false

0001705110

0001705110

2024-10-14

2024-10-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 14, 2024

Angi Inc.

(Exact name of registrant as specified in

charter)

| Delaware |

|

001-38220 |

|

82-1204801 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

3601 Walnut Street, Suite 700

Denver, CO |

|

80205 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 963-7200

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 |

ANGI |

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers. |

Departure of Principal

Accounting Officer

On October 14, 2024,

Christopher W. Bohnert, Senior Vice President, Chief Accounting Officer and Controller of Angi Inc. (the “Company” or

“Angi”), informed the Company that he will resign from his role, effective November 1, 2024 (the “Effective

Date”). Mr. Bohnert’s resignation is not the result of any disagreement relating to the Company’s accounting or

financial policies or procedures. Mr. Bohnert has agreed to remain with the Company for a to be determined period to assist with the transition of the role to his successor.

Appointment of Principal Accounting Officer

On October 14, 2024,

Julie Gosal Hoarau, age 41, was appointed as Chief Accounting Officer of the Company, effective on the Effective Date. Prior to

joining the Company, Ms. Gosal Hoarau worked at MongoDB, Inc. (NASDAQ: MDB), a developer data platform company, from May 2019 to

October 2024, where she most recently served as Vice President of Accounting Operations. During her tenure, Ms. Gosal Hoarau oversaw

various functions, including SEC reporting and technical accounting, corporate accounting, finance transformation, tax, treasury,

sales compensation and payroll. Prior to joining MongoDB, Ms. Gosal Hoarau served: (i) from April 2018 to May 2019, as Vice

President and then Senior Vice President, Finance of Aaptiv, a digital fitness application, (ii) from September 2017 to December

2017, as Senior Vice President, Finance of Evolving Systems, a provider of digital engagement solutions and services that was then

publicly traded (NASDAQ: EVOL), and (iii) from October 2012 to August 2017, as Director of Finance and Special Projects and Product

Owner, E-Commerce and Subscriptions, for Shutterstock (NYSE: SSTK), a leading online content marketplace. Prior to

these roles, from April 2010 to October 2012, she served as Vice President, Finance and Chief Financial Officer of Scanbuy, Inc., a

venture capital-backed developer of cloud-based mobile engagement solutions through QR codes. Earlier in her career, she held

various financial accounting and business consulting positions at KVB Partners, an accounting and tax services firm. Ms. Gosal

Hoarau holds both a Bachelor’s degree in Business Administration (DUT GEA and D.E.S.C.F) and a Master of Science degree in

Accounting (D.E.S.S.) from the University of Bordeaux and is a Certified Public Accountant.

In connection with her appointment,

as of the Effective Date, Ms. Gosal Hoarau shall receive a grant of Angi restricted stock units with a dollar value of $750,000 pursuant

to the Company’s Amended and Restated 2017 Stock and Annual Incentive Plan (the “2017 Plan”), which award shall be scheduled

to vest in three equal annual installments, on the first, second and third anniversaries of the Effective Date, subject to continued service.

Appointment of Chief

Operating Officer and Related Compensatory Arrangements

On

October 15, 2024, Bailey Carson, age 40, was appointed Chief Operating Officer of the Company, effective immediately (the “Carson

Effective Date”). In this role, Ms. Carson will oversee the Company’s sales, customer care and operations functions. Prior

to this appointment, Ms. Carson served as Chief Customer Experience Officer of the Company since January 2024 and in the following general

management roles at the Company and its businesses: (i) from November 2022 to December 2023, as General Manager of the Company’s

Services business, (ii) from April 2021 to November 2022, as General Manager of the Company’s Book Now product offering, (iii) from

May 2020 to April 2021, as a Category Manager of the Company’s Everyday Services category, and (iv) from August 2018 to May 2020,

as Senior Vice President, Growth of Handy Technologies Inc. (acquired by the Company in October 2018). Prior to joining the Company, she

served: (i) from October 2016 to August 2018, as Chief Operating Officer of Willing Beauty Company, a clean skincare brand (“Willing”),

(ii) from July 2014 to October 2016, as Chief Operating Officer and Chief Financial Officer of willa, a clean skincare brand for teens

(acquired by Willing’s parent company in September 2016), and (iii) from May 2013 to July 2014, as Product Manager of Compass, as

residential real estate brokerage firm. Earlier in her career, Ms. Carson served as a private equity associate at Irving Place Capital

and as an investment banking analyst at Lehman Brothers. Ms. Carson holds a Bachelors of Science in Business Administration and Accounting

from Washington and Lee University and a Master of Business Administration from Harvard Business School. In connection with Ms.

Carson’s appointment, on the Carson Effective Date, the Company and Ms. Carson entered into an

employment agreement (the “Carson Employment Agreement”).

Term. The Carson Employment

Agreement has a scheduled term of one (1) year from the Carson Effective Date and provides for automatic renewals for successive one (1)

year terms absent written notice from the Company or Ms. Carson ninety (90) days prior to the expiration of the then current term.

Compensation. The

Carson Employment Agreement provides that during the term, Ms. Carson will be eligible to receive an annual base salary (currently

$450,000), discretionary annual cash bonuses (with a target of $350,000), equity awards and such other employee benefits as may be

reasonably determined by the Compensation and Human Capital Committee of the Company’s Board of Directors (the “Committee”). In addition,

as of the Carson Effective Date, Ms. Carson shall receive a grant of 400,000 Angi restricted stock units pursuant to the 2017 Plan,

which award shall be scheduled to vest in four equal annual installments, on November 1, 2025, 2026, 2027 and 2028, subject to

continued service.

Severance. The Carson

Employment Agreement also provides that upon a termination of Ms. Carson’s employment by the Company without “cause”

(and other than by reason of death or disability), her resignation for “good reason” or the timely delivery of a non-renewal

notice by the Company (a “Qualifying Termination”), subject to Ms. Carson’s execution and non-revocation of a release

and her compliance with the restrictive covenants set forth below:

| (i) | the Company will continue to pay Ms. Carson her annual base salary for twelve (12) months following such Qualifying Termination (the

“Carson Severance Period”), subject to offset for amounts received from other employment during the Carson Severance Period; |

| (ii) | all unvested Angi equity awards (including cliff vesting awards, if any, which shall be pro-rated as though

such awards had an annual vesting schedule) held by Ms. Carson that would have otherwise vested during the Carson Severance Period shall

vest as of the date of such Qualifying Termination; and |

| (i) | all vested and outstanding Angi stock options and stock appreciation rights held by Ms. Carson as of the

date of such Qualifying Termination shall remain outstanding and exercisable for eighteen (18) months from the date of such Qualifying

Termination. |

Restrictive

Covenants. Pursuant

to the Carson Employment Agreement, Ms. Carson is bound by covenants not to compete with Angi and its businesses nor solicit Angi employees

or business partners during the term of her employment and the Carson Severance Period. In addition, Ms. Carson has agreed not to use

or disclose any confidential information of Angi or its affiliates and to be bound be customary covenants relating to proprietary rights

and the related assignment of such rights.

Ms. Carson has no direct or

indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K, has no

arrangement or understanding between her and any other person required to be disclosed pursuant to Item 401(b) of Regulation

S-K and has no family relationships required to be disclosed pursuant to Item 401(d) of Regulation S-K.

Appointment of Chief

Growth Officer and Related Compensatory Arrangements

On October 15, 2024, Glenn

Orchard, age 46, was appointed Chief Growth Officer of the Company, effective immediately (the “Orchard Effective Date”).

In this role, Mr. Orchard will oversee the Company’s growth and marketing strategy and execution. Prior to this appointment, he

served in the following marketing roles at the Company and its businesses: (i) from December 2023 to October 2024, as Senior Vice President

of Digital and Growth of the Company, (ii) from October 2021 to date, as Chief Marketing Officer of Instapro Group, which consists of

the businesses included within the Company’s International financial reporting segment, and (iii) from January 2018 to September

2021, as Chief Marketing Officer of MyBuilder, a leading home services marketplace in the United Kingdom included within the Company’s

International financial reporting segment. Prior to joining the Company, from August 2011 to December 2017, Mr. Orchard held various marketing,

commercial and e-commerce positions at Photobox Group, a European online photo print company (“Photobox”), most recently from

May 2016 to December 2017 as Marketing, Analytics and Business Intelligence Group Director. Prior to his tenure at Photobox, he held various

marketing, commercial and e-commerce positions at Dixons Retail, the former European consumer electronics dealer (since renamed Currys

plc) from March 2003 to March 2011, most recently from May 2008 to March 2011 as Head of Commercial – Mobile, Broadband and Content.

In connection with Mr. Orchard’s

appointment, on the Orchard Effective Date, the Company and Mr. Orchard agreed that Mr. Orchard shall

be compensated in the manner described immediately below (the “Orchard Employment Arrangements”).

Compensation. Pursuant

to the Orchard Employment Arrangements, Mr. Orchard will be eligible to receive an annual base salary (currently £330,000), discretionary

annual cash bonuses (with a target of £150,000), equity awards and such other employee benefits as may be reasonably determined

by the Committee. Mr. Orchard will also be eligible to receive tax equalization

payments if he is subject to income or other taxation outside of the United Kingdom during his employment with the Company,

grossed up for the impact of any tax withholding, and tax preparation services. In addition, as of the Orchard Effective

Date, Mr. Orchard shall receive a grant of 400,000 Angi restricted stock units pursuant to the 2017 Plan, which award shall be scheduled

to vest in four equal annual installments, on November 1, 2025, 2026, 2027 and 2028, subject to continued service.

Severance. Also pursuant

to the Orchard Employment Arrangements, upon a Qualifying Termination of Mr. Orchard’s employment, subject to Mr. Orchard’s

execution and non-revocation of a release and his compliance with the restrictive covenants set forth below:

| (ii) | the Company will continue to pay Mr. Orchard his annual base salary for twelve (12) months following such Qualifying Termination (the

“Orchard Severance Period”), subject to offset for amounts received from other employment during the Orchard Severance Period; |

| (ii) | all unvested Angi equity awards (including cliff vesting awards, if any, which shall be pro-rated as though

such awards had an annual vesting schedule) held by Mr. Orchard that would have otherwise vested during the Orchard Severance Period shall

vest as of the date of such Qualifying Termination; and |

| (ii) | all vested and outstanding Angi stock options and stock appreciation rights held by Mr. Orchard as of

the date of such Qualifying Termination shall remain outstanding and exercisable for eighteen (18) months from the date of such Qualifying

Termination. |

Restrictive

Covenants. Pursuant to the Orchard Employment Arrangements, Mr. Orchard will be

bound by covenants not to compete with Angi and its businesses nor solicit Angi employees or business partners during his employment

and the Orchard Severance Period. In addition, Mr. Orchard has agreed not to use or disclose any confidential information of Angi or

its affiliates and to be bound be customary covenants relating to proprietary rights and the related assignment of such

rights.

Mr. Orchard has no direct

or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K, has

no arrangement or understanding between him and any other person required to be disclosed pursuant to Item 401(b) of Regulation

S-K and has no family relationships required to be disclosed pursuant to Item 401(d) of Regulation S-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description |

| |

|

| 104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Angi Inc. |

| |

|

| Dated: October 15, 2024 |

By: |

/s/ Andrew Russakoff |

| |

|

Andrew Russakoff |

| |

|

Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

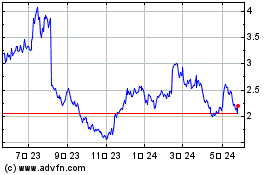

Angi (NASDAQ:ANGI)

過去 株価チャート

から 11 2024 まで 12 2024

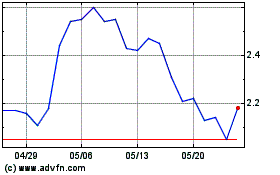

Angi (NASDAQ:ANGI)

過去 株価チャート

から 12 2023 まで 12 2024