UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment No. 2)*

Applied

Digital Corporation

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

038169207

(CUSIP

Number)

Wesley

Cummins

Applied

Digital Corporation

3811

Turtle Creek Blvd., Suite 2100

Dallas,

TX 75219

(214)

556-2465

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

Copies

to:

Steven

E. Siesser, Esq.

Lowenstein

Sandler LLP

1251

Avenue of the Americas

New

York, New York 10020

Tel:

(212) 204-8688

August

5, 2023

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a

prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 038169207

| 1. |

NAMES

OF REPORTING PERSONS

I.R.S.

IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Wesley

Cummins |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

☐ |

| (b) |

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS

PF |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

23,092,646* |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

23,092,646* |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,092,646* |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.9%* |

| 14. |

TYPE

OF REPORTING PERSON

IN |

*See

Item 5 for additional information.

Explanatory

Note

This

Amendment No. 2 (this “Amendment”) amends and supplements the Schedule 13D filed by the Reporting Person with the

Securities and Exchange Commission (the “SEC”) on April 21, 2022 (the “Schedule 13D”) and the Amendment

No. 1 to the Schedule 13D filed by the Reporting Person with the SEC on December 5, 2022 (the “Amendment No. 1”).

Except as specifically provided herein, this Amendment does not modify or amend any of the information previously reported on the Schedule

13D or the Amendment No. 1. Capitalized terms used and not otherwise defined herein shall have the meanings ascribed to such terms in

the Schedule 13D or the Amendment No. 1, as applicable. Information given in response to each item shall be deemed incorporated by reference

in all other items, as applicable.

Item

1. Security and Issuer.

Item

1 of the Schedule 13D is hereby amended and restated as follows:

This

Schedule 13D relates to the common stock, par value $0.001 per share (the “Common Stock”), issued by Applied Digital

Corporation (f/k/a Applied Blockchain, Inc.) (the “Issuer”). The Issuer’s principal executive office is located

at 3811 Turtle Creek Blvd., Suite 2100, Dallas, TX 75219.

Item

2. Identity and Background.

Item

2 of the Schedule 13D is hereby amended and restated as follows:

Wesley

Cummins (the “Reporting Person”) is an individual who is the Chairman and Chief Executive Officer of the Issuer, having

a principal business address located at c/o Applied Digital Corporation, 3811 Turtle Creek Blvd., Suite 2100, Dallas, TX 75219. During

the last five years, the Reporting Person has not been (i) convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of

such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws. The Reporting Person is a United States

citizen.

Item

3. Source and Amount of Funds or Other Consideration.

Item

3 of the Schedule 13D is hereby supplemented as follows:

From

January 12, 2023 to May 17, 2023, B. Riley Asset Management, LLC (“BRAM”), of which the Reporting Person was the President,

purchased an aggregate of 605,000 shares of Common Stock on the open market. The aggregate purchase price of the purchases was approximately

$1,663,900, paid from working capital of BRAM. These shares of Common Stock are now held by 272 Capital, LLC (“272 Capital”),

of which the Reporting Person serves as President. 272 Capital indirectly held 404,233 shares of Common Stock pursuant to a certain Subadvisory

Agreement with the investment manager of the relevant fund. On June 18, 2024, the Subadvisory Agreement was terminated (the “Subadvisory

Termination”). As a result of the Subadvisory Termination, the Reporting Person ceased having discretionary or voting authority

with respect to the 404,233 shares of Common Stock.

From

February 5, 2023 to October 4, 2024, the Reporting Person received a net aggregate of 454,125 shares of Common Stock from the vesting

of restricted stock units (“RSUs”) and the surrender of shares of Common Stock to the Issuer in connection with tax

withholding obligations related to such RSUs.

On

April 4, 2023, the Reporting Person received a grant of 600,000 RSUs, of which one-third (1/3) of the RSUs vested on April 4,

2024 and one-sixth (1/6) of the RSUs vested on October 4, 2024, and will further vest on April 4, 2025, October 4, 2025

and April 4, 2026. Such RSUs are not included in the Reporting Person’s beneficial ownership as of the date hereof to the extent

such RSUs remain unvested or will not vest within 60 days after the date hereof.

On

October 10, 2024, the Reporting Person received a grant of 600,000 RSUs (the “October 2024 Grant”), of which one-third

(1/3) of the RSUs vest on October 10, 2025 and one-sixth (1/6) of the RSUs vest on April 10, 2026, October 10, 2026, April

10, 2027, and October 10, 2027. Such RSUs are not included in the Reporting Person’s beneficial ownership as of the date hereof

to the extent such RSUs remain unvested or will not vest within 60 days after the date hereof.

Item

4. Purpose of Transaction.

Item

4 of the Schedule 13D is hereby amended and restated as follows:

As a

substantial owner of shares of Common Stock in the Issuer and the Chairman and Chief Executive Officer of the Issuer, the Reporting Person

may be able to control the Issuer’s business and influence the corporate activities of the Issuer, and expects in the future to

discuss and make decisions in the ordinary course of his duties regarding plans or proposals with respect to the transactions described

in clauses (a) through (j) of this Item 4.

On November 27, 2024, the

Reporting Person entered into a Stock Purchase Agreement (the “Purchase Agreement”) to sell 200,000 shares of

Common Stock at a price per share of $9.20 in connection with a private transaction.

Except

for the sale pursuant to the Purchase Agreement described herein, the Reporting Person does not at the present time have any plans or

proposals which relate to or would result in:

| |

(a) |

The

acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer, except for the

acquisition of Common Stock upon the vesting of equity compensation granted to the Reporting Person for service as the Chairman of

the Issuer’s board of directors (the “Board”) or service as the Chief Executive Officer of the Issuer; |

| |

(b) |

An

extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; |

| |

(c) |

A

sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; |

| |

(d) |

Any

change in the present Board or management of the Issuer, including any plans or proposals to change the number or term of directors

or to fill any existing vacancies on the Board; |

| |

(e) |

Any

material change in the present capitalization or dividend policy of the Issuer; |

| |

(f) |

Any

other material change in the Issuer’s business or corporate structure; |

| |

(g) |

Changes

in the Issuer’s Certificate of Incorporation, by-laws or instruments corresponding thereto or other actions which may impede

the acquisition of control of the Issuer by any person; |

| |

(h) |

Causing

a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted

in an inter-dealer quotation system of a registered national securities association; |

| |

(i) |

A

class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities

Exchange Act of 1934; or |

| |

(j) |

Any

action similar to any of those enumerated above. |

Depending on the factors

discussed herein, the Reporting Person may, from time to time, acquire additional shares of Common Stock and/or retain and/or sell all

or a portion of the shares of Common Stock held by the Reporting Person in the open market or in privately negotiated transactions, and/or

may distribute shares of Common Stock to be acquired or held by the Reporting Person to other entities. Any actions the Reporting Person

might undertake will be dependent upon the Reporting Person’s review of numerous factors, including, among other things, the price

levels of the Common Stock, general market and economic conditions, ongoing evaluation of the Issuer’s business, financial condition,

operations and prospects, the relative attractiveness of alternative business and investment opportunities, the Reporting Person’s

need for liquidity, and other future developments. Any future acquisitions of Common Stock by the Reporting Person will be subject to

the Issuer’s policies, including its insider trading policy, as applicable.

Item

5. Interest in Securities of the Issuer.

Item

5 of the Schedule 13D is hereby amended and restated as follows:

The

information contained in rows 7, 8, 9, 10, 11 and 13 of the cover page of this Amendment and the information set forth in or incorporated

by reference in Item 2, Item 3, Item 4 and Item 6 of this Amendment and the Schedule 13D, as applicable, is hereby incorporated by reference

in its entirety into this Item 5.

(a)-(b)

As

of the date hereof, the Reporting Person may be deemed to be the beneficial owner of an aggregate of 23,092,646 shares of Common Stock,

all of which securities he has sole voting and dispositive power, including: (i) 17,590,238 shares of Common Stock held by Cummins Family

Ltd, of which the Reporting Person is the Chief Executive Officer, (ii) 3,133,789 shares of Common Stock held directly by the Reporting

Person, (iii) 742,166 shares of Common Stock held by the Reporting Person’s individual retirement account, and (iv) 1,626,453 shares

of Common Stock held by 272 Capital, of which the Reporting Person is the President. The following RSUs are not included in the Reporting

Person’s beneficial ownership as of the date hereof to the extent such RSUs remain unvested or will not vest within 60 days

after the date hereof: (i) 500,000 RSUs granted on August 5, 2022, of which one-sixth (1/6) of the RSUs vested on February

5, 2023, August 5, 2023, February 5, 2024, and August 5, 2024, and will further vest on February 5, 2025 and August 5,

2025, (ii) 600,000 RSUs granted on April 4, 2023, of which one-third (1/3) of the RSUs vested on April 4, 2024 and one-sixth (1/6)

of the RSUs vested on October 4, 2024, and will further vest on April 4, 2025, October 4, 2025 and April 4, 2026, and (iii)

600,000 RSUs granted on October 10, 2024, of which one-third (1/3) of the RSUs vest on October 10, 2025 and one-sixth (1/6)

vest on April 10, 2026, October 10, 2026, April 10, 2027, and October 10, 2027. The Reporting Person’s holdings represent an

aggregate of approximately 10.9% of the Issuer’s outstanding shares of Common Stock (based on 211,245,607 shares

of Common Stock reported as outstanding as of November 20, 2024 in the Issuer’s Registration Statement on Form S-1/A,

filed with the SEC on November 22, 2024).

As

of August 5, 2023, the Reporting Person may be deemed to be the beneficial owner of an aggregate of 23,373,171 shares of Common Stock,

all of which securities he has sole voting and dispositive power. The Reporting Person’s holdings represented an aggregate

of approximately 22.5% of the Issuer’s outstanding shares of Common Stock (based on 103,950,005 shares of Common Stock reported

as outstanding as of July 25, 2023 in the Issuer’s Annual Report on Form 10-K, filed with the SEC on August 2, 2023).

As

of February 5, 2024, the Reporting Person may be deemed to be the beneficial owner of an aggregate of 23,434,801 shares of Common Stock,

all of which securities he has sole voting and dispositive power. The Reporting Person’s holdings represented an aggregate

of approximately 19.2% of the Issuer’s outstanding shares of Common Stock (based on 122,044,737 shares of Common Stock reported

as outstanding as of January 10, 2024 in the Issuer’s Quarterly Report on Form 10-Q, filed with the SEC on January 16, 2024).

As

of August 5, 2024, the Reporting Person may be deemed to be the beneficial owner of an aggregate of 23,231,996 shares of Common

Stock, all of which securities he has sole voting and dispositive power. The Reporting Person’s holdings represented an

aggregate of approximately 15.9% of the Issuer’s outstanding shares of Common Stock (based on 146,552,678 shares of Common Stock

reported as outstanding as of July 1, 2024 in the Issuer’s Rule 424(b)(5) Prospectus, filed with the SEC on July 9, 2024).

As

of October 4, 2024, the Reporting Person may be deemed to be the beneficial owner of an aggregate of 23,292,646 shares of Common Stock,

all of which securities he has sole voting and dispositive power. The Reporting Person’s holdings represented an aggregate

of approximately 10.9% of the Issuer’s outstanding shares of Common Stock (based on 214,678,114 shares of Common Stock reported

as outstanding as of October 3, 2024 in the Issuer’s Registration Statement on Form S-1, filed with the SEC on October 4, 2024).

(c)

There

were no transactions by the Reporting Person in shares of Common Stock during the period commencing sixty (60) days prior to August 5,

2023.

There

were no transactions by the Reporting Person in shares of Common Stock during the period commencing sixty (60) days prior to February

5, 2024.

Except

for the Subadvisory Termination, there were no transactions by the Reporting Person in shares of Common Stock during the period commencing

sixty (60) days prior to August 5, 2024.

On

August 5, 2024, as the result of previously issued RSUs vesting, the Reporting Person received 83,333 shares of Common Stock, of which

32,792 shares of Common Stock were withheld for tax purposes (collectively, the “August 2024 Vesting”). Except for

the August 2024 Vesting, there were no transactions by the Reporting Person in shares of Common Stock during the period commencing sixty

(60) days prior October 4, 2024.

On

October 4, 2024, as the result of previously issued RSUs vesting, the Reporting Person received 100,000 shares of Common Stock, of which

39,350 shares of Common Stock were withheld for tax purposes (collectively, the “October 2024 Vesting”). Except for

the October 2024 Vesting, the October 2024 Grant and the Purchase Agreement, there were no transactions by the Reporting Person in shares

of Common Stock during the period commencing sixty (60) days prior to the date hereof.

(d)

None.

(e)

Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item

6 of the Schedule 13D is hereby amended and restated as follows:

The

disclosure set forth above in Item 4 regarding the Purchase Agreement is incorporated herein and is qualified by reference to the text

thereof.

Item

7. Material to be Filed as Exhibits.

Item

7 of the Schedule 13D is hereby amended and restated in its entirety as follows:

Signatures

After

reasonable inquiry and to the best knowledge and belief of the undersigned, the undersigned certifies that the information set

forth in this statement is true, complete and correct.

| DATED: |

November

29, 2024 |

|

|

|

| |

|

|

By: |

/s/

Wesley Cummins |

| |

|

|

|

Wesley

Cummins |

Exhibit

1

STOCK

PURCHASE AGREEMENT

This

STOCK PURCHASE AGREEMENT, dated as of November 27, 2024 (this “Agreement”), is made by and among the individual listed

on Exhibit A, annexed hereto and made a part hereof (the “Seller”), and AFOB FIP MS, LLC, a Delaware limited

liability company (the “Purchaser”).

WHEREAS,

the Seller is the holder of the number of shares set forth opposite Seller’s name on Exhibit A, (the “Shares”)

of Common Stock, par value $0.001 per share (the “Common Stock”), of Applied Digital Corporation, a Nevada corporation

(the “Issuer”); and

WHEREAS,

the Seller desires to sell to the Purchaser the Shares, and the Purchaser is willing to purchase the Shares from the Seller, upon the

terms and subject to the conditions set forth in this Agreement.

NOW,

THEREFORE, in consideration of the foregoing and the covenants, agreements and warranties contained herein, the sufficiency of which

as consideration is hereby acknowledged, the parties agree as follows:

1.

Definitions. When used herein, the following terms shall have the indicated meanings:

“Encumbrance”

means any pledge, hypothecation, assignment, lien, restriction, charge, claim, security interest, option, preference, priority or other

preferential arrangement of any kind or nature whatsoever.

“Transfer

Restriction” means, with respect to any security or other property, any condition to or restriction on the ability of the holder

thereof to sell, assign or otherwise transfer such security or other property or to enforce the provisions thereof or of any document

related thereto, whether set forth in such security or other property itself or in any document related thereto or arising by operation

of law, including, without limitation, such conditions or restrictions arising under federal, state or foreign securities laws or under

contract, other than any of the foregoing known to the Purchaser.

2.

Sale and Purchase. The Seller will sell to the Purchaser, and the Purchaser will purchase from the Seller (the “Transaction”),

effective as of 4:05 p.m., New York City time, on the date hereof, the Shares for a purchase price per share of Common Stock equal to

$9.20, for an aggregate purchase price for all the Shares equal to $1,840,000.00 (the “Purchase Price”).

3.

Representations, Warranties and Agreements of the Seller.

The

Seller hereby represents, warrants and agrees on the date hereof and on the Settlement Date (as defined below):

(a)

The Seller has all requisite authority, power and capacity to enter into this Agreement and to consummate the Transaction. The execution,

delivery and performance of this Agreement and the consummation of the transactions contemplated herein have been duly authorized by

all necessary action, corporate or otherwise, of the Seller. This Agreement has been duly and validly executed and delivered by the Seller

and constitutes the legal, valid and binding obligation of the Seller, enforceable in accordance with its terms, except as such enforceability

may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or similar laws from time to time in effect that affect

creditors’ rights generally, and by legal and equitable limitations on the availability of specific remedies.

(b)

The execution, delivery and performance by the Seller of this Agreement and consummation by the Seller of the Transaction do not and

will not: (i) violate any decree or judgment of any court or other governmental authority applicable to or binding on the Seller; (ii)

violate any provision of any federal or state statute, rule or regulation which is, to the Seller’s knowledge, applicable to the

Seller; or (iii) violate any contract to which the Seller or any of its assets or properties are bound. Except for filings under Sections

13 and 16 of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder, no consent or approval

of, or filing with, any governmental authority or other person not a party hereto is required for the execution, delivery and performance

by the Seller of this Agreement or the consummation of the Transaction.

(c)

With respect to the Transaction, (i) the Seller is the record and beneficial owner of the Shares, free and clear of any Encumbrances;

and (ii) upon the transfer of the Shares to the Purchaser, the Purchaser will acquire good and marketable title thereto, free and clear

of any Encumbrances or Transfer Restrictions, other than Transfer Restrictions placed on the Shares as a result of the Seller being an

“affiliate” of the Issuer pursuant to the Securities Act of 1933, as amended (the “Securities Act”), and

the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

(d)

No proceedings relating to the Shares are pending or, to the knowledge of the Seller, threatened before any court, arbitrator or administrative

or governmental body that would adversely affect the Seller’s right to transfer the Shares to the Purchaser.

(e)

The Seller, by reason of, among other things, its business and financial experience, is capable of evaluating the merits and risks of

the Transaction and of protecting its own interests in connection with the Transaction.

(f)

The Seller has been given the opportunity to consult with its own counsel and financial and other advisors with respect to this Agreement

and the terms hereof and has delivered this Agreement freely and voluntarily.

4.

Representations, Warranties and Agreement of the Purchaser.

The

Purchaser hereby represents, warrants and agrees as of the date hereof and on the date hereof and on the Settlement Date:

(a)

The Purchaser has all requisite authority, power and capacity to enter into this Agreement and to consummate the Transaction. The execution,

delivery and performance of this Agreement and the consummation of the transactions contemplated herein have been duly authorized by

all necessary action, corporate or otherwise, of the Purchaser. This Agreement has been duly and validly executed and delivered by the

Purchaser and constitutes the legal, valid and binding obligation of the Purchaser, enforceable in accordance with its terms, except

as such enforceability may be limited by applicable bankruptcy, insolvency, moratorium, reorganization or similar laws from time to time

in effect that affect creditors’ rights generally, and by legal and equitable limitations on the availability of specific remedies.

(b)

The execution, delivery and performance by the Purchaser of this Agreement and consummation by the Purchaser of the Transaction do not

and will not: (i) violate any decree or judgment of any court or other governmental authority applicable to or binding on the Purchaser;

(ii) violate any provision of any federal or state statute, rule or regulation which is, to such Purchaser’s knowledge, applicable

to the Purchaser; or (iii) violate any contract to which the Purchaser or any of its assets or properties are bound. Except for filings

under Sections 13 and 16 of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder, no

consent or approval of, or filing with, any governmental authority or other person not a party hereto is required for the execution,

delivery and performance by the Purchaser of this Agreement or the consummation of the Transaction.

(c)

The Purchaser is an “accredited investor” within the meaning of Regulation D under the Securities Act. The Purchaser is acquiring

Shares pursuant to the Transaction hereunder for its own account and not with a view to the distribution thereof (within the meaning

of the Securities Act) in violation of applicable securities laws. The Purchaser does not have any present intention of selling, granting

any participation in, or otherwise distributing Shares. The acquisition by the Purchaser of Shares shall constitute confirmation of the

representation by the Purchaser that the Purchaser does not have any contract, undertaking, agreement or arrangement with any person

to sell, transfer or grant participations to such person or to any third person, with respect to the Shares. The Purchaser acknowledges

that upon its purchase of Shares that each such Share (i) will be a “restricted security” for purposes of Rule 144 promulgated

under the Securities Act by the Securities and Exchange Commission and (ii) cannot be resold unless it is registered under the Securities

Act or in a transaction exempt from or not subject to the registration requirements of the Securities Act (“Permitted Securities

Law Restrictions”).

5.

Conditions Precedent to Obligations of the Purchaser. The obligations of the Purchaser are subject to the satisfaction or

waiver (in its sole discretion) of the following conditions precedent:

(a)

The representations and warranties of the Seller contained herein shall be true and correct as of the Settlement Date.

(b)

The Seller shall have complied with all of the covenants and agreements contained herein to be performed by the Seller on or prior to

the Settlement Date.

6.

Conditions Precedent to Obligations of the Seller. The obligations of the Seller are subject to the satisfaction or waiver

(in its sole discretion) of the following conditions precedent:

(a)

The representations and warranties of the Purchaser contained herein shall be true and correct as of the Settlement Date.

(b)

The Purchaser shall have complied with all of the covenants and agreements contained herein to be performed by the Purchaser on or prior

to the Settlement Date.

7.

Settlement.

(a)

Settlement of the Transaction shall take place on November 29, 2024 (the “Settlement Date”). On the Settlement Date,

subject to Sections 5 and 6 of this Agreement, the Seller shall deliver to the Purchaser the Shares against payment by the Purchaser

of the Purchase Price. On the Settlement Date, the Seller shall promptly instruct the transfer agent for the Common Stock (the “Transfer

Agent”) to record the delivery of the Shares to the Purchaser in book-entry form pursuant to the Transfer Agent’s regular

procedures.

(b)

The Shares delivered to the Purchaser pursuant to this Agreement shall be free and clear of all Encumbrances and Transfer Restrictions

other than Permitted Securities Law Restrictions. The transfer of the Shares to the Purchaser shall have been registered on the books

of the Issuer and the applicable transfer agent for the Common Stock. The Shares delivered to the Purchaser pursuant to this Agreement

shall bear legends in substantially the following form:

THE

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT UNDER ANY CIRCUMSTANCES

BE SOLD, TRANSFERRED, OR OTHERWISE DISPOSED OF WITHOUT AN EFFECTIVE REGISTRATION STATEMENT FOR SUCH SECURITIES UNDER THE SECURITIES ACT

OF 1933, AS AMENDED, AND ANY OTHER APPLICABLE SECURITIES LAWS OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT REGISTRATION

IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE SECURITIES LAWS.

(c)

The Purchase Price shall be paid by wire transfer of immediately available funds to the bank account set forth on Exhibit A hereto.

(d)

Each of the Purchaser and the Seller will, upon the reasonable request of the other, execute and deliver all other such documents and

instruments reasonably deemed necessary or desirable by the other party to fully effect the purchase and sale contemplated hereby.

9.

Amendment. This Agreement shall not be amended, modified or supplemented except in a writing signed by the Seller and the

Purchaser.

10.

Notices. Any notice, request, instruction or other document to be given hereunder by a party hereto shall be in writing and

shall be deemed to have been given, (a) when received if given in person or by a courier or a courier service, (b) on the date of transmission

if sent by e-mail, facsimile transmission or other means of electronic transmission (provided that the sending party retains written

evidence of confirmed transmission), or (c) when actually received if mailed by first-class certified or registered United States mail

or recognized overnight courier service, postage-prepaid and return receipt requested, and all legal process with regard hereto shall

be validly served when served in accordance with applicable law, in each case addressed as follows:

| If to the Seller: |

To the address set forth on Exhibit A

hereto. |

| With a copy

to: |

Lowenstein Sandler LLP |

1251

Avenue of the Americas

New

York, NY 10020

Attention:

Steven E. Siesser, Esq.

Facsimile:

E-mail:

| If to the Purchaser:

|

To the address set forth beneath Purchaser’s

signature hereto. |

11.

Counterparts. This Agreement may be executed in two or more counterparts. Each such counterpart shall be deemed to be an original,

but all of which together shall constitute one and the same document. Executed counterparts to this Agreement transmitted by facsimile

or by electronic transmission of portable document format (PDF) files or tagged image file format (TIF) files shall be deemed to be original

signatures for all purposes.

12.

APPLICABLE LAW. THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK (without

reference to choice OF law doctrine).

13.

Expenses. Except as otherwise expressly provided herein, each party hereto will bear its own expenses in connection with the

purchase and sale of the Shares contemplated hereby, except that the Seller shall bear all transfer and issuance taxes, if any, imposed

on such purchase and sale.

14.

Entire Agreement. This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter

hereof and supersedes all prior agreements and understandings between such parties with respect to such subject matter.

15.

Severability. If any provision of this Agreement shall be held invalid, illegal or unenforceable, the validity, legality and

enforceability of the other provisions hereof shall not be affected thereby.

16.

Captions. The Section captions herein are for convenience of reference only and are not intended to be a part of or to affect

the meaning or interpretation of this Agreement.

17.

Specific Performance. The parties acknowledge that money damages will not be a sufficient remedy for breach of this Agreement

and that the parties hereto may obtain specific performance or other injunctive relief, without the necessity of posting a bond or security

therefor.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed and delivered as of the date first above written.

SELLER:

| /s/ Wesley Cummins |

|

| Wesley Cummins |

|

PURCHASER:

AFOB FIP MS, LLC

| By: |

AFO Blackberry LLC, its Manager |

|

| By: |

/s/ John Rigo |

|

| Name: |

John Rijo |

|

| Title: |

President |

|

Address:

[Signature

Page to Stock Purchase

Agreement]

Exhibit

A

Seller

| Seller | |

Address | |

Shares | | |

Wire

Instructions |

| Wesley Cummins | |

3811 Turtle Creek Boulevard

Ste 2100, Dallas, TX 75219

| |

| 200,000 | | |

Account: Bank: Account

Number: Routing

Number: |

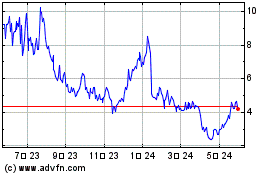

Applied Digital (NASDAQ:APLD)

過去 株価チャート

から 12 2024 まで 1 2025

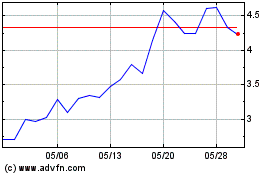

Applied Digital (NASDAQ:APLD)

過去 株価チャート

から 1 2024 まで 1 2025