RNS Number:9936P

Berkeley Resources Limited

13 March 2008

BERKELEY RESOURCES LIMITED

ABN 40 052 468 569

FINANCIAL REPORT

FOR THE HALF-YEAR ENDED

31 DECEMBER 2007

CORPORATE DIRECTORY

Directors Share Registry

Dr Robert Hawley - Chairman Australia

Mr Matthew Syme - Managing Director Computershare Investor Services Pty Ltd

Mr Scott Yelland - Chief Operating Officer Level 2

Dr James Ross 45 St Georges Terrace

Senor Jose Ramon Esteruelas Perth WA 6000

Mr Sean James Telephone: +61 8 9323 2000

Facsimile: +61 8 9323 2033

Company Secretary

Mr Clint McGhie United Kingdom

Computershare Investor Services Plc Registered Office

PO Box 82 Level 9, BGC Centre

The Pavillions 28 The Esplanade

Bridgwater Road Perth WA 6000

Bristol BS99 7NH Australia

Telephone: +44 870 889 3105 Telephone: +61 8 9322 6322

Facsimile: +61 8 9322 6558

Stock Exchange Listings

Australia

Auditor Australian Securities Exchange

Stantons International Home Branch - Perth

2 The Esplanade

Website Perth WA 6000

www.berkeleyresources.com.au

United Kingdom

Email London Stock Exchange - AIM

info@berkeleyresources.com.au 10 Paternoster Square

London EC4M 7LS

ASX Code

BKY - Fully paid ordinary shares

AIM TIDM

BKY - Fully paid ordinary shares

DIRECTORS' REPORT

The Board of Directors of Berkeley Resources Limited present their report on the

consolidated entity of Berkeley Resources Limited ("the Company" or "Berkeley

Resources") and the entities it controlled during the half-year ended 31

December 2007 ("Consolidated Entity").

DIRECTORS

The names of the Directors of Berkeley Resources in office during the half-year

and until the date of this report are:

Dr Robert Hawley

Mr Matthew Syme

Mr Scott Yelland (appointed 1 February 2008)

Dr James Ross

Senor Jose Ramon Esteruelas

Mr Sean James

Unless otherwise disclosed, Directors were in office from the beginning of the

half-year until the date of this report.

REVIEW AND RESULTS OF OPERATIONS

Operating Results

Net operating loss after tax for the half-year ended 31 December 2007 was

$5,377,393 (31 December 2006: $2,206,301).

This result included the following significant items:

O Exploration costs associated with the Company's Spanish uranium projects

of $4,458,221;

O A non-cash expense of $674,581 in relation to the issue of employee

options (Refer Note 11).

Review of Operations

During the half year ended 31 December 2007 the Company continued its focus on

developing its uranium exploration projects in Spain.

Within the Salamanca I project, exploration activities were focused on a

drilling program to allow the calculation of a revised resource at the

Retortillo deposit and the testing of radiometric anomalies in areas previously

undrilled within the license area. The program included diamond and reverse

circulation ("RC") drilling. The Company had success in achieving both of these

objectives with a new discovery of uranium mineralisation at Santidad, 2km

northwest of the Company's main Retortillo deposit and an upgraded resource

calculation released in November 2007.

The resource at the main Retortillo deposit increased to 13 million lbs at

615ppm U3O8, whilst there was a maiden inferred resource of 2.9 million lb at

382ppm at the Santidad deposit.

An airborne geophysical survey was completed over key target areas. Aretech

Solutions completed a 5,924 line kilometre, low level, close-spaced airborne

magnetic and radiometric survey. The survey covered Salamanca I, part of

Salamanca II, and the Caceres VI and Toledo II areas.

Interpreted results of the survey released in February 2008 confirmed the

potential to add additional uranium resources in outcropping and covered areas,

in proximity to the existing resource base. In particular, it significantly

enlarged target areas associated with known uranium mineralisation at the Zona 7

deposit, and at the two previously mined areas, Mina Caridad and Mina Cristina.

It has also identified covered extensions of favourable lithology along strike

from the Retortillo and Santidad depositions.

A vigorous new program of RC drilling is underway with the aim of assessing the

highest priority targets over the next six months.

The successful increase in the resource base at Salamanca I, along with the

potential for additional resources, gave the Company impetus to commence a

scoping study on the potential for mining at Salamanca I. AMC Consultants were

engaged to prepare the study. The study was completed and the results were

released in February 2008, confirming the potential economic viability of the

project. The study was based on the projects previously announced JORC inferred

and indicated resources of 16.9 million lb of U3O8.

Outcomes of the study included potential production of approximately 12.1

million lb U3O8 over 10 years and average cash operating costs of US$25 per lb

of U3O8. Initial capital costs were calculated at US$109 million for a plant

rated to process 1.5 mtpa. The plant design included in these calculations were

scaled to allow for potential future additional resources.

The Company continues to examine new opportunities in mineral exploration in

Spain and elsewhere.

Corporate

The following material corporate events occurred during or since the end of the

half year ended 31 December 2007:

* On 6 August 2007, the Company issued 2,970,000 Unlisted Options to

employees in accordance with the Company's Employee Option Scheme. The options

are exercisable for $1.86 each on or before 5 August 2011. Vesting conditions

apply.

* On 6 September 2007 the Company announced the new discovery of uranium

mineralisation at Santidad, 2km northwest of the Company's main Retortillo

deposit.

* On 30 September 2007, 2,000,000 Unlisted Options were exercised which

raised approximately $0.45 million.

* On 19 November 2007, the Company advised the results of an upgraded

resource calculation for the flagship Salamanca I project, including the

Retortillo deposit and the new Santidad discovery.

* In January 2008, Berkeley disposed of its holding in 1,300,000 shares

in Atlas Iron Limited on market. The Company received net proceeds of

$2,584,785 in consideration for these shares.

* On 1 February 2008, Mr Scott Yelland, the Company's Chief Operating

Officer, was appointed a Director of the Company.

* On 5 February 2008, Berkeley presented the interpreted results of the

aerial radiometric and magnetic survey flown over the Salamanca I project.

* On 14 February 2008, the Company advised that a Scoping Study on

mining at the Salamanca I project, prepared by AMC Consultants, confirmed the

potential economic viability of the project.

AUDITOR'S INDEPENDENCE DECLARATION

Section 307C of the Corporations Act 2001 requires our auditors, Stantons

International, to provide the Directors of Berkeley Resources Limited with an

Independence Declaration in relation to the audit of the half-year financial

report. This Independence Declaration is on page 16 and forms part of this

Directors' Report.

Signed in accordance with a resolution of Directors.

MATTHEW SYME

Managing Director

Perth, 13 March 2008

DIRECTORS' DECLARATION

In accordance with a resolution of the Directors of Berkeley Resources Limited,

I state that:

In the opinion of the Directors:

(a) the financial statements and notes of the consolidated entity are in

accordance with the Corporations Act 2001, including:

(i) giving a true and fair view of the financial position as at 31

December 2007 and the performance for the half-year ended on that date of the

consolidated entity; and

(ii) complying with Accounting Standard AASB 134 Interim Financial

Reporting and the Corporations Regulations 2001; and

(b) there are reasonable grounds to believe that the Company will be able

to pay its debts as and when they become due and payable.

On behalf of the Board

MATTHEW SYME

Managing Director

Perth, 13 March 2008

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE HALF YEAR ENDED 31 DECEMBER 2007

Half Year Ended 31 Half Year Ended

December 31 December

2007 2006

$ $

Revenue from continuing operations 4 743,813 1,158,890

Administration costs (921,924) (1,026,817)

Business development costs (119,005) (187,151)

Exploration costs (4,458,221) (1,853,394)

Share based payments expense (674,581) (447,750)

Loss before income tax (5,429,918) (2,356,222)

Income tax expense - -

(5,429,918) (2,356,222)

Loss for the half-year

Loss attributable to minority interest (52,525) (149,921)

Loss attributable to members of Berkeley Resources (5,377,393) (2,206,301)

Limited

Loss for the half-year (5,429,918) (2,356,222)

Basic earnings per share (cents per share) (5.24) (2.9)

Diluted earnings per share (cents per share) (5.24) (2.9)

The above Consolidated Income Statement should be read in conjunction with the

accompanying notes.

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2007

31 December 2007 30 June

$ 2007

$

Note

ASSETS

Current Assets

Cash and cash equivalents 20,964,253 25,535,846

Available for sale financial asset 3,120,000 -

Other financial assets 100,721 -

Trade and other receivables 840,587 327,538

Total Current Assets 25,025,561 25,863,384

Non-current Assets

Exploration expenditure 4,181,867 4,135,220

Property, plant and equipment 470,763 232,184

Other financial assets 16,841 1,802,015

Total Non-current Assets 4,669,471 6,169,419

TOTAL ASSETS 29,695,032 32,032,803

LIABILITIES

Current Liabilities

Trade and other payables 1,272,602 642,182

Provisions 36,993 34,432

Total Current Liabilities 1,309,595 676,614

TOTAL LIABILITIES 1,309,595 676,614

NET ASSETS 28,385,437 31,356,189

EQUITY

Issued capital 7 41,444,842 40,560,013

Reserves 8 6,203,867 4,604,619

Accumulated losses (19,263,272) (13,885,879)

Parent Interest 28,385,437 31,278,753

Minority interest - 77,436

TOTAL EQUITY 28,385,437 31,356,189

The above Consolidated Balance Sheet should be read in conjunction with the

accompanying notes.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED 31 DECEMBER 2007

Attributable to equity holder of the parent Minority Total equity

Issued Option Foreign Net Accumulated Total interest

Capital Premium Currency Unrealised Losses

Reserve Translation Gains

Reserve Reserve

$ $ $ $ $ $ $ $

As at 1 July 2006 14,258,232 2,170,538 - - (7,571,308) 8,857,462 321,421 9,178,883

Net loss for the period - - - - (2,206,301) (2,206,301) (149,921) (2,356,222)

Issue of shares (net of 3,533,984 - - - - 3,533,984 - 3,533,984

expenses)

Exchange differences arising

on translation of foreign

operations - - (8,411) - - (8,411) (8,180) (16,591)

Net unrealised gain on held

for sale financial assets

- - - 13,000 - 13,000 - 13,000

Exercise of options (net of 1,045,207 (1,045,207) - - - - - -

expenses)

Cost of share based payments - 447,750 - - - 447,750 - 447,750

As at 31 December 2006 18,837,423 1,573,081 (8,411) 13,000 (9,777,609) 10,637,484 163,320 10,800,804

As at 1 July 2007 40,560,013 3,482,581 (21,962) 1,144,000 (13,885,879) 31,278,753 77,436 31,356,189

Net loss for the period - - - - (5,377,393) (5,377,393) (52,525) (5,429,918)

Issue of shares (net of 447,044 - - - - 447,044 - 447,044

expenses)

Exchange differences arising

on translation of foreign

operations - - 36,452 - - 36,452 (24,911) 11,541

Net unrealised gain on held

for sale financial assets - - - 1,326,000 - 1,326,000 - 1,326,000

Exercise of options (net of 437,000 (437,000) - - - - - -

expenses)

Transfer from reserve 785 (785) - - - - - -

Cost of share based payments - 674,581 - - - 674,581 - 674,581

As at 31 December 2007 41,444,842 3,719,377 14,490 2,470,000 (19,263,272) 28,385,437 - 28,385,437

The above Consolidated Statement of Changes in Equity should be read in

conjunction with the accompanying notes.

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE HALF-YEAR ENDED 31 DECEMBER 2007

Half Year Ended 31 Half Year Ended 31

December 2007 December 2006

$ $

Cash flows from operating activities

Payments to suppliers and employees (5,477,387) (2,197,090)

Interest received 743,813 158,890

Net cash outflows from operating activities (4,733,574) (2,038,200)

Cash flows from investing activities

Payments for capitalised exploration

expenditure (31,871) (27,800)

Proceeds from sale of exploration projects - 350,000

Payments for plant and equipment (230,164) (74,123)

Security deposit (97,417) -

Other financial assets (8,256) -

Net cash (outflow)/inflow from investing activities (367,708) 248,077

Cash flows from financing activities

Proceeds from issue of shares 450,000 3,542,275

Share issue expenses (2,956) (4,491)

Net cash inflow from financing activities 447,044 3,537,784

Net increase in cash and cash equivalents (4,654,238) 1,747,661

Net foreign exchange differences 82,645 (12,359)

Cash and cash equivalents at the beginning of

the half year 25,535,846 6,295,162

Cash and cash equivalents at the end of the

half year 20,964,253 8,030,464

The above Consolidated Cash Flow Statement should be read in conjunction with

the accompanying notes.

1. REPORTING ENTITY

Berkeley Resources Limited (the "Company") is a company domiciled in Australia.

The interim financial report of the Company is as at and for the six months

ended 31 December 2007.

The annual financial report of the Company as at and for the year ended 30 June

2007 is available upon request from the Company's registered office.

2. STATEMENT OF COMPLIANCE

The interim financial report is a general purpose financial report which has

been prepared in accordance with Accounting Standard AASB 134: Interim Financial

Reporting and the Corporations Act 2001.

Since 1 July 2007 the Group has adopted the following Standards and

Interpretations mandatory for annual periods beginning on or after 1 January

2007. Adoption of these Standards and Interpretations did not have any effect on

the financial performance or position of the Group.

* AASB 7 Financial Instruments: Disclosures

* AASB 2005-10 Amendments to Australian Accounting Standards (AASB 132, 101,

114,117,133,139, 1, 4, 1023 and 1038)

* AASB 2007-04 Amendments to Australian Accounting Standards arising from ED

151 and other amendments

* AASB 2007-7 Amendments to Australian Accounting Standards (AASB 1, 2, 4, 5,

107 and 108)

This interim financial report does not include all the information of the type

normally included in an annual financial report. Accordingly, this report is to

be read in conjunction with the annual report of Berkeley Resources Limited for

the year ended 30 June 2007 and any public announcements made by Berkeley

Resources Limited during the interim reporting period in accordance with the

continuous disclosure requirements of the Corporations Act 2001.

The financial report has been prepared on a historical basis except for

available for sale financial assets which are shown at fair value.

For the purpose of preparing the half year financial report, the half year has

been treated as a discreet reporting period.

The interim financial report was approved by the Board of Directors on 11 March

2008.

3. SIGNIFICANT ACCOUNTING POLICIES

The accounting policies applied by the Company in this interim financial report

are the same as those applied by the Company in its financial report as at and

for the year ended 30 June 2007.

The adoption of amending standards mandatory for annual periods beginning on or

after 1 January 2006 are either not applicable to the Consolidated Entity or

have no material impact.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE HALF YEAR ENDED 31 DECEMBER 2007

4. SEGMENT INFORMATION

The Consolidated Entity operates in the mineral exploration industry in the

following geographical segments:

Geographical Segment Australia Spain Consolidated Entity

Half year Half year Half year Half year Half year Half year

ended ended ended ended ended ended

31 Dec 2007 31 Dec 2006 31 Dec 2007 31 Dec 2006 31 Dec 2007 31 Dec 2006

$ $ $ $ $ $

Revenue

Other revenues 743,656 1,000,000 157 158,890 743,813 1,158,890

Unallocated revenue - -

Total revenue 743,813 1,158,890

Results

Segment result (1,462,919) 1,000,000 (3,847,544) (3,169,071) (5,310,463) (2,169,071)

Unallocated expenses (119,455) (187,151)

Loss from ordinary activities

before income tax expense (5,429,918) (2,356,222)

Income tax expense - -

Loss attributable to outside equity

interests 52,525 149,921

Net loss (5,377,393) (2,206,301)

5. REVENUE FROM CONTINUING OPERATIONS

Consolidated Consolidated

31 December 31 December

2007 2006

$ $

Interest revenue 743,813 158,890

Gain on disposal of assets - 1,000,000

743,813 1,158,890

6. MINORITY INTEREST

Consolidated Consolidated

31 December 30 June

2007 2007

$ $

Interest in:

Capital 1,006,888 1,006,888

Reserves (43,855) (18,944)

Accumulated Losses (963,033) (910,508)

- 77,436

The minorities do not fund any exploration costs and their interests dilute as

the funds advanced by Berkeley Resources Ltd are converted into shares. At 31

December 2007 the minorities share of losses exceed their share of issued

capital and reserves. Minority losses in excess of their share of equity are

allocated to Berkeley Resources Ltd.

7. CONTRIBUTED EQUITY

Consolidated Consolidated

31 December 30 June

2007 2007

$ $

(a) Issued and paid up capital:

103,591,695 (30 June 2007: 101,591,695) fully paid ordinary shares 41,444,842 40,560,013

(b) Movements in ordinary share capital during the past six months were as

follows:-

Date Details Number of Shares Issue $

Price

$

1 Jul 07 Opening Balance 101,591,695 - 40,560,013

Exercise of Unlisted $0.20 Options 1,000,000 0.20 200,000

Transfer from option reserve - - 229,000

Exercise of Unlisted $0.25 Options 1,000,000 0.25 250,000

Transfer from option reserve - - 208,000

Transfer from option reserve - - 785

Share issue expenses - - (2,956)

31 Dec 07 Closing Balance 103,591,695 - 41,444,842

8. RESERVES

(a) Consolidated Consolidated

31 December 30 June

2007 2007

$ $

Option reserve:

Nil (30 June 2006: Nil) listed options -

785

Nil (30 June 2007: 1,000,000) $0.20 director incentive options - 229,000

Nil (30 June 2007: 1,000,000) $0.25 director incentive options - 208,000

10,600,000 (30 June 2007: 10,600,000) $0.70 unlisted options 687,546 687,546

2,250,000 (30 June 2007: 2,250,000) $1.00 incentive options 2,357,250 2,357,250

2,450,000 (30 June 2007: Nil) $1.86 employee incentive options 674,581 -

3,719,377 3,482,581

Foreign currency translation reserve 14,490 (21,962)

Net unrealised gains reserve 2,470,000 1,144,000

6,203,867 4,604,619

(b) Movements in options during the past six months were as follows:-

Date Details Number of Number of Number of Number of Number of Deemed $

Listed Director $0.70 $1.00 $1.86 Grant

Incentive Unlisted Incentive Employee Value

Options Options Options Options Incentive

Options $

($ various)

1 Jul 07 Opening Balance - 2,000,000 10,600,000 2,250,000 - - 3,482,581

Transfer to share

capital - - - - - - (785)

Exercise of Options - (2,000,000) - - - - (437,000)

Grant to Employees 817,757

(i) - - - - 2,970,000 1.121

Ceasing to be (143,176)

eligible employees - - - - (520,000) (1.121)

31 Dec 07 Closing Balance - - 10,600,000 2,250,000 2,250,000 - 3,719,377

(i) Incentive options granted to employees and consultants of

the Company following shareholder approval in accordance with Employee Share

Scheme. The fair value is recognised over the period during which the option

holders become unconditionally entitled to the options (ie the date of vesting

of the options), the latest date for which is 5 August 2010.

(ii) The value of employee options recognised on grant is

reversed where employees cease to be eligible employees of the Company prior to

the option vesting date.

(c) Foreign Currency Translation reserve:-

Consolidated Consolidated

31 December 30 June

2007 2007

$ $

Balance at 1 July 2007 (21,962) -

Translation of foreign operations 36,452 (21,962)

Balance at 31 December 2007 14,490 (21,962)

8. RESERVES (CONTINUED)

(d) Net Unrealised Gains reserve:-

Consolidated Consolidated

31 December 30 June

2007 2007

$ $

Balance at 1 July 2007 1,144,000 -

Unrealised gain on available for sale financial assets 1,326,000 1,144,000

Balance at 31 December 2007 2,470,000 1,144,000

9. Contingent Liabilities

Since the last annual reporting date, there has been no material change in contingent liabilities.

10. Dividends Paid or Provided For

No dividend has been paid or provided for during the half year.

11. SHARE BASED PAYMENTS

On 6 August 2007, 2,970,000 employee options were granted to employees of the Company pursuant to the Employee Option

Scheme which has received shareholder approval. The exercise price of the incentive options is $1.86 and, subject to

vesting conditions, the options are exercisable on or before 5 August 2011. The incentive options have been

independently valued using the Black-Scholes Option Valuation model, taking into account the terms and conditions upon

which the incentive options were granted. The following table lists the inputs to the model used in determining the

value:

Share Price at Grant Date $1.75

Dividend yield -

Volatility 85%

Risk-free interest rate 6.16%

Expected life of option 4 years

The estimated fair value of each incentive option is $1.121.

The value of employee options issued to employees who cease to be an eligible employee of the Company is reversed where

the option has yet to vest. 520,000 employee options which were yet to vest were issued to employees who ceased to be

eligible employees during the period.

12. Subsequent Events After Balance Date

Other than the events below, there were no significant events occurring after balance date requiring disclosure:

* In January 2008, Berkeley disposed of its holding in 1,300,000 shares in Atlas Iron Limited on market. The

Company received net proceeds of $2,584,785 in consideration for these shares. These shares were valued at $650,000 on

acquisition and at 31 December 2007 the recognised market value was $3,120,000. An actual gain on disposal of

$1,934,785 will be included in profit and loss for the year ended 30 June 2008 and the Net Unrealised Gain Reserve will

be adjusted to nil.

* On 1 February 2008, Mr Scott Yelland, the Company's Chief Operating Officer, was appointed a Director of the

Company.

* On 5 February 2008, Berkeley presented the interpreted results of the aerial radiometric and magnetic survey

flown over the Salamanca I project.

* On 14 February 2008, the Company advised that a Scoping Study on mining at the Salamanca I project, prepared by

AMC Consultants, confirmed the potential economic viability of the project.

Please note the auditors' Independence Declaration and Independent Review Report

can be viewed on the Company's website (www.berkeleyresources.com.au)

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFSFAESASEED

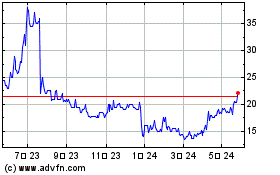

Berkeley Energia (LSE:BKY)

過去 株価チャート

から 6 2024 まで 7 2024

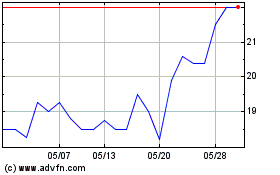

Berkeley Energia (LSE:BKY)

過去 株価チャート

から 7 2023 まで 7 2024