Goldshore

Intersects

5.64 g/t Au over 15.65m at East

Coldstream

Significant

Mineralization Outlined 13km Northeast of the Moss Lake

Deposit

VANCOUVER,

B.C., February 27, 2023 -- InvestorsHub NewsWire

-- Goldshore Resources Inc.

(TSXV:

GSHR

/ OTCQB:

GSHRF / FWB: 8X00) ("Goldshore" or the "Company"),

is pleased to announce assay

results from its ongoing 100,000-meter drill program at the Moss Lake Project in Northwest Ontario, Canada

(the "Moss Lake

Gold Project").

Highlights:

-

Results from the second half of the East

Coldstream Phase One drill program have confirmed the potential

for significant high-grade shears within East

Coldstream, approximately 13 kilometers northeast of

the Moss Lake Deposit. Best intercepts include:

-

3.49 g/t Au

over 26.35m from 76.85m depth in CED-22-010,

including

-

5.64 g/t

over 15.65m from 87.55m

-

1.12 g/t Au

over 21.9m from 206.5m

-

1.07 g/t Au

over 31.0m from 288.0m depth in CED-22-011

and

-

1.48 g/t Au

over 18.45m from 357.0m, including

-

4.68 g/t Au

over 4.85m from 370.6m

-

0.94 g/t Au

over 25.05m from 218.95m depth in CED-22-014,

including

-

1.10 g/t Au over 16.0m from

226.0m

-

1.23 g/t Au

over 35.15m from 338.45m depth in CED-22-017,

including

-

2.19 g/t Au

over 11.55m from 338.45m

-

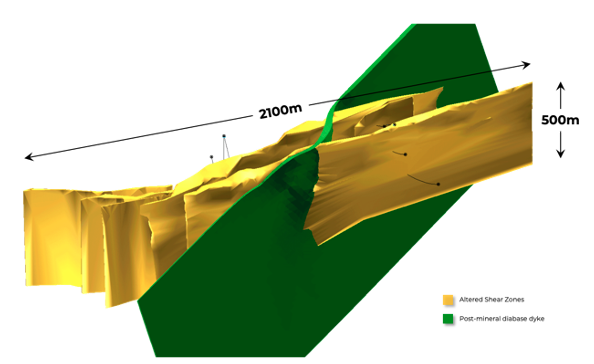

In addition

to the Moss Lake Deposit, the upcoming mineral

resource estimate update will include the East Coldstream

deposit. In support of this, a 3D wireframe of the

mineralization constraining alteration domain has been developed

utilizing both current and historical drilling data.

President and CEO Brett Richards stated:

"These

results at East Coldstream continue to support our thesis that the

size and scale of the entire Moss Lake Gold Project will be large

enough to support a material and meaningful update to the mineral

resource estimate in April 2023, with East Coldstream sequencing

into the mine plan in a preliminary economic assessment as a

satellite pit.

We look

forward to the continuing catalysts to the Moss Lake Gold Project

in an effort to demonstrate the true value of the

assets."

Technical Overview

Figure 1 shows the location of East

Coldstream relative to Moss Lake in addition to the now formally

identified gold and copper prospects controlled by Goldshore

Resources. Figure 2 shows the better intercepts in plan view, and

Figure 3 is a typical section through holes CED-22-013 to -015 and

-017. Table 1 shows the significant intercepts. Table 2 shows the

drill hole locations.

Figure 1: Plan showing location of Moss Lake and East Coldstream

deposits relative to the prospective Central Domain (from

geophysics survey) and field-developed prospects

Figure

2:

Drill plan showing best of several +1 g/t Au intercepts

relative

to the altered shears

Figure 3: Drill section through MCD-22-013 to -015 and -017

relative to the altered shears

Results have been received for the eight

remaining holes from the Phase One East Coldstream drill program

completed in the Summer of 2022.

All holes intersected visually distinct

silica, carbonate, and hematite alteration zones hosted in basalt

flows - historically been referred to as the "Coldstream Basalt" -

that host much of the gold mineralization (Figure 4). This

alteration also overprints and locally mineralizes quartz feldspar

porphyry sills and gabbro intrusions where they are intersected by

shear zones. The altered intrusions are significantly less "visual"

than the Coldstream Basalt, which resulted in inconsistent sampling

of historical drill core. Infill sampling of intervals within the

modelled alteration domain represents an opportunity to expand

mineralization. This is planned for the summer.

Goldshore has wireframed shear zone-hosted

alteration domains (Figure 5) ahead of a mineral resource update

planned for the second quarter. This consists of two major altered

shear zones - Main Lens and North Lens - and four minor altered

shear zone splays. The Main Lens has been historically split into

the Main Lens and Sanders Lens however these two lenses are now

understood to be the same zone split by a late Proterozoic diabase

dyke.

To evaluate the historical drilling, hole

CED-22-010 was drilled as a twin of hole C-10-23 in the core of the

East Coldstream deposit where both holes intersected two

shear-controlled Lenses. In the North Lens, CED-22-010 and C-10-23

intersected 1.81 g/t Au over

54.6m from 76.85m versus 1.35 g/t Au over

54.2m from 80.4m, respectively. In the South Lens,

CED-22-010 intersected 0.56 g/t Au over

51.5m from 206.5m versus 0.55 g/t Au over 34.7m

from 196.6m, respectively. This represents a 34% higher grade over

similar widths in the North Lens and a 48% increase in width with

similar grades in the South Lens in the current drill

hole.

The East Coldstream deposit also contains a

broad, low-grade mineralized envelope within the alteration domain.

Examples include 0.54 g/t Au over 27.5.0m from

562.5m in CED-22-009; 0.56 g/t Au over

51.5m from 206.5m depth in CED-22-010; 0.33 g/t Au

over 32.0m from 315m in CED-22-012; 0.72 g/t Au over 18.1m from

182.05m in CED-22-013; 0.69 g/t Au over 25.05m from 254.95m in

CED-22-014; and 0.85 g/t Au over 17.4m from 190.6m in

CED-22-015.

Figure

4:

Core box photos of CED-22-010 intercept in the North Lens

-

3.49 g/t Au over 26.35m from 76.85m depth (yellow box) including

5.64 g/t over 15.65m from 87.55m.

Note that these photos are not intended to be representative of

broader mineralization on the Moss Lake Gold Project.

Figure

5:

3D wireframe of the East Coldstream mineralization constraining

alteration domain.

Pete Flindell, VP Exploration for Goldshore,

said "These

drill results show that East Coldstream, which is well constrained

by altered and mineralized shears, may be significantly larger than

previously understood. Our focus will now be on developing a

mineral resource based around the high-grade shears and their

low-grade envelopes, which will form an important satellite to the

Moss Lake Gold Project approximately 13 kilometers to the

southwest."

Table 1: Significant downhole gold intercepts

|

HOLE

ID

|

FROM

|

TO

|

LENGTH

(m)

|

TRUE WIDTH

(m)

|

CUT

GRADE

(g/t

Au)

|

UNCUT

GRADE

(g/t

Au)

|

|

CED-22-009

|

497.00

|

511.65

|

14.65

|

11.5

|

0.58

|

0.58

|

|

including

|

497.00

|

501.00

|

4.00

|

3.1

|

1.20

|

1.20

|

|

|

562.50

|

590.00

|

27.50

|

22.5

|

0.54

|

0.54

|

|

including

|

572.50

|

581.00

|

8.50

|

7.0

|

1.44

|

1.44

|

|

|

|

|

|

|

|

|

|

CED-22-010

|

76.85

|

103.20

|

26.35

|

16.6

|

3.49

|

3.49

|

|

including

|

87.55

|

103.20

|

15.65

|

9.9

|

5.64

|

5.64

|

|

|

123.30

|

131.45

|

8.15

|

5.2

|

0.81

|

0.81

|

|

including

|

123.30

|

125.45

|

2.15

|

1.4

|

1.58

|

1.58

|

|

|

166.00

|

176.50

|

10.50

|

6.8

|

0.59

|

0.59

|

|

|

187.00

|

191.00

|

4.00

|

2.6

|

0.56

|

0.56

|

|

|

206.50

|

258.00

|

51.50

|

34.5

|

0.56

|

0.56

|

|

including

|

206.50

|

228.40

|

21.90

|

14.5

|

1.12

|

1.12

|

|

|

|

|

|

|

|

|

|

CED-22-011

|

248.40

|

251.75

|

3.35

|

2.0

|

1.49

|

1.49

|

|

including

|

248.40

|

251.00

|

2.60

|

1.6

|

1.73

|

1.73

|

|

|

284.50

|

324.60

|

40.10

|

24.8

|

0.91

|

0.91

|

|

including

|

288.00

|

319.00

|

31.00

|

19.1

|

1.07

|

1.07

|

|

|

339.00

|

344.50

|

5.50

|

3.5

|

0.70

|

0.70

|

|

|

357.00

|

375.45

|

18.45

|

11.8

|

1.48

|

1.48

|

|

including

|

370.60

|

375.45

|

4.85

|

3.1

|

4.68

|

4.68

|

|

|

400.40

|

413.90

|

13.50

|

8.8

|

0.54

|

0.54

|

|

including

|

400.40

|

404.45

|

4.05

|

2.6

|

1.25

|

1.25

|

|

|

|

|

|

|

|

|

|

CED-22-012

|

315.00

|

347.00

|

32.00

|

20.7

|

0.33

|

0.33

|

|

|

362.80

|

367.00

|

4.20

|

2.8

|

0.57

|

0.57

|

|

|

376.80

|

381.05

|

4.25

|

2.8

|

0.52

|

0.52

|

|

|

|

|

|

|

|

|

|

CED-22-013

|

119.00

|

121.00

|

2.00

|

1.5

|

1.14

|

1.14

|

|

|

137.65

|

149.85

|

12.20

|

9.1

|

0.41

|

0.41

|

|

|

182.05

|

200.10

|

18.05

|

13.9

|

0.72

|

0.72

|

|

including

|

182.05

|

194.40

|

12.35

|

9.5

|

1.02

|

1.02

|

|

|

|

|

|

|

|

|

|

CED-22-014

|

31.00

|

33.00

|

2.00

|

0.9

|

0.96

|

0.96

|

|

|

119.00

|

133.00

|

14.00

|

6.5

|

0.39

|

0.39

|

|

|

218.95

|

244.00

|

25.05

|

12.5

|

0.94

|

0.94

|

|

including

|

226.00

|

242.00

|

16.00

|

8.0

|

1.10

|

1.10

|

|

|

254.95

|

259.00

|

4.05

|

2.0

|

0.36

|

0.36

|

|

|

264.00

|

280.00

|

16.00

|

8.1

|

0.95

|

0.95

|

|

including

|

271.00

|

277.00

|

6.00

|

3.1

|

1.68

|

1.68

|

|

|

|

|

|

|

|

|

|

CED-22-015

|

9.00

|

11.00

|

2.00

|

1.3

|

0.70

|

0.70

|

|

|

21.00

|

23.00

|

2.00

|

1.3

|

0.42

|

0.42

|

|

|

31.00

|

33.00

|

2.00

|

1.3

|

0.33

|

0.33

|

|

|

118.00

|

120.00

|

2.00

|

1.4

|

0.31

|

0.31

|

|

|

190.60

|

208.00

|

17.40

|

12.6

|

0.85

|

0.85

|

|

including

|

190.60

|

195.80

|

5.20

|

3.7

|

1.20

|

1.20

|

|

and

|

206.00

|

208.00

|

2.00

|

1.4

|

1.95

|

1.95

|

|

|

|

|

|

|

|

|

|

CED-22-017

|

212.80

|

221.00

|

8.20

|

6.3

|

0.53

|

0.53

|

|

|

284.00

|

286.00

|

2.00

|

1.6

|

0.68

|

0.68

|

|

|

298.00

|

305.00

|

7.00

|

5.7

|

0.69

|

0.69

|

|

|

338.45

|

373.60

|

35.15

|

29.6

|

1.23

|

1.23

|

|

including

|

338.45

|

350.00

|

11.55

|

9.7

|

2.19

|

2.19

|

|

and

|

362.90

|

373.60

|

10.70

|

9.1

|

1.28

|

1.28

|

|

Intersections calculated

above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a

maximum internal waste interval of 10 metres. Shaded intervals are

intersections calculated above a 1.0 g/t Au cut off. Intervals in

bold are those with a grade thickness factor exceeding 20 gram x

metres / tonne gold. True widths are approximate and assume a

subvertical body.

|

Table 2: Location of drill holes in this press release

|

HOLE

|

EAST

|

NORTH

|

RL

|

AZIMUTH

|

DIP

|

EOH

|

|

CED-22-009

|

680,767

|

5,386,281

|

484

|

341°

|

-50°

|

599.95

|

|

CED-22-010

|

679,898

|

5,386,424

|

475

|

161°

|

-53°

|

315.00

|

|

CED-22-011

|

679,945

|

5,386,526

|

480

|

155°

|

-57°

|

642.00

|

|

CED-22-012

|

679,945

|

5,386,526

|

480

|

180°

|

-54°

|

600.00

|

|

CED-22-013

|

680,560

|

5,386,569

|

485

|

340°

|

-50°

|

300.00

|

|

CED-22-014

|

680,561

|

5,386,569

|

485

|

341°

|

-65°

|

450.00

|

|

CED-22-015

|

680,598

|

5,386,576

|

486

|

340°

|

-50°

|

300.00

|

|

CED-22-017

|

680,641

|

5,386,434

|

478

|

341°

|

-49°

|

456.00

|

|

Approximate collar

coordinates in NAD 83, Zone 15N

|

Analytical and QA/QC Procedures

All samples were sent to ALS Geochemistry in

Thunder Bay for preparation and analysis was performed in the ALS

Vancouver analytical facility. ALS is accredited by the Standards

Council of Canada (SCC) for the Accreditation of Mineral Analysis

Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were

analyzed for gold via fire assay with an AA finish ("Au-AA23") and

48 pathfinder elements via ICP-MS after four-acid digestion

("ME-MS61"). Samples that assayed over 10 ppm Au were re-run via

fire assay with a gravimetric finish

("Au-GRA21").

In addition to ALS quality assurance /

quality control ("QA/QC") protocols, Goldshore has implemented a

quality control program for all samples collected through the

drilling program. The

quality control program was designed by a qualified and independent

third party, with a focus on the quality of analytical results for

gold. Analytical results are received, imported to our secure

on-line database and evaluated to meet our established guidelines

to ensure that all sample batches pass industry best practice for

analytical quality control. Certified reference materials are

considered acceptable if values returned are within three standard

deviations of the certified value reported by the manufacture of

the material. In addition to the certified reference material,

certified blank material is included in the sample stream to

monitor contamination during sample preparation. Blank material

results are assessed based on the returned gold result being less

than ten times the quoted lower detection limit of the analytical

method. The results of the on-going analytical quality control

program are evaluated and reported to Goldshore by Orix Geoscience

Inc.

Director Resignation

Doug Ramshaw has announced he will step down

from the Board of Directors of the Company at the end of February

2023. Doug was

instrumental in the formation of Goldshore and the preliminary

launch of the initial public offering in June 2021, and is stepping

down to dedicate greater time to Minera Alamos and other ventures

he is involved in.

President and CEO Brett Richards stated:

"Doug's

exceptional contribution to the Goldshore Board has been a

testament to the broad investor awareness created around the

Company's launch and on-going development.

I

personally have thoroughly enjoyed working with Doug over the last

two years, as he has been sound counsel to myself and the Board,

and on behalf of all of us on the Board, we wish Doug the very best

in his future endeavors."

About Goldshore

Goldshore is an emerging junior gold

development company, and owns 100% of the Moss Lake Gold Project

located in Ontario. Wesdome is currently a large shareholder of

Goldshore with an approximate 22% equity position in the

Company. Well-financed and supported by an

industry-leading management group, board of directors and advisory

board, Goldshore is positioned to advance the Moss Lake Gold

Project through the next stages of exploration and

development.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice

President - Exploration of the Company, a qualified person under NI

43-101 has approved the scientific and technical information

contained in this news release.

Neither

the TSXV nor its Regulation Services Provider (as that term is

defined in the policies of the TSXV) accepts responsibility for the

adequacy or accuracy of this release.

For More

Information - Please Contact:

Brett A. Richards

President, Chief Executive Officer and

Director

Goldshore Resources Inc.

P. +1 604

288 4416 M. +1

905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes |

Twitter: GoldShoreRes |

LinkedIn: goldshoreres

Cautionary

Note Regarding Forward-Looking Statements

This news release contains statements that

constitute "forward-looking statements." Such forward looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company's actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Forward

looking statements are statements that are not historical facts and

are generally, but not always, identified by the words "expects,"

"plans," "anticipates," "believes," "intends," "estimates,"

"projects," "potential" and similar expressions, or that events or

conditions "will," "would," "may," "could" or "should"

occur.

Forward-looking statements in this news

release include, among others, statements relating to expectations

regarding the exploration and development of the Moss Lake Gold

Project, the release and timing of an updated mineral resource

estimate, the release of a preliminary economic assessment and

other statements that are not historical facts. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results,

performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors and risks include, among others: the

Company may require additional financing from time to time in order

to continue its operations which may not be available when needed

or on acceptable terms and conditions acceptable; compliance with

extensive government regulation; domestic and foreign laws and

regulations could adversely affect the Company's business and

results of operations; the stock markets have experienced

volatility that often has been unrelated to the performance of

companies and these fluctuations may adversely affect the price of

the Company's securities, regardless of its operating performance;

and the impact of COVID-19.

The forward-looking information contained in

this news release represents the expectations of the Company as of

the date of this news release and, accordingly, is subject to

change after such date. Readers should not place undue importance

on forward-looking information and should not rely upon this

information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors,

should change.

This news release does not constitute an

offer to sell, or a solicitation of an offer to buy, any securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.