0000910521false00009105212024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 25, 2024

DECKERS OUTDOOR CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36436 | 95-3015862 |

| (State of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

250 Coromar Drive, Goleta, California 93117

| | | | | |

| (Address of principal executive offices) (Zip Code) |

(805) 967-7611

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | DECK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

Item 2.02 | | Results of Operations and Financial Condition.

|

On July 25, 2024, Deckers Outdoor Corporation (the “Company”) issued a press release announcing its financial results for the three months ended June 30, 2024 and providing financial guidance for the fiscal year ending March 31, 2025. The Company intends to hold a conference call regarding these financial results. A copy of the press release is furnished hereto as Exhibit 99.1.

The information provided in Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Such information shall not be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as otherwise expressly set forth by specific reference in such filing.

| | | | | | | | |

Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description. |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: July 25, 2024 | | |

| | Deckers Outdoor Corporation |

| | /s/ Steven J. Fasching |

| | Steven J. Fasching, Chief Financial Officer |

DECKERS BRANDS REPORTS FIRST QUARTER FISCAL YEAR 2025 FINANCIAL RESULTS

•FIRST QUARTER FY 2025 REVENUE INCREASED 22% TO $825 MILLION

•FIRST QUARTER FY 2025 DILUTED EPS INCREASED 87% TO $4.52

•FY 2025 DILUTED EPS GUIDANCE RAISED TO RANGE OF $29.75-$30.65

Goleta, California (July 25, 2024) -- Deckers Brands (NYSE: DECK), a global leader in designing, marketing, and distributing innovative footwear, apparel, and accessories, today announced financial results for the first fiscal quarter ended June 30, 2024. The Company also provided an update to its financial outlook for the full fiscal year ending March 31, 2025.

“As this is my last quarter to report as CEO, I am pleased to share these strong results to kick-off fiscal year 2025,” said Dave Powers, President and Chief Executive Officer. “HOKA and UGG continue to drive robust full-price demand in the global marketplace by delivering compelling product that consumers love. Deckers has an exciting future ahead as Stefano transitions into his new role as CEO next week."

"Fiscal year 2025 is off to a great start, with HOKA and UGG delivering fantastic first quarter results that have contributed to our increased outlook for the full fiscal year," said Stefano Caroti, Chief Commercial Officer and incoming President and Chief Executive Officer. "I'm excited by the opportunity to now lead Deckers and its iconic brands, with the support of our talented teams that remain focused on the long-term opportunities ahead for this great company."

First Quarter Fiscal 2025 Financial Review (Compared to the Same Period Last Year)

•Net sales increased 22.1% to $825.3 million compared to $675.8 million. On a constant currency basis, net sales increased 23.0%.

◦Channel

▪Direct-to-Consumer (DTC) net sales increased 24.0% to $310.6 million compared to $250.4 million. DTC comparable net sales increased 21.9%.

▪Wholesale net sales increased 21.0% to $514.8 million compared to $425.4 million.

◦Geography

▪Domestic net sales increased 23.0% to $515.9 million compared to $419.5 million.

▪International net sales increased 20.8% to $309.5 million compared to $256.3 million.

•Gross margin was 56.9% compared to 51.3%.

•Selling, general, and administrative (SG&A) expenses were $337.2 million compared to $275.7 million.

•Operating income was $132.8 million compared to $70.7 million.

•Diluted earnings per share was $4.52 compared to $2.41.

First Quarter Fiscal 2025 Brand Summary (Compared to the Same Period Last Year)

•HOKA® brand net sales increased 29.7% to $545.2 million compared to $420.5 million.

•UGG® brand net sales increased 14.0% to $223.0 million compared to $195.5 million.

•Teva® brand net sales decreased 4.3% to $46.3 million compared to $48.4 million.

•Sanuk® brand net sales decreased 28.4% to $6.9 million compared to $9.6 million.

•Other brands, primarily composed of Koolaburra®, net sales increased 123.5% to $4.0 million compared to $1.8 million.

Balance Sheet (June 30, 2024 as compared to June 30, 2023)

•Cash and cash equivalents were $1.438 billion compared to $1.047 billion.

•Inventories were $753.3 million compared to $740.6 million.

•The Company had no outstanding borrowings.

Capital Allocation

During the first fiscal quarter, the Company repurchased approximately 177 thousand shares of its common stock for a total of $152.0 million at a weighted average price paid per share of $858.79. As of June 30, 2024, the Company had approximately $789.7 million remaining under its stock repurchase authorization.

Subsequent to quarter end, the Company entered into an agreement to divest the Sanuk brand, which we expect to close in August 2024.

Full Fiscal Year 2025 Outlook for the Twelve Month Period Ending March 31, 2025

The Company’s full fiscal year 2025 outlook is forward-looking in nature, reflecting our expectations as of July 25, 2024, and is subject to significant risks and uncertainties that limit our ability to accurately forecast results. This outlook assumes no meaningful changes to the Company’s business prospects or risks and uncertainties identified by management that could impact future results, which include but are not limited to: changes in economic conditions, including consumer confidence, discretionary spending, inflationary pressures, and foreign currency fluctuations; supply chain disruptions; and geopolitical tensions.

•Net sales are still expected to increase approximately 10% to $4.7 billion.

•Gross margin is now expected to be approximately 54%.

•SG&A expenses as a percentage of net sales are now expected to be in the range of 34% to 34.5%.

•Operating margin is now expected to be in the range of 19.5% to 20%.

•Effective tax rate is still expected to be in the range of 22% to 23%.

•Diluted earnings per share is now expected to be in the range of $29.75 to $30.65.

•The earnings per share guidance does not take into account the impact from any potential future share repurchases or the proposed six-for-one forward stock split, which has been approved by our Board of Directors and is pending stockholder approval at our 2024 annual meeting of stockholders to be held on September 9, 2024.

Non-GAAP Financial Measures

In certain instances the Company may present financial measures that were not prepared in accordance with generally accepted accounting principles in the United States (non-GAAP financial measures), including constant currency, to provide information that may assist investors in understanding its financial results and assessing its prospects for future performance. The Company believes these non-GAAP financial measures are important indicators of its operating performance because they exclude items that are unrelated to, and may not be indicative of, its core operating results.

The non-GAAP financial measures presented by the Company may not necessarily be comparable to similarly titled measures of other companies and may not be appropriate measures for comparing the performance of other companies relative to Deckers. For example, in order to calculate constant currency information, the Company calculates the current period financial information using the foreign currency exchange rates that were in effect during the previous comparable period, excluding the effects of foreign currency exchange rate hedges and remeasurements in the condensed consolidated financial statements. Further, the Company reports DTC comparable net sales on a constant currency basis for DTC operations that were open throughout the current and prior reporting periods, and may adjust prior reporting periods to conform to current year accounting policies. These non-GAAP financial measures are

not intended to represent, and should not be considered to be more meaningful measures than, or alternatives to, measures of operating performance as determined in accordance with GAAP. To the extent the Company utilizes such non-GAAP financial measures in the future, it expects to calculate them using a consistent method from period-to-period.

Conference Call Information

The Company’s conference call to review the results for the first quarter fiscal year 2025 will be broadcast live today, Thursday, July 25, 2024, at 4:30 pm Eastern Time and hosted at ir.deckers.com. You can access the broadcast by clicking on the link within the “Webcast” box at the top of the page. A replay of the broadcast will be available for at least 30 days following the conference call and can be accessed under the “Quarterly Earnings” section of the “Financials” tab at the aforementioned website.

About Deckers Brands

Deckers Brands is a global leader in designing, marketing, and distributing innovative footwear, apparel, and accessories developed for both everyday casual lifestyle use and high-performance activities. The Company’s portfolio of brands includes UGG®, HOKA®, Teva®, Sanuk®, Koolaburra®, and AHNU®. Deckers Brands products are sold in more than 50 countries and territories through select department and specialty stores, Company-owned and operated retail stores, and select online stores, including Company-owned websites. Deckers Brands has over 50 years of history building niche footwear brands into lifestyle market leaders attracting millions of loyal consumers globally. For more information, please visit www.deckers.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, which statements are subject to considerable risks and uncertainties. Forward-looking statements include all statements other than statements of historical fact contained in this press release, including statements regarding our projected financial results, including net sales, gross margin, SG&A expenses, operating margin, inventories, effective tax rate, and diluted earnings per share; consumer confidence and discretionary spending; the strength of our brands and demand for our products; our ability to drive future growth and profitability; our ability to execute on our long-term strategies and objectives; our capital allocation, including the potential repurchase of shares; the expected timing and impact of our planned leadership transition; and the impact of the pending forward stock split. We have attempted to identify forward-looking statements by using words such as “anticipate,” “believe,” “estimate,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” or “would,” and similar expressions or the negative of these expressions.

Forward-looking statements represent our management’s current expectations and predictions about trends affecting our business and industry and are based on information available as of the time such statements are made. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy or completeness. Forward-looking statements involve numerous known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements predicted, assumed or implied by the forward-looking statements. Some of the risks and uncertainties that may cause our actual results to materially differ from those expressed or implied by these forward-looking statements are described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024, as well as in our Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission.

Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. Except as required by applicable law

or the listing rules of the New York Stock Exchange, we expressly disclaim any intent or obligation to update any forward-looking statements, or to update the reasons actual results could differ materially from those expressed or implied by these forward-looking statements, whether to conform such statements to actual results or changes in our expectations, or as a result of the availability of new information.

# # #

Investor Contact:

Erinn Kohler | VP, Investor Relations, Corporate Planning & Business Analytics | Deckers Brands | 805.967.7611

DECKERS OUTDOOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(dollar and share data amounts in thousands, except per share data)

| | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, |

| | | | | 2024 | | 2023 |

| Net sales | | | | | $ | 825,347 | | | $ | 675,791 | |

| Cost of sales | | | | | 355,347 | | | 329,367 | |

| Gross profit | | | | | 470,000 | | | 346,424 | |

| Selling, general, and administrative expenses | | | | | 337,193 | | | 275,688 | |

| Income from operations | | | | | 132,807 | | | 70,736 | |

| Total other income, net | | | | | (16,346) | | | (10,628) | |

| Income before income taxes | | | | | 149,153 | | | 81,364 | |

| Income tax expense | | | | | 33,528 | | | 17,812 | |

| Net income | | | | | 115,625 | | | 63,552 | |

| Total other comprehensive loss, net of tax | | | | | (3,800) | | | (8,299) | |

| Comprehensive income | | | | | $ | 111,825 | | | $ | 55,253 | |

| | | | | | | |

| Net income per share | | | | | | | |

| Basic | | | | | $ | 4.54 | | | $ | 2.43 | |

| Diluted | | | | | $ | 4.52 | | | $ | 2.41 | |

| Weighted-average common shares outstanding | | | | | | | |

| Basic | | | | | 25,478 | | | 26,165 | |

| Diluted | | | | | 25,581 | | | 26,321 | |

DECKERS OUTDOOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(dollar amounts in thousands)

| | | | | | | | | | | |

| June 30, 2024 | | March 31, 2024 |

| ASSETS | | | (AUDITED) |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,438,397 | | | $ | 1,502,051 | |

| Trade accounts receivable, net | 303,128 | | | 296,565 | |

| Inventories | 753,282 | | | 474,311 | |

| Other current assets | 118,023 | | | 170,556 | |

| Total current assets | 2,612,830 | | | 2,443,483 | |

| Property and equipment, net | 305,585 | | | 302,122 | |

| Operating lease assets | 221,207 | | | 225,669 | |

| Other noncurrent assets | 166,597 | | | 164,305 | |

| Total assets | $ | 3,306,219 | | | $ | 3,135,579 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| | | |

| Trade accounts payable | $ | 642,595 | | | $ | 378,503 | |

| Operating lease liabilities | 46,362 | | | 53,581 | |

| Other current liabilities | 223,513 | | | 287,909 | |

| Total current liabilities | 912,470 | | | 719,993 | |

| Long-term operating lease liabilities | 216,006 | | | 213,298 | |

| Other long-term liabilities | 103,261 | | | 94,820 | |

| Total long-term liabilities | 319,267 | | | 308,118 | |

| Total stockholders’ equity | 2,074,482 | | | 2,107,468 | |

| Total liabilities and stockholders’ equity | $ | 3,306,219 | | | $ | 3,135,579 | |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

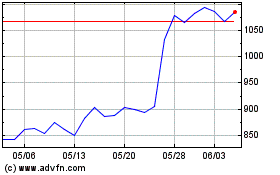

Deckers Outdoor (NYSE:DECK)

過去 株価チャート

から 6 2024 まで 7 2024

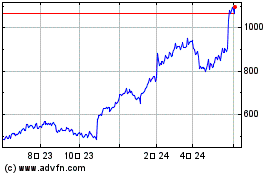

Deckers Outdoor (NYSE:DECK)

過去 株価チャート

から 7 2023 まで 7 2024