false

0001584754

0001584754

2024-11-21

2024-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 21, 2024

AKOUSTIS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-38029 |

33-1229046 |

| (State or Other Jurisdiction |

(Commission File Number) |

(I.R.S. Employer |

| of Incorporation) |

|

Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, NC 28078

(Address of principal executive offices, including

zip code)

704-997-5735

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol: |

|

Name of each exchange on which registered: |

| Common Stock, $0.001 par value |

|

AKTS |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

As previously reported, on May 17, 2024, after

a trial in the U.S. District Court for the District of Delaware (the “District Court”) in the matter of Qorvo Inc.

vs. Akoustis Technologies, Inc. DE Case 1:21-cv-01417-JPM (the “Qorvo Litigation”), a jury verdict was entered in

favor of plaintiff, Qorvo Inc. (“Qorvo”), and against Akoustis Technologies, Inc. (the “Company”).

On November 21, 2024, the District Court entered

an amended final judgment (the “Judgment”) against the Company consisting of the amounts of (i) $38,595,023.00 caused by the

Company’s infringement and misappropriation, (ii) $11,743,745.54 in attorneys’ fees awarded by the District Court, (iii) $51,782.00

in pre-judgment interest for patent infringement, (iv) $6,589,064.41 in pre-judgment interest for misappropriation of trade secrets under

North Carolina law, and (v) post-judgment interest on the damages awards included in items (i) through (iv) at a rate of 5.138%, calculated

daily and compounded annually from the respective dates of the various awards, being May 20, 2024 with respect to item (i), September

9, 2024 with respect to item (ii), September 10, 2024 with respect to item (iii), and September 10, 2024 with respect to item (iv) (items

(i) through (v) are collectively referred to herein as the “Fees and Interest Awards”).

The Judgment additionally granted the previously

entered injunctive relief against the Company in favor of Qorvo (the “Injunctive Order”), as described in the Company’s

Current Report on Form 8-K filed with the Securities and Exchange Commission on October 16, 2024. The Injunctive Order provides that:

| ● | the Company is permanently enjoined from possessing any confidential

information copied or derived from certain trade secrets that the jury found the Company to have misappropriated (“Qorvo Trade

Secret Information”), selling or distributing any product made using Qorvo Trade Secret Information, and promoting or otherwise

providing services that use Qorvo Trade Secret Information; |

| ● | the Company is required to engage, at its expense, an e-discovery

vendor to assist with the identification, collection and removal of any Qorvo confidential information and Qorvo Trade Secret Information

from any of the Company’s databases, document management systems, email accounts, computers and other storage media, and paper

files; |

| ● | for a period of four years from the issuance of the Injunctive

Order, Qorvo will have the right to conduct audits of the Company through an independent third party, a maximum of once per calendar

year, with the expense of such audits to be split evenly between the Company and Qorvo (unless an audit shows a violation of the Injunctive

Order, in which case the Company will bear the full cost of such audit). The audit rights terminate after two years if no violations

are found in the first two years; and |

| ● | the Company is permanently enjoined from making, using or

selling in the United States, or importing into the United States, certain Company products found by the jury to infringe the two asserted

Qorvo patents, or any products not more than colorably different than such products. |

The verdict in the Qorvo Litigation

awarding Qorvo approximately $38.6 million in damages together with the Fees and Interest Awards in the aggregate amount of approximately

$18.4 million, plus interest accrued and accruing thereon, have created significant uncertainty regarding the Company’s financial

condition and prospects. The Company is evaluating the impact of the Judgment on its business, results of operations, and financial condition.

However, depending on the Company’s ability to arrange any financing or any strategic alternative, the Company will be required

to seek protection under applicable bankruptcy laws.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on Form 8-K includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, each

as amended, that are intended to be covered by the “safe harbor” created by those sections. These forward-looking statements

include, but are not limited to, statements about the Company’s estimates, expectations, beliefs, intentions, plans or strategies

for the future (including its possible future results of operations, profitability, business strategies, competitive position, potential

growth opportunities, potential market opportunities and the effects of competition), and the assumptions underlying such statements.

Forward-looking statements include all statements that are not historical facts and typically are identified by use of terms such as:

“may,” “might,” “would,” “will,” “should,” “could,” “project,”

“expect,” “plan,” “strategy,” “anticipate,” “attempt,” “develop,”

“help,” “believe,” “think,” “estimate,” “predict,” “intend,” “forecast,”

“seek,” “potential,” “possible,” “continue,” “future,” and similar words (including

the negative of any of the foregoing), although not all forward-looking statements contain these words. These statements involve risks,

uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different

from the information expressed or implied by these forward-looking statements. Although the Company believes that it has a reasonable

basis for each forward-looking statement contained in this Current Report, the Company cautions you that these statements are based on

a combination of facts and factors currently known by it and its projections of the future, about which it cannot be certain. Forward-looking

statements in this Current Report include, but are not limited to, statements regarding the Company’s expectations regarding the

impact of the Judgment on its operations and prospects and its expectations that it will be required to seek protection under applicable

bankruptcy laws. Forward-looking statements are neither historical facts nor assurances of future results, performance, events or circumstances.

Instead, these forward-looking statements are based on management’s current beliefs, expectations and assumptions, and are subject

to risks and uncertainties. These risks and uncertainties include any adverse outcomes of any motions or appeals against the Company,

and other risks and uncertainties, including those more fully described in the Company’s Annual Report on Form 10-K for the year

ended June 30, 2024 and subsequent Quarterly Reports on Form 10-Q, and other factors detailed from time to time in the Company’s

filings with the Securities and Exchange Commission The Company undertakes no obligation to revise or update publicly any forward-looking

statements.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Akoustis Technologies, Inc. |

| |

|

| Date: November 22, 2024 |

By: |

/s/ Kenneth E. Boller |

| |

Name: |

Kenneth E. Boller |

| |

Title: |

Chief Financial Officer |

3

v3.24.3

Cover

|

Nov. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 21, 2024

|

| Entity File Number |

001-38029

|

| Entity Registrant Name |

AKOUSTIS TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001584754

|

| Entity Tax Identification Number |

33-1229046

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9805 Northcross Center Court

|

| Entity Address, Address Line Two |

Suite A

|

| Entity Address, City or Town |

Huntersville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28078

|

| City Area Code |

704

|

| Local Phone Number |

997-5735

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

AKTS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

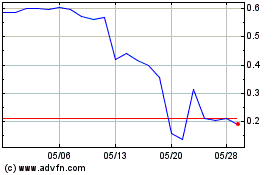

Akoustis Technologies (NASDAQ:AKTS)

過去 株価チャート

から 11 2024 まで 12 2024

Akoustis Technologies (NASDAQ:AKTS)

過去 株価チャート

から 12 2023 まで 12 2024