Japanese Yen Rebounds As BoJ Signals Forex Intervention

2022年9月14日 - 7:16PM

RTTF2

The Japanese yen erased its early losses against its major

counterparts in the European session on Wednesday, after reports of

a rate check by the Bank of Japan, which could be interpreted as a

preparation to intervene in the forex market to boost the battered

currency.

The BOJ made a rate check when the yen tumbled to around 144.9

to the dollar following an unexpectedly strong U.S. inflation data

released overnight.

The USD/JPY pair fell sharply following the reports of a

possible intervention in the foreign exchange market.

Finance Minister Shunichi Suzuki said that authorities should

respond without excluding any options to defend the yen's

slide.

The yen depreciated around 30 percent against the dollar this

year, triggering concerns among policymakers about the fall in the

currency.

The yen climbed to 142.81 against the greenback, from a 1-week

low of 144.96 seen at 6 pm ET. Should the currency rises further,

132.5 is seen as its next resistance level.

The yen firmed to a 5-day high of 164.82 against the pound and a

2-day high of 148.65 against the franc, after dropping to 166.51

and a 42-1/2-year low of 150.71, respectively in previous deals.

The yen is likely test resistance around 159.00 against the pound

and 119.00 against the franc.

The yen appreciated to 8-day highs of 108.33 against the loonie

and 85.61 against the kiwi, off its early lows of 109.99 and 86.91,

respectively. The yen is seen finding resistance around 103.00

against the loonie and 83.00 against the kiwi.

The yen touched a 1-week high of 96.04 against the aussie and a

5-day high of 142.89 against the euro, up from its previous lows of

97.60 and 144.47, respectively. The yen may possibly challenge

resistance around 91.00 against the aussie and 136.00 against the

euro.

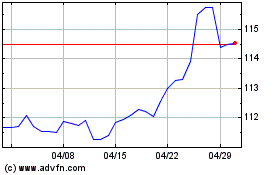

CAD vs Yen (FX:CADJPY)

FXチャート

から 3 2024 まで 4 2024

CAD vs Yen (FX:CADJPY)

FXチャート

から 4 2023 まで 4 2024