UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(RULE

14a-101)

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

ADDENTAX

GROUP CORP.

(Name

of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other than the Registrant)

Payment

of Filing Fee (Check the Appropriate Box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Kingkey

100, Block A, Room 4805

Luohu District, Shenzhen City, China 518000

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Be Held on June 28, 2024

May

30, 2024

Dear

Fellow Shareholder:

The

2024 Annual Meeting of Shareholders (the “2024 Annual Meeting” or “Meeting”)

of Addentax Group Corp. (the “Company, “we”, or “us”) will be held at 9:00 a.m., Eastern

Time on Friday, June 28, 2024. We have adopted a completely virtual format for our Meeting to provide a healthy, consistent, and

convenient experience to all stockholders regardless of location. You may attend, vote, and submit questions during the Meeting online

at www.proxyvote.com.

You

may also attend the Meeting by proxy, and may submit questions ahead of the Meeting through the designated website. For further information

about the Meeting, please see the Questions and Answers about the Meeting beginning on page 4 of the accompanying

proxy statement (the “Proxy Statement”). The purpose of the Meeting is as follows:

(1) To elect five directors

to hold office until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject

to earlier death, resignation, or removal;

(2)

To approve the 2024 Equity Incentive Plan (the “Equity Incentive Plan Proposal”);

(3)

To authorize the Company’s Board of

Directors to amend the Company’s articles of incorporation, as amended, to combine outstanding shares of the Company’s

common stock into a lesser number of outstanding shares, i.e. a “Reverse Stock Split,” by a ratio of not less

than one-for-two and not more than one-for-one hundred, with the exact ratio to be set within this range by the Company’s Board

of Directors in its sole discretion (the “Reverse Stock Split Proposal”);

(4)

To ratify the appointment of Pan-China Singapore

PAC as our independent registered public accounting firm for the fiscal year ended March 31, 2024 (the “Auditors

Proposal”); and

(5)

To transact such other business as may properly

come before the Annual Meeting or any adjournments or postponements thereof.

The record date for the Annual Meeting is May

22, 2024. Only stockholders of record at the close of business on that date are entitled to receive notice of and vote at the Annual

Meeting or any adjournment or postponement thereof.

All

shares represented by proxies will be voted at the 2024 Annual Meeting in accordance with the specifications marked thereon, or

if no specifications are made, the proxy confers authority to vote “FOR” for each of the forgoing proposals.

The

Company’s Board of Directors believes that a favorable vote for each nominee for a position on the Board of Directors and for all

other matters described in the attached Proxy Statement is in the best interest of the Company and its shareholders and recommends a

vote “FOR” each of the forgoing proposals.

Your

vote is important no matter how large or small your holdings in the Company may be. If you do not expect to be present at the Meeting

virtually, you are urged to promptly complete, date, sign, and return the proxy card. Please review the instructions on your voting options

described in the enclosed Proxy Statement you received in the mail.

This will not limit your right to virtually attend or vote at the Meeting. You may revoke your proxy at any time before it has been voted

at the Meeting.

Thank

you for your investment and continued interest in Addentax Group Corp.

| |

Sincerely, |

| |

|

|

| |

|

/s/ Hong Zhida |

| |

Name: |

Hong

Zhida |

| |

Title: |

Chairman

of the Board, Chief Executive Officer, President, Secretary, and Director |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 28, 2024

The

notice of annual meeting, the proxy statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 will be

available at http://www.addentax.com. Additionally, in accordance with the proxy materials, they will be available at

www.proxyvote.com.

I

M P O R T A N T

YOU

ARE CORDIALLY INVITED TO ATTEND THE MEETING VIRTUALLY. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN,

AND RETURN THE PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. PLEASE REVIEW THE INSTRUCTIONS

ON YOUR VOTING OPTIONS DESCRIBED IN THE ENCLOSED PROXY STATEMENT YOU RECEIVED IN THE MAIL. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL

VOTE IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK, OR OTHER NOMINEE AND

YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY CARD ISSUED IN YOUR NAME FROM THAT INTERMEDIARY. AT LEAST THIRTY-THREE AND ONE-THIRD

PERCENT (33 1/3%) OF THE VOTING POWER OF THE COMPANY’S OUTSTANDING SHARES OF CAPITAL STOCK MUST BE REPRESENTED AT THE MEETING,

EITHER VIRTUALLY OR BY PROXY, TO CONSTITUTE A QUORUM.

PROXY

STATEMENT

2024

ANNUAL MEETING OF SHAREHOLDERS

GENERAL

INFORMATION

This

proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of

Directors (the “Board”) of Addentax Group Corp. (the “Company”, “we” or “us”)

for use at the annual meeting of stockholders (the “Meeting” or the “2024 Annual Meeting”) of the

Company, to be held on 9:00 a.m., Eastern Time on Friday, June 28, 2024. You may attend, vote, and submit questions during the Meeting

via the Internet at www.proxyvote.com. You may also attend the Meeting by proxy, and may submit questions ahead of the Meeting

through the designated website. For further information about the Meeting, please see the Questions and Answers about the Meeting beginning

on page 4 of this Proxy Statement. This Proxy Statement and the enclosed proxy card will be made available to our stockholders on or

about May 30, 2024.

Only

stockholders of record at the close of business on May 22, 2024 (the “Record Date”), are entitled to notice of, and

to vote at, the Meeting. At the close of business on the Record Date, 6,043,769 shares of the Company’s common stock, par

value $0.001 per share (“Common Stock”), were issued and outstanding. At the close of business on the Record Date,

the shares of Common Stock were held by approximately 491 individual participants in securities positions listings of our capital

stock. One such holder is Cede & Co., a nominee for The Depository Trust Company, or DTC. Shares of Common Stock that are held by

financial institutions as nominees for beneficial owners are deposited into participant accounts at DTC and are considered to be held

of record by Cede & Co. as one stockholder. Shares cannot be voted at the Meeting unless the holder thereof as of the Record Date

is present or represented by proxy. The presence, virtually or by proxy, of the holders of at least 33 1/3% of the Company’s outstanding

shares of capital stock as of the Record Date will constitute a quorum for the transaction of business at the Meeting and any adjournment

or postponement thereof.

Our

Board has selected Huang Chao, our Chief Financial Officer and Treasurer, to serve as the holder of proxies for the Meeting. The

shares of capital stock represented by each executed and returned proxy will be voted by Mr. Chao in accordance with the directions

indicated on the proxy card. If you sign your proxy card without giving specific instructions, Mr. Chao will vote your shares

“FOR” the proposals being presented at the Meeting. The proxy also confers discretionary authority to vote the shares

authorized to be voted thereby on any matter that may be properly presented for action at the Meeting; we currently know of no other

business to be presented at the Meeting.

Any

proxy given may be revoked by the person giving it at any time before it is voted at the Meeting. If you have not voted through your

broker, there are three ways for you to revoke your proxy and change your vote. First, you may send a written notice to the Company’s

Secretary stating that you would like to revoke your proxy. Second, you may complete and submit a new proxy card, but it must bear a

later date than the original proxy card. Third, you may vote virtually at the Meeting. However, your attendance at the Meeting will not,

by itself, revoke your proxy. If you have instructed a broker to vote your shares, you must follow the directions you receive from your

broker to change your vote. Your last submitted proxy will be the proxy that is counted. Please note that dissenters’ rights are

not available with respect to any of the proposals to be voted on at the Meeting.

We

will pay the cost of soliciting the proxies. We will provide copies of this Proxy Statement and accompanying materials to brokerage firms,

fiduciaries, and custodians for forwarding to beneficial owners and will, upon request, reimburse these persons for their costs of forwarding

these materials. Our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal solicitation. We will

not pay additional compensation for any of these services.

The Company has retained

Lioness Consulting LLC to assist with the solicitation of proxies for a fee expected to be $10,000 plus expenses.

QUESTIONS

AND ANSWERS REGARDING THIS SOLICITATION AND VOTING AT THE MEETING

Q.

When is the Meeting?

A.

June 28, 2024, at 9:00 a.m., Eastern Time.

Q.

Where will the Meeting be held?

A.

You may attend the Meeting via the Internet at www.proxyvote.com. If you plan to attend virtually, we recommend that you log in

to the Meeting fifteen minutes before the scheduled meeting time on June 28, 2024, to ensure you are logged in when the Meeting

starts.

Q.

Will there be a Q&A session during the Meeting?

A.

As part of the Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during or prior

to the Meeting that are pertinent to the Company and the Meeting matters, as time permits. Only stockholders that have accessed the Meeting

as a stockholder will be permitted to submit questions during the Meeting. If you have questions, you may type them into the dialog box

provided at any point during the meeting (until the floor is closed to questions). Each stockholder is limited to no more than two questions.

Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

| |

● |

irrelevant

to the business of the Company or to the business of the Meeting; |

| |

|

|

| |

● |

related

to material non-public information of the Company, including the status or results of our business since our last earnings release; |

| |

|

|

| |

● |

related

to any pending, threatened or ongoing litigation; |

| |

|

|

| |

● |

related

to personal grievances; |

| |

|

|

| |

● |

derogatory

references to individuals or that are otherwise in bad taste; |

| |

|

|

| |

● |

substantially

repetitious of questions already made by another stockholder; |

| |

|

|

| |

● |

in

excess of the two-question limit; |

| |

|

|

| |

● |

in

furtherance of the stockholder’s personal or business interests; or |

| |

|

|

| |

● |

out

of order or not otherwise suitable for the conduct of the annual meeting as determined by the Chair or Secretary in their reasonable

judgment. |

Q.

Why am I receiving these proxy materials?

A.

As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), we are making this

Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 (the “Annual Report”)

available to our stockholders electronically via the Internet. The proxy materials containing instructions on how to access this Proxy

Statement and our Annual Report and vote via the Internet, by phone, or by mail is first being mailed to all stockholders of record entitled

to vote at the 2024 Annual Meeting on or about May 30, 2024. We will send you the proxy materials because the Board is soliciting

your proxy to vote at the 2024 Annual Meeting. You are invited to virtually attend the 2024 Annual Meeting to vote on the proposals described

in this Proxy Statement. However, you do not need to attend the Meeting to vote your shares. Instead, you may follow the instructions

on the proxy materials to vote by Internet, by phone or by mail.

Q.

Who is entitled to vote at the Meeting?

A.

Only stockholders who owned shares of our Common Stock at the close of business on the Record Date are entitled to notice of the Meeting

and to vote at the Meeting, and at any postponements or adjournments thereof. At the close of business on the Record Date, 6,043,769

shares of Common Stock were issued and outstanding. At the close of business on the Record Date, the shares of Common Stock were

held by approximately 491 individual participants in securities positions listings of our capital stock, respectively. One such

holder is Cede & Co., a nominee for DTC. Shares of Common Stock that are held by financial institutions as nominees for beneficial

owners are deposited into participant accounts at DTC and are considered to be held of record by Cede & Co. as one stockholder. For

each share of Common Stock held as of the Record Date, the holder is entitled to one vote on each proposal to be voted on. As such, holders

of Common Stock are entitled to a total of 6,043,769 votes.

Q.

How many shares must be present to conduct business?

A.

The presence at the Meeting, virtually or by proxy, of the holders of at least 33 1/3% of the Company’s outstanding shares of capital

stock as of the close of business on the Record Date will constitute a quorum. A quorum is required to conduct business at the Meeting

and any adjournment or postponement thereof.

Q.

What will be voted on at the Meeting?

A.

The following chart sets forth the proposals scheduled for a vote at the 2024 Annual Meeting and the vote required for such proposals

to be approved.

| Board

Proposal |

|

Vote

Required |

|

Voting

Options |

|

Recommendation |

| |

|

|

|

|

|

|

| Proposal 1: To elect five directors to hold office

until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject to earlier

death, resignation, or removal. |

|

The

plurality of the votes cast. This means that the nominees receiving the highest number of

affirmative (“FOR”) votes (among votes properly cast virtually or by proxy) will

be elected as directors.

Only votes “FOR” will affect the outcome. Withheld votes

or broker non-votes will not affect the outcome of the vote on this proposal.

|

|

“FOR ALL”; or “WITHHOLD ALL”; or “FOR ALL EXCEPT” |

|

“FOR” the nominated slate of directors |

Proposal

2: To approve the 2024 Equity Incentive Plan (the “Equity Incentive Plan Proposal”). |

|

The

affirmative (“FOR”) vote of a majority of the votes cast by the stockholders

entitled to vote at the 2024 Annual Meeting.

Abstentions

will not be counted for voting purposes, and thus, will not affect the outcome of the vote on this proposal. Brokers are not permitted to vote shares held for a customer on “non-routine” matters (such

as the Equity Incentive Plan Proposal) without specific instructions from the customer. Therefore, broker non-votes are not considered

votes cast and will also have no effect on the outcome of the Equity Incentive Plan Proposal. |

|

“FOR”;

or “AGAINST”; or “ABSTAIN” |

|

“FOR” |

| |

|

|

|

|

|

|

| Proposal

3: To authorize the Board of Directors to amend the Company’s articles of incorporation, as amended, to combine outstanding shares of Common Stock into a lesser number

of outstanding shares, i.e. a “Reverse Stock Split,” by a ratio of not less than one-for-two and not more than

one-for-one hundred, with the exact ratio to be set within this range by the Board in its sole discretion (the “Reverse

Stock Split Proposal”). |

|

The

affirmative (“FOR”) vote of a majority of the votes cast by the stockholders entitled to vote at the 2024 Annual Meeting.

Abstentions

will not be counted for voting purposes, and thus, will not affect the outcome of the vote on this proposal. Brokers are not

permitted to vote shares held for a customer on “non-routine” matters without specific instructions from the customer.

The vote on the Reverse Stock Split Proposal is considered “routine.” Therefore, broker discretionary voting

is allowed for this proposal and broker non-votes, if any, will have no effect on the outcome of the Reverse Stock Split Proposal. |

|

“FOR”;

or “AGAINST”; or “ABSTAIN” |

|

“FOR” |

Proposal

4: To ratify the appointment of Pan-China Singapore PAC as our independent

registered public accounting firm for the fiscal year ended March 31, 2024.

|

|

The

affirmative (“FOR”) vote of a majority of the votes cast by the stockholders

entitled to vote at the 2024 Annual Meeting.

Abstentions

will not be counted for voting purposes, and thus, will not affect the outcome of the vote on this proposal. Brokers are not permitted

to vote shares held for a customer on “non-routine” matters without specific instructions from the customer. The vote

on Proposal 4 is considered “routine.” Therefore, broker discretionary voting is allowed for this proposal and broker

non-votes, if any, will have no effect on the outcome of Proposal 4. |

|

“FOR”;

or “AGAINST”; or “ABSTAIN” |

|

“FOR” |

Q.

What shares can I vote at the Meeting?

A.

You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record,

and (ii) shares held for you as the beneficial owner through a broker, trustee, or other nominee such as a bank.

Q.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A.

Some of our stockholders may hold shares of our capital stock in their own name rather than through a broker or other nominee. As summarized

below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders

of Record. If your shares are registered directly in your name with our transfer agent, Transfer Online, Inc., you are considered

to be, with respect to those shares, the stockholder of record, and the proxy materials were sent directly to you. As the

stockholder of record, you have the right to vote at the 2024 Annual Meeting and to vote by proxy. Whether or not you plan to

attend the 2024 Annual Meeting, we urge you to vote by Internet, by phone or by mail to ensure your vote is counted. You may still

attend the 2024 Annual Meeting and vote virtually if you have already voted by proxy.

Beneficial

Owner. If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held

in “street name,” and these proxy materials, together with a voting instruction card, are being forwarded to

you from that organization. As the beneficial owner, you have the right to direct your broker, trustee, or nominee how to vote on your

behalf and are also invited to attend the 2024 Annual Meeting. Please note that since a beneficial owner is not the stockholder

of record, you may not vote these shares at the 2024 Annual Meeting unless you obtain a “legal proxy” from the broker,

trustee, or nominee that holds your shares, giving you the right to vote the shares at the 2024 Annual Meeting. If this applies

to you, your broker, trustee, or nominee will have enclosed or provided voting instructions for you to use in directing the broker, trustee,

or nominee how to vote your shares.

Q.

How can I vote my shares without attending the Meeting?

A.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted

without attending the Meeting. If you are a stockholder of record, you may vote by proxy by Internet, by phone or by mail by following

the instructions provided on the proxy materials. The proxy materials containing instructions on how to access this Proxy Statement and

our Annual Report and vote via the Internet, by phone, or by mail is first being mailed to all stockholders of record entitled to vote

at the 2024 Annual Meeting on or about May 30, 2024. We will send you the proxy materials because the Board is soliciting your

proxy to vote at the 2024 Annual Meeting. To vote using the proxy card, you simply complete, sign, and date the proxy card and return

it promptly in the envelope provided. If you return your signed proxy card to us before the 2024 Annual Meeting, we will vote your shares

as you direct. Stockholders who hold shares beneficially in street name may cause their shares to be voted by proxy in accordance with

the instructions provided by their broker, trustee, or nominee, by using the proxy card provided by the broker, trustee, or nominee and

mailing them in the envelope provided by such person.

Q.

How can I vote my shares?

A.

Stockholders who attend the virtual 2024 Annual Meeting should follow the instructions at www.proxyvote.com to vote or

submit questions during the Meeting. Voting online during the Meeting will replace any previous votes. Record holders who received a

copy of this Proxy Statement and accompanying proxy card in the mail can vote by filling out the proxy card, signing it, and returning

it in the postage paid return envelope. Record holders can also vote by telephone at 1-800-690-6903 or by Internet at www.proxyvote.com.

Voting instructions are provided on the proxy card. If you hold shares in street name, you must vote by giving instructions to your bank,

broker, or other nominee. You should follow the voting instructions on the form that you receive from your bank, broker, or other nominee.

Q.

How do I gain admission to the virtual 2024 Annual Meeting?

A.

You are entitled to participate in the virtual 2024 Annual Meeting only if you were a stockholder of record who owned shares of

the Company’s capital stock (Common Stock) at the close of business on May 22, 2024, the Record Date. To attend online and

participate in the 2024 Annual Meeting, stockholders of record will need to use the control number included on their proxy card to log into www.proxyvote.com. Beneficial owners who do not have a control

number may gain access to the Meeting by logging into their brokerage firm’s website and selecting the stockholder communication

mailbox to link through to the virtual 2024 Annual Meeting. Instructions should also be provided on the voting instruction card

provided by their broker, bank, or other nominee.

We

encourage you to access the Meeting prior to the start time. Please allow time for online check-in, which will begin at 9:00 a.m., Eastern

Time.

Stockholders

have multiple opportunities to submit questions to the Company for the 2024 Annual Meeting. Stockholders who wish to submit a

question in advance may do so in the question tab of the webcast online during the Meeting at www.proxyvote.com. See “Will

there be a Q&A session during the Meeting?” for information about how the Q&A session at the Meeting will be conducted.

Q.

How are my shares voted?

A.

If you provide specific instructions with regard to an item, your shares will be voted as you instruct on such item. If you sign your

proxy card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR”

all nominees identified in Proposal 1, “FOR” Proposal 2, “FOR” Proposal 3, and “FOR” Proposal

4, in the discretion of the proxy holder on any other matters that properly come before the Meeting).

Q.

What is a “broker non-vote”?

A.

A broker non-vote occurs when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding

the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial

owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does

not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,”

but not with respect to “non-routine” matters. The shares that cannot be voted by brokers and other nominees on non-routine

matters but are represented at the Meeting will be deemed present at our Meeting for purposes of determining whether the necessary quorum

exists to proceed with the Meeting, but will not be considered entitled to vote on the non-routine proposals.

We

believe that under applicable rules, Proposal 3 and Proposal 4 are each considered a routine matter for which brokerage

firms may vote shares that are held in the name of brokerage firms and which are not voted by the applicable beneficial owners.

Brokers

or other nominees cannot vote on Proposal 1 or Proposal 2 without instructions from beneficial owners. Broker non-votes will

not affect the outcome of the vote on Proposal 1 or Proposal 2.

Q.

How are abstentions counted?

A.

If you return a proxy card that indicates an abstention from voting on all matters, the shares represented will be counted for the purpose

of determining both the presence of a quorum and the total number of votes with respect to a proposal, but they will not be voted on

any matter at the Meeting.

With regard to Proposal 1, votes may be cast

in favor of a director nominee or withheld. Because directors are elected by plurality, abstentions will be entirely excluded from the

vote and will have no effect on its outcome.

With

regard to Proposal 2, because abstentions are not counted as votes cast, abstentions will have no effect on the outcome of such proposal.

With

regard to Proposal 3, because abstentions are not counted as votes cast, abstentions will have no effect on the outcome of such proposal.

With

regard to Proposal 4, because abstentions are not counted as votes cast, abstentions will have no effect on the outcome of such proposal.

Q.

Are dissenters’ rights available with respect to any of the proposals?

A.

Dissenters’ rights are not available with respect to any of the proposals to be voted on at the Meeting.

Q.

What should I do if I receive more than one proxy materials?

A.

If you receive more than one set of proxy materials, your shares are registered in more than one name or are registered in

different accounts. Please follow the instructions on the proxy materials to ensure that all of your shares are

voted.

Q.

Can I change my mind after I return my proxy?

A.

Yes. You may change your vote at any time before your proxy is voted at the Meeting. If you are a stockholder of record, you can do this

by giving written notice to the Company’s Secretary, by submitting another proxy with a later date, or by attending the Meeting

and voting virtually. If you are a stockholder in “street” or “nominee” name, you should consult with the bank,

broker, or other nominee regarding that entity’s procedures for revoking your voting instructions.

Q.

Who is soliciting my vote and who is paying the costs?

A.

The Company is making this solicitation and will pay the entire cost of preparing, printing, assembling, mailing, and distributing these

proxy materials. In addition to the use of the mails, proxies may be solicited by personal interview, telephone, electronic mail, and

facsimile by directors, officers, and regular employees of the Company. None of the Company’s directors, officers or employees

will receive any additional compensation for soliciting proxies on behalf of the Board. The Company may also make arrangements with brokerage

firms and other custodians, nominees, and fiduciaries for the forwarding of soliciting material to the beneficial owners of Common Stock

held of record by those owners. The Company will reimburse those brokers, custodians, nominees, and fiduciaries for their reasonable

out-of-pocket expenses incurred in connection with that service.

Q.

How can I find out the results of the voting?

A.

We intend to announce preliminary voting results at the Meeting and publish final results in a Current Report on Form 8-K within four

business days following the Meeting.

Q.

Whom should I contact if I have questions?

A.

If you have any additional questions about the Meeting or the proposals presented in this Proxy Statement, you should contact our Investor

Relations department at our principal executive office as follows:

| Investor

Relations: |

Addentax

Group Corp. |

| |

Kingkey

100, Block A, Room 4805 |

| |

Luohu

District, Shenzhen City, China 518000 |

| |

+(86)

755 8233 0336 |

| |

Email:

shunyu.zheng@weitian-ir.com |

If you have any questions or need assistance with voting your shares,

please contact Lioness Consulting LLC, the Company’s proxy solicitor at 917-576-3586 or info@lionessconsultingllc.com.

PROPOSAL

1

ELECTION

OF DIRECTORS

Nomination

of Directors

The

Nominations and Corporate Governance Committee of the Board (the “Nominating Committee”) is charged with making recommendations

to the Board regarding qualified candidates to serve as members of the Board. The Nominating Committee’s goal is to assemble a

board of directors with the skills and characteristics that, taken as a whole, will assure a strong board of directors with experience

and expertise in all aspects of corporate governance. Accordingly, the Nominating Committee believes that candidates for directorship

should have certain minimum qualifications, including personal integrity, strength of character, an inquiring and independent mind,

practical wisdom, and mature judgment. In evaluating director nominees, the Nominating Committee considers the following factors:

(1)

The appropriate size of the Board;

(2)

The Company’s needs with respect to the particular talents and experience of its directors; and

(3)

The knowledge, skills, and experience of nominees, including experience in technology, business, finance, administration, and/or public

service.

Other

than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee may also consider such

other factors as it deems to be in the Company’s and its stockholders’ best interests, including the independence requirements

for board and committee membership under The Nasdaq Stock Market LLC (“Nasdaq”) listing standards, diversity (though the Company does not have a formal policy with regard to the consideration

of diversity in identifying director nominees), and the requirements for at least one member of the Board to meet the criteria for an

“audit committee financial expert,” as defined by SEC rules. The Nominating Committee also believes it is appropriate for

our Chief Executive Officer to serve on the Board.

The

Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current

members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered

for re-nomination, but the Nominating Committee at all times seeks to balance the value of continuity of service by existing members

of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, the Nominating

Committee’s policy is to not re-nominate that member for reelection. The Nominating Committee identifies the desired skills and

experience of a new nominee, and then uses its network and external resources to solicit and compile a list of eligible candidates.

We

do not have a formal policy concerning stockholder recommendations of nominees for directorship to the Nominating Committee. The

absence of such a policy does not mean, however, that such recommendations will not be considered. Stockholders wishing to recommend

a candidate may do so by sending a written notice to the Nominating Committee, Attn: Chairman, Addentax Group Corp., Kingkey 100, Block

A, Room 4805, Luohu District, Shenzhen City, China 518000, naming the proposed candidate and providing detailed biographical and contact

information for such proposed candidate.

There

are no arrangements or understandings between any of our directors, nominees for directors, or officers, and any other person pursuant

to which any director, nominee for director, or officer was or is to be selected as a director, nominee, or officer, as applicable. There

currently are no legal proceedings, and during the past ten years there have been no legal proceedings, that are material to the evaluation

of the ability or integrity of any of our directors or director nominees. There are no material proceedings to which any director, officer,

affiliate, or owner of record or beneficially of more than 5% of any class of voting securities of the Company, or any associates of

any such persons, is a party adverse to the Company or any of our subsidiaries, and none of such persons has a material interest adverse

to the Company or any of its subsidiaries. Other than as disclosed below, during the last five years, none of our directors held any

other directorships in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered

as an investment company under the Investment Company Act of 1940. Our Nominating Committee currently consists of Li Weilin, Alex

P. Hamilton, and Xiao Jiangping (Gary), with Mr. Xiao Jiangping (Gary) serving as the chairman.

The

Nominating Committee has recommended, and the Board has nominated, Hong Zhida, Hong Zhiwang, Li Weilin, Alex P. Hamilton, and

Xiao Jiangping (Gary) as nominees for election as members of our Board at the 2024 Annual Meeting for a period of

one year or until each such director’s respective successor is elected and qualified or until such director’s earlier death,

resignation, or removal. Each of the nominees is currently a director of the Company. At the 2024 Annual Meeting, five directors

will be elected to the Board.

Information

Regarding Directors

| Name |

|

Age |

|

Position |

|

Date

of First Appointment |

| |

|

|

|

|

|

|

| Hong

Zhida |

|

34 |

|

Chairman,

CEO, Director, President, and Secretary |

|

March

10, 2017 |

| Hong

Zhiwang |

|

30 |

|

Director |

|

March

13, 2019 |

| Li

Weilin |

|

43 |

|

Independent

Director |

|

April

26, 2024 |

| Alex

P. Hamilton |

|

52 |

|

Independent

Director |

|

May

10, 2021 |

| Xiao

Jiangping (Gary) |

|

46 |

|

Independent

Director |

|

May

12, 2021 |

Hong

Zhida

Hong

Zhida received his Bachelor’s Degree in Electronic Information Science and Technology from Sun Yat-sen University in July 2013.

From June 2014 to present, he served as the Director of China Huiying Joint Supply Chain Group Co. Ltd. He was responsible for

assisting the company’s chairman to plan development strategy. From September 2013 to May 2014, he served as Head of Membership

Department of the Guangzhou Haifeng Chamber of Commerce. In that position he was responsible for the membership management of the institution.

Mr. Hong’s extensive experience in the Company which demonstrates his familiarity with the Company’s overall operations

and governance structure led to the conclusion that he should serve as a director.

Aside

from the above, Mr. Hong does not hold and has not held over the past five years any other directorships in any company with a

class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange

Act or any company registered as an investment company under the Investment Company Act of 1940.

Hong

Zhiwang

Hong

Zhiwang earned his bachelor’s degree in Automation Engineering from Beijing Institute of Technology University Zhuhai Campus, China

in 2014. Mr. Hong has been the brand marketing manager at Addentax Group Corp. since 2018 and is responsible for e-commerce marketing

covering design website, brand marketing, market investigation and development, and expanding marketing channels to develop new clients,

designing the company’s logo and registering copyrights. In 2014, he was the PDM Software Engineer for Hongfan Computer & Technology

Co., Ltd. and was responsible for developing software, on-site inspection and guidance and software maintenance, in assistance of ERP

to manage the system and create brand new demands design and in charge of R&D of PLM System, surface model design and function model

development, structure development and communications technology development. Mr. Hong brings to the Board deep brand marketing experience

and his extensive experience in the Company which demonstrates his familiarity with the Company’s overall operations and governance

structure led to the conclusion that he should serve as a director.

Aside

from the above, Mr. Hong does not hold and has not held over the past five years any other directorships in any company with a class

of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act

or any company registered as an investment company under the Investment Company Act of 1940.

Li

Weilin

Li

Weilin has been serving as the information and network center director in Xinhua College of Sun Yat-sen University since 2005. Since

2015, Mr. Li has been serving as the chief of senior engineer of Computer Application & Technology program in Guangdong

Polytechnic College. From March 2019 to May 2021, Mr. Li was appointed independent director, a compensation committee member, an

audit committee member and the chairperson of the nominating and corporate governance committee of Addentax Group Corp. Mr. Li is

experienced in the field of network & system safety, image processing, data mining, business intelligence, big data management

and network physical system. Mr. Li obtained a bachelor’s degree in Computer Science & Technology and a

master’s

degree in Software Engineering from Sun Yat-sen University, China in 2005 and 2011, respectively. We believe Mr. Li is qualified to

be an independent director due to his extensive experience in information technology and his prior experience in the Company which

demonstrates his familiarity with the Company’s operations and governance structure.

Aside

from the above, Mr. Li does not hold and has not held over the past five years any other directorships in any company with a class

of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act

or any company registered as an investment company under the Investment Company Act of 1940.

Alex

P. Hamilton

Alex

Hamilton obtained his B.A. in Economics from Brandeis

University in 1994. Mr. Hamilton has been the Chief Financial Officer of CBD Biotech Inc. since November 2018, and has also served as

Director of CBD Biotech Inc. since April 2019. In April 2016, Mr. Hamilton founded Hamilton Laundry, and has served as its chief executive

officer since then. Mr. Hamilton also founded Hamilton Strategy in November 2014, and has served as its chief executive officer since.

From November 2013 to November 2014, Mr. Hamilton was the president of Kei Advisors. Mr. Hamilton was also the Co-Founder of Donald Capital

LLC, and has served as its president since May 2019. From December 2020 to July 2021, Mr. Hamilton served as an independent director

and the chairman of the audit committee of Wunong Net Technology Company Limited (Nasdaq: WNW). Mr. Hamilton’s prior public

company experience led to the conclusion that he should serve as a director.

Aside

from the above, Mr. Hamilton does not hold and has not held over the past five years any other directorships in any company with a class

of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act

or any company registered as an investment company under the Investment Company Act of 1940.

Xiao

Jiangping (Gary)

Xiao

Jiangping (Gary) has been the vice president of

finance and accounting at Hilco IP Merchant Banking since July 2019. From December 2020 to July 2021, Mr. Xiao served as an independent

director and the chairman of the nominating and corporate governance committee of Wunong Net Technology Company Limited (Nasdaq: WNW).

From March 2017 to March 2019, Mr. Xiao served as the chief financial officer of Professional Diversity Network, Inc. From June 2013

to April 2016, Mr. Xiao served as the chief financial officer and financial controller of Petstages Inc. From August 2008 to May 2013,

Mr. Xiao served as the operation financial controller of the operations management group of The Jordan Company, a private equity firm.

From June 2006 to August 2008, Mr. Xiao served as a senior finance associate in the financial planning and analysis department of United

Airlines, Inc.. Mr. Xiao obtained a master’s degree in business administration from the Ross School of Business Management at the

University of Michigan in 2006 and a bachelor’s degree in accounting from Tsinghua University in Beijing, China, in 2000. Mr.

Xiao’s prior public company experience led to the conclusion that he should serve as a director.

Aside

from the above, Mr. Xiao does not hold and has not held over the past five years any other directorships in any company with a class

of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act

or any company registered as an investment company under the Investment Company Act of 1940.

Qualification

of Directors

The

Nominating Committee believes that each of the directors named above has the necessary qualifications to be a member of the Board. The Nominating Committee believes that each director brings a strong background and skill set to the Board, giving

the Board as a whole competence and experience in diverse areas, including corporate governance and board service, finance,

management and industry experience.

Required

Vote of Stockholders

Directors

are elected by plurality of the votes cast at the Meeting. If a quorum is present and voting at the Meeting, the five nominees receiving

the highest number of “FOR” votes will be elected. Shares represented by executed proxies will be voted for which no contrary

instruction is given, if authority to do so is not withheld, “FOR” the election of each of the nominees named above.

Only

votes “FOR” will affect the outcome. Broker non-votes and withheld votes will have no effect on this proposal, as brokers

or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

Recommendation

of our Board

THE

BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES UNDER PROPOSAL 1

PROPOSAL

2

APPROVAL

OF THE 2024 EQUITY INCENTIVE PLAN

Background

and Overview

The

Compensation Committee of the Board has recommended that the Company should establish and maintain an equity incentive plan pursuant

to which the Company may offer selected officers, directors (including independent directors), employees of and consultants

to the Company and its subsidiaries the opportunity to acquire or increase equity ownership in the Company.

On

May 17, 2024, the Board adopted, subject to shareholders’ approval, the Addentax Group Corp. 2024 Equity Incentive Plan (the

“Incentive Plan”). The Incentive Plan is designed to enable the flexibility to grant equity awards to

our key management employees, directors and consultants and to ensure that we can continue to grant equity awards to eligible

recipients at levels determined to be appropriate by the Board and/or the Compensation Committee. If the Incentive Plan is not

approved by the Shareholders, the Incentive Plan will not be in effect.

Summary

of the Provisions of the Incentive Plan

The

following summary briefly describes the material features of the Incentive Plan and is qualified, in its entirety, by the specific language

of the Incentive Plan, a copy of which is attached to this proxy statement as Annex A.

Shares

Available

Our

Board has authorized, subject to stockholder approval, 1,345,000 shares of our Common Stock for issuance under the

Incentive Plan. In the event of any stock dividend, stock split, reverse stock split, share combination, recapitalization, merger,

consolidation, spin-off, split-up, reorganization, rights offering, liquidation, or any similar change event of or by our company,

appropriate adjustments will be made to the shares subject to the Incentive Plan and to any outstanding Awards. Shares available for

Awards under the Incentive Plan may be either newly-issued shares or treasury shares.

In

certain circumstances, shares subject to an outstanding Award may again become available for issuance pursuant to other Awards available

under the Incentive Plan. For example, shares subject to forfeited, terminated, canceled or expired Awards will again become available

for future grants under the Incentive Plan.

Administration

The

Incentive Plan will be administered by the Compensation Committee (the “Committee”) of the Board. The Committee will consist of at

least two members who are non-employee directors within the meaning of Rule 16b-3 under the Exchange Act. With respect to the

participation of individuals who are subject to Section 16 of the Exchange Act, the Incentive Plan is administered in compliance

with the requirements of Rule 16b-3 under the Exchange Act. Subject to the provisions of the Incentive Plan, the Committee

determines the persons to whom grants of options, including but not limited to Stock Appreciation Rights (“SAR”), shares

of restricted stock and other stock-based awards are to be made, the number of shares of common stock to be covered by each grant

and all other terms and conditions of the grant. If an option is granted, the Committee determines whether the option is an

incentive stock option or a nonstatutory stock option, the option’s term, vesting and exercisability, the amount and type of

consideration to be paid to our company upon the option’s exercise and the other terms and conditions of the grant. The terms

and conditions of restricted stock and SAR Awards are also determined by the Committee. The Committee has the responsibility to

interpret the Incentive Plan and to make determinations with respect to all Awards granted under the Incentive Plan. All

determinations of the Committee are final and binding on all persons having an interest in the Incentive Plan or in any Award made

under the Incentive Plan. The costs and expenses of administering the Incentive Plan are borne by the Company.

Eligibility

Eligible

individuals include our and our subsidiaries’ employees (including our and our subsidiaries’ officers and directors who

are also employees), independent directors, advisor or consultants whose efforts, in the judgment of the Committee, are deemed

worthy of encouragement to promote our growth and success. Non-employee directors of our Board are also eligible to participate in

the Incentive Plan. All eligible individuals may receive one or more Awards under the Plan, upon the terms and conditions set forth

in the Incentive Plan. There is no assurance that an otherwise eligible individual will be selected by the Committee to receive an

Award under the Incentive Plan. Because future Awards under the Incentive Plan will be granted in the discretion of the Committee,

the type, number, recipients and other terms of such Awards cannot be determined at this time.

Stock

Options and SARs

Under

the Incentive Plan, the Committee is authorized to grant both stock options and SARs. Stock options may be either designated as non-qualified

stock options or incentive stock options. Incentive stock options, which are intended to meet the requirements of Section 422 of the

Internal Revenue Code such that a participant can receive potentially favorable tax treatment, may only be granted to employees. Therefore,

any stock option granted to consultants and non-employee directors are non-qualified stock options. The tax treatment of incentive and

non-qualified stock options is generally described later in this summary. SARs may be granted either alone or in tandem with stock options.

A SAR entitles the participant to receive the excess, if any, of the fair market value of a share on the exercise date over the strike

price of the SAR. This amount is payable in cash, except that the Committee may provide in an Award agreement that benefits may be paid

in shares of our common stock. In general, if a SAR is granted in tandem with an option, the exercise of the option will cancel the SAR,

and the exercise of the SAR will cancel the option. Any shares that are canceled will be made available for future Awards. The Committee,

in its sole discretion, determines the terms and conditions of each stock option and SAR granted under the Incentive Plan, including

the grant date, option or strike price (which, in no event, will be less than the par value of a share), whether a SAR is paid in cash

or shares, the term of each option or SAR, exercise conditions and restrictions, conditions of forfeitures, and any other terms, conditions

and restrictions consistent with the terms of the Incentive Plan, all of which will be evidenced in an individual Award agreement between

us and the participant.

Certain

limitations apply to incentive stock options and SARs granted in tandem with incentive stock options. The per share exercise price of

an incentive stock option may not be less than 100% of the fair market value of a share of our common stock on the date of the option’s

grant and the term of any such option shall expire not later than the tenth anniversary of the date of the option’s grant. In addition,

the per share exercise price of any option granted to a person who, at the time of the grant, owns stock possessing more than 10% of

the total combined voting power or value of all classes of our stock must be at least 110% of the fair market value of a share of our

common stock on the date of grant and such option shall expire not later than the fifth anniversary of the date of the option’s

grant.

Options

and SARs granted under the Incentive Plan become exercisable at such times as may be specified by the Committee. In general, options

and SARs granted to participants become exercisable in three equal annual installments, subject to the optionee’s continued employment

or service with us. However, the aggregate value (determined as of the grant date) of the shares subject to incentive stock options that

may become exercisable by a participant in any year may not exceed $100,000. If a SAR is granted in tandem with an option, the SAR will

become exercisable at the same time or times as the option becomes exercisable.

Except

as otherwise set forth in the Award agreement, options shall expire after a term of five years. However, the maximum term of options

and SARs granted under the Incentive Plan is ten years. If any participant terminates employment due to death or disability or retirement,

the portion of his or her option or SAR Awards that were exercisable at the time of such termination may be exercised for one year from

the date of termination. In the case of any other termination, the portion of his or her option or SAR Awards that were exercisable at

the time of such termination may be exercised for three months from the date of termination. However, if the remainder of the option

or SAR term is shorter than the applicable post-termination exercise period, the participant’s rights to exercise the option or

SAR will expire at the end of the term. In addition, if a participant’s service terminates due to cause, all rights under an option

or SAR will immediately expire, including rights to the exercisable portion of the option or SAR. Shares attributable to an option or

SAR that expire without being exercised will be forfeited by the participant and will again be available for Award under the Incentive

Plan.

Unless

limited by the Committee in an Award agreement, payment for shares purchased pursuant to an option exercise may be made (i) in cash,

check or wire transfer, (ii) subject to the Committee’s approval, in shares already owned by the participant (including restricted

shares held by the participant at least six months prior to the exercise of the option) valued at their fair market value on the date

of exercise, or (iii) through broker-assisted cashless exercise procedures.

Restricted

Stock

Under

the Incentive Plan, the Committee is also authorized to make Awards of restricted stock. A restricted stock Award entitles the participant

to all of the rights of a stockholder of our company, including the right to vote the shares and the right to receive any dividends.

However, the Committee may require the payment of cash dividends to be deferred and if the Committee so determines, re-invested in additional

shares of restricted stock. Before the end of a restricted period and/or lapse of other restrictions established by the Committee, shares

received as restricted stock shall contain a legend restricting their transfer, and may be forfeited (i) in the event of termination

of employment, (ii) if our company or the participant does not achieve specified performance goals after the grant date and before the

participant’s termination of employment or (iii) upon the failure to achieve other conditions set forth in the Award agreement.

An

Award of restricted stock will be evidenced by a written agreement between us and the participant. The Award agreement will specify the

number of shares of our common stock subject to the Award, the nature and/or length of the restrictions, the conditions that will result

in the automatic and complete forfeiture of the shares and the time and manner in which the restrictions will lapse, subject to the Award

holder’s continued employment by us, and any other terms and conditions the Committee shall impose consistent with the provisions

of the Incentive Plan. The Committee also determines the amount, if any, that the participant shall pay for the shares of restricted

stock. However, the participant must be required to pay at least the par value for each share of restricted stock. Upon the lapse of

the restrictions, any legends on the shares of our common stock subject to the Award will be re-issued to the participant without such

legend.

Unless

the Committee determines otherwise in the Award or other agreement, if a participant terminates employment for any reason, all rights

to restricted stock that are then forfeitable will be forfeited. Restricted stock that is forfeited by the participant will again be

available for Award under the Incentive Plan.

Other

Stock-Based Awards

Under

the Incentive Plane, the Committee is also authorized to grant other stock-based awards valued in whole or in part by reference to or

otherwise based on stock (“Other Stock-Based Awards”), which include performance shares, convertible preferred stock (to

the extent a series of preferred stock is authorized), convertible debentures, warrants, exchangeable securities and awards based of

stock or options based on fair market value, book value, or performance by the Company or any subsidiary, affiliate or division. Other

Stock-Based Awards may be granted in tandem with other Awards under the Incentive Plan.

Other

Stock-Based Awards may not be sold, assigned, transferred, pledged or otherwise encumbered prior to the date to which the stock is issued

or, if later, the date on which any applicable restriction, performance or deferral period lapses. The recipient of an Other Stock-Based

Award, subject to the terms of the grant agreement, is entitled to interest or dividends with respect to the number of shares covered

by their Other Stock-Based Award.

Change

in Control Provisions

In

the event of a change in control of the Company, and except as otherwise set forth in the applicable grant agreement, all unvested portions

of Awards shall vest immediately. Awards, whether or not then vested, shall be continued, assumed, or have new rights as determined by

the Committee in its sole discretion, and restrictions to which any shares of Restricted Stock or any other Award granted prior to the

change in control are subject shall not lapse. Awards shall, where appropriate at the Committee’s discretion, receive the same

distribution of the Company’s common stock on such terms as determined by the Committee. Upon a change in control, the Committee

may also provide for the purchase of any Awards for an amount of cash per share of common stock issuable under the Award equal to the

excess of the highest price per share of the Company’s common stock paid in any transaction related to a change in control of the

Company over the exercise price of such Award.

Fair

Market Value

Under

the Incentive Plan, fair market value means the fair market value of the shares based upon (i) the closing selling price of a share of

our common stock as quoted on the principal national securities exchange on which the stock is traded, if the stock is then traded on

a national securities exchange, or (ii) the closing bid price per share last quoted on that date by an established quotation service

for over-the-counter securities, if the common stock is not then traded on a national securities exchange.

Transferability

Restrictions

Generally

and unless otherwise provided in an Award agreement, shares or rights subject to an Award cannot be assigned or transferred other than

by will or by the laws of descent and distribution and Awards may be exercised during the participant’s lifetime only by the participant

or his or her guardian or legal representative. However, a participant may, if permitted by the Committee, in its sole discretion, transfer

an Award, or any portion thereof, to one or more of the participant’s spouse, children or grandchildren, or may designate in writing

a beneficiary to exercise an Award after his or her death.

Clawback

Policy

All

awards granted under the Incentive Plan are subject to the terms of any Company potential forfeiture, incentive compensation recoupment,

clawback, or similar actions. The Awards are also subject to policies established by the Company, such as anti-hedging or pledging policies.

These policies and shall include, without limitation, (i) any Company policy established to comply with applicable laws (including, without

limitation, Section 304 of the Sarbanes-Oxley Act and Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act),

and/or (ii) the rules and regulations of the applicable securities exchange or inter-dealer quotation system on which the shares of Stock

or other securities are listed or quoted, and these requirements shall be deemed incorporated by reference into all outstanding Award

Agreements.

Termination

or Amendment of the Incentive Plan

Unless

sooner terminated, no Awards may be granted under the Incentive Plan after May 17, 2034. Our Board may amend or

terminate the Incentive Plan at any time, but our Board may not, without stockholder approval, amend the Incentive Plan

to increase the total number of shares of our common stock reserved for issuance of Awards. In addition, any amendment or modification

of the Incentive Plan shall be subject to stockholder approval as required by any securities exchange on which our common stock is listed.

No amendment or termination may deprive any participant of any rights under Awards previously made under the Incentive Plan.

Summary

of Federal Income Tax Consequences of the Incentive Plan

The

following summary is intended only as a general guide as to the federal income tax consequences under current United States law with

respect to participation in the Incentive Plan and does not attempt to describe all possible federal or other tax consequences of such

participation. Furthermore, the tax consequences of awards made under the Incentive Plan are complex and subject to change, and a taxpayer’s

particular situation may be such that some variation of the described rules is applicable.

Options

and SARS. There are three points in time when a participant and our company could potentially incur federal income tax consequences:

date of grant, upon exercise and upon disposition. First, when an option or a SAR is granted to a participant, the participant does not

recognize any income for federal income tax purposes on the date of grant. We similarly do not have any federal income tax consequences

at the date of grant. Second, depending upon the type of option, the exercise of an option may or may not result in the recognition of

income for federal income tax purposes. With respect to an incentive stock option, a participant will not recognize any ordinary income

upon the option’s exercise (except that the alternative minimum tax may apply). However, a participant will generally recognize

ordinary income upon the exercise of a non-qualified stock option. In this case, the participant will recognize income equal to the difference

between the option price and the fair market value of shares purchased pursuant to the option on the date of exercise. With respect to

the exercise of a SAR, the participant must generally recognize ordinary income equal to the cash received (or, if applicable, value

of the shares received).

Incentive

stock options are subject to certain holding requirements before a participant can dispose of the shares purchased pursuant to the exercise

of the option and receive capital gains treatment on any income realized from the exercise of the option. Satisfaction of the holding

periods determines the tax treatment of any income realized upon exercise. If a participant disposes of shares acquired upon exercise

of an incentive stock option before the end of the applicable holding periods (called a “disqualifying disposition”), the

participant must generally recognize ordinary income equal to the lesser of (i) the fair market value of the shares at the date of exercise

of the incentive stock option minus the exercise price or (ii) the amount realized upon the disposition of the shares minus the exercise

price. Any excess of the fair market value on the date of such disposition over the fair market value on the date of exercise must be

recognized as capital gains by the participant. If a participant disposes of shares acquired upon the exercise of an incentive stock

option after the applicable holding periods have expired, such disposition generally will result in long-term capital gain or loss measured

by the difference between the sale price and the participant’s tax “basis” in such shares (generally, in such case,

the tax “basis” is the exercise price).

Generally,

we will be entitled to a tax deduction in an amount equal to the amount recognized as ordinary income by the participant in connection

with the exercise of options and SARs. However, we are generally not entitled to a tax deduction relating to amounts that represent capital

gains to a participant. Accordingly, if the participant satisfies the requisite holding period with respect to an incentive stock option

before disposition to receive the favorable tax treatment accorded incentive stock options, we will not be entitled to any tax deduction

with respect to an incentive stock option. In the event the participant has a disqualifying disposition with respect to an incentive

stock option, we will be entitled to a tax deduction in an amount equal to the amount that the participant recognized as ordinary income.

Restricted

Stock Awards. A participant will not be required to recognize any income for federal income tax purposes upon the grant of shares

of restricted stock. With respect to Awards involving shares or other property, such as restricted stock Awards, that contain restrictions

as to their transferability and are subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income

equal to the fair market value of the shares or other property received at the time the shares or other property become transferable

or are no longer subject to a substantial risk of forfeiture, whichever occurs first. We generally will be entitled to a deduction in

an amount equal to the ordinary income recognized by the participant. A participant may elect to be taxed at the time he or she receives

shares (e.g., restricted stock) or other property rather than upon the lapse of transferability restrictions or the substantial risk

of forfeiture. However, if the participant subsequently forfeits such shares he or she would not be entitled to any tax deduction or,

to recognize a loss, for the value of the shares or property on which he or she previously paid tax. Alternatively, if an Award that

results in a transfer to the participant of cash, shares or other property does not contain any restrictions as to their transferability

and is not subject to a substantial risk of forfeiture, the participant must generally recognize ordinary income equal to the cash or

the fair market value of shares or other property actually received. We generally will be entitled to a deduction for the same amount.

Required

Vote of Stockholders

The

approval of the Equity Incentive Plan Proposal requires that a quorum exist and that the number of votes cast in favor of approval

of the Equity Incentive Plan Proposal exceeds the number of votes cast against approval of the Equity Incentive Plan Proposal.

Abstentions are not considered votes cast and will therefore have no effect on the Equity Incentive Plan Proposal. Brokers

are not permitted to vote shares held for a customer on “non-routine” matters (such as the Equity Incentive Plan Proposal)

without specific instructions from the customer. Therefore, broker non-votes are not considered votes cast and will also have no

effect on the outcome of the Equity Incentive Plan Proposal.

Interests

of Directors and Executive Officers

Our

directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except

to the extent of their ownership of shares of our Common Stock.

Recommendation

of our Board

OUR

BOARD UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO APPROVE OF THE 2024 EQUITY

INCENTIVE PLAN AND THE FORM, TERMS AND PROVISIONS.

PROPOSAL

3

PROPOSAL

TO AUTHORIZE THE COMPANY’S BOARD OF DIRECTORS TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION, AS AMENDED, TO COMBINE OUTSTANDING SHARES OF THE COMPANY’S COMMON

STOCK INTO A LESSER NUMBER OF OUTSTANDING SHARES, I.E. A “REVERSE STOCK SPLIT,” BY A RATIO OF NOT LESS

THAN ONE-FOR-TWO AND NOT MORE THAN ONE-FOR-ONE HUNDRED, WITH THE EXACT RATIO TO BE SET WITHIN THIS RANGE BY THE COMPANY’S

BOARD OF DIRECTORS IN ITS SOLE DISCRETION

Background

and Overview

The

Board has approved the form of an amendment to our Articles of Incorporation to combine the outstanding shares of our Common Stock into

a lesser number of outstanding shares (the “Reverse Stock Split Amendment”). As of May 29, 2024, there were

6,043,769 shares of our Common Stock outstanding. If approved by the stockholders as proposed, the Board would have the sole discretion

to effect the amendment and combination at any time before the next annual meeting and to fix the specific ratio for the combination,

provided that the ratio would be not less than one-for-two and one-for-one hundred (the “Reverse Stock Split Ratio”).

The Board would also have the discretion to abandon the amendment prior to its effectiveness.

Form

of the Reverse Stock Split Amendment

If

stockholders approve the Reverse Stock Split Proposal, the Articles of Incorporation will be amended to include a new Article, the form

of which will read in its entirety as follows:

Contingent

and effective as of [_____] on [_____] (the “Effective Time”), each [_____] shares of Common Stock issued and outstanding

prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be combined and

converted into one (1) share of Common Stock (the “Reverse Stock Split”). No fractional share shall be issued in connection

with the foregoing combination of the shares pursuant to the Reverse Stock Split. Stockholders who would otherwise be entitled to receive

a fractional share as a result of the Reverse Stock Split will receive one whole share of common stock in lieu of such fractional share.

The

Reverse Stock Split shall occur automatically without any further action by the holders of Common Stock, and whether or not the certificates

representing such shares have been surrendered to the Company; provided, however, that the Company shall not be obligated to issue certificates

evidencing the shares of Common Stock issuable as a result of the Reverse Stock Split unless the existing certificates evidencing the

applicable shares of stock prior to the Reverse Stock Split are either delivered to the Company, or the holder notifies the Company that

such certificates have been lost, stolen or destroyed, and executes an agreement satisfactory to the Company to indemnify the Company

from any loss incurred by it in connection with such certificates.

Any

amendment to the Articles of Incorporation to effect the Reverse Stock Split will include the Reverse Stock Split Ratio fixed by the

Board, within the range approved by our stockholders.

Why

We are Seeking Stockholder Approval of the Reverse Stock Split Proposal

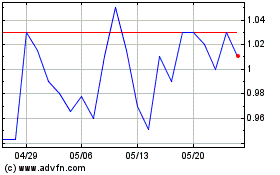

Our Common Stock is listed on the Nasdaq

Capital Market under the symbol “ATXG”. For our Common Stock to continue to be listed on the Nasdaq Capital Market, we must meet the

current continued listing requirements, including the requirement under Nasdaq Listing Rule 5550(a) that our Common Stock maintain a

minimum bid price per share of at least $1.00 per share (the “Minimum Bid Price Requirement”).

On April 24, 2024, we received a letter

from Nasdaq’s Listing Qualifications Department that for the last 30 consecutive business days, the closing bid price for the

Company’s Common Stock was below $1.00, which is the minimum closing bid price required for continued listing on Nasdaq

pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Notice”). This Notice is a notice of deficiency, not delisting, and has

no immediate effect on the listing of the Company’s Common Stock, and our Common Stock will continue to trade on the Nasdaq

Capital Market under the symbol “ATXG” at this time, subject to our compliance with the other Nasdaq listing

requirements.

In accordance with Nasdaq Listing Rule

5810(c)(3)(A), we were provided a compliance period of 180 calendar days from the date of the Notice, or until October 21, 2024, to

regain compliance with the Minimum Bid Price Requirement. If at any time during the 180-calendar day grace period, the

closing bid price of our Common Stock is at least $1.00 per share for a minimum of ten consecutive business days (unless the Nasdaq

staff exercises its discretion to extend this ten business day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H)), Nasdaq will

provide us with written confirmation of compliance, and the matter will be closed.

If we do not regain compliance during the compliance

period, we may be eligible for an additional 180-calendar day period to regain compliance, provided that on the 180th day of the first

compliance period we meet the applicable market value of publicly held shares requirement for continued listing and all other applicable

standards for initial listing on Nasdaq (except the Minimum Bid Price Requirement), based on our most recent public filings and market

information and notifies Nasdaq of its intent to cure the deficiency. If we do not regain compliance within the allotted compliance periods,

including any extensions that may be granted by Nasdaq, our Common Stock will be subject to delisting.

The Board has determined that the Reverse Split

Amendment is necessary so that a reverse split can be effectuated in order to continue the listing of our Common Stock on Nasdaq.

We

believe that potential delisting of our Common Stock

from Nasdaq may result in decreased liquidity, increased volatility in the price and trading volume of our common stock, a loss of current

or future coverage by certain sell-side analysts, a diminution of institutional investor interest and/or the impairment of our ability

to raise capital. Delisting could also cause a loss of confidence of our customers, collaborators, vendors, suppliers and employees,

which could have a material adverse effect on our business and future prospects. If our Common Stock will be delisted from Nasdaq, it