0001499494false--12-312023-06-30Q22023CN57844000103930009988000203000203000105960001019100040949000476530006311000163820003463800064035000417500038660004175000386600030463000601690003046300060169000397000170000300660005999900024370000481360006093000120330003046300060169000240530004799900060130001200000030066000599990000.030.050.990.34113402100010022010009357000129410002890002950006013460005561120004895000462900060653000056103600037754000392280004000500037758000392330006442880006002690001614390001614390005777000726400013202000121790003247700032477000817970007281000029330000259420003240220003121110004300003400003856360003836840001870600018706000918000091800005490002310001566790001810490006354200057528000320266000288158000644288000600269000147400014770001000631100016382000382490004526400051545000570930002660001580001023000106800089870009015000338800018750001640002900000164000290001640002900029500039600015800017000028900019700000014994942023-01-012023-06-3000014994942022-06-3000014994942021-12-3100014994942023-06-3000014994942022-01-012022-06-3000014994942022-12-31iso4217:CNYiso4217:USDxbrli:sharesiso4217:CNYxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission file number: 001-34958

DUNXIN FINANCIAL HOLDINGS LIMITED |

23rd Floor, Lianfa International Building

128 Xudong Road, Wuchang District

Wuhan City, Hubei Province 430063

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40- F.

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached as Exhibit 99.1 to this report is the unaudited financial results for the six months ended June 30, 2023 of Dunxin Financial Holdings Limited (the “Company”), dated October 2, 2023.

This Form 6-K is hereby incorporated by reference into the registration statements of the Company on Form S-8 (Registration No. 333-266073) and Form F-3 (Registration No. 333-264179), to the extent not superseded by documents or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 6-K and the exhibit hereto contain “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that represent the Company’s beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting the Company’s business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which the Company’s business strategy is based or the success of the Company’s business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, the Company’s performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed more fully under the headings “Item 3. Key Information—D. Risk Factors” and elsewhere in the Company’s Form 20-F filed with the Securities and Exchange Commission (“SEC”) on May 15, 2023, as amended, in this report on Form 6-K and the exhibit hereto.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dunxin Financial Holdings Limited | |

| | | |

Date: October 2, 2023 | By: | /s/ Yuan Gao | |

| Name: | Yuan Gao | |

| Title: | Chairman and Chief Executive Officer | |

EXHIBIT 99.1

Dunxin Financial Holdings Limited Reports Financial Results for the First Six Months of 2023

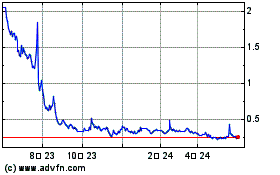

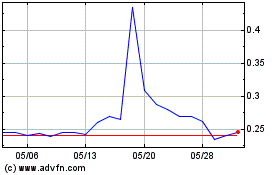

WUHAN, HUBEI, China—October 2, 2023—Dunxin Financial Holdings Limited ("Dunxin" or the "Company") (NYSE American: DXF), a licensed microfinance lender servicing individuals and small and medium enterprises (“SMEs”) in Hubei Province, China, today announced its unaudited financial results for the first six months of 2023. The unaudited consolidated financial statements and other financial information included in this press release have been stated in Renminbi (“RMB”) unless otherwise indicated.

First Six Months 2023 Highlights

| · | Total outstanding principal balance of loans was RMB753.0 million (US$103.8 million), which remained unchanged compared to the balance as of December 31, 2022. |

| · | Loans receivable, net of credit impairment losses of RMB646.6 million (US$89.2 million), was RMB601.3 million (US$82.9 million) as of June 30, 2023, representing an increase of 8.1% from RMB556.1 million as of December 31, 2022. |

| · | Total interest income was RMB51.5 million (US$7.4 million) in the first six months of 2023, representing a decrease of 10.9% from RMB57.8 million in the same period of the prior year. |

| · | Net interest income was RMB40.9 million (US$5.9 million) in the first six months of 2023, representing a decrease of 14.3% from RMB47.7 million in the same period of the prior year. |

| · | Net profit was RMB30.5 million (US$4.4 million) in the first six months of 2023, representing a decrease of 49.3% from RMB60.2 million in the same period of the prior year. |

| · | Earnings per American Depositary Share ("ADS") was US$0.34 in the first six months of 2023 compared to US$0.99 in the same period of the prior year. |

First Six Months 2023 Financial Results

Interest Income on Loans

Interest income on loans primarily consists of the accrued interest of Stage 3 credit-impaired loans. Accrued interest is the present value of the estimated future cash flows of credit-impaired loans expected to be recovered, discounted at the loan’s original effective interest rate. Interest income on loans for the first six months of 2023 decreased by 10.9% to RMB51.5 million (US$7.4 million) from RMB57.8 million in the same period of the prior year. The decrease was primarily attributable to the revaluation of the present value of interest receivable and estimated recovery date.

Interest Expense

Interest expenses on loans increased to RMB10.4 million (US$1.5 million) for the first six months of 2023 from RMB10.0 million in the same period of the prior year. The increase was mainly due to the company accrued RMB0.4 million (US$0.1 million) for relevant listing service fee in the current reporting period.

Net Interest Income

Net interest income for the first six months of 2023 was RMB40.9 million (US$5.9 million), representing a 14.3% decrease from RMB47.7 million in the same period of the prior year.

Credit Impairment Losses

The Company maintains the allowance for loan losses, as presented in the financial statements, at a level it considers to be reasonable by management to absorb probable losses inherent in the loan portfolio as of each balance sheet date. The management evaluates the adequacy of the allowance for loan losses on a regular basis or more often as necessary. The allowance is based on the past loan loss history, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant revision as more information becomes available.

The Company provided the credit impairment losses amounting to RMB6.3 million (US$0.9 million) for the first six months of 2023. The increase was primarily attributable to the revaluation of the present value of interest receivable and estimated recovery date during the first six months of 2023. Although the economic and business environment for SMEs remained challenging and some of the Company’s loan customers were experiencing financial difficulty, the Company believed that the recoverability of loan was much more optimistic due to the ending of government controls procedures of the epidemic. The Company assessed credit loss allowance on these credit-impaired loans based on an assessment of the recoverable cash flows under a range of scenarios, including the realization of any collateral held where appropriate. The loss provisions held represent the difference between the present value of the cash flows expected to be recovered, discounted at the instrument’s original effective interest rate, and the gross carrying value of the instrument prior to any credit impairment.

Operation Expenses

Operating expenses consisted solely of general and administrative expenses, which increased from RMB3.9 million for the first six months of 2022 to RMB4.2 million (US$0.6 million) for the first six months of 2023. The increase was primarily attributable to accrual more expenses for services rendered by auditor and counsel in the current reporting period.

Net Profit and Earnings per ADS

As a result of the foregoing, net profit was RMB30.5 million (US$4.4 million) for the first six months of 2023, as compared to RMB60.2 million (US$9.3 million) in the same period of the prior year.

Earnings per ADS for the first six months of 2023 was US$0.34, compared to US$0.99 in the same period of the prior year.

Statements of Financial Position

As of June 30, 2023, the Company had cash and restricted cash of RMB289,000 (US$40,000) compared to RMB295,000 as of December 31, 2022. Most cash deposits with the bank are frozen by court orders as the Company is involved in multiple legal proceedings, administrative proceedings, claims and other litigation as a result of overdue payments to service providers and loans payable to the lenders. The Company has actively worked with Wuchang District Court to broker a series of settlement solution for its obligations with a hope of reaching a deal.

Loans receivable, net of credit impairment losses of RMB646.6 million (US$89.2 million), was RMB601.3 million (US$82.9 million) as of June 30, 2023, representing an increase of 8.1% from RMB556.1 million as of December 31, 2022, primarily due to increase of interest accrued. Accrued interest is the present value of the estimated future cash flows of credit-impaired loans expected to be recovered, discounted at the loan’s original effective interest rate.

As of December 31, 2022 and June 30, 2023, loans payable to third parties, related parties and shareholders, amounting to RMB161.4 million (US$22.3 million) are all overdue. Although certain loans payable were negotiated with new schedules of repayments, the Company is unable to fulfil those obligations due to liquidity issues.

Statements of Cash Flows

Net cash used by operating activities for the first six months of 2023 was RMB164,000 compared to RMB29,000 net cash used by operating activities in the same period of the prior year and the Company has very limited liquidity available to fulfil its obligations for the first six months of 2022.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "target," "going forward," "outlook" and similar statements. Such statements are based upon management's current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company's control, which may cause the Company's actual results, performance or achievements to differ materially from those in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. The Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

Exchange Rate Information

The United States dollar (US$) amounts disclosed in this press release are presented solely for the convenience of the reader. Translations of amounts from Renminbi (“RMB”) into United States dollars for the convenience of the reader were calculated at the certified exchange rate of US$1.00 = RMB7.2513 on June 30, 2023 as set forth in the H.10 weekly statistical release of The Board of Governors of the Federal Reserve System. No representation is made that the RMB amounts could have been, or could be, converted into US$ at that rate on June 30, 2023, or at any other date. The percentages stated are calculated based on RMB amounts.

About Dunxin Financial Holdings Limited

Dunxin is a licensed microfinance lender in Hubei Province, China. The Company has been granted a microfinance license by the Financial Affairs Office of the Hubei Provincial People’s Government to provide loans to individuals and SMEs. The Company was awarded the “Vice President Unit” of China Micro-credit Companies Association under the China Banking Regulatory Commission in January 2017 and the “President Unit” of Hubei Micro-credit Company Association in December 2017. In 2016, we were recognized as a “National Excellent Microfinance Company” by China Micro-credit Companies Association. We have been named one of the “Top 100 Most Competitive Microfinance Companies in China” by China Microfinance Institution Association for four consecutive years since 2013, an “AA- Credit Rating Enterprise” by China Credit Management Co., Ltd in August 2017, and a “Top 10 Private Enterprises in Wuchang District, Wuhan City” by the People's Government of Wuchang District in July 2017. The Company has professional credit business experience in the microfinance industry in China. For more information, please visit the Company's website at http://hbctxed.com.

For additional information, please contact Mr. Johnny Zhou: +86-13917303401.

DUNXIN FINANCIAL HOLDINGS LIMITED

UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Expressed in Thousands of Chinese Renminbi Yuan, except per share and per ADS amounts)

| | For the six months ended June 30 | |

| | 2022 RMB | | | 2023 RMB | | | 2023 US$ | |

| | | | | | | | | |

Interest income on loans | | | 57,844 | | | | 51,545 | | | | 7,393 | |

Interest expense: | | | | | | | | | | | | |

Interest expenses on loans | | | (9,988 | ) | | | (10,393 | ) | | | (1,491 | ) |

Business related taxes and surcharges | | | (203 | ) | | | (203 | ) | | | (29 | ) |

Total interest expense | | | (10,191 | ) | | | (10,596 | ) | | | (1,520 | ) |

| | | | | | | | | | | | |

Net interest income | | | 47,653 | | | | 40,949 | | | | 5,873 | |

Reversal of /(Provision of) credit impairment losses | | | 16,382 | | | | (6,311 | ) | | | (905 | ) |

Net interest income after credit impairment losses | | | 64,035 | | | | 34,638 | | | | 4,968 | |

| | | | | | | | | | | | |

Operating costs and expenses | | | | | | | | | | | | |

General and administrative | | | (3,866 | ) | | | (4,175 | ) | | | (599 | ) |

Total operating costs and expenses | | | (3,866 | ) | | | (4,175 | ) | | | (599 | ) |

| | | | | | | | | | | | |

Profit before income taxes | | | 60,169 | | | | 30,463 | | | | 4,369 | |

Income tax expense | | | - | | | | - | | | | - | |

Net profit | | | 60,169 | | | | 30,463 | | | | 4,369 | |

| | | | | | | | | | | | |

Other comprehensive income for the period: | | | | | | | | | | | | |

Exchange differences on translation of financial statements of entities outside the mainland of the People’s Republic of China | | | (170 | ) | | | (397 | ) | | | (57 | ) |

Total comprehensive income for the period | | | 59,999 | | | | 30,066 | | | | 4,312 | |

| | | | | | | | | | | | |

Net profit attributable to: | | | | | | | | | | | | |

Equity holders of the Company | | | 48,136 | | | | 24,370 | | | | 3,495 | |

Non-controlling interests | | | 12,033 | | | | 6,093 | | | | 874 | |

Net profit | | | 60,169 | | | | 30,463 | | | | 4,369 | |

| | | | | | | | | | | | |

Total comprehensive income attributable to: | | | | | | | | | | | | |

Equity holders of the Company | | | 47,999 | | | | 24,053 | | | | 3,450 | |

Non-controlling interests | | | 12,000 | | | | 6,013 | | | | 862 | |

Total comprehensive income | | | 59,999 | | | | 30,066 | | | | 4,312 | |

| | | | | | | | | | | | |

Earnings per share - basic and diluted (in RMB) | | | 0.05 | | | | 0.03 | | | | | |

Earnings per ADS - basic and diluted (in US$) | | | 0.99 | | | | 0.34 | | | | | |

| | | | | | | | | | | | |

Weighted average shares outstanding in the period (‘000) | | | 1,002,201 | | | | 1,134,021 | | | | | |

Weighted average ADS outstanding in the period (‘000) | | | 9,357 | | | | 12,941 | | | | | |

One ADS represents 480 ordinary shares.

DUNXIN FINANCIAL HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Expressed in Thousands of Chinese Renminbi Yuan)

| | As of | |

| | December 31, | | | June 30, | | | June 30, | |

| | 2022 | | | 2023 | | | 2023 | |

| | RMB | | | RMB | | | US$ | |

| | | | | Unaudited | | | Unaudited | |

| | | | | | | | | |

Assets | | | | | | | | | |

Current assets | | | | | | | | | |

Cash and restricted cash | | | 295 | | | | 289 | | | | 40 | |

Loans receivable, net of credit impairment losses | | | 556,112 | | | | 601,346 | | | | 82,929 | |

Prepaid expenses and others | | | 4,629 | | | | 4,895 | | | | 675 | |

Total current assets | | | 561,036 | | | | 606,530 | | | | 83,644 | |

| | | | | | | | | | | | |

Non-current assets | | | | | | | | | | | | |

Property and equipment, net | | | 39,228 | | | | 37,754 | | | | 5,206 | |

Intangible asset | | | 5 | | | | 4 | | | | 1 | |

Total non-current assets | | | 39,233 | | | | 37,758 | | | | 5,207 | |

| | | | | | | | | | | | |

Total assets | | | 600,269 | | | | 644,288 | | | | 88,851 | |

| | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | |

Loans payable | | | 161,439 | | | | 161,439 | | | | 22,263 | |

Convertible notes payable | | | 7,264 | | | | 5,777 | | | | 797 | |

Salary and benefit payable | | | 12,179 | | | | 13,202 | | | | 1,821 | |

Income taxes payable | | | 32,477 | | | | 32,477 | | | | 4,479 | |

Interest payable | | | 72,810 | | | | 81,797 | | | | 11,280 | |

Other payable | | | 25,942 | | | | 29,330 | | | | 4,045 | |

Total current liabilities | | | 312,111 | | | | 324,022 | | | | 44,685 | |

| | | | | | | | | | | | |

Shareholders’ equity | | | | | | | | | | | | |

Capital and reserve attributable to equity holders of the Company | | | | | | | | | | | | |

Share capital | | | 340 | | | | 430 | | | | 59 | |

Additional paid-in capital | | | 383,684 | | | | 385,636 | | | | 53,182 | |

Statutory reserve | | | 18,706 | | | | 18,706 | | | | 2,580 | |

General risk reserve | | | 9,180 | | | | 9,180 | | | | 1,266 | |

Foreign currency translation reserve | | | (231 | ) | | | (549 | ) | | | (76 | ) |

Accumulated losses | | | (181,049 | ) | | | (156,679 | ) | | | (21,608 | ) |

Non-controlling interests in equity | | | 57,528 | | | | 63,542 | | | | 8,763 | |

Total shareholders’ equity | | | 288,158 | | | | 320,266 | | | | 44,166 | |

| | | | | | | | | | | | |

Total equity and liabilities | | | 600,269 | | | | 644,288 | | | | 88,851 | |

DUNXIN FINANCIAL HOLDINGS LIMITED

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in Thousands of Chinese Renminbi Yuan)

| | For the six months ended June 30, | |

| | 2022 | | | 2023 | | | 2023 | |

| | RMB | | | RMB | | | US$ | |

Cash flows from operating activities: | | | | | | | | | |

Profit before income taxes | | | 60,169 | | | | 30,463 | | | | 4,369 | |

Adjustments for: | | | | | | | | | | | | |

Depreciation of property and equipment | | | 1,477 | | | | 1,474 | | | | 211 | |

Amortization of intangible asset | | | * | | | | 1 | | | * | |

(Reversal)/ Provision of credit impairment losses | | | (16,382 | ) | | | 6,311 | | | | 905 | |

Operating profit before working capital changes | | | 45,264 | | | | 38,249 | | | | 5,485 | |

Loans receivable | | | (57,093 | ) | | | (51,545 | ) | | | (7,393 | ) |

Prepaid expenses and others | | | (158 | ) | | | (266 | ) | | | (38 | ) |

Salary and benefit payable | | | 1,068 | | | | 1,023 | | | | 147 | |

Interest payable | | | 9,015 | | | | 8,987 | | | | 1,289 | |

Other payable | | | 1,875 | | | | 3,388 | | | | 486 | |

Cash used in operating activities | | | (29 | ) | | | (164 | ) | | | (24 | ) |

Income tax paid | | | - | | | | - | | | | - | |

Net cash used in operating activities | | | (29 | ) | | | (164 | ) | | | (24 | ) |

| | | | | | | | | | | | |

Net decrease in cash and restricted cash | | | (29 | ) | | | (164 | ) | | | (24 | ) |

Cash and restricted cash at beginning of the period | | | 396 | | | | 295 | | | | 43 | |

Exchange losses on cash and restricted cash | | | (170 | ) | | | 158 | | | | 21 | |

Cash and restricted cash at end of the period | | | 197 | | | | 289 | | | | 40 | |

* Less than 1,000.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.3

CONSOLIDATED STATEMENTS OF PROFIT AND OTHER COMPREHENSIVE INCOME - CNY (¥)

|

6 Months Ended |

Jun. 30, 2023 |

Jun. 30, 2022 |

| CONSOLIDATED STATEMENTS OF PROFIT AND OTHER COMPREHENSIVE INCOME |

|

|

| Interest income on loans |

¥ 51,545,000

|

¥ 57,844,000

|

| Interest expense: |

|

|

| Interest expenses on loans |

(10,393,000)

|

(9,988,000)

|

| Business related taxes and surcharges |

(203,000)

|

(203,000)

|

| Total interest expense |

(10,596,000)

|

(10,191,000)

|

| Net interest income |

40,949,000

|

47,653,000

|

| Reversal of /(Provision of) credit impairment losses |

(6,311,000)

|

16,382,000

|

| Net interest income after credit impairment losses |

34,638,000

|

64,035,000

|

| General and administrative |

(4,175,000)

|

(3,866,000)

|

| Total operating costs and expenses |

(4,175,000)

|

(3,866,000)

|

| Profit before income tax |

30,463,000

|

60,169,000

|

| Income tax expense |

0

|

0

|

| Net profit |

30,463,000

|

60,169,000

|

| Exchange differences on translation of financial statements of entities outside the mainland of the People's Republic of China |

(397,000)

|

(170,000)

|

| Total comprehensive income for the period |

30,066,000

|

59,999,000

|

| Equity holders of the Company net profit |

24,370,000

|

48,136,000

|

| Non-controlling interests |

6,093,000

|

12,033,000

|

| Net profit loss |

30,463,000

|

60,169,000

|

| Total comprehensive income attributable to: |

|

|

| Equity holders of the Company |

24,053,000

|

47,999,000

|

| Comprehensive income non-controlling interests |

6,013,000

|

12,000,000

|

| Total comprehensive income |

¥ 30,066,000

|

¥ 59,999,000

|

| Earnings per share - basic and diluted (in RMB) |

¥ 0.03

|

¥ 0.05

|

| Earnings per ADS - basic and diluted (in US$) |

¥ 0.34

|

¥ 0.99

|

| Weighted average shares outstanding in the period ('000) |

1,134,021,000

|

1,002,201,000

|

| Weighted average ADS outstanding in the period ('000) |

12,941,000

|

9,357,000

|

| X |

- References

+ Details

| Name: |

dxf_ComprehensiveIncomeLossForThePeriod |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

dxf_ComprehensiveIncomeNonControllingInterests |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

dxf_EquityHoldersOfTheCompanyNetProft |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

dxf_NetProfitLoss |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

dxf_ProvisionForOtherCreditLosses |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe weighted average number of ordinary shares outstanding plus the weighted average number of ordinary shares that would be issued on the conversion of all the dilutive potential ordinary shares into ordinary shares. [Refer: Ordinary shares [member]; Weighted average [member]] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 70

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_70_b&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_AdjustedWeightedAverageShares |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of profit (loss) attributable to ordinary equity holders of the parent entity (the numerator) divided by the weighted average number of ordinary shares outstanding during the period (the denominator). Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 66

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_66&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 67

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_67&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_BasicEarningsLossPerShare |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ifrs-full_ComprehensiveIncomeAttributableToAbstract |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of comprehensive income attributable to non-controlling interests. [Refer: Comprehensive income; Non-controlling interests] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 81B

-Subparagraph b

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_81B_b_i&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 106

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_106_a&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_ComprehensiveIncomeAttributableToNoncontrollingInterests |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of profit (loss) attributable to ordinary equity holders of the parent entity (the numerator), divided by the weighted average number of ordinary shares outstanding during the period (the denominator), both adjusted for the effects of all dilutive potential ordinary shares. [Refer: Ordinary shares [member]; Weighted average [member]] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 66

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_66&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 67

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_67&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_DilutedEarningsLossPerShare |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of expense arising from the search for mineral resources, including minerals, oil, natural gas and similar non-regenerative resources after the entity has obtained legal rights to explore in a specific area, as well as the determination of the technical feasibility and commercial viability of extracting the mineral resource. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 6

-IssueDate 2022-03-24

-Paragraph 24

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=6&code=ifrs-tx-2022-en-r&anchor=para_24_b&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_ExpenseArisingFromExplorationForAndEvaluationOfMineralResources |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of expense arising from interest. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_e&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-Subparagraph d

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23_d&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B13

-Subparagraph f

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B13_f&doctype=Appendix&subtype=B

-URIDate 2022-03-24

| Name: |

ifrs-full_InterestExpense |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of interest expense on borrowings. [Refer: Interest expense; Borrowings] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 112

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_112_c&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_InterestExpenseOnBorrowings |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of interest income on loans and advances to banks. [Refer: Interest income; Loans and advances to banks] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 112

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_112_c&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_InterestIncomeOnLoansAndAdvancesToBanks |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of income or expense arising from interest. [Refer: Interest expense; Interest income] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_e&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 85

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_85&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_InterestRevenueExpense |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ifrs-full_MaterialIncomeAndExpenseAbstract |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of all operating expenses. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 85

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_85&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_OperatingExpense |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of income and expense (including reclassification adjustments) that is not recognised in profit or loss as required or permitted by IFRSs. [Refer: IFRSs [member]] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B12

-Subparagraph b

-Clause viii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B12_b_viii&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 81A

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_81A_b&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 91

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_91_a&doctype=Standard

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 106

-Subparagraph d

-Clause ii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_106_d_ii&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_OtherComprehensiveIncome |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe total of income less expenses from continuing and discontinued operations, excluding the components of other comprehensive income. [Refer: Other comprehensive income] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 7

-IssueDate 2022-03-24

-Paragraph 18

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=7&code=ifrs-tx-2022-en-r&anchor=para_18_b&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 1

-IssueDate 2022-03-24

-Paragraph 32

-Subparagraph a

-Clause ii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=1&code=ifrs-tx-2022-en-r&anchor=para_32_a_ii&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 1

-IssueDate 2022-03-24

-Paragraph 24

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=1&code=ifrs-tx-2022-en-r&anchor=para_24_b&doctype=Standard

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_b&doctype=Standard

-URIDate 2022-03-24

Reference 5: http://www.xbrl.org/2003/role/exampleRef

-Note Effective on first application of IFRS 9

-Name IFRS

-Number 4

-IssueDate 2022-03-24

-Paragraph 39L

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=4&code=ifrs-tx-2022-en-b&anchor=para_39L_e&doctype=Standard

-URIDate 2022-03-24

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23&doctype=Standard

-URIDate 2022-03-24

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 8: http://www.xbrl.org/2003/role/exampleRef

-Note Effective 2023-01-01

-Name IFRS

-Number 17

-IssueDate 2022-03-24

-Paragraph 113

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=17&code=ifrs-tx-2022-en-r&anchor=para_113_b&doctype=Standard

-URIDate 2022-03-24

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 81A

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_81A_a&doctype=Standard

-URIDate 2022-03-24

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 106

-Subparagraph d

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_106_d_i&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_ProfitLoss |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe profit (loss) attributable to ordinary equity holders of the parent entity, adjusted for the effects of all dilutive potential ordinary shares. [Refer: Profit (loss)] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 70

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_70_a&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_ProfitLossAttributableToOrdinaryEquityHoldersOfParentEntityIncludingDilutiveEffects |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe profit (loss) before tax expense or income. [Refer: Profit (loss)] Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_b&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 5

-IssueDate 2022-03-24

-Paragraph 33

-Subparagraph b

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=5&code=ifrs-tx-2022-en-r&anchor=para_33_b_i&doctype=Standard

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2003/role/exampleRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 103

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_103&doctype=Standard

-URIDate 2022-03-24

Reference 5: http://www.xbrl.org/2003/role/exampleRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 102

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_102&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_ProfitLossBeforeTax |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of income arising from interest. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23_c&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_e&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B13

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B13_e&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 112

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_112_c&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_RevenueFromInterest |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of expense relating to selling, general and administrative activities of the entity. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 85

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_85&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_SellingGeneralAndAdministrativeExpense |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ifrs-full_StatementOfComprehensiveIncomeAbstract |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe number of ordinary shares outstanding at the beginning of the period, adjusted by the number of ordinary shares bought back or issued during the period multiplied by a time-weighting factor. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 33

-IssueDate 2022-03-24

-Paragraph 70

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=33&code=ifrs-tx-2022-en-r&anchor=para_70_b&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_WeightedAverageShares |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.3

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION - CNY (¥)

|

Jun. 30, 2023 |

Dec. 31, 2022 |

| Current assets |

|

|

| Cash and restricted cash |

¥ 289,000

|

¥ 295,000

|

| Loans receivable, net of credit impairment losses |

601,346,000

|

556,112,000

|

| Prepaid expenses and others |

4,895,000

|

4,629,000

|

| Total current assets |

606,530,000

|

561,036,000

|

| Property and equipment, net |

37,754,000

|

39,228,000

|

| Intangible asset |

4,000

|

5,000

|

| Total non-current assets |

37,758,000

|

39,233,000

|

| Total assets |

644,288,000

|

600,269,000

|

| Loans payable |

161,439,000

|

161,439,000

|

| Convertible notes payable |

5,777,000

|

7,264,000

|

| Salary and benefit payable |

13,202,000

|

12,179,000

|

| Income taxes payable |

32,477,000

|

32,477,000

|

| Interest payable |

81,797,000

|

72,810,000

|

| Other payable |

29,330,000

|

25,942,000

|

| Total current liabilities |

324,022,000

|

312,111,000

|

| Share capital |

430,000

|

340,000

|

| Additional paid-in capital |

385,636,000

|

383,684,000

|

| Statutory reserve |

18,706,000

|

18,706,000

|

| General risk reserve |

9,180,000

|

9,180,000

|

| Foreign currency translation reserve |

(549,000)

|

(231,000)

|

| Accumulated losses |

(156,679,000)

|

(181,049,000)

|

| Non-controlling interests in equity |

63,542,000

|

57,528,000

|

| Total shareholders' equity |

320,266,000

|

288,158,000

|

| Total equity and liabilities |

¥ 644,288,000

|

¥ 600,269,000

|

| X |

- References

+ Details

| Name: |

dxf_ConvertibleNotesPayable |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

dxf_ForeignCurrencyTranslationReserve |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

dxf_GeneralRiskReserve |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

dxf_LoansReceivableNetOfCreditImpairmentLosses |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

dxf_SalaryAndBenefitPayable |

| Namespace Prefix: |

dxf_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount received or receivable from the issuance of the entity's shares in excess of nominal value and amounts received from other transactions involving the entity's stock or stockholders. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_AdditionalPaidinCapital |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of a present economic resource controlled by the entity as a result of past events. Economic resource is a right that has the potential to produce economic benefits. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_a&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 28

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_28_c&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_b&doctype=Standard

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_e&doctype=Standard

-URIDate 2022-03-24

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2022-03-24

-Paragraph 23

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2022-en-r&anchor=para_23&doctype=Standard

-URIDate 2022-03-24

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_Assets |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of assets that the entity (a) expects to realise or intends to sell or consume in its normal operating cycle; (b) holds primarily for the purpose of trading; (c) expects to realise within twelve months after the reporting period; or (d) classifies as cash or cash equivalents (as defined in IAS 7) unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. [Refer: Assets] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B12

-Subparagraph b

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B12_b_i&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 66

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_66&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_CurrentAssets |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

ifrs-full_CurrentAssetsAbstract |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of current interest payable. [Refer: Interest payable] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 112

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_112_c&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_CurrentInterestPayable |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionExpiry date 2023-01-01: The amount of liabilities that: (a) the entity expects to settle in its normal operating cycle; (b) the entity holds primarily for the purpose of trading; (c) are due to be settled within twelve months after the reporting period; or (d) the entity does not have an unconditional right to defer settlement for at least twelve months after the reporting period.

Effective 2023-01-01: The amount of liabilities that: (a) the entity expects to settle in its normal operating cycle; (b) the entity holds primarily for the purpose of trading; (c) are due to be settled within twelve months after the reporting period; or (d) the entity does not have the right at the end of the reporting period to defer settlement for at least twelve months after the reporting period. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B12

-Subparagraph b

-Clause iii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B12_b_iii&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 69

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_69&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_CurrentLiabilities |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount recognised as a current asset for expenditures made prior to the period when the economic benefit will be realised. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 112

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_112_c&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_CurrentPrepaidExpenses |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of current tax for current and prior periods to the extent unpaid. Current tax is the amount of income taxes payable (recoverable) in respect of the taxable profit (tax loss) for a period. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 54

-Subparagraph n

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_54_n&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_CurrentTaxLiabilities |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of residual interest in the assets of the entity after deducting all its liabilities. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 1

-IssueDate 2022-03-24

-Paragraph 24

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=1&code=ifrs-tx-2022-en-r&anchor=para_24_a&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 1

-IssueDate 2022-03-24

-Paragraph 32

-Subparagraph a

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=1&code=ifrs-tx-2022-en-r&anchor=para_32_a_i&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_a&doctype=Standard

-URIDate 2022-03-24

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_b&doctype=Standard

-URIDate 2022-03-24

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2022-03-24

-Paragraph 93

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2022-en-r&anchor=para_93_e&doctype=Standard

-URIDate 2022-03-24

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 78

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_78_e&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_Equity |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of the entity's equity and liabilities. [Refer: Equity; Liabilities] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_EquityAndLiabilities |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of intangible assets and goodwill held by the entity. [Refer: Goodwill; Intangible assets other than goodwill] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_IntangibleAssetsAndGoodwill |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe nominal value of capital issued. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 78

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_78_e&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_IssuedCapital |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of equity in a subsidiary not attributable, directly or indirectly, to a parent. [Refer: Subsidiaries [member]] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph 12

-Subparagraph f

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_12_f&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 10

-IssueDate 2022-03-24

-Paragraph 22

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=10&code=ifrs-tx-2022-en-r&anchor=para_22&doctype=Standard

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 54

-Subparagraph q

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_54_q&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_NoncontrollingInterests |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of assets that do not meet the definition of current assets. [Refer: Current assets] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B12

-Subparagraph b

-Clause ii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B12_b_ii&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2022-03-24

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2022-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2022-03-24

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 66

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_66&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_NoncurrentAssets |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of current payables that the entity does not separately disclose in the same statement or note. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_OtherCurrentPayables |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmounts payable that the entity does not separately disclose in the same statement or note. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_OtherPayables |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of tangible assets that: (a) are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and (b) are expected to be used during more than one period. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 16

-IssueDate 2022-03-24

-Paragraph 73

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=16&code=ifrs-tx-2022-en-r&anchor=para_73_e&doctype=Standard

-URIDate 2022-03-24

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 54

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_54_a&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_PropertyPlantAndEquipment |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of cash and cash equivalents whose use or withdrawal is restricted. [Refer: Cash and cash equivalents] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_55&doctype=Standard

-URIDate 2022-03-24

| Name: |

ifrs-full_RestrictedCashAndCashEquivalents |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionA component of equity representing the entity's cumulative undistributed earnings or deficit. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Name IAS

-Number 1

-IssueDate 2022-03-24

-Paragraph IG6

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2022-en-r&anchor=para_IG6&doctype=Implementation%20Guidance

-URIDate 2022-03-24