false

2023

Q3

--12-31

0001527352

0001527352

2023-01-01

2023-09-30

0001527352

NXL:CommonStockParValue0.001PerShareMember

2023-01-01

2023-09-30

0001527352

NXL:WarrantsExercisableForOneShareOfCommonStockMember

2023-01-01

2023-09-30

0001527352

2023-11-10

0001527352

2023-09-30

0001527352

2022-12-31

0001527352

2023-07-01

2023-09-30

0001527352

2022-07-01

2022-09-30

0001527352

2022-01-01

2022-09-30

0001527352

us-gaap:CommonStockMember

2021-12-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001527352

us-gaap:RetainedEarningsMember

2021-12-31

0001527352

2021-12-31

0001527352

us-gaap:CommonStockMember

2022-03-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001527352

us-gaap:RetainedEarningsMember

2022-03-31

0001527352

2022-03-31

0001527352

us-gaap:CommonStockMember

2022-06-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001527352

us-gaap:RetainedEarningsMember

2022-06-30

0001527352

2022-06-30

0001527352

us-gaap:CommonStockMember

2022-12-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001527352

us-gaap:RetainedEarningsMember

2022-12-31

0001527352

us-gaap:CommonStockMember

2023-03-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001527352

us-gaap:RetainedEarningsMember

2023-03-31

0001527352

2023-03-31

0001527352

us-gaap:CommonStockMember

2023-06-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001527352

us-gaap:RetainedEarningsMember

2023-06-30

0001527352

2023-06-30

0001527352

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001527352

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001527352

2022-01-01

2022-03-31

0001527352

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001527352

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001527352

2022-04-01

2022-06-30

0001527352

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-09-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001527352

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001527352

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001527352

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001527352

2023-01-01

2023-03-31

0001527352

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001527352

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001527352

2023-04-01

2023-06-30

0001527352

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001527352

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001527352

us-gaap:CommonStockMember

2022-09-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001527352

us-gaap:RetainedEarningsMember

2022-09-30

0001527352

2022-09-30

0001527352

us-gaap:CommonStockMember

2023-09-30

0001527352

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001527352

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001527352

us-gaap:RetainedEarningsMember

2023-09-30

0001527352

us-gaap:IPOMember

2022-09-01

2022-09-20

0001527352

us-gaap:CommonStockMember

2022-09-01

2022-09-20

0001527352

us-gaap:WarrantMember

2022-09-01

2022-09-20

0001527352

2022-09-20

0001527352

2022-09-01

2022-09-20

0001527352

us-gaap:OverAllotmentOptionMember

2022-09-01

2022-09-20

0001527352

NXL:NexalinMember

2023-09-30

0001527352

NXL:DeviceSalesMember

2023-07-01

2023-09-30

0001527352

NXL:DeviceSalesMember

2022-07-01

2022-09-30

0001527352

NXL:LicensingFeeMember

2023-07-01

2023-09-30

0001527352

NXL:LicensingFeeMember

2022-07-01

2022-09-30

0001527352

us-gaap:EquipmentMember

2023-07-01

2023-09-30

0001527352

us-gaap:EquipmentMember

2022-07-01

2022-09-30

0001527352

NXL:OtherMember

2023-07-01

2023-09-30

0001527352

NXL:OtherMember

2022-07-01

2022-09-30

0001527352

NXL:DeviceSalesMember

2023-01-01

2023-09-30

0001527352

NXL:DeviceSalesMember

2022-01-01

2022-09-30

0001527352

NXL:LicensingFeeMember

2023-01-01

2023-09-30

0001527352

NXL:LicensingFeeMember

2022-01-01

2022-09-30

0001527352

NXL:RoyaltyFeeMember

2023-01-01

2023-09-30

0001527352

NXL:RoyaltyFeeMember

2022-01-01

2022-09-30

0001527352

us-gaap:EquipmentMember

2023-01-01

2023-09-30

0001527352

us-gaap:EquipmentMember

2022-01-01

2022-09-30

0001527352

NXL:OtherMember

2023-01-01

2023-09-30

0001527352

NXL:OtherMember

2022-01-01

2022-09-30

0001527352

country:US

2023-07-01

2023-09-30

0001527352

country:US

2022-07-01

2022-09-30

0001527352

country:CN

2023-07-01

2023-09-30

0001527352

country:CN

2022-07-01

2022-09-30

0001527352

country:US

2023-01-01

2023-09-30

0001527352

country:US

2022-01-01

2022-09-30

0001527352

country:CN

2023-01-01

2023-09-30

0001527352

country:CN

2022-01-01

2022-09-30

0001527352

us-gaap:PatentsMember

2023-09-30

0001527352

us-gaap:PatentsMember

2022-12-31

0001527352

us-gaap:ShortTermInvestmentsMember

2023-09-30

0001527352

us-gaap:ShortTermInvestmentsMember

2023-01-01

2023-09-30

0001527352

us-gaap:ShortTermInvestmentsMember

2022-12-31

0001527352

us-gaap:ShortTermInvestmentsMember

2022-01-01

2022-12-31

0001527352

2022-01-01

2022-12-31

0001527352

us-gaap:FairValueInputsLevel1Member

2023-09-30

0001527352

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001527352

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001527352

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001527352

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001527352

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001527352

us-gaap:WarrantMember

2023-07-01

2023-09-30

0001527352

us-gaap:WarrantMember

2022-07-01

2022-09-30

0001527352

us-gaap:WarrantMember

2023-01-01

2023-09-30

0001527352

us-gaap:WarrantMember

2022-01-01

2022-09-30

0001527352

NXL:WiderMember

2023-09-30

0001527352

2020-04-01

2020-04-06

0001527352

2018-09-21

0001527352

2020-12-31

0001527352

2020-01-01

2020-12-31

0001527352

NXL:WiderMember

2023-01-01

2023-09-30

0001527352

NXL:WiderMember

2022-01-01

2022-09-30

0001527352

NXL:WiderMember

2023-07-01

2023-09-30

0001527352

NXL:WiderMember

2022-07-01

2022-09-30

0001527352

NXL:USAsianConsultingGroupLLCMember

2018-05-01

2018-05-09

0001527352

NXL:USAsianConsultingGroupLLCMember

NXL:ConsultingAgreementMember

2023-01-01

2023-09-30

0001527352

NXL:USAsianConsultingGroupLLCMember

2023-09-30

0001527352

NXL:USAsianConsultingGroupLLCMember

2022-12-31

0001527352

2023-06-28

2023-07-02

0001527352

srt:ChiefExecutiveOfficerMember

2021-10-30

2021-11-02

0001527352

srt:ChiefExecutiveOfficerMember

2021-11-02

0001527352

2023-03-17

0001527352

NXL:LoansPayableOfficerMember

2023-01-01

2023-09-30

0001527352

NXL:LoansPayableOfficerMember

2022-01-01

2022-09-30

0001527352

2023-05-17

0001527352

2023-04-26

0001527352

NXL:LegacyVenturesInternationalIncMember

2017-09-11

0001527352

NXL:LegacyVenturesInternationalIncMember

2017-09-01

2017-09-11

0001527352

NXL:LegacyVenturesInternationalIncMember

2023-01-01

2023-09-30

0001527352

NXL:LegacyVenturesInternationalIncMember

2022-01-01

2022-09-30

0001527352

NXL:LegacyVenturesInternationalIncMember

2023-07-01

2023-09-30

0001527352

NXL:LegacyVenturesInternationalIncMember

2022-07-01

2022-09-30

0001527352

NXL:LegacyVenturesInternationalIncMember

2023-09-30

0001527352

NXL:LegacyVenturesInternationalIncMember

2022-12-31

0001527352

NXL:AnInvestorMember

2022-07-01

2022-09-30

0001527352

NXL:AnInvestorMember

2022-01-01

2022-09-30

0001527352

NXL:OutsideConsultantsMember

2022-01-01

2022-09-30

0001527352

NXL:USAsianMember

2022-01-01

2022-09-30

0001527352

NXL:BoardMembersMember

2022-01-01

2022-09-30

0001527352

NXL:Range1Member

2023-09-30

0001527352

NXL:Range1Member

2023-01-01

2023-09-30

0001527352

NXL:Range2Member

2023-09-30

0001527352

NXL:Range2Member

2023-01-01

2023-09-30

0001527352

2023-10-01

2023-10-13

0001527352

2022-01-02

0001527352

NXL:ThreeCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2023-09-30

0001527352

NXL:ThreeCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-07-01

2022-09-30

0001527352

NXL:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-09-30

0001527352

NXL:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:FourCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001527352

NXL:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2023-09-30

0001527352

NXL:CustomerAMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2023-09-30

0001527352

NXL:CustomerBMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2023-09-30

0001527352

NXL:CustomerCMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001527352

NXL:CustomerAMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001527352

NXL:CustomerBMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001527352

NXL:CustomerCMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001527352

NXL:CustomerDMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Quarterly Period Ended September 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to _______.

Commission

file number: 001-41507

NEXALIN TECHNOLOGY, INC.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

27-5566468 |

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

1776 Yorktown, Suite 550

Houston,

TX 77056

|

|

77056 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (832) 260-0222

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

NXL |

|

The

Nasdaq Capital Market |

| Warrants,

exercisable for one share of Common Stock |

|

NXLIW |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐

No

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company,

and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large

Accelerated Filer |

☐ |

Accelerated

Filer |

☐ |

| Non-Accelerated Filer |

☒ |

Smaller

Reporting Company |

☒ |

| |

|

Emerging

Growth Company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

No

As

of November 10, 2023, there were 7,436,562 shares of the Registrant’s common stock outstanding.

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

FORM

10-Q

For

the Quarter Ended September 30, 2023

PART

I—FINANCIAL INFORMATION

Item

1. Financial Statements

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

| | | |

| | |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current

Assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 361,397 | | |

$ | 162,743 | |

| Short-term

investments | |

| 3,575,805 | | |

| 6,831,192 | |

| Accounts

receivable (Includes related party of $10,207 and $0, respectively) | |

| 14,483 | | |

| 4,875 | |

| Inventory | |

| 158,619 | | |

| 154,370 | |

| Prepaid

expenses and other current assets | |

| 153,045 | | |

| 272,282 | |

| Total

Current Assets | |

| 4,263,349 | | |

| 7,425,462 | |

| ROU

Asset | |

| 1,963 | | |

| 6,171 | |

| Equipment,

net of accumulated depreciation of $2,583 and $2,181, respectively | |

| 100 | | |

| 503 | |

| Patent,

net of amortization | |

| 72,355 | | |

| - | |

| Equity

Method Investment | |

| 96,000 | | |

| - | |

| Total

Assets | |

$ | 4,433,767 | | |

$ | 7,432,136 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current

Liabilities: | |

| | | |

| | |

| Accounts

payable (Includes related party of $0 and $260,000, respectively) | |

$ | 72,549 | | |

$ | 658,367 | |

| Accrued

expenses | |

| 606,891 | | |

| 539,822 | |

| Lease

liability, current portion | |

| 17,635 | | |

| 50,797 | |

| Loan

payable - officer | |

| - | | |

| 200,000 | |

| Note

payable | |

| 500,000 | | |

| 500,000 | |

| Total

Current Liabilities | |

| 1,197,075 | | |

| 1,948,986 | |

| Long-term

Liabilities: | |

| | | |

| | |

| Lease

liability, net of current portion | |

| - | | |

| 4,463 | |

| Total

Liabilities | |

| 1,197,075 | | |

| 1,953,449 | |

| | |

| | | |

| | |

| Commitments

and Contingencies (Note 8) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’

Equity: | |

| | | |

| | |

| Common

stock, $0.001 par value; 100,000,000 shares authorized; 7,436,562 and 7,286,562 shares issued and outstanding at September 30, 2023

and December 31, 2022, respectively | |

| 7,437 | | |

| 7,287 | |

| Accumulated

other comprehensive income | |

| 800 | | |

| 36,313 | |

| Additional

paid in capital | |

| 79,485,835 | | |

| 77,824,427 | |

| Accumulated

deficit | |

| (76,257,380 | ) | |

| (72,389,340 | ) |

| Total

Stockholders’ Equity | |

| 3,236,692 | | |

| 5,478,687 | |

| Total

Liabilities and Stockholders’ Equity | |

$ | 4,433,767 | | |

$ | 7,432,136 | |

The

accompanying footnotes are an integral part of these unaudited condensed consolidated financial statements.

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues,

net (Includes related party of $0 and $520,000 for the three months ended and $10,207 and $1,183,367 for the nine months ended respectively) | |

$ | 24,113 | | |

$ | 545,323 | | |

$ | 90,212 | | |

$ | 1,282,933 | |

| Cost

of revenues | |

| 3,973 | | |

| 187,298 | | |

| 20,457 | | |

| 356,345 | |

| Gross

profit | |

| 20,140 | | |

| 358,025 | | |

| 69,755 | | |

| 926,588 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

expenses: | |

| | | |

| | | |

| | | |

| | |

| Professional

fees | |

| 127,202 | | |

| 7,632 | | |

| 405,949 | | |

| 486,197 | |

| Salaries

and benefits | |

| 363,330 | | |

| 164,142 | | |

| 965,988 | | |

| 469,996 | |

| Selling,

general and administrative | |

| 1,945,145 | | |

| 479,445 | | |

| 2,769,641 | | |

| 1,083,809 | |

| Total

operating expenses | |

| 2,435,677 | | |

| 651,219 | | |

| 4,141,578 | | |

| 2,040,002 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

from operations | |

| (2,415,537 | ) | |

| (293,194 | ) | |

| (4,071,823 | ) | |

| (1,113,414 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other

income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Interest

income (expense), net | |

| (5,330 | ) | |

| (10,452 | ) | |

| (19,685 | ) | |

| (45,886 | ) |

| Gain

on sale of short-term investments | |

| 82,943 | | |

| - | | |

| 180,593 | | |

| - | |

| Other

income | |

| 40,735 | | |

| 168,245 | | |

| 42,875 | | |

| 168,245 | |

| Other

income - PPP loan forgiveness | |

| - | | |

| - | | |

| - | | |

| 22,916 | |

| Total

other income (expense), net | |

| 118,348 | | |

| 157,793 | | |

| 203,783 | | |

| 145,275 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

| (2,297,189 | ) | |

| (135,401 | ) | |

| (3,868,040 | ) | |

| (968,139 | ) |

| Other

comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Unrealized

loss from short-term investments | |

| (32,289 | ) | |

| - | | |

| (35,513 | ) | |

| - | |

| Comprehensive

loss | |

$ | (2,329,478 | ) | |

$ | (135,401 | ) | |

$ | (3,903,553 | ) | |

$ | (968,139 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss per share attributable to common stockholders - Basic and Diluted | |

$ | (0.31 | ) | |

$ | (0.03 | ) | |

$ | (0.53 | ) | |

$ | (0.19 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

Average Shares Outstanding - Basic and Diluted | |

| 7,415,366 | | |

| 5,186,692 | | |

| 7,330,128 | | |

| 4,994,797 | |

The

accompanying footnotes are an integral part of these unaudited condensed consolidated financial statements.

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

Accumulated

Other

Comprehensive Gain | | |

Additional | | |

| | |

Total

Stockholders’ | |

| | |

Common

Stock | | |

(Loss)

on ST | | |

Paid-in | | |

Accumulated | | |

Equity | |

| | |

Shares | | |

Amount | | |

Investments | | |

Capital | | |

Deficit | | |

(Deficit) | |

| Balance

as January 1, 2022 | |

| 4,879,923 | | |

$ | 4,880 | | |

$ | - | | |

$ | 69,004,703 | | |

$ | (70,691,524 | ) | |

$ | (1,681,941 | ) |

| Stock

issued for cash | |

| 850 | | |

| 1 | | |

| - | | |

| 5,099 | | |

| - | | |

| 5,100 | |

| Stock

compensation | |

| 24,390 | | |

| 24 | | |

| - | | |

| 97,476 | | |

| - | | |

| 97,500 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (393,249 | ) | |

| (393,249 | ) |

| Balance

as of March 31, 2022 | |

| 4,905,163 | | |

$ | 4,905 | | |

$ | - | | |

$ | 69,107,278 | | |

$ | (71,084,773 | ) | |

$ | (1,972,590 | ) |

| Stock

compensation | |

| - | | |

| - | | |

| - | | |

| 171,600 | | |

| - | | |

| 171,600 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (439,489 | ) | |

| (439,489 | ) |

| Balance

as of June 30, 2022 | |

| 4,905,163 | | |

$ | 4,905 | | |

$ | - | | |

$ | 69,278,878 | | |

$ | (71,524,262 | ) | |

$ | (2,240,479 | ) |

| Stock

Issued for cash | |

| 2,315,000 | | |

| 2,315 | | |

| - | | |

| 8,537,856 | | |

| - | | |

| 8,540,171 | |

| Stock

compensation | |

| 59,798 | | |

| 60 | | |

| - | | |

| 184,231 | | |

| - | | |

| 184,291 | |

| Related

party foregone interest | |

| - | | |

| - | | |

| - | | |

| 2,718 | | |

| - | | |

| 2,718 | |

| Warrants

issued for cash | |

| - | | |

| - | | |

| - | | |

| 3,473 | | |

| - | | |

| 3,473 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| | | |

| (135,401 | ) | |

| (135,401 | ) |

| Balance

as of September 30, 2022 | |

| 7,279,961 | | |

$ | 7,280 | | |

$ | - | | |

$ | 78,007,156 | | |

$ | (71,659,663 | ) | |

$ | 6,354,773 | |

| | |

| | |

| | |

Accumulated

Other Comprehensive Gain | | |

Additional | | |

| | |

Total | |

| | |

Common

Stock | | |

(Loss)

on ST | | |

Paid-in | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Investments | | |

Capital | | |

Deficit | | |

Equity | |

| Balance

as of January 1, 2023 | |

| 7,286,562 | | |

$ | 7,287 | | |

$ | 36,313 | | |

$ | 77,824,427 | | |

$ | (72,389,340 | ) | |

$ | 5,478,687 | |

| Other

comprehensive gain | |

| - | | |

| - | | |

| 4,756 | | |

| - | | |

| - | | |

| 4,756 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (748,414 | ) | |

| (748,414 | ) |

| Balance

as of March 31, 2023 | |

| 7,286,562 | | |

$ | 7,287 | | |

$ | 41,069 | | |

$ | 77,824,427 | | |

$ | (73,137,754 | ) | |

$ | 4,735,029 | |

| Other

comprehensive loss | |

| - | | |

| - | | |

| (7,980 | ) | |

| - | | |

| - | | |

| (7,980 | ) |

| Stock

compensation | |

| - | | |

| - | | |

| - | | |

| 88,388 | | |

| - | | |

| 88,388 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (822,437 | ) | |

| (822,437 | ) |

| Balance

as of June 30, 2023 | |

| 7,286,562 | | |

$ | 7,287 | | |

$ | 33,089 | | |

$ | 77,912,815 | | |

$ | (73,960,191 | ) | |

$ | 3,993,000 | |

| Other

comprehensive loss | |

| - | | |

| - | | |

| (32,289 | ) | |

| - | | |

| - | | |

| (32,289 | ) |

| Stock

compensation | |

| 150,000 | | |

| 150 | | |

| - | | |

| 1,573,020 | | |

| - | | |

| 1,573,170 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,297,189 | ) | |

| (2,297,189 | ) |

| Balance

as of September 30, 2023 | |

| 7,436,562 | | |

$ | 7,437 | | |

$ | 800 | | |

$ | 79,485,835 | | |

$ | (76,257,380 | ) | |

$ | 3,236,692 | |

The

accompanying footnotes are an integral part of these unaudited condensed consolidated financial statements.

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

| | | |

| | |

| | |

Nine

Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

loss | |

$ | (3,868,040 | ) | |

$ | (968,139 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Bad

debt | |

| - | | |

| 11,175 | |

| Stock

compensation | |

| 1,661,558 | | |

| 453,391 | |

| Depreciation | |

| 402 | | |

| 403 | |

| Amortization | |

| 2,105 | | |

| - | |

| Forgiveness

of interest expense | |

| - | | |

| (168,361 | ) |

| Forgiveness

of PPP Loan | |

| - | | |

| (22,916 | ) |

| Non-cash

lease expense | |

| 4,208 | | |

| 3,848 | |

| Gain

on sale of short-term investments | |

| (180,593 | ) | |

| - | |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Accounts

receivable | |

| (9,608 | ) | |

| (5,224 | ) |

| Prepaid

assets | |

| 119,237 | | |

| (274,945 | ) |

| Inventory | |

| (4,249 | ) | |

| (120,661 | ) |

| Accounts

payable - related party | |

| (260,000 | ) | |

| (149,320 | ) |

| Accounts

payable | |

| (325,818 | ) | |

| 93,819 | |

| Accrued

expenses | |

| 67,069 | | |

| 1,785 | |

| Deferred

revenue | |

| - | | |

| (130,000 | ) |

| Lease

liability | |

| (37,625 | ) | |

| (34,097 | ) |

| Net

cash (used) provided in operating activities | |

| (2,831,354 | ) | |

| (1,309,242 | ) |

| | |

| | | |

| | |

| Cash

flows from investing activities: | |

| | | |

| | |

| Sale

of short-term investments | |

| 32,671,394 | | |

| - | |

| Purchase

of short-term investments | |

| (29,270,926 | ) | |

| - | |

| Investment

in Equity Method Investment | |

| (96,000 | ) | |

| - | |

| Purchase

of patents | |

| (74,460 | ) | |

| - | |

| Net

cash provided by investing activities | |

| 3,230,008 | | |

| - | |

| | |

| | | |

| | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Sale

of common stock for cash, net of financing fees | |

| - | | |

| 8,545,270 | |

| Proceeds

from exercise of warrants | |

| - | | |

| 3,473 | |

| Payments

on loan payable - shareholder | |

| - | | |

| (37,200 | ) |

| Payments

on notes payable - officer | |

| (200,000 | ) | |

| - | |

| Net

cash (used) provided in financing activities | |

| (200,000 | ) | |

| 8,511,543 | |

| | |

| | | |

| | |

| Net

increase in cash and cash equivalents | |

| 198,654 | | |

| 7,202,301 | |

| Cash

and cash equivalents - beginning of period | |

| 162,743 | | |

| 661,778 | |

| Cash

and cash equivalents - end of period | |

$ | 361,397 | | |

$ | 7,864,079 | |

| | |

| | | |

| | |

| Non-cash

investing and financing activities: | |

| | | |

| | |

| Unrealized

loss on short-term investments | |

$ | (35,513 | ) | |

$ | - | |

| ROU

asset and lease liability recorded | |

$ | - | | |

$ | 11,359 | |

| Forgiveness

of interest expense | |

$ | - | | |

$ | 168,361 | |

| Forgiveness

of PPP Loan | |

$ | - | | |

$ | 22,916 | |

The

accompanying footnotes are an integral part of these unaudited condensed consolidated financial statements.

NEXALIN

TECHNOLOGY, INC. AND SUBSIDIARY

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1 — NATURE OF THE ORGANIZATION AND BUSINESS

Corporate

History

Nexalin

Technology, Inc. (“NV Nexalin”) was formed on October 19, 2010 as a Nevada corporation. The Company’s principal

offices are located at 1776 Yorktown, Suite 550, Houston, Texas 77056.

On

September 6, 2019, Neuro-Health International, Inc. (“Neuro-Health”), a Nevada corporation and wholly owned subsidiary

of NV Nexalin, was formed. Neuro-Health had no activity from December 6, 2019 (Inception) through September 30, 2023.

On

November 22, 2021, NV Nexalin entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Nexalin

Technology, Inc., a Delaware corporation (“Nexalin”, or the “Company”). Pursuant to the Merger Agreement,

NV Nexalin merged with and into Nexalin with all shareholders of NV Nexalin receiving one common share of Nexalin in exchange for

twenty shares of NV Nexalin held at the time of the Merger Agreement. NV Nexalin treated the transaction as a corporate reorganization

with the historical consolidated financial statements of NV Nexalin becoming the historical consolidated financial statements of

Nexalin. Nexalin had nominal assets and liabilities and did not conduct any operations prior to the reorganization other than its

incorporation. NV Nexalin has retroactively applied the 20-for-1 exchange, effective on November 22, 2021, to share and per

share amounts on the unaudited condensed consolidated financial statements for the nine months ended September 30, 2023 and

2022. NV Nexalin’s authorized shares of common stock were not affected as a result of the Merger Agreement. As a result of

the Merger Agreement, NV Nexalin was dissolved, and Neuro-Health became a subsidiary of Nexalin. The Company completed its initial

public offering on September 16, 2022.

The

initial public offering consisted of 2,315,000 units consisting of 2,315,000 shares of Common Stock and 2,315,000 accompanying

warrants to purchase up to 2,315,000 shares of common stock. Each share of common stock was sold together with one Warrant, each

to purchase one share of common stock with an exercise price of $4.15 per share at a combined offering price of $4.15, for gross

proceeds of $9,607,250, before deducting underwriting discounts and offering expenses. In addition, the underwriters purchased

347,250 warrants for net proceeds of $3,473.

Our

shares and warrants began trading on the Nasdaq Capital Market tier of the Nasdaq Stock Market (“Nasdaq”) on September 16,

2022, under the symbols “NXL” and “NXLIW”, respectively.

Throughout

this report, the terms “Nexalin,” “our,” “we,” “us,” and the “Company”

refer to Nexalin Technology, Inc.

Business

Overview

We

design and develop innovative neurostimulation products to uniquely and effectively help combat the ongoing global mental health

epidemic. We developed an easy-to-administer medical device — referred to as Generation 1 or Gen-1 — that utilizes

bioelectronic medical technology to treat anxiety and insomnia, without the need for drugs or psychotherapy. Our original Gen-1

devices are cranial electrotherapy stimulation (CES) devices that emit waveform at 4 milliamps during treatment and are presently

classified by the U.S. Food and Drug Administration (“FDA”) as a Class II device.

While

we continue providing services to medical professionals to support patients’ use of the Gen-1 devices which were in operation prior

to December 2019, we are not making new sales or new marketing efforts of Gen-1 devices. We continue to derive revenue from devices

which we sold or leased prior to the FDA’s December 2019 reclassification announcements. This revenue consists of monthly

licensing fees and payments for the sale of electrodes. We have suspended marketing efforts for new sales of devices related to the Gen-1

device for treatment of anxiety and insomnia in the United States until the Nexalin regulatory team makes a final decision on amending

our existing 510(k) application at 4 milliamps. A new pre-sub document in preparation of a new 510(k) for our Gen-3 Halo headset at 15

milliamps was filed with the FDA in January of 2023. Formal comments to our pre-sub document filing were received in March of 2023. A

formal meeting to address FDA comments took place on May 9, 2023. Minutes of the meeting with the FDA were filed with the FDA on

May 16, 2023. No additional comments have been received from the FDA at this time.

We

have designed and developed a new advanced wave form technology to be emitted at 15 milliamps through new and improved medical

devices referred to as Generation 2 or Gen-2 and Generation 3 or Gen-3. Gen-2 is a clinical use device with a modern enclosure

to emit the new 15 milliamp advanced waveform. Gen-3 is a new patient headset that is intended to be prescribed by licensed medical

professionals in a virtual clinic setting similar to existing Tele-health platforms. Preliminary data provided by the University

of California San Diego supports the safety of utilizing our 15 milliamp waveform technology, however the determination of safety

and efficacy of medical devices in the United States is subject to clearance by the FDA.

Additionally,

we are currently designing clinical trial strategies for the use of Gen-3 for the treatment of substance use disorders including

opiate, cocaine, and alcohol abuse. Recently the Gen-2 device was tested in pilot trials in China for the treatment of Alzheimer’s

disease, and dementia. Continued pilot testing for Alzheimer’s and dementia, cognition and memory, and neurotransmitter changes

is planned in China in 2023.

On

May 31, 2023, the Company formalized an agreement related to the formation of a joint venture established to engage in the

clinical development, marketing, sale and distribution of Nexalin’s second generation transcranial Alternating Current

Stimulation (“tACS”) devices (“Gen-2 devices”) in China and the greater Asia Pacific region. In connection

with the formation of the joint venture, to be conducted through a company formed under the laws of Hong Kong (the

“JV”), the Company entered into a Joint Venture Agreement (“JV Agreement”) with Wider Come Limited

(“Wider”). Under the JV Agreement, the Company was issued a 48% minority interest in the JV. The investment in the JV is

accounted for using the equity method of accounting. There has been no activity in the joint venture through September 30,

2023. The Incorporation Form (Company Limited by Shares) filed with the Companies Registry in Hong Kong originally reflected a

50%-50% ownership interest in the JV, but has been amended to properly reflect the 52%-48% ownership formalized in the JV agreement.

The Company invested $96,000

in the joint venture in September 2023, while Wider contributed $104,000 bringing the Company’s ownership percentage to 48%.

There has been no operating activity in the joint venture through September 30, 2023.

Emerging

Growth Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart

Our Business Startups Act of 2012 (the “JOBS Act”), and it may take advantage of certain exemptions from various reporting

requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to,

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced

disclosure obligations regarding executive compensation in its periodic reports and proxy statements, and exemptions from the requirements

of holding a nonbinding advisory vote on executive compensation and approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised

financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement

declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new

or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition

period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable.

The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised

and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the

new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of the Company’s

consolidated financial statements with another public company which is neither an emerging growth company, nor an emerging growth

company which has opted out of using the extended transition period, difficult or impossible because of the potential differences

in accounting standards used.

Risks

and Uncertainties

Management

continues to evaluate the impact of the economy and the capital markets and has concluded that, while it is reasonably possible

that events could have negative effects on the Company’s financial position and results of its operations, the specific impacts

are not readily determinable as of the date of these unaudited condensed consolidated financial statements. The unaudited condensed

consolidated financial statements do not include any adjustments that might result from the outcome of uncertainties.

The

current challenging economic climate may lead to adverse changes in cash flows, working capital levels and/or debt balances, which

may also have a direct impact on the Company’s operating results and financial position in the future. The ultimate duration

and magnitude of the impact and the efficacy of government interventions on the economy has and may continue to indirectly impact

the Company because of its current dependence upon its joint venture relationship with Wider Come Limited. Wider Come Limited,

as part of its obligations under the JV Agreement, acts as a distributor for the Company’s devices in China and Asia. Because

of significant restrictions imposed by the Chinese government during the COVID-19 pandemic through calendar year 2022 and into

2023, Wider’s ability to market and sell the Company’s devices has been negatively impacted, resulting in decreased

revenue to the Company. Patients and salespeople have been restricted in their movements resulting in a significant slowdown in

the medical and other sectors. Significant efforts and funds expended by our Chinese distributor has led to regulatory approval

in China in both depression and insomnia thus far which has allowed for sales of our devices in China in 2022, and into 2023. The

extent of future impact is dependent on future developments, including future activities by the Chinese government and other possible

events which are highly uncertain and not in the Company’s control, including new information which may emerge concerning

the spread and severity of COVID-19, or any of its variants, and actions taken to address its impact, among others. The repercussions

of this health crisis could have a material adverse effect on the Company’s business, financial condition, liquidity and

operating results.

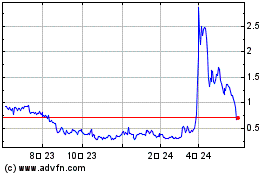

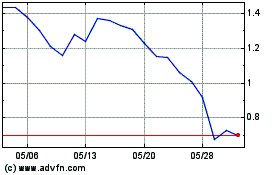

Continued Nasdaq Listing

On May 10, 2023,

the Company received written notice from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it was no

longer in compliance with the minimum bid price requirement for continued listing on Nasdaq, as the closing bid price for the

Company’s common stock was below $1.00 per share as set forth in the Nasdaq listing rules. The Company was afforded 180

calendar days, or until November 6, 2023, to regain compliance with the Nasdaq listing rules. The Company was unable to regain

compliance with the bid price requirement by November 6, 2023.

On November 7, 2023,

the Company submitted a letter to NASDAQ requesting a second 180-day period in order to regain compliance with NASDAQ Rule 5550(a)(2).

The Company stated in that letter that it believed it will be able to cure the deficiency and increase its stock price to above $1.00

per share pursuant to its plan to do so.

On November 7, 2023,

the Company received written notice from the Nasdaq Listing Qualifications Department (the “Staff”) that the Company was not

eligible for an additional 180 calendar day compliance period because the Company no longer

complied with Nasdaq’s $5 million minimum stockholders equity initial listing requirement.

As of the filing

date of this Quarterly Report, the Company has requested an appeal of the Staff’s determination and submitted a hearing

request to the Nasdaq Hearings Panel (“Panel”). As a result of the request for the appeal to the Panel, and while the

appeal process is pending, the suspension of trading of the Company’s common stock is stayed, and the Company’s common

stock and warrants will continue to trade on Nasdaq until the hearing process concludes and the Panel issues a written decision. As

part of the appeal process, the Company will be asked to provide the Panel with a plan to regain compliance with the minimum bid

price and stockholder equity requirements. The Company’s plan will need to include a discussion of the events that the Company

believes will enable it to timely regain compliance with such requirements. The Company intends to submit a plan that it believes

will be sufficient to permit the Company to regain compliance with the minimum bid price requirement and stockholder equity

requirements.

There can be no assurance

that the Panel will grant the Company a 180-day extension to regain compliance, or that Company will be able to regain compliance with

such applicable Nasdaq listing requirements. If the Company’s common stock and warrants are delisted by Nasdaq, it could adversely

affect the Company’s ability to attract new investors, decrease the liquidity of the outstanding shares of common stock, reduce

the Company’s flexibility to raise additional capital, reduce the price at which the Company’s common stock and warrants trade,

and increase the transaction costs inherent in trading such shares and warrants with overall negative effects for the stockholders. In

addition, delisting of the Company’s common stock and warrants could deter broker-dealers from making a market in or otherwise seeking

or generating interest in the Company’s common stock. Furthermore, the delisting of the Company’s common stock and warrants

from The Nasdaq Stock Market could adversely affect the business, financial condition and results of operations of the Company.

NOTE

2 — LIQUIDITY AND GOING CONCERN

The

accompanying unaudited condensed consolidated financial statements have been prepared on the basis that we will continue as a going

concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. At

September 30, 2023, we had a significant accumulated deficit of $76.3 76,257,380

million. For the three and nine months ended September 30, 2023, we had a loss from operations of $2.4 2,415,537

million and $4.1 4,071,823

million, respectively and negative cash flows used in operations of approximately $2.8 2,831,354 million for the nine months ended

September 30, 2023. While we had a working capital surplus as of September 30, 2023 of approximately $3.1 million our

operating activities consume most of our cash resources.

We

expect to continue to incur operating losses as we execute our development plans, as well as undertaking other potential strategic

and business development initiatives through 2023 and through the twelve months from the date of this report. In addition, we have

had and expect to have negative cash flows from operations, at least into the near future. We have previously funded these losses

primarily through the sale of equity and issuance of convertible notes. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period.

Our ability to continue as a going concern will

be dependent upon our ability to execute on our business plan, including the ability to generate revenue from the joint venture and

obtain U.S. approval for the sale of our devices in the United States, and, if necessary, our ability to raise additional capital.

These plans require the Company to place reliance on several factors including, favourable market conditions, to access additional

capital in the future. These plans were therefore determined not to be sufficient to overcome the presumption of substantial doubt

about the Company’s ability to continue as a going concern within one year after the date that the financial statements are

issued. Additionally, management does not believe we have sufficient cash for the next twelve months from the issuance of the

financial statements. The unaudited condensed consolidated financial statements do not include any adjustments that might result

from the outcome of this uncertainty.

NOTE

3 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NEW ACCOUNTING STANDARDS

Basis

of Presentation

The

accompanying unaudited condensed consolidated financial information has been prepared in accordance with Generally Accepted Accounting

Principles (“GAAP”) for interim financial information. In the opinion of management, such financial information includes

all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation of the Company’s

financial position and the operating results and cash flows. Operating results for the three and nine months ended September 30,

2023 and 2022 are not necessarily indicative of the results that may be expected for the entire year or for any other subsequent

interim period.

Certain

information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been omitted

pursuant to the rules of the U.S. Securities and Exchange Commission (the “SEC”). These unaudited condensed consolidated

financial statements and related notes should be read in conjunction with the Company’s audited consolidated financial statements

for the year ended December 31, 2022.

Principles

of Consolidation

The

consolidated financial statements include the accounts of Nexalin and its wholly owned subsidiary Neuro-Health. Intercompany accounts

and transactions have been eliminated in consolidation.

The

Company accounts for investments in unconsolidated entities where it exercises significant influence, but does not have control,

using the equity method. Under the equity method of accounting, the Company recognizes its share of the investee’s net income

or loss. Losses are only recognized to the extent the Company has positive carrying value related to the investee. Carrying values

are only reduced below zero if the Company has an obligation to provide funding to the investee. The Company’s equity method

investments are required to be reviewed for impairment when it is determined there may be another than-temporary loss in value.

The Company’s equity method investment is its interest in the newly formed joint venture. The Company invested $96,000 in

the joint venture in September 2023.There has been no operating activity in the joint venture through September 30, 2023.

Use

of Estimates

The

preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets, liabilities, equity-based transactions, revenue and expenses and disclosure of contingent liabilities

at the date of the financial statements. The Company bases its estimates and assumptions on historical experience, known or expected

trends and various other assumptions that it believes to be reasonable. As future events and their effects cannot be determined

with precision, actual results could differ from these estimates, which may cause the Company’s future results to be affected.

Revenue

The

Company recognizes revenue when its performance obligations with its customers have been satisfied. At contract inception, the

Company determines if the contract is within the scope of ASC Topic 606 and then evaluates the contract using the following five

steps: (1) identify the contract with the customer; (2) identify the performance obligations; (3) determine the transaction price;

(4) allocate the transaction price to the performance obligations; and (5) recognize revenue when (or as) the entity satisfies

a performance obligation. The Company only recognizes revenue to the extent that it is probable that a significant revenue reversal

will not occur in a future period.

The

Company has existing licensing and treatment fee agreements with its customers for the use of the Nexalin device in their practices.

These agreements generally have terms of one year with automatic renewal if certain requirements are met and amounts due per these

agreements are billed monthly. The Company also sells products related to the provision of services. The Company sells its devices

in China to its acting distributor and sells products relating to the use of the devices. The Company has a Royalty Agreement whereby

the manufacturer of the Company’s electrodes will pay a royalty to the Company for a three-year period beginning January 1,

2022. The amount of the Royalty is equal to 20% of the amount that the manufacturer invoices to the acting distributor for the

sale of the electrodes.

Revenue

Streams

The

Company derives revenues from its license agreements by charging a monthly licensing fee for the duration of the agreement. The

Company derives revenues from equipment by selling additional individual electrodes to customers for use with the Nexalin device.

The Company receives revenue from the sale in China of its devices to its acting distributor and from the sale of products relating

to the use of those devices. The Company derives revenue as a royalty fee from the China-based manufacturer for electrodes ordered

in connection with the Company’s China sales.

Performance

Obligations

Management

identified that subsequent licensing revenue has one performance obligation. That performance obligation is satisfied as long as

the licensing contract remains valid and is not terminated. The licensing revenue is invoiced monthly and is recognized at a point

in time in which the invoice is sent to the customer.

Management

identified that the Company’s equipment and device revenue has one performance obligation. That performance obligation is

satisfied when the equipment and devices are shipped. The Company recognizes revenue at a point in time in which the electrodes

and devices are shipped to the customer. The Company does not offer a warranty on the electrodes and devices.

Management

identified that treatment fee revenue has one performance obligation. The performance obligation is satisfied upon the completion

of individual treatments on patients by customers.

Management

identified that royalty revenue has one performance obligation. The performance obligation is satisfied at the time the Electrode

manufacturer invoices the acting distributor for the sale to the acting distributor.

Practical

Expedients

As

part of ASC 606, the Company has adopted several practical expedients including:

| |

● |

Significant

Financing Component — the Company does not adjust the promised amount of consideration for the effects of a significant

financing component since the Company expects, at contract inception, that the period between when the Company transfers

a promised goods or services to the customer and when the customer pays for that service will be one year or less. |

| |

● |

Unsatisfied

Performance Obligations — all performance obligations related to contracts with a duration of less than one year, the

Company has elected to apply the optional exemption provided in ASC Topic 606 and therefore, is not required to disclose

the aggregate amount of the transaction price allocated to performance obligations that are unsatisfied or partially unsatisfied

at the end of the reporting period. |

| |

● |

Shipping and

Handling Activities — the Company elected to account for shipping and handling activities as a fulfilment cost rather

than as a separate performance obligation. |

| |

● |

Right to Invoice

— the Company has a right to consideration from a customer in an amount that corresponds directly with the value to

the customer of the Company’s performance completed to date the Company may recognize revenue in the amount to which

the entity has a right to invoice. |

Disaggregated

Revenues

Major

Revenue Streams

Revenue

consists of the following by service offering:

| Schedule of disaggregation of revenue | |

| | | |

| | |

| | |

Three

Months Ended | |

| | |

September 30,

2023 | | |

September 30,

2022 | |

| Device

sales | |

$ | - | | |

$ | 520,000 | |

| Licensing

fee | |

| 18,664 | | |

| 21,113 | |

| Equipment | |

| 5,179 | | |

| 4,100 | |

| Other | |

| 270 | | |

| 110 | |

| Total | |

$ | 24,113 | | |

$ | 545,323 | |

| | |

Nine

Months Ended | |

| | |

September 30,

2023 | | |

September 30, 2022 | |

| Device

sales | |

$ | 9,600 | | |

$ | 1,164,500 | |

| Licensing

fee | |

| 62,566 | | |

| 60,561 | |

| Royalty

Fee | |

| - | | |

| 9,702 | |

| Equipment | |

| 16,679 | | |

| 22,033 | |

| Other | |

| 1,367 | | |

| 26,137 | |

| Total | |

$ | 90,212 | | |

$ | 1,282,933 | |

Major

Geographic Locations

| | |

Three

Months Ended | |

| | |

September 30,

2023 | | |

September 30,

2022 | |

| U.S.

sales | |

$ | 24,113 | | |

$ | 25,323 | |

| China

sales | |

| - | | |

| 520,000 | |

| Total | |

$ | 24,113 | | |

$ | 545,323 | |

| | |

Nine

Months Ended | |

| | |

September 30,

2023 | | |

September 30,

2022 | |

| U.S.

sales | |

$ | 80,005 | | |

$ | 89,864 | |

| China

sales | |

| 10,207 | | |

| 1,193,069 | |

| Total | |

$ | 90,212 | | |

$ | 1,282,933 | |

Contract

Modifications

There

were no contract modifications during the nine months ended September 30, 2023 and 2022. Contract modifications are not routine

in the performance of the Company’s contracts.

Deferred

Revenue

The

Company receives payment for equipment and devices in advance of shipping. The Company recognizes the revenue as being earned upon

shipment. No deferred revenue was recognized as of September 30, 2023 and December 31, 2022.

Cash

and Cash Equivalents

Cash

held at financial institutions may at times exceed insured amounts. The Company believes it mitigates such risk by investing in

or through, as well as maintaining cash balances, with major financial institutions.

Short-Term

Investments

The

appropriate classification of marketable securities is determined at the time of purchase and evaluated as of each reporting balance

sheet date. Investments in marketable debt and equity securities classified as available-for-sale are reported at fair value. Fair

value is determined using quoted market prices in active markets for identical assets or liabilities or quoted prices for similar

assets or liabilities or other inputs that are observable or can be corroborated by observable market data for substantially the

full term of the assets or liabilities. Unrealized holding gains and losses for equity securities are recognized in earnings. Unrealized

holding gains and losses for available for sale debt securities are recognized in other comprehensive income. Realized gains and

losses and interest and dividends earned are included in other income (expense), net. For individual debt securities classified

as available-for-sale securities, the company determines whether a decline in fair value below the amortized cost basis has resulted

from a credit loss or other factors. If the decline below amortized cost is a result of credit loss or the company will more likely

than not be required to sell the security before recovery of its amortized cost basis, the company will recognize an impairment

relating to the decline through an allowance for credit losses. There were no impairments recognized for the three and nine months

ended September 30, 2023.

Accounts

Receivable

Accounts

receivables are reported at their outstanding unpaid principal balances, net of allowances for credit loss. The Company periodically

assesses its accounts and other receivables for collectability on a specific identification basis. The Company provides for an

allowance for credit loss based on management’s estimate of uncollectible amounts considering age, collection history, and

any other factors considered appropriate. Payments are generally due within 30 days of invoice. The Company writes off accounts

receivable against the allowance for credit loss when a balance is determined to be uncollectible. During the nine months ended

September 30, 2023 and 2022, the Company wrote off accounts receivable of $0 and $11,175, respectively. The Company did not

record an allowance for credit loss on September 30, 2023 and December 31, 2022, respectively.

Inventory

Inventory

consists of finished goods and components stated at the lower of cost or net realizable value (NRV) with cost determined on a first-in

first-out basis. The Company reviews the composition of inventory at each reporting period in order to identify obsolete quantities

in excess of demand, or otherwise non-saleable items.

Equipment

Equipment

is recorded at cost. Depreciation is computed using straight-line method over the estimated useful lives of the related assets,

generally five years.

Maintenance

and repairs are charged to expense as incurred. The Company capitalizes costs attributable to the betterment of property and equipment

when such betterment enhances the functionality of the asset or extends the useful life of the asset. Should an asset be disposed

of before the end of its useful life, the cost and accumulated depreciation at that date is removed from the consolidated balance

sheets, with the resulting gain or loss, if any, reflected in operations in that period.

Patents

Patents

are amortized over their useful lives and are reviewed for impairment when warranted by economic conditions. Amortization expense

was $2,105 and $0 for the nine months ended September 30, 2023 and 2022, respectively. Amortization expense was $753 and $0

for the three months ended September 30, 2023 and 2022, respectively.

The

following table summarizes the gross carrying amount, amortization and the net carrying value at September 30, 2023 and December 31,

2022.

| Schedule of patents | |

| | | |

| | | |

| | |

| | |

Gross

Carrying

Amount | | |

Accumulated

Amortization | | |

Net

Carrying Value | |

| September 30,

2023 | |

| | | |

| | | |

| | |

| Patents | |

$ | 74,460 | | |

$ | (2,105 | ) | |

$ | 72,355 | |

| Total

September 30, 2023 | |

$ | 74,460 | | |

$ | (2,105 | ) | |

$ | 72,355 | |

| December 31,

2022 | |

| | | |

| | | |

| | |

| Patents | |

$ | - | | |

$ | - | | |

$ | - | |

| Total

December 31, 2022 | |

$ | - | | |

$ | - | | |

$ | - | |

Income

Taxes

The

Company accounts for income taxes pursuant to the asset and liability method which requires the recognition of deferred income

tax assets and liabilities related to the expected future tax consequences arising from temporary differences between the carrying

amounts and tax bases of assets and liabilities based on enacted statutory tax rates applicable to the periods in which the temporary

differences are expected to reverse. Any effects of changes in income tax rates or laws are included in income tax expense in the

period of enactment.

The

Company records valuation allowances against deferred tax assets when it is more likely than not that all or a portion of a deferred

tax asset will not be realized. At September 30, 2023 and December 31, 2022, the Company had a full valuation allowance

applied against its net tax assets.

Fair

Value Measurements

As

defined in ASC 820, Fair Value Measurements and Disclosures, fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). The

Company utilizes market data or assumptions that market participants would use in pricing the asset or liability, including assumptions

about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated,

or generally unobservable. ASC 820 establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The

hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1

measurement) and the lowest priority to unobservable inputs (level 3 measurement). This fair value measurement framework applies

at both initial and subsequent measurement.

| |

● |

Level 1: Quoted

prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those

in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information

on an ongoing basis. |

| |

● |

Level 2: Pricing

inputs are other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable

as of the reported date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies.

These models are primarily industry-standard models that consider various assumptions, including quoted forward prices for

commodities, time value, volatility factors and current market and contractual prices for the underlying instruments, as

well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout

the full term of the instrument, can be derived from observable data or are supported by observable levels at which transactions

are executed in the marketplace. |

| |

● |

Level 3: Pricing

inputs include significant inputs that are generally less observable from objective sources. These inputs may be used with

internally developed methodologies that result in management’s best estimate of fair value. The significant unobservable

inputs used in the fair value measurement for nonrecurring fair value measurements of long-lived assets include pricing models,

discounted cash flow methodologies and similar techniques. |

Fair

Value of Financial Instruments

The

carrying value of cash, short-term investments, accounts receivable, inventory, prepaids, accounts payable and accrued expenses,

and other current liabilities approximate their fair values based on the short-term maturity of these instruments. The carrying

amount of the loans payable approximates the estimated fair value for this financial instrument as management believes that such

debt and interest payable on the note approximates the Company’s incremental borrowing rate.

The

following table summarizes the amortized cost, unrealized gains and the fair value at September 30, 2023 and December 31,

2022.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortized

Cost |

|

|

Unrealized

Gain |

|

|

Fair

Value

|

|

| September 30,

2023 |

|

|

|

|

|

|

|

|

|

| Short-term

investments |

|

$ |

3,575,005 |

|

|

$ |

800 |

|

|

$ |

3,575,805 |

|

| Total

September 30, 2023 |

|

$ |

3,575,005 |

|

|

$ |

800 |

|

|

$ |

3,575,805 |

|

| December 31,

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term

investments |

|

$ |

6,794,879 |

|

|

$ |

36,313 |

|

|

$ |

6,831,192 |

|

| Total

December 31, 2022 |

|

$ |

6,794,879 |

|

|

$ |

36,313 |

|

|

$ |

6,831,192 |

|

The

unrealized loss of $35,513 for the nine months ended September 30, 2023 is included in the table above as a reduction in the

total unrealized gain.

The

following table provides the carrying value and fair value of the Company’s financial assets measured at fair value as of

September 30, 2023 and December 31, 2022.

| Schedule of fair value, assets measured on recurring basis | |

| | | |

| | | |

| | | |

| | |

| | |

Carrying

Value | | |

Level

1 | | |

Level

2 | | |

Level

3 | |

| September 30,

2023 | |

| | | |

| | | |

| | | |

| | |

| U.S.

Treasury Notes | |

$ | 3,575,805 | | |

$ | 3,575,805 | | |

$ | - | | |

$ | - | |

| December 31,

2022 | |

| | | |

| | | |

| | | |

| | |

| U.S.

Treasury Notes | |

$ | 6,831,192 | | |

$ | 6,831,192 | | |

$ | - | | |

$ | - | |

Net

Loss per Common Share

Net

loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding during the

period. The dilutive effect, if any, of warrants is calculated using the treasury stock method. All outstanding convertible notes,

if any, are considered common stock at the beginning of the period or at the time of issuance, if later, pursuant to the if-converted

method. Since the effect of common stock equivalents is anti-dilutive with respect to losses, the warrants have been excluded from

the Company’s computation of net loss per common share for the three and nine months ended September 30, 2023 and 2022.

The

following table summarizes the securities that would be excluded from the diluted per share calculation because the effect of including

these potential shares was antidilutive due to the Company’s net loss position even though the exercise price could be less

than the most recent fair value of the common shares:

| Schedule of antidilutive shares | |

| | |

| |

| | |

Three

Months Ended

September 30,

| |

| | |

2023 | | |

2022 | |

| Warrants | |

| 2,662,250 | | |

| 2,503,850 | |

| Total | |

| 2,662,250 | | |

| 2,503,850 | |

| |

|

Nine

Months Ended

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Warrants |

|

|

2,662,250 |

|

|

|

2,503,850 |

|

| Total |

|

|

2,662,250 |

|

|

|

2,503,850 |

|

Stock-Based

Compensation

The

Company applies the provisions of ASC 718, Compensation — Stock Compensation (“ASC 718”), which requires

the measurement and recognition of compensation expense for all stock-based awards made to employees, including employee stock

options, in the unaudited condensed consolidated statements of operations and comprehensive loss.

For

stock options issued to employees and members of the board of directors for their services, the Company estimates the grant date

fair value of each option using the Black-Scholes option pricing model. The use of the Black-Scholes option pricing model requires