UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |

☒ |

| Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

☐ |

Soliciting Material under §240.14a-12 |

BIOVIE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

BIOVIE INC.

680 W Nye Lane, Suite 201

Carson City, NV 89703

(775) 888-3162

NOTICE OF INTENT TO CONVENE IN VIRTUAL MEETING FORMAT THE ANNUAL MEETING OF

THE STOCKHOLDERS TO BE HELD ON November 8, 2023

Dear Stockholders of BioVie Inc.:

You are invited to participate in the 2023 Annual Meeting (the “Annual

Meeting”) of stockholders of BioVie Inc., a Nevada corporation (“BioVie” or the “Company”), to be held on

Wednesday, November 8, 2023 at 10:00 a.m. Pacific Time. The Board of Directors has determined to convene and conduct the Annual Meeting

on Wednesday, November 8, 2023 at 10:00 a.m. Pacific Time, in a virtual meeting format at www.virtualshareholdermeeting.com/BIVI2023.

Stockholders will NOT be able to attend the Annual Meeting in-person. The accompanying Proxy Statement includes instruction on how to

access the virtual Annual Meeting and how to listen, vote, and submit questions from home or any remote location with Internet connectivity.

At the Annual Meeting, we will consider and vote upon the following items:

| |

1. |

To elect seven (7) Directors to hold office until the next annual meeting and until their respective successors are elected and qualified (the “Board Election Proposal”); |

| |

2. |

To ratify the appointment of EisnerAmper LLP as BioVie’s independent registered public accounting firm for the 2024 fiscal year (the “Auditor Ratification Proposal”); and |

| |

3. |

To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

These items of business are more fully described in

the Proxy Statement accompanying this Notice.

YOUR BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE FOR THE NOMINEES AND IN FAVOR OF THE OTHER PROPOSALS OUTLINED IN THE ACCOMPANYING PROXY STATEMENT.

The board of directors of BioVie has fixed the close of business on October

2, 2023 as the record date for the Annual Meeting. Only stockholders of record on the record date are entitled to notice of and to vote

at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying Proxy

Statement.

You are cordially invited to participate in the Annual Meeting. Whether

or not you expect to participate in the Annual Meeting, please complete, date, sign and return the enclosed proxy or submit your proxy

through the internet or by telephone as promptly as possible in order to ensure your representation at the Annual Meeting. If you have

requested physical materials to be mailed to you, a return envelope (which is postage prepaid if mailed in the United States) is enclosed

for your convenience to use if you choose to submit your proxy by mail. Even if you have voted by proxy, you may still vote online if

you attend the virtual Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and

you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. Only stockholders of record

at the close of business on the record date may vote at the Annual Meeting or any adjournment or postponement thereof. This notice is

being mailed to all stockholders of record entitled to vote at the Annual Meeting on or about October 9, 2023.

By order of the Board of Directors,

Jim Lang

Chairman

Carson City, Nevada

September 29, 2023

BIOVIE INC.

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

Important Notice Regarding the Availability of Proxy

Materials for the 2023 Annual Meeting

This proxy statement and our Annual Report on Form 10-K for the year

ended June 30, 2023 (the “2023 Annual Report”) are available for viewing, printing and downloading at https://bioviepharma.com/investors.html.

Certain documents referenced in the proxy statement are available on our website. However, we are not including the information contained

on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this

Proxy Statement.

The Notice of Annual Meeting, Proxy Statement and proxy card and the

2023 Annual Report are first being mailed to our stockholders on or about October 9, 2023.

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT,

THE VIRTUAL ANNUAL

MEETING AND VOTING

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation

by the Board of Directors of BioVie Inc., a Nevada corporation (sometimes referred to as “we,” “our,” “us,”

the “Company,” the “Corporation” or “BioVie”), of proxies to be voted at our 2023 Annual Meeting of

Stockholders (the “Annual Meeting”) and at any adjournment or postponement thereof.

How may I participate in the virtual Annual Meeting?

To participate in the virtual Annual Meeting, go to www.virtualshareholdermeeting.com/BIVI2023

at 10:00 a.m. PDT on November 8, 2023 and use the 16-digit control number that appears on the accompanying proxy card (printed in the

box and marked by the arrow) and the instructions that accompanied these proxy materials. If you are a stockholder of record as of October

2, 2023, the record date (the “Record Date”) for the Annual Meeting, you will need to log-in to www.virtualshareholdermeeting.com/BIVI2023

using the 16-digit control number on the proxy card or voting instruction form.

If your shares are held in “street name” through a broker,

bank or other nominee, in order to participate in the virtual annual meeting you must first obtain a legal proxy from your broker, bank

or other nominee reflecting the number of shares of BioVie’s Class A common stock, or “common stock,” you beneficially

held as of the Record Date, your name and email address. You then must submit a request for registration to West Coast Stock Transfer,

Inc.: (1) by email to fbrickell@wcsti.com; (2) by facsimile to (760)-452-4423 or (3) by mail to West Coast Stock Transfer, Inc., 721 N.

Vulcan Ave. 1st FL, Encinitas, CA 92024 Attn: Frank Brickell. Requests for registration must be labeled as “Legal Proxy” and

be received by West Coast Stock Transfer, Inc. no later than 5:00 p.m. Eastern Time on November 2, 2023.

If I already submitted a proxy, do I have to vote again?

No. If you already submitted a proxy, your vote will

be counted and you do not need to submit a new proxy or vote online at the virtual Annual Meeting.

If I have not yet submitted a proxy, may I still do so?

Yes. If you have not yet submitted a proxy, you may do so by (a) visiting

www.virtualshareholdermeeting.com/BIVI2023 and following the on screen instructions (have your proxy card available when you access the

webpage), or (b) calling toll-free 1-800-690-6903 in the U.S., or (c) submitting your proxy card by mail by using the previously provided

self-addressed, stamped envelope.

May I revoke a previously submitted proxy or otherwise change my vote

at the virtual Annual Meeting?

Yes. You may change or revoke your vote by writing to us, by submitting

another properly signed proxy card with a more recent date, or by voting again by the telephone or Internet voting options described below.

If your shares are held in “street name” through a bank, broker or other nominee, any changes need to be made through them.

Your last vote will be the vote that is counted.

Unless revoked, a proxy will be voted at the virtual meeting in accordance

with the stockholder’s indicated instructions. In the absence of instructions, proxies will be voted FOR the election of the seven

nominees identified in the Proxy Statement as directors and FOR the ratification of EisnerAmper LLP as BioVie’s independent registered

public accounting firm for the 2024 fiscal year.

How do I vote at the virtual Annual Meeting?

Stockholders of record; Shares registered directly in your name.

If you are a stockholder of record, you may vote online at the virtual

Annual Meeting on November 8, 2023 or vote by proxy using the enclosed proxy card, the Internet or telephone. Whether or not you plan

to participate in the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have already voted by proxy,

you may still attend the virtual Annual Meeting and vote online at the virtual Annual Meeting on November 8, 2023, if you choose.

| |

● |

To vote online at the virtual Annual Meeting on November 8, 2023, go to www.virtualshareholdermeeting.com/BIVI2023 at 10:00 a.m. PDT on November 8, 2023 and use the 16-digit control number that appears on the accompanying proxy card (printed in the box and marked by the arrow) and the instructions that accompanied these proxy materials. |

| |

● |

To vote using the proxy card, please complete, sign and date the proxy card and return it in the prepaid envelope. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. If you do not have the prepaid envelope, please mail your completed proxy card to Vote Processing, C/O Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| |

● |

To vote via the telephone, you can vote by calling the telephone number on your proxy card. Please have your proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded. |

| |

● |

To vote via the Internet, please go to www.virtualshareholdermeeting.com/BIVI2023 and follow the instructions. Please have your proxy card handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded. |

Telephone and Internet voting facilities for stockholders of record will

be available 24 hours a day until 11:59 p.m. Eastern Time on November 7, 2023. After that, telephone and Internet voting will be closed,

and if you want to vote your shares, you will either need to ensure that your proxy card is received by the Company before the date of

the Annual Meeting or attend the virtual Annual Meeting to vote your shares online.

Beneficial owner; Shares held in account at brokerage, bank or other

organization.

If your shares are registered in the name of your broker, bank or other

agent, you are the “beneficial owner” of those shares and those shares are considered as held in “street name.”

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card

and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy

card as instructed by your broker, bank or other agent to ensure that your vote is counted. You may be eligible to vote your shares electronically

over the Internet or by telephone depending on your broker, bank or other agent. A large number of banks and brokerage firms offer Internet

and telephone voting. If your bank or brokerage firm does not offer Internet or telephone voting information, please complete and return

your proxy card in the self-addressed, postage-paid envelope provided. To vote in person at the virtual Annual Meeting, you must first

obtain a valid legal proxy from your broker, bank or other agent and then register in advance to attend the Annual Meeting. Follow the

instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a legal proxy form.

After obtaining a valid legal proxy from your broker, bank or other agent,

to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with

your name and email address to West Coast Stock Transfer. Inc. Requests for registration should be directed to fbrickell@wcsti.com

or to facsimile number (760)-452-4423. Written requests can be mailed to:

West Coast Stock Transfer, Inc.

Attn: Frank Brickell

721 N. Vulcan Ave. 1st FL

Encinitas, CA 92024

Requests for registration must be labeled as “Legal Proxy”

and be received no later than 5:00 p.m., Eastern Time, on November 2, 2023.

You will receive a confirmation of your registration by email after we

receive your registration materials. You may attend the Annual Meeting and vote your shares at www.virtualshareholdermeeting.com/BIVI2023

and use the 16-digit control number that appears on the accompanying proxy card (printed in the box and marked by the arrow) during the

meeting. We encourage you to access the meeting prior to the start time leaving ample time for the check in.

Who can help answer any other questions I might have?

If you have any questions concerning the virtual Annual Meeting (including

accessing the meeting by virtual means) or would like additional copies of the Proxy Statement or need help voting your shares of the

Company’s common stock, please contact our transfer agent:

West Coast Stock Transfer, Inc.

The Notice of Annual Meeting, 2023 Annual Report, Proxy Statement and form

of Proxy Card are available at:

https://www.westcoaststocktransfer.com/proxy-bivi/

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on October 2, 2023

(the “Record Date”), are entitled to vote at the Annual Meeting. On the Record Date, there were shares of BioVie’s common

stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the

Annual Meeting.

What is the difference between holding shares as a stockholder of record

and as a beneficial owner?

If on October 2, 2023 your shares were registered directly in your name

with BioVie’s transfer agent, West Coast Stock Transfer, Inc., then you are the “stockholder of record.” Whether or

not you plan to participate in the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote via the Internet

or by telephone to ensure your vote is counted.

If on October 2, 2023 your shares were held in a stock brokerage account

or by a bank or other similar organization, then you are considered the “beneficial owner” of those shares. These proxy materials

have been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes

of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or other agent how to vote the

shares in your account. You are also invited to participate in the Annual Meeting. However, because you are not the stockholder of record,

you may not vote your shares online at the virtual Annual Meeting unless you request and obtain a valid proxy from your broker, bank or

other agent.

What am I voting on?

There are two matters scheduled for a vote:

| |

1. |

To elect seven (7) Directors to hold office until the next annual meeting and until their respective successors are elected and qualified (the “Board Election Proposal”); |

| |

2. |

To ratify the appointment of EisnerAmper LLP as BioVie’s independent registered public accounting firm for the 2024 fiscal year (the “Auditor Ratification Proposal”); and |

| |

3. |

To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

What if I return a proxy card but do not make specific choices?

If your card does not indicate your voting preferences, the persons named

in the proxy card will vote the shares represented by your proxy card as recommended by the Board of Directors, unless your shares are

held in street name and you fail to provide your broker, bank or other agent, as applicable, with voting instructions on proposal 1, in

which case your shares will be voted as “broker non-votes” on such proposal as described below. BioVie does not expect that

any matters other than the election of Directors and the other proposals described herein will be brought before the Annual Meeting. If

any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your

shares using their best judgment.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you can revoke your proxy at any time

before the final vote at the Annual Meeting by:

| |

● |

giving written notice that you are revoking your proxy to the Secretary, BioVie Inc., 680 W Nye Lane, Suite 201, Carson City, NV 89703; |

| |

● |

delivering a properly completed proxy card with a later date, or vote by telephone or on the Internet at a later date (we will vote your shares as directed in the last instructions properly received from you prior to the Annual Meeting); or |

| |

● |

attending and voting online at the virtual Annual Meeting (note, simply attending the Annual Meeting will not, by itself, revoke your proxy). |

If you are a beneficial owner of shares, you may submit new voting instructions

by contacting your broker, bank or other agent that is the holder of record and following its instructions.

Please note that to be effective, your new proxy card, internet or telephonic

voting instructions or written notice of revocation must be received by the Secretary prior to the Annual Meeting and, in the case of

internet or telephonic voting instructions, must be received before 11:59 p.m. Eastern Time on November 7, 2023.

What shares are included on the proxy card?

If you are a stockholder of record, you will receive only one proxy card

for all the shares you hold of record in certificate and book-entry form. If you are a beneficial owner, you will receive voting instructions

from your broker, bank or other agent that is the holder of record.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting

will be available ten days prior to the Annual Meeting for any purpose relevant to the Annual Meeting, by contacting the Secretary of

BioVie Inc.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual

Meeting, who will separately count “For” and “Against” votes, and broker non-votes.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker,

you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any

proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases,

the broker can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will

not be able to vote on those matters for which specific authorization is required.

If you are a beneficial owner whose shares are held of record by a broker,

your broker has discretionary voting authority to vote your shares on Proposal No. 2, the Auditor Ratification Proposal, even if the broker

does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on Proposal No. 1, the

Board Election Proposal. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares.

What is the quorum requirement for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid Annual Meeting.

A quorum will be present if the holders of majority of the outstanding shares are represented by proxy or by stockholders present

and entitled to vote at the Annual Meeting. On the Record Date, there were 36,920,560 shares outstanding and entitled to vote. Thus,

18,460,280 shares must be represented by proxy or by stockholders present and entitled to vote at the Annual Meeting. Abstentions

and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

If there is no quorum, a majority of the shares so represented may adjourn

the Annual Meeting to another time or date.

How many votes are required to approve each proposal?

| Proposal |

|

Vote Required |

|

Broker Discretionary

Voting Allowed? |

| Proposal No. 1 -- Board Election Proposal |

|

Plurality of votes cast |

|

No |

| Proposal No. 2 – Auditor Ratification Proposal |

|

Majority of votes cast |

|

Yes |

If you abstain from voting or there is a broker non-vote on any matter,

your abstention or broker non-vote will not affect the outcome of such vote, because abstentions and broker non-votes are not considered

votes cast under our Amended and Restated Bylaws or under the laws of Nevada (our state of incorporation).

Proposal No. 1 - Board Election Proposal; plurality vote

Directors are elected by a plurality of votes cast. This means that Directors

who receive the most “For” votes are elected. There is no “Against” option and votes that are “withheld”

or not cast, including broker non-votes, are not counted as votes “For” or “Against.” If a Director nominee receives

a plurality of votes but does not, however, receive a majority of votes, that fact will be considered by the Compensation and Nominating

Committee of the Board in any future decision on Director Nominations.

Proposal No. 2 - Auditor Ratification Proposal; majority vote

The votes cast “For” must exceed the votes cast “Against”

to approve the Auditor Ratification Proposal. Abstentions will not be counted as votes cast and accordingly, will not have an effect on

this Proposal No. 2.

How will my shares be voted at the Annual Meeting?

At the Annual Meeting, the persons named in the proxy card will vote your

shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your proxy

will be voted as the Board of Directors recommends, unless your votes constitute broker non-votes, which is:

| |

● |

FOR the election of each of the Director nominees named in this Proxy Statement; |

| |

● |

FOR the ratification of the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year; |

Do I have cumulative voting rights?

No, our Amended and Restated Certificate of Incorporation does not provide

for cumulative voting.

Am I entitled to dissenter rights or appraisal rights?

No, our stockholders are not entitled to dissenters’ rights or appraisal

rights under the Nevada General Corporation Law for the matters being submitted to stockholders at the Annual Meeting.

Could other matters be decided at the Annual Meeting?

At the date of this Proxy Statement, we did not know of any matters to

be considered at the Annual Meeting other than the items described in this Proxy Statement. If any other business is properly presented

at the Annual Meeting, your proxy card grants authority to the proxy holders to vote on such matters in their discretion.

Can I access the Notice of Annual Meeting and Proxy Statement and the

2023 Annual Report via the Internet?

Yes, this Notice of Annual Meeting, Proxy Statement and the 2023 Annual

Report are available on our website at www.bioviepharma.com. Instead of receiving future proxy statements and accompanying materials by

mail, most stockholders can elect to receive an e-mail that will provide electronic links to them. Opting to receive your proxy materials

online will save us the cost of producing documents and mailing them to your home or business, and also gives you an electronic link to

the proxy voting site.

Stockholders of Record: You may enroll in the electronic proxy delivery

service at any time by accessing your stockholder account at www.amstock.com and following the enrollment instructions.

Beneficial Owners: You also may be able to receive copies of these

documents electronically. Please check the information provided in the proxy materials sent to you by your broker, bank or other holder

of record regarding the availability of this service.

Who will pay for the cost of this proxy solicitation?

BioVie will pay the cost of soliciting proxies. Proxies may be solicited

on our behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission or by

other means of communication. Directors, officers or employees will not be paid any additional compensation for soliciting proxies. We

may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to the beneficial owners.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final

voting results will be reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Nominees

We currently have a Board consisting of seven directors. There are seven

(7) nominees for director to be voted on at the 2023 Annual Meeting. All of the nominees are current Directors and have consented to serve

as Directors. Each Director to be elected will hold office until the next annual meeting and until his or her respective successor is

elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the

election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as

we may designate. Should a nominee become unable to serve or should a vacancy on the Board occur before the 2023 Annual Meeting, the Board

may either reduce its size or designate a substitute nominee. If a substitute nominee is named, your shares will be voted for the election

of the substitute nominee designated by the Board, unless your shares are treated as a broker non-vote. In the vote on the election of

the Director nominees, stockholders may vote “FOR” nominees or “WITHHOLD” votes from nominees. The seven (7) Director

nominees receiving the highest number of “FOR” votes will be elected as Directors. Votes that are withheld, abstentions and

broker non-votes will have no effect on the outcome of the election.

The persons appointed by the Board as proxies intend to vote for the election

of each of the below director nominees, unless you indicate otherwise on the proxy or voting instruction card or if your vote is treated

as a broker non-vote. Set forth below is biographical and other information about the Director nominees. Following each nominee’s

biographical information, we have provided information concerning the particular experience, qualifications, attributes and/or skills

that led the Nominations and Governance Committee and the Board to determine that each nominee should serve as a Director.

Our Board unanimously recommends that you vote “FOR” the nominees

named below.

| Name |

|

Age |

|

Position |

|

Director

Since |

| Jim Lang |

|

58 |

|

Chairman of the Board, Chairman of the Nominating and Corporate Governance Committee, and Member of the Audit Committee |

|

2016 |

| Cuong Do |

|

57 |

|

Director, President and Chief Executive Officer |

|

2016 |

| Michael Sherman |

|

64 |

|

Director, Chairman of the Compensation Committee and Member of the Audit Committee and Nominating and Corporate Governance Committee |

|

2017 |

| Richard J. Berman |

|

81 |

|

Director, Chairman of the Audit Committee and Member of the Compensation Committee |

|

2019 |

| Steve Gorlin |

|

86 |

|

Director and Compensation Committee Member |

|

2020 |

| Robert Hariri, M.D. Ph.D. |

|

64 |

|

Director and Nominating and Corporate Governance Committee |

|

2020 |

| Sigmund Rogich |

|

79 |

|

Director and Audit Committee Member |

|

2020 |

Mr. Jim Lang, Chairman of the Board of Directors since March 2023

and has served as the Company’s director since 2016. He is currently CEO of EVERSANA, the leading commercialization services company

for the life sciences industry. In five years since he founded EVERSANA, it is now over $1B in revenue, with >7000 employees across

40 global locations. He formerly served as the CEO of Decision Resources Group (DRG), which he transformed into a leading healthcare data

and analytics firm. Prior to that, Jim was CEO of IHS Cambridge Energy Research Associates (IHS CERA), a recognized leader in energy industry

subscription information products, and formerly the President of Strategic Decisions Group (SDG), a leading global strategy consultancy.

Mr. Lang holds a BS summa cum laude in electrical and computer engineering from the University of New Hampshire and an MBA with Distinction

from the Tuck School of Business. Jim Lang currently also serves as a Director at OptimizeRX (OPRX), a Nasdaq listed Company.

Jim Lang’s qualifications to serve on our Board of Directors are

primarily based on his decades of experience as a strategy consultant, broad industry expertise, and senior-level management experience

running several healthcare and information technology companies.

Mr. Cuong Do, has served on the Company’s board of directors

since 2016 and effective April 27, 2021 was appointed the Company’s CEO and President. He served as the President, Global Strategy

Group, at Samsung from February 2015 to December 2020. Mr. Do helped set the strategic direction for Samsung Group’s diverse business

portfolio. He was previously the Chief Strategy Officer for Merck from October 2011 to March 2014, and Tyco Electronics from June 2009

to October 2011, and Lenovo from December 2007 to March 2009. Mr. Do is a former senior partner at McKinsey & Company, where he spent

17 years and helped build the healthcare, high tech and corporate finance practices. He holds a BA from Dartmouth College, and an MBA

from the Tuck School of Business at Dartmouth.

We believe Mr. Do’s qualifications to serve on our Board of Directors

and as the CEO are primarily based on his decades of experience as an executive in the pharma, biotech, and other high technology industries

and his extensive experience in strategy, corporate finance practice and the development of companies in all stages.

Mr. Michael Sherman JD has served as the Company director since

2017. He retired from his position as a Managing Director at Barclays Plc in 2018, where he had worked since 2008. Previously he was a

Managing Director at Lehman Brothers, Inc. He has worked in investment banking for 30 years. Mr. Sherman has significant experience in

healthcare finance, most recently assisting on a $450 million convertible transaction for Neurocrine Biosciences. He has worked on successful

financial transactions for Teva Pharmaceutical Industries, Amgen Inc., Cubist Pharmaceuticals, Merck & Co., and Cardinal Health, among

other companies. After graduating from the University of Pennsylvania, Michael Sherman received his JD, cum laude, from the Harvard Law

School.

Michael Sherman’s qualifications to serve on our Board of Directors

are primarily based on his decades of finance industry experience and investment banking. Mr. Sherman has significant experience in healthcare

finance including having worked on successful financial transactions for several pharmaceutical and healthcare focused companies.

Mr. Richard J. Berman has served as the Company’s director

since June 2019. Mr. Berman has over 35 years of venture capital, senior management, and merger & acquisitions experience. He currently

is a director of four public companies including; Cryoport Inc., Genius Group, Context Therapeutics, and over the last decade served on

the boards of six companies that reached a market capitalization over one billion including Cryoport, Advaxis, EXIDE, Internet Commerce

Corporation, Kapitus and Ontrak. From 1998-2000, he was employed by Internet Commerce Corporation (now Easylink Services) as Chairman

and CEO and was a director from 1998-2012. Previously, Mr. Berman was Senior Vice President of Bankers Trust Company, where he started

the M&A and Leveraged Buyout Departments; created the largest battery company in the world in the 1980’s by merging Prestolite,

General

Battery and Exide and advised on over $4 billion of M&A transactions

(completed over 300 deals). He is a past Director of the Stern School of Business of NYU where he obtained his BS and MBA. He also has

US and foreign law degrees from Boston College and The Hague Academy of International Law, respectively.

We believe Richard J. Berman’s qualifications to serve on our board

of directors include his experience in the healthcare industry, and his current and past experience in numerous private and publicly traded

companies.

Mr. Steven Gorlin has served as the Company’s director since

June 2020. He has founded many biopharma companies including Hycor Biomedical, Theragenics, Medicis Pharmaceutical, EntreMed, MRI Interventions,

DARA BioSciences, MiMedx, Medivation (sold to Pfizer for $14 billion) and NantKwest. Mr. Gorlin served for many years on the Business

Advisory Council to the Johns Hopkins School of Medicine and on The Johns Hopkins BioMedical Engineering Advisory Board. He is currently

a member of the Research Institute Advisory Committee (RIAC) of Massachusetts General Hospital. He started The Touch Foundation, a nonprofit

organization for the blind, and was a principal contributor to Camp Kudzu for diabetic children.

Steve Gorlin’s qualifications to serve on our Board of Directors

are primarily based on his over 45 years of experience in founding and investing in several biopharma companies, leading multiple NASDAQ

AND NYSE companies to their success.

Dr. Robert Hariri MD, PhD, has served as the Company’s director

since June 2020. Dr Hariri is the Chairman, founder, and CEO of Celularity, Inc., a leading cellular therapeutics company. He was the

founder and CEO of Anthrogenesis Corporation, and after its acquisition served as CEO of Celgene Cellular Therapeutics. Dr. Hariri co-founded

the genomic health intelligence company, Human Longevity, Inc. Dr. Hariri pioneered the use of stem cells to treat a range of life-threatening

human diseases. He is widely acknowledged for his discovery of pluripotent stem cells and for assisting with discovering the physiological

activities of tumor necrosis factor (TNF). He holds over 170 issued and pending patents.

Robert (Bob) Hariri’s qualifications to serve on our Board of Directors

are primarily based on his decades of founding and leading several companies in the cellular therapeutic space, as well as pioneering

in the use of stem cells to treat a range of life-threatening human diseases and discoveries in the physiological activities of tumor

necrosis factor. He has authored over 150 publications and garnered numerous awards for contributions to the fields of biomedicine and

aviation.

Mr. Sigmund (Sig) Rogich, has served as the Company’s director

since June 2020. Sig is the CEO and President of The Rogich Communications Group and serves on the Board of Keep Memory Alive, a philanthropic

organization which raises awareness about brain disorders and Alzheimer’s disease. Keep Memory Alive funds clinical trials to advance

new treatments for patients with Alzheimer’s, Huntington’s and Parkinson’s disease, as well as multiple sclerosis. Mr.

Rogich was formerly the US Ambassador to Iceland. He has served as a senior consultant to Presidents Ronald Reagan and George H.W. Bush.

Mr. Rogich serves on multiple boards of directors for charitable causes.

We believe Mr. Rogich’s qualifications to serve on our Board of Directors

are based on his experience in the Communications sector and philanthropic organization raising awareness about brain disorders. His experience

in service as a senior consultant to candidates of the highest office.

Plurality Voting

Under Nevada law and BioVie’s Amended and Restated Bylaws, a vote

by a plurality of the shares voting is required for the election of Directors. Under plurality voting, nominees who receive the most “For”

votes are elected; there is no “Against” option and votes that are “withheld” or not cast are disregarded in the

count. If a nominee receives a plurality of votes but does not, however, receive a majority of votes, that fact will be considered by

the Compensation and Nominating Committee in any future decision on nominations.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE “FOR”

THE ELECTION OF EACH OF THESE NOMINEES AS DIRECTORS.

Role and Composition of the Board of Directors

The Board of Directors, which is elected by the stockholders, is the ultimate

decision-making body of the Company, except with respect to those matters reserved to the stockholders. It selects the President and Chief

Executive Officer, or person or persons performing similar functions, and other members of the senior management team, and provides an

oversight function for the President and Chief Executive Officer’s execution of overall business strategy and objectives. The Board

acts as an advisor and counselor to senior management and validates business strategy and direction. The Board’s primary function

is to monitor the performance of senior management and facilitate growth and success by providing mentoring and actionable business advice

honed by substantial substantive knowledge of the Company’s business and history tempered with significant outside business experience.

Our Amended and Restated Bylaws state that the number of Directors shall

be determined from time to time by the Board of Directors. Directors shall be elected at the annual meeting of stockholders and each director

shall be elected to serve until his successor shall be elected and shall qualify. In all elections for Directors, every stockholder shall

have the right to vote the number of shares owned by such stockholders for each director to be elected. A director or the entire Board,

may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at the election of directors.

Vacancies in the Board may be filled by a majority of the Directors or by an election either at an annual meeting or at a special meeting

of the stockholders called for that purpose. Any directors elected by the stockholders to fill the vacancy shall hold office for the balance

of the term for which he or she was elected. A director appointed by the Board to fill the vacancy shall serve until the next meeting

of stockholders at which directors are elected.

A director need not be a stockholder. Directors shall not receive any stated

salary for their services as directors or as members of committees, but by resolution of the Board of Directors a fixed fee and expenses

of attendance may be allowed for attendance at each meeting. Our Amended and Restated Bylaws shall not be construed to preclude any director

from serving the Company in any other capacity as an officer, agent or otherwise, and receiving compensation therefor.

There are no familial relationships among any of our directors or officers.

Except as described under “The Nominees” above or “Executive Officers” below, none of our other directors or officers

is or has been a director or has held any form of directorship in any other U.S. reporting companies. None of our directors or officers

has been affiliated with any Company that has filed for bankruptcy within the last five years. We are not aware of any proceedings to

which any of our officers or directors, or any associate of any such officer or director, is a party that are adverse to the Company.

We are also not aware of any material interest of any of our officers or directors that is adverse to our own interests.

Code of Ethics

We have adopted a code of conduct and ethics meeting the requirements of

Section 406 of the Sarbanes-Oxley Act of 2002. We believe our code of conduct and ethics is reasonably designed to deter wrongdoing and

promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with

applicable laws; ensure prompt internal reporting of violations; and provide accountability for adherence to the provisions of the code

of ethic. Our code of ethics is accessible under the “Investors-Governance” section of our website at www.bioviepharma.com.

Disclosure regarding any amendments to, or waivers from, provisions of the code of ethics will be included in a Current Report on Form

8-K that will be filed with the SEC within four business days following the date of the amendment or waiver.

Independence of the Board of Directors

Our common stock is traded on the Nasdaq Capital Market. The Board of Directors

has determined that six of the members of the Board of Directors qualify as “independent,” as defined by the listing standards

of the Nasdaq. Consistent with these considerations, after review of all relevant transactions and relationships between each director,

or any of the director’s family members, and the Company, its senior management and its independent auditors, the Board has determined

further that Messrs. Lang, Sherman, Berman, Gorlin, Hariri and Rogich are independent under the listing standards of Nasdaq. In making

this determination, the Board of Directors considered that there were no new transactions or relationships between its current independent

directors and the Company, its senior management and its independent auditors since last making this determination.

2023 Meetings and Attendance

During fiscal year 2023, the Board held five Board of Directors meetings, four Audit Committee meetings,

five Compensation Committee meetings and one Nominating and Corporate Governance Committee meeting. All Directors attended at least 75%

or more of the aggregate number of meetings of the Board and Board Committees on which they served.

Committees of the Board of Directors

Our Board of Directors has three standing committees: an audit committee,

a compensation committee and a nominating and corporate governance committee. Both our audit committee and our compensation committee

will be composed solely of independent directors. The audit committee is comprised solely of independent directors, and the compensation

committee and the nominating and corporate governance committee are comprised solely of independent directors. Each committee operates

under a charter approved by our Board of Directors and have the composition and responsibilities described below. The charter of each

committee is available on our website.

Audit Committee

We have established an audit committee of the Board of Directors.

The members of our audit committee are Richard Berman, Michael Sherman, Jim Lang and Sigmund Rogich each of whom is an independent director

within the meaning of the Nasdaq rules. Mr. Berman has served as chairman of the audit committee since October 2020 and qualifies as an

“audit committee financial expert” as defined by Item 401(h)(2) of Regulation S-K.

We have adopted an audit committee charter, detailing the principal functions

of the audit committee, including:

| |

● |

assisting board oversight of (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) our independent auditor’s qualifications and independence, and (4) the performance of our internal audit function and independent auditors; the appointment, compensation, retention, replacement, and oversight of the work of the independent auditors and any other independent registered public accounting firm engaged by us; |

| |

● |

pre-approving all audit and non-audit services to be provided by the independent auditors or any other registered public accounting firm engaged by us, and establishing pre-approval policies and procedures; reviewing and discussing with the independent auditors all relationships the auditors have with us in order to evaluate their continued independence; |

| |

● |

setting clear policies for audit partner rotation in compliance with applicable laws and regulations; |

| |

● |

obtaining and reviewing a report, at least annually, from the independent auditors describing (1) the independent auditor’s internal quality-control procedures and (2) any material issues raised by the most recent internal quality-control review, or peer review, of the audit firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years respecting one or more independent audits carried out by the firm and any steps taken to deal with such issues; |

| |

● |

meeting to review and discuss our annual audited financial statements and quarterly financial statements with management and the independent auditor, including reviewing our specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; reviewing and approving any related party transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC prior to us entering into such transaction; and |

| |

● |

reviewing with management, the independent auditors, and our legal advisors, as appropriate, any legal, regulatory or compliance matters, including any correspondence with regulators or government agencies and any employee complaints or published reports that raise material issues regarding our financial statements or accounting policies and any significant changes in accounting standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other regulatory authorities. |

Compensation Committee

We have established a compensation committee of the Board of Directors.

The members of our Compensation Committee are Richard Berman, Michael Sherman and Steve Gorlin. Mr. Sherman has served as chairman of

the compensation committee since October 2020.

We have adopted a compensation committee charter, which details the principal

functions of the compensation committee, including:

| |

● |

reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration (if any) of our Chief Executive Officer based on such evaluation; |

| |

● |

reviewing and making recommendations to our Board of Directors with respect to the compensation, and any incentive-compensation and equity-based plans that are subject to board approval of all of our other officers; |

| |

● |

reviewing our executive compensation policies and plans; |

| |

● |

implementing and administering our incentive compensation equity-based remuneration plans; assisting management in complying with our proxy statement and annual report disclosure requirements; |

| |

● |

approving all special perquisites, special cash payments and other special compensation and benefit arrangements for our officers and employees; and |

| |

● |

producing a report on executive compensation to be included in our annual proxy statement; and reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. |

The charter also provides that the compensation committee may, in

its sole discretion, retain or obtain the advice of a compensation consultant, independent legal counsel or other adviser and will be

directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving

advice from a compensation consultant, external legal counsel or any other adviser, the compensation committee will consider the independence

of each such adviser, including the factors required by Nasdaq and the SEC.

Compensation Committee Interlocks and Insider Participation

None of our officers currently serves, or in the past year has served,

as a member of the compensation committee of any entity that has one or more officers serving on our Board of Directors.

Nominating and Corporate Governance Committee

We have established a nominating and corporate governance committee

of the Board of Directors. The members of our nominating and corporate governance committee are, Jim Lang, Michael Sherman and Robert

Hariri. Mr. Lang has served as chair of the nominating and corporate governance committee since August 2021.

We have adopted a nominating and corporate governance committee charter,

which details the purpose and responsibilities of the nominating and corporate governance committee, including:

| |

● |

identifying, screening and reviewing individuals qualified to serve as directors, consistent with criteria approved by the Board of Directors, and recommending to the Board of Directors candidates for nomination for election at the annual meeting of stockholders or to fill vacancies on the Board of Directors; |

| |

● |

developing and recommending to the Board of Directors and overseeing implementation of our corporate governance guidelines; |

| |

● |

coordinating and overseeing the annual self-evaluation of the Board of Directors, its committees, individual directors and management in the governance of the company; and |

| |

● |

reviewing on a regular basis our overall corporate governance and recommending improvements as and when necessary. |

The charter also provides that the nominating and corporate governance

committee may, in its sole discretion, retain or obtain the advice of, and terminate, any search firm to be used to identify director

candidates, and will be directly responsible for approving the search firm’s fees and other retention terms.

We have not formally established any specific, minimum qualifications that

must be met or skills that are necessary for directors to possess. In general, in identifying and evaluating nominees for director, the

Board of Directors considers educational background, diversity of professional experience, knowledge of our business, integrity, professional

reputation, independence, wisdom, and the ability to represent the best interests of our stockholders. Prior to our initial business combination,

holders of our public shares will not have the right to recommend director candidates for nomination to our Board of Directors.

Set forth below is information concerning the gender and demographic background

of each of our current directors, as self-identified and reported by each director. This information is being provided in accordance with

Nasdaq’s board diversity rules.

Board Diversity Matrix (As of August 11, 2023)

| Total Number of Directors: |

7 |

|

| |

|

|

|

|

|

|

|

Did Not |

|

| |

|

|

|

|

|

Non- |

Disclose |

| |

|

Female |

Male |

|

Binary |

Gender |

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

0 |

|

7 |

0 |

|

0 |

|

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

| African American or Black |

— |

|

— |

— |

|

— |

|

| Alaskan Native or Native American |

— |

|

— |

— |

|

— |

|

| Asian |

— |

|

1 |

— |

|

— |

|

| Hispanic or Latinx |

— |

|

— |

— |

|

— |

|

| Native Hawaiian or Pacific Islander |

— |

|

— |

— |

|

— |

|

| White |

— |

|

3 |

— |

|

— |

|

| Two or More Races or Ethnicities |

— |

|

— |

— |

|

— |

|

| LGBTQ+ |

— |

|

— |

— |

|

— |

|

| Did Not Disclose Demographic Background |

— |

|

3 |

— |

|

— |

|

Code of Ethics

We have adopted a code of conduct and ethics meeting the requirements of

Section 406 of the Sarbanes-Oxley Act of 2002. We believe our code of conduct and ethics is reasonably designed to deter wrongdoing and

promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with

applicable laws; ensure prompt internal reporting of violations; and provide accountability for adherence to the provisions of the code

of ethic. Our code of conduct and ethics is available on our website.

A copy of our code of conduct and ethics is filed as an exhibit to this

Form 10-K.

Executive Officers

The following table sets forth certain information regarding our executive

officers and some of our key employees, as of September 28, 2023. For information regarding

Cuong Do, our President & Chief Executive Officer, see “The Nominees” above.

| Name |

|

Age |

|

|

Director Since |

|

|

Position |

| Cuong Do |

|

|

57 |

|

|

|

2016 |

|

|

CEO & President and Director |

| Joanne Wendy Kim |

|

|

68 |

|

|

|

-- |

|

|

Chief Financial Officer |

| Joseph M. Palumbo, MD |

|

|

63 |

|

|

|

-- |

|

|

Chief Medical Officer |

Ms. Joanne Wendy Kim has served as the Company’s Chief

Financial Officer since October 2018. Ms. Kim previously served as CFO for several companies throughout her career, previously with Landmark

Education Enterprises, and prior to that, other public entities in the entertainment and financial services industry sectors. She provided

interim CFO services to various organizations through Group JWK from 2016 to 2018. In her various roles, Ms. Kim oversaw corporate finance

and operational groups, closed eight acquisitions, secured bank financings, developed and implemented new business strategies, managed

risk and implemented new financial policies and procedures. As a CPA professional, she advised on accounting transactions, SEC reporting

matters and other regulatory matters to clients serving as a Director at BDO USA, LLP’s National Office SEC Department and sat the

US desk in London for BDO LLP UK Firm in 2008-2016 and as a Senior Manager at KPMG in earlier part of her career. She brings more than

35 years of accounting and finance experience to this position. Ms. Kim earned her BSA in accounting and finance at California State University,

Long Beach.

Wendy Kim’s qualifications to serve as our Chief Financial Officer

are primarily based on her 35 years of accounting and finance experience both as a CFO and as a CPA in major global accounting and consultancy

firms.

Dr. Joseph M. Palumbo has served

as our Chief Medical Officer since November 2021. Formerly he served as the CMO at Zynerba Pharmaceuticals from July 2019 to October 2021,

responsible for clinical operations, development, regulatory, and medical affairs. Prior to his time at Zynerba, Dr. Palumbo held senior

worldwide governance roles at Mitsubishi Tanabe Pharma in both the United States and Japan from April 2012 to June 2019, where he led

medical science and translational research across multiple therapeutic areas, and guided successful registrational programs for

Radicava® (edaravone) for the treatment of Amyotrophic Lateral Sclerosis. From April 2003 to March 2012,

Dr. Palumbo was Global Head and Franchise Medical Leader for Psychiatry, and the Interim Head of Global Neuroscience at Johnson

& Johnson, where he led the medical teams who achieved successful global registrations for Risperdal® (risperidone); Concerta®

(methylphenidate HCL); and Invega® (paliperidone). He was Head of Psychiatry and Neurology at Pharmanet for from April 2002 to April

2003. Dr Palumbo previously held industry positions in European Pharma with Sanofi-Synthelabo from April 1999 to April 2002, Biotech at

Cephalon, from April 1997 to April 1998, and from July 1989 to April 2002, he held senior leadership and hospital administration roles

at prestigious academic research institutions including Yale, Cornell, and the University of Pennsylvania. He holds a Bachelor of Arts

at the University of Pennsylvania and received his Doctor of Medicine at the George Washington University School of Medicine. He was a

Biological Sciences Training Program Fellow of the National Institutes of Health and Chief Resident for the Abraham Ribicoff Clinical

Neuroscience Research Unit at Yale University. Dr Palumbo has received Board Certification in Psychiatry and Addiction Psychiatry.

Dr. Palumbo’s qualifications to serve as our Chief Medical Officer

is based on the decades and depth of experiences in the roles he has served in his medical profession and commercial experience in the

healthcare industry and biopharma industries.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (Exchange

Act), requires our directors and executive officers, and persons who own more than 10% of our outstanding Common Stock, to file with the

SEC, initial reports of ownership and reports of changes in ownership of our equity securities. Such persons are required by SEC regulations

to furnish us with copies of all such reports they file.

To our knowledge, based solely on a review of the copies of such reports

furnished to us regarding the filing of required reports, we believe that, except for the reports filed by Clarence Ahlem (Form 4s filed

on January 18, 2023 and February 22, 2023), Richard J. Berman (Form 4s filed on January 18, 2023, April 6, 2023 and June 15, 2023), Cuong

Do (Form 4s filed on July 7, 2022, January 18, 2023, February 22, 2023 and June 26, 2023), Steve Gorlin (Form 4 filed on January 18, 2023),

Robert J. Hariri (Form 4 filed on January 18, 2023), Wendy Kim (Form 4s filed on January 8, 2023 and February 22, 2023), James Lang (Form

4 filed on January 18, 2023), Penelope Markham (Form 4s filed on January 18, 2023 and February 22, 2023), Joseph M Palumbo (Form 4s filed

on January 18, 2023, February 22, 2023 and July 3, 2023), Terren Peizer (Form 3 filed on August 16, 2022 and Form 4s filed on August 26,

2022 and January 18, 2023), Christopher Reading (Form 4s filed on January 18, 2023 and February 22, 2023), Sigmund Rogich (Form 4 filed

on January 18, 2023) and Michael Sherman (Form 4 filed on January 18, 2023), all Section 16(a) reports applicable to our directors, executive

officers and greater-than-ten-percent beneficial owners with respect to fiscal 2023 were timely filed.

Anti-Hedging Policy

We have adopted an insider trading policy that includes a provision restricting

trading of any interest or provision relating to the future price of our securities, such as a put, call or short sale.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation paid during the last

two fiscal years ended June 30, 2023 and 2022 to the following executive officers of the Company, who are referred to as our “named

executive officers”:

| |

● |

Cuong Do, our President and Chief Executive Officer |

| |

● |

Joanne Wendy Kim, our Chief Financial Officer and Corporate Secretary |

| |

● |

Joseph Palumbo, our Chief Medical Officer |

| Name and Principal Position | |

Year | |

Salary | |

Bonus | |

Stock Awards (1) | |

Option Awards (1) | |

Non-Equity Incentive Plan Compensation | |

Nonqualified Deferred Compensation Earnings | |

All Other Compensation | |

Total |

| Cuong Do (2) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Chief Executive Officer and President | |

| 2023 | | |

$ | 618,000 | | |

$ | 463,500 | | |

$ | 734,668 | | |

$ | 521,500 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 2,337,668 | |

| | |

| 2022 | | |

$ | 300,000 | | |

$ | 400,000 | | |

$ | 210,439 | | |

$ | 3,632,382 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 4,542,821 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Joanne Wendy Kim (3) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Chief Financial Officer, Treasurer and Corporate Secretary | |

| 2023 | | |

$ | 246,750 | | |

$ | 150,625 | | |

$ | 242,499 | | |

$ | 84,000 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 723,874 | |

| | |

| 2022 | | |

$ | 235,000 | | |

$ | 127,656 | | |

$ | — | | |

$ | 582,343 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 944,999 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Joseph Palumbo (4) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Chief Medical officer | |

| 2022 | | |

$ | 525,000 | | |

$ | 197,000 | | |

$ | 242,499 | | |

$ | 126,000 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 1,090,499 | |

| | |

| 2022 | | |

$ | 333,333 | | |

$ | 239,167 | | |

$ | — | | |

$ | 244,465 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 816,965 | |

| |

(1) |

The aggregate grant date fair value of such awards were computed in accordance with Financial Accounting Standards Board ASC Topic 718, Stock Compensation (ASC Topic 718), and do not take into account estimated forfeitures related to service-based vesting conditions, if any. The valuation assumptions used in calculating these values are discussed in Note 10 of our Notes to Financial Statements included in our Annual Report on Form 10-K for the year ended June 30, 2023. These amounts do not represent actual amounts paid or to be realized. Amounts shown are not necessarily indicative of values to be achieved, which may be more or less than the amounts shown as awards may subject to time-based vesting. The stock awards in form of RSUs and Stock Option Awards were awarded pursuant to the 2019 Omnibus Incentive Plan, (the “2019 Plan”). |

| |

(2) |

Mr. Do’s salary from April 27, 2021 (date of his appointment as CEO) through December 31, 2021 was paid through RSUs. The aggregate grant date fair value of the award was $454,794 and the total 58,759 RSUs awarded allows Mr. Do to receive one shares of Common Stock for each RSU. |

| |

(3) |

Ms. Kim served as the Chief Financial Officer and Corporate Secretary and Treasurer on a full time basis effective July 1, 2021. |

| |

(4) |

Dr. Palumbo joined the Company on November 1, 2021 and served as the Chief Medical Officer. |

Narrative Disclosures to Summary Compensation Table

Employment Agreements

All employment arrangements are “at will” agreements.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth all outstanding equity

awards held by our named executive officers as of June 30, 2023:

| | |

| |

Options | |

| |

Stock Awards |

| Name | |

Grant Date | |

Number of securities underlying unexercised options exercisable | |

Number of securities underlying unexercised options unexercisable | |

Equity incentive plan awards: number of securities underlying unexercised unearned options | |

Option exercise price | |

Option expiration date | |

Number of shares or units of stock that have not vested | |

Market value of shares or units of stock that have to vested | |

Equity incentive plan awards: number of unearned shares, units or other rights that have not vested | |

Equity incentive plan awards: market or payout value of unearned shares, units or other right that have not vested |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Cuong Do, CEO | |

01-19-19 | |

| 800 | | |

| — | | |

| — | | |

$ | 3.75 | | |

01-19-24 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

01-19-20 | |

| 800 | | |

| — | | |

| — | | |

$ | 2.80 | | |

01-19-25 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

12-18-20 | |

| 24,375 | | |

| — | | |

| — | | |

$ | 13.91 | | |

12-18-25 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

08-20-21 | |

| 387,400 | | |

| — | | |

| 357,600 | | |

$ | 7.74 | | |

08-20-31 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

06-21-22 | |

| 41,506 | | |

| — | | |

| 83,014 | | |

$ | 1.69 | | |

06-21-32 | |

| — | | |

| — | | |

| 83,014 | | |

$ | 357,790 | |

| | |

11-23-23 | |

| — | | |

| — | | |

| — | | |

$ | — | | |

| |

| — | | |

| — | | |

| 59,436 | | |

$ | 256,169 | |

| | |

06-29-23 | |

| — | | |

| — | | |

| 175,000 | | |

$ | 4.09 | | |

06-29-33 | |

| — | | |

| — | | |

| 149,500 | | |

$ | 644,345 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | |

| Joanne W. Kim, CFO | |

10-01-18 | |

| 800 | | |

| — | | |

| — | | |

$ | 8.75 | | |

10-01-23 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

10-01-19 | |

| 800 | | |

| — | | |

| — | | |

$ | 8.75 | | |

10-01-24 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

10-01-20 | |

| 800 | | |

| — | | |

| — | | |

$ | 9.54 | | |

10-01-25 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

08-20-21 | |

| 40,726 | | |

| — | | |

| 83,441 | | |

$ | 7.74 | | |

08-20-31 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

11-23-22 | |

| — | | |

| — | | |

| — | | |

$ | — | | |

| |

| — | | |

| — | | |

| 29,718 | | |

$ | 128,085 | |

| | |

06-07-23 | |

| 5,000 | | |

| — | | |

| 15,000 | | |

$ | 5.78 | | |

06-07-33 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | |

| Joseph M. Palumbo, CMO | |

02-01-22 | |

| 24,833 | | |

| — | | |

| 99,334 | | |

$ | 3.20 | | |

02-01-32 | |

| — | | |

| — | | |

| — | | |

$ | — | |

| | |

11-23-22 | |

| — | | |

| — | | |

| — | | |

$ | — | | |

| |

| — | | |

| — | | |

| 29,718 | | |

$ | 128,085 | |

| | |

06-07-23 | |

| 7,500 | | |

| — | | |

| 22,500 | | |

$ | 5.78 | | |

06-07-33 | |

| — | | |

| — | | |

| — | | |

$ | — | |

Named executive officers held stock options to

purchase a total of 1,371,729 shares of Common Stock as of June 30, 2023, with an aggregate grant date fair value of approximately $5.4

million, the last of which vests in 2027. Stock options granted prior to August 20, 2021, vested on the grant date; the stock options

granted on August 20, 2021 vested 20% on the grant date, with the remaining stock options vesting in five equal annual installments beginning

on the first grant date anniversary; the stock options granted on June 7, 2023, vested 25% on the grant date, with the remaining stock

options vesting in four equal annual installments beginning on the first grant date anniversary; and the stock options and stock awards

in the form RSUs granted to the CEO on June 21, 2022 and June 29, 2023 vests in three equal annual installments beginning on the first

grant date anniversary. The RSU awarded on November 23, 2022 vested 25% on the grant date with the remaining RSU vesting in three equal

annual installments beginning on the first grant date anniversary. The total RSUs outstanding awarded to the named executive officers

totaled 351,386 with a market value totaling approximately $1.5 million as of June 30, 2023.

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE-IN-CONTROL

There are no arrangements with the named executive officers or our equity

incentive plan or individual award agreements thereunder providing for certain payments to our named executive officers at or following

or in connection with a termination of their employment or a change of control of the Company.

DIRECTOR COMPENSATION

There are no arrangements pursuant to which our directors are or will be

compensated in the future for any services provided to the Company.

The following table provides information regarding compensation that was

earned or paid to the individuals who served as non-employee directors during the year ended June 30, 2023. Except as set forth in the

table, during the fiscal year 2023, directors did not earn nor receive cash compensation or compensation in the form of stock awards,

options awards or any other form:

| Name | |

Stock awards (1) | |

Option awards(1) | |

Non-equity incentive plan compensation | |

Change in pension value and nonqualified deferred compensation | |

All other compensation | |

Total |

| | |

| |

| |

| |

| |

| |

|

| Jim Lang | |

$ | 266,697 | | |

| — | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 266,697 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Michael Sherman | |

| — | | |

| 304,500 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 304,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Richard Berman | |

$ | 266,697 | | |

| — | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 266,697 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Steve Gorlin | |

$ | 209,549 | | |

| — | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 209,549 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert Hariri MD, Phd | |

$ | 209,549 | | |

| — | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 209,549 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sigmund Rogich | |

$ | — | | |

| 223,300 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 223,300 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Terren Piezer (2) | |

$ | — | | |

| 263,900 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 263,900 | |

| |

1) |

The aggregate grant date fair value of such awards were computed in accordance with Financial Accounting Standards Board ASC Topic 718, Stock Compensation (ASC Topic 718), and do not take into account estimated forfeitures related to service-based vesting conditions, if any. The valuation assumptions used in calculating these values are discussed in Note 9 of our Notes to Financial Statements included in our proxy statement for the year ended June 30, 2023. These amounts do not represent actual amounts paid or to be realized. Amounts shown are not necessarily indicative of values to be achieved, which may be more or less than the amounts shown as awards may subject to time-based vesting. |

| |

2) |

Mr. Piezer resigned from the Board of Directors effective March 2, 2023. |

Our directors are eligible to participate

in our equity incentive plans, which are administered by our Compensation Committee under authority delegated by our Board of

Directors. The terms and conditions of the option grants to our non-employee directors under our equity incentive plans are and will

be determined in the discretion of our Compensation Committee, consistent with the terms of the applicable plan. The fiscal year

2023 annual compensation granted to existing board members consisted of either an award of RSUs at one unit per share of Common

Stock, a total of 155,636 RSU at a grant date market value of $952,492 or stock options to purchase a total of 195,000 shares of

commons stock with a grant date fair value totaling $791,700. The former chairman of the Board of Directors, the chairman of the

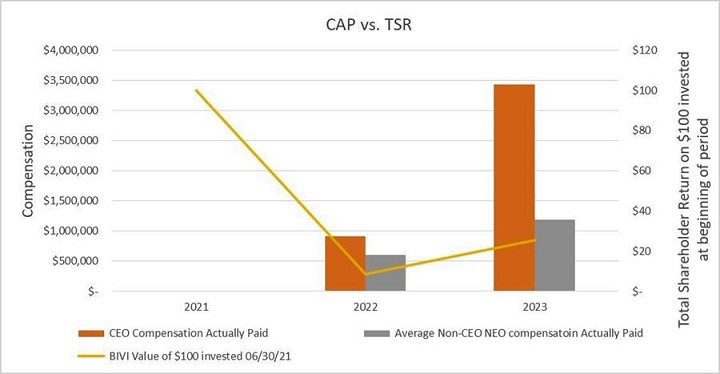

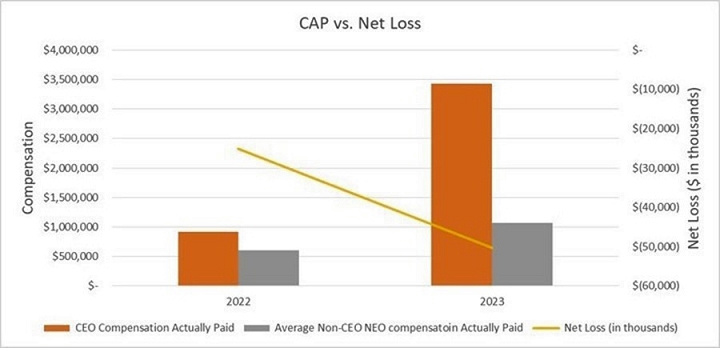

compensation committee and a member of the audit committee received stock options to purchase 65,000, 75,000 and 55,000 shares of