0000064040FALSE00000640402024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: July 30, 2024

S&P Global Inc.

(Exact Name of Registrant as specified in its charter)

| | | | | | | | |

| New York | 1-1023 | 13-1026995 |

| (State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employer Identification No.) |

55 Water Street, New York, New York 10041

(Address of Principal Executive Offices) (Zip Code)

(212) 438-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | |

| Title of each class | Trading Symbol | Name of Exchange on which registered | | |

| Common stock (par value $1.00 per share) | SPGI | New York Stock Exchange | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 and 7.01. Results of Operations and Financial Condition and Regulation FD Disclosure

On July 30, 2024, S&P Global Inc. (the “Registrant”) issued an earnings release containing a discussion of the Registrant’s results of operations and financial condition for the second quarter ended June 30, 2024, as well as certain guidance for 2024.

The earnings release is attached as Exhibit 99 to this Form 8-K and is incorporated by reference in this Item 2.02 and Item 7.01. Pursuant to general instruction B.2 to Form 8-K, the information furnished pursuant to Items 2.02 and 7.01, including Exhibit 99, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

The information in this Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are furnished with this report:

(104) Cover Page Interactive Data File (formatted as Inline XBRL).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 8-K Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| S&P Global Inc. | | |

| | | | |

| | /s/ | Alma Rosa Montanez | | |

| | By: | Alma Rosa Montanez | |

| | | Assistant Corporate Secretary & Chief Corporate Counsel | |

| | | | |

Dated: July 30, 2024

| | | | | |

|

55 Water Street New York, NY 10041 www.spglobal.com

Press Release For Immediate Release |

S&P Global Reports Second Quarter Results

New York, NY, July 30, 2024 – S&P Global (NYSE: SPGI) today reported second quarter results. This earnings release and supplemental materials are available at http://investor.spglobal.com/Quarterly-Earnings.

The Company reported second quarter 2024 revenue of $3.549 billion, an increase of 14% compared to the second quarter of 2023. Second quarter GAAP net income increased 98% to $1.011 billion and GAAP diluted earnings per share increased 102% to $3.23 as higher net income was driven primarily by strong growth in Ratings and Indices. Excluding the impact of Engineering Solutions (ES), revenue growth would have been 16% year over year. Adjusted net income for the second quarter increased 27% to $1.267 billion and adjusted diluted earnings per share increased 30% to $4.04.

On June 27, 2024, the Company announced that Douglas L. Peterson will retire as President and CEO effective November 1, 2024. Martina Cheung was unanimously selected by the Board as the next President and CEO. Ms. Cheung is currently serving as President of S&P Global Ratings. As previously announced, Yann Le Pallec will succeed Ms. Cheung as President of S&P Global Ratings, also effective November 1, 2024.

Notable transactions announced or completed include the Visible Alpha acquisition, which closed on May 1, 2024, and the announced divestiture of Fincentric, which is expected to be completed in the third quarter. The financial impact of all such transactions are fully contemplated in the Company's updated guidance, issued today.

| | | | | | | | | | | | | | |

•Quarterly revenue achieved a new record of $3.549 billion, increasing 14% year over year.

•GAAP operating margin increased over 1,100 basis points and adjusted operating margin increased 450 basis points, driving 102% growth in GAAP EPS and 30% growth in adjusted EPS, respectively, year over year.

•The Company expects to execute additional accelerated share repurchases (ASR) totaling $1.5 billion in the coming weeks.

•The Company is raising full-year 2024 guidance. Guidance now calls for revenue growth of 8.0% - 10.0%, GAAP diluted EPS in the range of $11.15 - $11.40, and adjusted diluted EPS in the range of $14.35 - $14.60. |

"Our second quarter results demonstrate the power of S&P Global's strategy and the ability to quickly respond to dynamic markets and create value for our customers.

In the current uncertain macro landscape, we delivered record revenue, significant operating margin expansion on both a GAAP and adjusted basis, and significant outperformance against our internal expectations on both GAAP and adjusted EPS.

I am very proud of what our teams have accomplished in the first half of this year, and what we have delivered for customers, shareholders, and our people. I'm also proud of the performance of this incredible company I've had the privilege to lead over the past 11 years." Douglas Peterson President and CEO | | | |

| | |

Second Quarter 2024 Revenue |

| | | | | | | | |

| | Second quarter revenue increased 14% and revenue excluding Engineering Solutions increased 16%, driven by growth in all divisions. Revenue from subscription products increased 8%, excluding Engineering Solutions.

(1) Total revenue includes the impact of inter-segment eliminations of $41M and $46M, and a contribution from Engineering Solutions of $33M and $0 in 2Q '23 and 2Q '24, respectively. |

| | |

Second Quarter 2024 Operating Profit, Expense, and Operating Margin |

Note: All presentations of revenue above refer to GAAP revenue. Adjusted financials refer to non-GAAP adjusted metrics in all periods.

The Company’s second quarter reported operating profit margin increased by over 1,100 basis points to 40.9%, primarily due to a $119 million loss on disposition recognized as an operating loss in the second quarter of 2023. Adjusted operating profit margin increased 450 basis points to 50.7%, primarily due to revenue growth in our Ratings and Indices divisions.

| | |

Second Quarter 2024 Diluted Earnings Per Share |

| | | | | | | | | | | |

| 2Q '24 | 2Q '23 | y/y change |

| GAAP Diluted EPS | $3.23 | $1.60 | 102% |

| Adjusted Diluted EPS | $4.04 | $3.12 | 30% |

Second quarter GAAP diluted earnings per share increased 102% to $3.23 primarily due to a 98% increase in net income, and a 2% reduction in diluted shares outstanding.

Adjusted diluted earnings per share increased 30% to $4.04 due to a 27% increase in adjusted net income and a 2% decrease in diluted shares outstanding. Currency positively impacted adjusted diluted EPS by $0.03. The largest non-core adjustments to earnings in the second quarter of 2024 were for deal-related amortization and merger-related costs.

| | | | | | | | |

| GAAP | Adjusted |

| Revenue growth | 8.0% - 10.0% | 8.0% - 10.0% |

| Corporate unallocated expense | $225 - $235 million | $165 - $175 million |

| Deal-related amortization | $1.125 - $1.135 billion | $1.125 - $1.135 billion |

| Operating profit margin expansion | 500 - 550 bps | 125 - 175 bps |

| Interest expense, net | $315 - $325 million | $340 - $350 million |

| Tax rate | 21.0% - 22.0% | 21.5% - 22.5% |

| Diluted EPS | $11.15 - $11.40 | $14.35 - $14.60 |

| Capital expenditures | $180 - $190 million | $180 - $190 million |

In addition to the above, the Company expects 2024 cash provided by operating activities, less capital expenditures and distributions to noncontrolling interest holders, of ~$4.4 billion, compared to prior expectation of ~$4.2 billion, as a result of higher net income expectations. The Company expects adjusted free cash flow, excluding certain items, of ~$4.7 billion, compared to prior guidance of ~$4.5 billion, also as a result of higher expected net income.

The Company is slightly increasing GAAP and adjusted deal-related amortization guidance by $30 million to reflect the Visible Alpha acquisition. The Company's updated guidance for revenue growth is 200 bps higher than the previous guidance range, given the strong performance in the second quarter. Corporate unallocated expense is expected to be approximately $5 million higher on a GAAP and adjusted basis, compared to prior guidance, due primarily to increased incentive compensation. The Company is reiterating GAAP operating margin guidance. Adjusted operating margin is expected to expand 125 - 175 bps compared to prior guidance of approximately 100 - 150 bps. GAAP and adjusted interest expense, net are each expected to be approximately $10 million lower than prior guidance due to higher expected interest income on cash balances. As a result of the higher expected revenue, GAAP diluted EPS is expected to be approximately $0.35 higher than previous guidance range. As a result of the higher expected revenue and operating margin, adjusted diluted EPS is expected to be approximately $0.50 higher than previous guidance range. The Company now expects lower GAAP and adjusted capital expenditures compared to prior guidance of approximately $185 - $195 million. The Company is reiterating GAAP and adjusted tax rate guidance.

GAAP and non-GAAP adjusted guidance include the impact of the Visible Alpha acquisition, the assumed divestiture of Fincentric in the third quarter, and contribution from completed divestitures in all periods. Non-GAAP adjusted guidance excludes merger-related costs and amortization of intangibles related to acquisitions.

Capital Return: For the full year 2024, the Company expects to return approximately 85% of adjusted free cash flow to shareholders through dividends and share repurchases. The Board of Directors has authorized a quarterly cash dividend of $0.91. The Company expects to execute additional accelerated share repurchases (ASR) totaling $1.5 billion in the coming weeks.

Supplemental Information/Conference Call/Webcast Details: The Company’s senior management will review the second quarter 2024 earnings results on a conference call scheduled for today, July 30, at 8:30 a.m. EDT. Additional information presented on the conference call, as well as the Company’s Supplemental slide content may be found on the Company’s Investor Relations Website at http://investor.spglobal.com/Quarterly-Earnings.

The Webcast will be available live and in replay at http://investor.spglobal.com/Quarterly-Earnings. (Please copy and paste URL into Web browser.)

Telephone access is available. U.S. participants may call (888) 603-9623; international participants may call +1 (630) 395-0220 (long-distance charges will apply). The passcode is “S&P Global” and the conference leader is Douglas Peterson. A recorded telephone replay will be available approximately two hours after the meeting concludes and will remain available until August 30, 2024. U.S. participants may call (800) 839-1171; international participants may call +1 (203) 369-3030 (long-distance charges will apply). No passcode is required.

Comparison of Adjusted Information to U.S. GAAP Information: The Company reports its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). The Company also refers to and presents certain additional non-GAAP financial measures, within the meaning of Regulation G under the Securities Exchange Act of 1934. These measures are: adjusted net income; adjusted diluted EPS; adjusted operating profit and margin; adjusted expenses; adjusted corporate unallocated expense; adjusted deal-related amortization; adjusted interest expense, net; adjusted provision for income taxes; adjusted effective tax rate; and cash provided by operating activities, less capital expenditures and distributions to noncontrolling interest holders, free cash flow, and adjusted free cash flow excluding certain items.

The Company has included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP on Exhibits 5, 7, and 8. The Company is not able to provide reconciliations of certain forward-looking non-GAAP financial measures to comparable GAAP measures because certain items required for such reconciliations are outside of the Company's control and/or cannot be reasonably predicted without unreasonable effort.

The Company's non-GAAP measures include adjustments that reflect how management views our businesses. The Company believes these non-GAAP financial measures provide useful supplemental information that, in the case of non-GAAP financial measures other than cash provided by operating activities, less capital expenditures and distributions to noncontrolling interest holders; free cash flow; and adjusted free cash flow excluding certain items, enables investors to better compare the Company's performance across periods, and management also uses these measures internally to assess the operating performance of its business, to assess performance for employee compensation purposes and to decide how to allocate resources. The Company believes that the presentation of cash provided by operating activities, less capital expenditures and distributions to noncontrolling interest holders; free cash flow; and adjusted free cash flow excluding certain items allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management and that such measures are useful in evaluating the cash available to us to prepay debt, make strategic acquisitions and investments, and repurchase stock. However, investors should not consider any of these non-GAAP measures in isolation from, or as a substitute for, the financial information that the Company reports.

Forward-Looking Statements: This press release contains “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s current views concerning future events, trends, contingencies or results, appear at various places in this press release and use words like “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would.” For example, management may use forward-looking statements when addressing topics such as: the outcome of contingencies; future actions by regulators; changes in the Company’s business strategies and methods of generating revenue; the development and performance of the Company’s services and products; the expected impact of acquisitions and dispositions; the Company’s effective tax rates; and the Company’s cost structure, dividend policy, cash flows or liquidity.

Forward-looking statements are subject to inherent risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements include, among other things:

▪worldwide economic, financial, political, and regulatory conditions (including slower GDP growth or recession, instability in the banking sector and inflation), and factors that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, public health crises (e.g., pandemics), geopolitical uncertainty (including military conflict), and conditions that may result from legislative, regulatory, trade and policy changes;

▪the volatility and health of debt, equity, commodities, energy and automotive markets, including credit quality and spreads, the level of liquidity and future debt issuances, demand for investment products that track indices and assessments and trading volumes of certain exchange traded derivatives;

▪the demand and market for credit ratings in and across the sectors and geographies where the Company operates;

▪the Company’s ability to maintain adequate physical, technical and administrative safeguards to protect the security of confidential information and data, and the potential for a system or network disruption that results in regulatory penalties and remedial costs or improper disclosure of confidential information or data;

▪the outcome of litigation, government and regulatory proceedings, investigations and inquiries;

▪concerns in the marketplace affecting the Company’s credibility or otherwise affecting market perceptions of the integrity or utility of independent credit ratings, benchmarks, indices and other services;

▪our ability to attract, incentivize and retain key employees, especially in a competitive business environment;

▪the Company’s exposure to potential criminal sanctions or civil penalties for noncompliance with foreign and U.S. laws and regulations that are applicable in the jurisdictions in which it operates, including sanctions laws relating to countries such as Iran, Russia and Venezuela, anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act of 2010, and local laws prohibiting corrupt payments to government officials, as well as import and export restrictions;

▪the continuously evolving regulatory environment in Europe, the United States and elsewhere around the globe affecting each of our businesses and the products they offer, and our compliance therewith;

▪the Company’s ability to make acquisitions and dispositions and successfully integrate the businesses we acquire;

▪consolidation of the Company’s customers, suppliers or competitors;

▪the introduction of competing products or technologies by other companies;

▪our ability to develop new products or technologies, to integrate our products with new technologies (e.g., artificial intelligence), or to compete with new products or technologies offered by new or existing competitors;

▪the effect of competitive products and pricing, including the level of success of new product developments and global expansion;

▪the impact of customer cost-cutting pressures;

▪a decline in the demand for our products and services by our customers and other market participants;

▪the ability of the Company, and its third-party service providers, to maintain adequate physical and technological infrastructure;

▪the Company’s ability to successfully recover from a disaster or other business continuity problem, such as an earthquake, hurricane, flood, civil unrest, protests, military conflict, terrorist attack, outbreak of pandemic or contagious diseases, security breach, cyber attack, data breach, power loss, telecommunications failure or other natural or man-made event;

▪the level of merger and acquisition activity in the United States and abroad;

▪the level of the Company’s future cash flows and capital investments;

▪the impact on the Company’s revenue and net income caused by fluctuations in foreign currency exchange rates; and

▪the impact of changes in applicable tax or accounting requirements on the Company.

The factors noted above are not exhaustive. The Company and its subsidiaries operate in a dynamic business environment in which new risks emerge frequently. Accordingly, the Company cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made, except as required by applicable law. Further information about the Company’s businesses, including information about factors that could materially affect its results of operations and financial condition, is contained in the Company’s filings with the SEC, including Item 1A, Risk Factors in our most recently filed Annual Report on Form 10-K.

About S&P Global

S&P Global (NYSE: SPGI) provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through sustainability and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today.

Investor Relations: http://investor.spglobal.com

Contact:

Investor Relations:

Mark Grant

Senior Vice President, Investor Relations

Tel: +1 (347) 640-1521

mark.grant@spglobal.com

Media:

Christina Twomey

Global Head of Communications

Tel: +1 (410) 382-3316

christina.twomey@spglobal.com

Josh Goldstein

Director, Communications

Tel: +1 (202) 383-2041

josh.goldstein@spglobal.com

###

S&P Global

Condensed Consolidated Statements of Income

Three and six months ended June 30, 2024 and 2023

(dollars in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | Three Months | Six Months |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | |

| Revenue | | $ | 3,549 | | | $ | 3,101 | | | 14% | | | $ | 7,040 | | | $ | 6,261 | | | 12% | |

| Expenses | | 2,110 | | | 2,082 | | | 1% | | | 4,222 | | | 4,161 | | | 1% | |

| Loss on dispositions, net | | — | | | 119 | | | N/M | | | — | | | 69 | | | N/M | |

| Equity in income on unconsolidated subsidiaries | | (13) | | | (11) | | | 15% | | | (19) | | | (25) | | | (24)% | |

| Operating profit | | 1,452 | | | 911 | | | 59% | | | 2,837 | | | 2,056 | | | 38% | |

| Other income, net | | (3) | | | (11) | | | 72% | | | (13) | | | — | | | N/M | |

| Interest expense, net | | 77 | | | 88 | | | (13)% | | | 156 | | | 174 | | | (11)% | |

| | | | | | | | | | | | | | |

| Income before taxes on income | | 1,378 | | | 834 | | | 65% | | | 2,694 | | | 1,882 | | | 43% | |

| Provision for taxes on income | | 293 | | | 259 | | | 13% | | | 540 | | | 447 | | | 21% | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income | | 1,085 | | | 575 | | | 89% | | | 2,154 | | | 1,435 | | | 50% | |

| Less: net income attributable to noncontrolling interests | | (74) | | | (64) | | | (16)% | | | (152) | | | (130) | | | (17)% | |

| | | | | | | | | | | | | | |

| Net income attributable to S&P Global Inc. | | $ | 1,011 | | | $ | 511 | | | 98% | | | $ | 2,002 | | | $ | 1,305 | | | 53% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Earnings per share attributable to S&P Global Inc. common shareholders: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net income: | | | | | | | | | | | | | | |

| Basic | | $ | 3.23 | | | $ | 1.60 | | | N/M | | | $ | 6.39 | | | $ | 4.08 | | | 57% | |

| Diluted | | $ | 3.23 | | | $ | 1.60 | | | N/M | | | $ | 6.38 | | | $ | 4.07 | | | 57% | |

| | | | | | | | | | | | | | |

Weighted-average number of common shares outstanding: | | | | | | | | | | | | | | |

| Basic | | 313.0 | | | 319.3 | | | | | | 313.3 | | | 320.3 | | | | |

| Diluted | | 313.2 | | | 319.8 | | | | | | 313.6 | | | 320.9 | | | | |

| | | | | | | | | | | | | | |

| Actual shares outstanding at period end | | | | | | | | | 313.0 | | | 318.2 | | | | |

| | | | | | | | | | | | | | | |

N/M - Represents a change equal to or in excess of 100% or not meaningful

Note - % change in the tables throughout the exhibits are calculated off of the actual number, not the rounded number presented.

S&P Global

Condensed Consolidated Balance Sheets

June 30, 2024 and December 31, 2023

(dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | June 30, | | | December 31, | |

| | 2024 | | | 2023 | |

| | | | | | | |

| Assets: | | | | | | |

| Cash, cash equivalents, and restricted cash | | $ | 2,039 | | | | $ | 1,291 | | |

| Other current assets | | 3,541 | | | | 3,852 | | |

Assets of a business held for sale 1 | | 62 | | | | — | | |

| Total current assets | | 5,642 | | | | 5,143 | | |

| Property and equipment, net | | 248 | | | | 258 | | |

| Right of use assets | | 372 | | | | 379 | | |

| Goodwill and other intangible assets, net | | 52,074 | | | | 52,248 | | |

| Equity investments in unconsolidated subsidiaries | | 1,795 | | | | 1,787 | | |

| Other non-current assets | | 825 | | | | 774 | | |

| Total assets | | $ | 60,956 | | | | $ | 60,589 | | |

| | | | | | | |

| Liabilities and Equity: | | | | | | |

| Short-term debt | | $ | 4 | | | | $ | 47 | | |

| Unearned revenue | | 3,406 | | | | 3,461 | | |

| Other current liabilities | | 2,077 | | | | 2,617 | | |

Liabilities of a business held for sale 1 | | 13 | | | | — | | |

| Long-term debt | | 11,401 | | | | 11,412 | | |

| Lease liabilities — non-current | | 515 | | | | 541 | | |

| Deferred tax liability — non-current | | 3,540 | | | | 3,690 | | |

| Pension, other postretirement benefits and other non-current liabilities | | 1,016 | | | | 721 | | |

| Total liabilities | | 21,972 | | | | 22,489 | | |

| Redeemable noncontrolling interests | | 4,014 | | | | 3,800 | | |

| Total equity | | 34,970 | | | | 34,300 | | |

| Total liabilities and equity | | $ | 60,956 | | | | $ | 60,589 | | |

| | | | | | | |

1 Includes Fincentric as of June 30, 2024.

S&P Global

Condensed Consolidated Statements of Cash Flows

Six months ended June 30, 2024 and 2023

(dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | 2024 | | | 2023 | |

| | | | | | | |

| Operating Activities: | | | | | | |

| Net income | | $ | 2,154 | | | | $ | 1,435 | | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | | | |

| Depreciation | | 48 | | | | 49 | | |

| Amortization of intangibles | | 531 | | | | 522 | | |

| Deferred income taxes | | (162) | | | | (384) | | |

| Stock-based compensation | | 82 | | | | 97 | | |

| Loss on dispositions, net | | — | | | | 69 | | |

| | | | | | |

| | | | | | |

| Other | | 134 | | | | 56 | | |

| | | | | | |

| Net changes in other operating assets and liabilities | | (283) | | | | (481) | | |

| Cash provided by operating activities | | 2,504 | | | | 1,363 | | |

| | | | | | |

| Investing Activities: | | | | | | |

| Capital expenditures | | (56) | | | | (59) | | |

| Acquisitions, net of cash acquired | | (261) | | | | (286) | | |

| Proceeds from dispositions, net | | (4) | | | | 1,002 | | |

| Changes in short-term investments | | 2 | | | | (1) | | |

| Cash (used for) provided by investing activities | | (319) | | | | 656 | | |

| | | | | | |

| Financing Activities: | | | | | | |

| Additions to short-term debt, net | | — | | | | 552 | | |

| | | | | | |

| Payments on senior notes | | (47) | | | | — | | |

| Dividends paid to shareholders | | (572) | | | | (578) | | |

| | | | | | |

| Distributions to noncontrolling interest holders, net | | (133) | | | | (140) | | |

| | | | | | |

| Repurchase of treasury shares | | (500) | | | | (1,501) | | |

| Contingent consideration payments, employee withholding tax on share-based payments and exercise of stock options | | (153) | | | | (80) | | |

| Cash used for financing activities | | (1,405) | | | | (1,747) | | |

| Effect of exchange rate changes on cash | | (32) | | | | 3 | | |

| | | | | | |

| | | | | | |

| Net change in cash, cash equivalents, and restricted cash | | 748 | | | | 275 | | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 1,291 | | | | 1,287 | | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 2,039 | | | | $ | 1,562 | | |

| | | | | | | |

S&P Global

Operating Results by Segment

Three and six months ended June 30, 2024 and 2023

(dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | Three Months | Six Months |

| | Revenue | | | Revenue | |

| | | | | | | | | | | | | | | |

| | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | |

| Market Intelligence | | $ | 1,155 | | | $ | 1,079 | | | 7% | | | $ | 2,297 | | | $ | 2,150 | | | 7% | |

| Ratings | | 1,135 | | | 851 | | | 33% | | | 2,197 | | | 1,675 | | | 31% | |

| Commodity Insights | | 516 | | | 462 | | | 12% | | | 1,075 | | | 970 | | | 11% | |

| Mobility | | 400 | | | 369 | | | 8% | | | 786 | | | 727 | | | 8% | |

| Indices | | 389 | | | 348 | | | 12% | | | 776 | | | 689 | | | 13% | |

| Engineering Solutions | | — | | | 33 | | | N/M | | | — | | | 133 | | | N/M | |

| | | | | | | | | | | | | | |

| Intersegment Elimination | | (46) | | | (41) | | | (12)% | | | (91) | | | (83) | | | (9)% | |

| Total revenue | | $ | 3,549 | | | $ | 3,101 | | | 14% | | | $ | 7,040 | | | $ | 6,261 | | | 12% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Expenses | | | Expenses | |

| | | | | | | | | | | | | | |

| | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | |

| Market Intelligence (a) | | $ | 925 | | | $ | 903 | | | 2% | | | $ | 1,878 | | | $ | 1,746 | | | 8% | |

| Ratings (b) | | 410 | | | 365 | | | 12% | | | 793 | | | 713 | | | 11% | |

| Commodity Insights (c) | | 310 | | | 306 | | | 1% | | | 643 | | | 627 | | | 2% | |

| Mobility (d) | | 320 | | | 301 | | | 6% | | | 635 | | | 594 | | | 7% | |

| Indices (e) | | 126 | | | 122 | | | 4% | | | 242 | | | 225 | | | 8% | |

| Engineering Solutions (f) | | — | | | 29 | | | N/M | | | — | | | 114 | | | N/M | |

| Corporate Unallocated expense (g) | | 65 | | | 216 | | | (70)% | | | 122 | | | 294 | | | (58)% | |

| Equity in Income on Unconsolidated Subsidiaries (h) | | (13) | | | (11) | | | (15)% | | | (19) | | | (25) | | | 24% | |

| Intersegment Elimination | | (46) | | | (41) | | | (12)% | | | (91) | | | (83) | | | (9)% | |

| Total expenses | | $ | 2,097 | | | $ | 2,190 | | | (4)% | | | $ | 4,203 | | | $ | 4,205 | | | —% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | Operating Profit | | | Operating Profit | |

| | | | | | | | | | | | | | | |

| | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | |

| Market Intelligence (a) | | $ | 230 | | | $ | 176 | | | 31% | | | $ | 419 | | | $ | 404 | | | 4% | |

| Ratings (b) | | 725 | | | 486 | | | 49% | | | 1,404 | | | 962 | | | 46% | |

| Commodity Insights (c) | | 206 | | | 156 | | | 32% | | | 432 | | | 343 | | | 26% | |

| Mobility (d) | | 80 | | | 68 | | | 17% | | | 151 | | | 133 | | | 13% | |

| Indices (e) | | 263 | | | 226 | | | 16% | | | 534 | | | 464 | | | 15% | |

| Engineering Solutions (f) | | — | | | 4 | | | N/M | | | — | | | 19 | | | N/M | |

| Total reportable segments | | 1,504 | | | 1,116 | | | 35% | | | 2,940 | | | 2,325 | | | 26% | |

| Corporate Unallocated expense (g) | | (65) | | | (216) | | | 70% | | | (122) | | | (294) | | | 58% | |

| Equity in Income on Unconsolidated Subsidiaries (h) | | 13 | | | 11 | | | 15% | | | 19 | | | 25 | | | (24)% | |

| Total operating profit | | $ | 1,452 | | | $ | 911 | | | 59% | | | $ | 2,837 | | | $ | 2,056 | | | 38% | |

| | | | | | | | | | | | | | | |

N/M - Represents a change equal to or in excess of 100% or not meaningful

(a) The three and six months ended June 30, 2024 include a net acquisition-related benefit of $11 million and $8 million, respectively, IHS Markit merger costs of $9 million and $20 million, respectively, and employee severance charges of $4 million and $35 million, respectively. The three and six months ended June 30, 2023 include employee severance charges of $16 million and $22 million, respectively, IHS Markit merger costs of $12 million and $25 million, respectively, and an asset impairment of $5 million. The six months ended June 30, 2023 include a gain on disposition of $46 million. Additionally, amortization of intangibles from acquisitions of $147 million and $140 million is included for the three months ended June 30, 2024 and 2023, respectively, and $288 million and $281 million for the six months ended June 30, 2024 and 2023, respectively.

(b) The three and six months ended June 30, 2024 include legal costs of $20 million. The six months ended June 30, 2024 also include employee severance charges of $2 million. The three and six months ended June 30, 2023 include employee severance charges of $4 million and $5 million, respectively. Additionally, amortization of intangibles from acquisitions of $2 million is included for the three months ended June 30, 2024 and 2023, and $9 million and $4 million for the six months ended June 30, 2024 and 2023, respectively.

(c) The three and six months ended June 30, 2024 include IHS Markit merger costs of $5 million and $10 million, respectively, an asset write-off of $1 million and disposition-related costs of $1 million. The three and six months ended June 30, 2023 include employee severance charges of $14 million and $15 million, respectively, and IHS Markit merger costs of $8 million and $20 million, respectively. Additionally, amortization of intangibles from acquisitions of $32 million and $33 million is included for the three months ended June 30, 2024 and 2023, respectively, and $65 million and $66 million for the six months ended June 30, 2024 and 2023, respectively.

(d) The three and six months ended June 30, 2024 include employee severance charges of $6 million, IHS Markit merger costs of $1 million, and acquisition-related costs of $1 million. The three and six months ended June 30, 2023 include employee severance charges of $3 million and $4 million, respectively, and acquisition-related costs of $1 million. The six months ended June 30, 2023 include IHS Markit merger costs of $1 million. Additionally, amortization of intangibles from acquisitions of $76 million is included for the three months ended June 30, 2024 and 2023, and $151 million and $150 million for the six months ended June 30, 2024 and 2023, respectively.

(e) The three and six months ended June 30, 2024 include IHS Markit merger costs of $2 million and $3 million, respectively, and a loss on disposition of $1 million. The six months ended June 30, 2024 include employee severance charges of $1 million. The three and six months ended June 30, 2023 include employee severance charges of $2 million and $3 million, respectively, and IHS Markit merger costs of $1 million and $2 million, respectively. The six months ended June 30, 2023 include a gain on disposition of $4 million. Additionally, amortization of intangibles from acquisitions of $9 million is included for the three months ended June 30, 2024 and 2023, and $18 million for the six months ended June 30, 2024 and 2023.

(f) As of May 2, 2023, we completed the sale of Engineering Solutions and the results are included through that date. Amortization of intangibles from acquisitions of $1 million is included for the six months ended June 30, 2023.

(g) The three and six months ended June 30, 2024 include IHS Markit merger costs of $20 million and $38 million, respectively, acquisition-related costs of $6 million and $7 million, respectively, disposition-related costs of $2 million and $3 million, respectively, and a gain on disposition of $2 million. The six months ended June 30, 2024 includes employee severance charges of $2 million and recovery of lease-related costs of $1 million. The three and six months ended June 30, 2023 include a loss on disposition of $120 million, IHS Markit merger costs of $30 million and $66 million, respectively, lease impairments of $15 million, employee severance charges of $12 million and $14 million, respectively, disposition-related costs of $3 million and $16 million, respectively, and acquisition-related costs of $1 million and $2 million, respectively. Additionally, amortization of intangibles from acquisitions of $1 million is included for the three months ended June 30, 2024 and 2023, and $1 million and $2 million for the six months ended June 30, 2024 and 2023, respectively.

(h) Amortization of intangibles from acquisitions of $14 million is included for the three months ended June 30, 2024 and 2023, and $28 million for the six months ended June 30, 2024 and 2023.

S&P Global

Operating Results - Reported vs. Adjusted

Non-GAAP Financial Information

Three and six months ended June 30, 2024 and 2023

(dollars in millions, except per share amounts)

Adjusted Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | | Six Months |

| | | 2024 | | 2023 | | % Change | | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | | |

| Market Intelligence | Expenses | | $ | 925 | | | $ | 903 | | | 2% | | | | $ | 1,878 | | | $ | 1,746 | | | 8% | |

| Non-GAAP adjustments (a) | | (3) | | | (33) | | | | | | | (47) | | | (7) | | | | |

| Deal-related amortization | | (147) | | | (140) | | | | | | | (288) | | | (281) | | | | |

| | | | | | | | | | | | | | | |

| Adjusted expenses | | $ | 775 | | | $ | 730 | | | 6% | | | | $ | 1,543 | | | $ | 1,458 | | | 6% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Ratings | Expenses | | $ | 410 | | | $ | 365 | | | 12% | | | | $ | 793 | | | $ | 713 | | | 11% | |

| Non-GAAP adjustments (b) | | (20) | | | (4) | | | | | | | (22) | | | (5) | | | | |

| Deal-related amortization | | (2) | | | (2) | | | | | | | (9) | | | (4) | | | | |

| Adjusted expenses | | $ | 388 | | | $ | 360 | | | 8% | | | | $ | 762 | | | $ | 704 | | | 8% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Commodity Insights | Expenses | | $ | 310 | | | $ | 306 | | | 1% | | | | $ | 643 | | | $ | 627 | | | 2% | |

| Non-GAAP adjustments (c) | | (6) | | | (22) | | | | | | | (12) | | | (36) | | | | |

| Deal-related amortization | | (32) | | | (33) | | | | | | | (65) | | | (66) | | | | |

| | | | | | | | | | | | | | | |

| Adjusted expenses | | $ | 272 | | | $ | 251 | | | 8% | | | | $ | 567 | | | $ | 525 | | | 8% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Mobility | Expenses | | $ | 320 | | | $ | 301 | | | 6% | | | | $ | 635 | | | $ | 594 | | | 7% | |

| Non-GAAP adjustments (d) | | (8) | | | (4) | | | | | | | (9) | | | (6) | | | | |

| Deal-related amortization | | (76) | | | (76) | | | | | | | (151) | | | (150) | | | | |

| Adjusted expenses | | $ | 236 | | | $ | 220 | | | 7% | | | | $ | 475 | | | $ | 438 | | | 8% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Indices | Expenses | | $ | 126 | | | $ | 122 | | | 4% | | | | $ | 242 | | | $ | 225 | | | 8% | |

| Non-GAAP adjustments (e) | | (3) | | | (3) | | | | | | | (5) | | | (1) | | | | |

| Deal-related amortization | | (9) | | | (9) | | | | | | | (18) | | | (18) | | | | |

| Adjusted expenses | | $ | 114 | | | $ | 110 | | | 4% | | | | $ | 219 | | | $ | 206 | | | 7% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Engineering Solutions | Expenses | | $ | — | | | $ | 29 | | | N/M | | | | $ | — | | | $ | 114 | | | N/M | |

| | | | | | | | | | | | | | | |

| Deal-related amortization | | — | | | — | | | | | | | — | | | (1) | | | | |

| Adjusted expenses | | $ | — | | | $ | 29 | | | N/M | | | | $ | — | | | $ | 113 | | | N/M | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Corporate Unallocated Expense | Corporate Unallocated expense | | $ | 65 | | | $ | 216 | | | (70)% | | | | $ | 122 | | | $ | 294 | | | (58)% | |

| Non-GAAP adjustments (f) | | (27) | | | (180) | | | | | | | (47) | | | (232) | | | | |

| Deal-related amortization | | (1) | | | (1) | | | | | | | (1) | | | (2) | | | | |

| Adjusted Corporate Unallocated expenses | | $ | 38 | | | $ | 35 | | | 8% | | | | $ | 74 | | | $ | 61 | | | 22% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Equity in Income on Unconsolidated Subsidiaries | Equity in income on unconsolidated subsidiaries | | $ | (13) | | | $ | (11) | | | (15)% | | | | $ | (19) | | | $ | (25) | | | 24% | |

| Deal-related amortization | | (14) | | | (14) | | | | | | | (28) | | | (28) | | | | |

| Adjusted equity in income on unconsolidated subsidiaries | | $ | (27) | | | $ | (25) | | | (7)% | | | | $ | (47) | | | $ | (53) | | | 11% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total SPGI | Expenses | | $ | 2,097 | | | $ | 2,190 | | | (4)% | | | | $ | 4,203 | | | $ | 4,205 | | | —% | |

| Non-GAAP adjustments (a)(b)(c)(d)(e)(f) | | (66) | | | (246) | | | | | | | (141) | | | (287) | | | | |

| Deal-related amortization | | (281) | | | (275) | | | | | | | (560) | | | (550) | | | | |

| | | | | | | | | | | | | | | |

| Adjusted expenses | | $ | 1,749 | | | $ | 1,669 | | | 5% | | | | $ | 3,502 | | | $ | 3,369 | | | 4% | |

| | | | | | | | | | | | | | | | |

Adjusted Operating Profit | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | Six Months |

| | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | |

| Market Intelligence | Operating profit | | $ | 230 | | | $ | 176 | | | 31% | | | $ | 419 | | | $ | 404 | | | 4% | |

| Non-GAAP adjustments (a) | | 3 | | | 33 | | | | | | 47 | | | 7 | | | | |

| Deal-related amortization | | 147 | | | 140 | | | | | | 288 | | | 281 | | | | |

| | | | | | | | | | | | | | |

| Adjusted operating profit | | $ | 380 | | | $ | 349 | | | 9% | | | $ | 754 | | | $ | 692 | | | 9% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Ratings | Operating profit | | $ | 725 | | | $ | 486 | | | 49% | | | $ | 1,404 | | | $ | 962 | | | 46% | |

| Non-GAAP adjustments (b) | | 20 | | | 4 | | | | | | 22 | | | 5 | | | | |

| Deal-related amortization | | 2 | | | 2 | | | | | | 9 | | | 4 | | | | |

| Adjusted operating profit | | $ | 747 | | | $ | 491 | | | 52% | | | $ | 1,435 | | | $ | 971 | | | 48% | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Commodity Insights | Operating profit | | $ | 206 | | | $ | 156 | | | 32% | | | $ | 432 | | | $ | 343 | | | 26% | |

| Non-GAAP adjustments (c) | | 6 | | | 22 | | | | | | 12 | | | 36 | | | | |

| Deal-related amortization | | 32 | | | 33 | | | | | | 65 | | | 66 | | | | |

| | | | | | | | | | | | | | |

| Adjusted operating profit | | $ | 244 | | | $ | 211 | | | 16% | | | $ | 508 | | | $ | 445 | | | 14% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mobility | Operating profit | | $ | 80 | | | $ | 68 | | | 17% | | | $ | 151 | | | $ | 133 | | | 13% | |

| Non-GAAP adjustments (d) | | 8 | | | 4 | | | | | | 9 | | | 6 | | | | |

| Deal-related amortization | | 76 | | | 76 | | | | | | 151 | | | 150 | | | | |

| Adjusted operating profit | | $ | 164 | | | $ | 149 | | | 10% | | | $ | 311 | | | $ | 289 | | | 8% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Indices | Operating profit | | $ | 263 | | | $ | 226 | | | 16% | | | $ | 534 | | | $ | 464 | | | 15% | |

| Non-GAAP adjustments (e) | | 3 | | | 3 | | | | | | 5 | | | 1 | | | | |

| Deal-related amortization | | 9 | | | 9 | | | | | | 18 | | | 18 | | | | |

| | | | | | | | | | | | | | |

| Adjusted operating profit | | $ | 275 | | | $ | 238 | | | 15% | | | $ | 557 | | | $ | 483 | | | 15% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Engineering Solutions | Operating profit | | $ | — | | | $ | 4 | | | N/M | | | $ | — | | | $ | 19 | | | N/M | |

| | | | | | | | | | | | | | |

| Deal-related amortization | | — | | | — | | | | | | — | | | 1 | | | | |

| Adjusted operating profit | | $ | — | | | $ | 4 | | | N/M | | | $ | — | | | $ | 20 | | | N/M | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total Segments | Operating profit | | $ | 1,504 | | | $ | 1,116 | | | 35% | | | $ | 2,940 | | | $ | 2,325 | | | 26% | |

| Non-GAAP adjustments (a) (b) (c)(d) (e) | | 40 | | | 66 | | | | | | 94 | | | 54 | | | | |

| Deal-related amortization | | 266 | | | 260 | | | | | | 531 | | | 520 | | | | |

| Adjusted operating profit | | $ | 1,811 | | | $ | 1,442 | | | 26% | | | $ | 3,565 | | | $ | 2,900 | | | 23% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Corporate Unallocated Expense | Corporate unallocated expense | | $ | (65) | | | $ | (216) | | | 70% | | | $ | (122) | | | $ | (294) | | | 58% | |

| Non-GAAP adjustments (f) | | 27 | | | 180 | | | | | | 47 | | | 232 | | | | |

| Deal-related amortization | | 1 | | | 1 | | | | | | 1 | | | 2 | | | | |

| Adjusted corporate unallocated expense | | $ | (38) | | | $ | (35) | | | (8)% | | | $ | (74) | | | $ | (61) | | | (22)% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Equity in Income on Unconsolidated Subsidiaries | Equity in income on unconsolidated subsidiaries | | $ | 13 | | | $ | 11 | | | 15% | | | $ | 19 | | | $ | 25 | | | (24)% | |

| Deal-related amortization | | 14 | | | 14 | | | | | | 28 | | | 28 | | | | |

| Adjusted equity in income on unconsolidated subsidiaries | | $ | 27 | | | $ | 25 | | | 7% | | | $ | 47 | | | $ | 53 | | | (11)% | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total SPGI | Operating profit | | $ | 1,452 | | | $ | 911 | | | 59% | | | $ | 2,837 | | | $ | 2,056 | | | 38% | |

| Non-GAAP adjustments (a) (b) (c)(d) (e) (f) | | 66 | | | 246 | | | | | | 141 | | | 287 | | | | |

| Deal-related amortization | | 281 | | | 275 | | | | | | 560 | | | 550 | | | | |

| | | | | | | | | | | | | | |

| Adjusted operating profit | | $ | 1,800 | | | $ | 1,432 | | | 26% | | | $ | 3,538 | | | $ | 2,892 | | | 22% | |

| | | | | | | | | | | | | | | |

Adjusted Interest Expense, Net

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | | | Six Months | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | |

| Interest expense, net | | $ | 77 | | | $ | 88 | | | (13)% | | | $ | 156 | | | $ | 174 | | | (11)% | |

| Non-GAAP adjustments (g) | | 6 | | | 6 | | | | | | 13 | | | 13 | | | | |

| | | | | | | | | | | | | | |

| Adjusted interest expense, net | | $ | 84 | | | $ | 95 | | | (13)% | | | $ | 169 | | | $ | 187 | | | (10)% | |

| | | | | | | | | | | | | | | |

Adjusted Provision for Income Taxes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | | | Six Months | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | |

| Provision for income taxes | | $ | 293 | | | $ | 259 | | | 13% | | | $ | 540 | | | $ | 447 | | | 21% | |

| Non-GAAP adjustments (a) (b) (c)(d) (e) (f) (g) (h) | | 16 | | | (37) | | | | | | 29 | | | (13) | | | | |

| Deal-related amortization | | 69 | | | 66 | | | | | | 136 | | | 132 | | | | |

| | | | | | | | | | | | | | |

| Adjusted provision for income taxes | | $ | 378 | | | $ | 288 | | | 31% | | | $ | 706 | | | $ | 566 | | | 25% | |

| | | | | | | | | | | | | | | |

Adjusted Effective Tax Rate

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | | | Six Months | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | |

| Adjusted operating profit | | $ | 1,800 | | | $ | 1,432 | | | 26% | | | $ | 3,538 | | | $ | 2,892 | | | 22% | |

| Other income, net | | (3) | | | (11) | | | | | | (13) | | | — | | | | |

| Adjusted interest expense, net | | 84 | | | 95 | | | | | | 169 | | | 187 | | | | |

| Adjusted income before taxes on income | | $ | 1,719 | | | $ | 1,348 | | | 28% | | | $ | 3,382 | | | $ | 2,705 | | | 25% | |

| Adjusted provision for income taxes | | $ | 378 | | | $ | 288 | | | | | | $ | 706 | | | $ | 566 | | | | |

Adjusted effective tax rate 1 | | 22.0 | % | | 21.3 | % | | | | | 20.9 | % | | 20.9 | % | ` | | |

| | | | | | | | | | | | | | | |

1 The adjusted effective tax rate is calculated by dividing adjusted provision for income taxes by the adjusted income before taxes, which includes income from unconsolidated subsidiaries. The adjusted effective tax rate excluding income from unconsolidated subsidiaries for the three months ended June 30, 2024 and 2023 was 22.3% and 21.7%, respectively. The adjusted effective tax rate excluding income from unconsolidated subsidiaries for the six months ended June 30, 2024 and 2023 was 21.2% and 21.4%, respectively.

Adjusted Net Income attributable to SPGI and Diluted EPS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | 2024 | | | 2023 | | | % Change | |

| | Net Income attributable to SPGI | | Diluted EPS | | | Net Income attributable to SPGI | | Diluted EPS | | | Net Income attributable to SPGI | | Diluted EPS | |

| | | | | | | | | | | | | | | |

| | Three Months | | | | | | |

| Reported | | $ | 1,011 | | | $ | 3.23 | | | | $ | 511 | | | $ | 1.60 | | | | 98% | | N/M | |

| Non-GAAP adjustments | | 44 | | | 0.14 | | | | 277 | | | 0.87 | | | | | | | |

| Deal-related amortization | | 212 | | | 0.68 | | | | 209 | | | 0.65 | | | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted | | $ | 1,267 | | | $ | 4.04 | | | | $ | 996 | | | $ | 3.12 | | | | 27% | | 30% | |

| | | | | | | | | | | | | | | | |

| | Six Months | | | | | | |

| Reported | | $ | 2,002 | | | $ | 6.38 | | | | $ | 1,305 | | | $ | 4.07 | | | | 53% | | 57% | |

| Non-GAAP adjustments | | 99 | | | 0.32 | | | | 287 | | | 0.89 | | | | | | | |

| Deal-related amortization | | 423 | | | 1.35 | | | | 417 | | | 1.30 | | | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted | | $ | 2,525 | | | $ | 8.05 | | | | $ | 2,009 | | | $ | 6.26 | | | | 26% | | 29% | |

| | | | | | | | | | | | | | | |

N/M - Represents a change equal to or in excess of 100% or not meaningful

Note - Totals presented may not sum due to rounding.

Note - Adjusted operating profit margin for Market Intelligence, Ratings, Commodity Insights, Mobility and Indices was 33%, 66%, 47%, 41% and 71%, respectively, for the three months ended June 30, 2024. Adjusted operating profit margin for the Company was 51% for the three months ended June 30, 2024. Adjusted operating profit margin for Market Intelligence, Ratings, Commodity Insights, Mobility and Indices was 33%, 65%, 47%, 40%, and 72%, respectively, for the six months ended June 30, 2024. Adjusted operating profit margin for the Company was 50% for the six months ended June 30, 2024. Adjusted operating profit margin is calculated as adjusted operating profit divided by revenue.

(a) The three and six months ended June 30, 2024 include a net acquisition-related benefit of $11 million ($11 million after-tax) and $8 million ($9 million after-tax), respectively, IHS Markit merger costs of $9 million ($7 million after-tax) and $20 million ($15 million after-tax), respectively, and employee severance charges of $4 million ($3 million after-tax) and $35 million ($26 million after-tax), respectively. The three and six months ended June 30, 2023 include employee severance charges of $16 million ($12 million after-tax) and $22 million ($16 million after-tax), respectively, IHS Markit merger costs of $12 million ($9 million after-tax) and $25 million ($19 million after-tax), respectively, and an asset impairment of $5 million ($4 million after-tax). The six months ended June 30, 2023 include a gain on disposition of $46 million ($34 million after-tax).

(b) The three and six months ended June 30, 2024 include legal costs of $20 million ($20 million after-tax). The six months ended June 30, 2024 also include employee severance charges of $2 million ($1 million after-tax). The three and six months ended June 30, 2023 include employee severance charges of $4 million ($3 million after-tax) and $5 million ($4 million after-tax), respectively.

(c) The three and six months ended June 30, 2024 include IHS Markit merger costs of $5 million ($3 million after-tax) and $10 million ($8 million after-tax), respectively, an asset write-off of $1 million ($1 million after-tax) and disposition-related costs of $1 million (less than $1 million after-tax). The three and six months ended June 30, 2023 include employee severance charges of $14 million ($10 million after-tax) and $15 million ($12 million after-tax), respectively, and IHS Markit merger costs of $8 million ($6 million after-tax) and $20 million ($15 million after-tax), respectively.

(d) The three and six months ended June 30, 2024 include employee severance charges of $6 million ($5 million after-tax), IHS Markit merger costs of $1 million ($1 million after-tax) and acquisition-related costs of $1 million ($1 million after-tax). The three and six months ended June 30, 2023 include employee severance charges of $3 million ($3 million after-tax) and $4 million ($3 million after-tax), respectively, and acquisition-related costs of $1 million ($1 million after-tax). The six months ended June 30, 2023 include IHS Markit merger costs of $1 million ($1 million after-tax).

(e) The three and six months ended June 30, 2024 include IHS Markit merger costs of $2 million ($1 million after-tax) and $3 million ($2 million after-tax), respectively, and a loss on disposition of $1 million ($1 million after-tax). The six months ended June 30, 2024 include employee severance charges of $1 million ($1 million after-tax). The three and six months ended June 30, 2023 include employee severance charges of $2 million ($1 million after-tax) and $3 million ($2 million after-tax), respectively, and IHS Markit merger costs of $1 million ($1 million after-tax) and $2 million ($2 million after-tax), respectively. The six months ended June 30, 2023 include a gain on disposition of $4 million ($3 million after-tax).

(f) The three and six months ended June 30, 2024 include IHS Markit merger costs of $20 million ($15 million after-tax) and $38 million ($28 million after-tax), respectively, acquisition-related costs of $6 million ($5 million after-tax) and $7 million ($5 million after-tax), respectively, disposition-related costs of $2 million ($2 million after-tax) and $3 million ($2 million after-tax), respectively, and a gain on disposition of $2 million ($1 million after-tax). The six months ended June 30, 2024 include employee severance charges of $2 million ($1 million after-tax) and recovery of lease-related costs of $1 million ($1 million after-tax). The three and six months ended June 30, 2023 include a loss on disposition of $120 million ($186 million after-tax), IHS Markit merger costs of $30 million ($22 million after-tax) and $66 million ($50 million after-tax), respectively, lease impairments of $15 million ($11 million after-tax), employee severance charges of $12 million ($9 million after-tax) and $14 million ($10 million after-tax), respectively, disposition-related costs of $3 million ($2 million after-tax) and $16 million ($12 million after-tax), respectively, and acquisition-related costs of $1 million ($1 million after-tax) and $2 million ($2 million after-tax), respectively.

(g) The three and six months ended June 30, 2024 include a premium amortization benefit of $6 million ($5 million after-tax) and $13 million ($10 million after-tax), respectively. The three and six months ended June 30, 2023 include a premium amortization benefit of $6 million ($5 million after-tax) and $13 million ($10 million after-tax), respectively.

(h) The three months ended June 30, 2024 include a tax benefit of $3 million associated with a business held for sale. The six months ended June 30, 2024 include a tax expense of $6 million associated with IHS Markit prior to acquisition, offset by a tax benefit of $3 million associated with a business held for sale and $2 million due to annualized effective tax rate differences for GAAP. The six months ended June 30, 2023 include a tax benefit of $16 million associated with a disposition.

S&P Global

Revenue Information

Three and six months ended June 30, 2024 and 2023

(dollars in millions)

Revenue by Type

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | Three Months |

| | Subscription (a) | | | Non-subscription /

Transaction (b) | | | Non-transaction (c) | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | | | | | | | |

| Market Intelligence | | $ | 965 | | | $ | 910 | | | 6% | | | $ | 43 | | | $ | 39 | | | 11% | | | $ | — | | | $ | — | | | N/M | |

| Ratings | | — | | | — | | | N/M | | | 626 | | | 383 | | | 63% | | | 509 | | | 468 | | | 9% | |

| Commodity Insights | | 459 | | | 420 | | | 9% | | | 31 | | | 24 | | | 34% | | | — | | | — | | | N/M | |

| Mobility | | 323 | | | 292 | | | 11% | | | 77 | | | 77 | | | (1)% | | | — | | | — | | | N/M | |

| Indices | | 74 | | | 70 | | | 6% | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Engineering Solutions | | — | | | 31 | | | N/M | | | — | | | 2 | | | N/M | | | — | | | — | | | N/M | |

| Intersegment elimination | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | (46) | | | (41) | | | (12)% | |

| Total revenue | | $ | 1,821 | | | $ | 1,723 | | | 6% | | | $ | 777 | | | $ | 525 | | | 48% | | | $ | 463 | | | $ | 427 | | | 9% | |

| | | | | | | | | | | | | | | | | | | | | |

| | Asset-linked fees (d) | | | Sales usage-based

royalties (e) | | | Recurring variable (f) | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | | | | | | | |

| Market Intelligence | | $ | — | | | $ | — | | | N/M | | | $ | — | | | $ | — | | | N/M | | | $ | 147 | | | $ | 130 | | | 13% | |

| Ratings | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Commodity Insights | | — | | | — | | | N/M | | | 26 | | | 18 | | | 40% | | | — | | | — | | | N/M | |

| Mobility | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Indices | | 245 | | | 211 | | | 16% | | | 70 | | | 67 | | | 4% | | | — | | | — | | | N/M | |

| Engineering Solutions | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | $ | 245 | | | $ | 211 | | | 16% | | | $ | 96 | | | $ | 85 | | | 12% | | | $ | 147 | | | $ | 130 | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | |

| Six Months |

| | Subscription (a) | | | Non-subscription /

Transaction (b) | | | Non-transaction (c) | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | | | | | | | |

| Market Intelligence | | $ | 1,912 | | | $ | 1,800 | | | 6% | | | $ | 97 | | | $ | 95 | | | 3% | | | $ | — | | | $ | — | | | N/M | |

| Ratings | | — | | | — | | | N/M | | | 1,207 | | | 761 | | | 59% | | | 990 | | | 914 | | | 8% | |

| Commodity Insights | | 909 | | | 829 | | | 10% | | | 115 | | | 104 | | | 11% | | | — | | | — | | | N/M | |

| Mobility | | 635 | | | 573 | | | 11% | | | 151 | | | 154 | | | (2)% | | | — | | | — | | | N/M | |

| Indices | | 144 | | | 136 | | | 6% | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Engineering Solutions | | — | | | 125 | | | N/M | | | — | | | 8 | | | N/M | | | — | | | — | | | N/M | |

| Intersegment elimination | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | (91) | | | (83) | | | (9)% | |

| Total revenue | | $ | 3,600 | | | $ | 3,463 | | | 4% | | | $ | 1,570 | | | $ | 1,122 | | | 40% | | | $ | 899 | | | $ | 831 | | | 8% | |

| | | | | | | | | | | | | | | | | | | | | |

| | Asset-linked fees (d) | | | Sales usage-based

royalties (e) | | | Recurring variable (f) | |

| | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | | | 2024 | | 2023 | | % Change | |

| | | | | | | | | | | | | | | | | | | | | |

| Market Intelligence | | $ | — | | | $ | — | | | N/M | | | $ | — | | | $ | — | | | N/M | | | $ | 288 | | | $ | 255 | | | 13% | |

| Ratings | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Commodity Insights | | — | | | — | | | N/M | | | 51 | | | 37 | | | 38% | | | — | | | — | | | N/M | |

| Mobility | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Indices | | 489 | | | 420 | | | 16% | | | 143 | | | 133 | | | 8% | | | — | | | — | | | N/M | |

| Engineering Solutions | | — | | | — | | | N/M | | | — | | | — | | | N/M | | | — | | | — | | | N/M | |

| Total revenue | | $ | 489 | | | $ | 420 | | | 16% | | | $ | 194 | | | $ | 170 | | | 14% | | | $ | 288 | | | $ | 255 | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | |

N/M - Represents a change equal to or in excess of 100% or not meaningful

(a) Subscription revenue is primarily derived from distribution of data, valuation services, analytics, third party research, and credit ratings-related information through both feed and web-based channels, market data and market insights along with other information products and software term licenses, and Mobility's core information products.

(b) Non-subscription / transaction revenue is primarily related to ratings of publicly-issued debt and bank loan ratings.

(c) Non-transaction revenue is primarily related to surveillance of a credit rating, annual fees for customer relationship-based pricing programs, fees for entity credit ratings and global research and analytics at CRISIL. Non-transaction revenue also includes an intersegment revenue elimination charged to Market Intelligence for the rights to use and distribute content and data developed by Ratings.

(d) Asset-linked fees is primarily related to fees based on assets underlying exchange-traded funds, mutual funds and insurance products.

(e) Sales usage-based royalty revenue is primarily related to trading based fees from exchange-traded derivatives and licensing proprietary market price data and price assessments to commodity exchanges.

(f) Recurring variable revenue represents revenue from contracts for services that specify a fee based on, among other factors, the number of trades processed, assets under management, or the number of positions valued.

S&P Global

Non-GAAP Financial Information

Three and six months ended June 30, 2024 and 2023

(dollars in millions)

Computation of Free Cash Flow and Adjusted Free Cash Flow Excluding Certain Items

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | Three Months | | | Six Months | |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| Cash provided by operating activities | | $ | 1,556 | | | $ | 769 | | | | $ | 2,504 | | | $ | 1,363 | | |

| Capital expenditures | | (32) | | | (31) | | | | (56) | | | (59) | | |

| Distributions to noncontrolling interest holders, net | | (60) | | | (62) | | | | (133) | | | (140) | | |

| Free cash flow | | $ | 1,464 | | | $ | 676 | | | | $ | 2,315 | | | $ | 1,164 | | |

| IHS Markit merger costs | | 75 | | | 83 | | | | 242 | | | 257 | | |

| Tax on gain from sale of divestitures | | — | | | 109 | | | | — | | | 109 | | |

| Disposition-related costs | | — | | | 40 | | | | — | | | 40 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted free cash flow excluding certain items | | $ | 1,539 | | | $ | 908 | | | | $ | 2,557 | | | $ | 1,570 | | |

| | | | | | | | | | | |

S&P Global

Non-GAAP Guidance

Reconciliation of 2024 Non-GAAP Guidance | | | | | | | | | | | | | | | | | |

| (unaudited) | | | |

| | | Low | | High | |

| GAAP diluted EPS | | $ | 11.15 | | | $ | 11.40 | | |

| Deal-related amortization | | 2.85 | | | 2.85 | | |

| IHS Markit merger costs | | 0.26 | | | 0.26 | | |

| Premium amortization benefit | | (0.07) | | | (0.07) | | |

| Restructuring | | 0.11 | | | 0.11 | | |

| Tax rate and other | | 0.05 | | | 0.05 | | |

| Non-GAAP adjusted diluted EPS | | $ | 14.35 | | | $ | 14.60 | | |

| | | | | |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

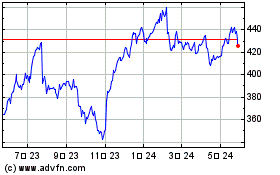

S&P Global (NYSE:SPGI)

過去 株価チャート

から 6 2024 まで 7 2024

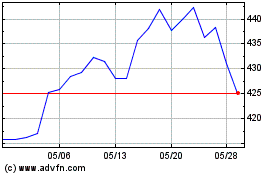

S&P Global (NYSE:SPGI)

過去 株価チャート

から 7 2023 まで 7 2024