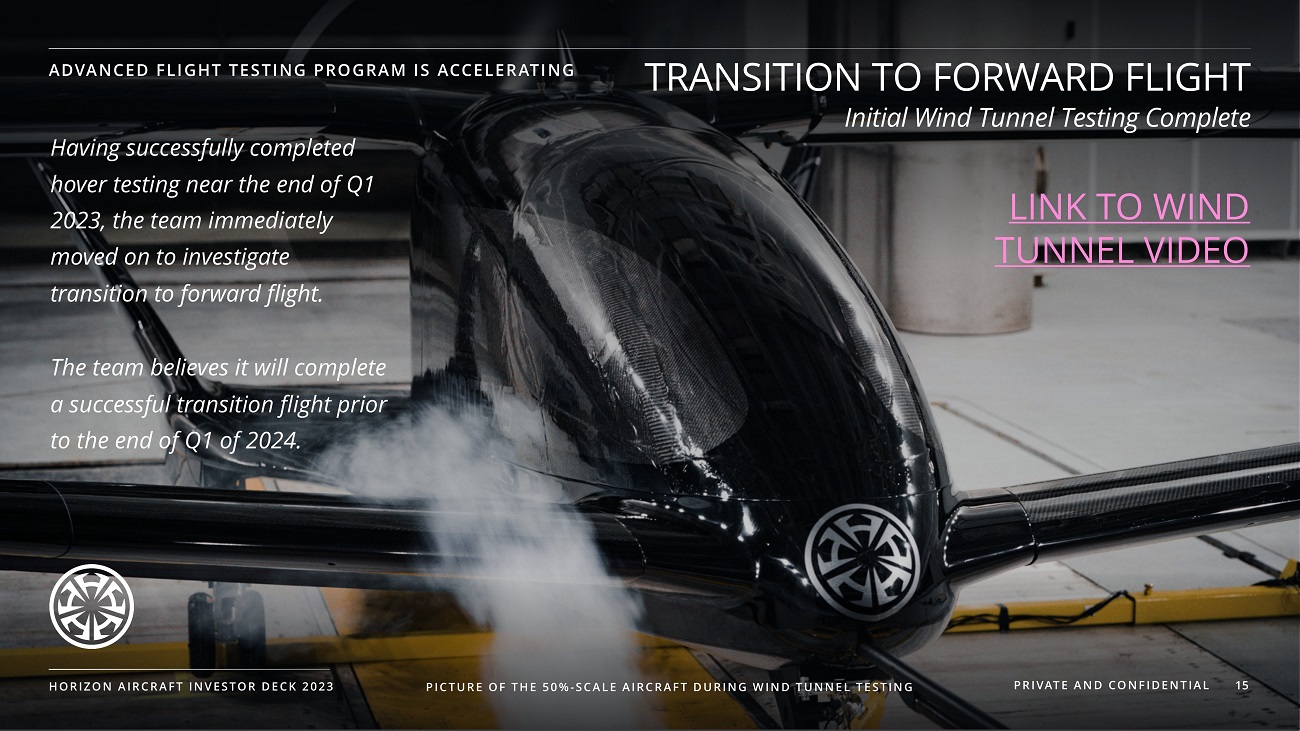

ADVANCED FLIGHT TESTING PROGRAM IS ACCELERATING HOR I Z ON A I R C R A F T IN V E S TO R D E C K 2 0 2 3 PR I VAT E A N D C O N F I D E N T I A L 15 TRANSITION TO FORWARD FLIGHT Initial Wind Tunnel Testing Complete Having successfully completed hover testing near the end of Q1 2023, the team immediately moved on to investigate transition to forward flight. The team believes it will complete a successful transition flight prior to the end of Q 1 of 2024 . LINK TO WIND TUNNEL VIDEO PI C T U R E O F T H E 5 0 % - SC A L E A I RC RA FT D U RI N G W I N D T U N N E L T E ST I N G

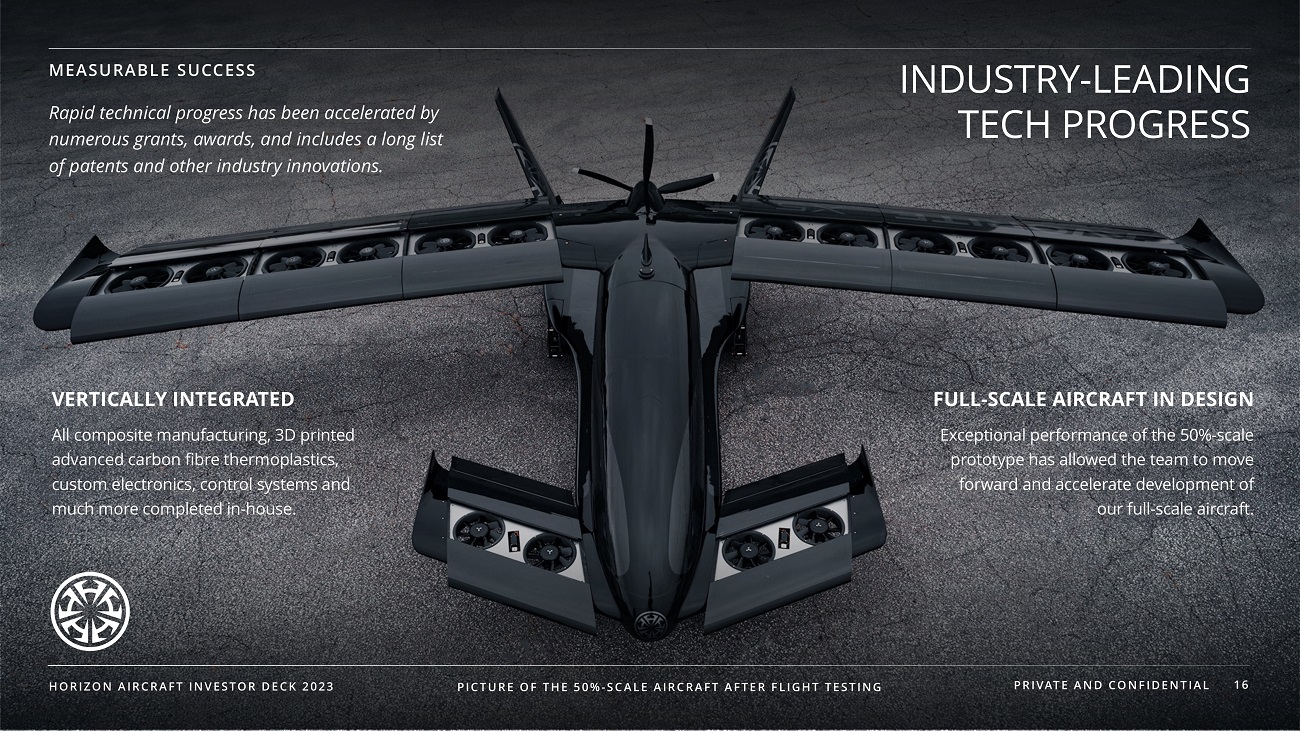

HOR I Z ON A I R C R A F T IN V E S TO R D E C K 2 0 2 3 MEASURABLE SUCCESS Rapid technical progress has been accelerated by numerous grants, awards, and includes a long list of patents and other industry innovations . INDUSTRY - LEADING TECH PROGRESS PR I VAT E A N D C O N F I D E N T I A L 16 VERTICALLY INTEGRATED All composite manufacturing, 3D printed advanced carbon fibre thermoplastics, custom electronics, control systems and much more completed in - house. FULL - SCALE AIRCRAFT IN DESIGN Exceptional performance of the 50 % - scale prototype has allowed the team to move forward and accelerate development of our full - scale aircraft . PI C T U R E O F T H E 5 0 % - SC A L E A I RC RA FT A FT E R FL I G H T T E ST I N G

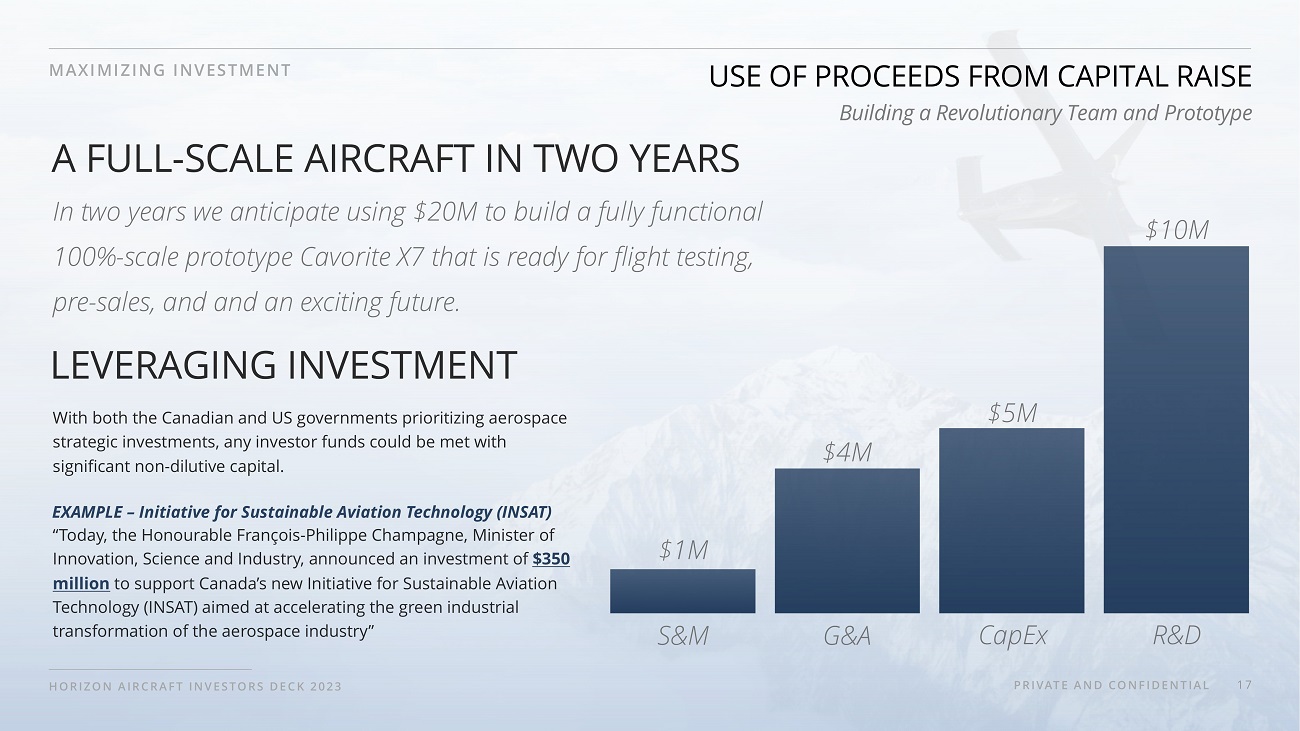

MAXIMIZING INVESTMENT HOR I Z ON A I R C R A F T I N V E S TOR S D E C K 2 0 2 3 USE OF PROCEEDS FROM CAPITAL RAISE EXAMPLE – Initiative for Sustainable Aviation Technology (INSAT) “Today, the Honourable François - Philippe Champagne, Minister of Innovation, Science and Industry, announced an investment of $350 million to support Canada’s new Initiative for Sustainable Aviation Technology (INSAT) aimed at accelerating the green industrial transformation of the aerospace industry” In two years we anticipate using $20M to build a fully functional 100% - scale prototype Cavorite X7 that is ready for flight testing, pre - sales, and and an exciting future. LEVERAGING INVESTMENT With both the Canadian and US governments prioritizing aerospace strategic investments, any investor funds could be met with significant non - dilutive capital. Building a Revolutionary Team and Prototype A FULL - SCALE AIRCRAFT IN TWO YEARS G&A S&M $5M $4M $1M CapEx R&D PR I VAT E A N D C O N F I D E N T I A L 17 $10M

SIGNIFICANT POTENTIAL PONO CAPITAL THREE BUSINESS COMBINATION WITH HORIZON AIRCRAFT 18 $96M NASDAQ: HOVR ANTICIPATED TICKER SYMBOL PR I VAT E A N D C O N F I D E N T I A L HOR I Z ON A I R C R A F T I N V E S TOR S D E C K 2 0 2 3 HORIZON ENTERPRISE VALUE $216M PRO FORMA EQUITY VALUE † † BE F O R E D E A L E X P E N S E S , A S S U M E S N O R E D E M P T I O N S TRANSACTION OVERVIEW Pono Capital Three with $115M in Treasury as of Sept 2023 Forward Share Purchase Agreement signed with Meteora Capital Majority of cash, net of closing expenses and redemptions, used for development of Horizon Aircraft’s hybrid eVTOL aircraft program Boards of Directors of both Horizon Aircraft and Pono Capital Three have unanimously approved the Business Combination Flat equity structure; close to zero net debt anticipated at closing

JOIN US TO HELP BUILD A BETTER FUTURE 19 HOR I Z ON A I R C R A F T IN V E S T O R DE C K 202 3 PR I VAT E A N D C O N F I D E N T I A L CONTACT: E. BRANDON ROBINSON, CEO brandon@horizonaircraft.com 613.866.1935 RE N D E RI N G O F T H E C AV O RI T E X 7 O N A SI M U L AT E D A P P RO A C H TO L A N D

v3.23.3

Cover

|

Nov. 29, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 29, 2023

|

| Entity File Number |

001-41607

|

| Entity Registrant Name |

PONO

CAPITAL THREE, INC.

|

| Entity Central Index Key |

0001930021

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

643

Ilalo Street

|

| Entity Address, Address Line Two |

#102

|

| Entity Address, City or Town |

Honolulu

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96813

|

| City Area Code |

808

|

| Local Phone Number |

892-6611

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share, and one Redeemable Warrant. |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A Ordinary Share, and one Redeemable Warrant.

|

| Trading Symbol |

PTHRU

|

| Security Exchange Name |

NASDAQ

|

| Class A Ordinary Share, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class

A Ordinary Share, $0.0001 par value per share

|

| Trading Symbol |

PTHR

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable

Warrants, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

PTHRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTHR_UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrant.Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTHR_ClassOrdinaryShare0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTHR_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Pono Capital Three (NASDAQ:PTHRU)

過去 株価チャート

から 11 2024 まで 12 2024

Pono Capital Three (NASDAQ:PTHRU)

過去 株価チャート

から 12 2023 まで 12 2024