Form 8-K - Current report

2024年11月16日 - 7:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 12, 2024 |

TUHURA BIOSCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Nevada |

001-37823 |

99-0360497 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10500 University Dr., Suite 110 |

Tampa, Florida 33612 |

(Address of Principal Executive Offices, including zip code) |

Registrant’s Telephone Number, Including Area Code: (813) 875-6600 |

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

HURA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 12, 2024, the Compensation Committee (the “Committee”) of the Board of Directors of TuHURA Biosciences, Inc. (the “Company”) approved an increase to the annual base salaries of James A. Bianco, M.D., Chief Executive Officer, as well as Dan Dearborn, Chief Financial Officer, to $499,000 and $375,000, respectively, with such increase to be effective as of January 1, 2025. In approving the base salary changes for Mr. Bianco and Mr. Dearborn, the Committee considered, among other factors, the compensation practices, trends and data from the Company’s compensation peer group, consisting of comparable companies as identified by the Committee and an independent compensation consultant engaged by the Committee, with the resulting adjustment putting Mr. Bianco’s and Mr. Dearborn’s base salary level at approximately 80% of the 50th percentile of base salary levels for the peer group.

In addition, on November 12, 2024, the Committee also approved the grant of stock options to Dr. Bianco and Mr. Dearborn with a grant date of November 12, 2024. Mr. Bianco received options to purchase 1,065,990 shares of the Company’s common stock, and Mr. Dearborn received options to purchase 489,848 shares of Company common stock (the “Stock Option Awards”). The Stock Option Awards were issued under the TuHURA Biosciences, Inc. 2024 Equity Incentive Plan (the “Plan”), at a per share exercise price equal to the closing price of the Company’s common stock on the grant date of $4.94. Each Stock Option Award has a term of ten years and vests in three equal annual installments commencing on the first anniversary of the grant date, subject to the respective executive’s continued service to the Company through the applicable vesting dates.

In connection with the issuance of the Stock Option Awards, the Committee also approved the form of option agreement used to make the awards, a copy of which is filed as Exhibit 10.1 to this report and is incorporated herein by reference, pursuant to its authority set forth in the Plan.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

10.1 Form of Stock Option Agreement under 2024 Equity Incentive Plan

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TUHURA BIOSCIENCES, INC. |

|

|

|

|

Date: |

November 15, 2024 |

By: |

/s/ Dan Dearborn |

|

|

|

Name: Dan Dearborn

Title: Chief Financial Officer |

TUHURA BIOSCIENCES, INC.

2024 EQUITY INCENTIVE PLAN

STOCK OPTION AGREEMENT

You have been granted an option (this “Option”) to purchase shares of the common stock, par value $0.001 per share (the “Stock”), of TuHURA Biosciences, Inc. (the “Company”) pursuant to the Company’s 2024 Equity Incentive Plan (the “Plan”) and this Stock Option Award Agreement (this “Award Agreement”). This Option is granted under and governed by the terms and conditions of the Plan and this Award Agreement. Capitalized terms used but not defined in this Award Agreement shall have the meaning set forth in the Plan.

|

|

Type of Option: |

Incentive Stock Option Nonqualified Stock Option |

Grant Date: Number of Shares: Term: |

[_________] [________] This Option shall expire on the tenth anniversary of the Grant Date (the “Expiration Date”), unless terminated earlier pursuant to the terms of this Award Agreement or the Plan. Upon termination or expiration of this Option, all your rights hereunder shall cease. |

Vesting: |

One-third (1/3) of the total Shares subject to this Option shall vest and become exercisable on each of the first three annual anniversaries of the Grant Date, provided that you are continuously employed by, or in the service of, the Company or an Affiliate through the applicable vesting date. If the application of the foregoing vesting schedule would cause a fractional Share to vest, then, unless the Administrator determines otherwise, the number of Shares that vest on any vesting date shall be rounded down to the nearest whole Share, and such fractional Shares shall accumulate and vest on the next vesting date that they add up to a whole share. |

Termination of Employment: |

a.Termination As a Result of Death or Disability. If your employment or service with the Company terminates by reason of your death or Disability at a time when your employment or service could not otherwise have been terminated for Cause, then the unvested portion of this Option will be immediately forfeited and cancelled upon such termination, and the vested portion of this Option will remain outstanding and exercisable until the earlier of (i) the Expiration Date and (ii) the one-year anniversary of your termination of employment. For purposes of this Option, “Disability” means that you are found to be disabled under the Company’s long-term disability plan, if any, and if such plan does not exist, then it means that you cannot work and engage in substantial gainful activity because of a medical condition that has lasted or is expected to last for at least 1 year or result in death. b.Termination for Cause. If your employment or service with the Company is terminated for Cause, this Option (vested and unvested) |

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4879-0805-1188.2

|

|

|

shall be forfeited immediately upon such termination, and you shall be prohibited from exercising your Option as of the date of such termination. c.Termination For a Reason Other than Cause, Death or Disability (e.g., resign or fired without Cause). If your employment or service with the Company is terminated for any reason other than those described in a. or b. above, then the unvested portion of this Option will be immediately forfeited and cancelled upon such termination, and the vested portion of this Option will remain outstanding and exercisable until the earlier of (i) the Expiration Date or (ii) the ninetieth (90th) day after such termination. d.Determination of Cause After Termination. Notwithstanding the foregoing, if after your employment or service terminates the Company determines that it could have terminated you for Cause had all relevant facts been known at the time of your termination, then this Option will immediately terminate upon such determination, you will be required to disgorge to the Company any gains attributable to any portion of this Option that were outstanding at the time of your termination and you will be prohibited from exercising this Option thereafter. In such event, you will be notified of the termination of this Option. If the date this Option terminates as specified above (other than as a result of a termination for Cause) falls on a day on which the stock market is not open for trading or on a date on which you are prohibited by Company policy (such as an insider trading policy) from exercising the Option, the termination date shall be automatically extended to the first available trading day following the original termination date, but not beyond the Expiration Date. |

Manner of Exercise: |

You may exercise this Option only if it has not been forfeited or has not otherwise expired, and only to the extent this Option has vested. To exercise this Option, you must comply with such exercise and notice procedures as the Administrator may establish from time to time, which may include exercising via electronic means. Your stock option exercise will become effective upon the Company’s (or its designee’s) receipt of any required notice and payment in cash (unless another method is expressly permitted by the Administrator in writing) of the exercise price and any required tax withholdings; provided that the Company may suspend exercise of the Option pending its determination of whether your employment will be or could have been terminated for Cause and if such a determination is made, your notice of stock option exercise (or such other notice as is prescribed) will automatically be rescinded. If, following your death, your beneficiary or heir, or such other person or persons as may acquire your rights under this Option by will or by the laws of descent and distribution, wishes to exercise this Option, such person must contact the Company and prove to the Company’s satisfaction that such person has the right and is entitled to exercise this Option. |

|

|

|

Your ability to exercise this Option, or the manner of exercise or payment of withholding taxes, may be restricted by the Company if required by applicable law or by the Company’s trading policies as in effect from time to time. |

Change of Control: |

Upon a Change of Control, this Option will be treated as set forth in the Plan. |

Restrictions on Resale |

By accepting this Option, you agree not to sell any Shares acquired under this Option at a time when applicable laws, Company policies or an agreement between the Company and its underwriters prohibit a sale. |

Transferability: |

You may not transfer or assign this Option for any reason, other than by will or the laws of descent and distribution, or as otherwise provided in the Plan. Any attempted transfer or assignment of this Option, other than as set forth in the preceding sentence or the Plan, will be null and void. |

Market Stand-Off: |

In connection with any underwritten public offering by the Company of its equity securities pursuant to an effective registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”), you agree that you shall not directly or indirectly sell, make any short sale of, loan, hypothecate, pledge, offer, grant or sell any option or other contract for the purchase of, purchase any option or other contract for the sale of, or otherwise dispose of or transfer or agree to engage in any of the foregoing transactions with respect to, any Shares acquired under this Option without the prior written consent of the Company and the Company’s underwriters. Such restriction shall be in effect for such period of time following the date of the final prospectus for the offering as may be requested by the Company or such underwriters. In no event, however, shall such period exceed one hundred eighty (180) days. |

Recoupment; Rescission of Exercise |

If the Administrator determines that recoupment of incentive compensation paid to you pursuant to this Option is required under any law or any recoupment policy of the Company, then this Option will terminate immediately on the date of such determination to the extent required by such law or recoupment policy, any prior exercise of this Option may be deemed to be rescinded, and the Company may recoup any such incentive compensation in accordance with such recoupment policy or as required by law. The Company shall have the right to offset against any other amounts due from the Company to you the amount owed by you hereunder and any exercise price and withholding amount tendered by you with respect to any such incentive compensation. |

Compliance with Securities Laws: |

No individual may exercise this Option, and no Shares subject to this Option will be issued, unless and until the Company has determined to its satisfaction that such exercise and issuance will comply with all applicable federal and state securities laws, rules and regulations of the Securities and Exchange Commission, rules of any stock exchange on which the Shares may then be traded, or any other applicable laws. In addition, if required by underwriters for the Company, you agree to enter into a lock-up |

|

|

|

agreement with respect to any Shares acquired or to be acquired under this Option. You acknowledge that you are acquiring this Option, and the right to purchase the Shares subject to this Option, for investment purposes only and not with a view toward resale or other distribution thereof to the public which would be in violation of the Securities Act. You agree and acknowledge with respect to any Shares that have not been registered under the Securities Act, that: (i) you will not sell or otherwise dispose of such Shares, except as permitted pursuant to a registration statement declared effective under the Securities Act and qualified under any applicable state securities laws, or in a transaction which in the opinion of counsel for the Company is exempt from such required registration, and (ii) that a legend containing a statement to such effect will be placed on the certificates evidencing such Shares. Further, as additional conditions to the issuance of the Shares subject to this Option, you agree (with such agreement being binding upon any of your beneficiaries, heirs, legatees and/or legal representatives) to do the following prior to any issuance of such Shares: (a) to execute and deliver to the Company such investment representations and warranties as are required by the Company; (b) to enter into a restrictive stock transfer agreement if required by the Board; and (y) to take or refrain from taking such other actions as counsel for the Company may deem necessary or appropriate for compliance with the Securities Act, and any other applicable federal or state securities laws, regardless of whether the Shares have at that time been registered under the Securities Act, or otherwise qualified under any applicable state securities laws. By accepting this Option, you agree not to sell any Shares acquired in connection with the Option at a time when applicable laws, Company policies or an agreement between the Company and its underwriters prohibit a sale. |

Miscellaneous: |

•This Award Agreement may be amended only by written consent signed by both you and the Company, unless the amendment is not to your detriment or the amendment is otherwise permitted without your consent by the Plan. •The failure of the Company to enforce any provision of this Award Agreement at any time shall in no way constitute a waiver of such provision or of any other provision hereof. •You will have none of the rights of a shareholder of the Company with respect to this Option until Shares are transferred to you upon exercise of the Option. •In the event any provision of this Award Agreement is held illegal or invalid for any reason, such illegality or invalidity shall not affect the legality or validity of the remaining provisions of this Award Agreement, and this Award Agreement shall be construed |

|

|

|

and enforced as if the illegal or invalid provision had not been included in this Award Agreement. •As a condition to the grant of this Option, you agree (with such agreement being binding upon your legal representatives, guardians, legatees or beneficiaries) that this Award Agreement shall be interpreted by the Committee and that any interpretation by the Committee of the terms of this Award Agreement or the Plan, and any determination made by the Committee pursuant to this Award Agreement or the Plan, shall be final, binding and conclusive. •The Company or its Affiliates may, in its or their sole discretion, decide to deliver any documents related to current or future participation in the Plan or related to this Option by electronic means. You hereby consent to receive such documents by electronic delivery and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company. You hereby agree that all on-line acknowledgements shall have the same force and effect as a written signature. •This Award Agreement may be executed in counterparts. |

BY SIGNING AND AGREEING TO THIS STOCK OPTION AGREEMENT, YOU AGREE TO ALL OF THE TERMS AND CONDITIONS DESCRIBED HEREIN AND IN THE PLAN. YOU ALSO ACKNOWLEDGE HAVING READ THIS AGREEMENT AND THE PLAN.

TuHURA BIOSCIENCES, INC. PARTICIPANT

By: _______________________ ___________________________

[NAME] [EMPLOYEE NAME]

[TITLE]

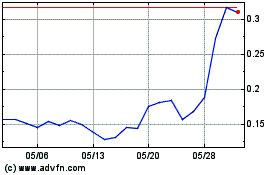

Kintara Therapeutics (NASDAQ:KTRA)

過去 株価チャート

から 10 2024 まで 11 2024

Kintara Therapeutics (NASDAQ:KTRA)

過去 株価チャート

から 11 2023 まで 11 2024