German Private Sector Downturn Eases On Cooling Inflation, Lower Recession Fears

2023年1月24日 - 6:12PM

RTTF2

Germany's private sector downturn softened to a stable footing

at the start of the year amid a moderation in price pressures along

with a renewed positive outlook on reducing recession risks and

ongoing strength in the job market, flash survey data from S&P

Global showed on Tuesday.

The flash composite output index rose to a seven-month high of

49.7 in January from 49.0 in December. The index was forecast to

rise slightly to 49.6.

However, any reading below 50 indicates contraction in the

sector.

The improvement in the composite index mainly relied on the

service sector, which returned to growth for the first time in

seven months. Meanwhile, the factory activity continued its

declining trend in January.

The services Purchasing Managers' Index, or PMI, climbed to a

7-month high of 50.4 in January from 49.2 in the prior month. The

score was forecast to increase to 49.6.

The manufacturing PMI dropped to a two-month low of 47.0 from

47.1 in December. The expected score was 47.9.

Read more: German Economy Roughly Stagnated In Q4:

Bundesbank The German private sector still remained in contraction

territory on account of lower demand due to multiple headwinds like

steep inflation, tightening financial conditions, and investment

reticence, as well as investment reticence in manufacturing.

However, the overall fall in new orders was the weakest in seven

months.

In addition, the easing of supply-chain bottlenecks amid falling

global demand contributed to a further cooling of inflationary

pressures in January.

The labor market also showed strong resilience, as employment

growth picked up pace to a 6-month high.

Business confidence remained on an upward trajectory in January

amid easing recession risks.

"Business confidence continues to recover from last October's

low point, but it nevertheless remains subdued compared to the

situation prior to Russia's invasion of Ukraine, particularly in

manufacturing where we're still seeing notable weakness in new

orders and perhaps the beginning of a period of stock depletion as

supply-chain concerns fade," Phil Smith, a senior economist at

S&P Global, said.

Read more: German Economic Sentiment Strengthens On

Favourable Energy Markets

Elsewhere on Tuesday, survey results from the market research

group GfK showed that Germany's consumer confidence is set to

improve for the fourth month in a row in February amid the

sustained recovery in both economic and income expectations as

energy prices rose less sharply and the government took

cost-cutting measures.

The forward-looking consumer confidence index climbed to -33.9

from -37.6 in January, which was revised from -37.8. However,

economists had expected a higher reading of -33.

Private consumption will not be able to make any positive

contribution to overall economic development this year and the

propensity to buy continued with its ups and downs as households

were expecting significantly higher amounts for their heating bills

in the coming months, the Nuremberg-based GfK said.

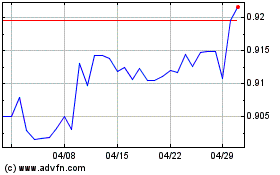

US Dollar vs CHF (FX:USDCHF)

FXチャート

から 3 2024 まで 4 2024

US Dollar vs CHF (FX:USDCHF)

FXチャート

から 4 2023 まで 4 2024