Verde AgriTech Ltd (TSX: “NPK”)

("

Verde” or the “

Company”) is

pleased to announce the results of its first Life Cycle

Analysis (“

LCA”)1, completed by LCA Design

Corporation, a leading Canadian consultancy firm.2 The LCA

determines the climate impacts associated with the production of

Verde’s potassium fertilizer K Forte® (the

“

Product”) from cradle-to-grave.3 The LCA was

conducted according to ISO 14040/44:2006 Standard4 and Puro Earth

Enhanced Rock Weathering (“

ERW”) Methodology.5

The Product's potential of carbon removal

through ERW, determined as carbon dioxide removal certificates

(“CORCs”)6, can reach up to 112.56 kilograms of

carbon dioxide equivalent per ton of Product

(“CO2e /

t”).7

The Company assessed several scenarios,

encompassing historical production, current production, and planned

production capacity ramp-up. The potential for CORCs generation

determined by the LCA was assessed based on the following

assumptions:

- Production

capacity: 3 million tons per year

(“Mtpy”). This capacity can be achieved by

utilizing Verde’s currently installed Plant 1 and Plant 2, both

operating at full capacity.

- Product

distribution: The CO2e emissions vary depending on the

product shipment distance from Verde's production facilities. The

greater the shipping distance increases the diesel consumption and,

consequently, the carbon footprint.

-

Transportation mode: The CO2e emissions were

calculated with the assumption that the Product transportation

would be exclusively done by road. Nevertheless, Verde has an

ongoing transition plan for railway transportation, with the

objective of constructing a railway branch line that will connect

its production facilities to a major freight route in Brazil.8 The

implementation of railway transportation is expected to contribute

to a reduction in the CO2 footprint compared to road

transportation.9

Calculation Methodology

The climate impact assessed in the LCA is quantified in terms of

kilograms of CO2e and encompasses all greenhouse gases directly and

indirectly associated with the process. This includes:

- Mining: This stage

encompasses all activities related to raw material extraction, as

well as its transportation to Verde’s production facilities,

including emissions from fuel, vehicles, and infrastructure.

- Processing: This

stage encompasses all processes involved in transforming Verde’s

raw material into K Forte®, as well as the Product handling on-site

(including transportation or conveying within the production

facility).

- Transport to application

site: This stage involves the transportation of the

Product to the farms where it will be applied. It encompasses

emissions related to fuel consumption, vehicles, and

infrastructure.

- Application to

site: This stage involves the actual application and use

of the Product. It assumes that the Product is applied to the soil

using agricultural equipment powered by diesel fuel.

- Weathering phase:

This stage occurs after the application of Product and involves

carbon capture through the ERW process.

- Carbon fate in

environment: This stage considers the potential risk of

remission of sequestered carbon into the environment.

Carbon Offset Removal Credits represent the net amount of CO2e

removed by the applied rock weathering within a specified time

frame, equivalent to 1 ton of CO2e, according to Puro Earth's ERW

Methodology. CORC values are presented in kilograms of CO2e in the

LCA.10

The overall equation for calculating CORCs generated by ERW

activity is as follows:

CORCs = (CO2

Stored) – (CO2

Supply Chain Footprint)

- CO2 Stored (kg of

CO2e): The amount of CO2 captured via ERW is determined by

the weathering of the Product after being applied to soil. This

process involves the generation of carbonate or bicarbonate ions

and has the potential for the precipitation of solid carbonate

minerals. CO2 Stored is the amount of CO2 that is sequestered from

the atmosphere as a result of the weathering process. The Product’s

CO2 Stored is equivalent to 120 kg CO2e per ton of K Forte®. The

CO2 Stored calculation was provided by Dr. Manning, determined

through an independent study conducted at Newcastle

University.11

- CO2 Supply Chain Footprint

(kg of CO2e): includes all greenhouse gas emissions that

occur throughout the entire supply chain process, from mining

activities and processing to transportation to the application

site, the actual application to the soil using agricultural

machinery, as well as monitoring, sampling, and testing activities

during the weathering phase. The CO2 Supply Chain Footprint

reflects the greenhouse gas emissions associated with the entire

life cycle of the Product. The CO2 Supply Chain Footprint was

calculated in the LCA.

In summary, CORCs represent the net CO2e removed by the

Product’s weathering through ERW activities.

LCA Results

Firstly, the table below displays the CORCs derived from the

cradle-to-gate12 life cycle assessment of K Forte®. This assessment

covers activities from raw material extraction to production

completion, taking into account the potential for carbon capture

through ERW.

Net carbon sequestration for K Forte®’s

cradle-to-gate LCA

|

CORCs (kg CO2e / t) |

|

CO2 Stored (kg CO2e / t) |

|

CO2 Supply Chain Footprint (kg CO2e / t) |

|

112.56 |

= |

120.00 |

- |

7.44 |

The greenhouse gas emissions associated with the cradle-to-gate

cycle of K Forte® are relatively low, less than 10% of the amount

of carbon captured by the Product. This can be attributed to

Verde's sustainable production process, which is characterized

by:

- 100% renewable power

supply: Our operations use 100% renewable energy sources

from hydropower.

- Negligible water

demand: Our production process consumes significantly

less water compared to that of other mining or fertilizer

production companies.

- Lower-impact

mining: The area where we extract our raw materials

primarily consists of degraded pastureland,

deforested decades ago by local landowners for

cattle breeding, minimizing environmental

interventions

- No toxic

contaminants: Our product does not

contain concerning amounts of the toxic contaminants

associated with basalt or olivine, namely nickel and

chromium, unlike many other ERW projects.

- Zero tailing dams:

Our mineral processing does not require generate

tailings nor does require any dams.

When considering the cradle-to-grave assessment of the Product,

the shipping distance between Verde's production facilities and the

application site of the Product significantly impacts the range of

greenhouse gas emissions within Verde's supply chain.

The table below shows the CORCs derived from the cradle-to-grave

life cycle assessment and market size for K Forte®, according to

the distance radius for the Product’s shipment from Verde’s

production facilities.

Net carbon sequestration for K Forte®’s

cradle-to-grave LCA and market size, according to shipment

distance

|

Distance from Verde’s production facilities

(km) |

Potash Market Size (tons

K2O)13 |

Product’s Market Size (tons K Forte®) |

CO2 Stored

(kg CO2e /

t) |

CO2 Supply Chain

Footprint(kg

CO2e / t) |

CORCs (kg

CO2e / t) |

|

100 |

1,350 |

13,500 |

120.00 |

12.41 |

107.59 |

|

200 |

59,720 |

597,200 |

120.00 |

17.38 |

102.62 |

|

300 |

129,200 |

1,292,000 |

120.00 |

22.35 |

97.65 |

|

400 |

301,460 |

3,014,600 |

120.00 |

27.32 |

92.68 |

It is important to note that the LCA was carried

out using 33-ton trucks for product shipping, while the standard

truck capacity in Brazil is 74 tons. This resulted in a significant

overestimation of transport emissions, as trucks with higher

capacity offer improved fuel consumption efficiency by reducing the

overall number of vehicles needed, thereby reducing total

emissions.

Verde’s ERW Carbon Capture

Potential

Scalable and cost-effective ERW carbon capture

projects depend on farmers' willingness to apply minerals on a

large scale over their farmland. In that sense, Verde's has

multiple advantages in ERW:

- The

Product has a fast dissolution rate, as evidenced by agronomic

trials and potassium release.

- The

Product is a source of essential macronutrients for plants, which

creates significant motivation for farmers to adopt them in place

of traditional chemical fertilizers;

- The

Product has NI 43-101 certified14 mineral reserves proving reliably

consistency in its mineralogy, carbon capture effectiveness and

absence of deleterious elements;

- The

Product is certified organic by several governmental and

non-governmental organizations, including some of the most

stringent global standards such as the Washington State Fertilizer

Registration and the California Department of Food &

Agriculture;

- The

Product undergo meticulous particle size control when of its

manufacturing process, guaranteeing a consistent particle size

distribution. This is advantageous because particle size is

essential for optimal carbon capture and its calculation.

Few carbon capture projects based on ERW

showcase all, if any, of the above advantages which are

consistently delivered by Verde.

About Verde AgriTech

Verde is an agricultural technology Company that

produces potash fertilizers. Our purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, we

make agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.15 Currently, the Company

is fully licensed to produce up to 2.8 million tons per year of its

multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®. In 2022, it became Brazil's

largest potash producer by capacity. Verde has a combined measured

and indicated mineral resource of 1.47 billion tons at 9.28% K2O

and an inferred mineral resource of 1.85 billion tons at 8.60% K2O

(using a 7.5% K2O cut-off grade).16 This amounts to 295.70 million

tons of potash in K2O. For context, in 2021 Brazil’s total

consumption of potash in K2O was 6.57 million17.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 97% of its potash needs. In 2022, potash accounted

for approximately 3% of all Brazilian imports by dollar

value.18

Corporate Presentation

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/kxdp27m8xprnhy9b

Investors Newsletter

Subscribe to receive the Company’s updates at:

http://bit.ly/InvestorNL-August2023

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

|

(i) |

the estimated amount and grade of Mineral Resources and Mineral

Reserves; |

|

(ii) |

the estimated amount of CO2 removal per tonne of rock; |

|

(iii) |

the PFS representing a viable development option for the

Project; |

|

(iv) |

estimates of the capital costs of constructing mine facilities and

bringing a mine into production, of sustaining capital and the

duration of financing payback periods; |

|

(v) |

the estimated amount of future production, both produced and

sold; |

|

(vi) |

timing of disclosure for the PFS and recommendations from the

Special Committee; |

|

(vii) |

the Company’s competitive position in Brazil and demand for potash;

and, |

|

(viii) |

estimates of operating costs and total costs, net cash flow, net

present value and economic returns from an operating mine. |

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

|

(i) |

the presence of and continuity of resources and reserves at the

Project at estimated grades; |

|

(ii) |

the estimation of CO2 removal based on the chemical and

mineralogical composition of assumed resources and reserves; |

|

(iii) |

the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations; |

|

(iv) |

the capacities and durability of various machinery and

equipment; |

|

(v) |

the availability of personnel, machinery and equipment at estimated

prices and within the estimated delivery times; |

|

(vi) |

currency exchange rates; |

|

(vii) |

Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed; |

|

(viii) |

appropriate discount rates applied to the cash flows in the

economic analysis; |

|

(ix) |

tax rates and royalty rates applicable to the proposed mining

operation; |

|

(x) |

the availability of acceptable financing under assumed structure

and costs; |

|

(xi) |

anticipated mining losses and dilution; |

|

(xii) |

reasonable contingency requirements; |

|

(xiii) |

success in realizing proposed operations; |

|

(xiv) |

receipt of permits and other regulatory approvals on acceptable

terms; and |

|

(xv) |

the fulfilment of environmental assessment commitments and

arrangements with local communities. |

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Lucas Brown, Vice-President of

Corporate Development

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.verde.ag | www.investor.verde.ag

1 Life-cycle assessment is a process of evaluating the effects

that a product has on the environment over the entire period of its

life thereby increasing resource-use efficiency and decreasing

liabilities. The LCA is a standardized, scientific method that can

be used to study the environmental impact of either a product or

the function the product is designed to perform. Source: European

Environment Agency. The terms "assessment" and "analysis" are used

interchangeably by different companies, but with the same

objective.2 For further information, please see:

https://lcadesign.ca/ 3 'Cradle-to-grave' assessment considers

impacts at each stage of a product's life-cycle, from the time

natural resources are extracted from the ground and processed

through each subsequent stage of manufacturing, transportation,

product use, and ultimately, disposal. Source: European Environment

Agency. 4 ISO (2006b), ISO 14040:2006, Environmental management –

Life cycle assessment – Principles and framework. ISO (2006c), ISO

14044: 2006, Environmental management – Life cycle assessment –

Requirements and guidelines.5 Puro Earth ERW Methodology (2022).

Puro Standard Edition 2022 V2.6 CO2 Removal Certificate (CORC) is

an electronic document, which records the Attributes of CO2 Removal

from registered Production Facilities. Each CORC represents a Net

Carbon Dioxide Removal (CDR) volume of 1 ton of Long-Term CO2

Removal, equivalent to 1 carbon credit. Source: Puro Earth, Puro

Standard General Rules, V3.1.7 The term CO2e is used to compare the

emissions from various greenhouse gases based upon their global

warming potential, normalized to the equivalent amount of CO2.

Source: UN-REDD Programme.8 See: “Railway to freight up to 50Mtpy

of Verde’s Product granted construction permit”.9 The CO2 emission

rate per kilometer for products transported by rail stands at

0.0220 kg of CO2 per ton, significantly lower than the 0.0497

kg of CO2 emitted per ton of products transported via road.

Sources: CO2 emission standard per kilometer for train transport

(Sphera Professional Database). CO2 emission standard per kilometer

for truck transport (EcoInvent Database, Brazil Dataset).10 1,000kg

of CO2 is equivalent to 1 CORC.11 See “Verde’s Products Remove

Carbon Dioxide From the Air”.12 Cradle-to-gate is the assessment of

a product’s life cycle from raw material extraction (cradle) to its

production facility gate. It does not include the carbon footprint

associated with product transportation to the final customer.

Source:

https://circularecology.com/glossary-of-terms-and-definitions.html

13 The potash market size was determined based on the potential

demand for K2O. This calculation was derived from the total planted

areas in Brazil in 2021 (Source: IBGE, 2022), considering the

typical dosages of potash fertilizers for the main crops: Cotton =

100 kg of K2O/ha; Coffee = 200 kg of K2O/ha; Soybean/Maize System =

150 kg of K2O/ha; Other Crops = 100 kg of K2O/ha.14 National

Instrument 43-101 Standards of Disclosure for Mineral Projects

within Canada.15 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r916 As per the

National Instrument 43-101 Standards of Disclosure for Mineral

Projects within Canada (“NI 43 -101”), filed on SEDAR in 2017. See

the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

17 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese).18

Source: Brazilian Comex Stat, available at:

http://comexstat.mdic.gov.br/en/geral

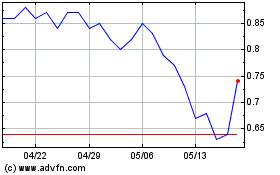

Verde Agritech (TSX:NPK)

過去 株価チャート

から 11 2024 まで 12 2024

Verde Agritech (TSX:NPK)

過去 株価チャート

から 12 2023 まで 12 2024