Goodfellow Inc. Renews Its Normal Course Issuer Bid

2024年11月18日 - 9:35PM

Goodfellow Inc. (TSX: GDL) (“Goodfellow” or the “Company”),

announced today that the Toronto Stock Exchange (the “TSX”) has

approved the notice filed by the Company to renew its normal course

issuer bid (“NCIB”) with respect to its common shares (the

“Shares”).

The notice provides that Goodfellow may, during

the 12-month period commencing November 20, 2024 and ending no

later than November 19, 2025, purchase up to 493,102 Shares,

representing approximately 10% of the Company’s public float. As at

November 11, 2024, a total of 8,465,654 Shares were issued and

outstanding and the public float was 4,931,022 Shares.

All Shares purchased under the NCIB will be

acquired on the open market, at times and in numbers to be

determined by the Company, at the prevailing market prices, plus

applicable brokerage fees, through the facilities of the TSX or

other designated exchanges or Canadian alternative trading systems,

and in accordance with the rules and policies of the TSX and

applicable securities laws, and cancelled. The Company may also

seek issuer bid exemption orders from securities regulators

allowing for purchases under private agreements, in which case

purchases may also be made in accordance with such exemptions, at a

discount to the market price.

The average daily trading volume of the Shares

on the TSX for the six-month period commencing on May 1, 2023 and

ending on October 31, 2024 is 3,052. Accordingly, pursuant to the

rules and policies of the TSX, daily purchases under the NCIB will

be limited to 1,000 Shares, except pursuant to certain prescribed

exceptions, including a weekly block purchase of Shares not owned

by insiders of the Company.

Goodfellow considers that the acquisition of

Shares for cancellation is a sound use of its funds. Decisions

regarding the actual number of Shares and timing of any purchases

or other actions in connection with the NCIB will be made by

Goodfellow based on various factors, including prevailing market

conditions and the Company’s capital and liquidity positions.

Goodfellow has also renewed its automatic share

purchase plan (“ASPP”) with a designated broker in connection with

the NCIB. The ASPP allows for the purchase for cancellation of

Shares, subject to certain trading parameters, by its designated

broker during times when Goodfellow would ordinarily not be active

in the market due to applicable regulatory restrictions or

self-imposed blackout periods. Outside these periods, Shares may be

repurchased by Goodfellow at its discretion under the NCIB.

There can be no assurances that Goodfellow will

purchase all or any of the number of Shares that are subject to the

NCIB referred to in this news release. Goodfellow may also suspend

or discontinue the NCIB at any time.

Under the Company’s current NCIB, which will

expire on November 19, 2024, the Company had received approval from

the TSX to purchase up to 426,157 Shares. As at November 11, 2024,

Goodfellow had repurchased 57,500 Shares under its current

NCIB in the last twelve months at an average weighted price of

$14.0449 per Share.

About

Goodfellow

Goodfellow is a diversified manufacturer of

value-added lumber products, as well as a wholesale distributor of

building materials and floor coverings. Goodfellow has a

distribution footprint from coast-to-coast in Canada servicing

commercial and residential sectors through lumber yard retailer

networks, manufacturers, industrial and infrastructure project

partners, and floor covering specialists. Goodfellow also leverages

its value-added product capabilities to serve lumber markets

internationally. Goodfellow Inc. is a publicly traded company, and

its shares are listed on the Toronto Stock Exchange under the

symbol “GDL”.

Forward-Looking Statements

This press release contains implicit and/or

explicit forward-looking statements relating, inter alia, to

objectives, strategies, priorities, goals, plans, financial

position, operating results, trends and activities of the Company

and its markets and industries. Forward-looking statements can be

identified by words such as: “believe,” “estimate,” “expect,”

“strategy,” “future,” “likely,” “may,” “should,” “will” and similar

references to future periods. Examples of forward-looking

statements include, among others, statements relating to the

repurchase of shares by the Company. Forward-looking statements are

neither historical facts nor assurances of future performance.

Instead, these statements are forward-looking to the extent that

they are based on expectations and on various assessments and

assumptions of the Company. Although it is believed that the

expectations reflected in the forward-looking statements contained

in this press release, and the assumptions on which such

forward-looking statements are made, are reasonable, there can be

no assurance that such expectations and assumptions will prove to

be correct. Some of these expectations and assumptions relate to

the state of the global economy and the economies of the regions in

which the Company operates; the level of demand for the Company’s

products including from its recurring client base, including

bookings from customers; prices and margins for its products;

competitors; reliability of supply chains; inflation; interest

rates; foreign currency fluctuations; overhead expenses; working

capital requirements and access to capital or funding to finance

same; the collection of accounts receivable; the availability and

sufficiency insurance coverage; the sufficiency and reliability of

the Company’s workforce; the successful management of environmental

and health and safety risk; the sufficiency, reliability and

effectiveness of information systems; the sufficiency, reliability

and effectiveness of internal and disclosure controls; and the

absence of adverse change in the Company’s regulatory environment

and legal proceedings. Readers are cautioned not to place undue

reliance on forward-looking statements included in this press

release, as there can be no assurance that the plans, intentions or

expectations upon which the forward-looking statements are based

will occur or prove to be accurate. Actual results could differ

significantly from the expectations of the management team if

recognized or unrecognized risks and uncertainties affect results

or if assessments or assumptions are inaccurate. These risks and

uncertainties include, among other things; the effects of general

economic and business conditions including the cyclical nature of

the Company’s business; industry competition; inflation, credit,

currency and interest rate risks; environmental risk; level of

demand and financial performance of the manufacturing industry;

competition from vendors; changes in customer demand; extent to

which the Company is successful in gaining new long-term

relationships with customers or retaining existing ones and the

level of service failures that could lead customers to use

competitors' services; increased customer bankruptcies; dependence

on key personnel; laws and regulation; information systems, cost

structure and working capital requirements; occurrence of

hostilities, political instability or catastrophic events and other

factors described in the Company’s public filings available at

www.sedarplus.ca. For these reasons, the Company cannot guarantee

the results of these forward-looking statements. The foregoing

risks and uncertainties are described in greater detail in the

latest annual and interim Management’s Discussion and Analysis of

the Company and its other public filings available at

www.sedarplus.ca. The Company disclaims any obligation to update or

revise these forward-looking statements, except as required by

applicable law.

|

From: |

Goodfellow

Inc. |

| |

Patrick Goodfellow |

| |

President and CEO |

| |

T: 450 635-6511 |

| |

F: 450 635-3730 |

| |

info@goodfellowinc.com |

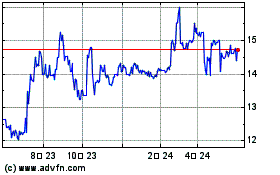

Goodfellow (TSX:GDL)

過去 株価チャート

から 11 2024 まで 12 2024

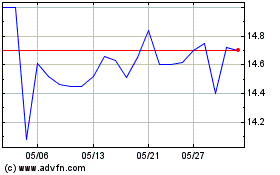

Goodfellow (TSX:GDL)

過去 株価チャート

から 12 2023 まで 12 2024