0001390777false00013907772024-07-122024-07-120001390777exch:XNYSus-gaap:CommonStockMember2024-07-122024-07-120001390777exch:XNYSus-gaap:PreferredStockMember2024-07-122024-07-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – July 12, 2024

THE BANK OF NEW YORK MELLON CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35651 | 13-2614959 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

240 Greenwich Street

New York, New York 10286

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code – (212) 495-1784

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading

symbol(s) | Name of each exchange

on which registered |

| Common Stock, $0.01 par value | BK | New York Stock Exchange |

| | |

| 6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV | BK/P | New York Stock Exchange |

| (fully and unconditionally guaranteed by The Bank of New York Mellon Corporation) | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 under the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 12, 2024, The Bank of New York Mellon Corporation (“BNY”) released information on its financial results for the second quarter ended June 30, 2024. Copies of the Earnings Release and the Financial Supplement are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

ITEM 7.01. REGULATION FD DISCLOSURE.

On July 12, 2024, BNY will hold a conference call and webcast to discuss its financial results for the second quarter ended June 30, 2024 and outlook. A copy of the Financial Highlights presentation for the conference call and webcast is attached hereto as Exhibit 99.3.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) EXHIBITS.

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

| | |

| 99.1 | | | |

| | The quotation in Exhibit 99.1 (the “Excluded Section”) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of BNY under the Securities Act of 1933 or the Exchange Act. The information included in Exhibit 99.1, other than in the Excluded Section, shall be deemed “filed” for purposes of the Exchange Act. |

| | |

| 99.2 | | | |

| | The information included in Exhibit 99.2 shall be deemed “filed” for purposes of the Exchange Act. |

| | |

| 99.3 | | | |

| | The information included in Exhibit 99.3 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of BNY under the Securities Act of 1933 or the Exchange Act. |

| | |

| 104 | | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| The Bank of New York Mellon Corporation (Registrant)

|

| Date: July 12, 2024 | By: | /s/ Jean Weng | |

| Name:

Title: | Jean Weng

Secretary | |

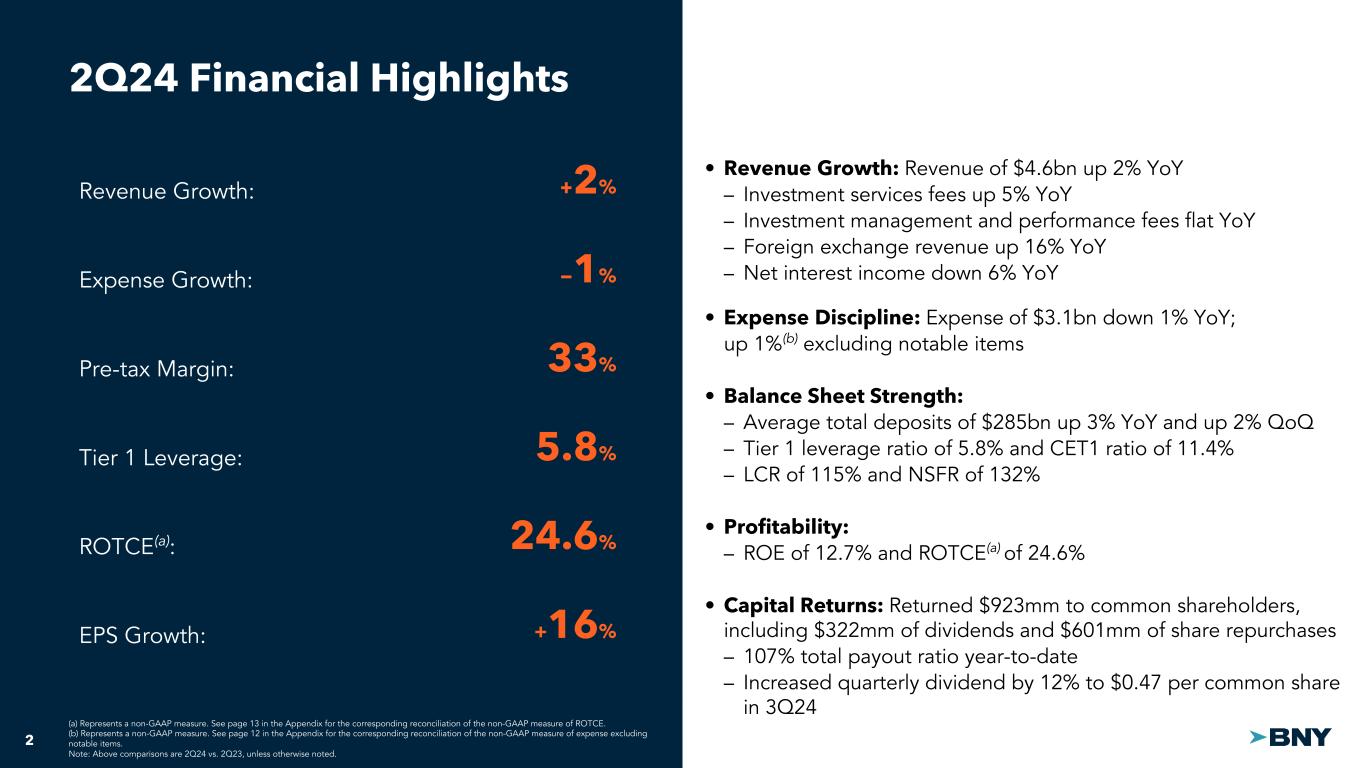

BNY Reports Second Quarter 2024

Earnings Per Common Share of $1.52, or $1.51 as Adjusted (a)

NEW YORK, July 12, 2024 – The Bank of New York Mellon Corporation (“BNY”) (NYSE: BK) today has reported financial results for the second quarter of 2024.

| | | | | | | | |

| CEO COMMENTARY |

|

|

| BNY delivered another quarter of improved financial performance, with positive operating leverage on the back of solid fee growth and continued expense discipline. The company reported earnings per share of $1.52, up 16% year-over-year. Excluding the impact of notable items, earnings per share were $1.51, up 9% year-over-year, and we generated a return on tangible common equity of 24% in the second quarter. Following the release of the Federal Reserve’s 2024 bank stress test in June, we increased our common dividend by 12% starting this quarter. |

|

| Last month, we celebrated the 240th anniversary of our company. As we write our next chapter, we continue to take steps to propel us forward – investing in our leadership team, launching new client solutions and modernizing our brand. |

|

| | |

| |

| Halfway through the year, we’re pleased with the progress we have made, but we are focused on running our company better and the hard work ahead. As highlighted in our improved financial performance to-date, we are starting to demonstrate the power of BNY’s franchise to our clients and shareholders, and we remain in execution mode to unlock the company’s full potential. | |

– Robin Vince, President and Chief Executive Officer |

| | | | | | | | | | | |

| KEY FINANCIAL INFORMATION |

| | | |

| | | |

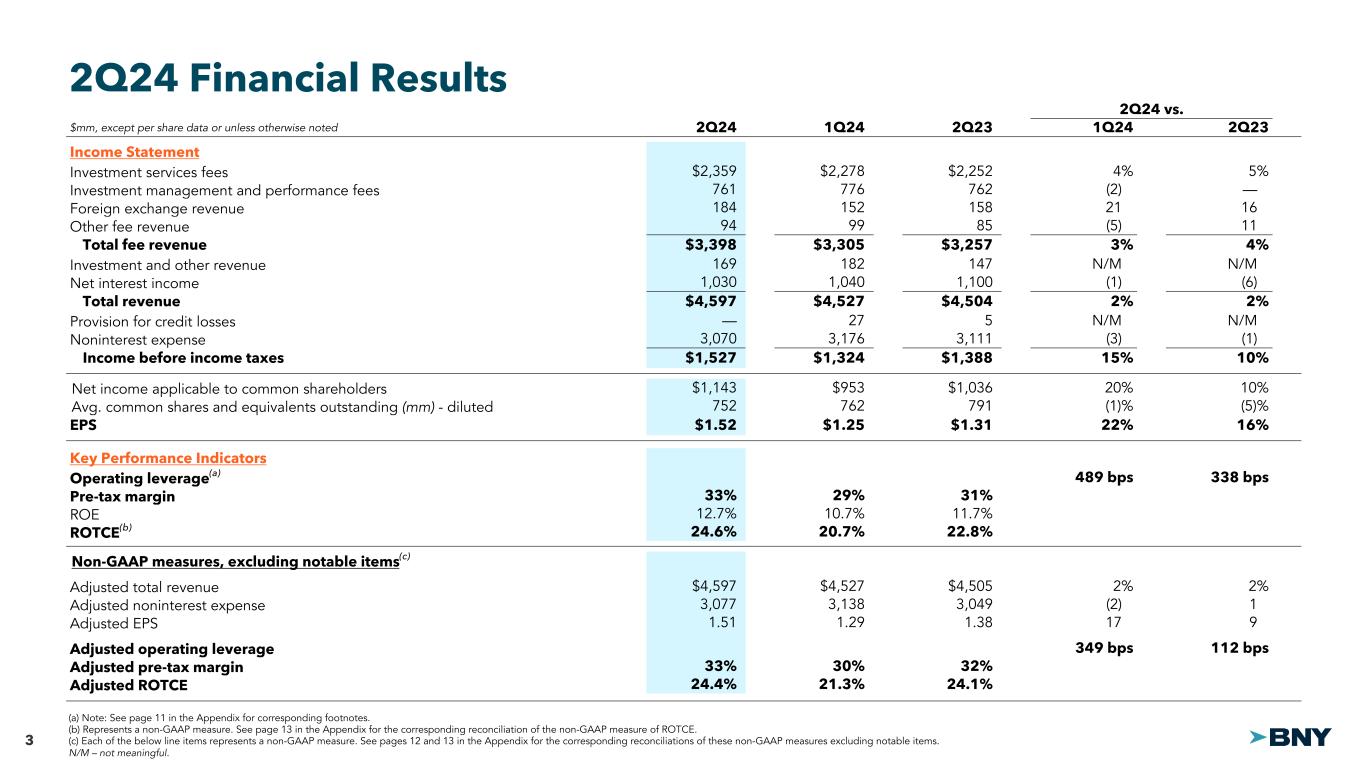

| (in millions, except per share amounts and unless otherwise noted) | | 2Q24 vs. |

| 2Q24 | 1Q24 | 2Q23 |

| Selected income statement data: | | | |

| | | |

| Total fee revenue | $ | 3,398 | | 3 | % | 4 | % |

| Investment and other revenue | 169 | | N/M | N/M |

| Net interest income | 1,030 | | (1) | | (6) | |

| Total revenue | $ | 4,597 | | 2 | % | 2 | % |

| Provision for credit losses | — | | N/M | N/M |

| Noninterest expense | $ | 3,070 | | (3) | % | (1) | % |

| Net income applicable to common shareholders | $ | 1,143 | | 20 | % | 10 | % |

| Diluted EPS | $ | 1.52 | | 22 | % | 16 | % |

| | | |

| Selected metrics: | | | |

| | | |

AUC/A (in trillions) | $ | 49.5 | | 1 | % | 6 | % |

AUM (in trillions) | $ | 2.0 | | 1 | % | 7 | % |

| | | |

| Financial ratios: | 2Q24 | 1Q24 | 2Q23 |

| | | |

| Pre-tax operating margin | 33 | % | 29 | % | 31 | % |

| ROE | 12.7 | % | 10.7 | % | 11.7 | % |

ROTCE (a) | 24.6 | % | 20.7 | % | 22.8 | % |

| | | |

| Capital ratios: | | | |

| | | |

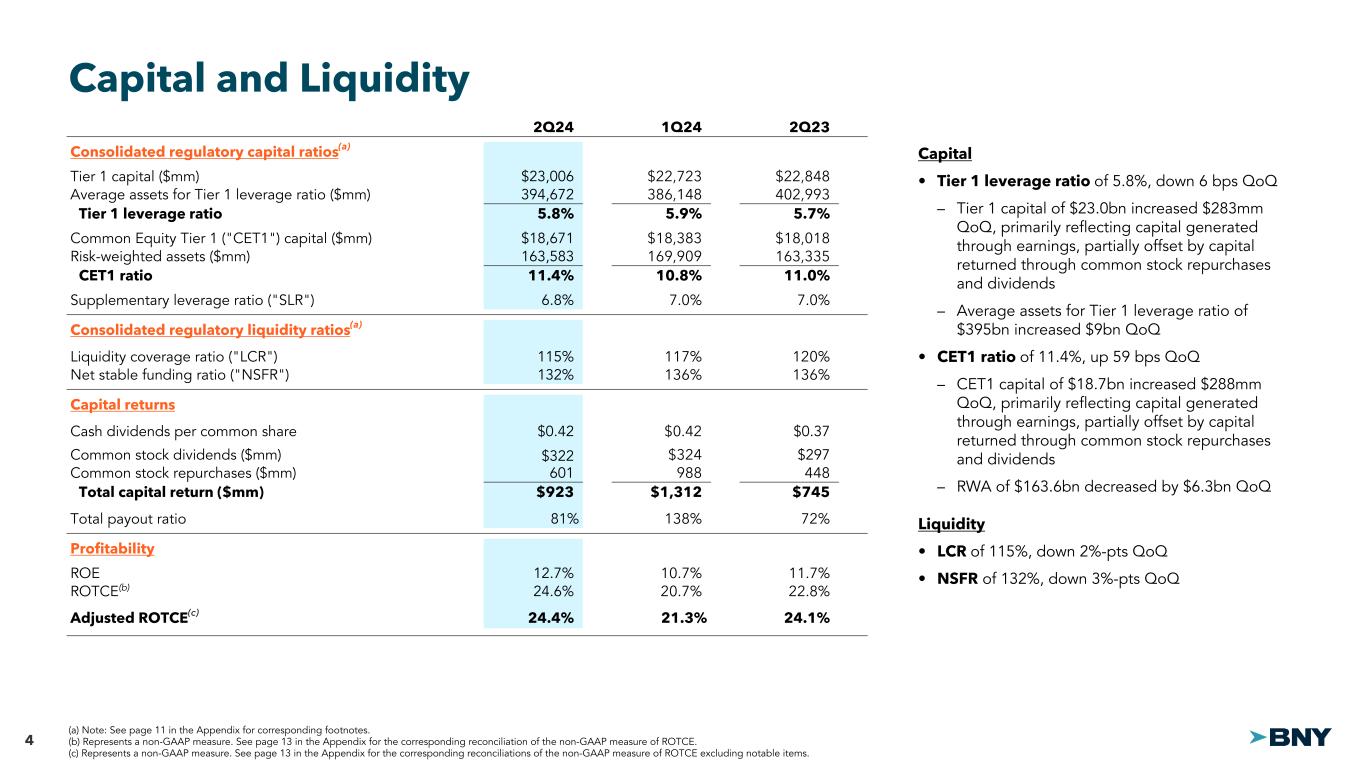

| Tier 1 leverage ratio | 5.8 | % | 5.9 | % | 5.7 | % |

| CET1 ratio | 11.4 | % | 10.8 | % | 11.0 | % |

Results

•Total revenue of $4.6 billion, increased 2%

•Noninterest expense of $3.1 billion, decreased 1%; or increased 1% excluding notable items (a)

•Diluted EPS of $1.52, increased 16%; or 9% excluding notable items (a)

Profitability

•Pre-tax operating margin of 33%; and 33% excluding notable items (a)

•ROTCE of 24.6% (a); or 24.4% excluding notable items (a)

Balance sheet

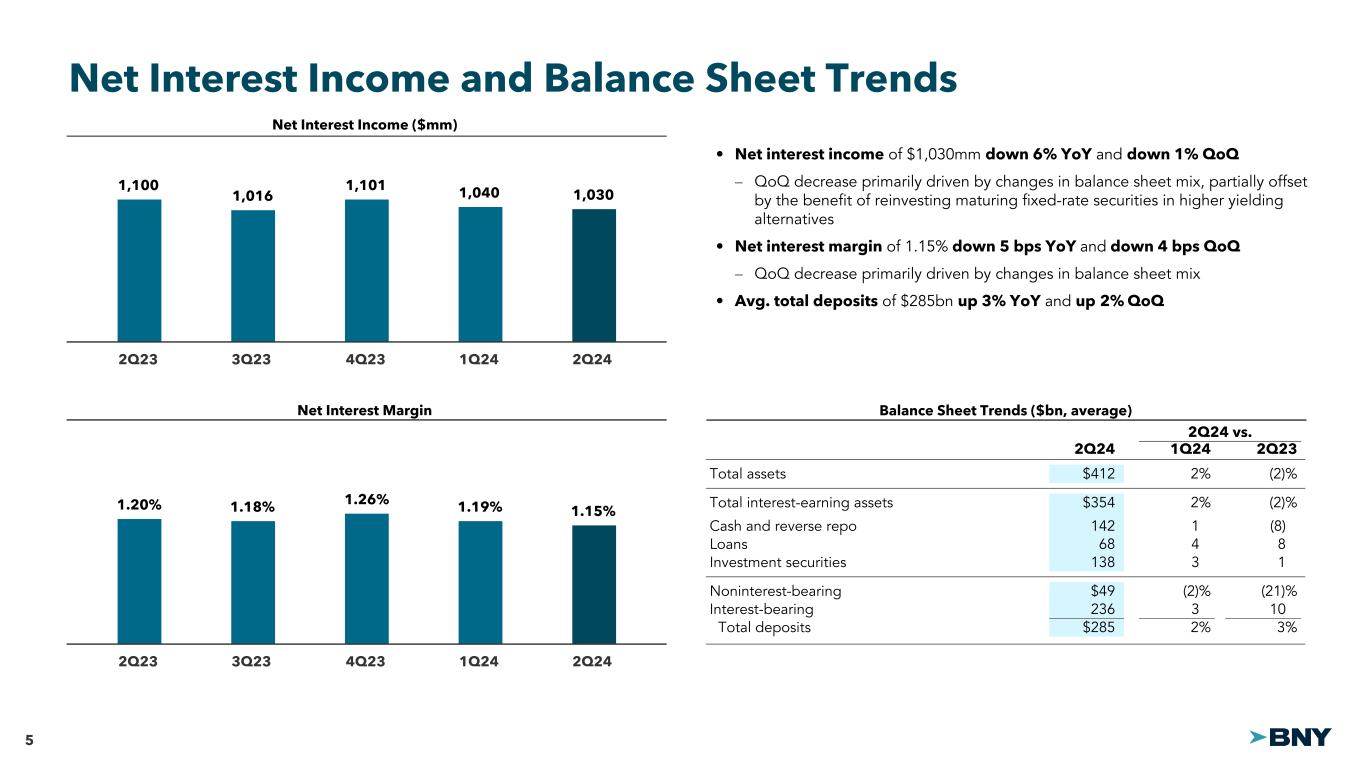

•Average deposits of $285 billion, increased 3% year-over-year and 2% sequentially

•Tier 1 leverage ratio of 5.8%, increased 16 bps year-over-year and decreased 6 bps sequentially

Capital distribution

•Returned $923 million of capital to common shareholders

•$322 million of dividends

•$601 million of share repurchases

•Total payout ratio of 107% year-to-date

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

$1.52 EPS | $1.51 (a) Adj. EPS | | 33% Pre-tax margin | 33% (a) Adj. Pre-tax margin | | 12.7% ROE | 24.4% (a) Adj. ROTCE | |

| | | | | |

|

| (a) For information on the Non-GAAP measures, see “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9. |

|

| Note: Above comparisons are 2Q24 vs. 2Q23, unless otherwise noted. |

Investor Relations: Marius Merz (212) 298-1480 | Media Relations: Garrett Marquis (949) 683-1503 |

| | |

BNY 2Q24 Financial Results |

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts and unless otherwise noted; not meaningful - N/M) | | | | 2Q24 vs. |

| 2Q24 | 1Q24 | 2Q23 | 1Q24 | 2Q23 |

| Fee revenue | $ | 3,398 | | $ | 3,305 | | $ | 3,257 | | 3 | % | 4 | % |

| Investment and other revenue | 169 | | 182 | | 147 | | N/M | N/M |

| Total fee and other revenue | 3,567 | | 3,487 | | 3,404 | | 2 | | 5 | |

| Net interest income | 1,030 | | 1,040 | | 1,100 | | (1) | | (6) | |

| Total revenue | 4,597 | | 4,527 | | 4,504 | | 2 | | 2 | |

| Provision for credit losses | — | | 27 | | 5 | | N/M | N/M |

| Noninterest expense | 3,070 | | 3,176 | | 3,111 | | (3) | | (1) | |

| Income before taxes | 1,527 | | 1,324 | | 1,388 | | 15 | | 10 | |

| Provision for income taxes | 357 | | 297 | | 315 | | 20 | | 13 | |

| Net income | $ | 1,170 | | $ | 1,027 | | $ | 1,073 | | 14 | % | 9 | % |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,143 | | $ | 953 | | $ | 1,036 | | 20 | % | 10 | % |

Operating leverage (a) | | | | 489 | bps | 338 | bps |

| Diluted earnings per common share | $ | 1.52 | | $ | 1.25 | | $ | 1.31 | | 22 | % | 16 | % |

Average common shares and equivalents outstanding - diluted (in thousands) | 751,596 | | 762,268 | | 790,725 | | | |

| Pre-tax operating margin | 33 | % | 29 | % | 31 | % | | |

| | | | | |

| Metrics: | | | | | |

| Average loans | $ | 68,283 | | $ | 65,844 | | $ | 63,459 | | 4 | % | 8 | % |

| Average deposits | 284,843 | | 278,846 | | 277,209 | | 2 | | 3 | |

AUC/A at period end (in trillions) (current period is preliminary) | 49.5 | | 48.8 | | 46.9 | | 1 | | 6 | |

AUM (in trillions) (current period is preliminary) | 2.05 | | 2.02 | | 1.91 | | 1 | | 7 | |

Non-GAAP measures, excluding notable items: (b) | | | | | |

| Adjusted total revenue | $ | 4,597 | | $ | 4,527 | | $ | 4,505 | | 2 | % | 2 | % |

| Adjusted noninterest expense | $ | 3,077 | | $ | 3,138 | | $ | 3,049 | | (2)% | 1 | % |

Adjusted operating leverage (a) | | | | 349 | bps | 112 | bps |

| Adjusted diluted earnings per common share | $ | 1.51 | | $ | 1.29 | | $ | 1.38 | | 17 | % | 9 | % |

| Adjusted pre-tax operating margin | 33 | % | 30 | % | 32 | % | | |

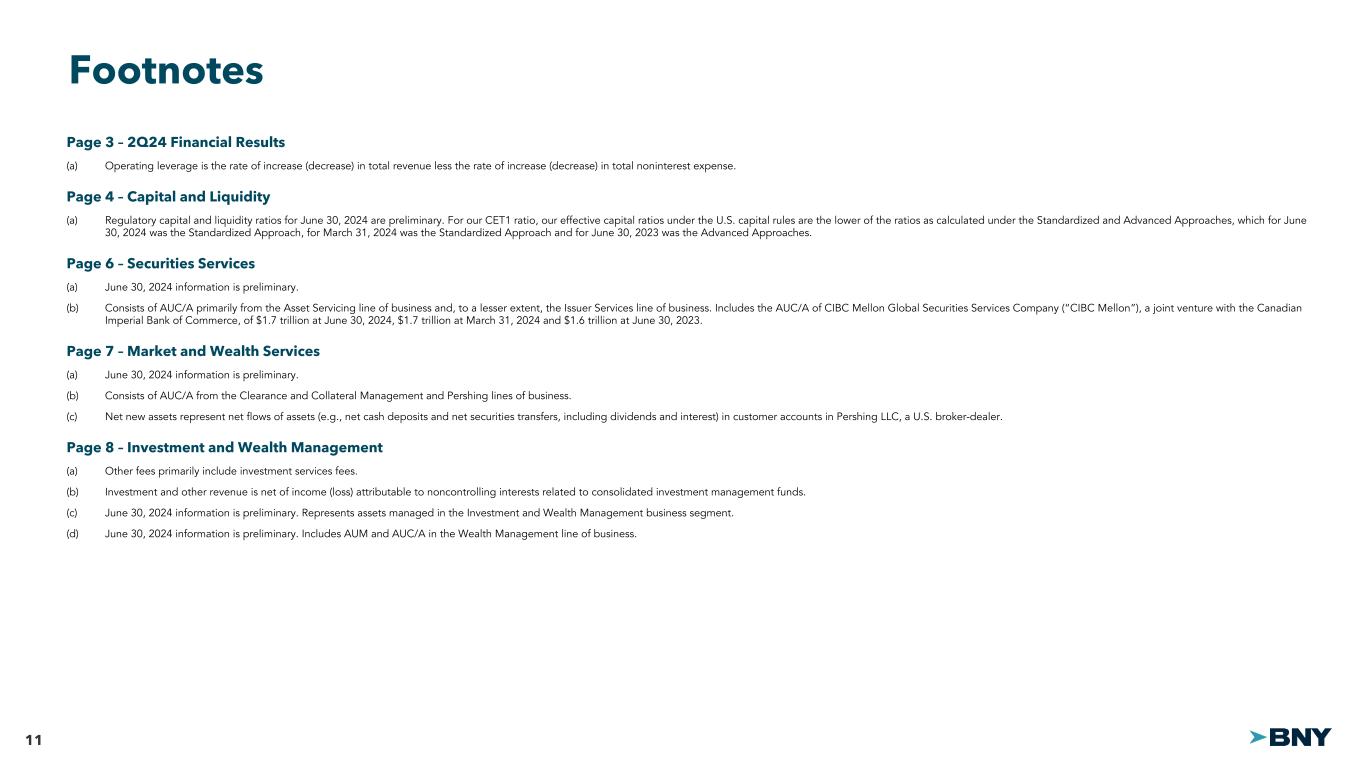

(a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense.

(b) See “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9 for additional information. bps – basis points.

KEY DRIVERS (comparisons are 2Q24 vs. 2Q23, unless otherwise noted)

•Total revenue increased 2%, primarily reflecting:

•Fee revenue increased 4%, primarily reflecting higher market values, net new business, higher foreign exchange revenue and higher client activity, partially offset by the mix of AUM flows.

•Investment and other revenue increased primarily reflecting higher client activity in our fixed income and equity trading business.

•Net interest income decreased 6%, primarily reflecting changes in balance sheet mix, partially offset by higher interest rates.

•Noninterest expense decreased 1%, primarily reflecting efficiency savings, a reduction in the FDIC special assessment and lower litigation reserves, partially offset by higher investments, employee merit increases and higher revenue-related expenses. Excluding notable items (a), noninterest expense increased 1%.

•Effective tax rate of 23.4%.

Assets under custody and/or administration (“AUC/A”) and Assets under management (“AUM”)

•AUC/A increased 6%, primarily reflecting higher market values.

•AUM increased 7%, primarily reflecting higher market values.

Capital and liquidity

•$322 million of dividends to common shareholders (b); $601 million of common share repurchases.

•Return on common equity (“ROE”) – 12.7%; Adjusted ROE – 12.7% (a).

•Return on tangible common equity (“ROTCE”) – 24.6% (a); Adjusted ROTCE - 24.4% (a).

•Common Equity Tier 1 (“CET1”) ratio – 11.4%.

•Tier 1 leverage ratio – 5.8%.

•Average liquidity coverage ratio (“LCR”) – 115%; Average net stable funding ratio (“NSFR”) – 132%.

•Total Loss Absorbing Capacity (“TLAC”) ratios exceed minimum requirements.

(a) See “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9 for additional information. (b) Including dividend-equivalents on share-based awards.

Note: Throughout this document, sequential growth rates are unannualized.

| | |

BNY 2Q24 Financial Results |

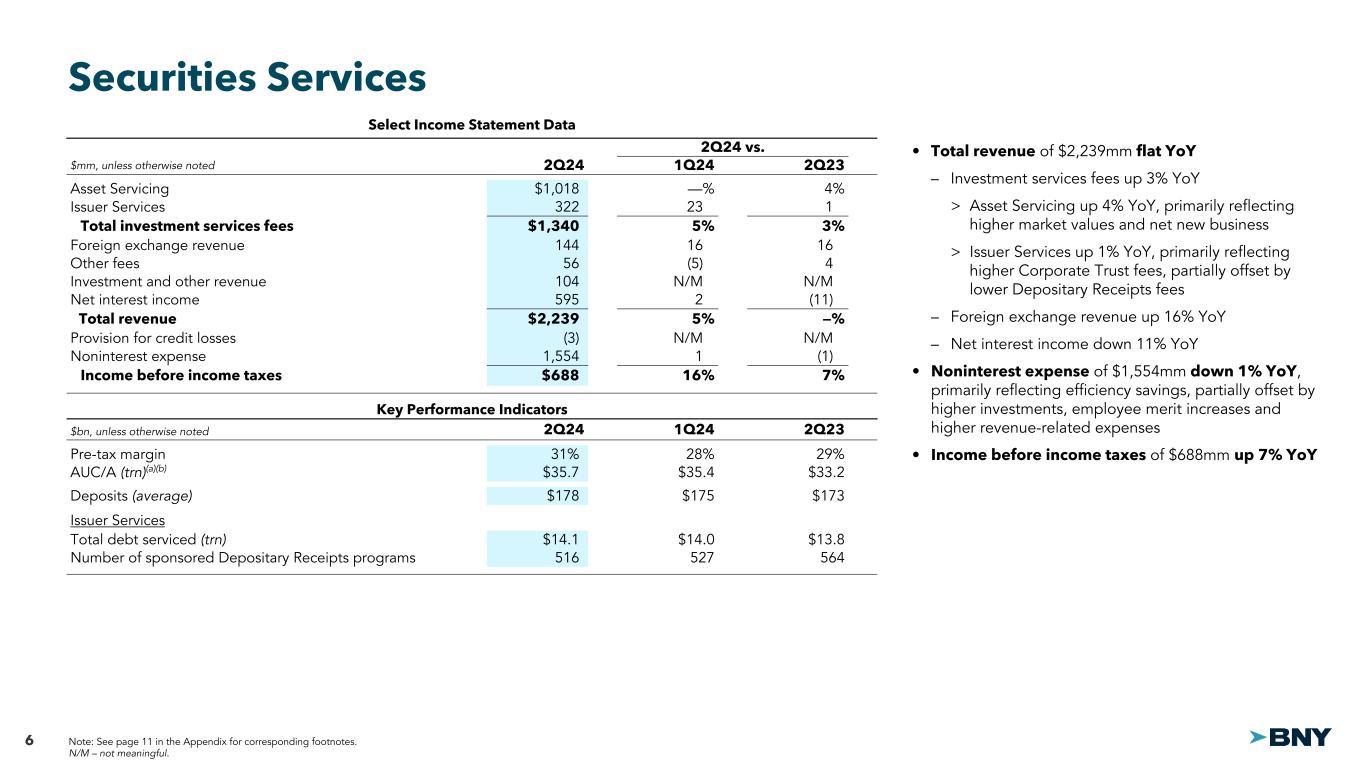

SECURITIES SERVICES BUSINESS SEGMENT HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | | | | | | | 2Q24 vs. |

| 2Q24 | | 1Q24 | | 2Q23 | | 1Q24 | 2Q23 |

| Investment services fees: | | | | | | | | |

| Asset Servicing | $ | 1,018 | | | $ | 1,013 | | | $ | 980 | | | — | % | 4 | % |

| Issuer Services | 322 | | | 261 | | | 319 | | | 23 | | 1 | |

| Total investment services fees | 1,340 | | | 1,274 | | | 1,299 | | | 5 | | 3 | |

| Foreign exchange revenue | 144 | | | 124 | | | 124 | | | 16 | | 16 | |

Other fees (a) | 56 | | | 59 | | | 54 | | | (5) | | 4 | |

| Total fee revenue | 1,540 | | | 1,457 | | | 1,477 | | | 6 | | 4 | |

| Investment and other revenue | 104 | | | 99 | | | 84 | | | N/M | N/M |

| Total fee and other revenue | 1,644 | | | 1,556 | | | 1,561 | | | 6 | | 5 | |

| Net interest income | 595 | | | 583 | | | 668 | | | 2 | | (11) | |

| Total revenue | 2,239 | | | 2,139 | | | 2,229 | | | 5 | | — | |

| Provision for credit losses | (3) | | | 11 | | | 16 | | | N/M | N/M |

| Noninterest expense | 1,554 | | | 1,537 | | | 1,567 | | | 1 | | (1) | |

| Income before taxes | $ | 688 | | | $ | 591 | | | $ | 646 | | | 16 | % | 7 | % |

| | | | | | | | |

| Total revenue by line of business: | | | | | | | | |

| Asset Servicing | $ | 1,687 | | | $ | 1,668 | | | $ | 1,695 | | | 1 | % | — | % |

| Issuer Services | 552 | | | 471 | | | 534 | | | 17 | | 3 | |

| Total revenue by line of business | $ | 2,239 | | | $ | 2,139 | | | $ | 2,229 | | | 5 | % | — | % |

| | | | | | | | |

| Pre-tax operating margin | 31 | % | | 28 | % | | 29 | % | | | |

| | | | | | | | |

Securities lending revenue (b) | $ | 46 | | | $ | 46 | | | $ | 47 | | | — | % | (2) | % |

| | | | | | | | |

| Metrics: | | | | | | | | |

| Average loans | $ | 11,103 | | | $ | 11,204 | | | $ | 11,283 | | | (1) | % | (2) | % |

| Average deposits | $ | 178,495 | | | $ | 174,687 | | | $ | 172,863 | | | 2 | % | 3 | % |

| | | | | | | | |

AUC/A at period end (in trillions) (current period is preliminary) (c) | $ | 35.7 | | | $ | 35.4 | | | $ | 33.2 | | | 1 | % | 8 | % |

Market value of securities on loan at period end (in billions) (d) | $ | 481 | | | $ | 486 | | | $ | 415 | | | (1) | % | 16 | % |

(a) Other fees primarily include financing-related fees.

(b) Included in investment services fees reported in the Asset Servicing line of business.

(c) Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Issuer Services line of business. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.7 trillion at June 30, 2024, $1.7 trillion at March 31, 2024 and $1.6 trillion at June 30, 2023.

(d) Represents the total amount of securities on loan in our agency securities lending program. Excludes securities for which BNY acts as agent on behalf of CIBC Mellon clients, which totaled $66 billion at June 30, 2024, $64 billion at March 31, 2024 and $66 billion at June 30, 2023.

KEY DRIVERS

•The drivers of the total revenue variances by line of business are indicated below.

•Asset Servicing – Total revenue was flat year-over-year reflecting higher market values, net new business and higher foreign exchange revenue, offset by lower net interest income. The sequential increase primarily reflects higher foreign exchange revenue and net new business.

•Issuer Services – The year-over-year increase primarily reflects higher Corporate Trust fees and net interest income, partially offset by lower Depositary Receipts revenue. The sequential increase primarily reflects higher Depositary Receipts revenue, net interest income and Corporate Trust fees.

•Noninterest expense decreased year-over-year, reflecting efficiency savings, partially offset by higher investments, employee merit increases and higher revenue-related expenses. The sequential increase primarily reflects higher revenue-related expenses and employee merit increases, partially offset by efficiency savings.

| | |

BNY 2Q24 Financial Results |

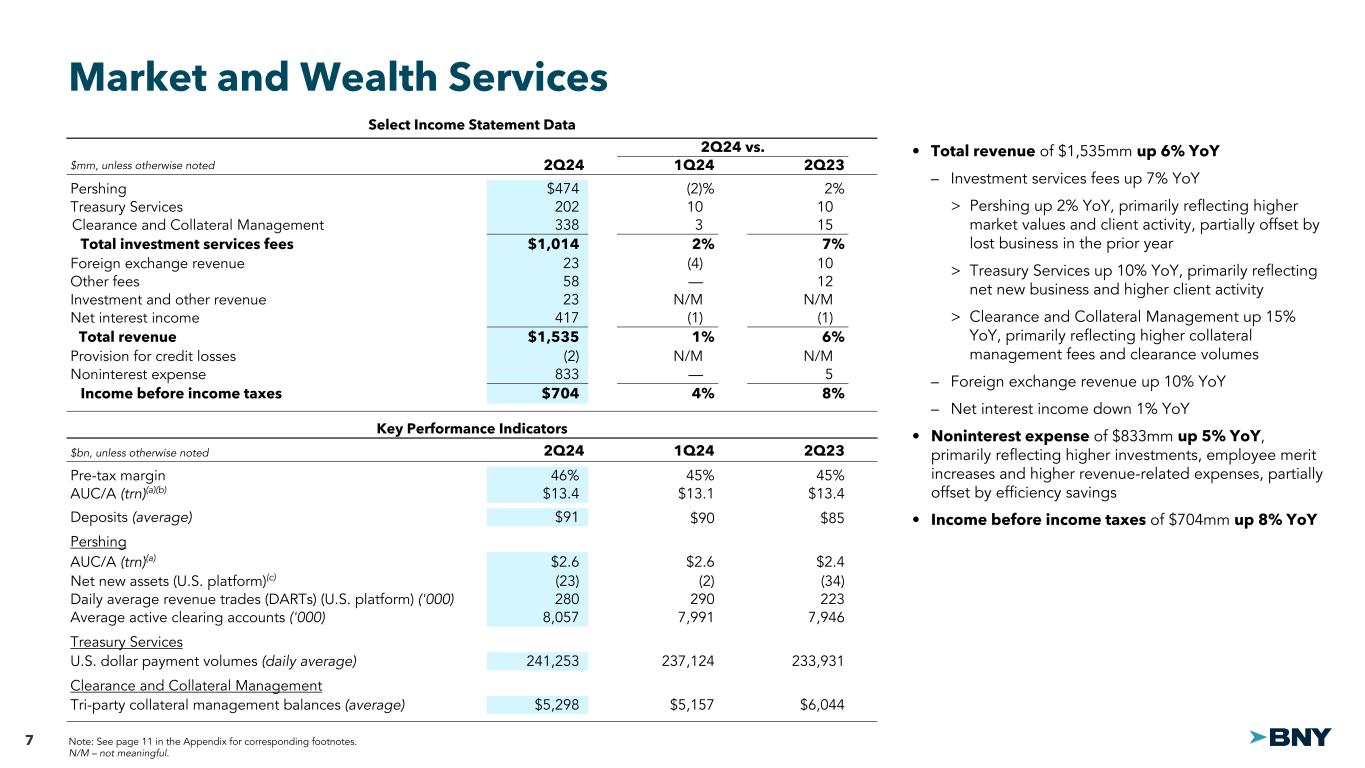

MARKET AND WEALTH SERVICES BUSINESS SEGMENT HIGHLIGHTS

| | | | | | | | | | | | | | | | | |

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | | | | 2Q24 vs. |

| 2Q24 | 1Q24 | 2Q23 | 1Q24 | 2Q23 |

| Investment services fees: | | | | | |

| Pershing | $ | 474 | | $ | 482 | | $ | 466 | | (2) | % | 2 | % |

| Treasury Services | 202 | | 184 | | 183 | | 10 | | 10 | |

| Clearance and Collateral Management | 338 | | 329 | | 295 | | 3 | | 15 | |

| Total investment services fees | 1,014 | | 995 | | 944 | | 2 | | 7 | |

| Foreign exchange revenue | 23 | | 24 | | 21 | | (4) | | 10 | |

Other fees (a) | 58 | | 58 | | 52 | | — | | 12 | |

| Total fee revenue | 1,095 | | 1,077 | | 1,017 | | 2 | | 8 | |

| Investment and other revenue | 23 | | 17 | | 16 | | N/M | N/M |

| Total fee and other revenue | 1,118 | | 1,094 | | 1,033 | | 2 | | 8 | |

| Net interest income | 417 | | 423 | | 420 | | (1) | | (1) | |

| Total revenue | 1,535 | | 1,517 | | 1,453 | | 1 | | 6 | |

| Provision for credit losses | (2) | | 5 | | 7 | | N/M | N/M |

| Noninterest expense | 833 | | 834 | | 794 | | — | | 5 | |

| Income before taxes | $ | 704 | | $ | 678 | | $ | 652 | | 4 | % | 8 | % |

| | | | | |

| Total revenue by line of business: | | | | | |

| Pershing | $ | 663 | | $ | 670 | | $ | 641 | | (1) | % | 3 | % |

| Treasury Services | 426 | | 416 | | 413 | | 2 | | 3 | |

| Clearance and Collateral Management | 446 | | 431 | | 399 | | 3 | | 12 | |

| Total revenue by line of business | $ | 1,535 | | $ | 1,517 | | $ | 1,453 | | 1 | % | 6 | % |

| | | | | |

| Pre-tax operating margin | 46 | % | 45 | % | 45 | % | | |

| | | | | |

| Metrics: | | | | | |

| Average loans | $ | 41,893 | | $ | 39,271 | | $ | 36,432 | | 7 | % | 15 | % |

| Average deposits | $ | 91,371 | | $ | 89,539 | | $ | 85,407 | | 2 | % | 7 | % |

| | | | | |

AUC/A at period end (in trillions) (current period is preliminary) (b) | $ | 13.4 | | $ | 13.1 | | $ | 13.4 | | 2 | % | — | % |

(a) Other fees primarily include financing-related fees.

(b) Consists of AUC/A from the Clearance and Collateral Management and Pershing lines of business.

KEY DRIVERS

•The drivers of the total revenue variances by line of business are indicated below.

•Pershing – The year-over-year increase primarily reflects higher market values and client activity, partially offset by lost business in the prior year. The sequential decrease primarily reflects lower net interest income and lost business in the prior year, partially offset by an equity investment gain.

•Treasury Services – The year-over-year and sequential increases primarily reflect net new business and higher client activity, partially offset by lower net interest income.

•Clearance and Collateral Management – The year-over-year and sequential increases primarily reflect higher collateral management fees and clearance volumes.

•Noninterest expense increased year-over-year, primarily reflecting higher investments, employee merit increases and higher revenue-related expenses, partially offset by efficiency savings.

| | |

BNY 2Q24 Financial Results |

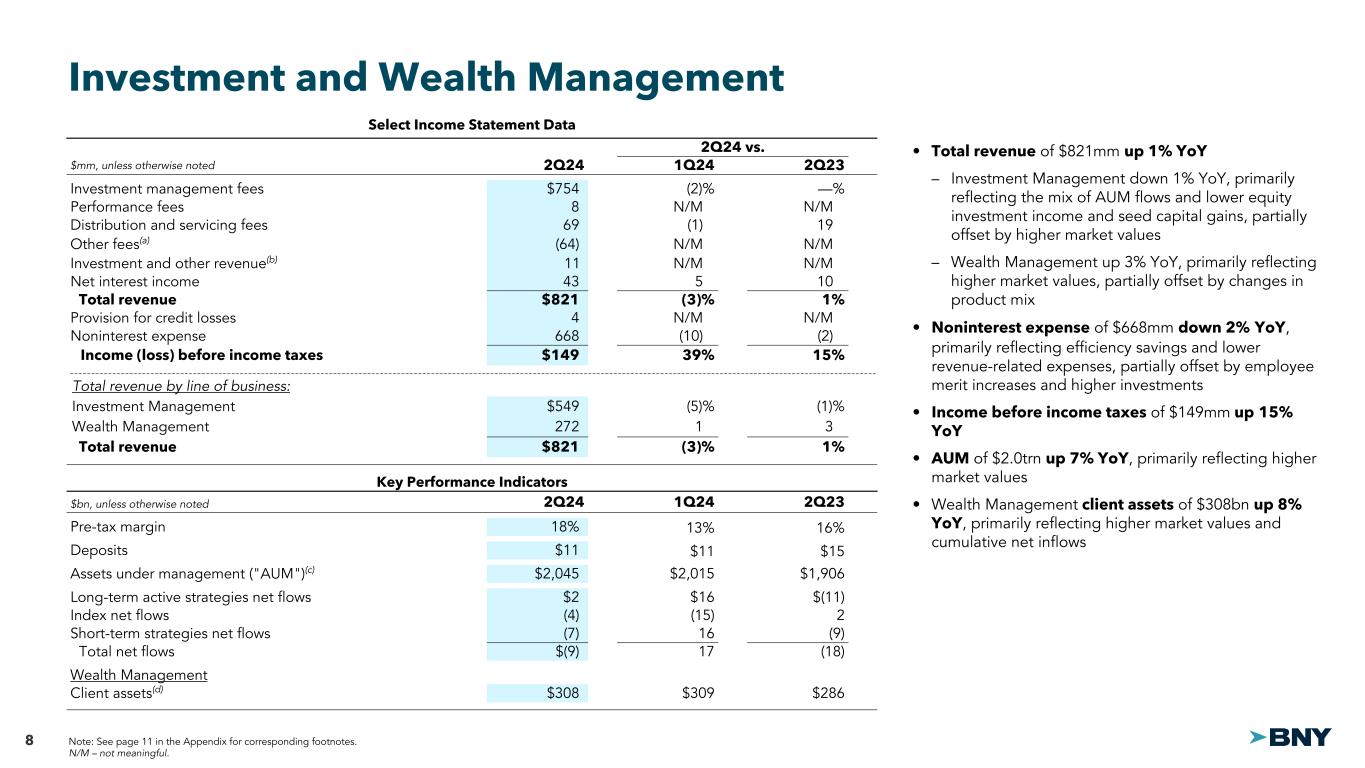

INVESTMENT AND WEALTH MANAGEMENT BUSINESS SEGMENT HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, unless otherwise noted; not meaningful - N/M) | | | | | | | 2Q24 vs. | |

| 2Q24 | | 1Q24 | | 2Q23 | | 1Q24 | | 2Q23 | |

| Investment management fees | $ | 754 | | | $ | 768 | | | $ | 753 | | | (2) | % | | — | % | |

| Performance fees | 8 | | | 10 | | | 10 | | | N/M | | N/M | |

| Investment management and performance fees | 762 | | | 778 | | | 763 | | | (2) | | | — | | |

| Distribution and servicing fees | 69 | | | 70 | | | 58 | | | (1) | | | 19 | | |

Other fees (a) | (64) | | | (60) | | | (56) | | | N/M | | N/M | |

| Total fee revenue | 767 | | | 788 | | | 765 | | | (3) | | | — | | |

Investment and other revenue (b) | 11 | | | 17 | | | 12 | | | N/M | | N/M | |

Total fee and other revenue (b) | 778 | | | 805 | | | 777 | | | (3) | | | — | | |

| Net interest income | 43 | | | 41 | | | 39 | | | 5 | | | 10 | | |

| Total revenue | 821 | | | 846 | | | 816 | | | (3) | | | 1 | | |

| Provision for credit losses | 4 | | | (1) | | | 7 | | | N/M | | N/M | |

| Noninterest expense | 668 | | | 740 | | | 679 | | | (10) | | | (2) | | |

| Income before taxes | $ | 149 | | | $ | 107 | | | $ | 130 | | | 39 | % | | 15 | % | |

| | | | | | | | | | |

| Total revenue by line of business: | | | | | | | | | | |

| Investment Management | $ | 549 | | | $ | 576 | | | $ | 553 | | | (5) | % | | (1) | % | |

| Wealth Management | 272 | | | 270 | | | 263 | | | 1 | | | 3 | | |

| Total revenue by line of business | $ | 821 | | | $ | 846 | | | $ | 816 | | | (3) | % | | 1 | % | |

| | | | | | | | | | |

| Pre-tax operating margin | 18 | % | | 13 | % | | 16 | % | | | | | |

Adjusted pre-tax operating margin – Non-GAAP (c) | 20 | % | | 14 | % | | 18 | % | | | | | |

| | | | | | | | | | |

| Metrics: | | | | | | | | | | |

| Average loans | $ | 13,520 | | | $ | 13,553 | | | $ | 13,995 | | | — | % | | (3) | % | |

| Average deposits | $ | 11,005 | | | $ | 11,364 | | | $ | 15,410 | | | (3) | % | | (29) | % | |

| | | | | | | | | | |

AUM (in billions) (current period is preliminary) (d) | $ | 2,045 | | | $ | 2,015 | | | $ | 1,906 | | | 1 | % | | 7 | % | |

Wealth Management client assets (in billions) (current period is preliminary) (e) | $ | 308 | | | $ | 309 | | | $ | 286 | | | — | % | | 8 | % | |

(a) Other fees primarily include investment services fees. (b) Investment and other revenue and total fee and other revenue are net of income (loss) attributable to noncontrolling interests related to consolidated investment management funds.

(c) Net of distribution and servicing expense. See “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9 for information on this Non-GAAP measure. (d) Represents assets managed in the Investment and Wealth Management business segment.

(e) Includes AUM and AUC/A in the Wealth Management line of business.

KEY DRIVERS

•The drivers of the total revenue variances by line of business are indicated below.

•Investment Management – The year-over-year decrease primarily reflects the mix of AUM flows and lower equity investment income and seed capital gains, partially offset by higher market values. The sequential decrease primarily reflects the mix of AUM flows and lower seed capital gains and equity investment income, partially offset by higher market values.

•Wealth Management – The year-over-year increase primarily reflects higher market values, partially offset by changes in product mix.

•Noninterest expense decreased year-over-year primarily reflecting efficiency savings and lower revenue-related expenses, partially offset by employee merit increases and higher investments. The sequential decrease primarily reflects lower revenue-related expenses.

| | |

BNY 2Q24 Financial Results |

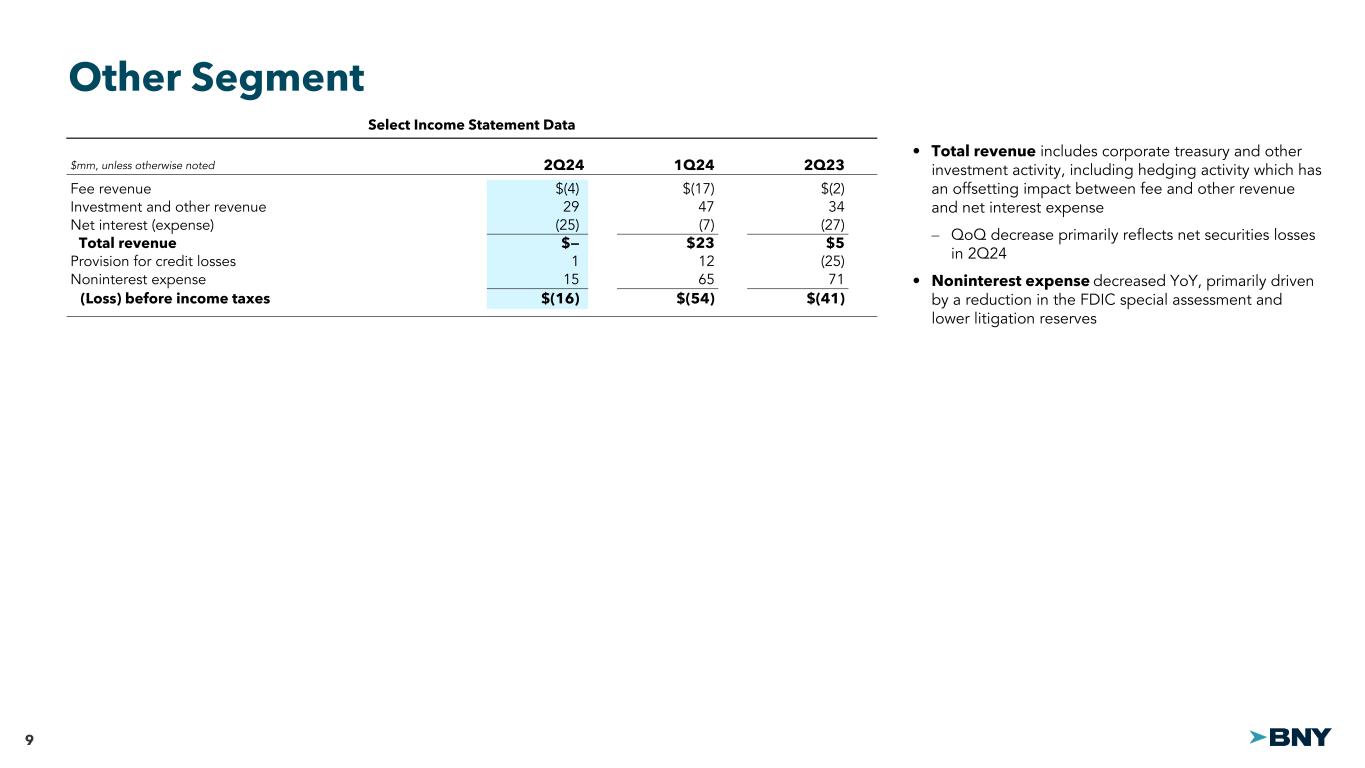

OTHER SEGMENT

The Other segment primarily includes the leasing portfolio, corporate treasury activities, including our securities portfolio, derivatives and other trading activity, renewable energy and other corporate investments, certain business exits and other corporate revenue and expense items.

| | | | | | | | | | | |

| | | |

| (in millions) | 2Q24 | 1Q24 | 2Q23 |

| Fee revenue | $ | (4) | | $ | (17) | | $ | (2) | |

| Investment and other revenue | 29 | | 47 | | 34 | |

| Total fee and other revenue | 25 | | 30 | | 32 | |

| Net interest (expense) | (25) | | (7) | | (27) | |

| Total revenue | — | | 23 | | 5 | |

| Provision for credit losses | 1 | | 12 | | (25) | |

| Noninterest expense | 15 | | 65 | | 71 | |

| (Loss) before taxes | $ | (16) | | $ | (54) | | $ | (41) | |

KEY DRIVERS

•Total revenue includes corporate treasury and other investment activity, including hedging activity which has an offsetting impact between fee and other revenue and net interest expense. Total revenue decreased sequentially primarily reflecting net securities losses in 2Q24.

•Noninterest expense decreased year-over-year primarily driven by a reduction in the FDIC special assessment and lower litigation reserves. The sequential decrease in noninterest expense primarily reflects a reduction in the FDIC special assessment.

| | |

BNY 2Q24 Financial Results |

CAPITAL AND LIQUIDITY

| | | | | | | | | | | | | |

| Capital and liquidity ratios | | June 30, 2024 | March 31, 2024 | Dec. 31, 2023 | |

Consolidated regulatory capital ratios: (a) | | | | | |

| CET1 ratio | | 11.4 | % | 10.8 | % | 11.5 | % | |

| Tier 1 capital ratio | | 14.1 | | 13.4 | | 14.2 | | |

| Total capital ratio | | 15.0 | | 14.3 | | 14.9 | | |

Tier 1 leverage ratio (a) | | 5.8 | | 5.9 | | 6.0 | | |

Supplementary leverage ratio (a) | | 6.8 | | 7.0 | | 7.3 | | |

| BNY shareholders’ equity to total assets ratio | | 9.5 | % | 9.3 | % | 9.9 | % | |

| BNY common shareholders’ equity to total assets ratio | | 8.5 | % | 8.3 | % | 8.9 | % | |

| | | | | |

Average LCR (a) | | 115 | % | 117 | % | 117 | % | |

Average NSFR (a) | | 132 | % | 136 | % | 135 | % | |

| | | | | |

| Book value per common share | | $ | 49.46 | | $ | 48.44 | | $ | 47.97 | | |

Tangible book value per common share – Non-GAAP (b) | | $ | 26.19 | | $ | 25.44 | | $ | 25.25 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Common shares outstanding (in thousands) | | 737,957 | | 747,816 | | 759,344 | | |

(a) Regulatory capital and liquidity ratios for June 30, 2024 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for June 30, 2024 was the Standardized Approach for the CET1 and Tier 1 capital ratios and the Advanced Approaches for the Total capital ratio, for March 31, 2024 was the Standardized Approach, and for Dec. 31, 2023 was the Advanced Approaches.

(b) Tangible book value per common share – Non-GAAP excludes goodwill and intangible assets, net of deferred tax liabilities. See “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9 for information on this Non-GAAP measure.

•CET1 capital totaled $18.7 billion and Tier 1 capital totaled $23.0 billion at June 30, 2024, both increasing compared with March 31, 2024, primarily reflecting capital generated through earnings, partially offset by capital returned through common stock repurchases and dividends. The CET1 ratio increased compared with March 31, 2024 reflecting the increase in capital and lower risk-weighted assets. The Tier 1 leverage ratio decreased compared with March 31, 2024 reflecting higher average assets, partially offset by the increase in capital.

NET INTEREST INCOME

| | | | | | | | | | | | | | | | | |

| Net interest income | | | | 2Q24 vs. |

| (dollars in millions; not meaningful - N/M) | 2Q24 | 1Q24 | 2Q23 | 1Q24 | 2Q23 |

| Net interest income | $ | 1,030 | | $ | 1,040 | | $ | 1,100 | | (1)% | (6)% |

| Add: Tax equivalent adjustment | 1 | | — | | 1 | | N/M | N/M |

Net interest income, on a fully taxable equivalent (“FTE”) basis – Non-GAAP (a) | $ | 1,031 | | $ | 1,040 | | $ | 1,101 | | (1)% | (6)% |

| | | | | |

| Net interest margin | 1.15 | % | 1.19 | % | 1.20 | % | (4) | bps | (5) | bps |

Net interest margin (FTE) – Non-GAAP (a) | 1.15 | % | 1.19 | % | 1.20 | % | (4) | bps | (5) | bps |

(a) Net interest income (FTE) – Non-GAAP and net interest margin (FTE) – Non-GAAP include the tax equivalent adjustments on tax-exempt income. See “Explanation of GAAP and Non-GAAP financial measures” beginning on page 9 for information on this Non-GAAP measure. bps – basis points.

•Net interest income decreased year-over-year primarily reflecting changes in balance sheet mix, partially offset by higher interest rates.

•The sequential decrease in net interest income primarily reflects changes in balance sheet mix, partially offset by the benefit of reinvesting maturing fixed-rate securities in higher yielding alternatives.

| | |

BNY 2Q24 Financial Results |

THE BANK OF NEW YORK MELLON CORPORATION

Condensed Consolidated Income Statement

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Quarter ended | | Year-to-date |

| June 30, 2024 | March 31, 2024 | June 30, 2023 | | June 30, 2024 | June 30, 2023 |

|

| Fee and other revenue | | | | | | |

| Investment services fees | $ | 2,359 | | $ | 2,278 | | $ | 2,252 | | | $ | 4,637 | | $ | 4,371 | |

| Investment management and performance fees | 761 | | 776 | | 762 | | | 1,537 | | 1,538 | |

| Foreign exchange revenue | 184 | | 152 | | 158 | | | 336 | | 334 | |

| Financing-related fees | 53 | | 57 | | 50 | | | 110 | | 102 | |

| Distribution and servicing fees | 41 | | 42 | | 35 | | | 83 | | 68 | |

| Total fee revenue | 3,398 | | 3,305 | | 3,257 | | | 6,703 | | 6,413 | |

| Investment and other revenue | 169 | | 182 | | 147 | | | 351 | | 278 | |

| Total fee and other revenue | 3,567 | | 3,487 | | 3,404 | | | 7,054 | | 6,691 | |

| Net interest income | | | | | | |

| Interest income | 6,392 | | 6,096 | | 5,224 | | | 12,488 | | 9,166 | |

| Interest expense | 5,362 | | 5,056 | | 4,124 | | | 10,418 | | 6,938 | |

| Net interest income | 1,030 | | 1,040 | | 1,100 | | | 2,070 | | 2,228 | |

| Total revenue | 4,597 | | 4,527 | | 4,504 | | | 9,124 | | 8,919 | |

| Provision for credit losses | — | | 27 | | 5 | | | 27 | | 32 | |

| Noninterest expense | | | | | | |

| Staff | 1,720 | | 1,857 | | 1,718 | | | 3,577 | | 3,509 | |

| Software and equipment | 476 | | 475 | | 450 | | | 951 | | 879 | |

| Professional, legal and other purchased services | 374 | | 349 | | 378 | | | 723 | | 753 | |

| Net occupancy | 134 | | 124 | | 121 | | | 258 | | 240 | |

| Sub-custodian and clearing | 134 | | 119 | | 119 | | | 253 | | 237 | |

| Distribution and servicing | 88 | | 96 | | 93 | | | 184 | | 178 | |

| Business development | 50 | | 36 | | 47 | | | 86 | | 86 | |

| Bank assessment charges | (7) | | 17 | | 41 | | | 10 | | 81 | |

| | | | | | |

| Amortization of intangible assets | 13 | | 12 | | 14 | | | 25 | | 28 | |

| Other | 88 | | 91 | | 130 | | | 179 | | 220 | |

| Total noninterest expense | 3,070 | | 3,176 | | 3,111 | | | 6,246 | | 6,211 | |

| Income | | | | | | |

| Income before taxes | 1,527 | | 1,324 | | 1,388 | | | 2,851 | | 2,676 | |

| Provision for income taxes | 357 | | 297 | | 315 | | | 654 | | 621 | |

| Net income | 1,170 | | 1,027 | | 1,073 | | | 2,197 | | 2,055 | |

| Net (income) attributable to noncontrolling interests related to consolidated investment management funds | (2) | | (2) | | (1) | | | (4) | | (1) | |

| Net income applicable to shareholders of The Bank of New York Mellon Corporation | 1,168 | | 1,025 | | 1,072 | | | 2,193 | | 2,054 | |

| Preferred stock dividends | (25) | | (72) | | (36) | | | (97) | | (107) | |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | $ | 1,143 | | $ | 953 | | $ | 1,036 | | | $ | 2,096 | | $ | 1,947 | |

| | | | | | | | | | | | | | | | | | | | |

| Earnings per share applicable to the common shareholders of The Bank of New York Mellon Corporation | Quarter ended | | Year-to-date |

| June 30, 2024 | March 31, 2024 | June 30, 2023 | | June 30, 2024 | June 30, 2023 |

| (in dollars) |

| Basic | $ | 1.53 | | $ | 1.26 | | $ | 1.32 | | | $ | 2.79 | | $ | 2.45 | |

| Diluted | $ | 1.52 | | $ | 1.25 | | $ | 1.31 | | | $ | 2.77 | | $ | 2.44 | |

| | |

BNY 2Q24 Financial Results |

EXPLANATION OF GAAP AND NON-GAAP FINANCIAL MEASURES

BNY has included in this Earnings Release certain Non-GAAP financial measures on a tangible basis as a supplement to GAAP information, which exclude goodwill and intangible assets, net of deferred tax liabilities. We believe that the return on tangible common equity – Non-GAAP is additional useful information for investors because it presents a measure of those assets that can generate income, and the tangible book value per common share – Non-GAAP is additional useful information because it presents the level of tangible assets in relation to shares of common stock outstanding.

Net interest income, on a fully taxable equivalent (“FTE”) basis – Non-GAAP and net interest margin (FTE) – Non-GAAP and other FTE measures include the tax equivalent adjustments on tax-exempt income which allows for the comparison of amounts arising from both taxable and tax-exempt sources and is consistent with industry practice. The adjustment to an FTE basis has no impact on net income.

BNY has included the adjusted pre-tax operating margin – Non-GAAP, which is the pre-tax operating margin for the Investment and Wealth Management business segment, net of distribution and servicing expense that was passed to third parties who distribute or service our managed funds. We believe that this measure is useful when evaluating the performance of the Investment and Wealth Management business segment relative to industry competitors.

See “Explanation of GAAP and Non-GAAP Financial Measures” in the Financial Supplement available at www.bny.com for additional reconciliations of Non-GAAP measures.

BNY has also included revenue measures excluding notable items, including disposal losses. Expense measures, excluding notable items, including FDIC special assessment, severance expense and litigation reserves, are also presented. Litigation reserves represent accruals for loss contingencies that are both probable and reasonably estimable, but exclude standard business-related legal fees. Net income applicable to common shareholders of The Bank of New York Mellon Corporation, diluted earnings per share, operating leverage, return on common equity, return on tangible common equity and pre-tax operating margin, excluding the notable items mentioned above, are also provided. These measures are provided to permit investors to view the financial measures on a basis consistent with how management views the businesses.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP measures, excluding notable items | | | | | | | 2Q24 vs. |

| (dollars in millions, except per share amounts) | 2Q24 | | 1Q24 | | 2Q23 | | 1Q24 | 2Q23 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total revenue – GAAP | $ | 4,597 | | | $ | 4,527 | | | $ | 4,504 | | | 2 | % | 2 | % |

| | | | | | | | |

Less: Disposal (losses) (a) | — | | | — | | | (1) | | | | |

| | | | | | | | |

| Adjusted total revenue – Non-GAAP | $ | 4,597 | | | $ | 4,527 | | | $ | 4,505 | | | 2 | % | 2 | % |

| | | | | | | | |

| Noninterest expense – GAAP | $ | 3,070 | | | $ | 3,176 | | | $ | 3,111 | | | (3) | % | (1) | % |

Less: Severance (b) | 29 | | | 36 | | | 26 | | | | |

Litigation reserves (b) | 2 | | | 2 | | | 36 | | | | |

FDIC special assessment (b) | (38) | | | — | | | — | | | | |

| | | | | | | | |

| Adjusted noninterest expense – Non-GAAP | $ | 3,077 | | | $ | 3,138 | | | $ | 3,049 | | | (2) | % | 1 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP | $ | 1,143 | | | $ | 953 | | | $ | 1,036 | | | 20 | % | 10 | % |

| | | | | | | | |

Less: Disposal (losses) (a) | — | | | — | | | — | | | | |

| | | | | | | | |

Severance (b) | (22) | | | (27) | | | (20) | | | | |

Litigation reserves (b) | — | | | (2) | | | (36) | | | | |

FDIC special assessment (b) | 29 | | | — | | | — | | | | |

| | | | | | | | |

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation – Non-GAAP | $ | 1,136 | | | $ | 982 | | | $ | 1,092 | | | 16 | % | 4 | % |

| | | | | | | | |

| Diluted earnings per common share – GAAP | $ | 1.52 | | | $ | 1.25 | | | $ | 1.31 | | | 22 | % | 16 | % |

| | | | | | | | |

Less: Disposal (losses) (a) | — | | | — | | | — | | | | |

| | | | | | | | |

Severance (b) | (0.03) | | | (0.04) | | | (0.02) | | | | |

Litigation reserves (b) | — | | | — | | | (0.05) | | | | |

FDIC special assessment (b) | 0.04 | | | — | | | — | | | | |

| Total diluted earnings per common share impact of notable items | 0.01 | | | (0.04) | | | (0.07) | | | | |

| Adjusted diluted earnings per common share – Non-GAAP | $ | 1.51 | | | $ | 1.29 | | | $ | 1.38 | | | 17 | % | 9 | % |

Operating leverage – GAAP (c) | | | | | | | 489 | bps | 338 | bps |

Adjusted operating leverage – Non-GAAP (c) | | | | | | | 349 | bps | 112 | bps |

(a) Reflected in Investment and other revenue.

(b) Severance is reflected in Staff expense, Litigation reserves in Other expense, and FDIC special assessment in Bank assessment charges, respectively.

(c) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense.

bps - basis points.

| | |

BNY 2Q24 Financial Results |

| | | | | | | | | | | | | | |

| Pre-tax operating margin reconciliation | | | | | | |

| (dollars in millions) | 2Q24 | 1Q24 | 2Q23 | | | |

| Income before taxes – GAAP | $ | 1,527 | | $ | 1,324 | | $ | 1,388 | | | | |

Impact of notable items (a) | 7 | | (38) | | (63) | | | | |

| Adjusted income before taxes, excluding notable items – Non-GAAP | $ | 1,520 | | $ | 1,362 | | $ | 1,451 | | | | |

| | | | | | |

| Total revenue – GAAP | $ | 4,597 | | $ | 4,527 | | $ | 4,504 | | | | |

Impact of notable items (a) | — | | — | | (1) | | | | |

| Adjusted total revenue, excluding notable items – Non-GAAP | $ | 4,597 | | $ | 4,527 | | $ | 4,505 | | | | |

| | | | | | |

Pre-tax operating margin – GAAP (b) | 33 | % | 29 | % | 31 | % | | | |

Adjusted pre-tax operating margin – Non-GAAP (b) | 33 | % | 30 | % | 32 | % | | | |

(a) See page 9 for details of notable items and line items impacted. (b) Income before taxes divided by total revenue.

| | | | | | | | | | | | | | |

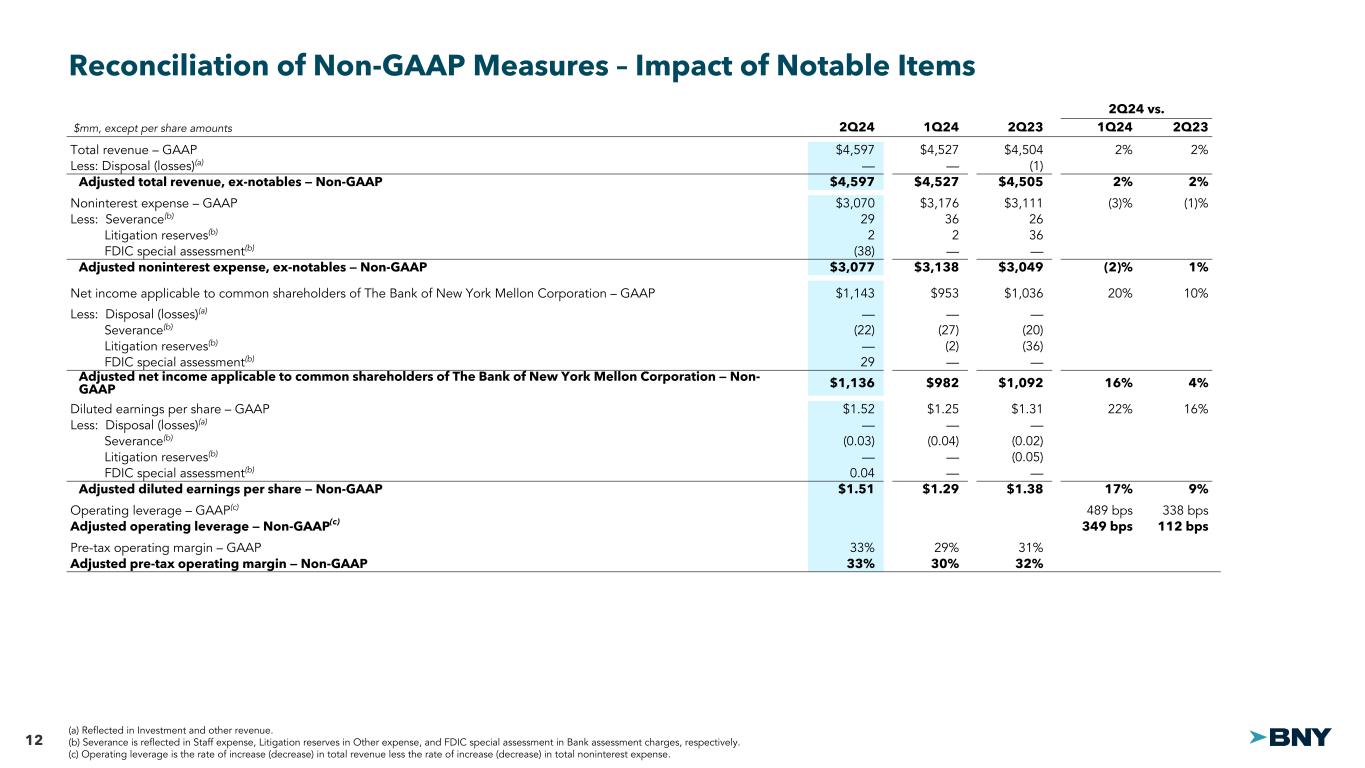

| Return on common equity and return on tangible common equity reconciliation | | | | | | |

| (dollars in millions) | 2Q24 | 1Q24 | 2Q23 | | | |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP | $ | 1,143 | | $ | 953 | | $ | 1,036 | | | | |

| Add: Amortization of intangible assets | 13 | | 12 | | 14 | | | | |

| Less: Tax impact of amortization of intangible assets | 3 | | 3 | | 4 | | | | |

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets – Non-GAAP | $ | 1,153 | | $ | 962 | | $ | 1,046 | | | | |

Impact of notable items (a) | 7 | | (29) | | (56) | | | | |

| Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets and notable items – Non-GAAP | $ | 1,146 | | $ | 991 | | $ | 1,102 | | | | |

| | | | | | |

| Average common shareholders’ equity | $ | 36,044 | | $ | 35,905 | | $ | 35,655 | | | | |

| Less: Average goodwill | 16,229 | | 16,238 | | 16,219 | | | | |

| Average intangible assets | 2,834 | | 2,848 | | 2,888 | | | | |

| Add: Deferred tax liability – tax deductible goodwill | 1,213 | | 1,209 | | 1,193 | | | | |

| Deferred tax liability – intangible assets | 655 | | 655 | | 660 | | | | |

| Average tangible common shareholders’ equity – Non-GAAP | $ | 18,849 | | $ | 18,683 | | $ | 18,401 | | | | |

| | | | | | |

Return on common equity – GAAP (b) | 12.7 | % | 10.7 | % | 11.7 | % | | | |

Adjusted return on common equity – Non-GAAP (b) | 12.7 | % | 11.0 | % | 12.3 | % | | | |

| | | | | | |

Return on tangible common equity – Non-GAAP (b) | 24.6 | % | 20.7 | % | 22.8 | % | | | |

Adjusted return on tangible common equity – Non-GAAP (b) | 24.4 | % | 21.3 | % | 24.1 | % | | | |

(a) See page 9 for details of notable items and line items impacted. (b) Returns are annualized.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

A number of statements in this Earnings Release and in our Financial Supplement may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our strategic priorities, financial performance and financial targets. Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially, as we complete our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. Forward-looking statements are not guarantees of future results or occurrences, are inherently uncertain and are based upon current beliefs and expectations of future events, many of which are, by their nature, difficult to predict, outside of our control and subject to change.

By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results expressed or implied in these forward-looking statements as a result of a number of important factors, including the risk factors and other uncertainties set forth in our Annual Report on Form 10-K for the year ended Dec. 31, 2023 and our other filings with the Securities and Exchange Commission.

You should not place undue reliance on any forward-looking statement. All forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

| | |

BNY 2Q24 Financial Results |

ABOUT BNY

BNY is a global financial services company that helps make money work for the world – managing it, moving it and keeping it safe. For 240 years we have partnered alongside our clients, putting our expertise and platforms to work to help them achieve their ambitions. Today we help over 90% of Fortune 100 companies and nearly all the top 100 banks globally access the money they need. We support governments in funding local projects and work with over 90% of the top 100 pension plans to safeguard investments for millions of individuals, and so much more. As of June 30, 2024, we oversee $49.5 trillion in assets under custody and/or administration and $2.0 trillion in assets under management.

BNY is the corporate brand of The Bank of New York Mellon Corporation (NYSE: BK). We are headquartered in New York City, employ over 50,000 people globally and have been named among Fortune’s World’s Most Admired Companies and Fast Company’s Best Workplaces for Innovators. Additional information is available on www.bny.com. Follow us on LinkedIn or visit our Newsroom for the latest company news.

CONFERENCE CALL INFORMATION

Robin Vince, President and Chief Executive Officer, and Dermot McDonogh, Chief Financial Officer, will host a conference call and simultaneous live audio webcast at 9:30 a.m. ET on July 12, 2024. This conference call and audio webcast will include forward-looking statements and may include other material information.

Investors and analysts wishing to access the conference call and audio webcast may do so by dialing (800) 390-5696 (U.S.) or (720) 452-9082 (International), and using the passcode: 200200, or by logging onto www.bny.com/investorrelations. Earnings materials will be available at www.bny.com/investorrelations beginning at approximately 6:30 a.m. ET on July 12, 2024. An archived version of the second quarter conference call and audio webcast will be available beginning on July 12, 2024 at approximately 2:00 p.m. ET through Aug. 12, 2024 at www.bny.com/investorrelations.

| | |

| The Bank of New York Mellon Corporation |

|

| Financial Supplement |

|

| Second Quarter 2024 |

|

|

| | | | | | | | |

| Table of Contents | |

|

|

| | |

| | |

| Consolidated Results | | Page |

| Consolidated Financial Highlights | | |

| Condensed Consolidated Income Statement | | |

| Condensed Consolidated Balance Sheet | | |

| Fee and Other Revenue | | |

| Average Balances and Interest Rates | | |

| Capital and Liquidity | | |

| | |

| Business Segment Results | | |

| Securities Services Business Segment | | |

| Market and Wealth Services Business Segment | | |

| Investment and Wealth Management Business Segment | | |

| AUM by Product Type, Changes in AUM and Wealth Management Client Assets | | |

| Other Segment | | |

| | |

| Other | | |

| Securities Portfolio | | |

| Allowance for Credit Losses and Nonperforming Assets | | |

| | |

| Supplemental Information | | |

| Explanation of GAAP and Non-GAAP Financial Measures | | |

| | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | |

| | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS | | | | | | | | | |

| (dollars in millions, except per common share amounts, or unless otherwise noted) | | | | | | | | | | | | 2Q24 vs. | | | | | | YTD24 vs. |

| 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q24 | | 2Q23 | | YTD24 | | YTD23 | | YTD23 |

| Selected income statement data | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Fee and other revenue | | $ | 3,567 | | | $ | 3,487 | | | $ | 3,257 | | | $ | 3,404 | | | $ | 3,404 | | | 2 | % | | 5 | % | | $ | 7,054 | | | $ | 6,691 | | | 5 | % |

| Net interest income | | 1,030 | | | 1,040 | | | 1,101 | | | 1,016 | | | 1,100 | | | (1) | | | (6) | | | 2,070 | | | 2,228 | | | (7) | |

| Total revenue | | 4,597 | | | 4,527 | | | 4,358 | | | 4,420 | | | 4,504 | | | 2 | | | 2 | | | 9,124 | | | 8,919 | | | 2 | |

| Provision for credit losses | | — | | | 27 | | | 84 | | | 3 | | | 5 | | | N/M | | N/M | | 27 | | | 32 | | | N/M |

| Noninterest expense | | 3,070 | | | 3,176 | | | 3,995 | | | 3,089 | | | 3,111 | | | (3) | | | (1) | | | 6,246 | | | 6,211 | | | 1 | |

| Income before income taxes | | 1,527 | | | 1,324 | | | 279 | | | 1,328 | | | 1,388 | | | 15 | | | 10 | | | 2,851 | | | 2,676 | | | 7 | |

| Provision for income taxes | | 357 | | | 297 | | | 73 | | | 285 | | | 315 | | | 20 | | | 13 | | | 654 | | | 621 | | | 5 | |

| Net income | | $ | 1,170 | | | $ | 1,027 | | | $ | 206 | | | $ | 1,043 | | | $ | 1,073 | | | 14 | % | | 9 | % | | $ | 2,197 | | | $ | 2,055 | | | 7 | % |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | | $ | 1,143 | | | $ | 953 | | | $ | 162 | | | $ | 958 | | | $ | 1,036 | | | 20 | % | | 10 | % | | $ | 2,096 | | | $ | 1,947 | | | 8 | % |

| Diluted earnings per common share | | $ | 1.52 | | | $ | 1.25 | | | $ | 0.21 | | | $ | 1.23 | | | $ | 1.31 | | | 22 | % | | 16 | % | | $ | 2.77 | | | $ | 2.44 | | | 14 | % |

Average common shares and equivalents outstanding – diluted (in thousands) | | 751,596 | | | 762,268 | | | 772,102 | | | 781,781 | | | 790,725 | | | (1) | % | | (5) | % | | 756,870 | | | 799,157 | | | (5) | % |

| | | | | | | | | | | | | | | | | | | | |

Financial ratios (Returns are annualized) | | | | | | | | | | | | | | | | | | | | |

| Pre-tax operating margin | | 33 | % | | 29 | % | | 6 | % | | 30 | % | | 31 | % | | | | | | 31 | % | | 30 | % | | |

| Return on common equity | | 12.7 | % | | 10.7 | % | | 1.8 | % | | 10.6 | % | | 11.7 | % | | | | | | 11.7 | % | | 11.0 | % | | |

Return on tangible common equity – Non-GAAP (a) | | 24.6 | % | | 20.7 | % | | 3.6 | % | | 20.6 | % | | 22.8 | % | | | | | | 22.7 | % | | 21.7 | % | | |

| Non-U.S. revenue as a percentage of total revenue | | 36 | % | | 34 | % | | 36 | % | | 36 | % | | 36 | % | | | | | | 35 | % | | 35 | % | | |

| | | | | | | | | | | | | | | | | | | | |

| Period end | | | | | | | | | | | | | | | | | | | | |

Assets under custody and/or administration (“AUC/A”) (in trillions) (b) | | $ | 49.5 | | | $ | 48.8 | | | $ | 47.8 | | | $ | 45.7 | | | $ | 46.9 | | | 1 | % | | 6 | % | | | | | | |

Assets under management (“AUM”) (in trillions) | | $ | 2.05 | | | $ | 2.02 | | | $ | 1.97 | | | $ | 1.82 | | | $ | 1.91 | | | 1 | % | | 7 | % | | | | | | |

Full-time employees (c) | | 52,000 | | | 52,100 | | | 53,400 | | | 53,600 | | | 53,200 | | | — | % | | (2) | % | | | | | | |

| Book value per common share | | $ | 49.46 | | | $ | 48.44 | | | $ | 47.97 | | | $ | 46.84 | | | $ | 46.21 | | | | | | | | | | | |

Tangible book value per common share – Non-GAAP (a) | | $ | 26.19 | | | $ | 25.44 | | | $ | 25.25 | | | $ | 24.52 | | | $ | 24.03 | | | | | | | | | | | |

| Cash dividends per common share | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.42 | | | $ | 0.37 | | | | | | | | | | | |

| Common dividend payout ratio | | 28 | % | | 34 | % | | 202 | % | | 35 | % | | 29 | % | | | | | | | | | | |

| Closing stock price per common share | | $ | 59.89 | | | $ | 57.62 | | | $ | 52.05 | | | $ | 42.65 | | | $ | 44.52 | | | | | | | | | | | |

| Market capitalization | | $ | 44,196 | | | $ | 43,089 | | | $ | 39,524 | | | $ | 32,801 | | | $ | 34,671 | | | | | | | | | | | |

Common shares outstanding (in thousands) | | 737,957 | | | 747,816 | | | 759,344 | | | 769,073 | | | 778,782 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Capital ratios at period end (d) | | | | | | | | | | | | | | | | | | | | |

| Common Equity Tier 1 ("CET1") ratio | | 11.4 | % | | 10.8 | % | | 11.5 | % | | 11.3 | % | | 11.0 | % | | | | | | | | | | |

| Tier 1 capital ratio | | 14.1 | % | | 13.4 | % | | 14.2 | % | | 14.3 | % | | 14.0 | % | | | | | | | | | | |

| Total capital ratio | | 15.0 | % | | 14.3 | % | | 14.9 | % | | 15.2 | % | | 14.8 | % | | | | | | | | | | |

| Tier 1 leverage ratio | | 5.8 | % | | 5.9 | % | | 6.0 | % | | 6.1 | % | | 5.7 | % | | | | | | | | | | |

| Supplementary leverage ratio ("SLR") | | 6.8 | % | | 7.0 | % | | 7.3 | % | | 7.2 | % | | 7.0 | % | | | | | | | | | | |

(a) Non-GAAP information, for all periods presented, excludes goodwill and intangible assets, net of deferred tax liabilities. See "Explanation of GAAP and Non-GAAP Financial Measures" beginning on page 18 for the reconciliation of Non-GAAP measures. |

(b) Includes the AUC/A of CIBC Mellon Global Securities Services Company ("CIBC Mellon"), a joint venture with the Canadian Imperial Bank of Commerce, of $1.7 trillion at June 30, 2024, March 31, 2024 and Dec. 31, 2023, $1.5 trillion at Sept. 30, 2023 and $1.6 trillion at June 30, 2023. |

| (c) Beginning March 31, 2024, the number of full-time employees excludes interns. |

(d) Regulatory capital ratios for June 30, 2024 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for June 30, 2024 was the Standardized Approach for the CET1 and Tier 1 capital ratios and the Advanced Approaches for the Total capital ratio, for March 31, 2024 was the Standardized Approach, and for Dec. 31, 2023, Sept. 30, 2023 and June 30, 2023, was the Advanced Approaches. |

| N/M – Not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | | | | | |

| CONDENSED CONSOLIDATED INCOME STATEMENT | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, except per share amounts; common shares in thousands) | | | | | | | | | | | | 2Q24 vs. | | | | | | YTD24 vs. |

| 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q24 | | 2Q23 | | YTD24 | | YTD23 | | YTD23 |

| Revenue | | | | | | | | | | | | | | | | | | | | |

| Investment services fees | | $ | 2,359 | | | $ | 2,278 | | | $ | 2,242 | | | $ | 2,230 | | | $ | 2,252 | | | 4 | % | | 5 | % | | $ | 4,637 | | | $ | 4,371 | | | 6 | % |

| Investment management and performance fees | | 761 | | | 776 | | | 743 | | | 777 | | | 762 | | | (2) | | | — | | | 1,537 | | | 1,538 | | | — | |

| Foreign exchange revenue | | 184 | | | 152 | | | 143 | | | 154 | | | 158 | | | 21 | | | 16 | | | 336 | | | 334 | | | 1 | |

| Financing-related fees | | 53 | | | 57 | | | 45 | | | 45 | | | 50 | | | (7) | | | 6 | | | 110 | | | 102 | | | 8 | |

| Distribution and servicing fees | | 41 | | | 42 | | | 41 | | | 39 | | | 35 | | | (2) | | | 17 | | | 83 | | | 68 | | | 22 | |

| Total fee revenue | | 3,398 | | | 3,305 | | | 3,214 | | | 3,245 | | | 3,257 | | | 3 | | | 4 | | | 6,703 | | | 6,413 | | | 5 | |

| Investment and other revenue | | 169 | | | 182 | | | 43 | | | 159 | | | 147 | | | N/M | | N/M | | 351 | | | 278 | | | N/M |

| Total fee and other revenue | | 3,567 | | | 3,487 | | | 3,257 | | | 3,404 | | | 3,404 | | | 2 | | | 5 | | | 7,054 | | | 6,691 | | | 5 | |

| Net interest income | | 1,030 | | | 1,040 | | | 1,101 | | | 1,016 | | | 1,100 | | | (1) | | | (6) | | | 2,070 | | | 2,228 | | | (7) | |

| Total revenue | | 4,597 | | | 4,527 | | | 4,358 | | | 4,420 | | | 4,504 | | | 2 | | | 2 | | | 9,124 | | | 8,919 | | | 2 | |

| Provision for credit losses | | — | | | 27 | | | 84 | | | 3 | | | 5 | | | N/M | | N/M | | 27 | | | 32 | | | N/M |

| Noninterest expense | | | | | | | | | | | | | | | | | | | | |

| Staff | | 1,720 | | | 1,857 | | | 1,831 | | | 1,755 | | | 1,718 | | | (7) | | | — | | | 3,577 | | | 3,509 | | | 2 | |

| Software and equipment | | 476 | | | 475 | | | 486 | | | 452 | | | 450 | | | — | | | 6 | | | 951 | | | 879 | | | 8 | |

| Professional, legal and other purchased services | | 374 | | | 349 | | | 406 | | | 368 | | | 378 | | | 7 | | | (1) | | | 723 | | | 753 | | | (4) | |

| Net occupancy | | 134 | | | 124 | | | 162 | | | 140 | | | 121 | | | 8 | | | 11 | | | 258 | | | 240 | | | 8 | |

| Sub-custodian and clearing | | 134 | | | 119 | | | 117 | | | 121 | | | 119 | | | 13 | | | 13 | | | 253 | | | 237 | | | 7 | |

| Distribution and servicing | | 88 | | | 96 | | | 88 | | | 87 | | | 93 | | | (8) | | | (5) | | | 184 | | | 178 | | | 3 | |

| Business development | | 50 | | | 36 | | | 61 | | | 36 | | | 47 | | | 39 | | | 6 | | | 86 | | | 86 | | | — | |

| Bank assessment charges | | (7) | | | 17 | | | 670 | | | 37 | | | 41 | | | N/M | | N/M | | 10 | | | 81 | | | N/M |

| | | | | | | | | | | | | | | | | | | | |

| Amortization of intangible assets | | 13 | | | 12 | | | 14 | | | 15 | | | 14 | | | 8 | | | (7) | | | 25 | | | 28 | | | (11) | |

| Other | | 88 | | | 91 | | | 160 | | | 78 | | | 130 | | | (3) | | | (32) | | | 179 | | | 220 | | | (19) | |

| Total noninterest expense | | 3,070 | | | 3,176 | | | 3,995 | | | 3,089 | | | 3,111 | | | (3) | | | (1) | | | 6,246 | | | 6,211 | | | 1 | |

| Income before income taxes | | 1,527 | | | 1,324 | | | 279 | | | 1,328 | | | 1,388 | | | 15 | | | 10 | | | 2,851 | | | 2,676 | | | 7 | |

| Provision for income taxes | | 357 | | | 297 | | | 73 | | | 285 | | | 315 | | | 20 | | | 13 | | | 654 | | | 621 | | | 5 | |

| Net income | | 1,170 | | | 1,027 | | | 206 | | | 1,043 | | | 1,073 | | | 14 | | | 9 | | | 2,197 | | | 2,055 | | | 7 | |

| Net (income) loss attributable to noncontrolling interests | | (2) | | | (2) | | | 2 | | | (3) | | | (1) | | | N/M | | N/M | | (4) | | | (1) | | | N/M |

| Preferred stock dividends | | (25) | | | (72) | | | (46) | | | (82) | | | (36) | | | N/M | | N/M | | (97) | | | (107) | | | N/M |

| Net income applicable to common shareholders of The Bank of New York Mellon Corporation | | $ | 1,143 | | | $ | 953 | | | $ | 162 | | | $ | 958 | | | $ | 1,036 | | | 20 | % | | 10 | % | | $ | 2,096 | | | $ | 1,947 | | | 8 | % |

| | | | | | | | | | | | | | | | | | | | |

| Average common shares and equivalents outstanding: Basic | | 746,904 | | | 756,937 | | | 767,146 | | | 777,813 | | | 787,718 | | | (1) | % | | (5) | % | | 751,961 | | | 795,512 | | | (5) | % |

| Diluted | | 751,596 | | | 762,268 | | | 772,102 | | | 781,781 | | | 790,725 | | | (1) | % | | (5) | % | | 756,870 | | | 799,157 | | | (5) | % |

| | | | | | | | | | | | | | | | | | | | |

| Earnings per common share: Basic | | $ | 1.53 | | | $ | 1.26 | | | $ | 0.21 | | | $ | 1.23 | | | $ | 1.32 | | | 21 | % | | 16 | % | | $ | 2.79 | | | $ | 2.45 | | | 14 | % |

| Diluted | | $ | 1.52 | | | $ | 1.25 | | | $ | 0.21 | | | $ | 1.23 | | | $ | 1.31 | | | 22 | % | | 16 | % | | $ | 2.77 | | | $ | 2.44 | | | 14 | % |

| N/M – Not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEET | | | | | |

| | | | | | | | |

| | 2024 | | 2023 |

| (in millions) | | June 30 | | March 31 | | Dec. 31 | | Sept. 30 | | June 30 |

| Assets | | | | | | | | | | |

| Cash and due from banks | | $ | 5,311 | | | $ | 5,305 | | | $ | 4,922 | | | $ | 4,904 | | | $ | 5,720 | |

| Interest-bearing deposits with the Federal Reserve and other central banks | | 116,139 | | | 119,197 | | | 111,550 | | | 107,419 | | | 118,908 | |

| Interest-bearing deposits with banks | | 11,488 | | | 10,636 | | | 12,139 | | | 12,999 | | | 12,316 | |

| Federal funds sold and securities purchased under resale agreements | | 29,723 | | | 29,661 | | | 28,900 | | | 26,299 | | | 35,378 | |

| Securities | | 136,850 | | | 138,909 | | | 126,395 | | | 128,225 | | | 134,233 | |

| Trading assets | | 9,609 | | | 10,078 | | | 10,058 | | | 10,699 | | | 10,562 | |

| Loans | | 70,642 | | | 73,615 | | | 66,879 | | | 66,290 | | | 64,469 | |

| Allowance for loan losses | | (286) | | | (322) | | | (303) | | | (211) | | | (191) | |

Net loans | | 70,356 | | | 73,293 | | | 66,576 | | | 66,079 | | | 64,278 | |

| Premises and equipment | | 3,267 | | | 3,136 | | | 3,163 | | | 3,234 | | | 3,241 | |

| Accrued interest receivable | | 1,253 | | | 1,343 | | | 1,150 | | | 1,141 | | | 963 | |

| Goodwill | | 16,217 | | | 16,228 | | | 16,261 | | | 16,159 | | | 16,246 | |

| Intangible assets | | 2,826 | | | 2,839 | | | 2,854 | | | 2,859 | | | 2,881 | |

| Other assets | | 25,500 | | | 24,103 | | | 25,909 | | | 25,035 | | | 25,455 | |

Total assets | | $ | 428,539 | | | $ | 434,728 | | | $ | 409,877 | | | $ | 405,052 | | | $ | 430,181 | |

| Liabilities | | | | | | | | | | |

| Deposits | | $ | 304,311 | | | $ | 309,020 | | | $ | 283,669 | | | $ | 277,467 | | | $ | 292,045 | |

| Federal funds purchased and securities sold under repurchase agreements | | 15,701 | | | 15,112 | | | 14,507 | | | 14,771 | | | 21,285 | |

| Trading liabilities | | 3,372 | | | 3,100 | | | 6,226 | | | 7,358 | | | 6,319 | |

| Payables to customers and broker-dealers | | 17,569 | | | 19,392 | | | 18,395 | | | 17,441 | | | 21,084 | |

| Commercial paper | | 301 | | | — | | | — | | | — | | | — | |

| Other borrowed funds | | 280 | | | 306 | | | 479 | | | 728 | | | 1,371 | |

| Accrued taxes and other expenses | | 4,729 | | | 4,395 | | | 5,411 | | | 5,225 | | | 4,986 | |

| Other liabilities | | 10,208 | | | 10,245 | | | 9,028 | | | 11,834 | | | 9,635 | |

| Long-term debt | | 30,947 | | | 32,396 | | | 31,257 | | | 29,205 | | | 32,463 | |

Total liabilities | | 387,418 | | | 393,966 | | | 368,972 | | | 364,029 | | | 389,188 | |

| Temporary equity | | | | | | | | | | |

| Redeemable noncontrolling interests | | 92 | | | 82 | | | 85 | | | 109 | | | 104 | |

| Permanent equity | | | | | | | | | | |

| Preferred stock | | 4,343 | | | 4,343 | | | 4,343 | | | 4,838 | | | 4,838 | |

| Common stock | | 14 | | | 14 | | | 14 | | | 14 | | | 14 | |

| Additional paid-in capital | | 29,139 | | | 29,055 | | | 28,908 | | | 28,793 | | | 28,726 | |

| Retained earnings | | 40,999 | | | 40,178 | | | 39,549 | | | 39,714 | | | 39,090 | |

| Accumulated other comprehensive loss, net of tax | | (4,900) | | | (4,876) | | | (4,893) | | | (5,805) | | | (5,602) | |

Less: Treasury stock, at cost | | (28,752) | | | (28,145) | | | (27,151) | | | (26,696) | | | (26,242) | |

| Total The Bank of New York Mellon Corporation shareholders’ equity | | 40,843 | | | 40,569 | | | 40,770 | | | 40,858 | | | 40,824 | |

Nonredeemable noncontrolling interests of consolidated investment management funds | | 186 | | | 111 | | | 50 | | | 56 | | | 65 | |

Total permanent equity | | 41,029 | | | 40,680 | | | 40,820 | | | 40,914 | | | 40,889 | |

Total liabilities, temporary equity and permanent equity | | $ | 428,539 | | | $ | 434,728 | | | $ | 409,877 | | | $ | 405,052 | | | $ | 430,181 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | | | | | |

| FEE AND OTHER REVENUE | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | 2Q24 vs. | | | | | | YTD24 vs. |

| (dollars in millions) | | 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q24 | | 2Q23 | | YTD24 | | YTD23 | | YTD23 |

| Investment services fees | | $ | 2,359 | | | $ | 2,278 | | | $ | 2,242 | | | $ | 2,230 | | | $ | 2,252 | | | 4 | % | | 5 | % | | $ | 4,637 | | | $ | 4,371 | | | 6 | % |

| Investment management and performance fees: | | | | | | | | | | | | | | | | | | | | |

Investment management fees (a) | | 753 | | | 766 | | | 724 | | | 747 | | | 752 | | | (2) | | | — | | | 1,519 | | | 1,506 | | | 1 | |

| Performance fees | | 8 | | | 10 | | | 19 | | | 30 | | | 10 | | | N/M | | N/M | | 18 | | | 32 | | | N/M |

Total investment management and performance fees (b) | | 761 | | | 776 | | | 743 | | | 777 | | | 762 | | | (2) | | | — | | | 1,537 | | | 1,538 | | | — | |

| Foreign exchange revenue | | 184 | | | 152 | | | 143 | | | 154 | | | 158 | | | 21 | | | 16 | | | 336 | | | 334 | | | 1 | |

| Financing-related fees | | 53 | | | 57 | | | 45 | | | 45 | | | 50 | | | (7) | | | 6 | | | 110 | | | 102 | | | 8 | |

| Distribution and servicing fees | | 41 | | | 42 | | | 41 | | | 39 | | | 35 | | | (2) | | | 17 | | | 83 | | | 68 | | | 22 | |

| Total fee revenue | | 3,398 | | | 3,305 | | | 3,214 | | | 3,245 | | | 3,257 | | | 3 | | | 4 | | | 6,703 | | | 6,413 | | | 5 | |

| Investment and other revenue: | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from consolidated investment management funds | | 8 | | | 15 | | | 26 | | | (11) | | | 10 | | | N/M | | N/M | | 23 | | | 15 | | | N/M |

Seed capital gains (losses) (c) | | — | | | 14 | | | 18 | | | (4) | | | 7 | | | N/M | | N/M | | 14 | | | 15 | | | N/M |

| Other trading revenue | | 77 | | | 69 | | | 47 | | | 86 | | | 53 | | | N/M | | N/M | | 146 | | | 98 | | | N/M |

| Renewable energy investment gains | | 8 | | | 6 | | | 2 | | | 1 | | | 5 | | | N/M | | N/M | | 14 | | | 25 | | | N/M |

| Corporate/bank-owned life insurance | | 26 | | | 28 | | | 39 | | | 29 | | | 23 | | | N/M | | N/M | | 54 | | | 50 | | | N/M |

Other investments gains (losses) (d) | | 30 | | | 17 | | | 55 | | | (9) | | | 10 | | | N/M | | N/M | | 47 | | | 1 | | | N/M |

| Disposal (losses) gains | | — | | | — | | | (6) | | | 2 | | | (1) | | | N/M | | N/M | | — | | | (2) | | | N/M |

| Expense reimbursements from joint venture | | 30 | | | 27 | | | 28 | | | 29 | | | 31 | | | N/M | | N/M | | 57 | | | 60 | | | N/M |

| Other income (loss) | | 7 | | | 7 | | | (118) | | | 55 | | | 9 | | | N/M | | N/M | | 14 | | | 17 | | | N/M |

| Net securities (losses) | | (17) | | | (1) | | | (48) | | | (19) | | | — | | | N/M | | N/M | | (18) | | | (1) | | | N/M |

| Total investment and other revenue | | 169 | | | 182 | | | 43 | | | 159 | | | 147 | | | N/M | | N/M | | 351 | | | 278 | | | N/M |

| Total fee and other revenue | | $ | 3,567 | | | $ | 3,487 | | | $ | 3,257 | | | $ | 3,404 | | | $ | 3,404 | | | 2 | % | | 5 | % | | $ | 7,054 | | | $ | 6,691 | | | 5 | % |

(a) Excludes seed capital gains (losses) related to consolidated investment management funds. |

(b) On a constant currency basis (Non-GAAP), investment management and performance fees were flat compared with 2Q23. See "Explanation of GAAP and Non-GAAP Financial Measures" beginning on page 18 for the reconciliation of this Non-GAAP measure. |

| (c) Includes gains (losses) on investments in BNY funds which hedge deferred incentive awards. |

| (d) Includes strategic equity, private equity and other investments. |

| N/M – Not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | | | | | | | | | |

| AVERAGE BALANCES AND INTEREST RATES | | | | | | | | | | | | | |

| | 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 |

| | Average balance | Average rate | | | Average balance | Average rate | | | Average balance | Average rate | | | Average balance | Average rate | | | Average balance | Average rate | |

| (dollars in millions; average rates are annualized) | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits with the Federal Reserve and other central banks | | $ | 102,257 | | 4.65 | % | | | $ | 102,795 | | 4.69 | % | | | $ | 107,291 | | 4.72 | % | | | $ | 98,767 | | 4.57 | % | | | $ | 114,578 | | 4.29 | % | |

| Interest-bearing deposits with banks | | 11,210 | | 3.91 | | | | 11,724 | | 4.16 | | | | 12,110 | | 4.26 | | | | 12,287 | | 4.04 | | | | 13,919 | | 3.68 | | |

| Federal funds sold and securities purchased under resale agreements | | 29,013 | | 36.48 | | (a) | | 27,019 | | 36.22 | | (a) | | 25,753 | | 35.55 | | (a) | | 26,915 | | 30.47 | | (a) | | 26,989 | | 26.38 | | (a) |

| Loans | | 68,283 | | 6.58 | | | | 65,844 | | 6.48 | | | | 65,677 | | 6.43 | | | | 63,962 | | 6.39 | | | | 63,459 | | 6.05 | | |

| Securities: | | | | | | | | | | | | | | | | | | | | |

| U.S. government obligations | | 28,347 | | 3.82 | | | | 27,242 | | 3.70 | | | | 28,641 | | 3.40 | | | | 32,224 | | 3.08 | | | | 34,147 | | 2.90 | | |

| U.S. government agency obligations | | 62,549 | | 3.29 | | | | 63,135 | | 3.22 | | | | 59,067 | | 2.95 | | | | 59,481 | | 2.87 | | | | 61,565 | | 2.78 | | |

| | | | | | | | | | | | | | | | | | | | |

Other securities (b) | | 46,828 | | 4.04 | | | | 43,528 | | 4.01 | | | | 39,415 | | 4.03 | | | | 39,874 | | 3.93 | | | | 40,989 | | 3.59 | | |

Total investment securities (b) | | 137,724 | | 3.66 | | | | 133,905 | | 3.57 | | | | 127,123 | | 3.39 | | | | 131,579 | | 3.24 | | | | 136,701 | | 3.05 | | |

Trading securities (b) | | 5,146 | | 5.89 | | | | 4,846 | | 5.75 | | | | 6,220 | | 5.59 | | | | 5,534 | | 5.49 | | | | 6,403 | | 5.02 | | |

Total securities (b) | | 142,870 | | 3.74 | | | | 138,751 | | 3.65 | | | | 133,343 | | 3.49 | | | | 137,113 | | 3.33 | | | | 143,104 | | 3.14 | | |

Total interest-earning assets (b) | | $ | 353,633 | | 7.24 | % | | | $ | 346,133 | | 7.06 | % | | | $ | 344,174 | | 6.86 | % | | | $ | 339,044 | | 6.45 | % | | | $ | 362,049 | | 5.77 | % | |

| Noninterest-earning assets | | 58,866 | | | | | 57,852 | | | | | 57,431 | | | | | 58,247 | | | | | 58,912 | | | |

| Total assets | | $ | 412,499 | | | | | $ | 403,985 | | | | | $ | 401,605 | | | | | $ | 397,291 | | | | | $ | 420,961 | | | |

| | | | | | | | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 235,878 | | 3.85 | % | | | $ | 228,897 | | 3.84 | % | | | $ | 220,408 | | 3.79 | % | | | $ | 209,641 | | 3.62 | % | | | $ | 215,057 | | 3.24 | % | |

| Federal funds purchased and securities sold under repurchase agreements | | 17,711 | | 55.26 | | (a) | | 16,133 | | 55.91 | | (a) | | 16,065 | | 52.41 | | (a) | | 21,512 | | 36.07 | | (a) | | 26,282 | | 26.39 | | (a) |

| Trading liabilities | | 1,689 | | 5.43 | | | | 1,649 | | 5.11 | | | | 2,857 | | 4.83 | | | | 3,959 | | 4.80 | | | | 3,893 | | 4.46 | | |

| Other borrowed funds | | 351 | | 8.61 | | | | 502 | | 3.47 | | | | 465 | | 5.56 | | | | 540 | | 4.47 | | | | 2,702 | | 4.60 | | |

| Commercial paper | | 954 | | 5.54 | | | | 8 | | 5.42 | | | | 5 | | 5.40 | | | | 7 | | 4.13 | | | | 5 | | 5.11 | | |

| Payables to customers and broker-dealers | | 12,066 | | 5.35 | | | | 12,420 | | 4.74 | | | | 12,586 | | 4.67 | | | | 13,515 | | 4.30 | | | | 14,801 | | 3.85 | | |

| Long-term debt | | 31,506 | | 5.92 | | | | 31,087 | | 5.82 | | | | 30,702 | | 5.70 | | | | 31,161 | | 5.52 | | | | 31,970 | | 5.45 | | |

| Total interest-bearing liabilities | | $ | 300,155 | | 7.18 | % | | | $ | 290,696 | | 6.99 | % | | | $ | 283,088 | | 6.81 | % | | | $ | 280,335 | | 6.37 | % | | | $ | 294,710 | | 5.61 | % | |

| Total noninterest-bearing deposits | | 48,965 | | | | | 49,949 | | | | | 52,667 | | | | | 52,467 | | | | | 62,152 | | | |

| Other noninterest-bearing liabilities | | 22,839 | | | | | 23,005 | | | | | 24,962 | | | | | 23,699 | | | | | 23,526 | | | |

| Total The Bank of New York Mellon Corporation shareholders’ equity | | 40,387 | | | | | 40,248 | | | | | 40,823 | | | | | 40,711 | | | | | 40,493 | | | |

| Noncontrolling interests | | 153 | | | | | 87 | | | | | 65 | | | | | 79 | | | | | 80 | | | |

| Total liabilities and equity | | $ | 412,499 | | | | | $ | 403,985 | | | | | $ | 401,605 | | | | | $ | 397,291 | | | | | $ | 420,961 | | | |

| Net interest margin | | | 1.15 | % | | | | 1.19 | % | | | | 1.26 | % | | | | 1.18 | % | | | | 1.20 | % | |

Net interest margin (FTE) – Non-GAAP (c) | | | 1.15 | % | | | | 1.19 | % | | | | 1.26 | % | | | | 1.18 | % | | | | 1.20 | % | |

(a) Includes the average impact of offsetting under enforceable netting agreements of approximately $163 billion for 2Q24, $151 billion for 1Q24, $141 billion for 4Q23, $126 billion for 3Q23 and $113 billion for 2Q23. On a Non-GAAP basis, excluding the impact of offsetting, the yield on federal funds sold and securities purchased under resale agreements would have been 5.51% for 2Q24, 5.49% for 1Q24, 5.48% for 4Q23, 5.36% for 3Q23 and 5.10% for 2Q23. On a Non-GAAP basis, excluding the impact of offsetting, the rate on federal funds purchased and securities sold under repurchase agreements would have been 5.41% for 2Q24, 5.38% for 1Q24, 5.35% for 4Q23, 5.26% for 3Q23 and 4.99% for 2Q23. We believe providing the rates excluding the impact of netting is useful to investors as it is more reflective of the actual rates earned and paid. |

| (b) Average rates were calculated on an FTE basis, at tax rates of approximately 21%. |

(c) See "Explanation of GAAP and Non-GAAP Financial Measures" beginning on page 18 for the reconciliation of this Non-GAAP measure. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | |

| CAPITAL AND LIQUIDITY | | | | | |

| | | | | | | | | | | | | |

| | 2024 | | 2023 | |

| (dollars in millions) | | June 30 | | March 31 | | Dec. 31 | | | Sept. 30 | | | June 30 | |

Consolidated regulatory capital ratios (a) | | | | | | | | | | | | | |

| Standardized Approach: | | | | | | | | | | | | | |

| CET1 capital | | $ | 18,671 | | | $ | 18,383 | | | $ | 18,534 | | | | $ | 18,156 | | | | $ | 18,018 | | |

| Tier 1 capital | | 23,006 | | | 22,723 | | | 22,863 | | | | 22,985 | | | | 22,848 | | |

| Total capital | | 24,539 | | | 24,310 | | | 24,414 | | | | 24,552 | | | | 24,413 | | |

| Risk-weighted assets | | 163,583 | | | 169,909 | | | 156,178 | | | | 153,167 | | | | 153,158 | | |

| | | | | | | | | | | | | |

| CET1 ratio | | 11.4 | % | | 10.8 | % | | 11.9 | % | | | 11.9 | % | | | 11.8 | % | |

| Tier 1 capital ratio | | 14.1 | | | 13.4 | | | 14.6 | | | | 15.0 | | | | 14.9 | | |

| Total capital ratio | | 15.0 | | | 14.3 | | | 15.6 | | | | 16.0 | | | | 15.9 | | |

| | | | | | | | | | | | | |

| Advanced Approaches: | | | | | | | | | | | | | |

| CET1 capital | | $ | 18,671 | | | $ | 18,383 | | | $ | 18,534 | | | | $ | 18,156 | | | | $ | 18,018 | | |

| Tier 1 capital | | 23,006 | | | 22,723 | | | 22,863 | | | | 22,985 | | | | 22,848 | | |

| Total capital | | 24,206 | | | 23,940 | | | 24,085 | | | | 24,305 | | | | 24,151 | | |

| Risk-weighted assets | | 161,830 | | | 165,663 | | | 161,528 | | | | 160,262 | | | | 163,335 | | |

| | | | | | | | | | | | | |

| CET1 ratio | | 11.5 | % | | 11.1 | % | | 11.5 | % | | | 11.3 | % | | | 11.0 | % | |

| Tier 1 capital ratio | | 14.2 | | | 13.7 | | | 14.2 | | | | 14.3 | | | | 14.0 | | |

| Total capital ratio | | 15.0 | | | 14.5 | | | 14.9 | | | | 15.2 | | | | 14.8 | | |

| | | | | | | | | | | | | |

Tier 1 leverage ratio (a): | | | | | | | | | | | | | |

| Average assets for Tier 1 leverage ratio | | $ | 394,672 | | | $ | 386,148 | | | $ | 383,705 | | | | $ | 379,429 | | | | $ | 402,993 | | |

| Tier 1 leverage ratio | | 5.8 | % | | 5.9 | % | | 6.0 | % | | | 6.1 | % | | | 5.7 | % | |

| | | | | | | | | | | | | |

SLR (a): | | | | | | | | | | | | | |

| Leverage exposure | | $ | 336,933 | | | $ | 325,801 | | | $ | 313,555 | | | | $ | 318,664 | | | | $ | 326,002 | | |

| SLR | | 6.8 | % | | 7.0 | % | | 7.3 | % | | | 7.2 | % | | | 7.0 | % | |

| | | | | | | | | | | | | |

Average liquidity coverage ratio (a) | | 115 | % | | 117 | % | | 117 | % | | | 121 | % | | | 120 | % | |

Average net stable funding ratio (a) | | 132 | % | | 136 | % | | 135 | % | | | 136 | % | | | 136 | % | |

(a) Regulatory capital and liquidity ratios for June 30, 2024 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for June 30, 2024 was the Standardized Approach for the CET1 and Tier 1 capital ratios and the Advanced Approaches for the Total capital ratio, for March 31, 2024 was the Standardized Approach, and for Dec. 31, 2023, Sept. 30, 2023 and June 30, 2023, was the Advanced Approaches. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE BANK OF NEW YORK MELLON CORPORATION | | | | | | | | | | |

| SECURITIES SERVICES BUSINESS SEGMENT | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | 2Q24 vs. | | | | | | YTD24 vs. |

| (dollars in millions) | | 2Q24 | | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q24 | | 2Q23 | | YTD24 | | YTD23 | | YTD23 |

| Revenue: | | | | | | | | | | | | | | | | | | | | |

| Investment services fees: | | | | | | | | | | | | | | | | | | | | |