true

0001478888

N-2/A

No

0001478888

2024-07-12

2024-07-12

0001478888

dei:BusinessContactMember

2024-07-12

2024-07-12

0001478888

nbb:CommonSharesMember

2024-07-05

0001478888

nbb:CommonSharesMember

2024-06-30

2024-06-30

0001478888

nbb:CommonSharesMember

2024-07-05

2024-07-05

0001478888

nbb:PreferredSharesMember

2024-07-12

2024-07-12

0001478888

nbb:PreferredSharesMember

2024-06-30

2024-06-30

0001478888

nbb:CommonSharesMember

2024-07-12

2024-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As filed with the U.S. Securities

and Exchange Commission on July 12, 2024

Securities Act Registration No. 333-276610

Investment Company Registration No. 811-22391

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM N-2

| ☒ |

Registration Statement under

the Securities Act of 1933: |

| |

| ☒ |

Pre-Effective Amendment No. 1 |

| |

| ☐ |

Post-Effective Amendment No. |

| |

| and |

| |

| ☒ |

Registration Statement under the Investment

Company Act of 1940: |

| |

| ☒ |

Amendment No. 7 |

Nuveen

Taxable Municipal Income Fund

Exact Name of Registrant as Specified in

the Declaration of Trust

333 West Wacker Drive

Chicago, Illinois 60606

Address of Principal Executive Offices

(Number, Street, City, State, Zip Code)

(800) 257-8787

Registrant’s Telephone Number, including

Area Code

Mark L. Winget

Vice President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

Name and Address (Number, Street, City,

State, Zip Code) of Agent for Service

Copies of Communications to:

| Eric

S. Purple, Esquire |

|

Joel

D. Corriero, Esquire |

|

Eric

F. Fess |

Stradley Ronon Stevens & Young,

LLP

2000 K Street, N.W., Suite 700

Washington, D.C. 20006

|

|

Stradley Ronon Stevens & Young,

LLP

2005 Market Street, Suite 2600

Philadelphia, Pennsylvania 19103

|

|

Chapman and Cutler LLP

111 West Monroe

Chicago, Illinois 60603

|

Approximate Date of Commencement of Proposed

Public Offering:

From time to time after the effective date

of this Registration Statement.

☐

Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment

plans.

☒

Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule

415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend

reinvestment plan.

☒

Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto.

☐

Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that

will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act.

☐

Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act.

It is proposed that this filing will become effective (check

appropriate box)

☐

when declared effective pursuant to Section 8(c) of the Securities Act.

If appropriate, check the following box:

☐

This [post-effective] amendment designates a new effective date for a previously filed [post-effective] amendment [registration

statement].

☐

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: ____________.

☐

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is: ____________.

☐

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is: ____________.

Check each box that appropriately characterizes the Registrant:

☒

Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940

(“Investment Company Act”)).

☐

Business Development Company (closed-end company that intends or has elected to be regulated as a business development

company under the Investment Company Act).

☐

Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under

Rule 23c-3 under the Investment Company Act).

☒

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

☐

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

☐

Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”).

☐

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

☐

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing).

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically

states that the Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to Section 8(a), may determine.

BASE PROSPECTUS

$120,480,111

Common Shares

Preferred Shares

Rights to Purchase Common Shares

Nuveen Taxable Municipal Income Fund

The Offering. Nuveen

Taxable Municipal Income Fund (the “Fund”) is offering, on an immediate, continuous or delayed basis, in one or more

offerings, with a maximum aggregate dollar offering price of up to $120,480,111, common shares (“Common Shares”),

preferred shares (“Preferred Shares”), and/or subscription rights to purchase Common Shares (“Rights,”

and collectively with Common Shares and Preferred Shares, “Securities”), in any combination. The Fund may offer and

sell such Securities directly to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates

from time to time, or through a combination of these methods. The prospectus supplement relating to any offering of Securities

will describe such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding

any applicable purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the

basis upon which such amount may be calculated. The prospectus supplement relating to any Rights offering will set forth the number

of Common Shares issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. For

more information about the manners in which the Fund may offer Securities, see “Plan of Distribution.”

The Fund. The Fund is

a diversified, closed-end management investment company. The Fund’s primary investment objective is to provide

current income through investments in taxable municipal securities. As a secondary objective, the Fund seeks to enhance portfolio

value and total return. There can be no assurance that the Fund will achieve its investment objectives or that the Fund’s

investment strategies will be successful.

This Prospectus, together with any

related prospectus supplement, sets forth concisely information about the Fund that a prospective investor should know before

investing, and should be retained for future reference. Investing in Securities involves risks, including the risks associated

with the Fund’s use of leverage. You could lose some or all of your investment. You should consider carefully these risks

together with all of the other information in this Prospectus and any related prospectus supplement before making a decision to

purchase any of the Securities. See “Risk Factors” beginning on page 19.

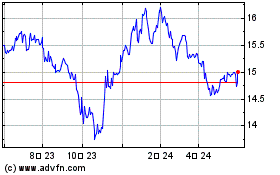

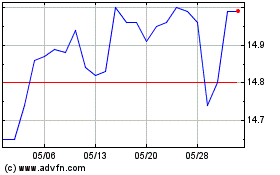

Common Shares are listed on the New

York Stock Exchange (the “NYSE”). The trading or “ticker” symbol of the Common Shares is “NBB.”

The closing price of the Common Shares, as reported by the NYSE on July 5, 2024, was $15.57 per Common Share. The net asset value of

the Common Shares at the close of business on that same date was $16.64 per Common Share. Preferred Shares and/or Rights issued

by the Fund may also be listed on a securities exchange.

* * *

You should read this Prospectus, together with any related

prospectus supplement, which contains important information about the Fund, before deciding whether to invest and retain it for

future reference. A Statement of Additional Information, dated July 16, 2024 (the “SAI”), containing

additional information about the Fund has been filed with the U.S. Securities and Exchange Commission (the “SEC”)

and is incorporated by reference in its entirety into this Prospectus. You may request a free copy of the SAI, the table of contents

of which is on the last page of this Prospectus, annual and semi-annual reports to shareholders and other information about the

Fund and make shareholder inquiries by calling (800) 257-8787, by writing to the Fund at 333 West Wacker Drive,

Chicago, Illinois 60606 or from the Fund’s website (http://www.nuveen.com). The information contained in, or that can be

accessed through, the Fund’s website is not part of this Prospectus, except to the extent specifically incorporated by reference

herein. You also may obtain a copy of the SAI (and other information regarding the Fund) from the SEC’s web site (http://www.sec.gov).

The date of this Prospectus is July

16, 2024.

The Securities do not represent a deposit

or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally

insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency.

Neither the SEC nor any state securities

commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated

by reference into this Prospectus and any related prospectus supplement. The Fund has not authorized anyone to provide you with

different information. The Fund is not making an offer of these securities in any state where the offer is not permitted. You should

not assume that the information contained in this Prospectus and any related prospectus supplement is accurate as of any date other

than the dates on their covers. The Fund will update this Prospectus to reflect any material changes to the disclosures herein.

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates

contained or incorporated by reference herein are forward looking statements and are based upon certain assumptions. Projections,

forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying

any projections, forecasts or estimates will not materialize or will vary significantly from actual results. Actual results may

vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause

actual results to differ materially from those in any forward looking statements include changes in interest rates, market, financial

or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently,

the inclusion of any projections, forecasts and estimates herein should not be regarded as a representation by the Fund or any

of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor

its affiliates has any obligation to update or otherwise revise any projections, forecasts and estimates including any revisions

to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of

unanticipated events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the

foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply

to investment companies such as the Fund.

PROSPECTUS SUMMARY

This is only a summary. You should review

the more detailed information contained elsewhere in this Prospectus and any related prospectus supplement and in the Statement

of Additional Information (the “SAI”).

| The Fund |

Nuveen Taxable Municipal Income Fund (the “Fund”) is a diversified, closed-end management investment company.

See “The Fund.” The Fund’s common shares, $0.01 par value per share (“Common Shares”), are traded

on the New York Stock Exchange (the “NYSE”) under the symbol “NBB.” Preferred Shares and/or Rights

issued by the Fund may also be listed on a securities exchange. |

|

The closing price of the Common Shares, as reported by the NYSE on July 5, 2024, was $15.57

per Common Share. The net asset value (“NAV”) of the Common Shares at the close of business on that same date was

$16.64

per Common Share. As of June 30, 2024 the Fund had 29,394,752

Common Shares outstanding and net assets of $485,760,956. See “Description of Shares.” |

| The Offering |

The Fund may offer, from time to time, in one or more offerings, with a maximum aggregate dollar

offering price of up to $120,480,111, Common Shares, preferred shares (“Preferred Shares”), and/or subscription

rights to purchase Common Shares (“Rights,” and collectively with Common Shares and Preferred Shares, “Securities”),

in any combination, on terms to be determined at the time of the offering. The Fund may offer and sell such Securities directly

to one or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time,

or through a combination of these methods. The prospectus supplement relating to any offering of Securities will describe

such offering, including, as applicable, the names of any underwriters, dealers or agents and information regarding any applicable

purchase price, fee, commission or discount arrangements made with those underwriters, dealers or agents or the basis upon

which such amount may be calculated. For more information about the manners in which the Fund may offer Securities, see “Plan

of Distribution.” The prospectus supplement relating to any Rights offering will set forth the number of Common Shares

issuable upon the exercise of each Right (or number of Rights) and the other terms of such Rights offering. The minimum price

on any day at which the Common Shares may be sold will not be less than the NAV per Common Share at the time of the offering

plus the per share amount of any underwriting commission or discount; provided that Rights offerings that meet certain conditions

may be offered at a price below the then current NAV. See “Rights Offerings.” |

|

The Fund may not sell any Securities through agents, underwriters or dealers without delivery, or deemed delivery, of a prospectus,

including the appropriate prospectus supplement, describing the method and terms of the particular offering of such Securities.

You should read this Prospectus and the applicable prospectus supplement carefully before you invest in our Securities. |

| Investment Objectives and Policies |

Please refer to the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current

Investment Objectives, Investment Policies and Principal Risks of the Fund—Investment Objectives” and “—Investment

Policies,” as such investment objectives and investment policies may be supplemented from time to time, which are incorporated

by reference herein, for a discussion of the Fund’s investment objectives and policies. |

|

There can be no assurance that such strategies will be successful. For a more complete discussion of the Fund’s portfolio

composition and its corresponding risks, see “The Fund’s Investments” and “Risk Factors.” |

| Investment Adviser |

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”), the Fund’s investment adviser,

is responsible for overseeing the Fund’s overall investment strategy and its implementation. Nuveen Fund Advisors offers

advisory and investment management services to a broad range of investment company clients. Nuveen Fund Advisors has overall

responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s

business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located

at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary of Nuveen, LLC (“Nuveen”),

the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”). TIAA is a life

insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and is the companion organization

of College Retirement Equities Fund. As of March 31, 2024, Nuveen managed approximately $1.2 trillion in assets, of which

approximately $143.2 billion was managed by Nuveen Fund Advisors. |

| Sub-Adviser | Nuveen Asset Management, LLC (“Nuveen Asset Management”) serves as the Fund’s sub-adviser. Nuveen

Asset Management, a registered investment adviser, is a wholly-owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management

oversees the day-to-day investment operations of the Fund. |

| Use of Leverage |

The Fund uses leverage to pursue its investment objectives. The Fund may use leverage to the extent permitted by the Investment

Company Act of 1940, as amended (the “1940 Act”). The Fund may source leverage through a number of methods, including

reverse repurchase agreements (effectively a secured borrowing), investments in inverse floating rate securities of tender option

bond trusts, borrowings (including loans from financial institutions), issuances of debt securities, and issuances of Preferred

Shares. The Fund may also use other forms of leverage including, but not limited to, portfolio investments that have the economic

effect of leverage. |

|

Currently, the Fund employs leverage through its use of reverse repurchase agreements. The Fund

also currently invests in residual interest certificates of tender option bond trusts, also called inverse floating rate securities,

that have the economic effect of leverage because the Fund’s investment exposure to the underlying bonds held by the

Fund have been effectively financed by the Fund’s issuance of floating rate certificates. As of May 31, 2024, the Fund’s

leverage through reverse repurchase agreements and through investments in inverse floating rate securities was approximately

41% of its Managed Assets. |

|

The Fund may also borrow for temporary purposes as permitted by the 1940 Act. |

|

The Fund may reduce or increase leverage based upon changes in market conditions and anticipates that its leverage ratio will

vary from time to time based upon variations in the value of the Fund’s holdings. So long as the rate of net income received

on the Fund’s investments exceeds the then current expense on any leverage, leverage will generate more net income than

if the Fund had not used leverage. If so, the excess net income will be available to pay higher distributions to holders of Common

Shares (“Common Shareholders”). However, if the rate of net income received from the Fund’s portfolio investments

is less than the then current expense on outstanding leverage, the Fund may be required to utilize other Fund assets to make expense

payments on outstanding leverage, which may result in a decline in Common Share NAV and reduced net investment income available

for distribution to Common Shareholders. |

|

The Fund pays a management fee to Nuveen Fund Advisors (which in turn pays a portion of its fee to Nuveen Asset Management) based

on a percentage of Managed Assets. Managed Assets for this purpose includes the proceeds realized and managed from the Fund’s

use of leverage as set forth in the Fund’s investment management agreement. Because Managed Assets include the Fund’s

net assets as well as assets that are attributable to the Fund’s use of leverage, it is anticipated that the Fund’s

Managed Assets will be greater than its net assets. Nuveen Fund Advisors and Nuveen Asset Management are responsible for using

leverage to pursue the Fund’s investment objectives, and base their decision regarding whether and how much leverage to

use for the Fund on their assessment of whether such use of leverage will advance the Fund’s investment objectives. However,

a decision to employ or increase the Fund’s leverage will have the effect, all other things being equal, of increasing Managed

Assets and therefore Nuveen Fund Advisors’ and Nuveen Asset Management’s fees. Thus, Nuveen Fund Advisors and Nuveen

Asset Management may have a conflict of interest in determining whether the Fund should use or increase leverage. Nuveen Fund

Advisors and Nuveen Asset Management will seek to manage that potential conflict by only employing or increasing the Fund’s

use of leverage when they determine that such increase is in the best interest of the Fund and is consistent with the Fund’s

investment objectives, and by periodically reviewing the Fund’s performance and use of leverage with the Fund’s Board

of Trustees (the “Board”). |

|

The use of leverage creates additional risks for Common Shareholders, including increased variability of the Fund’s NAV,

net income and distributions in relation to market changes. There is no assurance that the Fund will continue to use leverage

or that the Fund’s use of leverage will work as planned or achieve its goals. |

| Distributions | The Fund pays regular monthly cash distributions to Common Shareholders (stated in terms of a fixed cents per Common Share

dividend distribution rate which may be set from time to time). The Fund intends to distribute all or substantially all of its

net investment income each year through its regular monthly distributions and to distribute realized capital gains at least annually.

In addition, in any monthly period, to maintain its declared per common share distribution amount, the Fund may distribute more

or less than its net investment income during the period. In the event the Fund distributes more than its net investment income,

such distributions may also include realized gains and/or a return of capital. To the extent that a distribution includes a return

of capital the NAV per share may erode. If a distribution includes anything other than net investment income, the Fund provides

a notice of the best estimate of its distribution sources at the time. See “Distributions.” |

|

The Fund reserves the right to change its distribution policy and the basis for establishing the rate of its monthly distributions

at any time and may do so without prior notice to Common Shareholders. |

| Custodian and Transfer Agent |

State Street Bank and Trust Company serves as the Fund’s custodian, and Computershare Inc. and Computershare Trust Company,

N.A. serves as the Fund’s transfer agent for the Common Shares. The corresponding agent for any Preferred Shares will be

identified in the related prospectus supplement. See “Custodian and Transfer Agent.” |

| Risk Factors |

Investment in the Fund involves risk. The Fund is designed as a long-term investment and not as a trading vehicle. The Fund is

not intended to be a complete investment program. Please refer to the section of the Fund’s most recent annual report on

Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of

the Fund—Principal Risks of the Fund,” as such principal risks may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The

specific risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement. |

| Use of Proceeds |

Unless otherwise specified in a prospectus supplement, the Fund will use the net proceeds from any offering of Securities, pursuant

to this Prospectus, to make investments in accordance with the Fund’s investment objectives. See “Use of Proceeds.” |

| Federal Income Tax |

The Fund has elected to be treated, and intends to qualify each year, as a regulated investment company (“RIC”) under

Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). To qualify for the favorable U.S. federal

income tax treatment generally accorded to a RIC under Subchapter M of the Code the Fund must, among other requirements, derive

in each taxable year at least 90% of its gross income from certain prescribed sources and satisfy a diversification test on a

quarterly basis. If the Fund fails to satisfy the qualifying income or diversification requirements in any taxable year, the Fund

may be eligible for relief provisions if the failures are due to reasonable cause and not willful neglect and if a penalty tax

is paid with respect to each failure to satisfy the applicable requirements. Additionally, relief is provided for certain de

minimis failures of the diversification requirements where the Fund corrects the failure within a specified period. In

order to be eligible for the relief provisions with respect to a failure to meet the diversification requirements, the Fund may

be required to dispose of certain assets. If these relief provisions were not available to the Fund and it were to fail to qualify

for treatment as a RIC for a taxable year, all of its taxable income (including its net capital gain) would be subject to tax

at the 21% regular corporate rate without any deduction for distributions to shareholders, and such distributions would be taxable

as ordinary dividends to the extent of the Fund’s current and accumulated earnings and profits. To qualify to pay exempt-interest

dividends, which are treated as items of interest excludable from gross income for federal income tax purposes, at least 50% of

the value of the total assets of the Fund must consist of obligations exempt from regular income tax as of the close of each quarter

of the Fund’s taxable year. If the proportion of taxable investments held by the Fund exceeds 50% of the Fund’s total

assets as of the close of any quarter of any Fund taxable year, the Fund will not for that taxable year satisfy the general eligibility

test that otherwise permits it to pay exempt-interest dividends. While the Fund may invest in municipal securities the interest

income from which is exempt from regular federal income tax, the Fund does not expect to satisfy the requirements to pay exempt-interest

dividends to shareholders. |

|

See “Fund Tax Risk,” as contained in the section of the Fund’s most recent annual report on Form N-CSR entitled

“Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal

Risks of the Fund—Fund Level and Other Risks,” and “Tax Matters.” |

| Governing Law |

The Fund’s Declaration of Trust (the “Declaration of Trust”) is, and each Statement and Statement Supplement

for Preferred Shares will be, governed by the laws of the Commonwealth of Massachusetts. |

SUMMARY OF FUND EXPENSES

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment

Policies and Principal Risks of the Fund—Updated Disclosures for the Fund’s Effective Shelf Offering Registration Statement—Summary

of Fund Expenses,” which is incorporated by reference herein, for a discussion of fees and expenses of the Fund.

FINANCIAL HIGHLIGHTS

The Fund’s financial highlights

for the fiscal years ended March 31, 2024, March 31, 2023, March 31, 2022, March 31, 2021, and March 31, 2020, are incorporated

by reference from the Fund’s Annual

Report for the fiscal year ended March 31, 2024 (File No. 811-22391), as filed with the SEC on Form N-CSR on June 4, 2024.

The financial highlights for each of these fiscal years have been derived from financial statements audited by KPMG LLP (“KPMG”),

the Fund’s independent registered public accounting firm, for the last five fiscal years. The Fund’s financial highlights

for the fiscal years ended March 31, 2019, March 31, 2018, March 31, 2017, March 31, 2016, and March 31, 2015, are incorporated

by reference from the Fund’s Annual

Report for the fiscal year ended March 31, 2019 (File No. 811-22391), as filed with the SEC on Form N-CSR on June 6, 2019.

TRADING AND NET ASSET VALUE INFORMATION

Please refer to the section of the

Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment

Policies and Principal Risks of the Fund—Updated Disclosures for the Fund’s Effective Shelf Offering Registration

Statement—Trading and Net Asset Value Information,” which is incorporated by reference herein, for a discussion of

the following information for the periods indicated: (i) the high and low market prices for Common Shares reported as of

the end of the day on the NYSE, (ii) the high and low net asset values of Common Shares, and (iii) the high and low

of the premium/(discount) to net asset value (expressed as a percentage) of Common Shares.

The net

asset value per Common Share, the market price, and percentage of premium/(discount) to net asset value per Common Share on July

5, 2024, was $16.64,

$15.57

and (6.43)%,

respectively. As of June 30, 2024, the Fund had 29,394,752 Common Shares outstanding and net assets of $485,760,956.

THE FUND

The Fund is a diversified, closed-end management

investment company registered under the 1940 Act. The Fund was organized as a Massachusetts business trust on December 4, 2009,

pursuant to the Declaration of Trust, which is governed by the laws of the Commonwealth of Massachusetts. The Fund’s Common

Shares are listed on the NYSE under the symbol “NBB.” Preferred Shares and/or Rights issued by the Fund may also be

listed on a securities exchange.

The following provides information

about the Fund’s outstanding Common Shares and Preferred Shares as of June 30, 2024:

| Title of Class |

|

Amount

Authorized |

|

Amount Held

by the Fund or

for its Account |

|

Amount

Outstanding |

|

| Common Shares |

|

|

Unlimited |

|

|

0 |

|

|

29,394,752 |

|

| Preferred Shares |

|

|

Unlimited |

|

|

0 |

|

|

0 |

|

USE OF PROCEEDS

Unless otherwise specified in a prospectus

supplement, the net proceeds from any offering will be invested in accordance with the Fund’s investment objectives and policies

as stated below. Pending investment, the timing of which may vary depending on the size of the investment but in no case is expected

to exceed 30 days, it is anticipated that the proceeds will be invested in short-term or long-term securities issued by the U.S.

Government or its agencies or instrumentalities or in high-quality, short-term money market instruments. See “Use of Leverage.”

THE FUND’S INVESTMENTS

Investment Objectives and Policies

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Investment Objectives” and “—Investment Policies,” as such investment

objectives and investment policies may be supplemented from time to time, which is incorporated by reference herein, for a discussion

of the Fund’s investment objectives and policies.

Portfolio Composition and Other Information

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Investment Policies—Portfolio Contents,” as such portfolio contents may be supplemented

from time to time, which is incorporated by reference herein, for a discussion of the investments principally included in the Fund’s

portfolio. More detailed information about the Fund’s portfolio investments are contained in the SAI under “The Fund’s

Investments.”

Portfolio Turnover

The Fund may engage in portfolio trading

when considered appropriate, but short-term trading will not be used as the primary means of achieving the Fund’s investment

objectives. For the fiscal year ended March 31, 2024, the Fund’s portfolio turnover rate was 2%. However, there are no limits

on the Fund’s rate of portfolio turnover, and investments may be sold without regard to length of time held when, in Nuveen

Asset Management’s opinion, investment considerations warrant such action. A higher portfolio turnover rate would result

in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Although these commissions

and expenses are not reflected in the Fund’s “Total Annual Expenses” disclosed in this the Fund’s most

recent annual report on Form N-CSR, they will be reflected in the Fund’s total return. In addition, high portfolio turnover

may result in the realization of net short-term capital gains by the Fund which, when distributed to shareholders, will be taxable

as ordinary income. See “Tax Matters.”

Other Policies

Certain investment policies specifically identified in the SAI as such are considered

fundamental and may not be changed without shareholder approval. See “Investment Restrictions” in the SAI.

USE OF LEVERAGE

The Fund uses leverage to pursue its investment

objectives. The Fund may use leverage to the extent permitted by the 1940 Act. The Fund may source leverage through a number of

methods including reverse repurchase agreements (effectively a secured borrowing), investments in inverse floating rate securities

of tender option bond trusts, the issuance of Preferred Shares, and borrowings (subject to certain investment restrictions). See

“The Fund’s Investments—Portfolio Composition—Municipal Securities—Inverse Floating Rate Securities”

and “Investment Restrictions” in the SAI. For a discussion of risks, see “Portfolio Level Risks—Inverse

Floating Rate Securities Risk” and “Fund Level and Other Risks—Reverse Repurchase Agreement Risk,” as each

such risk is contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current

Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund.” The Fund may

also use certain derivatives and other forms of leverage that have the economic effect of leverage by creating additional investment

exposure.

Currently, the Fund employs leverage

through its use of reverse repurchase agreements. The Fund also currently invests in residual interest certificates of tender option

bond trusts, also called inverse floating rate securities, that have the economic effect of leverage because the Fund’s

investment exposure to the underlying bonds held by the trust have been effectively financed by the trust’s issuance of

floating rate certificates. As of May 31, 2024, the Fund’s leverage through reverse repurchase agreements and through

investments in inverse floating rate securities was approximately 41% of its Managed Assets.

To date, the Fund has not issued Preferred

Shares. The Fund may in the future issue certain types of Preferred Shares to increase the Fund’s leverage.

The Fund may reduce or increase leverage

based upon changes in market conditions and anticipates that its leverage ratio will vary from time to time based upon variations

in the value of the Fund’s holdings. So long as the net rate of income received on the Fund’s investments purchased

with leverage proceeds exceeds the then current expense on any leverage, the investment of leverage proceeds will generate more

net income than if the Fund had not used leverage. If so, the excess net income will be available to pay higher distributions to

Common Shareholders. However, if the rate of net income received from the Fund’s portfolio investments purchased with leverage

is less than the then current expense on outstanding leverage, the Fund may be required to utilize other Fund assets to make expense

payments on outstanding leverage, which may result in a decline in Common Share NAV and reduced net investment income available

for distribution to Common Shareholders. See “Leverage Risk,” as such risk is contained in the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Principal Risks of the Fund—Fund Level and Other Risks.”

Following an offering of additional Common

Shares from time to time, the Fund’s leverage ratio will decrease as a result of the increase in net assets attributable

to Common Shares. The Fund’s leverage ratio may decline further to the extent that the net proceeds of an offering of Common

Shares are used to reduce the Fund’s leverage. A lower leverage ratio may result in lower (higher) returns to Common Shareholders

over a period of time to the extent that net returns on the Fund’s investment portfolio exceed (fall below) its cost of leverage

over that period, which lower (higher) returns may impact the level of the Fund’s distributions. See “Leverage Risk,”

as such risk is contained in the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder

Update—Current Investment Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund—Fund

Level and Other Risks.”

The Fund may use derivatives, such as interest

rate swaps with varying terms, in order to manage the interest rate expense associated with all or a portion of its leverage. Interest

rate swaps are bi-lateral agreements whereby parties agree to exchange future payments, typically based upon the differential of

a fixed rate and a variable rate, on a specified notional amount. Interest rate swaps can enable the Fund to effectively convert

its variable leverage expense to fixed, or vice versa. For example, if the Fund issues leverage having a short-term floating rate

of interest, the Fund could use interest rate swaps to hedge against a rise in the short-term benchmark interest rates associated

with its outstanding leverage. In doing so, the Fund would seek to achieve lower leverage costs, and thereby enhance Common Share

distributions, over an extended period, which would be the result if short-term interest rates on average exceed the fixed interest

rate over the term of the swap. To the extent the fixed swap rate is greater than short-term market interest rates on average over

the period, overall costs associated with leverage will increase (and thereby reduce distributions to Common Shareholders) than

if the Fund had not entered into the interest rate swap(s).

The Fund pays a management fee to Nuveen

Fund Advisors (which in turn pays a portion of such fee to Nuveen Asset Management) based on a percentage of Managed Assets. Managed

Assets include the proceeds realized and managed from the Fund’s use of most types of leverage (excluding the leverage exposure

attributable to the use of futures, swaps and similar derivatives). Because Managed Assets include the Fund’s net assets

as well as assets that are attributable to the Fund’s investment of the proceeds of its leverage (including instruments like

inverse floating rate securities and reverse repurchase agreements), it is anticipated that the Fund’s Managed Assets will

be greater than its net assets. Nuveen Fund Advisors will be responsible for using leverage to pursue the Fund’s investment

objectives. Nuveen Fund Advisors will base its decision regarding whether and how much leverage to use for the Fund, and the terms

of that leverage, on its assessment of whether such use of leverage is in the best interests of the Fund. However, a decision to

employ or increase leverage will have the effect, all other things being equal, of increasing Managed Assets, and in turn Nuveen

Fund Advisors’ and Nuveen Asset Management’s management fees. Thus, Nuveen Fund Advisors may have a conflict of interest

in determining whether to use or increase leverage. Nuveen Fund Advisors will seek to manage that potential conflict by using leverage

only when it determines that it would be in the best interests of the Fund and its Common Shareholders, and by periodically reviewing

the Fund’s performance with the Board, the Fund’s degree of overall use of leverage and the impact of the use of leverage

on that performance.

The 1940 Act generally defines a “senior

security” as any bond, debenture, note, or similar obligation or instrument constituting a security and evidencing indebtedness,

and any stock of a class having priority over any other class as to distribution of assets or payment of dividends; however, the

term does not include any promissory note or other evidence of indebtedness issued in consideration of any loan, extension, or

renewal thereof, made for temporary purposes and in an amount not exceeding five percent of the value of the Fund’s total

assets. A loan shall be presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed.

Under the 1940 Act, the Fund is not permitted

to issue “senior securities representing indebtedness” if, immediately after the issuance of such senior securities

representing indebtedness, the asset coverage ratio with respect to such senior securities would be less than 300%. “Senior

securities representing indebtedness” include borrowings (including loans from financial institutions); debt securities;

and other derivative investments or transactions such as reverse repurchase agreements and investments in inverse floating rate

securities to the extent the Fund has not fully covered, segregated or earmarked cash or liquid assets having a market value at

least equal to its future obligation under such instruments. With respect to any such senior securities representing indebtedness,

asset coverage means the ratio which the value of the total assets of the Fund, less all liabilities and indebtedness not represented

by senior securities (as defined in the 1940 Act), bears to the aggregate amount of such borrowing represented by senior securities

representing indebtedness issued by the Fund.

Under the 1940 Act, the Fund is not permitted

to issue “senior securities” that are Preferred Shares if, immediately after the issuance of Preferred Shares, the

asset coverage ratio with respect to such Preferred Shares would be less than 200%. With respect to any such Preferred Shares,

asset coverage means the ratio which the value of the total assets of the Fund, less all liabilities and indebtedness not represented

by senior securities, bears to the aggregate amount of senior securities representing indebtedness of the Fund plus the aggregate

liquidation preference of such Preferred Shares.

The Fund is limited by certain investment

restrictions and may only issue senior securities that are Preferred Shares except the Fund may borrow money from a bank for temporary

or emergency purposes or for repurchase of its shares only in an amount not exceeding one-third of the Fund’s total assets

(including the amount borrowed) less the Fund’s liabilities (other than borrowings). See “Investment Restrictions”

in the SAI. These restrictions are fundamental and may not be changed without the approval of Common Shares and Preferred Shares

voting together as a single class.

If the asset coverage with respect to any

senior securities issued by the Fund declines below the required ratios discussed above (as a result of market fluctuations or

otherwise), the Fund may sell portfolio securities when it may be disadvantageous to do so.

Certain types of leverage used by the Fund

may result in the Fund being subject to certain covenants, asset coverage and, or other portfolio composition limits by its lenders,

Preferred Share purchasers, rating agencies that may rate Preferred Shares, or reverse repurchase agreement counterparties. Such

limitations may be more stringent than those imposed by the 1940 Act and may affect whether the Fund is able to maintain its desired

amount of leverage. At this time, Nuveen Fund Advisors does not believe that any such potential investment limitations will impede

it from managing the Fund’s portfolio in accordance with its investment objectives and policies.

Any borrowings of the Fund, including pursuant

to reverse repurchase agreements, will have seniority over Common Shares and Preferred Shares, and any Preferred Shares will have

seniority over Common Shares.

Obligations under reverse repurchase agreements

are fully secured by eligible portfolio securities of the Fund. In reverse repurchase agreements, the Fund retains the risk of

loss associated with the sold security. Reverse repurchase agreements also involve the risk that the purchaser fails to return

the securities as agreed upon, files for bankruptcy or becomes insolvent. Upon a bankruptcy or insolvency of a counterparty, the

Fund is considered to be an unsecured creditor with respect to excess collateral and as such the return of excess collateral may

be delayed.

So long as any Preferred Shares are outstanding,

the Fund will not be permitted to declare a dividend or distribution to Common Shareholders (other than a dividend in Common Shares

of the Fund) or purchase outstanding Common Shares unless all accumulated dividends on Preferred Shares have been paid and unless

the asset coverage, as defined in the 1940 Act, with respect to its Preferred Shares at the time of the declaration of such dividend

or distribution or at the time of such purchase would be at least 200% after giving effect to the dividend or distribution or purchase

price.

Utilization of leverage is a speculative

investment technique and involves certain risks to the Common Shareholders, including increased variability of the Fund’s

net income, distributions and NAV in relation to market changes. See “Leverage Risk,” as such risk is contained in

the section of the Fund’s most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment

Objectives, Investment Policies and Principal Risks of the Fund—Principal Risks of the Fund—Fund Level and Other Risks.”

There is no assurance that the Fund will use leverage or that the Fund’s use of leverage will work as planned or achieve

its goals.

Effects of Leverage

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies

and Principal Risks of the Fund—Effects of Leverage,” as such may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the effects of leverage.

RISK FACTORS

Risk is inherent in all investing. Investing

in any investment company security involves risk, including the risk that you may receive little or no return on your investment

or even that you may lose part or all of your investment. Please refer to the section of the Fund’s most recent annual report

on Form N-CSR entitled “Shareholder Update—Current Investment Objectives, Investment Policies and Principal Risks of

the Fund—Principal Risks of the Fund,” as such principal risks may be supplemented from time to time, which is incorporated

by reference herein, for a discussion of the principal risks you should consider before making an investment in the Fund. The specific

risks applicable to a particular offering of Securities will be set forth in the related prospectus supplement.

MANAGEMENT OF THE FUND

Trustees and Officers

The Board is responsible for the management

of the Fund, including supervision of the duties performed by Nuveen Fund Advisors and Nuveen Asset Management. The names and business

addresses of the trustees and officers of the Fund and their principal occupations and other affiliations during the past five years

are set forth under “Management of the Fund” in the SAI.

Investment Adviser, Sub-Adviser and Portfolio Managers

Investment Adviser. Nuveen

Fund Advisors, LLC, the Fund’s investment adviser, is responsible for overseeing the Fund’s overall investment strategy

and implementation. Nuveen Fund Advisors offers advisory and investment management services to a broad range of investment company

clients. Nuveen Fund Advisors has overall responsibility for management of the Fund, oversees the management of the Fund’s

portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services.

Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, Illinois 60606. Nuveen Fund Advisors is an indirect subsidiary

of Nuveen, the investment management arm of TIAA. TIAA is a life insurance company founded in 1918 by the Carnegie Foundation

for the Advancement of Teaching and is the companion organization of College Retirement Equities Fund. As of March 31, 2024, Nuveen

managed approximately $1.2 trillion in assets, of which approximately $143.2 billion was managed by Nuveen Fund Advisors.

Sub-Adviser. Nuveen Asset Management,

LLC, 333 West Wacker Drive, Chicago, Illinois 60606, serves as the Fund’s sub-adviser pursuant to a sub-advisory agreement

between Nuveen Fund Advisors and Nuveen Asset Management (the “Sub-Advisory Agreement”). Nuveen Asset Management, a

registered investment adviser, is a wholly owned subsidiary of Nuveen Fund Advisors. Nuveen Asset Management oversees day-to-day

investment operations of the Fund. Pursuant to the Sub-Advisory Agreement, Nuveen Asset Management is compensated for the services

it provides to the Fund with a portion of the management fee Nuveen Fund Advisors receives from the Fund. Nuveen Fund Advisors

and Nuveen Asset Management retain the right to reallocate investment advisory responsibilities and fees between themselves in

the future.

Portfolio Managers. Nuveen Asset

Management is responsible for the execution of specific investment strategies and day-to-day investment operations of the Fund.

Nuveen Asset Management manages the Nuveen funds using a team of analysts and portfolio managers that focuses on a specific group

of funds. The day-to-day operation of the Fund and the execution of its specific investment strategies is the primary responsibility

of Daniel J. Close and Kristen M. DeJong, the designated portfolio managers of the Fund, who have served as portfolio managers

of the Fund since 2010 and 2023, respectively.

Daniel J. Close, CFA, Managing Director

of Nuveen Asset Management, is the lead portfolio manager for Nuveen Asset Management’s taxable municipal strategies. He

manages several state-specific municipal bond strategies and related institutional portfolios. He also serves as portfolio manager

for national closed-end funds. He joined Nuveen Investments in 2000 as a member of Nuveen’s product management and development

team. He then served as a research analyst for Nuveen’s municipal investing team, covering corporate-backed, energy, transportation

and utility credits. He received his BS in Business from Miami University and his MBA from Northwestern University’s Kellogg

School of Management. Mr. Close has earned the Chartered Financial Analyst designation.

Kristen M. DeJong, CFA, is Managing Director

and Portfolio Manager at Nuveen Asset Management. She began her career in the financial services industry in 2005 and joined Nuveen

Asset Management in 2008. She served as a research associate at Nuveen in the wealth management services area and then as a senior

research analyst for Nuveen Asset Management’s municipal fixed income team before assuming portfolio management responsibilities

in 2021.

Additional information about the Portfolio

Managers’ compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers’ ownership of

securities in the Fund is provided in the SAI. The SAI is available free of charge by calling (800) 257-8787 or by visiting the

Fund’s website at www.nuveen.com. The information contained in, or that can be accessed through, the Fund’s website

is not part of this Prospectus or the SAI, except to the extent specifically incorporated by reference herein or in the SAI.

Investment Management and Sub-Advisory Agreements

Investment Management Agreement.

Pursuant to an investment management agreement between Nuveen Fund Advisors and the Fund (the “Investment Management Agreement”),

the Fund has agreed to pay an annual management fee for the services and facilities provided by Nuveen Fund Advisors, payable on

a monthly basis, based on the sum of a fund-level fee and a complex-level fee, as described below.

Fund-Level Fee. The annual fund-level

fee for the Fund, payable monthly, is calculated according to the following schedule:

| Average Daily Managed Assets* |

|

Fund-Level

Fee Rate |

|

| For the first $125 million |

|

|

0.4500 |

% |

| For the next $125 million |

|

|

0.4375 |

% |

| For the next $250 million |

|

|

0.4250 |

% |

| For the next $500 million |

|

|

0.4125 |

% |

| For the next $1 billion |

|

|

0.4000 |

% |

| For the next $3 billion |

|

|

0.3750 |

% |

| For managed assets over $5 billion |

|

|

0.3625 |

% |

Complex-Level Fee. The overall

complex-level fee, payable monthly, begins at a maximum rate of 0.1600% of the Fund’s average daily managed assets, with

breakpoints for eligible complex-level assets above $124.3 billion. Therefore, the maximum management fee rate for the Fund is

the Fund-level fee plus 0.1600%. The current overall complex-level fee schedule is as follows:

| Complex-Level Eligible Asset Breakpoint Level* | |

Effective

Complex-Level

Fee Rate at

Breakpoint Level | |

| For the first $124.3 billion | |

| 0.1600 | % |

| For the next $75.7 billion | |

| 0.1350 | % |

| For the next $200 billion | |

| 0.1325 | % |

| For eligible assets over $400 billion | |

| 0.1300 | % |

| * | See “Investment Adviser, Sub-Adviser and Portfolio Managers”

in the SAI for more detailed information about the complex-level fee and eligible complex-level

assets.

As of June 30, 2024, the complex-level fee rate for the Fund was 0.1574%. |

In addition to the fee of Nuveen Fund Advisors,

the Fund pays all other costs and expenses of its operations, including compensation of its trustees (other than those affiliated

with Nuveen Fund Advisors and Nuveen Asset Management), custodian, transfer agency and dividend disbursing expenses, legal fees,

expenses of independent auditors, expenses of repurchasing shares, expenses associated with any borrowings, expenses of issuing

any Preferred Shares, expenses of preparing, printing and distributing shareholder reports, notices, proxy statements and reports

to governmental agencies, and taxes, if any. All fees and expenses are accrued daily and deducted before payment of dividends to

investors.

A discussion regarding the basis for the

Board’s most recent approval of the Investment Management Agreement for the Fund may be found in the Fund’s semi-annual

report to shareholders dated September 30 of each year.

Sub-Advisory Agreement. Pursuant

to the Sub-Advisory Agreement, Nuveen Asset Management receives from Nuveen Fund Advisors a management fee equal to 53.8462% of

Nuveen Fund Advisors’ net management fee from the Fund. Nuveen Fund Advisors and Nuveen Asset Management retain the right

to reallocate investment advisory responsibilities and fees between themselves in the future.

A discussion regarding the basis for the

Board’s most recent approval of the Sub-Advisory Agreement may be found in the Fund’s semi-annual report to shareholders

dated September 30 of each year.

NET ASSET VALUE

The Fund’s NAV per Common Share

is determined as of the close of trading (normally 4:00 p.m. Eastern time) on each day the NYSE is open for business. NAV

is calculated by taking the market value of the Fund’s total assets, less all liabilities, and dividing by the total number

of Common Shares outstanding. The result, rounded to the nearest cent, is the NAV per share.

The Fund utilizes independent pricing services

approved by the Board to value portfolio instruments at their market value. Independent pricing services typically value non-equity

portfolio instruments utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained

from broker-dealers making markets in such instruments, cash flows and transactions for comparable instruments. In valuing municipal

securities, the pricing services may also consider, among other factors, the yields or prices of municipal securities of comparable

quality, type of issue, coupon, maturity and rating and the obligor’s credit characteristics considered relevant by the pricing

service or Nuveen Fund Advisors. In pricing certain securities, particularly less liquid and lower quality securities, the pricing

services may consider information about a security, its issuer or market activity provided by Nuveen Fund Advisors or Nuveen Asset

Management.

If a price cannot be obtained from a pricing

service or other pre-approved source, or if the Fund’s valuation designee deems such price to be unreliable, or if a significant

event occurs after the close of the local market but prior to the time at which the Fund’s NAV is calculated, a portfolio

instrument will be valued at its fair value as determined in good faith by the Fund’s valuation designee. The Fund’s

valuation designee may determine that a price is unreliable in various circumstances. For example, a price may be deemed unreliable

if it has not changed for an identified period of time, or has changed from the previous day’s price by more than a threshold

amount, and recent transactions and/or broker dealer price quotations differ materially from the price in question.

The Board has designated Nuveen Fund Advisors

as the Fund’s valuation designee pursuant to Rule 2a-5 under the 1940 Act and delegated to Nuveen Fund Advisors the day-to-day

responsibility of making fair value determinations. All fair value determinations made by Nuveen Fund Advisors are subject to review

by the Board. As a general principle, the fair value of a portfolio instrument is the amount that an owner might reasonably expect

to receive upon the instrument’s current sale. A range of factors and analysis may be considered when determining fair value,

including relevant market data, interest rates, credit considerations and/or issuer specific news. However, fair valuation involves

subjective judgments, and it is possible that the fair value determined for a portfolio instrument may be materially different

from the value that could be realized upon the sale of that instrument.

DISTRIBUTIONS

The Fund pays regular monthly cash distributions

to Common Shareholders (stated in terms of a fixed cents per Common Share dividend distribution rate which may be set from time

to time). The Fund intends to distribute all or substantially all of its net investment income each year through its regular monthly

distributions and to distribute realized capital gains at least annually. In addition, in any monthly period, to maintain its declared

per common share distribution amount, the Fund may distribute more or less than its net investment income during the period. In

the event the Fund distributes more than its net investment income, such distributions may also include realized gains and/or a

return of capital.

To the extent that a distribution includes

a return of capital the NAV per share may erode. A return of capital may occur, for example, when some or all of the money that

you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment

performance and should not be confused with “yield” or “income.”

If the Fund’s distribution includes

anything other than net investment income, the Fund will provide a notice to Common Shareholders of its best estimate of the distribution

sources at the time of the distribution. These estimates may not match the final tax characterization (for the full year’s

distributions) contained in the Common Shareholders’ 1099-DIV forms after the end of the year.

While the Fund intends to distribute all

realized capital gains at least annually, the Fund may elect to retain all or a portion of any net capital gain (which is the excess

of net long-term capital gain over net short-term capital loss) otherwise allocable to Common Shareholders and pay U.S. federal

income tax on the retained gain. As provided under U.S. federal income tax law, Common Shareholders of record as of the end of

the Fund’s taxable year will include their share of the retained net capital gain in their income for the year as a long-term

capital gain (regardless of their holding period in the common shares), and will be entitled to an income tax credit or refund

for the federal income tax deemed paid on their behalf by the Fund. If the Fund’s total distributions during a given year

is an amount that exceeds the Fund’s current and accumulated earnings and profits, the excess would be treated by Common

Shareholders as return of capital for federal income tax purposes to the extent of the Common Shareholder’s basis in their

shares and thereafter as capital gain.

Distributions will be reinvested in additional

shares under the Fund’s Dividend Reinvestment Plan unless a shareholder elects to receive cash. The Fund reserves the right

to change its distribution policy and the basis for establishing the rate of its monthly distributions at any time and may do so

without prior notice to Common Shareholders.

DIVIDEND REINVESTMENT PLAN

Please refer to the section of the Fund’s

most recent annual report on Form N-CSR entitled “Shareholder Update—Dividend Reinvestment Plan,” which is incorporated

by reference herein, for a discussion of the Fund’s dividend reinvestment plan.

PLAN OF DISTRIBUTION

The Fund may offer and sell Securities

from time to time on an immediate, continuous or delayed basis, in one or more offerings under this Prospectus and a related prospectus

supplement, on terms to be determined at the time of the offering. The Fund may offer and sell such Securities directly to one

or more purchasers, to or through underwriters, through dealers or agents that the Fund designates from time to time, or through

a combination of these methods. Sales of Securities may be made in transactions that are deemed to be “at the market”

as defined in Rule 415 under the Securities Act of 1933, as amended (the “1933 Act”), including sales made directly

on the NYSE or sales made to or through a market maker other than on an exchange.

The prospectus supplement relating to any

offering of Securities will describe the terms of such offering, including, as applicable:

| ● | the names of any agents, underwriters or dealers; |

| ● | any sales loads, underwriting discounts and commissions or agency fees and other items constituting underwriters’ or

agents’ compensation; |

| ● | any discounts, commissions, fees or concessions allowed or reallowed or paid to dealers or agents; |

| ● | the public offering or purchase price of the offered Securities, the estimated net proceeds the Fund will receive from the

sale and the use of proceeds; and |

| ● | any securities exchange on which the offered Securities may be listed. |

The prospectus supplement relating to any

Rights offering will set forth the number of Common Shares issuable upon the exercise of each Right (or number of Rights) and the

other terms of such Rights offering.

Direct Sales

The Fund may offer and sell Securities

directly to, and solicit offers from, institutional investors or others who may be deemed to be underwriters as defined in the

1933 Act for any resales of Securities. In this case, no underwriters or agents would be involved. The Fund may use electronic

media, including the Internet, to sell offered Securities directly. The Fund will describe the terms of any of those sales in a

prospectus supplement.

By Agents

The Fund may offer and sell Securities

through an agent or agents designated by the Fund from time to time. An agent may sell Securities it has purchased from the Fund

as principal to other dealers for resale to investors and other purchasers, and may reallow all or any portion of the discount

received in connection with the purchase from the Fund to the dealers. After the initial offering of Securities, the offering price

(in the case of Securities to be resold at a fixed offering price), the concession and the discount may be changed.

By Underwriters

If any underwriters are involved in the

offer and sale of Securities, such Securities will be acquired by the underwriters and may be resold by them, either at a fixed

public offering price established at the time of offering or from time to time in one or more negotiated transactions or otherwise,

at prices related to prevailing market prices determined at the time of sale. Unless otherwise set forth in the applicable prospectus

supplement, the obligations of the underwriters to purchase Securities will be subject to conditions precedent and the underwriters

will be obligated to purchase all Securities described in the prospectus supplement if any are purchased. Any initial public offering

price and any discounts or concessions allowed or re-allowed or paid to underwriters may be changed from time to time.

In connection with an offering of Common

Shares, if a prospectus supplement so indicates, the Fund may grant the underwriters an option to purchase additional Common Shares

at the public offering price, less the underwriting discounts and commissions, within 45 days from the date of the prospectus supplement,

to cover any overallotments.

By Dealers

The Fund may offer and sell Securities

from time to time through one or more dealers who would purchase the securities as principal. The dealers then may resell the offered

Securities to the public at fixed or varying prices to be determined by those dealers at the time of resale. The Fund will set

forth the names of the dealers and the terms of the transaction in the prospectus supplement.

General

Any underwriters, dealer or agent participating

in an offering of Securities may be deemed to be an “underwriter,” as that term is defined in the 1933 Act, of Securities

so offered and sold, and any discounts and commission received by them, and any profit realized by them on resale of the offered

Securities for whom they act as agent, may be deemed to be underwriting discounts and commissions under the 1933 Act.

Underwriters, dealers and agents may be

entitled, under agreements entered into with the Fund, to indemnification by the Fund against some liabilities, including liabilities

under the 1933 Act.

The Fund may offer to sell Securities either

at a fixed price or at prices that may vary, at market prices prevailing at the time of sale, at prices related to prevailing market

prices or at negotiated prices.

To facilitate an offering of Common Shares

in an underwritten transaction and in accordance with industry practice, the underwriters may engage in transactions that stabilize,

maintain, or otherwise affect the market price of the Common Shares or any other Security. Those transactions may include overallotment,

entering stabilizing bids, effecting syndicate covering transactions, and reclaiming selling concessions allowed to an underwriter

or a dealer.

| ● | An overallotment in connection with an offering creates a short position in the Common Shares for the underwriter’s own

account. |

| ● | An underwriter may place a stabilizing bid to purchase the Common Shares for the purpose of pegging, fixing, or maintaining

the price of the Common Shares. |

| ● | Underwriters may engage in syndicate covering transactions to cover overallotments or to stabilize the price of the Common

Shares by bidding for, and purchasing, the Common Shares or any other Securities in the open market in order to reduce a short

position created in connection with the offering. |

| ● | The managing underwriter may impose a penalty bid on a syndicate member to reclaim a selling concession in connection with

an offering when the Common Shares originally sold by the syndicate member are purchased in syndicate covering transactions or

otherwise. |

Any of these activities may stabilize or

maintain the market price of the Securities above independent market levels. Underwriters are not required to engage in these activities

and may end any of these activities at any time.

In connection with any Rights offering,

the Fund may also enter into a standby underwriting arrangement with one or more underwriters pursuant to which the underwriter(s)

will purchase Common Shares remaining unsubscribed for after the Rights offering.

Unless otherwise indicated in the prospectus

supplement, each series of offered Preferred Shares will be a new issue of securities for which there currently is no market. Any

underwriters to whom Preferred Shares are sold for public offering and sale may make a market in such Preferred Shares as permitted

by applicable laws and regulations, but such underwriters will not be obligated to do so, and any such market making may be discontinued

at any time without notice. Accordingly, there can be no assurance as to the development or liquidity of any market for the Preferred

Shares.

Underwriters, agents and dealers may engage

in transactions with or perform services, including various investment banking and other services, for the Fund and/or any of the

Fund’s affiliates in the ordinary course of business.

The maximum amount of compensation to be

received by any Financial Industry Regulatory Authority (“FINRA”) member or independent broker-dealer will not exceed

the applicable FINRA limit for the sale of any securities being offered pursuant to Rule 415 under the Securities Act. We will

not pay any compensation to any underwriter or agent in the form of warrants, options, consulting or structuring fees or similar

arrangements.

To the extent permitted under the 1940

Act and the rules and regulations promulgated thereunder, the underwriters may from time to time act as a broker or dealer and

receive fees in connection with the execution of the Fund’s portfolio transactions after the underwriters have ceased to

be underwriters and, subject to certain restrictions, each may act as a broker while it is an underwriter.

A prospectus and accompanying prospectus

supplement in electronic form may be made available on the websites maintained by underwriters. The underwriters may agree to allocate

a number of Securities for sale to their online brokerage account holders. Such allocations of Securities for Internet distributions

will be made on the same basis as other allocations. In addition, Securities may be sold by the underwriters to securities dealers

who resell Securities to online brokerage account holders.

DESCRIPTION OF SHARES

Common Shares

The Declaration of Trust authorizes the

issuance of an unlimited number of Common Shares. The Common Shares have a par value of $0.01 per share and, subject to the rights

of holders of any Preferred Shares, have equal rights to the payment of dividends and the distribution of assets upon liquidation.

The Common Shares when issued, are fully paid and, subject to matters discussed in “Certain Provisions in the Declaration

of Trust and By-Laws,” non-assessable, and have no preemptive or conversion rights or rights to cumulative voting. A copy

of the Declaration of Trust is filed with the SEC as an exhibit to the Fund’s registration statement of which this Prospectus

is a part.

Each whole Common Share has one vote with

respect to matters upon which a shareholder vote is required, and each fractional share shall be entitled to a proportional fractional

vote consistent with the requirements of the 1940 Act and the rules promulgated thereunder, and will vote together as a single

class. Whenever the Fund incurs borrowings and/or Preferred Shares are outstanding, Common Shareholders will not be entitled to

receive any cash distributions from the Fund unless all interest on such borrowings has been paid and all accumulated dividends

on Preferred Shares have been paid, unless asset coverage (as defined in the 1940 Act) with respect to any borrowings would be

at least 300% after giving effect to the distributions and asset coverage (as defined in the 1940 Act) with respect to Preferred

Shares would be at least 200% after giving effect to the distributions. See “—Preferred Shares” below.

The Common Shares are listed on the NYSE

and trade under the ticker symbol “NBB.” The Fund intends to hold annual meetings of shareholders so long as the Common

Shares are listed on a national securities exchange and such meetings are required as a condition to such listing. The Fund will

not issue share certificates.

Unlike open-end funds, closed-end funds

like the Fund do not provide daily redemptions. Rather, if a shareholder determines to buy additional Common Shares or sell shares

already held, the shareholder may conveniently do so by trading on the exchange through a broker or otherwise. Common shares of

closed-end investment companies may frequently trade on an exchange at prices lower than NAV. Common shares of closed-end investment

companies like the Fund have during some periods traded at prices higher than NAV and have during other periods traded at prices

lower than NAV.

Because the market value of the Common

Shares may be influenced by such factors as distribution levels (which are in turn affected by expenses), call protection, dividend

stability, portfolio credit quality, NAV, relative demand for and supply of such shares in the market, general market and economic