UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

DESKTOP METAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On July 19, 2024,

the following communication was sent to Desktop Metal, Inc. employees:

July 19, 2024

Update on Integration Planning with Nano Dimension

Hello Team DM,

Last week, key members of the Desktop Metal

leadership team began a series of meetings with key leaders of the Nano Dimension leadership team to begin an orderly integration planning

process that will take place over many months as we approach closing of this combination.

The meetings were held in Boston and led by

the Integration Executives appointed from the two companies – Tom Nogueira, Chief Operating Officer of DM, and Zivi Nedivi, President

of Nano Dimension.

At the onset of the kickoff meeting, Zivi clearly stated that he wants to come to the closing table on Day One of the combined company

with a comprehensive plan in place.

The meetings are being facilitated by

Integration Leader Ben Lazarus, a partner at PwC Advisory, with significant experience in M&A Integration projects, as well as 3D

printing. He outlined a focused process that will require thoughtful analysis to arrive at the proper conclusions given the complexity

of the integration effort.

We will be giving you periodic updates to

provide as much transparency as possible. We would like to provide the following highlights of what we can share to date:

| · | An orderly business process for planning to combine the companies has been

kicked off and is now underway |

| · | Investments for integration and post-integration activities are being planned |

| · | The goal of the integration is to combine the business in a way which seeks

to balance the following objectives: |

| o | Driving towards positive cash flow and profitability |

| o | Creating a platform for growth |

| o | Minimizing disruption and protecting the core assets of both businesses, which are being defined |

| · | While we need the vast majority of Team DM employees to

remain 100% focused on meeting our current business objectives, a few select people will be included on task

forces for certain topic areas where decision-making needs will be defined and eventually made. Those people will receive additional

details and training on protocol for information sharing and integration planning that comport with antitrust and other regulatory requirements. |

To be clear, until closing, Desktop Metal and

Nano will remain separate companies and will continue to operate independently of one another, at arm’s length, just as before

we announced the transaction.

We know it can be

distracting to have this process underway, and we kindly ask you to stay focused on

your near-term objectives. If you have feedback you’d like to provide the integration teams, you may send

it through this form.

Thank

you for the continued efforts and have a great weekend,

Tom Nogueira

Chief Operating Officer

Desktop Metal

Forward-Looking Statements

This communication contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements relating to the

proposed transaction between Desktop Metal and Nano, including statements regarding the benefits of the transaction and the anticipated

timing of the transaction, and information regarding Desktop Metal’s business, including expectations regarding outlook and all

underlying assumptions, Nano’s and Desktop Metal’s objectives, plans and strategies, information relating to operating trends

in markets where Desktop Metal operates, statements that contain projections of results of operations or of financial condition and all

other statements other than statements of historical fact that address activities, events or developments that Desktop Metal intends,

expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and

assumptions made based on information currently available to management. All statements in this communication, other than statements of

historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,”

“expects,” “believes,” “anticipates,” “should,” “estimates,” “may,”

“will,” “intends,” “projects,” “could,” “would,” “estimate,” “potential,”

“continue,” “plan,” “target,” or the negative of these words or similar expressions. These forward-looking

statements involve known and unknown risks and uncertainties, which may cause Desktop Metal’s actual results and performance to

be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may cause Desktop Metal’s

or Nano’s actual results or performance to be materially different from those expressed or implied in the forward-looking statements

include, but are not limited to, (i) the ultimate outcome of the proposed transaction between Desktop Metal and Nano, including the

possibility that Desktop Metal’s stockholders will reject the proposed transaction; (ii) the effect of the announcement of

the proposed transaction on the ability of Desktop Metal to operate its business and retain and hire key personnel and to maintain favorable

business relationships; (iii) the timing of the proposed transaction; (iv) the occurrence of any event, change or other circumstance

that could give rise to the termination of the proposed transaction; (v) the ability to satisfy closing conditions to the completion

of the proposed transaction (including any necessary stockholder approvals); (vi) other risks related to the completion of the proposed

transaction and actions related thereto; (vii) those factors and risks described in Item 3.D “Key Information - Risk Factors,”

Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Nano’s

Annual Report on Form 20-F for the year ended December 31, 2023 and Part 1, Item 1A, “Risk Factors” in

Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2023 and Part II, Item 1A, “Risk

Factors” in Desktop Metal’s most recent Quarterly Reports on Form 10-Q, each filed with the SEC, and in Desktop Metal’s

other filings with the SEC.

The forward-looking statements included in this communication are made

only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect subsequent events

or circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there

be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, Desktop Metal intends

to file a proxy statement with the SEC. Desktop Metal may also file other relevant documents with the SEC regarding the proposed transaction.

This document is not a substitute for the proxy statement or any other document that Desktop Metal may file with the SEC. The definitive

proxy statement (if and when available) will be mailed to stockholders of Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the proxy statement (if and when

available) and other documents containing important information about Desktop Metal and the proposed transaction, once such documents

are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by

Desktop Metal will be available free of charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Desktop Metal, Nano and certain of their respective directors and executive

officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the

directors and executive officers of Desktop Metal is set forth in Desktop Metal’s proxy statement for its 2024 Annual Meeting of

Stockholders, which was filed with the SEC on April 23, 2024. Information about the directors and executive officers of Nano is set

forth in Nano’s Annual Report on Form 20-F, which was filed with the SEC on March 21, 2024. Other information regarding

persons why may be deemed to be participants in the solicitation of Desktop Metal’s stockholders in connection with the proposed

transaction and any direct or indirect interests they may have in the proposed transaction will be set forth in Desktop Metal’s

definitive proxy statement for its special meeting of stockholders when it is filed with the SEC.

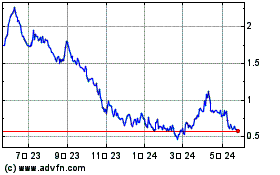

Desktop Metal (NYSE:DM)

過去 株価チャート

から 10 2024 まで 10 2024

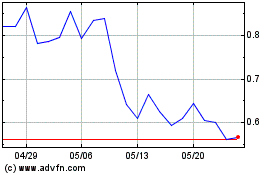

Desktop Metal (NYSE:DM)

過去 株価チャート

から 10 2023 まで 10 2024