Ethereum Holds Key Support To Set A $6,000 Target – Analyst

2024年10月31日 - 3:00AM

NEWSBTC

Ethereum (ETH) is showing strength, finding support at a critical

level around $2,400 and pushing to local highs near $2,800. Top

analyst Ali Martinez shared a technical analysis highlighting

Ethereum’s potential to break out. Holding this key level suggests

ETH could be on the verge of a significant rally. Martinez’s

analysis points to a large trading channel with an upper boundary

of around $6,000, indicating a substantial upside if ETH continues

to gain momentum. Related Reading: Bitcoin Bears Fear A Short

Squeeze Above $71,000 As Open Interest Rises To $22.6B As the

crypto market broadly trends toward new highs, Ethereum’s

performance has lagged behind some altcoins. A strong push past

$2,700 could build the momentum for Ethereum to attract renewed

interest, particularly from institutional and long-term

investors. Investors are watching to see if it can finally

catch up to the broader market’s gains. Should Ethereum hold its

ground and continue upwards, the anticipated surge could solidify

its position as a leading asset in the next major crypto rally.

Ethereum Accumulation About To End Ethereum has been consolidating

since early August. Some analysts see this as a strategic

accumulation phase by long-term investors before a potential

breakout. Ali Martinez highlights this view in his technical

analysis on X, sharing a chart showing Ethereum trading within a

channel. According to Martinez, this ongoing consolidation

around $2,400 suggests a buildup phase, positioning ETH for a

powerful surge if it breaks out of its current range. Martinez

points to the critical $2,400 support level as a foundation to

propel Ethereum toward the channel’s upper boundary at around

$6,000. Such a move, however, would require ETH to first breach the

$2,800 level, confirming a shift out of its consolidation

phase. If Ethereum’s price closes above this level, the

breakout would mark a reversal and signal a new upward trend. This

potential rally aligns with broader market trends, as other

altcoins and Bitcoin are pushing toward new highs. Analysts believe

this could create a domino effect, drawing capital into ETH as

investors look for high-upside assets with established use cases

and network activity. Related Reading: Cardano Might See A

Massive Pump Around November 18 – Analyst Exposes 2020 Similarities

If Ethereum can hold above $2,800 and build momentum, the move

could validate Martinez’s $6,000 target. Investors are watching as

a breakout could signal a phase of exponential growth for the

second-largest cryptocurrency by market cap. ETH Testing Critical

Supply level Ethereum (ETH) is trading at $2,680, just 3.5% away

from its 200-day exponential moving average (EMA) at $2,776. This

EMA level acts as a significant resistance point, and for bulls to

take control, ETH must break above it and then hold this level as

support to confirm an uptrend. A push above the $2,820 supply

level would further solidify bullish momentum and set the stage for

a potential breakout. However, ETH might spend several days trading

below these crucial levels before a decisive move unfolds. Market

conditions could favor a period of consolidation, allowing ETH to

gather more strength and push higher. Related Reading: If Dogecoin

Breaks Above Key Resistance ‘We Could See A 25% Rally’ – Top

Analyst A retrace is likely if ETH fails to hold prices above the

200-day EMA and the $2,820 supply zone. In this scenario, ETH would

potentially seek support around lower demand levels, notably near

$2,500, where it could stabilize. If ETH holds this support,

consolidation within a range could continue. Investors and traders

closely watch these levels to gauge ETH’s next direction in this

critical phase. Featured image from Dall-E, chart from TradingView

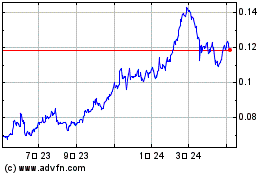

TRON (COIN:TRXUSD)

過去 株価チャート

から 10 2024 まで 10 2024

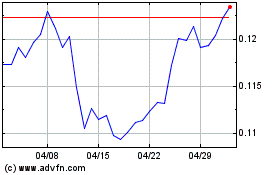

TRON (COIN:TRXUSD)

過去 株価チャート

から 10 2023 まで 10 2024