TIDMLAS

FOR IMMEDIATE RELEASE

25 August 2023

LONDON & ASSOCIATED PROPERTIES PLC

HALF YEAR RESULTS TO 30 June 2023

London & Associated Properties PLC ("LAP" or the "Group") is a main market

listed property investment group that specialises in industrial and essential

retail property in the UK.

It also holds a substantial stake in the main market listed Bisichi PLC which

operates coal mines in South Africa and invests in UK property.

HIGHLIGHTS

· Net assets attributable to shareholders -

· Decreased to £29.3 million (December 2022: £32.5 million)

· Now 34.32p (December 2022: 38.14p) per share

· Write down of £2.1m in value of Orchard Square, Sheffield despite strong

operational performance

· Property portfolio seeing continued strong operational performance with

Group occupancy levels of 98.4% by rental income (June 2022: 97.6%)

· Whilst no properties have been acquired in the period, we are actively

seeking to reinvest cash in new assets in targeted sectors. These must be at an

appropriate yield and with the potential to add value and income growth through

asset management initiatives.

"The results for the six months to 30 June 2023 have been impacted very

significantly by interest rate increases. Not only have the additional costs

damaged operating performance, but negative sentiment has meant that the

investment market for asset sales is becoming more uncertain .... We are,

though, seeing rental growth in both the industrial properties and the value

-orientated retail properties that we continue to hold."

-more-

Contact:

London & Associated Properties PLCTel: 020 7415 5000

John Heller, Chairman and Chief Executive

Baron Phillips AssociatesTel: 07767 444193

Baron Phillips

Half year results for the period ended

30 June 2023

Half year review

The results for the six months to 30 June 2023 have been impacted very

significantly by interest rate increases. Not only have the additional costs

damaged operating performance, but negative sentiment has meant that the

investment market for asset sales is becoming more uncertain. This has

materially affected us at Orchard Square in Sheffield where in May we instructed

agents to market this property in the run up to the September 2023 expiry of our

loan from QSix. As at the date of this report, we are unable to confirm that

any sales proceeds will be sufficient to repay this loan and return a surplus to

the Group. In light of this, we have adopted a prudent approach to the value of

Orchard Square and have written it down to the outstanding loan value of £12.65m

from £14.75m.

The loan on the property is non recourse to the LAP Group, is secured

exclusively on this asset and the write down in value in the period is the

maximum loss the Group can incur. However, this write-down contributed to

losses attributable to shareholders of £3.0 million (2022: profits of £4.3

million) while net assets attributable to shareholders have reduced from £32.5

million to £29.3 million (34.32p a share as compared with 38.14p at December

2022).

Orchard Square is held as inventory as it is readied for sale. Since September

2022, all surplus operating cash was retained within Orchard Square Ltd and not

distributed as a dividend to LAP as part of an agreement with the lender to

exercise our option to extend the loan by 12 months. During this period we have

sought to refinance the loan, but due to prevailing market conditions, this has

not been possible without a significant equity contribution which we do not feel

would be in shareholders' interests. In the last few days we have confirmed this

decision to the existing lender who has issued a reservation of rights letter.

The company will update shareholders on the progress of this matter in due

course.

This is a disappointing outcome for a property that had performed well over our

24 year ownership. Once again, Orchard Square has, operationally, performed

strongly this year. We have recently completed three significant lettings as we

continue to reposition the centre with a greater focus on food and beverage

operators. We have also upgraded thepublic areaswithnew paving, awnings for the

tenants and a weather proofing canopyhaving been completedwith the support of a

grant fromSheffield Council.This enables the year-round use of the public

areasandhasbeenwarmlywelcomed byallthe tenants. Operating income for Orchard

Square remains at c£1.7 million per annum (31 December 2022: £1.7m).

The remainder of our property portfolio is performing satisfactorily. Revenue

from property activities decreased slightly to £3.0 million (2022: £3.3

million), reflecting the disposal of our shopping centre in West Bromwich in

July 2022, the proceeds of which have not yet been reinvested.

We are, though, seeing rental growth in both our industrial and value-orientated

retail properties. While we remain open to selling any properties where we think

we can reinvest the proceeds into new assets with stronger growth potential, we

remain happy with the cash generating potential of the current portfolio.

Across our entire portfolio, voids remain at a low level of 1.6% by rental

income (2022: 2.4%), following the lettings at Orchard Square discussed above.

A 5-year loan with QIB (UK) plc for £13.6 million was executed in August 2022

with an initial LTV of 56%. This loan remains covenant compliant.

We continue to review all opportunities to reduce overheads and improve

profitability.

At our development site in West Ealing, we continue to explore options to

realise the value from the planning consent for 56 flats we obtained in 2021.

For the past year, building cost inflation has been a stumbling block to a land

sale, and we have therefore continued to work up detailed design drawings. A

recent stabilisation in material prices and a drop in contractors' workloads

have enabled us to achieve initial quotes from contractors that make committing

to a build out of this project more attractive. We are weighing up the risks and

rewards of both a land sale and building out the site and are optimistic that a

decision to realise the best value of this site can be taken shortly.

During the period a short term extension of the Dragon Retail Properties loan

with Santander was secured to October 2023. Further negotiations with Santander

were put on hold in the period immediately prior to an outstanding break clause

in favour of the largest tenant at the property. The break was not exercised and

with a current WAULT of 5.0 years we are exploring all options for refinancing

this property, including an offer of a new loan from the existing lender. This

loan remains covenant compliant, and the property continues to produce strong

net cash flow.

For the first six months of the year, gross revenue at Bisichi PLC, which is 42%

owned by LAP, was £25.3 million as compared with £44.8 million last year. This

resulted in a profit before interest, tax, depreciation and amortisation

(EBITDA) of £1.42 million (2022: £22.25 million) and a net profit of £0.1

million before foreign exchange losses of £0.9 million. The lower earnings for

Bisichi, compared to the first six months of 2022, are mainly attributable to

lower prices for coal sold by Sisonke Coal Processing, Bisichi's South African

coal processing operation, as well as difficult mining conditions at Black

Wattle Colliery.

Bisichi intends to pay an interim dividend on 4 February 2024 of 3p (2022: 10p)

per share, £133,000 of which will be receivable by LAP.

Further details of Bisichi's performance and a forward looking statement can be

found in their own half year report available at www.bisichi.com.

LAP has made significant progress during the period although the outlook for

interest rates and inflation are limiting our options more than we would wish.

The Board of LAP bases its decisions about dividend payments on the results and

financial position of the Group's property activities and accordingly has

decided not to declare a dividend for the half year. Once our cash has been

reinvested and property income has returned to previous levels, our dividend

policy will reflect this.

John Heller

Chairman and Chief Executive

24 August 2023

Consolidated income statement

for the six months ended 30 June 2023

6 months 6 months Year

ended ended ended

30 June 30 June 31

December

2023 2022 2022

(unaudited) (unaudited) (audited)

Notes £'000 £'000 £'000

Group revenue 1 28,335 48,076 100,243

Operating costs (28,708) (26,236) (64,730)

Operating 1 (373) 21,840 35,513

(loss)/profit

Finance income 2 171 40 199

Finance 2 (1,775) (1,470) (3,218)

expenses

Result before (1,977) 20,410 32,494

valuation and

other movements

Non-cash

changes in

valuation of

assets and

liabilities and

other movements

Exchange losses - - (270)

Decrease in - (200) (115)

value of

investment

properties

Profits on - - (83)

disposal of

investment

properties

Loss on - - 36

disposal of

fixed assets

(Decrease)/Incre (553) 49 1,036

ase in value of

trading

investments

Adjustment to - 70 70

interest rate

derivative

Result (2,530) 20,329 33,168

including

revaluation and

other movements

(Loss)/profit 1 (2,530) 20,329 33,168

for the period

before taxation

Income tax 3 (232) (5,646) (12,002)

charge

(Loss)/profit (2,762) 14,683 21,166

for the period

Attributable

to:

Equity holders (3,007) 4,293 2,704

of the Company

Non-controlling 245 10,390 18,462

interest

(Loss)/profit (2,762) 14,683 21,166

for the period

(Loss)/profit 4 (3.52) 3.17p

per share - 5.03p

basic and

diluted

Consolidated statement of comprehensive income

for the six months ended 30 June 2023

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

(Loss)/profit for the period (2,762) 14,683 21,166

Other comprehensive income:

Items that may be subsequently

recycled to the income

statement:

Exchange differences on (874) 565 (43)

translation of foreign

operations

Other comprehensive (874) 565 (43)

(expense)/income for the period,

net of tax

Total comprehensive (3,636) 15,248 21,123

(expense)/income for the period,

net of tax

Attributable to:

Equity shareholders (3,256) 4,496 2,696

Non-controlling interest (380) 10,752 18,427

(3,636) 15,248 21,123

Consolidated balance sheet

at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

Notes £'000 £'000 £'000

Non-current assets

Market value of properties 35,610 35,725 35,610

attributable to Group

Present value of head leases 1,552 3,221 1,552

Property 5 37,162 38,946 37,162

Mining reserves, property, plant 14,599 15,100 16,928

and equipment

Other investments at fair value 12,740 6,418 12,590

through profit and loss ("FVPL")

64,501 60,464 66,680

Current assets

Inventories - Property 5 21,256 25,493 22,862

Inventories - Mining 4,502 4,189 5,199

Assets held for sale - 4,550 -

Trade and other receivables 8,031 10,604 7,915

Investments in listed securities 779 1,209 886

held at FVPL

Cash and cash equivalents 10,886 7,816 15,382

45,454 53,861 52,244

Total assets 109,955 114,325 118,924

Current liabilities

Trade and other payables (14,386) (13,546) (17,058)

Borrowings (21,580) (36,151) (22,061)

Lease liabilities (345) (201) (414)

Interest rate derivatives - - -

Current tax liabilities (4,321) (1,657) (4,256)

(40,632) (51,555) (43,789)

Non-current liabilities

Borrowings (17,154) (3,932) (17,113)

Lease liabilities (1,599) (3,866) (1,839)

Provisions (1,475) (1,609) (1,716)

Deferred tax liabilities 236 (57) (752)

(19,992) (9,464) (21,420)

Total liabilities (60,624) (61,019) (65,209)

Net assets 49,331 53,306 53,715

Equity attributable to the

owners of the parent

Share capital 8,554 8,554 8,554

Share premium account 4,866 4,866 4,866

Translation reserve (Bisichi (1,314) (851) (1,063)

PLC)

Capital redemption reserve 47 47 47

Retained earnings (excluding 17,279 21,708 20,286

treasury shares)

Treasury shares (144) (144) (144)

Retained earnings 17,135 21,464 20,142

Total equity attributable to 29,288 34,180 32,546

equity shareholders

Non - controlling interest 20,043 19,126 21,169

Total equity 49,331 53,306 53,715

Net assets per share 6 34.32p 40.04p 38.14p

attributable to equity

shareholders

Consolidated statement of changes inshareholders' equity

for the six months ended 30 June 2023

Share Share Translation Capital Treasury Retained

Total Non-controlling Total

capital premium reserves redemption shares earnings

excluding Interests equity

£'000 £'000 £'000 reserve £'000 excluding

Non- £'000 £'000

£'000 treasury

Controlling

shares

Interests

£'000

£'000

Balance at 1 8,554 4,866 (1,055) 47 (144) 17,415

29,683 10,536 40,219

January 2022

Profit for the - - - - - 4,293

4,293 10,390 14,683

period

Other - - - - - -

- - -

comprehensive

income:

Currency - - 204 - - -

204 362 566

translation

Total other - - 204 - - -

204 362 566

comprehensive

income

Total - - 204 - - 4,293

4,497 10,752 15,249

comprehensive

income

Transactions

with

owners:

Dividends - - - - - - -

- (2,162) (2,162)

non-controlling

Interests

Transactions - - - - - -

- (2,162) (2,162)

with

owners

Balance at 30 8,554 4,866 (851) 47 (144) 21,708

34,180 19,126 53,306

June 2022

(unaudited)

Balance at 1 8,554 4,866 (1,055) 47 (144) 17,415

29,683 10,536 40,219

January 2022

Profit for the - - - - - 2,704

2,704 18,462 21,166

year

Other

comprehensive

income:

Currency - - (8) - - -

(8) (35) (43)

translation

Total other - - (8) - - -

(8) (35) (43)

comprehensive

expense

Total - - (8) - - 2,704

2,696 18,427 21,123

comprehensive

income

Transaction

with

owners:

Share options - - - - - 167

167 237 404

Dividends - - - - - - -

- (7,034) (7,034)

equity holders

Dividends - - - - - - -

- (997) (997)

non-controlling

Interests

Transactions 167

167 (7,794) (7,627)

with

owners

Balance at 31 8,554 4,866 (1,063) 47 (144) 20,286

32,546 21,169 53,715

December 2022

(audited)

Consolidated statement of changes inshareholders' equity - continued

for the six months ended 30 June 2023

Share Share Translation Capital Treasury Retained

Total Non-controlling Total

capital premium reserves redemption shares earnings

excluding Interests equity

£'000 £'000 £'000 reserve £'000 excluding

Non- £'000 £'000

£'000 treasury

Controlling

shares

Interests

£'000

£'000

Balance at 1 8,554 4,866 (1,063) 47 (144) 20,286

32,546 21,169 53,715

January 2023

(Loss)/profit - - - - - (3,007)

(3,007) 245 (2,762)

for

the period

Other

comprehensive

income:

Currency - - (251) - - -

(251) (623) (874)

translation

Total other - - (251) - - -

(251) (623) (874)

comprehensive

income

Total - - (251) - - (3,007)

(3,258) (378) (3,636)

comprehensive

income

Transactions

with

owners:

Dividends - - - - - - - -

(748) (748)

non

-controlling

interests

Transactions - - - - - - -

(748) (748)

with

owners

Balance at 30 8,554 4,866 (1,314) 47 (144) 17,279

29,288 20,043 49,331

June

2023

(unaudited)

Consolidated cash flow statement

for the six months ended 30 June 2023

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Operating activities

(Loss)/profit for the year before (2,530) 20,329 33,168

taxation

Finance income (171) (40) (199)

Finance expense 1,775 1,470 3,218

Decrease in value of investment - - 115

properties

Increase in value of trading - - (1,036)

investments

Expenditure on trading property - (260) -

Adjustment to interest rate derivative - (70) (70)

Loss on investments 6 - -

(Profit)/ loss on sale of investment (2) - 83

properties

Depreciation 899 884 1,362

Loss/(profit) on disposal of non - 200 (36)

-current assets

Share based payment expense 553 - 405

Development expenditure on inventories - - (747)

Exchange adjustments 188 37 270

Change in inventories 1,572 (2,803) (911)

Change in receivables 728 766 2,194

Change in payables (3,627) (2,813) 811

Cash (outflows)/inflows generated from (609) 17,700 38,627

operations

Income tax paid (327) (5,554) (7,946)

Cash (outflows)/inflows from operating (936) 12,146 30,681

activities

Investing activities

Acquisition of investment properties, (1,061) (7,994) (11,011)

mining reserves, plant and equipment

Sale of plant and equipment 16 504 102

Sale of investment properties - - 5,171

Disposal of other investments - - 2,083

Acquisition of other investments (596) (3,262) (10,207)

Interest received 171 40 199

Cash outflows from investing (1,470) (10,712) (13,663)

activities

Financing activities

Interest paid (1,693) (1,468) (2,751)

Interest on obligation under finance (17) (17) (353)

leases

Repayment of lease liability (126) (126) (236)

Lease assignment costs paid - - (52)

Receipt of bank loan - Bisichi PLC 27 48 524

Repayment of bank loan - Bisichi PLC (540) (150) (55)

Repayment of bank loan - Dragon Retail (183) (10) (21)

Properties Ltd

Receipt of bank loan - London & 3 220 13,337

Associated Properties PLC

Repayment of bank loan - London & (61) (188) (14,247)

Associated Properties PLC

Equity dividends paid - - (641)

Equity dividends paid - - (1,787) (6,323)

non-controlling interests

Cash outflows from financing (2,590) (3,478) (10,818)

activities

Consolidated cash flow statement - continued

for the six months ended 30 June 2023

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Net (4,996) (2,044) 6,200

(decrease)/i

ncrease in

cash and

cash

equivalents

Cash and 12,157 5,982 5,982

cash

equivalents

at

beginning

of period

Exchange 177 (51) (25)

adjustment

Cash and 7,338 3,887 12,157

cash

equivalents

at end of

period

The cash flows above relate to continuing and discontinued operations.

Cash and cash equivalents

For the purpose of the cash flow statement, cash and cash equivalents comprise

the following balance sheet amounts:

Cash and cash equivalents (before bank overdrafts) 10,886 7,816 15,382

Bank overdrafts (3,548) (3,929) (3,225)

Cash and cash equivalents at end of period 7,338 3,887 12,157

Notes to the half year report

for the six months ended 30 June 2023

1. Segmental analysis 6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Revenue

LAP

- - Rental 2,000 2,092 4,175

income

- - Service 378 471 788

charge income

- - 9 9 18

Management income from third

parties

Bisichi

- - Rental 524 543 955

income

- - Service - - 98

charge income

- - Mining 25,341 44,837 94,002

- Dragon

- - Rental 83 123 207

income

- - Service - 1 -

charge income

28,335 48,076 100,243

Operating (loss)/profit

LAP (1,728) 208 (3,041)

Bisichi 1,296 21,544 38,433

Dragon 59 88 121

(373) 21,840 35,513

(Loss)/profit before taxation

LAP (2,942) (986) (5,119)

Bisichi 390 21,249 38,267

Dragon 22 66 20

(2,530) 20,329 33,168

2. Finance costs 6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Finance income 171 40 199

Finance expenses:

Interest on bank loans and (1,671) (925) (1,862)

overdrafts

Unwinding of discount - - (319)

(Bisichi)

Other loans (32) (430) (837)

Interest on obligations under (72) (115) (200)

finance leases

Total finance expenses (1,775) (1,470) (3,218)

(1,604) (1,430) (3,019)

Notes to the half year report - continued

3. Income tax 6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Current tax 1,017 6,115 11,537

Deferred tax (785) (469) 465

232 5,646 12,002

4. Earnings per share 6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

(Loss)/profit attributable to (3,007) 4,293 2,704

equity shareholders after tax

(£'000)

Weighted average number of shares 85,326 85,326 85,326

in issue for the period ('000)

Basic earnings per share (3.52) 5.03p 3.17p

Diluted number of shares in issue 85,326 85,326 85,326

('000)

Diluted earnings per share (3.52) 5.03p 3.17p

5. Properties

Investment properties are held at fair value at each reporting period.

During the period no properties were acquired or sold.

Orchard Square, Sheffield, held as inventory, is currently being marketed for

sale. The property is secured by a loan that expires in September 2023 and we

are not currently able to confirm if the proceeds of any sale will be sufficient

to repay this loan and return a surplus to the Group. The value of this property

has therefore been written down to the outstanding loan value, from £14.75m to

£12.65m and is disclosed as an inventory write down within Operating Costs in

the Income Statement. The loan on the property is non-recourse to the rest of

the LAP Group, is secured exclusively on this asset and the write down in value

in the period is the maximum loss the Group can incur. Due to rising interest

rates the loan breached its income cover covenant in July 2023, we have recently

chosen not to cure this breach with the lender issuing a reservation of rights

letter.

Other than as discussed above, the Directors have placed a valuation on the

properties which is not materially different to the value as at 31 December

2022. Investment properties are therefore included at a directors' valuation

which is considered to be the fair value as at 30 June 2023. Please refer to

page 56 of the 2022 Annual report and Accounts for details on the valuation of

investment and inventory properties as at 31 December 2022.

6. Net assets per share 30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

Shares in issue ('000) 85,326 85,326 85,326

Net assets attributable to 29,288 34,165 32,546

equity shareholders (£'000)

Basic net assets per share 34.32 40.04p 38.14p

Shares in issue diluted by 85,326 85,326 85,326

outstanding share options

('000)

Net assets after issue of 29,288 34,165 32,546

share options (£'000)

Fully diluted net assets per 34.32p 40.04p 38.14p

share

Notes to the half year report - continued

7. Related party transactions

The related parties and the nature of costs recharged are as disclosed in the

group's annual financial statements for the year ended 31 December 2023.

8. Dividends

There is no interim dividend payable for the period (30 June 2022: Nil).

There is no final dividend payable in respect of 2022.

9. Risks and uncertainties

The group's principal risks and uncertainties are reported on pages 10 and 11 in

the 2022 Annual Report. They have been reviewed by the Directors and remain

unchanged for the current period.

The largest area of estimation and uncertainty in the interim financial

statements is in respect of the valuation of investment properties (which are

not revalued at the half year).

For Bisichi PLC, the largest area of estimation relates to currency movements

and coal mining activities in South Africa, including depreciation, impairment

and the provision for rehabilitation (relating to environmental rehabilitation

of mining areas).

Property, plant and equipment representing Bisichi's mining assets in South

Africa are reviewed for impairment where there is evidence of a material

impairment. The impairment test indicated significant headroom as at 31 December

2022 and no impairment was considered appropriate.

Other areas of estimation and uncertainly are referred to in the Group's annual

financial statements. There have been no significant changes to the basis of

accounting for key estimates and judgements as disclosed in the annual report as

at 31 December 2022.

10. Contingent Liabilities and Subsequent Events

Black Wattle Colliery (Pty) Ltd continues to be involved in a tax dispute in

South Africa related to VAT. The dispute arose during the year ended 31 December

2020 and is related to events which occurred prior to the years ended 31

December 2020. The interpretation of laws and regulations in South Africa where

the Group operates can be complex and can lead to challenges from or disputes

with regulatory authorities. Such situations often take significant time to

resolve. Where there is a dispute and where a reliable estimate of the potential

liability cannot be made, or where the Group, based on legal advice, considers

that it is improbable that there will be an outflow of economic resources, no

provision is recognised. Further details of the contingent tax liability can be

found on page 107 of Bisichi's 2022 Annual report and Accounts.

There are no other contingent liabilities as at 30 June 2023.

There are no subsequent events or transactions that require disclosure.

11. Financial information

The above financial information does not constitute statutory accounts within

the meaning of section 434 of the Companies Act 2006. The figures for the year

ended 31 December 2022 are based upon the latest statutory accounts, which have

been delivered to the Registrar of Companies; the report of the auditor on those

accounts was unqualified and did not contain a statement under Section 498(2) or

(3) of the Companies Act 2006.

As required by the Disclosure and Transparency Rules of the UK's Financial

Conduct Authority, the interim financial statements have been prepared in

accordance with the International Financial Reporting Standards (IFRS) and in

accordance with both IAS 34 'Interim Financial Reporting' and in conformity with

the requirements of the Companies Act 2006 applicable to companies reporting

under IFRS and the disclosure requirements of the Listing Rules.

The half year results have not been audited or subject to review by the

company's auditor.

The annual financial statements of London & Associated Properties PLC are

prepared in accordance with IFRS and in conformity with the requirements of the

Companies Act 2006 applicable to companies reporting under IFRS. The company has

applied UK-adopted IAS and at the date of application, both UK-adopted IAS and

EU-adopted IFRS are the same. The same accounting policies are used for the six

months ended 30 June 2023 as were used for the year ended 31 December 2022.

As stated in the 2022 Annual Report in the group accounting policies, Bisichi

PLC and Dragon Retail Properties Limited are consolidated with LAP, as required

by IFRS 10.

The assessment of new standards, amendments and interpretations issued but not

effective, is that these are not anticipated to have a material impact on the

financial statements.

The interim financial statements have been prepared on the going concern basis.

12. Board approval

The half year results were approved by the Board of London & Associated

Properties PLC on 24 August 2023.

Directors' responsibility statement

The Directors confirm that to the best of their knowledge:

(a) the condensed consolidated interim financial statements have been prepared

in accordance with UK-adopted International Accounting Standard 34, Interim

Financial Reporting.

(b) the interim management report includes a fair review of the information

required by:

(1) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of

important events that have occurred during the first six months of the financial

year and their impact on the condensed set of financial statements; and a

description of the principal risks and uncertainties for the remaining six

months of the year; and

(2) DTR 4.2.8R of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the entity during that period; and any changes in the related

party transactions described in the last annual report that could do

so.

This report contains forward-looking statements. These statements are based on

current estimates and projections of management and currently available

information. Future statements are not guarantees of the future developments and

results outlined therein. Rather, future developments and results are dependent

on a number of factors; they involve various risks and uncertainties and are

based upon assumptions that may not prove to be accurate. Risks and

uncertainties identified by the Group are set out on pages 10 and 11 of the 2022

Annual Report & Accounts. We do not assume any obligation to update the forward

-looking statements contained in this report.

Signed on behalf of the Board on 24 August 2023

John Heller Jonathan Mintz

Director Director

Directors and advisors

Directors

Executive directors

* Sir Michael Heller MA FCA (Chairman) (resigned 30 January 2023)

John A Heller LLB MBA (Chief Executive) and (Chairman from 24 February 2023)

Jonathan Mintz FCA (Finance Director)

Non-executive directors

? Howard D Goldring BSC (ECON) ACA

#?Clive A Parritt FCA CF FIIA

Robin Priest MA

Andrew R Heller MA, ACA (appointed 29 March 2023)

* Member of the nomination committee

# Senior independent director

? Member of the audit, remuneration and nomination

committees.

Secretary & registered office

Jonathan Mintz FCA

12 Little Portland Street

London W1W 8BJ

Registrars & transfer office

Link Group

Shareholder Services

The Registry

Central Square

29 Wellington Street

Leeds

LS1 4DL

UK Telephone: 0871 664 0300

(Calls cost 12p per minute plus network access charges; lines are open

Monday to

Friday between 9.00am and 5.30pm)

International Telephone: +44 371 664 0300

(Calls outside the United Kingdom will be charged at applicable

international

rate)

Lines are open between 9.00am and 5.30pm, Monday to Friday, excluding public

holidays in England and Wales.

Website:

www.linkassetservices.com (https://url.avanan.click/v2/___http://www.capitare

gistra

rs.com/___.YXAxZTpzaG9yZWNhcDphOm86YzBkNjQ5Mzk3NmEyO

WIzYjcwOTgzMGZiZTI1M2JmZGM6NjpmOTQ5OjYzZTIwMzVjNGM3M

2JlNjMxNjJhYWQyOTE4MmRjYzNhZjVhYzdjMThkZDE4NTA5OTMzNGE0NjQzZDdiYTA2ODc6cDpU)

E-mail: enquiries@linkgroup.co.uk

Company registration number

341829 (England and Wales)

Website

www.lap.co.uk (https://url.avanan.click/v2/___http://www.lap.co.uk___.YXAxZTp

zaG9yZ

WNhcDphOm86YzBkNjQ5Mzk3NmEyOWIzYjcwOTgzMGZiZTI1M2JmZ

GM6NjowODg4OmMwZjgwMTViODhhZDNlNzNhYmZlNmNhZWM0ZTZmN

WU4NGQwNjRhNDkyZjQ0OWZhOWFkZThhNTM3M2RiZDA2M2Y6cDpU)

E-mail

admin@lap.co.uk

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

August 25, 2023 02:00 ET (06:00 GMT)

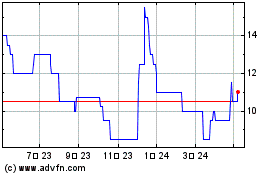

London & Associated Prop... (LSE:LAS)

過去 株価チャート

から 3 2024 まで 4 2024

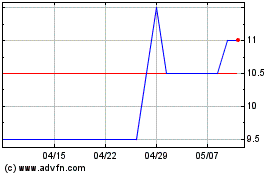

London & Associated Prop... (LSE:LAS)

過去 株価チャート

から 4 2023 まで 4 2024