false

0001096275

0001096275

2024-07-23

2024-07-23

0001096275

WKSP:CommonStockParValue0.0001Member

2024-07-23

2024-07-23

0001096275

WKSP:WarrantsToPurchaseCommonStockMember

2024-07-23

2024-07-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 23, 2024

WORKSPORT

LTD.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-40681 |

|

35-2696895 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

2500

N America Dr.

West

Seneca, NY 14224

(Address

of principal executive offices)

888-554-8789

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 |

|

WKSP |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase common stock |

|

WKSPW |

|

The

Nasdaq Stock Market LLC |

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(a)

Stock Option Repricing

On

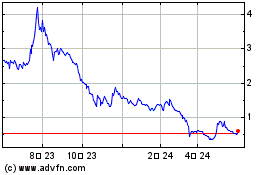

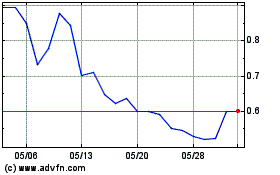

July 23, 2024, in order to align the interests of holders with that of shareholders, Worksport Ltd. (the “Company”),

the Board of Directors of the Company (the “Board”) approved a stock option repricing (the “Option Repricing”).

Pursuant

to the Option Repricing, the exercise price of an aggregate of 5,445,156 stock options granted to certain employees, executive officers

and members of the board of director of the Company (the “Repriced Options”) was amended to reduce such exercise price to

$0.7042, the closing price per share of the Company’s Common Stock as reported on The Nasdaq Stock Market on July 23, 2024 (the

“Effective Date”). The Repriced Options consisted of certain outstanding stock options that had been granted under

the Company’s 2015 Equity Incentive Plan, the 2021 Equity Incentive Plan and 2022 Stock Incentive Plan as of the Effective Date.

The

Board determined that the repricing of stock options was necessary to realign the interests of employees, executive officers, and directors

more closely with those of our shareholders. Prior to the Adjustment, the exercise price of the Repriced Options ranged from a $0.78

to $5.50 per share. By adjusting the exercise prices to the closing price per share of the Company’s Common Stock on the Nasdaq

Stock Market as of July 23, 2024, the Company aims to motivate and retain its key talent by providing them with a more immediate opportunity

to participate in the Company’s success as it moves forward. This adjustment is seen as an essential step in ensuring that the

interests of the Company’s team are aligned with the long-term goals and financial health of the Company, thereby driving collective

effort towards enhancing shareholder value.

The

table below sets forth the number of Repriced Options held by the Company’s executive officers and directors. Before the repricing,

the exercise price of such options ranged from $1.44 to $5.50 with a weighted exercise price of $2.44, and of which 420,000 were vested

as of the Effective Date.

| | |

Relevant | |

| Name and Position | |

Options | |

| Steven Rossi, CEO | |

| 3,650,000 | |

| Craig Loverock, Director | |

| 172,500 | |

| William Caragol, Director | |

| 172,500 | |

| Ned L. Siegel, Director | |

| 172,500 | |

(b)

Consulting Agreement with Steven Rossi

On

July 23, 2024, the Company entered into a consulting agreement (the “Consulting Agreement”) with Steven Rossi and

2230164 Ontario Inc., an Ontario corporation owned by Mr. Rossi (the “Consultant”). The terms of the Consulting Agreement

are substantially the same as the terms set forth in the employment agreement, dated May 10, 2021, with the Company. The Consulting Agreement

replaces such employment agreement it is entirety; provided however that all equity awards previously issued to the Consultant pursuant

to the employment agreement or otherwise, remain in full force and effect in accordance with their respective terms.

Pursuant

to the Consulting Agreement, Steven Rossi, acting through 2230164 Ontario Inc., agreed to serve as the Company’s Chief Executive

Officer (CEO) and President. The term of the Consulting Agreement commenced on July 23, 2024 (the “Effective Date”)

and continues unless terminated pursuant to the terms of the Consulting Agreement (as disclosed below).

The

Consultant shall receive an annual base payment of$300,000 (“Base Fees”) for services provided pursuant to the Consulting

Agreement and shall be afforded the opportunity to earn an annual incentive bonus (“Bonus”) equal to 50% of the Base

Fees, provided that certain performance goals are met. The performance goals will be established on an annual basis by the Compensation

Committee of the Board of Directors of the Company, when constituted.

The

Consulting Agreement may be terminated by the Company with or without “Cause” (as defined below) or by the Consultant

with or without “Good Reason” (as defined below).

The

term “Cause” includes discharge by Company on account of the occurrence of one or more of the following events:

i.

Consultant’s continued refusal or failure to perform (other than by reason of Disability) Consultant’s material duties and

responsibilities to Company if such refusal or failure is not cured within thirty (30) days following written notice of such refusal

or failure by Company to Consultant, or Consultant’s continued refusal or failure to follow any reasonable lawful direction of

the Board if such refusal or failure is not cured within thirty (30) days following written notice of such refusal or failure by Company

to Consultant;

ii.

a material breach of this Agreement (other than Section 7, Section 8 and Section 9) by Consultant or Rossi that,

if capable of being cured, is not cured within thirty (30) days following written notice of such breach by Company to Consultant;

iii.

an intentional and material breach of Section 7, Section 8, and Section 9 hereof by Consultant or Rossi;

iv.

willful, grossly negligent or unlawful misconduct by Consultant or Rossi which causes material harm to Company or its reputation;

v.

any conduct engaged in by Consultant or Rossi that is materially detrimental to the business or reputation of Company as determined by

the Board in good faith using its reasonable business judgment that is not cured within thirty (30) days following written notice from

Company to Consultant or Rossi;

vi.

Company is directed in writing by regulatory or governmental authorities to terminate the engagement of Consultant or Consultant or Rossi

engages in activities that (i) are not approved or authorized by the Board, and (ii) cause actions to be taken by regulatory or governmental

authorities that have a material adverse effect on Company; or

vii.

a conviction, plea of guilty, or plea of nolo contendere by Consultant or Rossi, of or with respect to a criminal offense which

is a felony or other crime involving dishonesty, disloyalty, fraud, embezzlement, theft, or similar action(s) (including, without limitation,

acceptance of bribes, kickbacks or self-dealing), or the material breach of Consultant’s or Rossi’s fiduciary duties with

respect to Company.

The

term “Good Reason” means, without Consultant’s express written consent, (i) a material reduction in the Base

Fees, then in effect, except a material diminution generally affecting the members of the Company’s management, (ii) a material

reduction in title, position or responsibility, (iii) a material breach of any term or condition contained in this Agreement, or (iv)

a relocation of Consultant’s principal worksite that is more than fifty (50) miles (80.46 km) from Consultant’s principal

worksite as of the Start Date. However, none of the foregoing events or conditions will constitute “Good Reason” unless (i)

Consultant provides Company with written notice of the existence of Good Reason within ninety (90) days following the occurrence thereof,

(ii) Company does not reverse or otherwise cure the event or condition within thirty (30) days of receiving that written notice, and

(iii) Consultant resigns Consultant’s engagement within thirty (30) days following the expiration of that cure period.

On

the Effective Date, the Company will grant the Consultant or Mr. Rossi a non-qualified stock option to purchase 3,500,000 shares of the

Company’s common stock at the Fair Market Value on the date of issuance. The option shall vest in equal quarterly installments

over a period of five (5) years and expire on the tenth anniversary of the date of grant, subject to the Consultant’s continuous

service with the Company. In the event of a Change of Control of the Company, the option shall immediately vest in full, ensuring the

Consultant/Mr. Rossi fully benefits from the change in the Company’s ownership structure.

During

the Term of the Agreement, if (i) a Change in Control has occurred, and (ii) as of such Change in Control, the price per share of Company’s

common stock is two (2) times or more the closing price per share of the common stock of the Company upon listing on the Nasdaq Stock

Market, Consultant shall be paid a bonus (the “Change in Control Transaction Bonus”), in cash, equal to two (2) times

the Base Fees as in effect immediately before such Change in Control. If applicable, the Change in Control Transaction Bonus shall be

paid in a lump sum within fifteen (15) days after the consummation of such Change in Control and the following certification by the Board

of the occurrence of clauses (i) and (ii) above.

Pursuant

to the clawback provisions of the Consulting Agreement, any amounts payable under the Employment Agreement or equity awards are subject

to any policy (whether in existence as of the Effective Date or later adopted) established by the Company providing for clawback or recovery

of amounts that were paid to the Executive. The Company will make any determination for clawback or recovery in its sole discretion and

in accordance with any applicable law or regulation.

The

Consulting Agreement provides that the Company shall indemnify the Consultant/Mr. Rossi to the fullest extent permitted by law for all

amounts (including, without limitation, judgments, fines, settlement payments, expenses and reasonable out-of-pocket attorneys’

fees) incurred or paid by Consultant/Mr. Rossi in connection with any action, suit, investigation or proceeding, or threatened action,

suit, investigation or proceeding, arising out of or relating to the performance by Consultant/Mr. Rossi of services for, or the acting

as a director, officer or consultant of, Company, or any subsidiary of the Company.

The

foregoing summary description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by the full

text of the Consulting Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01. Exhibits.

| + |

Pursuant

to Item 601(a)(5) of Regulation S-K, schedules have been omitted and will be furnished on a supplemental basis to the Securities

and Exchange Commission upon request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WORKSPORT

LTD. |

| |

|

| Date:

July 26, 2024 |

By: |

/s/

Steven Rossi |

| |

Name:

|

Steven

Rossi |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

Exhibit

10.1

CONSULTING

AGREEMENT

This

engagement Agreement, dated as of July __, 2024 (this “Agreement”), is made and entered into by and between Worksport,

Ltd., a Nevada corporation (the “Company”), and 2230164 Ontario Inc., an Ontario corporation (the “Consultant”)

and Steven Rossi (“Rossi”). Rossi, Consultant and the Company are hereinafter collectively referred to as the “Parties”

and individually as a “Party”. Terms used herein and not otherwise defined shall have the meanings set forth in Section

11.

RECITALS

WHEREAS,

Rossi is the shareholder and principal of Consultant;

WHEREAS,

the Company desires to engage Rossi, acting through Consultant, to serve as the full-time Chief Executive Officer (CEO) and President

of the Company, in order to benefit from his expertise and leadership; and

WHEREAS,

Rossi and Consultant wishes to provide such services to the Company, recognizing the mutual benefit of such an engagement;

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual promises, terms, provisions, and conditions set forth in this

Agreement, the adequacy and sufficiency of which are hereby acknowledged, the Parties hereto, intending to be legally bound, hereby agree

as follows:

AGREEMENT

1.

Engagement. Subject to the terms and conditions set forth in this Agreement, Company hereby offers, and Consultant hereby accepts

engagement with Company, as of the date first above written (the “Start Date”).

2.

Term. The Consultant’s engagement hereunder shall be effective as of the date both Parties have executed this Agreement

(the “Effective Date”) and shall continue indefinitely until terminated pursuant to the terms of this Agreement. The

term of this Agreement is hereinafter referred to as the “Term.”

3.

Services and Performance.

a.

Pursuant to the terms and conditions of this Agreement, Consultant agrees to perform services for the Company and/or its Affiliates in

the capacity of Chief Executive Officer President of the Company (the “Services”). Consultant shall perform such duties

and responsibilities as directed by the Board of Directors of the Company (the “Board”) consistent with Consultant’s

position on behalf of the Company.

b.

Consultant and Rossi shall devote their full business time, attention, skill, and best efforts to the performance of the Services under

this Agreement and shall not engage in any other business or occupation during the Term, including, without limitation, any activity

that (x) conflicts with the interests of the Company or any other member of the Company Group, (y) interferes with the proper and efficient

performance of Consultant duties for the Company, or (z) interferes with Consultant’s exercise of judgment in the Company’s

best interests. Notwithstanding the foregoing, nothing herein shall preclude Consultant or Rossi from (i) serving, with the prior written

consent of the Board, as a member of the Board of Directors or Advisory Board (or the equivalent in the case of a non-corporate entity)

of a noncompeting for-profit business and one or more charitable organizations, (ii) engaging in charitable activities and community

affairs, and (iii) managing Consultant’s and Rossi’s personal investments and affairs; provided, however, that the activities

set out in clauses (i), (ii), and (iii) shall be limited by Consultant and Rossi so as not to materially interfere, individually or in

the aggregate, with the performance of his duties and responsibilities hereunder.

c.

Consultant’s engagement with Company shall be exclusive with respect to the business of Company. Accordingly, during the Term,

Consultant and Rossi shall devote their full business time and best efforts, business judgment, skill and knowledge to the advancement

of the business and interests of Company and the discharge of Consultant’s duties and responsibilities hereunder, except for permitted

vacation (and other paid time off) periods, reasonable periods of illness or incapacity, and reasonable and customary time spent on civic,

charitable and religious activities, in each case such activities shall not interfere in any material respect with Consultant’s

duties and responsibilities hereunder.

d.

During the Term, the Consultant will report directly to the Board. The Parties herein acknowledge and agree that Consultant, in the provision

of services to the Company, is acting in the capacity of an independent contractor and not as an employee, agent, partner, or joint venturer

with or of the Company.

e.

For the entirety of the Agreement, the Board shall continue to appoint Rossi as a director of Company and shall, during the Term, nominate

and recommend Rossi for election as a director. Consultant and Rossi acknowledge and agrees that Rossi is not entitled to any additional

compensation in respect of Rossi’s appointment as a director of Company. If during the Term, Rossi ceases to be a director of Company

for any reason, Consultant’s engagement with the Company will continue (unless terminated under Section 5), and all terms of this

Agreement (other than those relating to Rossi’s position as a director of Company) will continue in full force, and effect and

Consultant will have no claims in respect of such cessation of office. Consultant agrees to abide by all statutory, fiduciary or common

law duties arising under applicable law that apply to Consultant as a director of Company.

f.

Consultant shall be engaged to perform his duties under this Agreement at the primary office location of Company, which currently is

in Ontario, Canada, or at such other location or locations as may be mutually agreeable to Consultant and Company. Notwithstanding this,

it is expected that Consultant shall be required to travel a reasonable amount of time in the performance of his duties under this Agreement.

4.

Compensation and Benefits.

a.

Base Salary. For services performed by Consultant under this Agreement, Company shall pay Consultant an annual base salary during

the Term at the rate of $300,000 per year, , payable at the same times as salaries are payable to other consultants of Company (the “Base

Salary”). During the Term, the Base Salary shall be reviewed by the Compensation Committee and/or the Board each year, and

the Board may, from time to time, increase such Base Salary and any reference to “Base Salary” herein shall refer

to such Base Salary, as increased.

b.

Annual Bonus. For each fiscal year of the Company during the Term, the Company shall afford Consultant the opportunity to earn

an incentive bonus (“Bonus”) as described in this Section 4(b). The aggregate target Bonus payable to Consultant

under such program(s) shall equal fifty percent (50%) of the Base Salary for such fiscal year and shall be payable to the extent the

applicable performance goals are achieved (which goals and payment matrices shall be set by the Compensation Committee of the Board in

its discretion). The amount of the Bonus will be determined by certification by the Board that the applicable goals have been achieved,

and the Board shall promptly provide such certification following achievement of the applicable goals. The amount payable under this

Section 4(b) shall be paid by the seventh (7th) day following the approval of the annual audited financial statements by the Board

or its audit committee, as applicable, for the calendar year in which the Bonus is earned or if later, the fifteenth day of the third

month following the end of the Company’s fiscal year in which the Bonus is earned.

c.

Equity Awards.

i.

On the Start Date, the Company shall grant the Consultant or Rossi a non-qualified stock option to purchase 3,500,000 shares of the Company’s

common stock at the Fair Market Value on the date of issuance. The option shall vest in equal quarterly installments over a period of

five (5) years and expire on the tenth anniversary of the date of grant, subject to the Consultant’s continuous service with the

Company, and shall be further subject to the terms and conditions set forth in the Plan. In the event of a Change of Control (as that

term is defined herein) of the Company, the option shall immediately vest in full, ensuring the Consultant/Rossi fully benefits from

the change in the Company’s ownership structure. Notwithstanding the termination of this Agreement for any reason, all stock options

vested in favor of the Consultant or Rossi shall remain vested pursuant to the terms of the option agreement.

ii.

During the Term, the Consultant or Rossi shall be entitled to receive equity awards either now or in the future, on terms and conditions

similar to those applicable to other executives of the Company generally, inside or outside of any established equity plan. The amount

and terms of the long-term incentive awards awarded to the Consultant/Rossi shall be set by the Compensation Committee in its discretion.

d.

Other Consultant Benefits. During the Term, the Consultant shall be entitled to participate in all benefit plans from time to

time generally in effect for Company’s consultants (collectively, “Benefit Plans”). Such participation and receipt

of benefits under any such Benefit Plans shall be on the same terms (including cost-sharing between Company and Consultant) as are applicable

to other Company consultants and shall be subject to the terms of the applicable plan documents and generally applicable Company policies.

Company may alter, modify, add to or delete the Benefit Plans in a manner nondiscriminatory to Consultant at any time in accordance with

applicable plan rules.

e.

Vacation. The Consultant shall be entitled to an annual vacation of twenty (20) days plus ten (10) established holiday days per

full calendar year of his engagement with the Company hereunder. Any unused vacation in one accrued calendar year may not be carried

over to any subsequent calendar year. However, the Company shall pay the Consultant (based on the Consultant’s Base Salary) for

any such unused vacation days within 30 days of the end of any such calendar year.

f.

Business and Travel Expenses. Company shall pay or reimburse Consultant for all reasonable, customary and necessary business expenses

(including cell phone, travel, lodging, and entertainment expenses) which are correctly documented and incurred or paid by Consultant

in the performance of Consultant’s duties and responsibilities hereunder, subject to the rules, regulations, and procedures of

Company and in effect from time to time.

g.

Change in Control Transaction Bonus. During Consultant’s engagement, if (i) a Change in Control has occurred, and (ii) as

of such Change in Control, the price per share of Company’s common stock is two (2) times or more the closing price per share of

the common stock of the Company upon listing on NASDAQ, Consultant shall be paid a bonus (the “Change in Control Transaction

Bonus”), in cash, equal to two (2) times the Base Salary as in effect immediately before such Change in Control. If applicable,

the Change in Control Transaction Bonus shall be paid in a lump sum within fifteen (15) days after the consummation of such Change in

Control and the following certification by the Board of the occurrence of clauses (i) and (ii) above.

5.

Termination of Engagement; Severance Benefits. The Consultant’s engagement hereunder shall terminate under the following

circumstances:

a.

Death. If Rossi dies during the Term, Consultant’s engagement hereunder shall immediately and automatically terminate. In such

event, Company shall pay to Consultant the Final Compensation. Company shall have no further obligation hereunder to Consultant upon

the termination of Consultant’s engagement under this Section 5(a) including, specifically, that the provisions of Section

5(d) shall not apply.

b.

Disability.

i.

Company may terminate Consultant’s engagement hereunder due to Rossi’s Disability during the Term by giving Consultant thirty

(30) days’ written notice of its intent to terminate, but in no event shall such termination be effective prior to the expiration

of the time periods in the definition of “Disability.” Notwithstanding the foregoing, Company will, after engaging

in an interactive process with Consultant to discern whether reasonable accommodation(s) can be provided without undue hardship upon

Company, offer Consultant reasonable accommodation(s) to enable Consultant to perform the essential functions of Consultant’s position

to the extent required by applicable law (if any) before terminating Consultant’s engagement hereunder. Consultant may decline

such reasonable accommodation, in which case Consultant’s engagement hereunder will terminate as provided in this subsection.

ii.

In the event of such termination for Disability, Consultant will receive Consultant’s Final Compensation. Company shall have no

further obligation hereunder to Consultant upon termination of Consultant’s engagement under this Section 5(b), including,

specifically, that the provisions of Section 5(d) shall not apply.

c.

By Company for Cause. Company may terminate Consultant’s engagement hereunder for Cause, as defined in Section 11(c),

at any time upon notice to Consultant setting forth in reasonable detail the nature of such Cause. Upon the giving of notice of termination

of Consultant’s engagement hereunder for Cause, Consultant will receive Consultant’s Final Compensation. Except as provided

herein, Company will have no further obligation to Consultant upon termination of Consultant’s engagement under this Section

5(c). Any notice of termination of Consultant’s engagement hereunder for Cause, or any notice to Consultant regarding any event,

condition or circumstance that, if not cured, if applicable, in accordance with the above, could give rise to a termination of Consultant’s

engagement hereunder for Cause, shall set forth in detail the applicable event(s), condition(s) or circumstance(s) constituting reason(s)

or potential reason(s) for such termination hereunder.

d.

By Company Other than for Cause or by Consultant for Good Reason. Company may terminate Consultant’s engagement hereunder

other than for Cause at any time upon thirty (30) days’ written notice to Consultant and Consultant may terminate Consultant’s

engagement hereunder for Good Reason at any time upon thirty (30) days’ written notice to Company.

i.

In the event of a termination of Consultant’s engagement under this Section 5(d), in addition to the Final Compensation,

Consultant shall receive:

1.

continuation of Consultant’s Base Salary, at the rate in effect as of the date immediately preceding the date of termination, until

the first anniversary of the date of termination, provided, however, if the date of termination is after the first anniversary

of the Start Date, the period pursuant to this subsection shall be eighteen (18) months after the date of termination, payable in accordance

with the Company’s regular payroll practices, ,commencing at the conclusion of the period set forth in Section 5(d)(iii),

provided that the first installment of such payments shall include all amounts which would have been paid during the period between Consultant’s

date of termination and the date of such first installment; and

2.

if the date of termination occurs after the end of a calendar year but prior to the date on which a Bonus is paid under Section 4(b),

payment of such Bonus as determined under Section 4(b) shall be at the time proscribed by Section 4(b); and

3.

payment of a pro-rata portion of the amount of Consultant’s Bonus for the year in which termination occurs that would have been

payable based on actual performance determined under the terms of the Bonus as then in effect for such year, with such pro-rata portion

calculated by multiplying the amount of such bonus for the year in which such termination occurs (as determined by the Board based on

actual performance for such year) by a number: (x) the numerator of which is the number of days worked by Consultant during the year

of such termination, and (y) the denominator of which is three hundred sixty-five (365), with such payment to be made after the determination

of the Bonus pursuant to Section 4(b).

ii.

Any obligation of Company to Consultant under this Section 5(d) (other than for the Final Compensation or for benefits required

by law) is conditioned upon Consultant’s execution and delivery to Company and the expiration of all applicable statutory revocation

periods of a release of claims in the form attached hereto as Exhibit A (the “Consultant Release”), provided, that

the terms of such Consultant Release shall be subject to modification to the extent necessary to comply with (a) the fact that Company

is simultaneously terminating more than one consultant as part of a group termination decision or (b) changes in applicable law, if any,

occurring after the date hereof, and prior to the date such Consultant Release is executed.

e.

By Consultant Other than for Good Reason. Consultant may terminate Consultant’s engagement hereunder other than for Good

Reason upon thirty (30) days’ written notice to Company; provided, that Company may, in its sole and absolute discretion,

by written notice accelerate such date of termination. In the event of a termination of Consultant’s engagement under this Section

5(e)), Consultant will receive the Final Compensation. Company shall have no further obligation hereunder to Consultant upon termination

of Consultant’s engagement under this Section 5(e).

f.

Change in Control Severance. Except as otherwise set forth herein, if a Change in Control occurs, and on, or at any time during

the 24 months following, the Change in Control, (i) the Company terminates Consultant’s engagement for any reason other than Good

Cause or Disability, or (ii) Consultant terminates Consultant’s engagement for Good Reason, Consultant shall be entitled to the

following benefits:

i.

The Company shall pay Consultant, in a lump sum within 60 days following termination of Consultant’s engagement, severance equal

to two times the sum of Consultant’s Base Salary and Bonus (the full, non-prorated Bonus for the year of termination assuming attainment

of the targeted performance goals at the 100% payout level).

ii.

Consultant also shall be entitled to receive any and all vested benefits accrued under any other incentive plans to the date of termination

of engagement, the amount, entitlement to, form, and time of payment of such benefits to be determined by the terms of such incentive

plans. For purposes of calculating Consultant’s benefits under the incentive plans, Consultant’s engagement shall be deemed

to have terminated under circumstances that have the most favorable result for Consultant under the applicable incentive plan.

iii.

If, upon the date of termination of Consultant’s engagement, Consultant holds any awards with respect to securities of the Company,

(i) all such awards that are options shall immediately become vested and exercisable upon such date and shall be exercisable thereafter

until the earlier of the third (3rd) year anniversary of Consultant’s termination of engagement or the expiration of the term of

the options; (ii) all restrictions on any such awards of restricted stock, restricted stock units or other awards shall terminate or

lapse, and all such awards of restricted stock, restricted stock units or other awards shall be vested and payable; and (iii) all performance

goals applicable to any such performance-based awards that are “in cycle” (i.e., the performance period is not yet complete)

shall be deemed satisfied at the “target” level (assuming 100% payout), and (iv) all such awards shall be paid in accordance

with the terms of the applicable award agreement. The provisions of this subsection shall be subject (and defer) to the provisions of

any incentive plan, award agreement or other agreement as it relates to an individual award to the extent such provisions provide treatment

that is more favorable to Consultant than the treatment described in this subsection and such more favorable provisions in such incentive

plan, award agreement or other agreement shall supersede any inconsistent or contrary provision of this subsection. All of Consultant’s

awards with respect to securities of the Company that are outstanding upon the date of termination of Consultant’s engagement shall

continue to be subject to, and enjoy the benefits and protections under, the terms of the incentive plan, the award agreement and any

other plan, agreement, policy or other arrangement to which such awards are subject as of the effective date of Consultant’s participation,

including any engagement security agreement or other written compensation arrangement (even if the remaining terms thereof are waived),

without application of this subsection.

iv.

Consultant shall be entitled to payment for any accrued but unused vacation in accordance with the Company’s policy in effect at

the time of termination of Consultant’s engagement, in a lump sum within 60 days following such termination. Consultant shall not

be entitled to receive any payments or other compensation attributable to vacation that would have been earned had Consultant’s

engagement continued during the Termination Period, and Consultant waives any right to receive any such compensation.

v.

The Company shall, at the Company’s expense, provide Consultant with 12 months of Consultant outplacement services with a professional

outplacement firm selected by the Company; provided that Consultant must use the outplacement services by no later than the end of the

second calendar year following the calendar year in which the termination of Consultant’s engagement occurred and the total cost

of such outplacement services must not exceed any per individual cap on such amounts in the Company’s agreement with the professional

outplacement firm selected by the Company.

vi.

Consultant shall not be entitled to reimbursement for any other fringe benefits or perquisite payments during the Termination Period,

including but not limited to dues and expenses related to club memberships, automobile, cell phone, expenses for professional services,

Consultant physicals, and other similar perquisites.

vii.

The Company shall pay as incurred (within ten calendar days following the Company’s receipt of an invoice from Consultant) Consultant’s

out-of-pocket expenses, including legal fees, incurred by Consultant at any time from the date of this Agreement through Consultant’s

remaining lifetime or, if longer, the statute of limitations for contract claims under applicable law, in connection with any action

taken to enforce the Consultant’s rights under this Agreement or construe or determine the validity of this Agreement or otherwise

in connection herewith, including any claim or legal action or proceeding, whether brought by Consultant or the Company or another party;

provided, Consultant must be successful through judgment in his/her favor with respect to such action in order to recover fees under

this Section 7; provided further, that Consultant shall have submitted an invoice for such fees and expenses at least fifteen

calendar days before the end of the calendar year next following the calendar year in which such fees and expenses were incurred. The

amount of such legal fees and expenses that the Company is obligated to pay in any given calendar year shall not affect the legal fees

and expenses that the Company is obligated to pay in any other calendar year, and Consultant’s right to have the Company pay such

legal fees and expenses may not be liquidated or exchanged for any other benefit. The Company’s obligation to pay Consultant’s

eligible legal fees and expenses under this Section 7(c)(ii) shall not be conditioned upon the termination of Consultant’s

engagement.

6.

Effect of Termination.

a.

Upon termination of Consultant’s engagement hereunder, and subject to the provisions of Section 5 and Section 6(c),

Company’s entire obligation to Consultant shall be payment of Final Compensation.

b.

In connection with the cessation of Consultant’s service as President and Chief Executive Officer of Company for any reason, except

as may otherwise be requested by the Company in writing and agreed upon in writing by Consultant, Consultant and Rossi shall be deemed

to have resigned from any and all directorships, committee memberships, and any other positions Consultant or Rossi holds with the Company

or any other member of the Company Group. Consultant and Rossi hereby agree that no further action is required by Consultant or Rossi

or any of the preceding to make the transitions and resignations provided for in this paragraph effective, but Consultant and Rossi nonetheless

agrees to execute any documentation Company reasonably requests at the time to confirm it and to not reassume any such service or position

without the written consent of Company.

c.

Except as otherwise required by applicable law, benefits shall continue or terminate pursuant to the terms of the applicable benefit

plan or agreement, without regard to any continuation of Base Salary or other payment to Consultant following such date of termination.

d.

The provisions of this Section 6 shall apply to any termination of engagement. Provisions of this Agreement will survive any termination

if so provided herein or if necessary or desirable to accomplish the purposes of other surviving provisions, including, without limitation,

the obligations of Consultant under Section 7 through Section 9.

e.

Any termination of Consultant’s engagement with Company under this Agreement shall automatically be deemed to be simultaneous resignation

of all other positions and titles (including any director positions) that Consultant or Rossi holds with Company and any Affiliate or

subsidiary thereof. This Section 6(e)) shall constitute a resignation notice for such purposes.

f.

Upon termination of the Consultant’s engagement or upon the Company’s request at any other time, the Consultant will deliver

to the Company all of the Company’s property, equipment, and documents, together with all copies thereof, and any other material

containing or disclosing any Intellectual Property or Confidential Information and certify in writing that the Consultant has fully complied

with the foregoing obligation. The Consultant agrees that the Consultant will not copy, delete, or alter any Company computer equipment

information before the Consultant returns it to the Company. In addition, if the Consultant has used any personal computer, server, or

email system to receive, store, review, prepare or transmit any Company information, including but not limited to, Confidential Information,

the Consultant agrees to provide the Company with a computer-usable copy of all such Confidential Information and then permanently delete

and expunge such Confidential Information from those systems; and the Consultant agrees to provide the Company access to the Consultant’s

system as reasonably requested to verify that the necessary copying and/or deletion is completed.

7.

Confidential Information.

a.

Consultant and Rossi acknowledge that Company continually develops Confidential Information, that Consultant may develop Confidential

Information for Company and that Consultant and Rossi may learn of Confidential Information during the course of engagement with Company.

Consultant and Rossi will comply with the policies and procedures of Company for protecting Confidential Information and shall not disclose

to any Person or use, other than as required by applicable law, regulation or process or for the proper performance of Consultant’s

duties and responsibilities to Company, any Confidential Information obtained by Consultant or Rossi incident to Consultant’s engagement

or other association with Company. Consultant and Rossi understands that this restriction shall continue to apply after Consultant’s

engagement terminates, regardless of the reason for such termination.

b.

Notwithstanding anything contained in this Section 7 to the contrary, nothing contained herein shall prevent Consultant or Rossi

from disclosing any Confidential Information required by law, subpoena, court order or other legal processes to be disclosed; provided,

that, Consultant and Rossi shall give prompt written notice to Company of such requirement, disclose no more information than is so required

and cooperate, at Company’s cost and expense, with any attempt by Company to obtain a protective order or similar treatment with

respect to such information.

c.

Consultant and Rossi understand that:

i.

Consultant and Rossi may not be held criminally or civilly liable under any trade secret law for the disclosure of a trade secret that

is made in confidence to a federal, state, provincial or local government official, either directly or indirectly, or to an lawyer and

solely for the purpose of reporting or investigating a suspected violation of law; or is made in a complaint or other document that is

filed under seal in a lawsuit or other proceeding; and

ii.

if Consultant or Rossi files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Consultant and Rossi

may disclose Company’s trade secrets to Consultant’s lawyer and use the trade secret information in the court proceeding

if Consultant or Rossi files any document containing the trade secret under seal and does not disclose the trade secret, except pursuant

to court order.

8.

Assignment of Rights to Intellectual Property. Consultant shall promptly and fully disclose to Company all Intellectual Property

developed for the benefit of Company in the course of Consultant’s engagement by Company. Consultant hereby assigns and agrees

to assign to Company (or as otherwise directed by Company) Consultant’s full right, title, and interest in and to all such Intellectual

Property. Consultant agrees to execute any and all applications for domestic and foreign patents, copyrights or other proprietary rights

and to do such other acts (including without limitation the execution and delivery of instruments of further assurance or confirmation)

requested by Company (at Company’s expense) to assign to Company the Intellectual Property developed for the benefit of Company

in the course of Consultant’s engagement by Company and to permit Company to enforce any patents, copyrights or other proprietary

rights to the Intellectual Property. Consultant will not charge Company for time spent in complying with these obligations. All copyrightable

works that Consultant creates developed for the benefit of Company in the course of Consultant’s engagement by Company shall be

considered “work made for hire.”

9.

Restricted Activities. Consultant and Rossi agree that the restrictions on Consultant’s and Rossi’s activities during

and after Consultant’s engagement set forth below are necessary to protect the goodwill, Confidential Information and other legitimate

interests of Company and its successors and assigns:

a.

During the Term of this Agreement and during the Restricted Period following termination of engagement, Consultant and Rossi will not,

without the prior written consent of Company, directly or indirectly, and whether as principal or investor or as an consultant, officer,

director, manager, partner, consultant, agent, or otherwise, alone or in association with any other Person, firm, corporation, or other

business organization, engage or otherwise become involved in a Competing Business (as defined below) in any country in which the Company

conducted business during the Term; provided, however, that the provisions of this Section 9 shall apply solely to those activities

of a Competing Business which are congruent with those activities with which Consultant was personally involved or for which Consultant

was responsible while engaged by Company or its subsidiaries during the twelve (12) month period preceding termination of Consultant’s

engagement. This Section 9 will not be violated, however, by (i) Consultant’s or Rossi’s investment of up to $100,000

in the aggregate in one or more publicly-traded companies that engage in a Competing Business. “Competing Business”

means a business or enterprise (other than Company or its subsidiaries) engaged in dermatology and plastic surgery and any other business

directly competing with the business of the Company as currently conducted or otherwise conducted by the Company during the Term. “Restricted

Period” means twelve (12) months.

b.

During the Term of this Agreement and during the Restricted Period (as defined above), Consultant and Rossi will not engage in any Wrongful

Solicitation. A “Wrongful Solicitation” shall be deemed to occur when Consultant or Rossi directly or indirectly (except

in the course of Consultant’s engagement with Company), for the purpose of conducting or engaging in a Competing Business, calls

upon, solicits, advises or otherwise does, or attempts to do, business with any Person who is, or was, during the then most recent 12-month

period, a customer of Company or any of its subsidiaries, or takes away or interferes or attempts to take away or interfere with any

custom, trade, business, patronage or affairs of Company or any of its subsidiaries, or hires or attempts to hire any Person who is,

or was during the most recent 12-month period, a consultant, officer, representative or agent of Company or any of its subsidiaries,

or solicits, induces, or attempts to solicit or induce any Person who is a consultant, officer, representative or agent of Company or

any of its subsidiaries to leave the employ of Company or any of its subsidiaries, or violate the terms of their contract, or any engagement

agreement, with it.

c.

It is expressly understood and agreed that although Consultant, Rossi and Company consider the restrictions contained in this Section

9 to be reasonable if a court makes a final judicial determination of competent jurisdiction that the time or territory or any other

restriction contained in this Agreement is an unenforceable restriction against Consultant and Rossi, the provisions of this Agreement

shall not be rendered void but shall be deemed amended to apply as to such maximum time and territory and to such maximum extent as the

court may judicially determine or indicate to be enforceable. Alternatively, if any court of competent jurisdiction finds that any restriction

contained in this Agreement is unenforceable, and such restriction cannot be amended so as to make it enforceable, such finding shall

not affect the enforceability of any of the other restrictions contained herein.

d.

Consultant and Rossi expressly understands that in the event of a violation of any period specified in this Section 9, such period

shall be extended by a period of time equal to that period beginning with the commencement of any such violation and ending when such

violation shall have been finally terminated in good faith.

Notwithstanding

anything contained in this Section 9, Consultant’s service pursuant to Section 3(f) shall not constitute

a breach of this Section 9.

10.

Enforcement of Covenants. Consultant and Rossi acknowledge that Consultant and Rossi have carefully read and considered all the

terms and conditions of this Agreement, including the restraints imposed upon Consultant and Rossi pursuant to Section 7, Section

8, and Section 9, and Consultant and Rossi agree that these restraints are necessary for the reasonable and proper protection

of Company and its successors and assigns and that each and every one of the restraints is reasonable in respect to the subject matter,

length of time and geographic area. Consultant and Rossi further acknowledge that, were Consultant or Rossi to breach any of the covenants

in Section 7, Section 8 and Section 9 the damage to the Company would be irreparable. Consultant and Rossi therefore agree that Company,

in addition to any other remedies available to it, shall be entitled to preliminary and permanent injunctive relief against any breach

or threatened breach by Consultant or Rossi of any of the covenants herein, without any requirement to post a bond or similar security.

The Parties further agree that in the event that any provision of Section 7, Section 8, and Section 9 shall be determined

by any court of competent jurisdiction to be unenforceable by reason of its being extended over too great a time, too large a geographic

area or too great a range of activities, such provision shall be deemed to be modified to permit its enforcement to the maximum extent

permitted by law.

11.

Definitions. Words or phrases that are initially capitalized or within quotation marks shall have the meanings provided in this

Section 11 and as provided elsewhere. For purposes of this Agreement, the following definitions apply:

a.

“$” refers to U.S. Dollars.

b.

“Affiliate” means, with respect to any specified Person, any other Person which directly or indirectly through one

or more intermediaries controls, or is controlled by, or is under common control with, such specified Person (for the purposes of this

definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by”

and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the

power to either (i) direct or cause the direction of the management or policies of such Person, whether through the ownership of voting

securities, by agreement or otherwise or (ii) vote at least fifty percent (50%) or more of the securities having voting power for the

election of a majority of the directors (or Persons performing similar functions) of such Person.

c.

“Cause” means if Consultant is discharged by Company on account of the occurrence of one or more of the following events:

i.

Consultant’s continued refusal or failure to perform (other than by reason of Disability) Consultant’s material duties and

responsibilities to Company if such refusal or failure is not cured within thirty (30) days following written notice of such refusal

or failure by Company to Consultant, or Consultant’s continued refusal or failure to follow any reasonable lawful direction of

the Board if such refusal or failure is not cured within thirty (30) days following written notice of such refusal or failure by Company

to Consultant;

ii.

a material breach of this Agreement (other than Section 7, Section 8 and Section 9) by Consultant or Rossi that,

if capable of being cured, is not cured within thirty (30) days following written notice of such breach by Company to Consultant;

iii.

an intentional and material breach of Section 7, Section 8, and Section 9 hereof by Consultant or Rossi;

iv.

willful, grossly negligent or unlawful misconduct by Consultant or Rossi which causes material harm to Company or its reputation;

v.

any conduct engaged in by Consultant or Rossi that is materially detrimental to the business or reputation of Company as determined by

the Board in good faith using its reasonable business judgment that is not cured within thirty (30) days following written notice from

Company to Consultant or Rossi;

vi.

Company is directed in writing by regulatory or governmental authorities to terminate the engagement of Consultant or Consultant or Rossi

engages in activities that (i) are not approved or authorized by the Board, and (ii) cause actions to be taken by regulatory or governmental

authorities that have a material adverse effect on Company; or

vii.

a conviction, plea of guilty, or plea of nolo contendere by Consultant or Rossi, of or with respect to a criminal offense which

is a felony or other crime involving dishonesty, disloyalty, fraud, embezzlement, theft, or similar action(s) (including, without limitation,

acceptance of bribes, kickbacks or self-dealing), or the material breach of Consultant’s or Rossi’s fiduciary duties with

respect to Company.

d.

“Change in Control” means the occurrence, in a single transaction or in a series of related transactions, of any one

or more of the following events:

i.

A transaction or series of transactions (other than an offering of common stock to the general public through a registration statement

filed with the Securities and Exchange Commission or any other securities regulator) whereby any “Person” or related “group”

of “persons” (as such terms are used in Sections 13(d) and 14(d)(2) of the Exchange Act) (other than the Company, any of

its subsidiaries, an employee benefit plan maintained by the Company or any of its subsidiaries or a “Person” that, prior

to such transaction, directly or indirectly controls, is controlled by, or is under common control with, the Company) directly or indirectly

acquires beneficial ownership (within the meaning of Rule 13(d)(3) under the Exchange Act) of securities of the Company possessing more

than fifty percent (50%) of the total combined voting power of the Company’s securities outstanding immediately after such acquisition;

ii.

The consummation by the Company (whether directly involving the Company or indirectly involving the Company through one or more intermediaries)

of (x) a merger, consolidation, reorganization, or business combination or (y) a sale or other disposition of all or substantially all

of the Company’s assets in any single transaction or series of related transactions:

(a)

which results in the Company’s voting securities outstanding immediately before the transaction continuing to represent (either

by remaining outstanding or by being converted into voting securities of the Company or the Person that, as a result of the transaction,

controls, directly or indirectly, the Company or owns, directly or indirectly, all or substantially all of the Company’s assets

or otherwise succeeds to the business of the Company (the Company or such Person, the “Successor Entity”) directly

or indirectly, at least a majority of the combined voting power of the Successor Entity’s outstanding voting securities immediately

after the transaction, and

(b)

after which no Person or group beneficially owns voting securities representing fifty percent (50%) or more of the combined voting power

of the Successor Entity; provided, however, that no Person or group shall be treated for purposes of this Section 11(d)

as beneficially owning fifty percent (50%) or more of the combined voting power of the Successor Entity solely as a result of the voting

power held in the Company prior to the consummation of the transaction.

A

transaction shall not constitute a Change in Control if its sole purpose is to change the province of the Company’s incorporation

or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities

immediately before such transaction.

e.

“Company” has the meaning ascribed to it in the preamble of this Agreement.

f.

“Company Group” shall mean the Company together with any of its direct or indirect Affiliates.

g.

“Compensation Committee” shall mean the committee of the Board designated to make compensation decisions relating

to senior executive officers of the Company.

h.

“Confidential Information” means any and all nonpublic information of the Company. Confidential Information includes,

without limitation, such information relating to (i) the development, research, testing, manufacturing, marketing, and financial activities

of the Company, (ii) the Services, (iii) the costs, sources of supply, financial performance, and strategic and/or business plans of

Company, (iv) the identity and special needs of the customers and prospective customers of Company, and (v) the people and organizations

with whom Company has business relationships and those relationships. Confidential Information also includes any information that Company

has received, or may receive hereafter, belonging to customers or others with any understanding, express or implied, that the information

would not be disclosed. Notwithstanding the foregoing, “Confidential Information” does not include (x) any information

that is or becomes generally known to the industry or the public through no wrongful act of Consultant or any representative of Consultant

and (y) any information that is made legitimately available to Consultant by a third party without breach of any confidentiality obligation.

i.

“Disability” means Consultant’s inability, due to any illness, injury, accident or condition of Rossi of either

a physical or psychological nature, to substantially perform Consultant’s duties and responsibilities hereunder for a period of

one hundred twenty (120) consecutive days, or for any one hundred and eighty (180) days during any period of three hundred and sixty-five

(365) consecutive calendar days.

j.

“Final Compensation” means the amount equal to the sum of (i) the Base Salary earned but not paid through the date

of termination of engagement, payable not later than the next scheduled payroll date, (ii) any business and related expenses and allowances

incurred by Consultant or to which Consultant is entitled under Section 4(g) but unreimbursed on the date of termination of engagement;

provided that with respect to business expenses unreimbursed under Section 4(g), such expenses and required substantiation and

documentation are submitted within one hundred eighty (180) days of termination in the case of termination on account of Rossi’s

death, or thirty (30) days on account of termination for any reason other than death, and that such expenses are reimbursable under Company’s

applicable reimbursement policy, and (iii) any other supplemental compensation, insurance, retirement or other benefits due and payable

or otherwise required to be provided under Section 4 in accordance with the terms and conditions of the applicable plan or agreement.

k.

“Good Reason” means, without Consultant’s express written consent, (i) a material reduction in the Base Salary,

then in effect, except a material diminution generally affecting the members of the Company’s management, (ii) a material reduction

in title, position or responsibility, (iii) a material breach of any term or condition contained in this Agreement, or (iv) a relocation

of Consultant’s principal worksite that is more than fifty (50) miles (80.46 km) from Consultant’s principal worksite as

of the Start Date. However, none of the foregoing events or conditions will constitute “Good Reason” unless (i) Consultant

provides Company with written notice of the existence of Good Reason within ninety (90) days following the occurrence thereof, (ii) Company

does not reverse or otherwise cure the event or condition within thirty (30) days of receiving that written notice, and (iii) Consultant

resigns Consultant’s engagement within thirty (30) days following the expiration of that cure period.

l.

“Intellectual Property” means inventions, discoveries, developments, methods, processes, compositions, works, concepts

and ideas (whether or not patentable or copyrightable or constituting trade secrets) conceived, made, created, developed or reduced to

practice by Consultant (whether alone or with others, whether or not during normal business hours or on or off Company premises) during

Consultant’s engagement that relate to either the Services or any prospective activity of Company or that make use of Confidential

Information or any of the equipment or facilities of Company.

m.

“Person” means an individual, a corporation, a limited liability company, an association, a partnership, an estate,

a trust, and any other entity or organization other than Company.

n.

“Sale of Company” means the sale of Company to an independent third party or group of independent third Parties pursuant

to which such party or Parties acquire (i) equity interests possessing the voting power under normal circumstances to elect a majority

of the Board of Directors or similar governing body of Company (whether by merger, consolidation or sale or transfer of such equity interests),

or (ii) all or substantially all of Company’s assets determined on a consolidated basis.

o.

“Services” means all services planned, researched, developed, tested, manufactured, sold, licensed, leased or otherwise

distributed or put into use by Company, together with all products provided or planned by Company, during Consultant’s engagement.

p.

“Termination Period” shall mean that number of years or partial years following termination of Consultant’s

engagement equal to the number of years or partial years of Base Salary that the Consultant receives under Section 5(f).

12.

Not Used.

13.

Assignment. Neither Company nor Consultant may make any assignment of this Agreement or any interest herein, by operation of law

or otherwise, without the prior written consent of the other; provided, however, that Company may assign its rights and obligations under

this Agreement without the consent of Consultant in the event of a Sale of Company. This Agreement shall inure to the benefit of and

be binding upon Company and Consultant, their respective successors, executors, administrators, heirs and permitted assigns.

14.

Not Used.

15.

Not Used.

16.

Successors.

a.

Subject to Section 5(f), any successor to the Company (whether direct or indirect and whether by purchase, merger, consolidation,

liquidation or otherwise) to all or substantially all of the Company’s business and/or assets shall assume the obligations under

this Agreement and agree expressly to perform the obligations under this Agreement in the same manner and to the same extent as the Company

would be required to perform such obligations in the absence of a succession. For all purposes under this Agreement, the term “Company”

shall include any successor to the Company’s business and/or assets which executes and delivers the assumption agreement described

in this Section 16 or which becomes bound by the terms of this Agreement by operation of law.

b.

The terms of this Agreement and all rights of Consultant hereunder shall inure to the benefit of, and be enforceable by, Consultant’s

personal or legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees

17.

Clawback Provisions. Any amounts payable under this Agreement or equity awards granted to Consultant under this Agreement or otherwise

are subject to any policy (whether in existence as of the Effective Date or later adopted) established by the Company providing for clawback

or recovery of amounts that were paid to the Consultant. The Company will make any determination for clawback or recovery in its sole

discretion and in accordance with any applicable law or regulation.

18.

Indemnification. Company will indemnify Consultant and Rossi to the fullest extent permitted by law, for all amounts (including,

without limitation, judgments, fines, settlement payments, expenses and reasonable out-of-pocket attorneys’ fees) incurred or paid

by Consultant or Rossi in connection with any action, suit, investigation or proceeding, or threatened action, suit, investigation or

proceeding, arising out of or relating to the performance by Consultant or Rossi of services for, or the acting by Consultant or Rossi

as a director, officer or consultant of, Company, or any Affiliate of Company. Any fees or other necessary expenses incurred by Consultant

or Rossi in defending any such action, suit, investigation or proceeding shall be paid by Company in advance, subject to Company’s

right to seek repayment from Consultant or Rossi if a determination is made that Consultant or Rossi was not entitled to indemnification.

19.

Severability. If any portion or provision of this Agreement shall to any extent be declared illegal or unenforceable by a court

of competent jurisdiction, then the remainder of this Agreement, or the application of such portion or provision in the circumstances

other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision

of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

20.

Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure

of either party to require the performance of any term or obligation of this Agreement, or the waiver by either party of any breach of

this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

21.

Survival. Section 6 through Section 32 shall survive and continue in full force in accordance with their terms notwithstanding

the termination of Consultant’s engagement (and hence the Term of this Agreement) for any reason.

22.

Notices. Any and all notices, requests, demands and other communications provided for by this Agreement shall be in writing and

shall be effective when delivered in Person, with respect to notices delivered personally, or upon confirmed receipt when delivered by

facsimile or deposited with a reputable, nationally recognized overnight courier service and addressed or faxed to Consultant at Consultant’s

last known address on the books of Company or, in the case of Company, at its principal place of business, attention: Secretary, Board

of Directors.

23.

Entire Agreement. This Agreement constitutes the entire agreement between the Parties (including with respect to Company, its

successors and assigns) with respect to Consultant’s engagement and supersedes all prior communications, agreements and understandings,

written or oral, with respect to the terms and conditions of Consultant’s engagement. Specifically, this Agreement supersedes and

replaces in its entirety the Employment Agreement between Rossi and the Company, dated May 10, 2021. Notwithstanding anything herein

to the contrary, all equity awards previously issued to the Consultant prior to the Effective Date of this Agreement shall remain in

full force and effect in accordance with their respective terms.

24.

Amendment. This Agreement may be amended or modified only by a written instrument signed by Consultant and by an expressly authorized

representative of Company.

25.

Headings. The headings and captions in this Agreement are for convenience only and in no way define or describe the scope or content

of any provision of this Agreement.

26.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be an original and all of which

together shall constitute one and the same instrument. Furthermore, the delivery of a copy of such signature by facsimile transmission

or other electronic exchange methodology shall constitute a valid and binding execution and delivery of this Agreement by such party,

and such electronic copy shall constitute an enforceable original document. Counterpart signatures need not be on the same page and shall

be deemed effective upon receipt.

27.

Additional Obligations. Without implication that the contrary would otherwise be true, Consultant’s obligations under Section

7, Section 8 and Section 9 are in addition to, and not in limitation of, any obligations that Consultant may have under

applicable law (including any law regarding trade secrets, duty of loyalty, fiduciary duty, unfair competition, unjust enrichment, slander,

libel, conversion, misappropriation and fraud).

28.

Legal Fees. In any action or proceeding brought to enforce any provision of this Agreement, the prevailing party shall be entitled

to recover reasonable legal fees, costs, and expenses from the other party to the action or proceeding. For purposes of this Agreement,

the “prevailing party” shall be deemed to be that party who obtains substantially the result sought, whether by settlement,

mediation, judgment or otherwise, and “legal fees” shall include, without limitation, the reasonable out-of-pocket

attorneys’ fees incurred in retaining counsel for advice, negotiations, suit, appeal or other legal proceeding, including mediation

and arbitration.

29.

Confidentiality. The Parties acknowledge and agree that this Agreement and each of its provisions are and shall be treated strictly

confidential. During the Term and thereafter, Consultant and Rossi shall not disclose any terms of this Agreement to any Person or entity

without the prior written consent of Company, with the exception of Consultant’s or Rossi’s tax, legal or accounting advisors

or for legitimate business purposes of Consultant or Rossi, or as otherwise required by law. Notwithstanding the foregoing or anything

contained herein, Consultant and Rossi acknowledges that this Agreement, including all terms and conditions herein, and the form of this

Agreement shall be filed with the Securities and Exchange Commission as required by applicable law and regulations.

30.

No Rule of Construction. This Agreement shall be construed to be neither against nor in favor of any party hereto based upon any

party’s role in drafting this Agreement, but rather in accordance with the fair meaning hereof.

31.

Governing Law. The validity, interpretation, construction and performance of this Agreement

shall be governed by the laws of the Province of Ontario. To the extent any terms of this Agreement are not applicable or enforceable

due to the location of the Company’s offices or Consultant’s residence in Ontario, Canada, the terms shall be interpreted

and enforced under applicable law of similar import and to the extent most favorable to the Consultant.

32.

WAIVER OF JURY TRIAL. CONSULTANT AND COMPANY EXPRESSLY WAIVE ANY RIGHT EITHER MAY HAVE TO A JURY TRIAL CONCERNING ANY CIVIL ACTION

THAT MAY ARISE FROM THIS AGREEMENT OR THE RELATIONSHIP OF THE PARTIES HERETO.

33.

Conditions. This Agreement and the Consultant’s continued engagement hereunder is conditional on the Company’s satisfaction

(determined in the Company’s sole discretion) that the Consultant and Rossi have met the legal requirements to perform the Consultant’s

role, including but not limited to satisfactory results of Health Canada or any other applicable security clearance checks and criminal

record checks and other reference checks that the Company performs. The Consultant and Rossi acknowledge and agrees that in signing this

Agreement, and providing the Company with the necessary documentation to perform the checks required for the Consultant’s role

and with references, the Consultant and Rossi are providing consent to the Company or its agent, to performs such checks and contact

the references the Consultant or Rossi provided to the Company.

34.

Prior Restrictions. By signing below, the Consultant and Rossi represent that the Consultant and Rossi are not bound by the terms

of any agreement with any Person which restricts in any way the Consultant’s or Rossi’s engagement by the Company and the

performance of the Consultant’s expected duties; the Consultant and Rossi also represent that, during the Consultant’s engagement

with the Company, the Consultant and Rossi shall not disclose or make use of any confidential information of any other persons or entities

in violation of any of their applicable policies or agreements and/or applicable law.

35.

Independent Legal Counsel. By signing below, the Consultant and Rossi hereby acknowledge that the Consultant and Rossi has been

encouraged to obtain independent legal advice regarding the execution of this Agreement, and that the Consultant and Rossi has either

obtained such advice or voluntarily chosen not to do so, and hereby waives any objections or claims the Consultant or Rossi may make

resulting from any failure on the Consultant’s or Rossi’s part to obtain such advice.

36.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original when executed,

but all of which taken together shall constitute the same Agreement. Delivery of an executed counterpart of a signature page to this

Agreement by electronic transmission, including in portable document format (.pdf), shall be deemed as effective as delivery of an original

executed counterpart of this Agreement.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, this Agreement has been executed by the Parties hereto, as of the date first above written.

| |

WORKSPORT

LTD. |

| |

|

|

| |

By: |

|

| |

Name: |

William

J. Caragol |

| |

Title: |

Chairman

of Compensation Committee |

| |

CONSULTANT: |

| |

|

| |

2230164 ONTARIO INC. |

| |

|

| |

By: |

|

| |

Title: |

President |

| |

Name: |

Steven

Rossi |

| |

|

|

| |

|

| |

Steven Rossi |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |