Tutor Perini Further Strengthens Balance Sheet with $100 Million Debt Paydown

2024年11月20日 - 8:00PM

ビジネスワイヤ(英語)

Tutor Perini Corporation (NYSE: TPC) (the “Company”), a leading

civil, building and specialty construction company, announced today

that the Company has pre-paid an additional $100 million of its

Term Loan B debt. Building on the paydown of $50 million of the

Term Loan B debt that was disclosed in the Company’s November 6,

2024 earnings release, Tutor Perini has now successfully

deleveraged its balance sheet by $150 million in the last month,

representing the upper end of its targeted debt reduction plan for

the fourth quarter of 2024.

As of November 20, 2024, the remaining principal balance of the

Term Loan B, after these recent paydowns, was approximately $123

million. The Company recently disclosed plans to pay down an

additional $50 million to $75 million of the Term Loan B debt in

the first quarter of 2025, and it now expects to pay down an amount

that exceeds the upper end of this range. All the debt repayments

mentioned above represent voluntary, early paydowns of the Term

Loan B debt.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private customers and

public agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget, while adhering to strict quality control measures. We offer

general contracting, pre-construction planning and comprehensive

project management services, including planning and scheduling of

manpower, equipment, materials and subcontractors required for a

project. We also offer self-performed construction services

including site work, concrete forming and placement, steel

erection, electrical, mechanical, plumbing and heating, ventilation

and air conditioning (HVAC).

Forward-Looking Statements

The statements contained in this release that are not purely

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding the Company’s expectations

regarding future repayment of debt. These forward-looking

statements are based on the Company’s current expectations and

beliefs concerning future developments and their potential impacts

on the Company. While the Company’s expectations, beliefs and

projections are expressed in good faith and the Company believes

there is a reasonable basis for them, there can be no assurance

that future developments affecting the Company will be those that

we have anticipated. These forward-looking statements involve a

number of risks, uncertainties (some of which are beyond the

control of the Company) or other assumptions that may cause actual

results or performance to be materially different from those

expressed or implied by such forward-looking statements. These

risks and uncertainties include, but are not limited to:

unfavorable outcomes of existing or future litigation or dispute

resolution proceedings against us or customers (project owners,

developers, general contractors, etc.), subcontractors or

suppliers, as well as failure to promptly recover significant

working capital invested in projects subject to such matters;

revisions of estimates of contract risks, revenue or costs,

economic factors such as inflation, the timing of new awards, or

the pace of project execution, which has resulted and may continue

to result in losses or lower than anticipated profit; contract

requirements to perform extra work beyond the initial project

scope, which has and in the future could result in disputes or

claims and adversely affect our working capital, profits and cash

flows; risks and other uncertainties associated with estimates and

assumptions used to prepare our financial statements; failure to

meet contractual schedule requirements, which could result in

higher costs and reduced profits or, in some cases, exposure to

financial liability for liquidated damages and/or damages to

customers, as well as damage to our reputation; an inability to

obtain bonding, which could have a negative impact on our

operations and results; possible systems and information technology

interruptions and breaches in data security and/or privacy;

inability to attract and retain our key officers, and to adequately

plan for their succession, and hire and retain personnel required

to execute and perform on our contracts; the impact of inclement

weather conditions, disasters and other catastrophic events outside

of our control on projects; risks related to our international

operations, such as uncertainty of U.S. government funding, as well

as economic, political, regulatory and other risks, including risks

of loss due to acts of war, labor conditions, and other

unforeseeable events in countries where we do business, which could

adversely affect our revenue and earnings; increased competition

and failure to secure new contracts; a significant slowdown or

decline in economic conditions, such as those presented during a

recession; decreases in the level of federal, state and local

government spending for infrastructure and other public projects;

client cancellations of, or reductions in scope under, contracts

reported in our backlog; risks related to government contracts and

related procurement regulations; significant fluctuations in the

market price of our common stock, which could result in substantial

losses for stockholders and potentially subject us to securities

litigation; failure of our joint venture partners to perform their

venture obligations, which could impose additional financial and

performance obligations on us, resulting in reduced profits or

losses and/or reputational harm; violations of the U.S. Foreign

Corrupt Practices Act and similar worldwide anti-bribery laws;

failure to meet our obligations under our debt agreements

(especially in a high interest rate environment); downgrades in our

credit ratings; public health crises, such as COVID-19, which have

adversely impacted, and could in the future adversely impact, our

business, financial condition and results of operations by, among

other things, delaying the timing of project bids and/or awards and

the timing of dispute resolutions and associated collections;

physical and regulatory risks related to climate change; impairment

of our goodwill or other indefinite-lived intangible assets; the

exertion of influence over the Company by our chairman and chief

executive officer due to his position and significant ownership

interest; and other risks and uncertainties discussed under the

heading “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023 filed on February 28, 2024 and in

other reports that we file with the Securities and Exchange

Commission from time to time. The Company undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120392466/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations and Corporate Communications

www.tutorperini.com

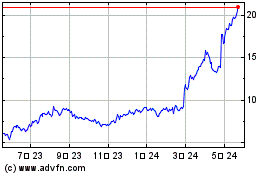

Tutor Perini (NYSE:TPC)

過去 株価チャート

から 12 2024 まで 1 2025

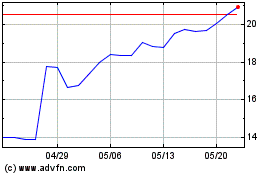

Tutor Perini (NYSE:TPC)

過去 株価チャート

から 1 2024 まで 1 2025