UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION WASHINGTON, DC 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act

of 1934

For the month of December 2024

Commission File

Number: 001-41709

SEALSQ

CORP

(Exact Name of

Registrant as Specified in Charter)

N/A

(Translation

of Registrant’s name into English)

| British Virgin Islands |

Avenue

Louis-Casaï 58

1216 Cointrin,

Switzerland |

Not Applicable |

| |

|

|

| (State or other jurisdiction of incorporation or organization) |

(Address of principal executive office) |

(I.R.S. Employer Identification No.) |

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form

20-F ☐ Form 40-F

Warrant Inducement Agreement

On December 30, 2024, SEALSQ

Corp (the “Company”) entered into a letter agreement (the “Warrant Inducement Agreement”) with the holders (the

“Investors”) of all of its outstanding warrants in order to provide the Investors with an opportunity to exercise such warrants

to purchase ordinary shares, par value $0.01 per share of the Company (the “Ordinary Shares”), at a reduced exercise price

and to receive additional Ordinary Shares upon exercise of such warrants, in each case prior to the Exercise Date (as defined below).

Under the Warrant Inducement

Agreement, the Company agreed to reduce the exercise price per Ordinary Share issuable upon exercise of a Warrant (“Warrant Share(s)”)

for (i) the July 2023 warrants (the “First Tranche Warrants”) to purchase Warrant Shares, (ii) the January 2024 warrants (the

“Second Tranche Warrants”) to purchase Warrant Shares and (iii) the January 2024 warrants (the “Third Tranche Warrants”

and collectively with the First Tranche Warrants and the Second Tranche Warrants, the “Warrants”) to purchase Warrant Shares,

in each case from $2.00 to $1.65 per Warrant Share payable in cash provided that the Investors exercise the Warrants on or prior to 5:00

p.m. (New York Time) January 3, 2025 (the “Exercise Date”). In addition, in the event that the Warrants are exercised by the

Exercise Date, the number of Warrant Shares issuable upon the exercise of the Warrants shall be increased such that the aggregate exercise

price payable upon the exercise of such Warrants after taking into account the decrease in exercise price of such Warrants shall be equal

to the aggregate exercise price of such Warrants prior to such adjustment. As a result, if the First Tranche Warrants are exercised by the Exercise Date, the number of Warrant Shares issuable will be 4,469,382;

if the Second Tranche Warrants are exercised by the Exercise Date, the number of Warrant Shares issuable will be 3,033,159; if the Third

Tranche Warrants are exercised by the Exercise Date, the number of Warrant Shares issuable will be 2,821,498.

With respect to the purchase

of the Warrant Shares underlying the First Tranche Warrants, if no effective registration statement and current prospectus is available

on or prior to 9:00 a.m. (New York Time) on January 3, 2025, the exercise price of the Warrant Shares underlying the First Tranche Warrants

shall be further reduced to $1.30 per Warrant Share and the number of Warrant Shares issuable upon the exercise of the First Tranche Warrants

shall be further increased such that the aggregate exercise price payable upon the exercise of such First Tranche Warrants after taking

into account the additional decrease in exercise price of such First Tranche Warrants shall be equal to the aggregate exercise price of

such First Tranche Warrants prior to such adjustment.

Under

the Warrant Inducement Agreement, the Company and the Investors agreed to waive the obligations of the Company and the Investors as set

forth in (i) Section 4.19 of the Securities Purchase Agreement, dated as of December 12, 2024, by and among the Company and the Investors,

to close an additional convertible note tranche in an aggregate principal amount of $10.0 million pursuant to that certain securities

purchase agreement, dated July 11, 2023, as amended, by January 16, 2025, and (ii) Section 4.15 in each of the Securities Purchase Agreements,

dated as of December 12, 2024, December 16, 2024 and December 17, 2024, by and among the Company and the Investors.

The offering of Ordinary Shares

to be issued to the Investors upon exercise of the First Tranche Warrants was made pursuant to the Company’s existing shelf registration

statement on Form F-3 (File No. 333-283358), which was declared effective on November 27, 2024 by the U.S. Securities and Exchange Commission

(the “Registration Statement”). A prospectus supplement to the Registration Statement is expected to be filed with the Commission

on or around January 3, 2025.

The Ordinary Shares issuable

upon exercise of the Second Tranche Warrants and the Third Tranche Warrants were registered for resale under the Company’s registration

statement on Form F-1/A (File No. 333-278685) filed on September 12, 2024 and declared effective on September 24, 2024.

The foregoing description

of the Warrant Inducement Agreement is qualified in its entirety by reference to the full text of the Warrant Inducement Agreement, which

is attached to this Report of Foreign Private Issuer on Form 6-K as Exhibit 10.1 and incorporated herein by reference.

The foregoing information

contained in this Report on Form 6-K (this “Report”) and Exhibit 10.1 filed herewith is hereby incorporated by reference in

the Company’s Registration Statement on Form F-3 (File No. 333- 283358) and is deemed to be a part thereof from the date on which

this Report is filed, to the extent not superseded by documents or reports subsequently filed with or furnished to the SEC.

This

Report shall not constitute an offer to sell or a solicitation of an offer to buy any Ordinary Shares, nor shall there be any sale of

Ordinary Shares in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or other jurisdiction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: December 30, 2024 |

SEALSQ CORP |

| |

|

|

| |

By: |

/s/ Carlos Moreira |

| |

Name: |

Carlos Moreira |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

By: |

/s/ John O’Hara |

| |

Name: |

John O’Hara |

| |

Title: |

Chief Financial Officer |

SEALSQ CORP.

Avenue Louis-Casaï 58

1216 Cointrin, Switzerland

December 30, 2024

To the Holders of the July 2023, January 2024

and January 2024 Ordinary Share Purchase Warrants

Re: Inducement Offer to Exercise Existing

Ordinary Share Purchase Warrants

Dear Holder:

SEALSQ Corp. (the “Company”)

is pleased to offer to you the opportunity to exercise (i) the July 2023 warrants (the “First Tranche Warrants”) to

purchase ordinary shares par value $0.01 per share of the Company (the “Ordinary Shares”), (ii) the January 2024 warrants

(the “Second Tranche Warrants”) to purchase Ordinary Shares and (iii) the January 2024 warrants (the “Third

Tranche Warrants” and collectively with the First Tranche Warrants and the Second Tranche Warrants, the “Warrants”)

to purchase Ordinary Shares currently held by you (the “Holder,” and collectively with the other holders of Warrants,

the “Holders”) “you” or similar terminology). The resale by the Holders of the number of Ordinary Shares

underlying the Second Tranche Warrants that each Holder agrees to exercise on terms set forth herein and as set forth on the signature

page hereto is registered pursuant to registration statement on Form F-1 (File No. 333-276877) (the “Second Tranche Registration

Statement”) and the resale by the Holders of the number of Ordinary Shares underlying the Third Tranche Warrants that each Holder

agrees to exercise on terms set forth herein and as set forth on the signature page hereto is registered pursuant to registration statement

on Form F-1 (File No. 333-278685 ) (the “Third Tranche Registration Statement” and collectively with the Second

Tranche Registration Statement, the “Registration Statements”). Each of the Registration Statements is currently effective

and the respective prospectuses contained therein are current and, upon exercise of the Second Tranche Warrants and the Third Tranche

Warrants pursuant to this letter agreement, will be effective and current ( as applicable) for the resale of the Ordinary Shares underlying

the Second Tranche Warrants and the Third Tranche Warrants if sold pursuant thereto.

In consideration for exercising

on or prior to 5:00. p.m. New York, New York Time January 3, 2025, the Warrants held by you and set forth on your signature page hereto

(the “Warrant Exercise”) the exercise price per Ordinary Share issuable upon exercise of a Warrant (a “Warrant

Share”) shall be reduced to $1.65 per Warrant Share payable in cash and the number of Warrant Shares issuable upon the exercise

of such First Tranche Warrants, Second Tranche Warrants and Third Tranche Warrants, shall be increased such that the aggregate exercise

price payable upon the exercise of such Warrants after taking into account the decrease in exercise price of such Warrants agreed hereunder

shall be equal to the aggregate exercise price of such Warrants prior to such adjustment; provided, however, that in the event that no

effective registration statement and current prospectus with respect to the purchase of the Warrant Shares underlying the First Tranche

Warrants is available on or prior to 9:00 a.m. New York, New York Time on January 3, 2025, the exercise price of the Warrant Shares underlying

the First Tranche Warrants shall be further reduced to (and shall thereafter remain at) $1.30 per share and the number of Warrant Shares

issuable upon the exercise of the First Tranche Warrants shall be further increased such that the aggregate exercise price payable upon

the exercise of such First Tranche Warrants after taking into account the additional decrease in exercise price of such First Tranche

Warrants agreed hereunder shall be equal to the aggregate exercise price of such First Tranche Warrants prior to such adjustment. The

Company acknowledges that Annex A is a part of this letter agreement.

Expressly subject to the paragraph

immediately following this paragraph below the Holder may accept this offer by signing this letter below on or before 12:00 p.m. (noon),

New York, New York Time, on December 30, 2024 (the “Execution Time”)., with such acceptance constituting the Holder’s

agreement to exercise in full on or prior to 5:00. p.m. New York, New York Time on January 3, 2025, the Warrants for an aggregate exercise

price set forth on the Holder’s signature page hereto (the “Warrants Exercise Price”).

The Company agrees to the

representations, warranties and covenants set forth on Annex A attached hereto.

The Holder represents and

warrants that, as of the date hereof it is an “accredited investor” as defined in Rule 501 of Regulation D promulgated under

the Securities Act of 1933, as amended (the “Securities Act”).

By execution hereof, the Company

and the Holders agree to waive the obligation of the Company and the Holders set forth in (i) Sections 4.19 of the Securities Purchase

Agreement dated as of December 12, 2024, by and among the Company and the Holders, to close an additional convertible note tranche in

an aggregate principal amount of $10.0 million pursuant to that certain securities purchase agreement, dated July 11, 2023, as amended,

by January 16, 2025, and (ii) 4.15 [capital changes] in each of the Securities Purchase Agreements, dated as of December 12, 2024, December

16, 2024 and December 17, 2024 by and among the Company and the Holders.

If this offer is accepted

and the transaction documents are executed by the Execution Time, then on or before 12:00 p.m. (noon), New York, New York Time, on the

date hereof, the Company shall issue a press release and/or file a Report on Form 6-K with the Securities and Exchange Commission (the

“Commission”) disclosing all material terms of the transactions contemplated hereunder, including attaching this form

of this letter agreement as an exhibit thereto to the Form 6-K with the Commission. From and after the issuance of such press release

or filing of such of such Report on Form 6-K, as applicable, the Company represents to you that it shall have publicly disclosed all material,

non-public information delivered to you by the Company, or any of its respective officers, directors, employees or agents in connection

with the transactions contemplated hereunder. In addition, effective upon the issuance of such press release and/or filing of such Report

on Form 6-K, the Company acknowledges and agrees that any and all confidentiality or similar obligations under any agreement, whether

written or oral, between the Company, any of its Subsidiaries or any of their respective officers, directors, agents, employees or Affiliates

on the one hand, and you and your Affiliates on the other hand, shall terminate. The Company represents, warrants and covenants that,

upon acceptance of this offer, and upon issuance of the Warrant Shares, the Warrant Shares shall be issued free of any legends or restrictions

on resale by Holder.

No later than the earlier

of January 3, 2025 or one trading day after the Holder delivers the exercise notice the closing of each Warrant exercise (each a “Closing”)

shall occur at such location as the parties shall mutually agree. Settlement of the Warrant Shares shall occur via “DWAC” (i.e.,

on the applicable Closing Date, the Company shall issue the Warrant Shares registered in the Holder’s name and address provided

to the Company in writing and released by the Transfer Agent directly to the account(s) identified by the Holders). The date of the Closing

of the exercise of the applicable Warrants shall be referred to as the “Closing Date.”

[Signture Pages to Follow]

| |

SEALSQ CORP. |

| |

|

|

| |

By: |

|

| |

Name: |

Carlos Moreira |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

By: |

|

| |

Name: |

John O’Hara |

| |

Title: |

Chief Financial Officer |

[Holder Signature Page Follows]

[Signature Page to SEALSQ Corp. Inducement

Letter]

Accepted and Agreed to:

Name of Holder: ____________________________________________

Signature of Authorized Signatory of

Holder: __________________________________

Name of Authorized Signatory: _________________________________________

Title of Authorized Signatory: __________________________________________

Number of First Tranche Warrants: ______________________________________

| Number of Second Tranche Warrants |

|

| |

|

|

| Number of Third Tranche Warrants |

|

Aggregate Warrant Exercise Price being exercised

on or prior to January 3, 2025: ___________________________

[Signature Page to SEALSQ Corp. Inducement

Letter]

Annex A

Representations, Warranties and Covenants of

the Company. The Company hereby makes the following representations and warranties to the Holder:

a) SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by

the Company under the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof

(or such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials, including the

exhibits thereto and documents incorporated by reference therein “SEC Reports”). As of their respective dates, the

SEC Reports complied in all material respects with the requirements of the Exchange Act and none of the SEC Reports, when filed, contained

any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make

the statements therein, in the light of the circumstances under which they were made, not misleading except as otherwise noted in a subsequent

SEC Report. The Company has never been an issuer subject to Rule 144(i) under the Securities Act.

b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate

the transactions contemplated by this letter agreement and otherwise to carry out its obligations hereunder. The execution and delivery

of this letter agreement by the Company and the consummation by the Company of the transactions contemplated hereby have been duly authorized

by all necessary action on the part of the Company and no further action is required by the Company, its board of directors or its stockholders

in connection herewith. This letter agreement has been duly executed by the Company and, when delivered in accordance with the terms hereof,

will constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i)

as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general

application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific

performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited

by applicable law.

c) No Conflicts. The execution, delivery and performance of this letter agreement by the Company and the consummation by the

Company of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s

certificate or articles of incorporation, bylaws or other organizational or charter documents; or (ii) conflict with, or constitute a

default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any liens, claims,

security interests, other encumbrances or defects upon any of the properties or assets of the Company in connection with, or give to others

any rights of termination, amendment, acceleration or cancellation ( with or without notice, lapse of time or both) of, any material agreement,

credit facility, debt or other material instrument (evidencing Company debt or otherwise) or other material understanding to which such

Company is a party or by which any property or asset of the Company is bound or affected; or (iii) conflict with or result in a violation

of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which

the Company is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company

is bound or affected, except, in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result

in a material adverse effect upon the business, prospects, properties, operations, condition (financial or otherwise) or results of operations

of the Company, taken as a whole, or in its ability to perform its obligations under this letter agreement.

d) [Reserved].

e) Trading Market. The transactions contemplated under this letter agreement comply with all the rules and regulations of The

Nasdaq Capital Market.

f) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give

any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other

Person in connection with the execution, delivery and performance by the Company of this letter agreement, other than: the filings required

pursuant to this letter agreement.

g) Listing

of Ordinary Shares. The Company will then take all action reasonably necessary to continue the listing and trading of its Ordinary

Shares on the Nasdaq and will comply in all respects with the Company’s reporting, filing and other obligations under the bylaws

or rules of the Nasdaq. The Company agrees to maintain the eligibility of the Ordinary Shares for electronic transfer through the Depository

Trust Company or another established clearing corporation, including, without limitation, by timely payment of fees to the Depository

Trust Company or such other established clearing corporation in connection with such electronic transfer.

2

SEALSQ Announces Strong Year End Financial

Position

Geneva,

Switzerland, Dec. 30, 2024 -- SEALSQ Corp (NASDAQ: LAES) ("SEALSQ" or "Company"), a company that focuses on developing

and selling Semiconductors, PKI and Post-Quantum technology hardware and software products, today announced it expects to end the

year with a strong balance sheet and a cash position which is projected to be in excess of $85 million by January 3, 2025. The Company’s

advancements in post-quantum technology, widely recognized as a key driver of future growth, have positioned SEALSQ as a leader in this

transformative sector.

As part of its strategic initiatives, SEALSQ recently

raised gross proceeds of $60 million through multiple registered direct offerings. This includes a $10 million registered direct offering

announced on December 12, 2024, and an additional $50 million raised through two subsequent registered direct offerings completed in December

2024. As a result, at December 30, 2024, SEALSQ’s total ordinary shares outstanding reached 93.8 million, and its market capitalization

surpassed $700 million.

The net proceeds raised via these transactions

will be used to accelerate the deployment of its post-quantum semiconductor technology and Application-Specific Integrated Circuit (ASIC)

capabilities in the U.S., while also supporting general corporate objectives.

Warrants Cleared and Convertible Facilities

Canceled

The first registered direct offering included

a requirement that the Company enter into a convertible loan for a value of $10 million on or before January 16, 2025. If the Company

failed to do so, the remaining warrants would all reset to an exercise price of $1.30 with an associated increase in the quantity of warrants

to retain the net proceeds.

In order to remove the requirement to enter into

the convertible loan, and to avoid the associated reduction in the warrant exercise price, the Company has today agreed with the holders

of its outstanding warrants to a one-off reduction in exercise price of all outstanding warrants to $1.65 on the condition that all outstanding

warrants are exercised by January 3, 2025 (subject to a potential reduction of the strike price of $1.30 for some of the warrants, in

the event certain regulatory filings are not completed by the Company on or prior to January 3, 2025).

Once this has been completed, SEALSQ will have

successfully fulfilled its outstanding warrant obligations and will no longer be required to enter into the convertible loan facility

noted above. These financial measures are expected to solidify the Company’s balance sheet and support its long-term growth strategy.

Optimized Financial Structure

Legacy financing tools, utilized during the Company’s

growth phase, have been phased out, reflecting SEALSQ’s strengthened financial position. The Company also received formal written

confirmation from The Nasdaq Stock Market, LLC (“Nasdaq”) confirming that it regained compliance with Nasdaq’s minimum

bid price requirement, as announced on December 26, 2024.

The regaining of compliance with Nasdaq’s

minimum bid price requirement is the result of the Company’s closing bid price of the Ordinary Shares being at least $1.00 for at

least 10 consecutive business days prior to January 28, 2025 deadline, as described in the initial notice from Nasdaq received by the

Company on August 1, 2024.

The Company reaffirms its statement from December

19, 2024 that, given the terms of the financings completed in December, it does not currently expect to enter into any further registered

direct offering of ordinary shares for at least 60 days following the December 19, 2024 announcement as a result of the financings raised.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such state or other jurisdiction.

About SEALSQ

SEALSQ is a leading innovator in Post-Quantum

Technology hardware and software solutions. Our technology seamlessly integrates Semiconductors, PKI (Public Key Infrastructure), and

Provisioning Services, with a strategic emphasis on developing state-of-the-art Quantum Resistant Cryptography and Semiconductors designed

to address the urgent security challenges posed by quantum computing. As quantum computers advance, traditional cryptographic methods

like RSA and Elliptic Curve Cryptography (ECC) are increasingly vulnerable.

SEALSQ is pioneering the development of Post-Quantum

Semiconductors that provide robust, future-proof protection for sensitive data across a wide range of applications, including Multi-Factor

Authentication tokens, Smart Energy, Medical and Healthcare Systems, Defense, IT Network Infrastructure, Automotive, and Industrial Automation

and Control Systems. By embedding Post-Quantum Cryptography into our semiconductor solutions, SEALSQ ensures that organizations stay protected

against quantum threats. Our products are engineered to safeguard critical systems, enhancing resilience and security across diverse industries.

For more information on our Post-Quantum Semiconductors

and security solutions, please visit www.sealsq.com.

Forward Looking Statements

This communication expressly or implicitly contains

certain forward-looking statements concerning SEALSQ Corp and its businesses. Forward-looking statements include statements regarding

our business strategy, financial performance, results of operations, market data, events or developments that we expect or anticipates

will occur in the future, as well as any other statements which are not historical facts. Although we believe that the expectations reflected

in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant

uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied

by such forward-looking statements. Important factors that, in our view, could cause actual results to differ materially from those discussed

in the forward-looking statements include the investors’ exercise of the warrants; SEALSQ’s ability to implement its growth

strategies; SEALSQ’s ability to successfully launch post-quantum semiconductor technology; SEALSQ’s ability to capture a share

of the quantum semiconductor market; the growth of the quantum computing market; SEALSQ’s ability to expand its U.S. operations;

SEALSQ’s ability to make additional investments towards the development of a new generation of quantum-ready semiconductors; SEALSQ’s

ability to continue beneficial transactions with material parties, including a limited number of significant customers; market demand

and semiconductor industry conditions; the growth of the quantum computing market; and the risks discussed in SEALSQ’s filings with

the SEC. Risks and uncertainties are further described in reports filed by SEALSQ with the SEC.

SEALSQ Corp is providing this communication as

of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events

or otherwise.

Press and Investor Contacts

SEALSQ Corp

Carlos Moreira

Chairman & CEO

Tel: +41 22 594 3000

info@sealsq.com

SEALSQ Investor Relations (US)

The Equity Group Inc.

Lena Cati

Tel: +1 212 836-9611 / lcati@equityny.com

Katie Murphy

Tel: +212 836-9612 / kmurphy@equityny.com

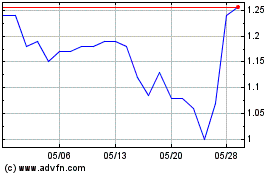

SEALSQ (NASDAQ:LAES)

過去 株価チャート

から 12 2024 まで 1 2025

SEALSQ (NASDAQ:LAES)

過去 株価チャート

から 1 2024 まで 1 2025