JAKKS Pacific, Inc. (NASDAQ: JAKK) today reported financial results

for the second quarter ended June 30, 2024.

First-half net sales for JAKKS Pacific, Inc.

were $238.7 million, a year-over-year decrease of 13.0%, primarily

attributable to a lack of new content-related product launches,

which occurred in the first half of last year.

Second Quarter 2024

Overview

- Net sales were $148.6 million, a

year-over-year decrease of 11.0%

- Toys/Consumer Products net sales

were $104.6 million, a year-over-year decrease of 11.3%

- Costumes net sales were $44.0

million, a year-over-year decrease of 10.1%

- Gross profit was $47.6 million, a

year-over-year decrease of 7.1% from $51.2 million

- Gross margin was 32.0%, up 130

basis points vs. Q2 2023

- Operating income was $7.6 million

(5.1% of net sales) vs. $16.4 million (9.9% of net sales) in Q2

2023

- Net income attributable to common

stockholders was $5.3 million or $0.47 per diluted share, compared

to net income attributable to common stockholders of $6.1 million

or $0.58 per share in Q2 2023

- Adjusted net income attributable to

common stockholders (a non-GAAP measure) was $7.3 million or $0.65

per diluted share, compared to an adjusted net income attributable

to common stockholders of $13.3 million or $1.26 per diluted share

in Q2 2023

- Adjusted EBITDA (a non-GAAP

measure) was $12.3 million, vs. $20.7 million in Q2 2023

- Trailing twelve month adjusted

EBITDA was $51.2 million (7.6% of net sales) down 23% from $66.9

million (9.2% of net sales) in the trailing twelve months ended

June 2023

Management Commentary“The first

half of 2024 closes with our delivering solid results anchored by

our evergreen business of time-tested toy categories and play

patterns,” said Stephen Berman, CEO of JAKKS Pacific, Inc. “A lack

of new content releases created unfavorable topline comparisons

with prior year, but our base business continued to perform and

adapt in an ever-changing marketplace.

“We are pleased with our progress to date and our positioning

and preparation for the new product we’re shipping in the latter

half of the year. Exciting new launches supporting Moana 2,

releasing in theatres this November, and Sonic the Hedgehog™ 3,

releasing in theaters this December will be the cornerstones of the

broad retail support we have secured with our top customers

globally. We are also in the middle of the exciting initial launch

of our new line of products inspired by “The Simpsons,” the launch

of our Authentic Brands Group business as well as several other new

IP and category extensions.”

Second Quarter 2024 HighlightsThe Dolls,

Role-Play/Dress-Up division generated net sales of $63.6 million,

up 6.6% from $59.7 million last year. The Action Play &

Collectibles division generated net sales of $36.6 million, down

30.5% from $52.6 million last year.

For the first half, North America was down 8%, attributable to

the impact of lower contribution from product lines launched in

support of new entertainment content and lower Costume sales.

International was down 31%, primarily due to orders slipping into

the following quarter due to logistics-related issues but also

negatively impacted by the content slate comparison with the prior

year.

Balance Sheet HighlightsThe Company’s cash and

cash equivalents (including restricted cash) totaled $17.9 million

as of June 30, 2024, compared to $32.4 million as of June 30, 2023,

and $72.6 million as of December 31, 2023.

Inventory totaled $51.3 million as of June 30, 2024, compared to

$65.1 million as of June 30, 2023, and $52.6 million as of December

31, 2023.

Use of Non-GAAP Financial Information and Reconciliation

of GAAP to Non-GAAP measures:In addition to the

preliminary results reported in accordance with U.S. GAAP included

in this release, the Company has provided certain non-GAAP

financial information including Adjusted EBITDA and Adjusted Net

Income (Loss) which are non-GAAP metrics that exclude various items

that are detailed in the financial tables and accompanying

footnotes reconciling GAAP to non-GAAP results contained in this

release. These schedules provide certain information regarding

Adjusted EBITDA and Adjusted Net Income (Loss), which may be

considered non-GAAP financial measures under the rules of the

Securities and Exchange Commission. The non-GAAP financial measures

included in the press release are reconciled to the corresponding

GAAP financial measures below, as required under the rules of the

Securities and Exchange Commission regarding the use of non-GAAP

financial measures.

We define Adjusted EBITDA as income (loss) from operations

before depreciation, amortization and adjusted for certain

non-recurring and non-cash charges, such as reorganization expenses

and restricted stock compensation expense. Net income (loss) is

similarly adjusted and tax-effected to arrive at Adjusted Net

Income (Loss). Adjusted EBITDA and Adjusted Net Income (Loss) are

not recognized financial measures under GAAP, but we believe that

they are useful in measuring our operating performance.

Management believes that the presentation of these non-GAAP

financial measures provides useful information to investors because

the information may allow investors to better evaluate ongoing

business performance and certain components of the Company’s

results. In addition, the Company believes that the presentation of

these financial measures enhances an investor’s ability to make

period-to-period comparisons of the Company’s operating

results.

Investors should not consider these measures in isolation or as

a substitute for net income, operating income, or any other measure

for determining the Company’s operating performance that is

calculated in accordance with GAAP. This information should be

considered in addition to the results presented in accordance with

GAAP and should not be considered a substitute for the GAAP

results. The Company has reconciled the non-GAAP financial

information included in this release to the nearest GAAP measures.

In addition, because these measures are not calculated in

accordance with GAAP, they may not necessarily be comparable to

similarly titled measures employed by other companies.

Conference Call Live WebcastJAKKS Pacific,

Inc. invites analysts, investors and media to listen to the

teleconference scheduled for 5:00 p.m. ET / 2:00

p.m. PT on July 31, 2024. A live webcast of the call will

be available on the “Investor Relations” page of the Company’s

website at www.jakks.com/investors. To access the call by phone,

please go to this link (2Q24 Registration link) and you will be

provided with dial in details. To avoid delays, we encourage

participants to dial into the conference call several minutes ahead

of the scheduled start time. A replay of the webcast will also be

available for a limited time at (www.jakks.com/investors).

About JAKKS Pacific, Inc.

JAKKS Pacific, Inc. is a leading designer, manufacturer and

marketer of toys and consumer products sold throughout the world,

with its headquarters in Santa Monica, California. JAKKS Pacific’s

popular proprietary brands include: AirTitans®, Disguise®, Fly

Wheels®, JAKKS Wild Games®, Moose Mountain®, Maui®, Perfectly

Cute®, ReDo® Skateboard Co., Sky Ball®, SportsZone™, Xtreme Power

Dozer®, WeeeDo®, and Wild Manes™ as well as a wide range of

entertainment-inspired products featuring premier licensed

properties. Through our products and our charitable donations,

JAKKS is helping to make a positive impact on the lives of

children. Visit us at www.jakks.com and follow us on Instagram

(@jakkspacific.toys), Twitter (@jakkstoys) and Facebook

(@jakkspacific.toys).

Forward Looking Statements

This press release may contain “forward-looking statements”

(within the meaning of the Private Securities Litigation Reform Act

of 1995) that are based on current expectations, estimates and

projections about JAKKS Pacific's business based partly on

assumptions made by its management. These statements are not

guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecasted in such statements due to numerous factors,

including, but not limited to, those described above, changes in

demand for JAKKS Pacific's products, product mix, the timing of

customer orders and deliveries, the impact of competitive products

and pricing, or that any future transactions will result in future

growth or success of JAKKS. The “forward-looking statements”

contained herein speak only as of the date on which they are made,

and JAKKS undertakes no obligation to update any of them to reflect

events or circumstances after the date of this release.

|

JAKKS Pacific, Inc. and Subsidiaries |

|

Condensed Consolidated Balance Sheets

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

| |

|

|

|

|

(In thousands) |

|

Assets |

|

|

|

Current assets: |

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

17,700 |

|

|

$ |

32,228 |

|

|

$ |

72,350 |

|

| |

Restricted cash |

|

|

202 |

|

|

|

203 |

|

|

|

204 |

|

| |

Accounts receivable, net |

|

|

140,006 |

|

|

|

132,479 |

|

|

|

123,797 |

|

| |

Inventory |

|

|

51,327 |

|

|

|

65,059 |

|

|

|

52,647 |

|

| |

Prepaid expenses and other assets |

|

|

26,457 |

|

|

|

11,227 |

|

|

|

6,374 |

|

| |

|

Total current assets |

|

|

235,692 |

|

|

|

241,196 |

|

|

|

255,372 |

|

| |

|

|

|

|

|

|

|

|

|

|

Property and equipment |

|

|

141,326 |

|

|

|

134,091 |

|

|

|

135,956 |

|

|

Less accumulated depreciation and amortization |

|

|

124,580 |

|

|

|

116,813 |

|

|

|

121,357 |

|

| |

Property and equipment, net |

|

|

16,746 |

|

|

|

17,278 |

|

|

|

14,599 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets, net |

|

|

20,667 |

|

|

|

15,249 |

|

|

|

23,592 |

|

|

Deferred income tax assets, net |

|

|

68,141 |

|

|

|

57,804 |

|

|

|

68,143 |

|

|

Goodwill |

|

|

35,029 |

|

|

|

35,083 |

|

|

|

35,083 |

|

|

Other long-term assets |

|

|

1,976 |

|

|

|

2,331 |

|

|

|

2,162 |

|

| |

|

Total assets |

|

$ |

378,251 |

|

|

$ |

368,941 |

|

|

$ |

398,951 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Liabilities, Preferred Stock and Stockholders'

Equity |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

55,368 |

|

|

$ |

57,768 |

|

|

$ |

42,177 |

|

| |

Accounts payable - Meisheng (related party) |

|

|

19,130 |

|

|

|

18,612 |

|

|

|

12,259 |

|

| |

Accrued expenses |

|

|

45,026 |

|

|

|

46,448 |

|

|

|

45,102 |

|

| |

Reserve for sales returns and allowances |

|

|

29,456 |

|

|

|

37,851 |

|

|

|

38,531 |

|

| |

Income taxes payable |

|

|

- |

|

|

|

5,808 |

|

|

|

3,785 |

|

| |

Short term operating lease liabilities |

|

|

7,777 |

|

|

|

9,226 |

|

|

|

7,380 |

|

| |

Short term debt, net |

|

|

5,000 |

|

|

|

- |

|

|

|

- |

|

| |

|

Total current liabilities |

|

|

161,757 |

|

|

|

175,713 |

|

|

|

149,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

Long term operating lease liabilities |

|

|

14,859 |

|

|

|

6,220 |

|

|

|

16,666 |

|

|

Accrued expenses - long term |

|

|

2,299 |

|

|

|

- |

|

|

|

3,746 |

|

|

Preferred stock derivative liability |

|

|

- |

|

|

|

27,793 |

|

|

|

29,947 |

|

|

Income taxes payable |

|

|

3,441 |

|

|

|

2,971 |

|

|

|

3,245 |

|

| |

|

Total liabilities |

|

|

182,356 |

|

|

|

212,697 |

|

|

|

202,838 |

|

| |

|

|

|

|

|

|

|

|

|

|

Preferred stock accrued dividends |

|

|

- |

|

|

|

5,230 |

|

|

|

5,992 |

|

| |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

| |

Common stock, $.001 par value |

|

|

11 |

|

|

|

10 |

|

|

|

10 |

|

| |

Additional paid-in capital |

|

|

294,543 |

|

|

|

277,178 |

|

|

|

278,642 |

|

| |

Accumulated deficit |

|

|

(82,851 |

) |

|

|

(110,876 |

) |

|

|

(73,612 |

) |

| |

Accumulated other comprehensive loss |

|

|

(16,308 |

) |

|

|

(16,021 |

) |

|

|

(15,627 |

) |

| |

|

Total JAKKS Pacific, Inc. stockholders' equity |

|

|

195,395 |

|

|

|

150,291 |

|

|

|

189,413 |

|

| |

Non-controlling interests |

|

|

500 |

|

|

|

723 |

|

|

|

708 |

|

| |

|

Total stockholders' equity |

|

|

195,895 |

|

|

|

151,014 |

|

|

|

190,121 |

|

| |

|

Total liabilities, preferred stock and stockholders' equity |

|

$ |

378,251 |

|

|

$ |

368,941 |

|

|

$ |

398,951 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Supplemental Balance Sheet and Cash Flow Data

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

June 30, |

|

Key Balance Sheet Data: |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable days sales outstanding (DSO) |

|

|

|

|

86 |

|

|

|

72 |

|

|

Inventory turnover (DSI) |

|

|

|

|

46 |

|

|

|

51 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

|

|

|

Condensed Cash Flow Data: |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows provided by (used in) operating activities |

|

|

|

$ |

(27,665 |

) |

|

$ |

20,805 |

|

|

Cash flows used in investing activities |

|

|

|

|

(6,174 |

) |

|

|

(4,893 |

) |

|

Cash flows used in financing activities and other |

|

|

|

|

(20,813 |

) |

|

|

(68,971 |

) |

|

Increase in cash, cash equivalents and restricted cash |

|

|

|

$ |

(54,652 |

) |

|

$ |

(53,059 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

|

$ |

(4,627 |

) |

|

$ |

(4,918 |

) |

| |

|

JAKKS Pacific, Inc. and Subsidiaries |

| |

|

Condensed Consolidated Statements of Operations

(Unaudited) |

|

|

|

|

|

|

|

| |

|

|

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Δ (%) |

|

|

2024 |

|

|

|

2023 |

|

|

Δ (%) |

|

|

|

|

(In thousands, except per share data) |

|

|

|

(In thousands, except per share data) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

148,619 |

|

|

$ |

166,933 |

|

|

|

(11 |

)% |

|

$ |

238,695 |

|

|

$ |

274,417 |

|

|

(13 |

)% |

|

Less: Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

| |

Cost of goods |

|

76,599 |

|

|

|

86,156 |

|

|

|

(11 |

) |

|

|

130,420 |

|

|

|

144,460 |

|

|

(10 |

) |

| |

Royalty expense |

|

22,394 |

|

|

|

27,279 |

|

|

|

(18 |

) |

|

|

36,170 |

|

|

|

43,933 |

|

|

(18 |

) |

| |

Amortization of tools and molds |

|

2,041 |

|

|

|

2,300 |

|

|

|

(11 |

) |

|

|

3,468 |

|

|

|

3,389 |

|

|

2 |

|

| |

Cost of sales |

|

101,034 |

|

|

|

115,735 |

|

|

|

(13 |

) |

|

|

170,058 |

|

|

|

191,782 |

|

|

(11 |

) |

|

|

|

Gross profit |

|

47,585 |

|

|

|

51,198 |

|

|

|

(7 |

) |

|

|

68,637 |

|

|

|

82,635 |

|

|

(17 |

) |

|

Direct selling expenses |

|

6,255 |

|

|

|

3,980 |

|

|

|

57 |

|

|

|

14,352 |

|

|

|

11,721 |

|

|

22 |

|

|

General and administrative expenses |

|

33,594 |

|

|

|

30,677 |

|

|

|

10 |

|

|

|

67,786 |

|

|

|

58,671 |

|

|

16 |

|

|

Depreciation and amortization |

|

93 |

|

|

|

93 |

|

|

|

- |

|

|

|

180 |

|

|

|

195 |

|

|

(8 |

) |

| |

Selling, general and administrative expenses |

|

39,942 |

|

|

|

34,750 |

|

|

|

15 |

|

|

|

82,318 |

|

|

|

70,587 |

|

|

17 |

|

| |

|

Income (loss) from operations |

|

7,643 |

|

|

|

16,448 |

|

|

|

(54 |

) |

|

|

(13,681 |

) |

|

|

12,048 |

|

|

nm |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from joint ventures |

|

- |

|

|

|

(565 |

) |

|

|

nm |

|

|

|

- |

|

|

|

(565 |

) |

|

nm |

|

| |

Other income (expense), net |

|

72 |

|

|

|

38 |

|

|

|

89 |

|

|

|

210 |

|

|

|

476 |

|

|

(56 |

) |

| |

Change in fair value of preferred stock derivative liability |

|

- |

|

|

|

(6,022 |

) |

|

|

nm |

|

|

|

- |

|

|

|

(5,875 |

) |

|

nm |

|

| |

Loss on debt extinguishment |

|

- |

|

|

|

(1,023 |

) |

|

|

nm |

|

|

|

- |

|

|

|

(1,023 |

) |

|

nm |

|

| |

Interest income |

|

88 |

|

|

|

86 |

|

|

|

2 |

|

|

|

464 |

|

|

|

203 |

|

|

129 |

|

| |

Interest expense |

|

(256 |

) |

|

|

(1,302 |

) |

|

|

(80 |

) |

|

|

(399 |

) |

|

|

(4,305 |

) |

|

(91 |

) |

|

Income (loss) before provision for (benefit from) income taxes |

|

7,547 |

|

|

|

7,660 |

|

|

|

(1 |

) |

|

|

(13,406 |

) |

|

|

959 |

|

|

nm |

|

|

Provision for (benefit from) income taxes |

|

2,281 |

|

|

|

1,478 |

|

|

|

54 |

|

|

|

(4,447 |

) |

|

|

95 |

|

|

nm |

|

|

Net income (loss) |

|

5,266 |

|

|

|

6,182 |

|

|

|

(15 |

) |

|

|

(8,959 |

) |

|

|

864 |

|

|

nm |

|

|

Net income (loss) attributable to non-controlling interests |

|

- |

|

|

|

(273 |

) |

|

|

nm |

|

|

|

280 |

|

|

|

(278 |

) |

|

nm |

|

|

Net income (loss) attributable to JAKKS Pacific, Inc. |

$ |

5,266 |

|

|

$ |

6,455 |

|

|

|

(18 |

)% |

|

$ |

(9,239 |

) |

|

$ |

1,142 |

|

|

nm |

% |

|

Net income (loss) attributable to common stockholders |

$ |

5,266 |

|

|

$ |

6,082 |

|

|

|

(13 |

)% |

|

$ |

(7,909 |

) |

|

$ |

402 |

|

|

nm |

% |

|

|

Earnings (loss) per share - basic |

$ |

0.49 |

|

|

$ |

0.62 |

|

|

|

|

$ |

(0.75 |

) |

|

$ |

0.04 |

|

|

|

|

|

Shares used in earnings (loss) per share - basic |

|

10,801 |

|

|

|

9,871 |

|

|

|

|

|

10,577 |

|

|

|

9,871 |

|

|

|

|

|

Earnings (loss) per share - diluted |

$ |

0.47 |

|

|

$ |

0.58 |

|

|

|

|

$ |

(0.75 |

) |

|

$ |

0.04 |

|

|

|

|

|

Shares used in earnings (loss) per share - diluted |

|

11,245 |

|

|

|

10,532 |

|

|

|

|

|

10,577 |

|

|

|

10,428 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

2024 |

|

|

|

2023 |

|

|

Δ bps |

|

|

2024 |

|

|

|

2023 |

|

|

Δ bps |

| |

|

|

|

|

|

|

Fav/(Unfav) |

|

|

|

|

|

Fav/(Unfav) |

|

Net sales |

|

100.0 |

% |

|

|

100.0 |

% |

|

|

- |

|

|

|

100.0 |

% |

|

|

100.0 |

% |

|

- |

|

|

Less: Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

| |

Cost of goods |

|

51.5 |

|

|

|

51.6 |

|

|

|

10 |

|

|

|

54.5 |

|

|

|

52.6 |

|

|

(190 |

) |

| |

Royalty expense |

|

15.1 |

|

|

|

16.3 |

|

|

|

120 |

|

|

|

15.2 |

|

|

|

16.0 |

|

|

80 |

|

| |

Amortization of tools and molds |

|

1.4 |

|

|

|

1.4 |

|

|

|

- |

|

|

|

1.5 |

|

|

|

1.3 |

|

|

(20 |

) |

| |

Cost of sales |

|

68.0 |

|

|

|

69.3 |

|

|

|

130 |

|

|

|

71.2 |

|

|

|

69.9 |

|

|

(130 |

) |

| |

|

Gross profit |

|

32.0 |

|

|

|

30.7 |

|

|

|

130 |

|

|

|

28.8 |

|

|

|

30.1 |

|

|

(130 |

) |

|

Direct selling expenses |

|

4.2 |

|

|

|

2.4 |

|

|

|

(180 |

) |

|

|

6.0 |

|

|

|

4.3 |

|

|

(170 |

) |

|

General and administrative expenses |

|

22.6 |

|

|

|

18.3 |

|

|

|

(430 |

) |

|

|

28.4 |

|

|

|

21.3 |

|

|

(710 |

) |

|

Depreciation and amortization |

|

0.1 |

|

|

|

0.1 |

|

|

|

- |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

- |

|

| |

Selling, general and administrative expenses |

|

26.9 |

|

|

|

20.8 |

|

|

|

(610 |

) |

|

|

34.5 |

|

|

|

25.7 |

|

|

(880 |

) |

| |

|

Income (loss) from operations |

|

5.1 |

|

|

|

9.9 |

|

|

|

(480 |

) |

|

|

(5.7 |

) |

|

|

4.4 |

|

|

(1,010 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

| |

Loss from joint ventures |

|

- |

|

|

|

(0.3 |

) |

|

|

|

|

- |

|

|

|

(0.2 |

) |

|

|

| |

Other income (expense), net |

|

- |

|

|

|

- |

|

|

|

|

|

0.1 |

|

|

|

0.2 |

|

|

|

| |

Change in fair value of preferred stock derivative liability |

|

- |

|

|

|

(3.6 |

) |

|

|

|

|

- |

|

|

|

(2.1 |

) |

|

|

| |

Loss on debt extinguishment |

|

- |

|

|

|

(0.6 |

) |

|

|

|

|

- |

|

|

|

(0.4 |

) |

|

|

| |

Interest income |

|

0.1 |

|

|

|

- |

|

|

|

|

|

0.2 |

|

|

|

0.1 |

|

|

|

| |

Interest expense |

|

(0.2 |

) |

|

|

(0.8 |

) |

|

|

|

|

(0.2 |

) |

|

|

(1.6 |

) |

|

|

|

Income (loss) before provision for (benefit from) income taxes |

|

5.0 |

|

|

|

4.6 |

|

|

|

|

|

(5.6 |

) |

|

|

0.4 |

|

|

|

|

Provision for (benefit from) income taxes |

|

1.5 |

|

|

|

0.9 |

|

|

|

|

|

(1.8 |

) |

|

|

- |

|

|

|

|

Net income (loss) |

|

3.5 |

|

|

|

3.7 |

|

|

|

|

|

(3.8 |

) |

|

|

0.4 |

|

|

|

|

Net income (loss) attributable to non-controlling interests |

|

- |

|

|

|

(0.2 |

) |

|

|

|

|

0.1 |

|

|

|

(0.1 |

) |

|

|

|

Net income (loss) attributable to JAKKS Pacific, Inc. |

|

3.5 |

% |

|

|

3.9 |

% |

|

|

|

|

(3.9 |

)% |

|

|

0.5 |

% |

|

|

|

Net income (loss) attributable to common stockholders |

|

3.5 |

% |

|

|

3.6 |

% |

|

|

|

|

(3.3 |

)% |

|

|

0.1 |

% |

|

|

|

JAKKS Pacific, Inc. and Subsidiaries |

|

Reconciliation of Non-GAAP Financial Information

(Unaudited) |

|

|

|

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

| |

|

(In thousands) |

|

|

|

(In thousands) |

|

|

|

EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

5,266 |

|

|

$ |

6,182 |

|

|

$ |

(916 |

) |

|

$ |

(8,959 |

) |

|

$ |

864 |

|

|

$ |

(9,823 |

) |

|

Interest expense |

|

|

256 |

|

|

|

1,302 |

|

|

|

(1,046 |

) |

|

|

399 |

|

|

|

4,305 |

|

|

|

(3,906 |

) |

|

Interest income |

|

|

(88 |

) |

|

|

(86 |

) |

|

|

(2 |

) |

|

|

(464 |

) |

|

|

(203 |

) |

|

|

(261 |

) |

|

Provision for income taxes |

|

|

2,281 |

|

|

|

1,478 |

|

|

|

803 |

|

|

|

(4,447 |

) |

|

|

95 |

|

|

|

(4,542 |

) |

|

Depreciation and amortization |

|

|

2,134 |

|

|

|

2,393 |

|

|

|

(259 |

) |

|

|

3,648 |

|

|

|

3,584 |

|

|

|

64 |

|

|

EBITDA |

|

|

9,849 |

|

|

|

11,269 |

|

|

|

(1,420 |

) |

|

|

(9,823 |

) |

|

|

8,645 |

|

|

|

(18,468 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

- |

|

|

|

292 |

|

|

|

(292 |

) |

|

|

- |

|

|

|

287 |

|

|

|

(287 |

) |

|

Loss from joint ventures (Meisheng - 49%) |

|

|

- |

|

|

|

273 |

|

|

|

(273 |

) |

|

|

- |

|

|

|

278 |

|

|

|

(278 |

) |

|

Other (income) expense, net |

|

|

(72 |

) |

|

|

(38 |

) |

|

|

(34 |

) |

|

|

(210 |

) |

|

|

(476 |

) |

|

|

266 |

|

|

Restricted stock compensation expense |

|

|

2,519 |

|

|

|

1,856 |

|

|

|

663 |

|

|

|

5,094 |

|

|

|

3,945 |

|

|

|

1,149 |

|

|

Change in fair value of preferred stock derivative liability |

|

|

- |

|

|

|

6,022 |

|

|

|

(6,022 |

) |

|

|

- |

|

|

|

5,875 |

|

|

|

(5,875 |

) |

|

Loss on debt extinguishment |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

Adjusted EBITDA |

|

$ |

12,296 |

|

|

$ |

20,697 |

|

|

$ |

(8,401 |

) |

|

$ |

(4,939 |

) |

|

$ |

19,577 |

|

|

$ |

(24,516 |

) |

|

Adjusted EBITDA/Net sales % |

|

|

8.3 |

% |

|

|

12.4 |

% |

|

-410 bps |

|

|

(2.1 |

)% |

|

|

7.1 |

% |

|

-920 bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Trailing Twelve Months Ended June 30, |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

|

|

|

| |

|

(In thousands) |

|

|

|

|

|

|

|

|

|

TTM EBITDA and TTM Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

TTM net income |

|

$ |

28,290 |

|

|

$ |

69,649 |

|

|

$ |

(41,359 |

) |

|

|

|

|

|

|

|

Interest expense |

|

|

2,545 |

|

|

|

10,949 |

|

|

|

(8,404 |

) |

|

|

|

|

|

|

|

Interest income |

|

|

(1,605 |

) |

|

|

(321 |

) |

|

|

(1,284 |

) |

|

|

|

|

|

|

|

Provision for (benefit from) income taxes |

|

|

2,291 |

|

|

|

(42,664 |

) |

|

|

44,955 |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

10,400 |

|

|

|

9,794 |

|

|

|

606 |

|

|

|

|

|

|

|

|

TTM EBITDA |

|

|

41,921 |

|

|

|

47,407 |

|

|

|

(5,486 |

) |

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

(11 |

) |

|

|

287 |

|

|

|

(298 |

) |

|

|

|

|

|

|

|

Loss from joint ventures (Meisheng - 49%) |

|

|

11 |

|

|

|

278 |

|

|

|

(267 |

) |

|

|

|

|

|

|

|

Other (income) expense, net |

|

|

(297 |

) |

|

|

(1,004 |

) |

|

|

707 |

|

|

|

|

|

|

|

|

Restricted stock compensation expense |

|

|

9,176 |

|

|

|

7,002 |

|

|

|

2,174 |

|

|

|

|

|

|

|

|

Change in fair value of preferred stock derivative liability |

|

|

2,154 |

|

|

|

11,895 |

|

|

|

(9,741 |

) |

|

|

|

|

|

|

|

Molds and tooling capitalization |

|

|

(1,751 |

) |

|

|

- |

|

|

|

(1,751 |

) |

|

|

|

|

|

|

|

Loss on debt extinguishment |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

|

|

|

|

|

TTM Adjusted EBITDA |

|

$ |

51,203 |

|

|

$ |

66,888 |

|

|

$ |

(15,685 |

) |

|

|

|

|

|

|

|

TTM Adjusted EBITDA/TTM Net sales % |

|

|

7.6 |

|

% |

|

9.2 |

% |

|

-160 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

2024 |

|

|

|

2023 |

|

|

Δ ($) |

|

|

|

(In thousands, except per share data) |

|

|

|

(In thousands, except per share data) |

|

|

|

Adjusted net loss attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders |

|

$ |

5,266 |

|

|

$ |

6,082 |

|

|

$ |

(816 |

) |

|

$ |

(7,909 |

) |

|

$ |

402 |

|

|

$ |

(8,311 |

) |

|

Restricted stock compensation expense |

|

|

2,519 |

|

|

|

1,856 |

|

|

|

663 |

|

|

|

5,094 |

|

|

|

3,945 |

|

|

|

1,149 |

|

|

Change in fair value of preferred stock derivative liability |

|

|

- |

|

|

|

6,022 |

|

|

|

(6,022 |

) |

|

|

- |

|

|

|

5,875 |

|

|

|

(5,875 |

) |

|

Loss on debt extinguishment |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

|

- |

|

|

|

1,023 |

|

|

|

(1,023 |

) |

|

Loss from joint ventures (JAKKS Pacific, Inc. - 51%) |

|

|

- |

|

|

|

292 |

|

|

|

(292 |

) |

|

|

- |

|

|

|

287 |

|

|

|

(287 |

) |

|

2021 BSP Term Loan prepayment penalty |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

150 |

|

|

|

(150 |

) |

|

Tax impact of additional charges |

|

|

(530 |

) |

|

|

(1,979 |

) |

|

|

1,449 |

|

|

|

(1,187 |

) |

|

|

(2,347 |

) |

|

|

1,160 |

|

|

Adjusted net income (loss) attributable to common stockholders |

|

$ |

7,255 |

|

|

$ |

13,296 |

|

|

$ |

(6,041 |

) |

|

$ |

(4,002 |

) |

|

$ |

9,335 |

|

|

$ |

(13,337 |

) |

|

Adjusted earnings (loss) per share - basic & diluted |

|

$ |

0.67 |

|

|

$ |

1.35 |

|

|

$ |

(0.68 |

) |

|

$ |

(0.38 |

) |

|

$ |

0.95 |

|

|

$ |

(1.33 |

) |

|

Shares used in adjusted earnings (loss) per share - basic |

|

|

10,801 |

|

|

|

9,871 |

|

|

|

930 |

|

|

|

10,577 |

|

|

|

9,871 |

|

|

|

706 |

|

|

Adjusted earnings (loss) per share - diluted |

|

$ |

0.65 |

|

|

$ |

1.26 |

|

|

$ |

(0.61 |

) |

|

$ |

(0.38 |

) |

|

$ |

0.90 |

|

|

$ |

(1.28 |

) |

|

Shares used in adjusted earnings (loss) per share - diluted |

|

|

11,245 |

|

|

|

10,532 |

|

|

|

713 |

|

|

|

10,577 |

|

|

|

10,428 |

|

|

|

149 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

JAKKS Pacific, Inc. and Subsidiaries |

|

Net Sales by Division and Geographic Region |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

QTD Q2 |

|

(In thousands) |

YTD Q2 |

|

Divisions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Divisions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Toys/Consumer Products |

$ |

104,570 |

$ |

117,934 |

$ |

148,860 |

-11.3 |

% |

-20.8 |

% |

|

Toys/Consumer Products |

$ |

187,480 |

$ |

215,827 |

$ |

259,983 |

-13.1 |

% |

-17.0 |

% |

|

Dolls, Role-Play/Dress Up |

|

63,608 |

|

59,669 |

|

102,186 |

6.6 |

% |

-41.6 |

% |

|

Dolls, Role-Play/Dress Up |

|

104,182 |

|

107,512 |

|

164,192 |

-3.1 |

% |

-34.5 |

% |

|

Action Play & Collectibles |

|

36,555 |

|

52,571 |

|

37,170 |

-30.5 |

% |

41.4 |

% |

|

Action Play & Collectibles |

|

69,563 |

|

90,417 |

|

68,868 |

-23.1 |

% |

31.3 |

% |

|

Outdoor/Seasonal Toys |

|

4,407 |

|

5,694 |

|

9,504 |

-22.6 |

% |

-40.1 |

% |

|

Outdoor/Seasonal Toys |

|

13,735 |

|

17,898 |

|

26,923 |

-23.3 |

% |

-33.5 |

% |

|

Costumes |

$ |

44,049 |

$ |

48,999 |

$ |

71,562 |

-10.1 |

% |

-31.5 |

% |

|

Costumes |

$ |

51,215 |

$ |

58,590 |

$ |

81,320 |

-12.6 |

% |

-28.0 |

% |

|

Total |

$ |

148,619 |

$ |

166,933 |

$ |

220,422 |

-11.0 |

% |

-24.3 |

% |

|

Total |

$ |

238,695 |

$ |

274,417 |

$ |

341,303 |

-13.0 |

% |

-19.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

QTD Q2 |

|

(In thousands) |

YTD Q2 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

United States |

$ |

125,837 |

$ |

136,187 |

$ |

192,484 |

-7.6 |

% |

-29.2 |

% |

|

United States |

$ |

196,267 |

$ |

216,630 |

$ |

289,534 |

-9.4 |

% |

-25.2 |

% |

|

Europe |

|

10,264 |

|

16,638 |

|

14,447 |

-38.3 |

% |

15.2 |

% |

|

Europe |

|

15,999 |

|

26,800 |

|

27,836 |

-40.3 |

% |

-3.7 |

% |

|

Latin America |

|

3,239 |

|

3,067 |

|

3,823 |

5.6 |

% |

-19.8 |

% |

|

Latin America |

|

11,235 |

|

12,271 |

|

6,208 |

-8.4 |

% |

97.7 |

% |

|

Canada |

|

6,288 |

|

6,799 |

|

5,537 |

-7.5 |

% |

22.8 |

% |

|

Canada |

|

9,658 |

|

10,853 |

|

8,916 |

-11.0 |

% |

21.7 |

% |

|

Asia |

|

1,268 |

|

1,831 |

|

2,363 |

-30.7 |

% |

-22.5 |

% |

|

Asia |

|

2,233 |

|

3,211 |

|

4,439 |

-30.5 |

% |

-27.7 |

% |

|

Australia & New Zealand |

|

1,607 |

|

1,756 |

|

1,582 |

-8.5 |

% |

11.0 |

% |

|

Australia & New Zealand |

|

2,953 |

|

3,364 |

|

3,073 |

-12.2 |

% |

9.5 |

% |

|

Middle East & Africa |

|

116 |

|

655 |

|

186 |

-82.3 |

% |

252.2 |

% |

|

Middle East & Africa |

|

350 |

|

1,288 |

|

1,297 |

-72.8 |

% |

-0.7 |

% |

|

Total |

$ |

148,619 |

$ |

166,933 |

$ |

220,422 |

-11.0 |

% |

-24.3 |

% |

|

Total |

$ |

238,695 |

$ |

274,417 |

$ |

341,303 |

-13.0 |

% |

-19.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

QTD Q2 |

|

(In thousands) |

YTD Q2 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

Regions |

|

2024 |

|

2023 |

|

2022 |

% Change 2024 v 2023 |

% Change 2023 v 2022 |

|

North America |

$ |

132,125 |

$ |

142,986 |

$ |

198,021 |

-7.6 |

% |

-27.8 |

% |

|

North America |

$ |

205,925 |

$ |

227,483 |

$ |

298,450 |

-9.5 |

% |

-23.8 |

% |

|

International |

|

16,494 |

|

23,947 |

|

22,401 |

-31.1 |

% |

6.9 |

% |

|

International |

|

32,770 |

|

46,934 |

|

42,853 |

-30.2 |

% |

9.5 |

% |

|

Total |

$ |

148,619 |

$ |

166,933 |

$ |

220,422 |

-11.0 |

% |

-24.3 |

% |

|

Total |

$ |

238,695 |

$ |

274,417 |

$ |

341,303 |

-13.0 |

% |

-19.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:

JAKKS Pacific Investor Relations

(424) 268-9567

Lucas Natalini, investors@jakks.net

JAKKS Pacific (NASDAQ:JAKK)

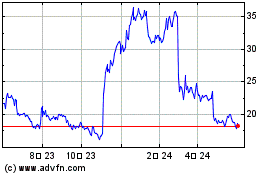

過去 株価チャート

から 10 2024 まで 11 2024

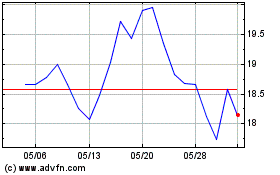

JAKKS Pacific (NASDAQ:JAKK)

過去 株価チャート

から 11 2023 まで 11 2024