Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

2024年10月25日 - 10:59PM

Edgar (US Regulatory)

|

Tortoise Midstream Energy Fund

|

|

|

Schedule of Investments

|

|

|

August 31, 2024 (Unaudited)

|

|

| |

|

|

COMMON STOCKS - 93.8%

|

|

Shares

|

|

|

Value

|

|

|

Canada Crude Oil Pipelines - 7.9%

|

|

|

|

|

|

Enbridge, Inc.

|

|

|

256,103

|

|

|

$

|

10,290,218

|

|

|

Pembina Pipeline Corp.

|

|

|

278,903

|

|

|

|

11,234,213

|

|

| |

|

|

|

|

|

|

21,524,431

|

|

| |

|

|

|

|

|

|

|

|

|

Canada Natural Gas/Natural Gas Liquids Pipelines - 3.8%

|

|

|

|

|

|

|

TC Energy Corp.

|

|

|

224,613

|

|

|

|

10,408,567

|

|

| |

|

|

|

|

|

|

|

|

|

United States Crude Oil Pipelines - 9.3%

|

|

|

|

|

|

|

Plains GP Holdings LP

|

|

|

1,315,066

|

|

|

|

25,249,267

|

|

| |

|

|

|

|

|

|

|

|

|

United States Natural Gas Gathering/Processing - 10.8%

|

|

|

|

|

|

|

EnLink Midstream LLC

|

|

|

800,186

|

|

|

|

11,490,671

|

|

|

Hess Midstream Partners LP - Class A

|

|

|

420,939

|

|

|

|

15,722,072

|

|

|

Kinetik Holdings, Inc.

|

|

|

46,011

|

|

|

|

2,035,526

|

|

| |

|

|

|

|

|

|

29,248,269

|

|

| |

|

|

|

|

|

|

|

|

|

United States Natural Gas/Natural Gas Liquids Pipelines - 53.1%

|

|

|

|

|

|

|

Cheniere Energy, Inc.

|

|

|

71,192

|

|

|

|

13,189,030

|

|

|

DT Midstream, Inc.

|

|

|

199,939

|

|

|

|

15,713,206

|

|

|

Excelerate Energy, Inc. - Class A

|

|

|

70,562

|

|

|

|

1,286,345

|

|

|

Kinder Morgan, Inc.

|

|

|

641,386

|

|

|

|

13,834,696

|

|

|

New Fortress Energy, Inc.

|

|

|

109,719

|

|

|

|

1,351,738

|

|

|

NextDecade Corp. (a)

|

|

|

228,576

|

|

|

|

1,065,164

|

|

|

ONEOK, Inc.

|

|

|

327,155

|

|

|

|

30,216,036

|

|

|

Targa Resources Corp.

|

|

|

234,259

|

|

|

|

34,412,647

|

|

|

The Williams Companies, Inc.

|

|

|

710,249

|

|

|

|

32,508,097

|

|

| |

|

|

|

|

|

|

143,576,959

|

|

| |

|

|

|

|

|

|

|

|

|

United States Renewables and Power Infrastructure – 8.9%

|

|

|

|

|

|

|

Clearway Energy, Inc. - Class C

|

|

|

406,177

|

|

|

|

11,762,886

|

|

|

NextEra Energy, Inc.

|

|

|

26,725

|

|

|

|

2,151,630

|

|

|

Vistra Corp.

|

|

|

121,875

|

|

|

|

10,411,781

|

|

| |

|

|

|

|

|

|

24,326,297

|

|

|

TOTAL COMMON STOCKS (Cost $251,855,753)

|

|

|

|

254,333,790

|

|

| |

|

|

|

|

|

|

|

|

|

MASTER LIMITED PARTNERSHIPS - 26.0%

|

|

Units

|

|

|

Value

|

|

|

United States Natural Gas Gathering/Processing - 5.0%

|

|

|

|

|

|

|

Western Midstream Partners LP

|

|

|

352,572

|

|

|

|

13,602,228

|

|

| |

|

|

|

|

|

|

|

|

|

United States Natural Gas/Natural Gas Liquids Pipelines - 11.0%

|

|

|

|

|

|

|

Energy Transfer LP

|

|

|

962,003

|

|

|

|

15,488,248

|

|

|

Enterprise Products Partners LP

|

|

|

489,300

|

|

|

|

14,356,062

|

|

| |

|

|

|

|

|

|

29,844,310

|

|

| |

|

|

|

|

|

|

|

|

|

United States Refined Product Pipelines - 10.0%

|

|

|

|

|

|

|

MPLX LP

|

|

|

630,996

|

|

|

|

27,057,109

|

|

|

TOTAL MASTER LIMITED PARTNERSHIPS (Cost $39,310,839)

|

|

|

|

70,503,647

|

|

| |

|

|

|

|

|

|

|

|

|

PREFERRED STOCK - 1.3%

|

|

Units

|

|

|

Value

|

|

|

United States Natural Gas Gathering/Processing - 1.3%

|

|

|

|

|

|

|

EnLink Midstream Partners 9.72% (3 mo. Term SOFR + 4.37%), Perpetual

|

|

|

3,400

|

|

|

|

3,391,125

|

|

|

TOTAL PREFERRED STOCK (Cost $3,400,000)

|

|

|

|

3,391,125

|

|

| |

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS - 0.2%

|

|

|

|

|

|

|

|

|

|

Money Market Funds - 0.2%

|

|

Shares

|

|

|

|

|

|

|

First American Government Obligations Fund - Class X, 5.22% (b)

|

|

|

490,844

|

|

|

|

490,844

|

|

|

TOTAL SHORT-TERM INVESTMENTS

(Cost $490,844)

|

|

|

|

490,844

|

|

| |

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS - 121.3% (Cost

$295,057,436)

|

|

|

|

328,719,406

|

|

|

Other Assets in Excess of Liabilities - 0.3%

|

|

|

|

714,415

|

|

|

Credit Facility Borrowings - (5.7)%

|

|

|

|

(15,600,000

|

)

|

|

Senior Notes - (10.8)%

|

|

|

|

(29,170,677

|

)

|

|

Mandatory Redeemable Preferred Stock at Liquidation Value - (5.1)%

|

|

|

|

(13,753,775

|

)

|

|

TOTAL NET ASSETS - 100.0%

|

|

|

|

|

|

$

|

270,909,369

|

|

| |

|

|

|

|

|

|

|

|

|

Percentages are stated as a percent of net assets.

|

|

|

|

|

|

|

SOFR - Secured Overnight Financing Rate

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

The rate shown represents the 7-day annualized effective yield as of August 31, 2024.

|

| |

|

Summary of Fair Value Disclosure as of August 31, 2024 (Unaudited)

Tortoise Midstream Energy Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of

fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation

techniques and related inputs during the period, and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below. The inputs or methodology used for valuing securities are not

an indication of the risk associated with investing in those securities.

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or

indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the

Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The following is a summary of the fair valuation hierarchy of the Fund’s securities as of August 31, 2024:

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

$

|

254,333,790

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

254,333,790

|

|

|

Master Limited Partnerships

|

|

|

70,503,647

|

|

|

|

–

|

|

|

|

–

|

|

|

|

70,503,647

|

|

|

Preferred Stock

|

|

|

–

|

|

|

|

3,391,125

|

|

|

|

–

|

|

|

|

3,391,125

|

|

|

Money Market Funds

|

|

|

490,844

|

|

|

|

–

|

|

|

|

–

|

|

|

|

490,844

|

|

|

Total Investments

|

|

$

|

325,328,281

|

|

|

$

|

3,391,125

|

|

|

$

|

–

|

|

|

$

|

328,719,406

|

|

| |

|

|

Refer to the Schedule of Investments for further disaggregation of investment categories.

|

|

| |

|

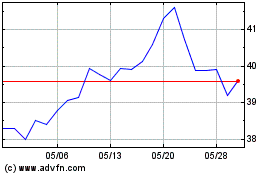

Tortoise Midstream Energy (NYSE:NTG)

過去 株価チャート

から 1 2025 まで 2 2025

Tortoise Midstream Energy (NYSE:NTG)

過去 株価チャート

から 2 2024 まで 2 2025