Piedmont Office Realty Trust, Inc. ("Piedmont" or the "Company")

(NYSE:PDM), an owner of Class A office properties located primarily

in major U.S. Sunbelt markets, today announced its results for the

quarter ended June 30, 2024, including the completion of over

one million square feet of leasing, the largest amount of leasing

the Company has completed in a single quarter in over a decade.

Highlights for the Three Months Ended June 30,

2024:

Financial Results:

| |

Three Months Ended |

| (in 000s other than per share

amounts ) |

June 30, 2024 |

June 30, 2023 |

| Net loss applicable to

Piedmont |

$ |

(9,809 |

) |

$ |

(1,988 |

) |

| Net loss per share applicable

to common stockholders - diluted |

$ |

(0.08 |

) |

$ |

(0.02 |

) |

| Interest expense, net of

interest income |

$ |

29,381 |

|

$ |

21,858 |

|

| NAREIT and Core FFO applicable

to common stock |

$ |

46,751 |

|

$ |

55,535 |

|

| NAREIT and Core FFO per

diluted share |

$ |

0.37 |

|

$ |

0.45 |

|

| Adjusted FFO applicable to

common stock |

$ |

27,758 |

|

$ |

44,444 |

|

| Same Store NOI - cash

basis |

|

5.7 |

% |

|

| Same Store NOI - accrual

basis |

|

3.7 |

% |

|

- Piedmont recognized a net loss of

$9.8 million, or $0.08 per diluted share, for the second quarter of

2024, as compared to a net loss of $2.0 million, or $0.02 per

diluted share, for the second quarter of 2023, with the second

quarter of 2024 reflecting an approximately $7.5 million, or $0.06

per diluted share, increase in interest expense, net of interest

income, as compared to the second quarter of 2023.

- Core FFO, which removes depreciation

and amortization expense, was $0.37 per diluted share for the

second quarter of 2024, as compared to $0.45 per diluted share for

the second quarter of 2023. Approximately $0.06 of the decrease is

due to the increased interest expense, net of interest income

mentioned above, with the remaining decrease attributable to a

combination of the sale of One Lincoln Park during the first

quarter of 2024, as well as the expiration of two large leases

during the six months ended June 30, 2024.

- Same Store NOI - Cash basis and Same

Store NOI - Accrual basis increased 5.7% and 3.7%, respectively,

for the three months ended June 30, 2024, as compared to the

same period in the prior year, as newly commenced leases or those

with expiring abatements outweighed expiring leases.

Leasing:

| |

Three Months Ended June 30, 2024 |

| # of lease transactions |

65 |

|

| Total leasing sf (in

000s) |

1,038 |

|

| New tenant leasing sf (in

000s) |

404 |

|

| Cash rent roll up |

15.2 |

% |

| Accrual rent roll up |

23.0 |

% |

| Leased Percentage as of period

end |

87.3 |

% |

- The Company

completed over one million square feet of leasing during the second

quarter, the largest amount of leasing the Company has completed in

a single quarter in over a decade, which included over 400,000

square feet of new tenant leasing.

- The largest new lease completed

during the quarter was for the relocation of Travel + Leisure Co.'s

(NYSE:TNL) headquarters to the Company's 182,000 square foot 501

West Church Street building in downtown Orlando, FL.

- The largest renewal completed during

the quarter was for over 240,000 square feet through 2030 for an

e-commerce retailer at Dallas Galleria Office Towers.

- The average size lease executed

during the quarter was approximately 16,000 square feet and the

weighted average lease term was approximately eight years.

- Rents on leases executed during the

three months ended June 30, 2024 for space vacant one year or

less increased approximately 15.2% and 23.0% on a cash and accrual

basis, respectively.

- The Company's leased percentage for

its in-service portfolio as of June 30, 2024 was 87.3%, as

compared to 87.1% as of December 31, 2023, with the increase

attributable to net leasing activity completed during the first six

months of 2024, and reflecting the sale of the One Lincoln Park

building during the first quarter of 2024 and the reclassification

of the 9320 Excelsior and Meridian Crossings projects in

Minneapolis, MN to out-of-service as of June 30, 2024. Both

projects are being redeveloped into multi-tenant assets following

the expiration of the sole tenant lease at each project during the

six months ended June 30, 2024.

- As of June 30, 2024, the

Company had approximately 1.6 million square feet of executed

leases for vacant space that is yet to commence or is currently

under rental abatement, representing approximately $51 million of

future additional annual cash rents.

Balance Sheet:

| (in 000s except for

ratios) |

June 30, 2024 |

|

December 31, 2023 |

| Total Real Estate Assets |

$ |

3,468,030 |

|

|

$ |

3,512,527 |

|

| Total Assets |

$ |

4,158,643 |

|

|

$ |

4,057,082 |

|

| Total Debt |

$ |

2,221,738 |

|

|

$ |

2,054,596 |

|

| Weighted Average Cost of

Debt |

|

6.08 |

% |

|

|

5.82 |

% |

| Net Principal Amount of

Debt/Total Gross Assets less Cash and Cash Equivalents |

|

39.1 |

% |

|

|

38.2 |

% |

| Average Net Debt-to-Core

EBITDA (ttm*) |

|

6.6 |

x |

|

|

6.4 |

x |

- During the three months ended June

30, 2024, the Company issued $400 million of 6.875% senior notes

due in 2029 and used the net proceeds to repay the balance

outstanding on its $600 million line of credit, as well as a $25

million unsecured bank term loan that was scheduled to mature in

January of 2025. The remaining proceeds have been invested until

they will be used (along with any disposition proceeds and the

Company's line of credit if necessary) to repay a $250 million

unsecured bank term loan that matures in March of 2025. The Company

has no other debt with a final maturity until 2027.

- As of June 30, 2024, our liquidity

position was comprised of our $600 million line of credit and

$138.5 million in cash and cash equivalents.

ESG and Operations:

- Four projects: The Exchange and

400&500 TownPark Commons in Orlando, FL; Crescent Ridge II, in

Minneapolis, MN; and Wayside Office Park in Boston, MA won Regional

The Outstanding Building of the Year ("TOBY") awards during the

second quarter of 2024 and Wayside Office Park won at the

International level during the third quarter of 2024. The award is

presented by the Building Owners and Managers Association ("BOMA")

and recognizes excellence in building management.

- As of June 30, 2024, approximately

84% and 72% of the Company's portfolio was ENERGY STAR rated and

LEED certified, respectively, and 57% of its portfolio is certified

LEED gold or higher.

Commenting on second quarter results, Brent Smith, Piedmont's

President and Chief Executive Officer, said, "Our portfolio of

well-located, hospitality-inspired workplaces is resonating with

the market, delivering continued leasing success across our

portfolio. We achieved the largest level of quarterly leasing

volume since 2013 with over a million square feet spread across 65

transactions. Approximately 40% of the second quarter’s leasing

volume was related to new tenancy, and transaction activity

reflected a cash rental rate roll-up of greater than 15%.

Additionally, we completed a significant debt refinancing,

essentially addressing our debt maturities through early 2027 at a

much improved interest rate compared to our 2023 issuance,

demonstrating increased confidence from unsecured bond investors in

the office sector, and specifically for our high-quality

portfolio."

Third Quarter 2024 Dividend

As previously announced, on July 25, 2024, the board of

directors of Piedmont declared a dividend for the third quarter of

2024 in the amount of $0.125 per share on its common stock to

stockholders of record as of the close of business on August 23,

2024, payable on September 20, 2024.

Guidance for 2024

The Company is narrowing its previous guidance for the year

ending December 31, 2024 primarily to reflect the impact of its

recent $400 million bond issuance as follows:

| |

Current |

|

Previous |

| (in millions, except per share

data) |

Low |

|

High |

|

Low |

|

High |

| Net loss |

$ |

(63 |

) |

|

$ |

(60 |

) |

|

$ |

(47 |

) |

|

$ |

(41 |

) |

| Add: |

|

|

|

|

|

|

|

|

Depreciation |

|

147 |

|

|

|

149 |

|

|

|

148 |

|

|

|

151 |

|

|

Amortization |

|

80 |

|

|

|

82 |

|

|

|

81 |

|

|

|

84 |

|

|

Impairment Charges |

|

18 |

|

|

|

18 |

|

|

|

— |

|

|

|

— |

|

| Core FFO applicable to common

stock |

$ |

182 |

|

|

$ |

189 |

|

|

$ |

182 |

|

|

$ |

194 |

|

| Core FFO applicable to common

stock per diluted share |

$ |

1.46 |

|

|

$ |

1.52 |

|

|

$ |

1.46 |

|

|

$ |

1.56 |

|

This guidance is based on information available to management as

of the date of this release and reflects management's view of

current market conditions, including the following specific

assumptions and projections:

- Executed leasing in the range of 2-2.3 million square feet with

year-end leased percentage for the Company's in-service portfolio

anticipated to be approximately 87.5-88.5%, exclusive of any

speculative acquisition or disposition activity;

- Same Store NOI raised from flat to 2% increase to a 2-3%

increase on both a cash and accrual basis for the year;

- Interest expense of approximately $123-126 million, reflecting

a full year of higher interest rates as a result of refinancing

activity completed by the Company during the latter half of 2023

and in the first half of 2024;

- Updated interest income to approximately $4 million due to

temporarily investing a portion of the net proceeds from the

Company's recent bond offering which it anticipates using to repay

a $250 million term loan in March of 2025; and,

- General and administrative expense adjusted to approximately

$30 million based on mid-year estimates of potential performance

based compensation as a result of year-to-date leasing

results.

No speculative acquisitions, dispositions, or refinancings are

included in the above guidance. The Company will adjust guidance if

such transactions occur.

Note that actual results could differ materially from these

estimates and individual quarters may fluctuate on both a cash

basis and an accrual basis due to the timing of any future

dispositions, significant lease commencements and expirations,

abatement periods, repairs and maintenance expenses, capital

expenditures, capital markets activities, general and

administrative expenses, accrued potential performance-based

compensation expense, one-time revenue or expense events, and other

factors discussed under "Forward Looking Statements" below.

Non-GAAP Financial Measures

To supplement the presentation of the Company’s financial

results prepared in accordance with U.S. generally accepted

accounting principles ("GAAP"), this release and the accompanying

quarterly supplemental information as of and for the period ended

June 30, 2024 contain certain financial measures that are not

prepared in accordance with GAAP, including FFO, Core FFO, AFFO,

Same Store NOI (cash and accrual basis), Property NOI (cash and

accrual basis), EBITDAre, and Core EBITDA. Definitions and

reconciliations of each of these non-GAAP measures to their most

comparable GAAP metrics are included below and in the accompanying

quarterly supplemental information.

Each of the non-GAAP measures included in this release and the

accompanying quarterly supplemental financial information has

limitations as an analytical tool and should not be considered in

isolation or as a substitute for an analysis of the Company’s

results calculated in accordance with GAAP. In addition, because

not all companies use identical calculations, the Company’s

presentation of non-GAAP measures in this release and the

accompanying quarterly supplemental information may not be

comparable to similarly titled measures disclosed by other

companies, including other REITs. The Company may also change the

calculation of any of the non-GAAP measures included in this

release and the accompanying quarterly supplemental financial

information from time to time in light of its then existing

operations.

Conference Call Information

Piedmont has scheduled a conference call and an audio web cast

for Thursday, August 1, 2024, at 9:00 A.M. Eastern time. The live,

listen-only, audio web cast of the call may be accessed on the

Company's website at

http://investor.piedmontreit.com/news-and-events/events-calendar.

Dial-in numbers for analysts who plan to actively participate in

the call are (888) 506-0062 for participants in the United States

and Canada and (973) 528-0011 for international participants.

Participant Access Code is 453069. A replay of the conference call

will be available through August 15, 2024, and may be accessed by

dialing (877) 481-4010 for participants in the United States and

Canada and (919) 882-2331 for international participants, followed

by conference identification code 50877. A web cast replay will

also be available after the conference call in the Investor

Relations section of the Company's website. During the audio web

cast and conference call, the Company's management team will review

second quarter 2024 performance, discuss recent events, and conduct

a question-and-answer period.

Supplemental Information

Quarterly supplemental information as of and for the period

ended June 30, 2024 can be accessed on the Company`s website

under the Investor Relations section at www.piedmontreit.com.

About Piedmont Office Realty Trust

Piedmont Office Realty Trust, Inc. (NYSE: PDM) is an owner,

manager, developer, redeveloper, and operator of high-quality,

Class A office properties located primarily in major U.S. Sunbelt

markets. Its approximately $5 billion portfolio is currently

comprised of approximately 16 million square feet. The Company is a

fully integrated, self-managed real estate investment trust (REIT)

with local management offices in each of its markets and is

investment-grade rated by S&P Global Ratings (BBB-) and Moody’s

(Baa3). Piedmont is a 2024 ENERGY STAR Partner of the Year -

Sustained Excellence. For more information, see

www.piedmontreit.com.

Forward-Looking Statements

Certain statements contained in this press release constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended (the "Securities Act"), and

Section 21E of the Securities Exchange Act of 1934, as amended (the

"Exchange Act"). The Company intends for all such forward-looking

statements to be covered by the safe-harbor provisions for

forward-looking statements contained in Section 27A of the

Securities Act and Section 21E of the Exchange Act, as applicable.

Such information is subject to certain known and unknown risks and

uncertainties, which could cause actual results to differ

materially from those anticipated. Therefore, such statements are

not intended to be a guarantee of the Company`s performance in

future periods. Such forward-looking statements can generally be

identified by the Company's use of forward-looking terminology such

as "may," "will," "expect," "intend," "anticipate," "estimate,"

"believe," "continue" or similar words or phrases that indicate

predictions of future events or trends or that do not relate solely

to historical matters. Examples of such statements in this press

release include the Company's estimated range of Net Income/(Loss),

Depreciation, Amortization, Core FFO and Core FFO per diluted share

for the year ending December 31, 2024. These statements are based

on beliefs and assumptions of Piedmont’s management, which in turn

are based on information available at the time the statements are

made.

The following are some of the factors that could cause the

Company's actual results and its expectations to differ materially

from those described in the Company's forward-looking

statements:

- Economic, regulatory, socio-economic (including work from home

and "hybrid" work policies), technological (e.g. artificial

intelligence and machine learning, Zoom, etc.), and other changes

that impact the real estate market generally, the office sector or

the patterns of use of commercial office space in general, or the

markets where we primarily operate or have high concentrations of

revenue;

- The impact of competition on our efforts to renew existing

leases or re-let space on terms similar to existing leases;

- Lease terminations, lease defaults, lease contractions, or

changes in the financial condition of our tenants, particularly by

one of our large lead tenants;

- Impairment charges on our long-lived assets or goodwill

resulting therefrom;

- The success of our real estate strategies and investment

objectives, including our ability to implement successful

redevelopment and development strategies or identify and consummate

suitable acquisitions and divestitures;

- The illiquidity of real estate investments, including economic

changes, such as rising interest rates and available financing,

which could impact the number of buyers/sellers of our target

properties, and regulatory restrictions to which real estate

investment trusts ("REITs") are subject and the resulting

impediment on our ability to quickly respond to adverse changes in

the performance of our properties;

- The risks and uncertainties associated with our acquisition and

disposition of properties, many of which risks and uncertainties

may not be known at the time of acquisition or disposition;

- Development and construction delays, including the potential of

supply chain disruptions, and resultant increased costs and

risks;

- Future acts of terrorism, civil unrest, or armed hostilities in

any of the major metropolitan areas in which we own

properties;

- Risks related to the occurrence of cybersecurity incidents,

including cybersecurity incidents against us or any of our

properties or tenants, or a deficiency in our identification,

assessment or management of cybersecurity threats impacting our

operations and the public's reaction to reported cybersecurity

incidents, including the reputational impact on our business and

value of our common stock;

- Costs of complying with governmental laws and regulations,

including environmental standards imposed on office building

owners;

- Uninsured losses or losses in excess of our insurance coverage,

and our inability to obtain adequate insurance coverage at a

reasonable cost;

- Additional risks and costs associated with directly managing

properties occupied by government tenants, such as potential

changes in the political environment, a reduction in federal or

state funding of our governmental tenants, or an increased risk of

default by government tenants during periods in which state or

federal governments are shut down or on furlough;

- Significant price and volume fluctuations in the public

markets, including on the exchange which we listed our common

stock;

- Risks associated with incurring mortgage and other

indebtedness, including changing capital reserve requirements on

our lenders and rising interest rates for new debt financings;

- A downgrade in our credit ratings, the credit ratings of

Piedmont Operating Partnership, L.P. (the "Operating Partnership")

or the credit ratings of our or the Operating Partnership's

unsecured debt securities, which could, among other effects,

trigger an increase in the stated rate of one or more of our

unsecured debt instruments;

- The effect of future offerings of debt or equity securities on

the value of our common stock;

- Additional risks and costs associated with inflation and

potential increases in the rate of inflation, including the impact

of a possible recession, and any changes in governmental rules,

regulations, and fiscal policies;

- Uncertainties associated with environmental and regulatory

matters;

- Changes in the financial condition of our tenants directly or

indirectly resulting from geopolitical developments that could

negatively affect important supply chains and international trade,

the termination or threatened termination of existing international

trade agreements, or the implementation of tariffs or retaliatory

tariffs on imported or exported goods;

- The effect of any litigation to which we are, or may become,

subject;

- Additional risks and costs associated with owning properties

occupied by tenants in particular industries, such as oil and gas,

hospitality, travel, co-working, etc., including risks of default

during start-up and during economic downturns;

- Changes in tax laws impacting REITs and real estate in general,

as well as our ability to continue to qualify as a REIT under the

Internal Revenue Code of 1986, as amended (the “Code”), or other

tax law changes which may adversely affect our stockholders;

- The future effectiveness of our internal controls and

procedures;

- Actual or threatened public health epidemics or outbreaks, such

as the COVID-19 pandemic, as well as governmental and private

measures taken to combat such health crises; and

- Other factors, including the risk factors described in Item 1A.

of our Annual Report on Form 10-K for the year ended December 31,

2023.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company cannot guarantee the accuracy of any

such forward-looking statements contained in this press release,

and the Company does not intend to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Research Analysts/ Institutional Investors

Contact:770-418-8592research.analysts@piedmontreit.com

Shareholder Services/Transfer Agent Services

Contact:Computershare,

Inc.866-354-3485investor.services@piedmontreit.com

- PDM 6 30 24 EX 99 1 Q2 2024 EARNINGS RELEASE Financials

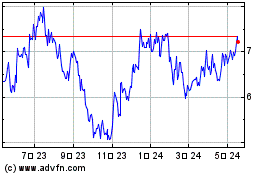

Piedmont Office Realty (NYSE:PDM)

過去 株価チャート

から 12 2024 まで 1 2025

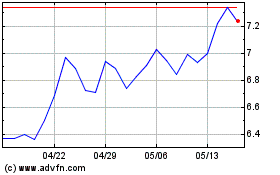

Piedmont Office Realty (NYSE:PDM)

過去 株価チャート

から 1 2024 まで 1 2025