SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2024

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its

charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

1/5

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ/MF): 76.483.817/0001-20

PUBLICLY-HELD COMPANY

CVM Registration 1431-1

Company Registry (NIRE): 41300036535

CERTIFICATE OF THE MINUTES OF THE 247TH

BOARD OF DIRECTORS’ MEETING

I hereby certify, for all legal purposes, that the

members of the Board of Directors (BoD) met on February 24, 2024, at 8:30 a.m. at Rua José Izidoro Biazetto, 158 - Bloco A, in

the City of Curitiba, State of Paraná. Mr. Marco Antônio Barbosa Cândido welcomed everyone, recorded the justified

absence of Mr. Marcel Martins Malczewski, Chair of the Board, and invited me, Victória Baraldi Mendes Batista, to act as a secretary.

The Board of Directors resolved on the following matters,

among other topics:

1. Resolution on the 2023 Annual Report of the Statutory

Audit Committee, Mr. Carlos Biedermann, Coordinator of the Statutory Audit Committee (CAE), presented the

2023 Annual Report of the Statutory Audit Committee, including information regarding the work performed by its members throughout 2023.

He emphasized that the document includes recommendations addressed to the Company’s Management,

under current regulations, and reinforces Copel’s image regarding good corporate governance practices. He emphasized that, based

on the CAE’s work plan, 26 meetings were held in 2023, covering 151 agendas. Subsequently, the members of the Statutory Audit

Committee were heard, stated that they analyzed the matter in their 296th Meeting, held on 02.28.2024, and recommended its approval to

this Board. After analyzing the matter and considering the documentation provided, which remains in the custody of the Governance Bodies

Secretariat, and based on the favorable recommendation of the Statutory Audit Committee Members, the Board of Directors unanimously approved

the 2023 Annual Report of the Statutory Audit Committee, as presented. -----------------------------------------------------------------------------------------------------------------

2. Information regarding the New Accounting Standards,

Mr. Adriano Rudek de Moura, Chief Finance and Investor Relations Officer, along with his team, presented changes, improvements, and

new accounting standards, emphasizing that they had no significant impact on the Company’s financial statements for the period ended

on 12.31.2023. Then, the members of the Statutory Audit Committee (CAE) were heard and presented their considerations on the matter to

the Board, which was discussed and recorded in the 296th Meeting of that Committee, held on 02.28.2024. The Board of Directors took

note and discussed the information presented, whose details are included in the material provided and remain in the custody of the Governance

Bodies Secretariat. ------------------------------------------------------------------------------

3. Information on Accounting Practices used by the

Company, Mr. Adriano Rudek de Moura, Chief Finance and Investors Relations Officer, along with his team, presented the material accounting

practices adopted by the Company, which guide the accounting records and, when disclosed, provide relevant information to the readers

of the Financial Statements. He emphasized that such practices are included in the Financial Statements for 12.31.2023. Then, the members

of the Statutory Audit Committee (CAE) were heard and presented their considerations on the matter to the Board, which was discussed and

recorded in the 296th Meeting of that Committee, held on 02.28.2024. The Board of Directors was informed and discussed the information

presented, whose details are included in the material provided and remain in the custody of the Governance Bodies Secretariat. -------

4. Disclosure of estimates and judgments applied

during the preparation of the Financial Statements, Mr. Adriano Rudek de Moura, Chief Finance and Investors Relations Officer, along

with his team, presented information regarding the disclosure of estimates and judgments applied during the preparation of the Financial

Statements for 12.31.2023, emphasizing compliance with current accounting standards and other requirements of the regulatory bodies of

the Brazilian and American capital markets. Then, the members of the Statutory Audit Committee (CAE) were heard and

2/5

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ/MF): 76.483.817/0001-20

PUBLICLY-HELD COMPANY

CVM Registration 1431-1

Company Registry (NIRE): 41300036535

presented their considerations on the matter to the

Board, which were discussed and recorded in the 296th Meeting

of that Committee, held on 02.28.2024. The Board of Directors was informed and discussed the information presented, whose details are

included in the material provided and remain in the custody of the Governance Bodies Secretariat. ---------------------------------

5. Resolution on the estimate of realization of

Deferred Taxes, Mr. Adriano Rudek de Moura, Chief Finance and Investors Relations Officer, along with his team, presented the result

of the projection study for the realization of deferred taxes, according to the expectation of future taxable income generation. He informed

that such studies are based on the Company’s results projections prepared by the economic-financial planning department, with the

appropriate assumptions validated by the business departments. He also informed that the study conducted proves the existence of an expectation

of sufficient future taxable income for the realization of deferred taxes recorded in the 2023 Financial Statements. He also emphasized

that, due to the lack of individual expectation of future taxable income for Cutia Empreendimentos Eólicos S.A., Copel Serviços

S.A., and Brownfield Investment Holding S.A., the amount of R$87.4 million in deferred taxes is not recorded in the 2023 Consolidated

Financial Statements. Subsequently, the members of the Statutory Audit Committee (CAE) were heard, stated that they analyzed the matter

in their 296th Meeting, held on 02.28.2024, and recommended its approval to this Board. After analyzing and discussing the matter,

and considering the favorable recommendation of the Company’s Executive Board, issued at its 2589th Meeting, held on 02.22.2024,

and after hearing the CAE, as recorded above, the Board of Directors unanimously approved the technical study for the projection of the

realization of deferred taxes according to the material provided, which remains filed at the Governance Bodies Secretariat. ------------------------------------------------------------------------------

6. Resolution on the Annual Management Report, Balance

Sheet, and other Financial Statements for 2023 (Consolidated), Mr. Adriano Rudek de Moura, Chief Finance and Investors Relations Officer,

along with the accounting team, presented the final versions of the Annual Management Report, Balance Sheet, and Financial Statements

for 2023. The results for 2023 and the main variations were presented in comparison to 2022. It was recorded that, under CVM Resolution

80/2022, the Executive Board signed a declaration agreeing i. with the final version of the 2023 Financial Statements, already

considering the independent auditor’s review, and ii. with the opinion to be issued on that date. Subsequently, Mr. Jonas

Dal Ponte, representative of Deloitte Touche Tohmatsu Auditores Independentes Ltda., presented information on internal controls, key audit

matters, and the draft of the independent auditor’s Report (Independent Auditor’s Report on the Parent Company and Consolidated

Financial Statements for the Year ended on December 31, 2023), which will be signed, with no qualification, on this date, after this

Board of Directors’ meeting. Subsequently, the members of the Statutory Audit Committee (CAE) were heard, stated that they analyzed

the matter in their 296th Meeting, held on 02.28.2024, and recommended its approval to this Board. After providing any necessary clarifications

and based on a) the work conducted throughout the year and the information presented; b) the analyses conducted and clarifications

provided by Management and Deloitte Touche Tohmatsu Auditores Independentes Ltda.; c) Deloitte’s unqualified report on the

Parent Company and Consolidated Financial Statements; d) the favorable recommendation of the Company’s Executive Board, issued

at its 2589th Meeting, held on 02.22.2024; and e) the favorable recommendation of the aforementioned Statutory Audit Committee

Members, the Board of Directors recorded that it had no knowledge of any facts or evidence not reflected in the documentation presented

and unanimously approved the Annual Management Report, Balance Sheet, and other Financial Statements for 2023, as well as their submission

to the Fiscal Council and General Shareholders’ Meeting, whose convening was authorized for 04.22.2024, for analysis and final resolution,

in addition to their filing at the Brazilian Securities and Exchange Commission (CVM), the U.S. Securities and Exchange Commission (SEC),

and the Stock Exchanges of New York, Madrid, and São Paulo. -----------------------------------------------------------------------------------------------

3/5

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ/MF): 76.483.817/0001-20

PUBLICLY-HELD COMPANY

CVM Registration 1431-1

Company Registry (NIRE): 41300036535

7. Resolution on the Executive Board’s proposal

for the Allocation of the Net Income for 2023 and Payment of Profit Sharing Regarding the Integration between Capital and Labor and Incentive

to Productivity, Mr. Adriano Rudek de Moura, Chief Finance and

Investors Relations Officer, along with his team, presented the draft of the Proposal for the Allocation of the Net Income for 2023

and Payment of Profit Sharing Regarding the Integration between Capital and Labor and Incentive to Productivity, transcribed below,

with the following content: “Mr. Chair of the Board of Directors of Companhia Paranaense de Energia - Copel: in compliance with

Article 192 of Law 6,404 of 12.15.1976, as well as other current legal and statutory provisions, we hereby present to this Board, to be

submitted to the resolution of the 69th Annual Shareholders’ Meeting, having heard the Fiscal Council, the propositions specified

below. I. ALLOCATION OF THE NET INCOME: From the net income for 2023, calculated according to corporate law, totaling R$2,258,811,025.50

(two billion, two hundred and fifty-eight million, eight hundred and eleven thousand, twenty-five reais, and fifty centavos), the

Executive Board proposes the following allocations: a) R$112,940,551.28 (one hundred and twelve million, nine hundred and forty

thousand, five hundred and fifty-one reais, and twenty-eight centavos), equivalent to 5% of the net income for 2023, for the creation

of the legal reserve, according to Article 193 of Law 6,404, of 12.15.1976, and item II of Paragraph 2 of Article 86 of the Bylaws;

b) R$32,552,297.22 (thirty-two million, five hundred and fifty-two thousand, two hundred and ninety-seven reais, and twenty-two

centavos) added to the adjusted net income due to the realization of the equity revaluation reserve, arising from the effects of the application

of the deemed cost in the initial adoption of Technical Pronouncement CPC 27 for fixed assets; c) R$913,840,073.51 (nine hundred

and thirteen million, eight hundred and forty thousand, seventy-three reais, and fifty-one centavos) already discussed at the 242nd

Board of Directors’ Meeting of 09.20.2023 that approved, according to the Bylaws and the Dividend Policy, the distribution of

profits in the form of Interest on Equity (IoE) imputed to mandatory dividends, of which R$456,920,036.75 (four hundred and fifty-six

million, nine hundred and twenty thousand, thirty-six reais, and seventy-five centavos) were paid on 11.30.2023 (R$0.14500531 per common

share - ON; R$0.15950586 per class “A” preferred share - PNA; R$0.15950586 per preferred share - PNB; R$0.78302875 per UNIT),

and R$456,920,036.76 (four hundred and fifty-six million, nine hundred and twenty thousand, thirty-six reais, and seventy-six centavos)

to be paid on the same date of the payment of dividends approved at the Annual Shareholders’ Meeting that resolves on the allocation

of the current year’s result (R$0.14500531 per common share - ON; R$0.15950586 per class “A” preferred share - PNA;

R$0.15950586 per preferred share - PNB; R$0.78302875 per UNIT); d) R$131,211,385.72 (one hundred and thirty-one million, two hundred

and eleven thousand, three hundred and eighty-five reais, and seventy-two centavos) for the payment of proposed additional dividends,

according to item VII of Article 17 of the Bylaws and the Dividend Policy, and in compliance with the rules established by CVM Resolution

143, of 06.15.2022, and Technical Interpretation ICPC 08 (R1) issued by the Accounting Pronouncements Committee, which addresses the accounting

of the proposal for dividend payment; e) R$1,133,371,312.21 (one billion, one hundred and thirty-three million, three hundred and

seventy-one thousand, three hundred and twelve reais, and twenty-one centavos), for the creation of the profit retention reserve,

aimed at ensuring the Company’s investment program, according to the capital budged proposal presented in Exhibit I and established

in Article 196 of Law 6,404, of 12.15.1976. In addition to the gross amount of IoE distributed based on the net income determined on 06.30.2023,

the 242nd Board of Directors’ Meeting of 09.20.2023 also approved the distribution of IoE in the gross amount

of R$44,159,926.49 (forty-four million, one hundred and fifty-nine thousand, nine hundred and twenty-six reais, and forty-nine

centavos) based on the profit retention reserve from previous years not capitalized, to be paid on the same date of the payment of the

dividends approved at the Annual Shareholders’ Meeting that resolves on the allocation of the current year’s result (R$0.01401431

per common share - ON; R$0.01541576 per class “A” preferred share - PNA; R$0.01541576 per class "B” preferred share

- PNB; R$0.07567735 per UNIT). According to the Company’s Dividend Policy, the calculation of regular dividends is based on the

Financial Leverage Ratio defined at the end of each fiscal year.

4/5

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ/MF): 76.483.817/0001-20

PUBLICLY-HELD COMPANY

CVM Registration 1431-1

Company Registry (NIRE): 41300036535

For a leverage ratio below 1.5, the dividend is 65%

of the adjusted net income; if the ratio is between 1.5 and 2.7, the dividend is 50% of the adjusted net income; and if the ratio is above

2.7, the dividend is 25% of the adjusted net income (mandatory minimum). These values, except for the mandatory minimum dividend, will

be limited to the amount of available cash flow of the same fiscal year, equivalent to cash generated by operating activities, less net

cash used in investing activities. Management may also propose extraordinary dividends, limited to the balance of distributable profit

reserves of the Company, subject to resolution and approval by the Board of Directors, after consultation with the Fiscal Council. The

Financial Leverage Ratio determined in 2023 was 1.94, so the proposed regular dividend is 50% of the adjusted net income, totaling R$1,089,211,385.72

(one billion, eighty-nine million, two hundred and eleven thousand, three hundred and eighty-five reais, and seventy-two centavos),

of which R$958,000,000.00 (nine hundred and fifty-eight million reais) were already approved at the 242nd Board of Directors’

Meeting of 09.20.2023, and R$131,211,385.72 (one hundred and thirty-one million, two hundred and eleven thousand, three hundred and eighty-five

reais, and seventy-two centavos) is being proposed for resolution at the Annual Shareholders’ Meeting, as well as the ratification

of the amount approved at the 242nd Board of Directors’ Meeting. The financial statements for 2023 reflect the effects

of the accounting records of the aforementioned allocations, based on the assumption of their approval by the 69th Annual Shareholder’s

Meeting, as established in Paragraph 3 of Article 176 of Law 6,404, of 12.15.1976. I.1. PROFIT SHARING REGARDING THE INTEGRATION BETWEEN

CAPITAL AND LABOR AND INCENTIVE TO PRODUCTIVITY: Federal Law 10,101, of 12.19.2000, regulates the participation of workers in the

Company’s profit, as an instrument of integration between capital and labor and as an incentive to productivity, under item XI of

Article 7 of the Brazilian Constitution. In compliance with said law, the Executive Board proposes the distribution, as Profit Sharing,

of R$107,442,109.71 (one hundred and seven million, four hundred and forty-two thousand, one hundred and nine reais, and seventy-one

centavos) to be paid to employees by the Parent Company and the Wholly-Owned Subsidiaries. Such profit sharing estimate is provisioned

in the financial statements for 2023, specifically in the “personnel expenses” line, according to item 26.2 of Circular Letter

CVM/SNC/SEP no. 1, of 02.14.2007. In our opinion, the proposals above comply with current legal and statutory provisions and serve the

Company’s interest and, for this reason, will be fully accepted by this Board, Fiscal Council, and the 69th Annual Shareholder’s

Meeting. Curitiba, February 22, 2024. (a) DANIEL PIMENTEL SLAVIERO - CEO; ANA LETÍCIA FELLER - People and Business

Management Officer; ADRIANO RUDEK DE MOURA - Chief Finance and Investors Relations Officer; CASSIO SANTANA DA SILVA - Business

Development Officer; EDUARDO VIEIRA DE SOUZA BARBOSA - Legal and Compliance Officer.” Subsequently, the members of the Statutory

Audit Committee (CAE) were heard, stated that they analyzed the

matter in their 296th Meeting, held on 02.28.2024, and recommended its approval to this Board. After considering the documentation

made available, which remains in the custody of the Governance Bodies Secretariat, providing the necessary clarifications, and considering

the favorable recommendation of the Executive Board, issued at its 2589th Meeting, held on 02.22.2024, and having heard the

Statutory Audit Committee, as recorded above, the Board of Directors unanimously approved the Proposal for the Allocation of the Net

Income for 2023 and Payment of Profit Sharing Regarding the Integration between Capital and Labor and Incentive to Productivity, and

its submission to the Fiscal Council and Annual Shareholders’ Meeting for analysis and final resolution, whose convening was authorized

for 04.22.2024. ------------------------------------------

8. External Audit Report (Deloitte) on the work

related to the 2023 Financial Statements and Internal Controls, Mr. Jonas Dal Ponte, representative of Deloitte Touche Tohmatsu Auditores

Independentes Ltda. - Deloitte, presented a detailed overview of the following matters: Auditor’s Responsibilities and Responsibilities

of the Executive Board and Governance; Auditor’s Independence; Other Audit-Related Information and Communications; Unadjusted Audit

Adjustments; Status of Audit Procedures; Progress on matters presented in Previous Meetings; Internal Controls - Use of Internal Audit

Work; Internal Controls - Unremedied Deficiencies; Internal

5/5

COMPANHIA PARANAENSE DE ENERGIA - COPEL

Corporate Taxpayer’s ID (CNPJ/MF): 76.483.817/0001-20

PUBLICLY-HELD COMPANY

CVM Registration 1431-1

Company Registry (NIRE): 41300036535

Controls - Deficiencies Identified in 2022 and Remedied

for 2023; Internal Controls Observations Identified in 2023; Key Audits Matters; Relationship between Deloitte and Copel; Other Important

Formal Communications; Unusual Transactions; New Accounting Standards Effective in 2023; Amendments to Accounting Standards Not Yet Effective;

and Fees. Information on “Material Accounting Policies and Practices” and “Critical Accounting Policies, Practices,

and Estimates” was also covered. Then, the members of the Statutory Audit Committee (CAE) were heard and presented their considerations

on the matter to the Board, which was discussed and recorded in the 296th

Meeting of that Committee, held on 02.28.2024. The Board of Directors took note, analyzed, and discussed the information presented,

whose details are included in the material provided and remain in the custody of the Governance Bodies Secretariat. ---------------------------------------------------------------------------------------------

The other topics addressed at this meeting were omitted

from this certificate due to legitimate caution, based on the duty of Management confidentiality, under the main section of Article 155

of Law 6,404/76, as they relate solely to the Company’s internal interests, therefore lying outside the scope of the provision contained

in Paragraph 1 of Article 142 of the aforementioned Law.

Attendance: MARCO ANTÔNIO BARBOSA CÂNDIDO;

CARLOS BIEDERMANN; FAUSTO AUGUSTO DE SOUZA; FERNANDO TADEU PEREZ; GERALDO CORRÊA DE LYRA JUNIOR; JACILDO LARA MARTINS; LUCIA MARIA

MARTINS CASASANTA; MARCELO SOUZA MONTEIRO, and VICTÓRIA BARALDI MENDES BATISTA (Secretary).

VICTÓRIA BARALDI MENDES BATISTA

Secretary of Copel’s Governance Department

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date March 11, 2024

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| |

|

|

| By: |

/S/

Daniel Pimentel Slaviero

|

|

| |

Daniel Pimentel Slaviero

Chief Executive Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

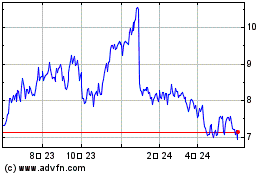

Companhia Parana De Energ (NYSE:ELP)

過去 株価チャート

から 10 2024 まで 11 2024

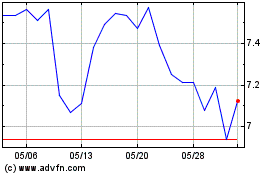

Companhia Parana De Energ (NYSE:ELP)

過去 株価チャート

から 11 2023 まで 11 2024