Furnished by Paramount Global

pursuant to Rule 425 under the Securities Act of 1933, as

amended, and pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company:

Paramount Global (SEC File No.: 001-09553)

Date: July 8, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 7, 2024

Paramount Global

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09553 | 04-2949533 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer Identification

Number) |

| | | | | | | | | | | |

| 1515 Broadway | | |

| New York, | New York | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 258-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value | | | PARAA | | | | The Nasdaq Stock Market LLC | |

| Class B Common Stock, $0.001 par value | | | PARA | | | | The Nasdaq Stock Market LLC | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

On July 7, 2024, Paramount Global (“Paramount”) and Skydance Media, LLC, a California limited liability company (“Skydance”), issued the joint press release attached hereto as Exhibit 99.1, announcing the entry into a definitive agreement to merge the companies. Upon the terms and subject to the conditions set forth in the agreement, Skydance will merge with Paramount through a two-step transaction including an acquisition by Skydance of National Amusements, Inc. (“NAI”), which holds a controlling interest in Paramount, and subsequently a merger of Skydance and Paramount. Also on July 7, 2024, the Special Committee of Paramount’s Board of Directors issued the press release attached hereto as Exhibit 99.2.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit Number | Description of Exhibit |

| |

| 99.1 | Joint Press Release of Skydance and Paramount, dated July 7, 2024, announcing the merger of Skydance and Paramount. |

| 99.2 | Press Release of the Special Committee of Paramount’s Board of Directors, dated July 7, 2024, announcing the merger of Skydance and Paramount. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Important Information About the Transactions and Where To Find It

In connection with the proposed transactions involving Paramount, Skydance and NAI (the “Transactions”), Paramount will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include an information statement on Schedule 14C and that will also constitute a prospectus of Paramount. Paramount may also file other documents with the SEC regarding the Transactions.

This document is not a substitute for the information statement/prospectus or registration statement or any other document that Paramount may file with the SEC. INVESTORS AND SECURITY HOLDERS OF PARAMOUNT ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE THE INFORMATION STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement on Form S-4 (when available), which will include the information statement/prospectus, and other documents filed with the SEC by Paramount through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Paramount (+1-646-824-5450; jaime.morris@paramount.com).

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Cautionary Notes on Forward-Looking Statements

This communication contains both historical and forward-looking statements, including statements related to our future results, performance and achievements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect our current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “may,” “could,” “estimate” or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause our actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements.

Important risk factors that may cause such a difference include, but are not limited to: (i) that the Transactions may not be completed on anticipated terms and timing (or at all), (ii) that a condition to closing of the Transactions may not be satisfied, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) that the anticipated tax treatment of the Transactions may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the Transactions, (v) potential litigation relating to the Transactions that could be instituted against Paramount or its directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions, (vii) any negative effects of the announcement, pendency or consummation of the Transactions on the market price of Paramount’s common stock and on Paramount’s or Skydance’s operating results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the Transactions, (ix) the risks and costs associated with the integration of, and the ability of Paramount and Skydance to integrate, the businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the Transactions will harm Paramount’s business, including current plans and operations or by diverting management’s attention Paramount’s ongoing business operations, (xi) the ability of Paramount to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, (xiii) the other risks described in Paramount’s most recent annual report on Form 10-K and quarterly report on Form 10-Q, and (xiv) management’s response to any of the aforementioned factors. There may be additional risks, uncertainties and factors that we do not currently view as material or that are not necessarily known.

These risks, as well as other risks associated with the Transactions, will be more fully discussed in the information statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Transactions. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 is, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Paramount’s consolidated financial condition, results of operations, credit rating or liquidity. The forward-looking statements included in this communication are made only as of the date of this communication, and we do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by applicable law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| PARAMOUNT GLOBAL |

| | |

| By: | /s/ Caryn K. Groce |

| Name: | Caryn K. Groce |

| Title: | Executive Vice President, |

| | Acting General Counsel and Secretary |

Date: July 8, 2024

Exhibit 99.1

SKYDANCE MEDIA AND PARAMOUNT GLOBAL SIGN DEFINITIVE AGREEMENT TO ADVANCE PARAMOUNT AS A WORLD-CLASS MEDIA AND TECHNOLOGY ENTERPRISE

ELLISON FAMILY AND REDBIRD CAPITAL PARTNERS TO INVEST OVER $8 BILLION

IN NEW PARAMOUNT AND TO ACQUIRE NATIONAL AMUSEMENTS, INC.

PARAMOUNT CLASS A STOCKHOLDERS TO RECEIVE $23 PER SHARE IN CASH/STOCK ELECTION, CLASS B STOCKHOLDERS TO RECEIVE $15 PER SHARE IN CASH/STOCK ELECTION; CASH CONSIDERATION AVAILABLE TO PUBLIC SHAREHOLDERS TOTALS $4.5 BILLION

•Next generation leadership team to take helm, led by David Ellison as Chairman and Chief Executive Officer, and Jeff Shell as President; Skydance plans to enhance and reinvigorate marquee Paramount and CBS brands

•New Paramount will be a creative-driven destination for storytellers dedicated to delivering top-quality content

•Paramount’s premier content platform to be enhanced and powered by best-in-class technology and modernized infrastructure offering scalability and ingenuity focused on delivering content through wholly-owned DTC platforms of Paramount+ and Pluto while enhancing CBS and Paramount’s linear networks

•Ellison team plans to reposition Paramount to improve profitability, foster stability and independence for creators, and enable more investment in faster growing digital platforms

•Skydance will merge with Paramount in an all-stock transaction, valuing Skydance at $4.75 billion; Skydance equity holders will receive 317 million Class B Shares valued at $15 per share

•Skydance Investor Group, comprised of the Ellison Family and RedBird Capital Partners, to invest $2.4 billion to acquire National Amusements for cash and $4.5 billion for the stock/cash merger consideration to be paid for publicly traded Class A shares and Class B shares, as well as $1.5 billion of primary capital to be added to Paramount’s balance sheet

•Post transaction close, Skydance Investor Group will own 100% of New Paramount Class A Shares and 69% of outstanding Class B shares, or approximately 70% of the pro forma shares outstanding

•The per share cash election amount to be offered to Paramount’s stockholders represents a 48% premium to the price of the Class B stock as of July 1, 2024, and a 28% premium to the Class A stock on the same date. By continuing to own shares of the newly combined company, Paramount Class B stockholders will have the opportunity to participate in New Paramount’s long-term value creation potential

•Skydance and Paramount to host investor call at 8:30 a.m. Eastern on July 8, 2024

LOS ANGELES, CA AND NEW YORK, NY – July 7, 2024 – Skydance Media (“Skydance”) and Paramount Global (NASDAQ: PARA, PARAA) (“Paramount”) today announced that they have entered into a definitive agreement to form “New Paramount” – a next-generation media and technology leader, through a two-step transaction including the acquisition of National Amusements, Inc. (“NAI”), which holds the controlling share stake in Paramount, and subsequently a merger of Skydance and Paramount Global.

The transaction combines the Skydance Investor Group’s (“Skydance IG”) financial resources, deep operating experience, and expertise in cutting-edge technology with Paramount’s iconic IP, deep film and television library, proven hit-making capabilities, and linear and streaming platforms that reach millions of viewers. New Paramount will be a premier, creative-first destination for storytellers, dedicated to top-quality content and will be positioned to improve profitability, foster stability and independence for creators, and enable more investment in growth areas. The transaction will stabilize and strengthen Paramount as a world-class media enterprise, with a focus on technological advancements, across multiple entertainment platforms including animation, gaming, film, sports, news and television.

The management team of New Paramount, led by David Ellison as Chairman and Chief Executive Officer and Jeff Shell as President, will draw on a wealth of operational experience and proven expertise in driving creative and media company growth designed to improve Paramount’s performance and foster further advancement.

Shari Redstone, Chair of Paramount Global and Chair, President, and CEO of National Amusements, Inc. said, “In 1987, my father, Sumner Redstone, acquired Viacom and began assembling and growing the businesses today known as Paramount Global. He had a vision that "content was king" and was always committed to delivering great content for all audiences around the world. That vision has remained at the core of Paramount’s success and our accomplishments are a direct result of the incredibly talented, creative, and dedicated individuals who work at the company. Given the changes in the industry, we want to fortify Paramount for the future while ensuring that content remains king. Our hope is that the Skydance transaction will enable Paramount’s continued success in this rapidly changing environment. As a longtime production partner to Paramount, Skydance knows Paramount well and has a clear strategic vision and the resources to take it to its next stage of growth. We believe in Paramount and we always will.”

Importantly, the transaction preserves the over 100-year-old legacy of Paramount as one of Hollywood’s most iconic production companies and CBS’s stature as a cherished source of news and entertainment. It also preserves American jobs, fosters continued innovation and secures a prosperous future for the creative community at Paramount, while protecting the legacy that viewers across the globe know and love.

With a 15-year history of partnering on highly successful projects, the Skydance-Paramount combination will unite key intellectual property and enhance Paramount’s exposure in cutting-edge and next-generation digital businesses. Skydance’s exceptional pool of in-house creative animation talent, led by pioneer John Lasseter, will expand Paramount’s animation capabilities as well as consumer products opportunities over the long-term.

Skydance offers Paramount critical investment and significant entrees into burgeoning new entertainment and media verticals with clear economic upsides. For example, Skydance brings state-of-the-art interactive and gaming proficiencies, including two in-house game developer studios with industry-leading franchises, such as Skydance’s upcoming console games in Marvel and Star Wars and hit VR game, The Walking Dead. Skydance also brings an exciting partnership with the NFL, which complements the resources of CBS and its local affiliates, creating a premier global multi-sports studio. As a long-term global rights buyer with expansive distribution across both direct-to-consumer and linear channels, Paramount’s value proposition will be complemented as a result of the transaction.

David Ellison, Founder and Chief Executive Officer of Skydance said: “This is a defining and transformative time for our industry and the storytellers, content creators and financial stakeholders who are invested in the Paramount legacy and the longevity of the entertainment economy. I am incredibly grateful to Shari Redstone and her family who have agreed to entrust us with the opportunity to lead Paramount. We are committed to energizing the business and bolstering Paramount with contemporary technology, new leadership and a creative discipline that aims to enrich generations to come.”

Gerry Cardinale, Founder and Managing Partner of RedBird Capital said: “The recapitalization of Paramount and combination with Skydance under David Ellison’s leadership will be an important moment in the entertainment industry at a time when incumbent media companies are increasingly challenged by technological disintermediation. As one of the iconic media brands and libraries in Hollywood, Paramount has the intellectual property foundation to ensure longevity through this evolution – but it will require a new generation of visionary leadership together with experienced operational management to navigate this next phase. RedBird is making a substantial financial investment in partnership with the Ellison family because we believe that the pro forma company under this leadership team will be the pace car for how these incumbent legacy media businesses will need to be run in the future.”

On behalf of the Special Committee, Charles E. Phillips, Jr. said: “We are pleased to have reached an agreement that we believe delivers to Paramount stockholders both immediate value and future upside opportunity. The Special Committee, with the assistance of independent financial and legal advisors, conducted a thorough review of actionable potential transactions to drive value for our stockholders. In addition to economic value, the Special Committee took into account the certainty of closing and regulatory approvals. Following extensive negotiations with Skydance, we believe this proposed transaction will position Paramount for success in a rapidly evolving industry landscape. Upon closing, it will deliver immediate cash consideration at a premium to both the minority Class A and Class B stockholders, who will also benefit from what we believe to be considerable upside through continued equity participation in New Paramount.”

Mr. Phillips continued, “The Special Committee would like to thank our Co-CEOs George Cheeks, Chris McCarthy and Brian Robbins for making significant progress on optimizing company operations in a short period of time, positioning Paramount for a sustainable transformation and a path to profitable growth going forward.”

Transaction Overview

The proposed merger creates immediate value, upside opportunity and stability for all of Paramount’s stockholders and employees during a period of industry transition. Under the terms of the agreement, which has been approved by the Paramount Board of Directors, acting on the unanimous recommendation of the Special Committee, and by National Amusements, Inc. (“NAI”), majority owner of Paramount’s Class A stock, Skydance will merge with Paramount in a transaction valuing New Paramount at an enterprise value of approximately $28 billion. Existing Skydance investors will receive 317 million newly issued Class B shares in New Paramount valuing Skydance at $4.75 billion based on $15 per Paramount Class B share.

Skydance IG, led by the Ellison Family and RedBird Capital Partners, will invest up to $6 billion to:

1.Offer Class A stockholders other than NAI an election to receive in the merger $23 cash per share or 1.5333 shares of Class B stock of New Paramount;

2.Offer Class B stockholders other than NAI an election to receive in the merger $15 cash per share or one share of Class B stock of New Paramount, subject to proration if Class B elections exceed $4.3 billion in the aggregate (approximately 48% of the non-NAI float as of the date of this release);

3.Use the additional capital to paydown debt and re-capitalize the balance sheet of New Paramount to support strategic initiatives.

The merger consideration represents a 48% premium to the price of the Class B stock as of July 1, 2024, and a 28% premium to the Class A stock on the same date. Also, by continuing to own shares of the new combined company, Paramount Class B stockholders will have the opportunity to participate in the new company's long-term value creation potential.

NAI and its owners have entered into a definitive agreement to sell NAI to Skydance IG for $2.4 billion on a cash-free, debt-free basis. Following completion of the transaction, only Skydance IG will hold Class A shares.

Following the close of the transaction and the growth equity investment and assuming full participation in the cash election by Class B stockholders, Class B stockholders will own approximately 30% of the outstanding equity of New Paramount and Skydance IG will own approximately 70% of the outstanding equity of New Paramount.

Management Team and Synergies

When the transaction closes, David Ellison will become Chairman and Chief Executive Officer. Jeff Shell, Chairman of RedBird Sports & Media and former CEO of NBCUniversal, will be President. Mr. Ellison, as the founder and Chief Executive Officer of Skydance, brings hands-on experience in building a successful creative media and technology-enabled enterprise, with a proven track record of strong content development including runaway hits like Top Gun: Maverick. Mr. Shell brings deep operational expertise in leading and transforming media and entertainment businesses.

The transaction will strengthen Paramount and enhance its balance sheet flexibility, allowing the Company to invest in new initiatives and deliver greater cash flow growth. The transaction serves as a catalyst to re-imagine the Company’s operating model, transform its technology platform, streamline its organization and accelerate other initiatives already underway.

The overriding objective of the repositioned New Paramount platform and properties is to bring stability to the business, protect creative independence and to enable investment in growth initiatives.

Board Approval

On January 2, 2024, the Board of Directors of Paramount formed a Special Committee of independent directors to evaluate strategic alternatives, including third party proposals. The Special Committee reviewed, negotiated, unanimously approved and recommended the Skydance transaction for approval by the Board. Following formal approval by the Board, the Transaction Agreement was signed.

Transaction Approvals

NAI, which holds approximately 77% of the Paramount Class A shares, has delivered a written consent approving the transaction. No further stockholder approval is required. The consummation of the transaction is not subject to any financing condition. Completion of this transaction is subject to regulatory approvals and other customary closing conditions. The transaction is anticipated to close in the first half of 2025.

“Go-Shop” and Further Information

The definitive Transaction Agreement includes a 45-day go-shop period during which the Special Committee of Paramount’s Board of Directors, with the assistance of its financial advisors, will be permitted to actively solicit and evaluate alternative acquisition proposals. There can be no assurance that this process will result in a superior proposal, and Paramount does not intend to disclose developments with respect to the go-shop process unless and until it determines such disclosure is appropriate or is otherwise required.

Further information regarding terms and conditions contained in the Transaction Agreement will be made available in the Company’s Current Report on Form 8-K, to be filed in connection with this transaction.

Investor Call Details

Skydance and Paramount will host a call to discuss the transaction with securities analysts on Monday, July 8, 2024, at 8:30 a.m. ET. A webcast of the meeting will be available in a listen-only mode to individual investors, media, and other interested parties via edge.media-server.com/mmc/p/vrzasxwd or on Paramount’s website at ir.paramount.com under the “Investors” section. Presentation materials for the call will be available prior to the call at approximately 8:15 a.m. ET and located under “Events and Presentations” in the “Investors” section on the Paramount website.

Advisors

RedBird Advisors, BofA Securities, Inc., Moelis & Company LLC and The Raine Group serve as financial advisors to Skydance and the Investor Group. Latham & Watkins LLP serves as legal counsel to Skydance and the Investor Group. Sullivan & Cromwell LLP serves as legal counsel to RedBird Capital Partners. BDT & MSD Partners serves as financial advisor to National Amusements, Inc. and Ropes & Gray LLP serves as legal counsel. Centerview Partners LLC serves as financial advisor to the Paramount Special Committee and Cravath, Swaine & Moore LLP serves as legal counsel. Rothschild & Co serves as financial advisor to Paramount Global and Simpson Thacher & Bartlett LLP serves as legal counsel.

About Skydance

Skydance is the diversified media company founded by David Ellison in 2010 to create high-quality, event-level entertainment for global audiences. The company first launched with Feature Films and has since strategically expanded to include Television, Games, Animation, and Sports, with studios in Los Angeles, Silicon Valley, Spain, and Canada. In total, Skydance’s films have earned more than $8 billion at the worldwide box office and include the box office record-breaking and Academy Award winning film Top Gun: Maverick. The studio’s other recent releases include Mission: Impossible - Dead Reckoning and Transformers: Rise of the Beasts; as well as, The Family Plan on Apple TV+; The Adam Project and The Old Guard on Netflix, and The Tomorrow War on Prime Video. The studio’s upcoming film slate includes The Gorge, Mayday, and Fountain of Youth for Apple TV+; The Old Guard 2 for Netflix; and the eighth installment of the Mission: Impossible global franchise.

Skydance Television is a leading supplier of premium scripted content across a range of platforms including Netflix, Amazon Prime Video, and Apple TV+. The studio’s current slate includes the Emmy-nominated series Grace and Frankie, which became Netflix’s longest running series following the release of its final season last year, as well as Foundation, Reacher, Tom Clancy’s Jack Ryan, Cross, The Big Door Prize, and FUBAR. Skydance Games delivers blockbuster gaming experiences of all kinds and is known for high-quality visuals and rich narratives. Encompassing each of the company’s two gaming studios, the Skydance Games’ portfolio holds award-winning titles across console, VR, PC, and mobile, including Archangel and The Walking Dead: Saints & Sinners, and the upcoming Skydance’s Behemoth, Marvel 1943: Rise of Hydra, and a collaboration with Lucasfilm Games set in the legendary Star Wars galaxy.

Skydance Animation develops and produces high-end feature films and television series with full production capability across two studios in Los Angeles and Madrid. In addition to the studio’s first animated feature, Luck, Skydance Animation’s slate includes the upcoming feature films Spellbound, Pookoo, Ray Gunn and an untitled Jack and the Beanstalk project for Netflix and the series WondLa for Apple TV+.

Skydance Sports, the joint venture between the NFL and Skydance, develops premium scripted and unscripted sports-related content, documentaries, and events. The Sports studios’ slate includes NFL Draft: The Pick Is In, Kelce, Hard Knocks: Offseason with the New York Giants, and the Golden Globe nominated feature Air as well as an upcoming docuseries chronicling the Dallas Cowboys’ dynasty and franchise owner Jerry Jones and Holiday Touchdown: A Chiefs Love Story for the Hallmark Channel.

About Paramount

Paramount Global (NASDAQ: PARA, PARAA) is a leading global media, streaming and entertainment company that creates premium content and experiences for audiences worldwide. Driven by iconic consumer brands, Paramount's portfolio includes CBS, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+ and Pluto TV. Paramount holds one of the industry's most extensive libraries of TV and film titles. In addition to offering innovative streaming services and digital video products, the company provides powerful capabilities in production, distribution, and advertising solutions.

For more information about Paramount, please visit www.paramount.com and follow @ParamountCo on social platforms.

About National Amusements, Inc.

National Amusements, Inc. is a world leader in the motion picture exhibition industry operating 759 movie screens in the U.S., U.K. and Latin America. National Amusements delivers a superior entertainment experience in theatres around the world under its Showcase, Cinema de Lux, Multiplex, SuperLux and UCI brands. Based in Norwood, Massachusetts, National Amusements is a closely held company operating under the fourth generation of leadership by the Redstone family, through which they have been the majority voting shareholders of Paramount Global for more than 35 years. National Amusements, directly and through subsidiaries, owns 77.4% of the Class A (voting) common stock of Paramount Global and 5.1% of the Class B common stock, constituting approximately 9.5% of the overall equity of the Company.

About RedBird Capital Partners

RedBird Capital Partners is a private investment firm that builds high-growth companies with strategic capital solutions to founders and entrepreneurs. The firm currently manages $10 billion in assets on behalf of a global group of blue-chip institutional and family office investors. Founded in 2014 by Gerry Cardinale, RedBird integrates sophisticated private equity investing with a hands-on business-building mandate that focuses on three core industry verticals – Sports, Media & Entertainment, and Financial Services. Over his 30-year investment career, Cardinale has partnered with founders and entrepreneurs to build some of the most iconic growth companies in their respective industries. For more information, please go to www.redbirdcap.com.

Important Information About the Transactions and Where to Find It

In connection with the proposed transactions involving Paramount, Skydance and NAI (the “Transactions”), Paramount will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include an information statement on Schedule 14C and that will also constitute a prospectus of Paramount. Paramount may also file other documents with the SEC regarding the Transactions.

This document is not a substitute for the information statement/prospectus or registration statement or any other document that Paramount may file with the SEC. INVESTORS AND SECURITY HOLDERS OF PARAMOUNT ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE THE INFORMATION STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement on Form S-4 (when available), which will include the information statement/prospectus, and other documents filed with the SEC by Paramount through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Paramount (+1-646-824-5450; jaime.morris@paramount.com).

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in an jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Cautionary Notes on Forward-Looking Statements

This communication contains both historical and forward-looking statements, including statements related to our future results, performance and achievements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect our current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “may,” “could,” “estimate” or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause our actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. Important risk factors that may cause such a difference include, but are not limited to: (i) that the Transactions may not be completed on anticipated terms and timing (or at all), (ii) that a condition to closing of the Transactions may not be satisfied, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) that the anticipated tax treatment of the Transactions may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the Transactions, (v) potential litigation relating to the Transactions that could be instituted against Paramount or its directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions, (vii) any negative effects of the announcement, pendency or consummation of the Transactions on the market price of Paramount’s common stock and on Paramount’s or Skydance’s operating results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the Transactions, (ix) the risks and costs associated with the integration of, and the ability of Paramount and Skydance to integrate, the businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the Transactions will harm Paramount’s business, including current plans and operations or by diverting management’s attention Paramount’s ongoing business operations, (xi) the ability of Paramount to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, (xiii) the other risks described in Paramount’s most recent annual report on Form 10-K and quarterly report on Form 10-Q, and (xiv) management’s response to any of the aforementioned factors. There may be additional risks, uncertainties and factors that we do not currently view as material or that are not necessarily known.

These risks, as well as other risks associated with the Transactions, will be more fully discussed in the information statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Transactions. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 is, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational

problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Paramount’s consolidated financial condition, results of operations, credit rating or liquidity. The forward-looking statements included in this communication are made only as of the date of this communication, and we do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by applicable law.

Contacts:

Skydance Media & RedBird Capital

Melissa Zukerman

Principal Communications Group

melissa@pcommgroup.com

(323) 658-1555

Dan Gagnier

Gagnier Communications

skydance@gagnierfc.com

(646) 569-5897

Paramount Global

Media:

Justin Dini

Executive Vice President, Head of Communications

(212) 846-2724

justin.dini@paramount.com

Allison McLarty

Senior Vice President, Corporate and Financial Communications

(323) 376-7903

allison.mclarty@paramount.com

Investors:

Jaime Morris

Executive Vice President, Investor Relations

(646) 824-5450

jaime.morris@paramount.com

National Amusements

Molly Morse / Daniel Hoadley

(212) 521-4826 / (212) 521-4850

molly.morse@kekstcnc.com / daniel.hoadley@kekstcnc.com

Exhibit 99.2

PARAMOUNT GLOBAL’S SPECIAL COMMITTEE UNANIMOUSLY APPROVES

MERGER WITH SKYDANCE MEDIA

NEW YORK, July 7, 2024 – The Special Committee of the Board of Directors (the “Special Committee”) of Paramount Global (NASDAQ: PARA, PARAA) (“Paramount” or “the Company”) today confirmed that it has unanimously approved a merger agreement between Paramount and Skydance Media, LLC (“Skydance”).

The Special Committee was formed on January 2, 2024, at the request of Paramount’s controlling stockholder, National Amusements, Inc. (“NAI”), to evaluate potential transactions involving both NAI and Paramount as NAI considered its options relating to its investment in Paramount. The Special Committee retained independent financial and legal advisors, Centerview Partners LLC and Cravath, Swaine & Moore LLP respectively. Over a period of more than six months, the Special Committee considered multiple approaches and constructs from various counterparties and solicited interest from potential counterparties for an acquisition of Paramount.

The merger agreement includes a 45-day “go-shop” period, which permits the Special Committee and its representatives to actively solicit and consider alternative acquisition proposals. There can be no assurance that this process will result in a superior proposal, and the Company does not intend to disclose developments with respect to the go-shop process unless and until it determines such disclosure is appropriate or is otherwise required.

On behalf of the Special Committee, Charles E. Phillips, Jr. said: “We are pleased to have reached an agreement that we believe delivers to Paramount stockholders both immediate value and future upside opportunity. The Special Committee, with the assistance of independent financial and legal advisors, conducted a thorough review of actionable potential transactions to drive value for our stockholders. In addition to economic value, the Special Committee took into account the certainty of closing and regulatory approvals. Following extensive negotiations with Skydance, we believe this proposed transaction will position Paramount for success in a rapidly evolving industry landscape. Upon closing, it will deliver immediate cash consideration at a premium to both the minority Class A and Class B stockholders, who will also benefit from what we believe to be considerable upside through continued equity participation in New Paramount.”

Mr. Phillips continued, “The Special Committee would like to thank our Co-CEOs George Cheeks, Chris McCarthy and Brian Robbins for making significant progress on optimizing company operations in a short period of time, positioning Paramount for a sustainable transformation and a path to profitable growth going forward.”

Further information regarding terms and conditions contained in the merger agreement will be available on the investor relations section of Paramount’s website at https://ir.paramount.com/ and in a joint press release issued earlier today by Paramount and Skydance.

Important Information About the Transactions and Where To Find It

In connection with the proposed transactions involving Paramount, Skydance and NAI (the “Transactions”), Paramount will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include an information statement on Schedule 14C and that will also constitute a prospectus of Paramount. Paramount may also file other documents with the SEC regarding the Transactions.

This document is not a substitute for the information statement/prospectus or registration statement or any other document that Paramount may file with the SEC. INVESTORS AND SECURITY HOLDERS OF PARAMOUNT ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE

THE INFORMATION STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement on Form S-4 (when available), which will include the information statement/prospectus, and other documents filed with the SEC by Paramount through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Paramount (+1-646-824-5450; jaime.morris@paramount.com).

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Cautionary Notes on Forward-Looking Statements

This communication contains both historical and forward-looking statements, including statements related to our future results, performance and achievements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect our current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “may,” “could,” “estimate” or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause our actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements.

Important risk factors that may cause such a difference include, but are not limited to: (i) that the Transactions may not be completed on anticipated terms and timing (or at all), (ii) that a condition to closing of the Transactions may not be satisfied, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) that the anticipated tax treatment of the Transactions may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the Transactions, (v) potential litigation relating to the Transactions that could be instituted against Paramount or its directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions, (vii) any negative effects of the announcement, pendency or consummation of the Transactions on the market price of Paramount’s common stock and on Paramount’s or Skydance’s operating results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the Transactions, (ix) the risks and costs associated with the integration of, and the ability of Paramount and Skydance to integrate, the businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the Transactions will harm Paramount’s business, including current plans and operations or by diverting management’s attention Paramount’s ongoing business operations, (xi) the ability of Paramount to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, (xiii) the other risks described in Paramount’s most recent annual report on Form 10-K and quarterly report on Form 10-Q, and (xiv)

management’s response to any of the aforementioned factors. There may be additional risks, uncertainties and factors that we do not currently view as material or that are not necessarily known.

These risks, as well as other risks associated with the Transactions, will be more fully discussed in the information statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Transactions. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 is, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Paramount’s consolidated financial condition, results of operations, credit rating or liquidity. The forward-looking statements included in this communication are made only as of the date of this communication, and we do not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by applicable law.

Contact:

Brunswick Group

ParamountSpecialCommittee@brunswickgroup.com

(212) 333 – 3810

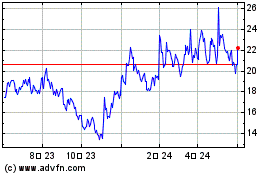

Paramount Global (NASDAQ:PARAA)

過去 株価チャート

から 10 2024 まで 11 2024

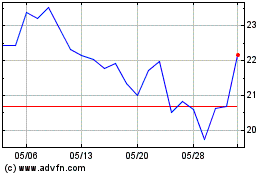

Paramount Global (NASDAQ:PARAA)

過去 株価チャート

から 11 2023 まで 11 2024