false

0001547459

0001547459

2024-11-21

2024-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 21, 2024

Natural Grocers by Vitamin Cottage, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35608

|

|

45-5034161

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.)

|

12612 West Alameda Parkway

Lakewood, Colorado 80228

(Address of principal executive offices) (Zip Code)

(303) 986-4600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

NGVC

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On November 21, 2024, Natural Grocers by Vitamin Cottage, Inc. (the “Company”) issued a press release announcing its financial results for the three months and fiscal year ended September 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Additionally, the information contained in this Item 2.02 or Exhibit 99.1 shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On November 21, 2024, the Company announced that its Board of Directors has declared a quarterly cash dividend of $0.12 per common share, increasing its quarterly cash dividend by 20%. The quarterly cash dividend will be paid on December 18, 2024 to stockholders of record as of the close of business on December 2, 2024.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 21, 2024

|

|

Natural Grocers by Vitamin Cottage, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Kemper Isely

|

|

|

Name:

|

Kemper Isely

|

|

|

Title:

|

Co-President

|

Exhibit 99.1

Natural Grocers by Vitamin Cottage Announces Fiscal 2024 Fourth Quarter and Full Year Results

Reports Record Sales and Earnings

Increases Quarterly Cash Dividend by 20% to $0.12 per Common Share

Lakewood, Colorado, November 21, 2024. Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC) today announced results for its fourth quarter and fiscal year ended September 30, 2024 and provided its outlook for fiscal 2025.

Highlights for Fourth Quarter Fiscal 2024 Compared to Fourth Quarter Fiscal 2023

| |

●

|

Net sales increased 9.3% to $322.7 million;

|

| |

●

|

Daily average comparable store sales increased 7.1%, and increased 14.0% on a two-year basis;

|

| |

●

|

Net income increased 53.2% to $9.0 million, with diluted earnings per share of $0.39; and

|

| |

●

|

Adjusted EBITDA was $22.6 million.

|

Highlights for Fiscal 2024 Compared to Fiscal 2023

| |

●

|

Net sales increased 8.9% to $1.24 billion;

|

| |

●

|

Daily average comparable store sales increased 7.0%, and increased 10.6% on a two-year basis;

|

| |

●

|

21st consecutive year of positive comparable store sales growth;

|

| |

●

|

Net income increased 46.0% to $33.9 million, with diluted earnings per share of $1.47;

|

| |

●

|

Adjusted EBITDA was $83.3 million; and

|

| |

●

|

Opened four new stores and relocated/remodeled four stores.

|

“Our outstanding fourth quarter and fiscal year results underscore our customers’ appreciation for our commitment to the exceptional quality, value and convenience provided by our innovative business model along with consumers’ increasing prioritization of products that support health and sustainability,” said Kemper Isely, Co-President. “Our commitment to offering the highest quality products at Always AffordableSM prices is distinctive in the market and has been pivotal to our success. Fourth quarter results were broadly positive with daily average comparable store sales growth of 7.1% and 14.0% on a two-year basis, as well as a 53% increase in net income. We are particularly pleased with the balanced nature of our sales growth in fiscal 2024, including increases in transaction counts and items per transaction, modest price inflation and sales contribution from new stores.”

Mr. Isely continued, “The combination of consumer trends and our focus on customer engagement and operational initiatives have driven our sustained growth. Over the previous five years we have grown net sales by 37%, and diluted earnings per share have more than tripled. Furthermore, during this period we returned $108 million in capital to our stockholders through $4.76 of cumulative cash dividends per common share. As we look forward to fiscal 2025, we expect to build upon our momentum by continuing to execute to our founding principles, leveraging our differentiated model and emphasizing operational excellence to drive profitable growth.”

In addition to presenting the financial results of Natural Grocers by Vitamin Cottage, Inc. and its subsidiaries (collectively, the Company) in conformity with U.S. generally accepted accounting principles (GAAP), the Company is also presenting EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. The reconciliation from GAAP to these non-GAAP financial measures is provided at the end of this earnings release.

Operating Results — Fourth Quarter Fiscal 2024 Compared to Fourth Quarter Fiscal 2023

Net sales during the fourth quarter of fiscal 2024 increased $27.6 million, or 9.3%, to $322.7 million, compared to the fourth quarter of fiscal 2023, due to a $21.0 million increase in comparable store sales and a $6.6 million increase in new store sales. Daily average comparable store sales increased 7.1% in the fourth quarter of fiscal 2024, comprised of a 3.6% increase in daily average transaction count and a 3.4% increase in daily average transaction size. The increase in net sales was driven by increases in transaction counts, items per transaction, retail prices and new store sales. Sales growth was driven by enhanced customer engagement with our {N}power® rewards program, compelling offers, marketing initiatives, and increased sales of Natural Grocers® brand products.

Gross profit during the fourth quarter of fiscal 2024 increased $11.0 million, or 13.1%, to $95.4 million, compared to $84.3 million in the fourth quarter of fiscal 2023. Gross profit reflects earnings after product and store occupancy costs. Gross margin increased 100 basis points to 29.6% during the fourth quarter of fiscal 2024, compared to 28.6% in the fourth quarter of fiscal 2023. The increase in gross margin was driven by store occupancy cost leverage and higher product margin.

Store expenses during the fourth quarter of fiscal 2024 increased 10.2% to $72.6 million, primarily driven by higher compensation expenses and long-lived asset impairment charges related to a planned store closure. Store expenses as a percentage of net sales were 22.5% during the fourth quarter of fiscal 2024, up from 22.3% in the fourth quarter of fiscal 2023. The increase in store expenses as a percentage of net sales was primarily driven by higher long-lived asset impairment charges partially offset by expense leverage.

Administrative expenses during the fourth quarter of fiscal 2024 increased 4.4% to $10.2 million. Administrative expenses as a percentage of net sales were 3.2% in the fourth quarter of fiscal 2024, down from 3.3% in the fourth quarter of fiscal 2023.

Operating income for the fourth quarter of fiscal 2024 increased 56.0% to $12.1 million. Operating margin during the fourth quarter of fiscal 2024 was 3.7%, up from 2.6% in the fourth quarter of fiscal 2023.

Net income for the fourth quarter of fiscal 2024 was $9.0 million, or $0.39 diluted earnings per share, compared to net income of $5.9 million, or $0.26 diluted earnings per share, for the fourth quarter of fiscal 2023.

Adjusted EBITDA for the fourth quarter of fiscal 2024 was $22.6 million, compared to $16.1 million in the fourth quarter of fiscal 2023.

Operating Results — Fiscal 2024 Compared to Fiscal 2023

Net sales during fiscal 2024 increased $101.0 million, or 8.9%, to $1,241.6 million, compared to fiscal 2023, due to an $83.0 million increase in comparable store sales and a $22.6 million increase in new store sales, partially offset by a $4.6 million decrease in sales related to closed stores. Daily average comparable store sales increased 7.0% in fiscal 2024, comprised of a 3.8% increase in daily average transaction count and a 3.1% increase in daily average transaction size. The increase in net sales was driven by increases in transaction counts, retail prices, items per transaction and new store sales. Sales growth was driven by enhanced customer engagement with our {N}power rewards program, compelling offers, marketing initiatives including market-specific campaigns, and increased sales of Natural Grocers brand products.

Gross profit during fiscal 2024 increased $37.9 million, or 11.6%, to $364.8 million. Gross profit reflects earnings after product and store occupancy costs. Gross margin increased 70 basis points to 29.4% during fiscal 2024, compared to 28.7% in 2023. The increase in gross margin was primarily driven by store occupancy cost leverage and higher product margin attributed to effective pricing and promotions.

Store expenses during fiscal 2024 increased 7.8% to $277.4 million, primarily driven by higher compensation expenses, depreciation expenses and long-lived asset impairment charges. Store expenses as a percentage of net sales were 22.3% during fiscal 2024, down from 22.6% in fiscal 2023. The decrease in store expenses as a percentage of net sales primarily reflects expense leverage.

Administrative expenses during fiscal 2024 increased 7.6% to $38.7 million, driven by higher compensation expenses. Administrative expenses as a percentage of net sales were 3.1% for fiscal 2024, down from 3.2% in fiscal 2023.

Operating income for fiscal 2024 increased 48.3% to $47.0 million. Operating margin during fiscal 2024 was 3.8%, up from 2.8% in fiscal 2023.

Net income for fiscal 2024 was $33.9 million, or $1.47 diluted earnings per share, compared to net income of $23.2 million, or $1.02 diluted earnings per share, for fiscal 2023.

Adjusted EBITDA for fiscal 2024 was $83.3 million, compared to $63.4 million in fiscal 2023.

Balance Sheet and Cash Flow

As of September 30, 2024, the Company had $8.9 million in cash and cash equivalents, and no amounts outstanding on its $75.0 million revolving credit facility.

During fiscal 2024, the Company generated $73.8 million in cash from operations and invested $38.6 million in net capital expenditures, primarily for new and relocated/remodeled stores.

Dividend Announcement

Today, the Company announced the declaration of a quarterly cash dividend of $0.12 per common share, a 20% increase over the Company’s previous quarterly dividend. The dividend will be paid on December 18, 2024 to stockholders of record at the close of business on December 2, 2024.

Growth and Development

During the fourth quarter of fiscal 2024 the Company opened one new store, ending the fourth quarter with 169 stores in 21 states. A total of four new stores were opened during fiscal 2024.

Fiscal 2025 Outlook

The Company is introducing its fiscal 2025 outlook. The Company expects:

| |

|

Fiscal

2025 Outlook

|

|

|

Number of new stores

|

|

|

4 to 6 |

|

|

Number of relocations/remodels

|

|

|

2 to 4 |

|

|

Daily average comparable store sales growth

|

|

|

4.0% to 6.0% |

|

|

Diluted earnings per share

|

|

$1.52 to $1.60

|

|

| |

|

|

|

|

|

Capital expenditures (in millions)

|

|

$36 to $44

|

|

Earnings Conference Call

The Company will host a conference call today at 2:30 p.m. Mountain Time (4:30 p.m. Eastern Time) to discuss this earnings release. The dial-in number is 1-888-347-6606 (US) or 1-412-902-4289 (International). The conference ID is “Natural Grocers Q4 FY 2024 Earnings Call.” A simultaneous audio webcast will be available at http://Investors.NaturalGrocers.com and archived for a minimum of 20 days.

About Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC) is an expanding specialty retailer of natural and organic groceries, body care products and dietary supplements. The products sold by Natural Grocers must meet strict quality guidelines and may not contain artificial colors, flavors, preservatives or sweeteners, or partially hydrogenated or hydrogenated oils. The Company sells only USDA certified organic produce and exclusively pasture-raised, non-confinement dairy products, and free-range eggs. Natural Grocers’ flexible smaller-store format allows it to offer affordable prices in a shopper-friendly, clean and convenient retail environment. The Company also provides extensive free science-based nutrition education programs to help customers make informed health and nutrition choices. The Company, founded in 1955, has 168 stores in 21 states.

Visit www.NaturalGrocers.com for more information and store locations.

Forward-Looking Statements

The following constitutes a "safe harbor" statement under the Private Securities Litigation Reform Act of 1995. Except for the historical information contained herein, statements in this release are "forward-looking statements" and are based on management’s current expectations and are subject to uncertainty and changes in circumstances. All statements that are not statements of historical fact are forward-looking statements. Actual results could differ materially from these expectations due to changes in global, national, regional or local political, economic, inflationary, deflationary, recessionary, business, interest rate, labor market, competitive, market, regulatory and other factors, and other risks detailed in the Company's Annual Report on Form 10-K and the Company's subsequent quarterly reports on Form 10-Q. The information contained herein speaks only as of the date of this release and the Company undertakes no obligation to publicly update forward-looking statements, except as may be required by the securities laws.

For further information regarding risks and uncertainties associated with the Company's business, please refer to the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" sections of the Company's filings with the Securities and Exchange Commission, including, but not limited to, the Form 10-K and the Company's subsequent quarterly reports on Form 10-Q, copies of which may be obtained by contacting Investor Relations at 303-986-4600 or by visiting the Company's website at http://Investors.NaturalGrocers.com.

Investor Contact:

Reed Anderson, ICR, 646-277-1260, reed.anderson@icrinc.com

NATURAL GROCERS BY VITAMIN COTTAGE, INC.

Consolidated Statements of Income

(Unaudited)

(Dollars in thousands, except per share data)

| |

|

Three months ended

September 30,

|

|

|

Year ended

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net sales

|

|

$ |

322,661 |

|

|

|

295,075 |

|

|

|

1,241,585 |

|

|

|

1,140,568 |

|

|

Cost of goods sold and occupancy costs

|

|

|

227,299 |

|

|

|

210,730 |

|

|

|

876,775 |

|

|

|

813,637 |

|

|

Gross profit

|

|

|

95,362 |

|

|

|

84,345 |

|

|

|

364,810 |

|

|

|

326,931 |

|

|

Store expenses

|

|

|

72,605 |

|

|

|

65,863 |

|

|

|

277,396 |

|

|

|

257,282 |

|

|

Administrative expenses

|

|

|

10,241 |

|

|

|

9,807 |

|

|

|

38,715 |

|

|

|

35,973 |

|

|

Pre-opening expenses

|

|

|

450 |

|

|

|

938 |

|

|

|

1,722 |

|

|

|

2,007 |

|

|

Operating income

|

|

|

12,066 |

|

|

|

7,737 |

|

|

|

46,977 |

|

|

|

31,669 |

|

|

Interest expense, net

|

|

|

(1,053 |

) |

|

|

(821 |

) |

|

|

(4,176 |

) |

|

|

(3,299 |

) |

|

Income before income taxes

|

|

|

11,013 |

|

|

|

6,916 |

|

|

|

42,801 |

|

|

|

28,370 |

|

|

Provision for income taxes

|

|

|

(2,003 |

) |

|

|

(1,036 |

) |

|

|

(8,866 |

) |

|

|

(5,127 |

) |

|

Net income

|

|

$ |

9,010 |

|

|

|

5,880 |

|

|

|

33,935 |

|

|

|

23,243 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share of common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.40 |

|

|

|

0.26 |

|

|

|

1.49 |

|

|

|

1.02 |

|

|

Diluted

|

|

$ |

0.39 |

|

|

|

0.26 |

|

|

|

1.47 |

|

|

|

1.02 |

|

|

Weighted average number of shares of common stock outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,799,571 |

|

|

|

22,738,284 |

|

|

|

22,774,825 |

|

|

|

22,725,088 |

|

|

Diluted

|

|

|

23,175,214 |

|

|

|

22,945,750 |

|

|

|

23,083,903 |

|

|

|

22,834,316 |

|

NATURAL GROCERS BY VITAMIN COTTAGE, INC.

Consolidated Balance Sheets

(Unaudited)

(Dollars in thousands, except per share data)

| |

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

8,871 |

|

|

|

18,342 |

|

|

Accounts receivable, net

|

|

|

12,610 |

|

|

|

10,797 |

|

|

Merchandise inventory

|

|

|

120,672 |

|

|

|

119,260 |

|

|

Prepaid expenses and other current assets

|

|

|

4,905 |

|

|

|

4,151 |

|

|

Total current assets

|

|

|

147,058 |

|

|

|

152,550 |

|

|

Property and equipment, net

|

|

|

178,609 |

|

|

|

169,060 |

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

Operating lease assets, net

|

|

|

275,111 |

|

|

|

287,941 |

|

|

Finance lease assets, net

|

|

|

40,752 |

|

|

|

45,110 |

|

|

Other assets

|

|

|

458 |

|

|

|

395 |

|

|

Goodwill and other intangible assets, net

|

|

|

13,488 |

|

|

|

14,129 |

|

|

Total other assets

|

|

|

329,809 |

|

|

|

347,575 |

|

|

Total assets

|

|

$ |

655,476 |

|

|

|

669,185 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

88,397 |

|

|

|

80,675 |

|

|

Accrued expenses

|

|

|

35,847 |

|

|

|

33,064 |

|

|

Term loan, current portion

|

|

|

— |

|

|

|

1,750 |

|

|

Operating lease obligations, current portion

|

|

|

35,926 |

|

|

|

34,850 |

|

|

Finance lease obligations, current portion

|

|

|

3,960 |

|

|

|

3,690 |

|

|

Total current liabilities

|

|

|

164,130 |

|

|

|

154,029 |

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Term loan, net of current portion

|

|

|

— |

|

|

|

5,938 |

|

|

Operating lease obligations, net of current portion

|

|

|

263,404 |

|

|

|

276,808 |

|

|

Finance lease obligations, net of current portion

|

|

|

43,217 |

|

|

|

47,142 |

|

|

Deferred income tax liabilities, net

|

|

|

10,471 |

|

|

|

14,427 |

|

|

Total long-term liabilities

|

|

|

317,092 |

|

|

|

344,315 |

|

|

Total liabilities

|

|

|

481,222 |

|

|

|

498,344 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value. 50,000,000 shares authorized, 22,888,540 and 22,745,412 shares issued at September 30, 2024 and 2023, respectively, and 22,888,540 and 22,738,915 shares outstanding at September 30, 2024 and 2023, respectively

|

|

|

23 |

|

|

|

23 |

|

|

Additional paid-in capital

|

|

|

60,327 |

|

|

|

59,013 |

|

|

Retained earnings

|

|

|

113,904 |

|

|

|

111,871 |

|

|

Common stock in treasury at cost, 6,497 shares at September 30, 2023

|

|

|

— |

|

|

|

(66 |

) |

|

Total stockholders’ equity

|

|

|

174,254 |

|

|

|

170,841 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

655,476 |

|

|

|

669,185 |

|

NATURAL GROCERS BY VITAMIN COTTAGE, INC.

Consolidated Statements of Cash Flows

(Unaudited)

(Dollars in thousands)

| |

|

Year ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

33,935 |

|

|

|

23,243 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

30,930 |

|

|

|

28,906 |

|

|

Loss on impairment of long-lived assets and store closing costs

|

|

|

2,102 |

|

|

|

1,268 |

|

|

Loss on disposal of property and equipment

|

|

|

10 |

|

|

|

379 |

|

|

Share-based compensation

|

|

|

2,829 |

|

|

|

1,360 |

|

|

Deferred income tax benefit

|

|

|

(3,955 |

) |

|

|

(1,475 |

) |

|

Non-cash interest expense

|

|

|

17 |

|

|

|

19 |

|

|

Other

|

|

|

(160 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

(1,790 |

) |

|

|

315 |

|

|

Income tax receivable

|

|

|

252 |

|

|

|

378 |

|

|

Merchandise inventory

|

|

|

(1,412 |

) |

|

|

(5,504 |

) |

|

Prepaid expenses and other assets

|

|

|

(1,069 |

) |

|

|

(128 |

) |

|

Operating lease assets

|

|

|

33,446 |

|

|

|

33,067 |

|

|

(Decrease) increase in:

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities

|

|

|

(34,197 |

) |

|

|

(33,899 |

) |

|

Accounts payable

|

|

|

10,039 |

|

|

|

10,350 |

|

|

Accrued expenses

|

|

|

2,783 |

|

|

|

6,327 |

|

|

Net cash provided by operating activities

|

|

|

73,760 |

|

|

|

64,606 |

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment

|

|

|

(37,541 |

) |

|

|

(36,568 |

) |

|

Acquisition of other intangibles

|

|

|

(1,139 |

) |

|

|

(1,525 |

) |

|

Proceeds from sale of property and equipment

|

|

|

37 |

|

|

|

107 |

|

|

Proceeds from property insurance settlements

|

|

|

43 |

|

|

|

36 |

|

|

Net cash used in investing activities

|

|

|

(38,600 |

) |

|

|

(37,950 |

) |

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Borrowings under revolving loans

|

|

|

604,200 |

|

|

|

531,100 |

|

|

Repayments under revolving loans

|

|

|

(604,200 |

) |

|

|

(531,100 |

) |

|

Repayments under term loan

|

|

|

(7,688 |

) |

|

|

(8,000 |

) |

|

Finance lease obligation payments

|

|

|

(3,610 |

) |

|

|

(2,779 |

) |

|

Dividends to shareholders

|

|

|

(31,866 |

) |

|

|

(9,089 |

) |

|

Repurchase of common stock

|

|

|

— |

|

|

|

(181 |

) |

|

Payments of deferred financing costs

|

|

|

(18 |

) |

|

|

— |

|

|

Payments on withholding tax for restricted stock unit vesting

|

|

|

(1,449 |

) |

|

|

(304 |

) |

|

Net cash used in financing activities

|

|

|

(44,631 |

) |

|

|

(20,353 |

) |

|

Net (decrease) increase in cash and cash equivalents

|

|

|

(9,471 |

) |

|

|

6,303 |

|

|

Cash and cash equivalents, beginning of year

|

|

|

18,342 |

|

|

|

12,039 |

|

|

Cash and cash equivalents, end of year

|

|

$ |

8,871 |

|

|

|

18,342 |

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$ |

2,216 |

|

|

|

1,305 |

|

|

Cash paid for interest on financing lease obligations, net of capitalized interest of $338 and $318, respectively

|

|

|

1,939 |

|

|

|

2,002 |

|

|

Income taxes paid

|

|

|

13,581 |

|

|

|

5,048 |

|

|

Supplemental disclosures of non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment not yet paid

|

|

$ |

3,679 |

|

|

|

6,016 |

|

|

Acquisition of other intangibles not yet paid

|

|

|

22 |

|

|

|

3 |

|

|

Property acquired through operating lease obligations

|

|

|

22,317 |

|

|

|

15,274 |

|

|

Property acquired through finance lease obligations

|

|

|

(45 |

) |

|

|

5,724 |

|

NATURAL GROCERS BY VITAMIN COTTAGE, INC.

Non-GAAP Financial Measures

(Unaudited)

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are not measures of financial performance under GAAP. We define EBITDA as net income before interest expense, provision for income taxes, depreciation and amortization. We define Adjusted EBITDA as EBITDA as adjusted to exclude the effects of certain income and expense items that management believes make it more difficult to assess the Company’s actual operating performance, including certain items such as impairment charges, store closing costs, share-based compensation and non-recurring items.

The following table reconciles net income to EBITDA and Adjusted EBITDA, dollars in thousands:

| |

|

Three months ended

September 30,

|

|

|

Year ended

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net income

|

|

$ |

9,010 |

|

|

|

5,880 |

|

|

|

33,935 |

|

|

|

23,243 |

|

|

Interest expense, net

|

|

|

1,053 |

|

|

|

821 |

|

|

|

4,176 |

|

|

|

3,299 |

|

|

Provision for income taxes

|

|

|

2,003 |

|

|

|

1,036 |

|

|

|

8,866 |

|

|

|

5,127 |

|

|

Depreciation and amortization

|

|

|

7,932 |

|

|

|

7,480 |

|

|

|

30,930 |

|

|

|

28,906 |

|

|

EBITDA

|

|

|

19,998 |

|

|

|

15,217 |

|

|

|

77,907 |

|

|

|

60,575 |

|

|

Impairment of long-lived assets and store closing costs

|

|

|

1,721 |

|

|

|

534 |

|

|

|

2,547 |

|

|

|

1,464 |

|

|

Share-based compensation

|

|

|

929 |

|

|

|

314 |

|

|

|

2,829 |

|

|

|

1,360 |

|

|

Adjusted EBITDA

|

|

$ |

22,648 |

|

|

|

16,065 |

|

|

|

83,283 |

|

|

|

63,399 |

|

EBITDA increased 31.4% to $20.0 million for the fourth quarter of fiscal 2024 compared to $15.2 million for the fourth quarter of fiscal 2023. EBITDA increased 28.6% to $77.9 million for the year ended September 30, 2024 compared to $60.6 million for the year ended September 30, 2023. EBITDA as a percentage of net sales was 6.2% and 5.2% for the fourth quarter of 2024 and 2023, respectively. EBITDA as a percentage of net sales was 6.3% and 5.3% for the years ended September 30, 2024 and 2023, respectively.

Adjusted EBITDA increased 41.0% to $22.6 million for the fourth quarter of fiscal 2024 compared to $16.1 million for the fourth quarter of fiscal 2023. Adjusted EBITDA increased 31.4% to $83.3 million for the year ended September 30, 2024 compared to $63.4 million for the year ended September 30, 2023. Adjusted EBITDA as a percentage of net sales was 7.0% and 5.4% for the fourth quarter of fiscal 2024 and 2023, respectively. Adjusted EBITDA as a percentage of net sales was 6.7% and 5.6% for the years ended September 30, 2024 and 2023, respectively.

Management believes some investors’ understanding of our performance is enhanced by including EBITDA and Adjusted EBITDA, which are non-GAAP financial measures. We believe EBITDA and Adjusted EBITDA provide additional information about: (i) our operating performance, because they assist us in comparing the operating performance of our stores on a consistent basis, as they remove the impact of non-cash depreciation and amortization expense as well as items not directly resulting from our core operations, such as interest expense and income taxes and (ii) our performance and the effectiveness of our operational strategies. Additionally, EBITDA is a component of a measure in our financial covenants under our credit facility.

Furthermore, management believes some investors use EBITDA and Adjusted EBITDA as supplemental measures to evaluate the overall operating performance of companies in our industry. Management believes that some investors’ understanding of our performance is enhanced by including these non-GAAP financial measures as a reasonable basis for comparing our ongoing results of operations. By providing these non-GAAP financial measures, together with a reconciliation from net income, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives.

Our competitors may define EBITDA and Adjusted EBITDA differently, and as a result, our measures of EBITDA and Adjusted EBITDA may not be directly comparable to EBITDA and Adjusted EBITDA of other companies. Items excluded from EBITDA and Adjusted EBITDA are significant components in understanding and assessing financial performance. EBITDA and Adjusted EBITDA are supplemental measures of operating performance that do not represent and should not be considered in isolation or as an alternative to, or substitute for, net income or other financial statement data presented in the consolidated financial statements as indicators of financial performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of the limitations are:

| |

●

|

EBITDA and Adjusted EBITDA do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments;

|

| |

●

|

EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs;

|

| |

●

|

EBITDA and Adjusted EBITDA do not reflect any depreciation or interest expense for leases classified as finance leases;

|

| |

●

|

EBITDA and Adjusted EBITDA do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments on our debt;

|

| |

●

|

Adjusted EBITDA does not reflect share-based compensation, impairment charges, and store closing costs;

|

| |

●

|

EBITDA and Adjusted EBITDA do not reflect our tax expense or the cash requirements to pay our taxes; and

|

| |

●

|

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements.

|

Due to these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA as supplemental information.

Exhibit 99.2

Natural Grocers by Vitamin Cottage, Inc. Declares Quarterly Dividend

Increases Quarterly Cash Dividend by 20% to $0.12 per Common Share

Lakewood, CO, November 21, 2024 /PRNewswire/ -- Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC) today announced that the Company’s Board of Directors has declared a quarterly cash dividend of $0.12 per common share. The dividend will be paid on December 18, 2024 to all stockholders of record at the close of business on December 2, 2024.

About Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc. (NYSE: NGVC) is an expanding specialty retailer of natural and organic groceries, body care products and dietary supplements. The products sold by Natural Grocers must meet strict quality guidelines and may not contain artificial colors, flavors, preservatives or sweeteners, or partially hydrogenated or hydrogenated oils. The Company sells only USDA certified organic produce and exclusively pasture-raised, non-confinement dairy products, and free-range eggs. Natural Grocers’ flexible smaller-store format allows it to offer affordable prices in a shopper-friendly, clean and convenient retail environment. The Company also provides extensive free science-based nutrition education programs to help customers make informed health and nutrition choices. The Company, founded in 1955, has 168 stores in 21 states.

Visit www.NaturalGrocers.com for more information and store locations.

Forward-Looking Statements

The following constitutes a "safe harbor" statement under the Private Securities Litigation Reform Act of 1995. Except for the historical information contained herein, statements in this release are "forward-looking statements" and are based on management’s current expectations and are subject to uncertainty and changes in circumstances. All statements that are not statements of historical fact are forward-looking statements. Actual results could differ materially from these expectations due to changes in global, national, regional or local political, economic, inflationary, deflationary, recessionary, business, interest rate, labor market, competitive, market, regulatory and other factors, and other risks detailed in the Company's Annual Report on Form 10-K and the Company's subsequent quarterly reports on Form 10-Q. The information contained herein speaks only as of the date of this release and the Company undertakes no obligation to publicly update forward-looking statements, except as may be required by the securities laws.

For further information regarding risks and uncertainties associated with the Company's business, please refer to the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" sections of the Company's filings with the Securities and Exchange Commission, including, but not limited to, the Form 10-K and the Company's subsequent quarterly reports on Form 10-Q, copies of which may be obtained by contacting Investor Relations at 303-986-4600 or by visiting the Company's website at http://Investors.NaturalGrocers.com.

Investor Contact:

Reed Anderson, ICR, 646-277-1260, reed.anderson@icrinc.com

v3.24.3

Document And Entity Information

|

Nov. 21, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Natural Grocers by Vitamin Cottage, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 21, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35608

|

| Entity, Tax Identification Number |

45-5034161

|

| Entity, Address, Address Line One |

12612 West Alameda Parkway

|

| Entity, Address, City or Town |

Lakewood

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80228

|

| City Area Code |

303

|

| Local Phone Number |

986-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NGVC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001547459

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

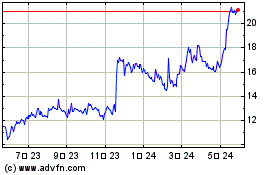

Natural Grocers by Vitam... (NYSE:NGVC)

過去 株価チャート

から 11 2024 まで 12 2024

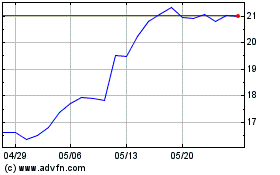

Natural Grocers by Vitam... (NYSE:NGVC)

過去 株価チャート

から 12 2023 まで 12 2024