HarborOne Bancorp, Inc. (the “Company” or “HarborOne”) (NASDAQ:

HONE), the holding company for HarborOne Bank (the “Bank”),

announced net income of $7.3 million, or $0.18 per diluted share,

for the second quarter of 2024, compared to a net income of $7.3

million, or $0.17 per diluted share for the preceding quarter, and

net income of $7.5 million, or $0.17 per diluted share for the same

period last year. Net income for the six months ended June 30, 2024

was $14.6 million, or $0.35 per diluted share, compared to $14.8

million, or $0.33 per diluted share for the same period in

2023.

Selected Financial Highlights:

- Loan growth of $62.5 million, or 5.2% annualized; client

deposit growth of $66.9 million, or 6.7% annualized.

- Improved asset quality; nonperforming loans as a percentage of

total loans were 0.20% compared to 0.25% last quarter.

- Net interest margin improvement to 2.31% from 2.25% on a

linked-quarter basis.

- Commenced new share repurchase program to repurchase

approximately 5% of outstanding shares over the next year.

- $1.8 million gain on sale of former Bank headquarters,

partially offset by a $1.0 million loss on sale of low-yielding

securities.

“I am pleased with our team’s execution this quarter, producing

19% annualized revenue growth, and improved net interest margin,

through balanced loan and deposit growth,” said Joseph F. Casey,

President and CEO. “Additionally, we improved our already solid

asset quality.”

Net Interest Income Net interest and dividend income was

$31.4 million for the quarter ended June 30, 2024, compared to

$30.6 million for the quarter ended March 31, 2024, and $32.1

million for the quarter ended June 30, 2023. The tax equivalent

interest rate spread and net interest margin were 1.66% and 2.31%,

respectively, for the quarter ended June 30, 2024, compared to

1.62% and 2.25%, respectively, for the quarter ended March 31,

2024, and 1.89% and 2.45%, respectively, for the quarter ended June

30, 2023.

On a linked-quarter basis, the increase in the net interest

margin, interest rate spread and net interest and dividend income

reflects average interest-earning assets increasing $1.6 million

and the yield on interest-earning assets increasing 7 basis points,

while average interest-bearing liabilities decreased $10.9 million

and the cost of those liabilities increased 3 basis points. The

cost of interest-bearing deposits, excluding brokered deposits,

increased 10 basis points, primarily due to certificate of deposit

rollovers at higher rates. Average checking account balances

increased $25.7 million on a linked-quarter basis.

The $750,000 decrease in net interest and dividend income from

the prior year quarter reflects an increase of $7.9 million, or

27.5%, in total interest expense, partially offset by an increase

of $7.2 million, or 11.8%, in total interest and dividend income.

The total cost of funding liabilities increased 53 basis points,

while the average balance increased $199.2 million, and the yield

on interest-earning assets increased 35 basis points, while the

average balance increased $216.7 million.

Noninterest Income Total noninterest income improved $1.2

million, or 11.0%, to $11.9 million for the quarter ended June 30,

2024, from $10.7 million for the quarter ended March 31, 2024.

HarborOne Mortgage, LLC (“HarborOne Mortgage”) capitalized on the

seasonal increase in residential real estate sales, with gain on

loan sales of $3.1 million from mortgage closings of $173.0 million

for the quarter ended June 30, 2024, compared to $2.0 million from

mortgage loan closings of $102.1 million on a linked-quarter basis.

Mortgage loan closings for the quarter ended June 30, 2023 were

$172.2 million with a gain on loan sales of $3.3 million. The

rate-locked pipeline is up $29.0 million on a linked-quarter basis

and up $11.5 million compared to June 30, 2023.

The mortgage servicing rights (“MSR”) valuation declined

$273,000 for the three months ended June 30, 2024, compared to an

increase of $628,000 in the MSR valuation for the three months

ended March 31, 2024. Although key benchmark interest rates used in

the valuation model increased slightly from the prior quarter, the

MSR valuation was negative as a result of model assumption caps.

The impact on the MSR valuation of principal payments on the

underlying mortgages was $545,000 and $353,000 for the quarters

ended June 30, 2024 and March 31, 2024, respectively. During the

first quarter of 2024, HarborOne Mortgage executed an economic

hedge to partially mitigate potential MSR valuation losses in a

declining rate environment. For the three months ended June 30,

2024 and March 31, 2024, the hedging loss was $280,000 and

$221,000, respectively.

Total noninterest income for the quarter ended June 30, 2024

included a $1.8 million gain on the sale-leaseback of the building

that currently houses HarborOne’s Legion Parkway banking center in

downtown Brockton and previously served as the Bank’s headquarters.

The sale-leaseback continues the Company’s longtime commitment to

Brockton, which was made in conjunction with a partnership to

revitalize the downtown area, with plans for a mixed-use property

that includes a lease-back by the Company for a state-of-the-art

HarborOne banking center. The gain was partially offset by $675,000

in contribution expense from the bargain purchase element of the

property sale and a $1.0 million loss on the sale of $17.5 million

of available-for-sale securities with a weighted average book yield

of 2.84%, as we take opportunities to improve the yield on earning

assets. Management utilized the proceeds upon settlement to pay

down wholesale funding carrying a rate of approximately 5.53%.

Total noninterest income decreased $743,000, or 5.9%, compared

to the quarter ended June 30, 2023, primarily due to a $1.6

million, or 27.2%, decrease in mortgage banking income, partially

offset by the gain noted above. The prior year quarter also

reflected a $915,000 million increase in the MSR valuation.

Noninterest Expense Total noninterest expense increased

$1.3 million, or 4.4%, to $33.1 million for the quarter ended June

30, 2024, from $31.8 million for the quarter ended March 31, 2024.

The primary driver was a $1.3 million increase in compensation and

benefits expenses due to both an increase in mortgage bankers

during the quarter, and an increase in mortgage originator’s

commission consistent with the increase in residential real estate

mortgage origination volume. Additionally, marketing expense

increased $552,000, primarily due to the $675,000 contribution

expense noted above.

Total noninterest expense increased $1.4 million, or 4.5%,

compared to the prior year quarter of $31.7 million. The primary

driver was a $756,000 increase in compensation and benefits

expenses due to accruals for incentive expense in the current

period and none in the prior year period.

Asset Quality and Allowance for Credit Losses Total

nonperforming assets were $9.8 million at June 30, 2024, compared

to $12.2 million at March 31, 2024 and $20.2 million at June 30,

2023. Nonperforming assets as a percentage of total assets were

0.17% at June 30, 2024, 0.21% at March 31, 2024, and 0.36% at June

30, 2023. During the second quarter of 2024, a single nonperforming

credit, included in the business-oriented hotel loan segment, with

a carrying value of $1.8 million, was paid-off.

The Company recorded a $615,000 provision for credit losses for

the quarter ended June 30, 2024. The provision for loan credit

losses was $1.1 million, partially offset by a negative provision

of $534,000 for unfunded commitments. For the quarter ended March

31, 2024, a negative provision for credit losses of $168,000 was

recorded, a result of $506,000 negative provision for unfunded

commitments partially offset by a provision for loan credit losses

of $338,000. The Company recorded a provision for credit losses of

$3.3 million for the quarter ended June 30, 2023, driven by a

provision for loan credit losses of $3.5 million and a negative

$215,000 provision for unfunded commitments. Loan credit loss

provisioning primarily reflects replenishment of the allowance for

credit losses (“ACL”) on loans due to charge-offs and loan growth.

The June 30, 2024 ACL estimate also includes annually updated model

assumptions.

Net charge-offs totaled $195,000, or 0.02%, of average loans

outstanding on an annualized basis, for the quarter ended June 30,

2024, $125,000, or 0.01% of average loans outstanding on an

annualized basis, for the quarter ended March 30, 2024, and $2.7

million, or 0.23% of average loans outstanding on an annualized

basis, for the quarter ended June 30, 2023.

The ACL on loans was $49.1 million, or 1.02% of total loans, at

June 30, 2024, compared to $48.2 million, or 1.01% of total loans,

at March 31, 2024 and $47.8 million, or 1.02% of total loans, at

June 30, 2023. The ACL on unfunded commitments, included in other

liabilities on the unaudited Consolidated Balance Sheets, amounted

to $2.9 million at June 30, 2024, compared to $3.4 million at March

31, 2024 and $4.8 million at June 30, 2023.

Management continues to closely monitor the loan portfolio for

signs of deterioration in light of speculation that commercial real

estate values may deteriorate as the market adjusts to higher

vacancies and interest rates. The commercial real estate portfolio

is centered in New England, with approximately 75% of the portfolio

secured by property located in Massachusetts and Rhode Island.

Approximately 60% of the commercial real estate loans are

fixed-rate loans which, in the opinion of management, have limited

near-term maturity risk. As of June 30, 2024 and March 31, 2024,

commercial loans rated “watch” amounted to $87.7 million and $67.9

million, respectively. Loans are rated “watch” at the point when

there are signs of potential weakness. Management performs

comprehensive reviews and works proactively with creditworthy

borrowers facing financial distress and implements prudent workouts

and accommodations to improve the Bank’s prospects of contractual

repayment.

Three sub-sectors that management identified as potentially more

susceptible to weakness includes business-oriented hotels,

non-anchored retail space, and metro office space. As of June 30,

2024, business-oriented hotels loans included 12 loans with a total

outstanding balance of $119.7 million, non-anchored retail space

loans included 29 loans with a total outstanding balance of $48.6

million, and metro office space loans included one loan with a

total outstanding balance of $6.2 million. All of the loans in

these groups were performing in accordance with their terms.

Balance Sheet Total assets decreased $75.2 million, or

1.3%, to $5.79 billion at June 30, 2024, from $5.86 billion at

March 31, 2024. The linked-quarter decrease primarily reflects a

decrease in cash and cash equivalents, partially offset by loan

growth.

Available-for-sale securities decreased $21.9 million to $269.1

million at June 30, 2024 from $291.0 million at March 31, 2024 due

to the sale noted above. The unrealized loss on securities

available for sale decreased to $65.3 million as of June 30, 2024,

as compared to $67.0 million of unrealized losses as of March 31,

2024. Securities held to maturity were flat at $19.7 million, or

0.3% of total assets, at June 30, 2024.

Loans increased $62.5 million, or 1.3%, to $4.84 billion at June

30, 2024, from $4.78 billion at March 31, 2024. The linked-quarter

increase was primarily due to increases in commercial and

industrial loans of $27.8 million, commercial real estate loans of

$25.2 million, and $11.0 million of residential mortgage loans.

Total deposits increased $64.3 million to $4.46 billion at June

30, 2024 from $4.39 billion at March 31, 2024. Compared to the

prior quarter, non-certificate accounts decreased $66.0 million and

term certificate accounts increased $133.0 million, as a

competitive rate environment continued to pressure deposit mix and

rates. Brokered deposits decreased $2.7 million. As of June 30,

2024, FDIC-insured deposits were approximately 76% of total

deposits, including Bank subsidiary deposits.

Borrowed funds decreased $135.0 million to $619.4 million at

June 30, 2024 from $754.4 million at March 31, 2024, as excess

liquidity was used to paydown high rate borrowings. As of June 30,

2024, the Bank had $1.16 billion in available borrowing capacity

across multiple relationships.

Total stockholders’ equity was $577.3 million at June 30, 2024,

compared to $577.7 million at March 31, 2024. Stockholders’ equity

decreased 0.1% when compared to the prior quarter, as net income

was offset by share repurchases and dividends. The Company

continues to implement and execute share repurchase programs,

repurchasing 1,230,353 shares at an average price of $10.37,

including $0.10 per share of excise tax, during the six months

ended June 30, 2024. The tangible-common-equity-to-tangible-assets

ratio(1) was 9.03% at June 30, 2024, 8.92% at March 31, 2024, and

9.38% at June 30, 2023. At June 30, 2024, the Company and the Bank

had strong capital positions, exceeding all regulatory capital

requirements, and are considered well-capitalized.

(1) This non-GAAP ratio is total

stockholders’ equity less goodwill and intangible assets to total

assets less goodwill and intangible assets.

About HarborOne Bancorp, Inc. HarborOne Bancorp, Inc. is

the holding company for HarborOne Bank, a Massachusetts-chartered

trust company. HarborOne Bank serves the financial needs of

consumers, businesses, and municipalities throughout Eastern

Massachusetts and Rhode Island through a network of 30 full-service

banking centers located in Massachusetts and Rhode Island, and

commercial lending offices in Boston, Massachusetts and Providence,

Rhode Island. HarborOne Bank also provides a range of educational

resources through “HarborOne U,” with free digital content,

webinars, and recordings for small business and personal financial

education. HarborOne Mortgage, LLC, a subsidiary of HarborOne Bank,

provides mortgage lending services throughout New England and other

states.

Forward Looking Statements Certain statements herein

constitute forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Exchange Act and are intended to be covered by the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

We may also make forward-looking statements in other documents we

file with the Securities and Exchange Commission (“SEC”), in our

annual reports to shareholders, in press releases and other written

materials, and in oral statements made by our officers, directors

or employees. Such statements may be identified by words such as

“believes,” “will,” “would,” “expects,” “project,” “may,” “could,”

“developments,” “strategic,” “launching,” “opportunities,”

“anticipates,” “estimates,” “intends,” “plans,” “targets” and

similar expressions. These statements are based upon the current

beliefs and expectations of the Company’s management and are

subject to significant risks and uncertainties. Actual results may

differ materially from those set forth in the forward-looking

statements as a result of numerous factors. Factors that could

cause such differences to exist include, but are not limited to,

changes in general business and economic conditions (including

inflation and concerns about inflation) on a national basis and in

the local markets in which the Company operates, including changes

that adversely affect borrowers’ ability to service and repay the

Company’s loans; changes in interest rates; changes in customer

behavior; ongoing turbulence in the capital and debt markets and

the impact of such conditions on the Company’s business activities;

increases in loan default and charge-off rates; decreases in the

value of securities in the Company’s investment portfolio;

fluctuations in real estate values; the possibility that future

credit losses may be higher than currently expected due to changes

in economic assumptions, customer behavior or adverse economic

developments; the adequacy of loan loss reserves; decreases in

deposit levels necessitating increased borrowing to fund loans and

investments; competitive pressures from other financial

institutions; cybersecurity incidents, fraud, natural disasters,

war, terrorism, civil unrest, and future pandemics; changes in

regulation; changes in accounting standards and practices; the risk

that goodwill and intangibles recorded in the Company’s financial

statements will become impaired; demand for loans in the Company’s

market area; the Company’s ability to attract and maintain

deposits; risks related to the implementation of acquisitions,

dispositions, and restructurings; the risk that the Company may not

be successful in the implementation of its business strategy;

changes in assumptions used in making such forward-looking

statements and the risk factors described in the Annual Report on

Form 10‑K and Quarterly Reports on Form 10‑Q as filed with the SEC,

which are available at the SEC’s website, www.sec.gov. Should one

or more of these risks materialize or should underlying beliefs or

assumptions prove incorrect, HarborOne’s actual results could

differ materially from those discussed. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this release. The Company disclaims

any obligation to publicly update or revise any forward-looking

statements to reflect changes in underlying assumptions or factors,

new information, future events or other changes, except as required

by law.

Use of Non-GAAP Measures In addition to results presented

in accordance with generally accepted accounting principles

(“GAAP”), this press release contains certain non-GAAP financial

measures. The Company’s management believes that the supplemental

non-GAAP information, which consists of income statement results

excluding the goodwill impairment charge, total adjusted

noninterest expense excluding the goodwill impairment charge,

diluted earnings per share excluding the goodwill impairment

charge, return on average assets (ROAA), excluding the goodwill

impairment charge, return on average equity (ROAE), excluding

goodwill impairment charge, the efficiency ratio, efficiency ratio

excluding the goodwill impairment charge,

tangible-common-equity-to-tangible-assets ratio and tangible book

value per share, are utilized by regulators and market analysts to

evaluate a company’s financial condition and therefore, such

information is useful to investors. These disclosures should not be

viewed as a substitute for financial results determined in

accordance with GAAP, nor are they necessarily comparable to

non-GAAP performance measures which may be presented by other

companies. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial

measures with other companies’ non-GAAP financial measures having

the same or similar names.

HarborOne Bancorp,

Inc.

Consolidated Balance Sheet

Trend

(Unaudited)

June 30,

March 31,

December 31,

September 30,

June 30,

(in thousands)

2024

2024

2023

2023

2023

Assets

Cash and due from banks

$

48,097

$

36,340

$

38,876

$

38,573

$

43,525

Short-term investments

186,965

357,101

188,474

208,211

209,326

Total cash and cash equivalents

235,062

393,441

227,350

246,784

252,851

Securities available for sale, at fair

value

269,078

291,008

290,151

271,078

292,012

Securities held to maturity, at amortized

cost

19,725

19,724

19,796

19,795

19,839

Federal Home Loan Bank stock, at cost

25,311

26,565

27,098

23,378

27,123

Asset held for sale

—

348

348

966

966

Loans held for sale, at fair value

41,814

16,434

19,686

17,796

20,949

Loans:

Commercial real estate

2,380,881

2,355,672

2,343,675

2,349,886

2,286,688

Commercial construction

233,926

234,811

208,443

191,224

228,902

Commercial and industrial

499,043

471,215

466,443

450,547

453,422

Total commercial loans

3,113,850

3,061,698

3,018,561

2,991,657

2,969,012

Residential real estate

1,706,678

1,695,686

1,709,714

1,706,950

1,701,766

Consumer

18,704

19,301

22,036

24,247

27,425

Loans

4,839,232

4,776,685

4,750,311

4,722,854

4,698,203

Less: Allowance for credit losses on

loans

(49,139

)

(48,185

)

(47,972

)

(48,312

)

(47,821

)

Net loans

4,790,093

4,728,500

4,702,339

4,674,542

4,650,382

Mortgage servicing rights, at fair

value

46,209

46,597

46,111

49,201

48,176

Goodwill

59,042

59,042

59,042

69,802

69,802

Other intangible assets

1,136

1,326

1,515

1,704

1,893

Other assets

299,565

279,237

274,460

289,341

275,261

Total assets

$

5,787,035

$

5,862,222

$

5,667,896

$

5,664,387

$

5,659,254

Liabilities and Stockholders'

Equity

Deposits:

Demand deposit accounts

$

689,800

$

677,152

$

659,973

$

708,847

$

717,572

NOW accounts

308,016

305,071

305,825

289,141

286,956

Regular savings and club accounts

989,720

1,110,404

1,265,315

1,324,635

1,390,906

Money market deposit accounts

1,100,215

1,061,145

966,201

951,128

834,120

Term certificate accounts

985,293

852,326

863,457

859,266

742,931

Brokered deposits

385,253

387,926

326,638

276,941

315,003

Total deposits

4,458,297

4,394,024

4,387,409

4,409,958

4,287,488

Borrowings

619,372

754,380

568,462

475,470

604,568

Subordinated debt

—

—

—

34,380

34,348

Other liabilities and accrued expenses

132,037

136,135

128,266

159,945

137,318

Total liabilities

5,209,706

5,284,539

5,084,137

5,079,753

5,063,722

Common stock

598

598

598

597

597

Additional paid-in capital

487,980

487,277

486,502

485,144

484,544

Unearned compensation - ESOP

(24,866

)

(25,326

)

(25,785

)

(26,245

)

(26,704

)

Retained earnings

367,584

363,591

359,656

369,930

364,709

Treasury stock

(205,944

)

(199,853

)

(193,590

)

(187,803

)

(181,324

)

Accumulated other comprehensive loss

(48,023

)

(48,604

)

(43,622

)

(56,989

)

(46,290

)

Total stockholders' equity

577,329

577,683

583,759

584,634

595,532

Total liabilities and stockholders'

equity

$

5,787,035

$

5,862,222

$

5,667,896

$

5,664,387

$

5,659,254

HarborOne Bancorp,

Inc.

Consolidated Statements of Net

Income - Trend

(Unaudited)

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

(in thousands, except share data)

2024

2024

2023

2023

2023

Interest and dividend income:

Interest and fees on loans

$

61,512

$

59,937

$

59,499

$

58,124

$

55,504

Interest on loans held for sale

347

243

369

370

326

Interest on securities

2,121

2,065

2,001

2,003

2,035

Other interest and dividend income

3,971

4,659

2,516

2,667

2,935

Total interest and dividend income

67,951

66,904

64,385

63,164

60,800

Interest expense:

Interest on deposits

27,272

26,899

27,310

25,039

20,062

Interest on borrowings

9,329

9,423

6,260

6,439

8,114

Interest on subordinated debentures

—

—

1,122

606

524

Total interest expense

36,601

36,322

34,692

32,084

28,700

Net interest and dividend income

31,350

30,582

29,693

31,080

32,100

Provision (benefit) for credit losses

615

(168

)

644

(113

)

3,283

Net interest and dividend income, after

provision for credit losses

30,735

30,750

29,049

31,193

28,817

Noninterest income:

Mortgage banking income:

Gain on sale of mortgage loans

3,143

2,013

2,176

2,704

3,300

Changes in mortgage servicing rights fair

value

(1,098

)

54

(3,553

)

125

436

Other

2,356

2,276

2,301

2,270

2,312

Total mortgage banking income

4,401

4,343

924

5,099

6,048

Deposit account fees

5,223

4,983

5,178

5,133

5,012

Income on retirement plan annuities

141

145

147

146

128

Gain on sale of asset held for sale

1,809

—

—

—

—

Loss on sale of securities

(1,041

)

—

—

—

—

Bank-owned life insurance income

758

746

1,207

531

511

Other income

628

524

1,448

689

963

Total noninterest income

11,919

10,741

8,904

11,598

12,662

Noninterest expenses:

Compensation and benefits

18,976

17,636

19,199

18,699

18,220

Occupancy and equipment

4,636

4,781

4,670

4,430

4,633

Data processing

2,375

2,479

2,474

2,548

2,403

Loan expense (income)

461

371

(317

)

385

417

Marketing

1,368

816

811

794

925

Professional fees

1,236

1,457

1,690

1,374

1,114

Deposit insurance

993

1,164

795

1,004

1,176

Goodwill impairment

—

—

10,760

—

—

Other expenses

3,099

3,046

3,132

2,638

2,837

Total noninterest expenses

33,144

31,750

43,214

31,872

31,725

Income (loss) before income taxes

9,510

9,741

(5,261

)

10,919

9,754

Income tax provision

2,214

2,441

1,850

2,507

2,275

Net income (loss)

$

7,296

$

7,300

$

(7,111

)

$

8,412

$

7,479

Earnings (losses) per common share:

Basic

$

0.18

$

0.17

$

(0.17

)

$

0.20

$

0.17

Diluted

$

0.18

$

0.17

$

(0.17

)

$

0.20

$

0.17

Weighted average shares outstanding:

Basic

41,293,787

41,912,421

42,111,872

42,876,893

43,063,507

Diluted

41,370,289

42,127,037

42,299,858

42,983,477

43,133,455

HarborOne Bancorp,

Inc.

Consolidated Statements of Net

Income - Trend

(Unaudited)

For the Six Months Ended June

30,

(dollars in thousands, except share

data)

2024

2023

$ Change

% Change

Interest and dividend income:

Interest and fees on loans

$

121,449

$

108,275

$

13,174

12.2

%

Interest on loans held for sale

590

612

(22

)

(3.6

)

Interest on securities

4,186

4,114

72

1.8

Other interest and dividend income

8,630

3,738

4,892

130.9

Total interest and dividend income

134,855

116,739

18,116

15.5

Interest expense:

Interest on deposits

54,171

35,975

18,196

50.6

Interest on borrowings

18,752

13,219

5,533

41.9

Interest on subordinated debentures

—

1,047

(1,047

)

(100.0

)

Total interest expense

72,923

50,241

22,682

45.1

Net interest and dividend income

61,932

66,498

(4,566

)

(6.9

)

Provision for credit losses

447

5,149

(4,702

)

(91.3

)

Net interest and dividend income, after

provision for credit losses

61,485

61,349

136

0.2

Noninterest income:

Mortgage banking income:

Gain on sale of mortgage loans

5,156

5,524

(368

)

(6.7

)

Changes in mortgage servicing rights fair

value

(1,044

)

(1,256

)

212

16.9

Other

4,632

4,528

104

2.3

Total mortgage banking income

8,744

8,796

(52

)

(0.6

)

Deposit account fees

10,206

9,745

461

4.7

Income on retirement plan annuities

286

247

39

15.8

Gain on sale of asset held for sale

1,809

—

1,809

100.0

Loss on sale of securities

(1,041

)

—

(1,041

)

(100.0

)

Bank-owned life insurance income

1,504

1,011

493

48.8

Other income

1,152

1,553

(401

)

(25.8

)

Total noninterest income

22,660

21,352

1,308

6.1

Noninterest expenses:

Compensation and benefits

36,612

36,019

593

1.6

Occupancy and equipment

9,417

9,673

(256

)

(2.6

)

Data processing

4,854

4,749

105

2.2

Loan expense

832

730

102

14.0

Marketing

2,184

2,106

78

3.7

Professional fees

2,693

2,615

78

3.0

Deposit insurance

2,157

1,686

471

27.9

Other expenses

6,145

5,656

489

8.6

Total noninterest expenses

64,894

63,234

1,660

2.6

Income before income taxes

19,251

19,467

(216

)

(1.1

)

Income tax provision

4,655

4,691

(36

)

(0.8

)

Net income

$

14,596

$

14,776

$

(180

)

(1.2

)%

Earnings per common share:

Basic

$

0.35

$

0.34

Diluted

$

0.35

$

0.33

Weighted average shares outstanding:

Basic

41,603,104

43,955,411

Diluted

41,748,663

44,203,893

HarborOne Bancorp,

Inc.

Average Balances and Yield

Trend

(Unaudited)

Quarters Ended

June 30, 2024

March 31, 2024

June 30, 2023

Average

Average

Average

Outstanding

Yield/

Outstanding

Yield/

Outstanding

Yield/

Balance

Interest

Cost (8)

Balance

Interest

Cost (8)

Balance

Interest

Cost (8)

(dollars in thousands)

Interest-earning assets:

Investment securities (1)

$

374,730

$

2,121

2.28

%

$

372,787

$

2,065

2.23

%

$

381,762

$

2,035

2.14

%

Other interest-earning assets

306,361

3,971

5.21

356,470

4,659

5.26

238,891

2,935

4.93

Loans held for sale

20,775

347

6.72

14,260

243

6.85

19,614

326

6.67

Loans

Commercial loans (2)(3)

3,091,004

43,023

5.60

3,040,835

41,653

5.51

2,938,292

38,842

5.30

Residential real estate loans (3)(4)

1,695,059

18,393

4.36

1,700,694

18,175

4.30

1,682,860

16,456

3.92

Consumer loans (3)

19,221

352

7.37

20,539

358

7.01

29,025

419

5.79

Total loans

4,805,284

61,768

5.17

4,762,068

60,186

5.08

4,650,177

55,717

4.81

Total interest-earning assets

5,507,150

68,207

4.98

5,505,585

67,153

4.91

5,290,444

61,013

4.63

Noninterest-earning assets

300,847

299,153

305,132

Total assets

$

5,807,997

$

5,804,738

$

5,595,576

Interest-bearing liabilities:

Savings accounts

$

1,058,524

4,305

1.64

$

1,186,201

5,523

1.87

$

1,421,622

6,165

1.74

NOW accounts

299,536

88

0.12

289,902

75

0.10

280,501

59

0.08

Money market accounts

1,069,153

10,186

3.83

994,353

9,313

3.77

802,373

6,256

3.13

Certificates of deposit

931,255

9,946

4.30

855,070

8,554

4.02

708,087

5,273

2.99

Brokered deposits

300,385

2,747

3.68

356,459

3,434

3.87

281,614

2,309

3.29

Total interest-bearing deposits

3,658,853

27,272

3.00

3,681,985

26,899

2.94

3,494,197

20,062

2.30

Borrowings

776,852

9,329

4.83

764,623

9,423

4.96

666,345

8,114

4.88

Subordinated debentures

—

—

—

—

—

—

34,331

524

6.12

Total borrowings

776,852

9,329

4.83

764,623

9,423

4.96

700,676

8,638

4.94

Total interest-bearing liabilities

4,435,705

36,601

3.32

4,446,608

36,322

3.29

4,194,873

28,700

2.74

Noninterest-bearing

liabilities:

Noninterest-bearing deposits

670,494

654,436

712,081

Other noninterest-bearing liabilities

126,477

119,289

88,363

Total liabilities

5,232,676

5,220,333

4,995,317

Total stockholders' equity

575,321

584,405

600,259

Total liabilities and stockholders'

equity

$

5,807,997

$

5,804,738

$

5,595,576

Tax equivalent net interest income

31,606

30,831

32,313

Tax equivalent interest rate spread

(5)

1.66

%

1.62

%

1.89

%

Less: tax equivalent adjustment

256

249

213

Net interest income as reported

$

31,350

$

30,582

$

32,100

Net interest-earning assets (6)

$

1,071,445

$

1,058,977

$

1,095,571

Net interest margin (7)

2.29

%

2.23

%

2.43

%

Tax equivalent effect

0.02

0.02

0.02

Net interest margin on a fully tax

equivalent basis

2.31

%

2.25

%

2.45

%

Ratio of interest-earning assets to

interest-bearing liabilities

124.16

%

123.82

%

126.12

%

Supplemental information:

Total deposits, including demand

deposits

$

4,329,347

$

27,272

$

4,336,421

$

26,899

$

4,206,278

$

20,062

Cost of total deposits

2.53

%

2.49

%

1.91

%

Total funding liabilities, including

demand deposits

$

5,106,199

$

36,601

$

5,101,044

$

36,322

$

4,906,954

$

28,700

Cost of total funding liabilities

2.88

%

2.86

%

2.35

%

(1) Includes securities available for sale

and securities held to maturity.

(2) Tax-exempt income on industrial

revenue bonds is included in commercial loans on a tax-equivalent

basis.

(3) Includes nonaccruing loan balances and

interest received on such loans.

(4) Includes the basis adjustments of

certain loans included in fair value hedging relationships.

(5) Net interest rate spread represents

the difference between the yield on average interest-earning assets

and the cost of average interest-bearing liabilities.

(6) Net interest-earning assets represents

total interest-earning assets less total interest-bearing

liabilities.

(7) Net interest margin represents net

interest income divided by average total interest-earning

assets.

(8) Annualized

HarborOne Bancorp,

Inc.

Average Balances and Yield

Trend

(Unaudited)

For the Six Months

Ended

June 30, 2024

June 30, 2023

Average

Average

Outstanding

Yield/

Outstanding

Yield/

Balance

Interest

Cost (8)

Balance

Interest

Cost (8)

(dollars in thousands)

Interest-earning assets:

Investment securities (1)

$

373,758

$

4,186

2.25

%

$

384,517

$

4,114

2.16

%

Other interest-earning assets

331,416

8,630

5.24

151,644

3,738

4.97

Loans held for sale

17,517

590

6.77

18,865

612

6.54

Loans

Commercial loans (2)(3)

3,065,921

84,675

5.55

2,919,980

75,679

5.23

Residential real estate loans (3)(4)

1,697,878

36,568

4.33

1,665,083

32,072

3.88

Consumer loans (3)

19,879

711

7.19

32,647

938

5.79

Total loans

4,783,678

121,954

5.13

4,617,710

108,689

4.75

Total interest-earning assets

5,506,369

135,360

4.94

5,172,736

117,153

4.57

Noninterest-earning assets

299,999

309,198

Total assets

$

5,806,368

$

5,481,934

Interest-bearing liabilities:

Savings accounts

$

1,122,362

9,827

1.76

$

1,440,403

11,610

1.63

NOW accounts

294,719

163

0.11

278,164

95

0.07

Money market accounts

1,031,753

19,499

3.80

813,472

11,494

2.85

Certificates of deposit

893,162

18,501

4.17

630,791

7,958

2.54

Brokered deposits

328,422

6,181

3.78

305,885

4,818

3.18

Total interest-bearing deposits

3,670,418

54,171

2.97

3,468,715

35,975

2.09

FHLB and FRB borrowings

770,738

18,752

4.89

557,823

13,219

4.78

Subordinated debentures

—

—

—

34,315

1,047

6.15

Total borrowings

770,738

18,752

4.89

592,138

14,266

4.86

Total interest-bearing liabilities

4,441,156

72,923

3.30

4,060,853

50,241

2.49

Noninterest-bearing

liabilities:

Noninterest-bearing deposits

662,465

716,782

Other noninterest-bearing liabilities

122,884

95,054

Total liabilities

5,226,505

4,872,689

Total stockholders' equity

579,863

609,245

Total liabilities and stockholders'

equity

$

5,806,368

$

5,481,934

Tax equivalent net interest income

62,437

66,912

Tax equivalent interest rate spread

(5)

1.64

%

2.07

%

Less: tax equivalent adjustment

505

414

Net interest income as reported

$

61,932

$

66,498

Net interest-earning assets (6)

$

1,065,213

$

1,111,883

Net interest margin (7)

2.26

%

2.59

%

Tax equivalent effect

0.02

0.02

Net interest margin on a fully tax

equivalent basis

2.28

%

2.61

%

Ratio of interest-earning assets to

interest-bearing liabilities

123.99

%

127.38

%

Supplemental information:

Total deposits, including demand

deposits

$

4,332,883

$

54,171

$

4,185,497

$

35,975

Cost of total deposits

2.51

%

1.73

%

Total funding liabilities, including

demand deposits

$

5,103,621

$

72,923

$

4,777,635

$

50,241

Cost of total funding liabilities

2.87

%

2.12

%

Tax-exempt income on industrial revenue

bonds is included in commercial loans on a tax-equivalent

basis.

(1) Includes securities available for sale

and securities held to maturity.

(2) Tax-exempt income on industrial

revenue bonds is included in commercial loans on a tax-equivalent

basis.

(3) Includes nonaccruing loan balances and

interest received on such loans.

(4) Includes the basis adjustments of

certain loans included in fair value hedging relationships.

(5) Net interest rate spread represents

the difference between the yield on average interest-earning assets

and the cost of average interest-bearing liabilities.

(6) Net interest-earning assets represents

total interest-earning assets less total interest-bearing

liabilities.

(7) Net interest margin represents net

interest income divided by average total interest-earning

assets.

(8) Annualized.

HarborOne Bancorp,

Inc.

Average Balances and Yield

Trend

(Unaudited)

Average Balances - Trend -

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

2024

2024

2023

2023

2023

(in thousands)

Interest-earning assets:

Investment securities (1)

$

374,730

$

372,787

$

370,683

$

375,779

$

381,762

Other interest-earning assets

306,361

356,470

205,929

207,234

238,891

Loans held for sale

20,775

14,260

20,010

20,919

19,614

Loans

Commercial loans (2)(3)

3,091,004

3,040,835

3,005,840

2,980,817

2,938,292

Residential real estate loans (3)(4)

1,695,059

1,700,694

1,707,978

1,700,383

1,682,860

Consumer loans (3)

19,221

20,539

22,324

25,126

29,025

Total loans

4,805,284

4,762,068

4,736,142

4,706,326

4,650,177

Total interest-earning assets

5,507,150

5,505,585

5,332,764

5,310,258

5,290,444

Noninterest-earning assets

300,847

299,153

313,729

314,030

305,132

Total assets

$

5,807,997

$

5,804,738

$

5,646,493

$

5,624,288

$

5,595,576

Interest-bearing liabilities:

Savings accounts

$

1,058,524

$

1,186,201

$

1,307,774

$

1,360,728

$

1,421,622

NOW accounts

299,536

289,902

290,147

274,329

280,501

Money market accounts

1,069,153

994,353

963,223

910,694

802,373

Certificates of deposit

931,255

855,070

859,274

818,182

708,087

Brokered deposits

300,385

356,459

288,449

287,428

281,614

Total interest-bearing deposits

3,658,853

3,681,985

3,708,867

3,651,361

3,494,197

Borrowings

776,852

764,623

507,520

508,001

666,345

Subordinated debentures

—

—

22,614

34,364

34,331

Total borrowings

776,852

764,623

530,134

542,365

700,676

Total interest-bearing liabilities

4,435,705

4,446,608

4,239,001

4,193,726

4,194,873

Noninterest-bearing

liabilities:

Noninterest-bearing deposits

670,494

654,436

683,548

705,009

712,081

Other noninterest-bearing liabilities

126,477

119,289

137,239

126,742

88,363

Total liabilities

5,232,676

5,220,333

5,059,788

5,025,477

4,995,317

Total stockholders' equity

575,321

584,405

586,705

598,811

600,259

Total liabilities and stockholders'

equity

$

5,807,997

$

5,804,738

$

5,646,493

$

5,624,288

$

5,595,576

Annualized Yield Trend -

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

2024

2024

2023

2023

2023

Interest-earning assets:

Investment securities (1)

2.28

%

2.23

%

2.14

%

2.11

%

2.14

%

Other interest-earning assets

5.21

%

5.26

%

4.85

%

5.11

%

4.93

%

Loans held for sale

6.72

%

6.85

%

7.32

%

7.02

%

6.67

%

Commercial loans (2)(3)

5.60

%

5.51

%

5.45

%

5.38

%

5.30

%

Residential real estate loans (3)(4)

4.36

%

4.30

%

4.21

%

4.09

%

3.92

%

Consumer loans (3)

7.37

%

7.01

%

6.82

%

6.51

%

5.79

%

Total loans

5.17

%

5.08

%

5.01

%

4.92

%

4.81

%

Total interest-earning assets

4.98

%

4.91

%

4.81

%

4.74

%

4.63

%

Interest-bearing liabilities:

Savings accounts

1.64

%

1.87

%

2.09

%

1.98

%

1.74

%

NOW accounts

0.12

%

0.10

%

0.17

%

0.11

%

0.08

%

Money market accounts

3.83

%

3.77

%

3.83

%

3.64

%

3.13

%

Certificates of deposit

4.30

%

4.02

%

3.85

%

3.50

%

2.99

%

Brokered deposits

3.68

%

3.87

%

3.71

%

3.60

%

3.29

%

Total interest-bearing deposits

3.00

%

2.94

%

2.92

%

2.72

%

2.30

%

Borrowings

4.83

%

4.96

%

4.89

%

5.03

%

4.88

%

Subordinated debentures

—

%

—

%

19.68

%

7.00

%

6.12

%

Total borrowings

4.83

%

4.96

%

5.52

%

5.15

%

4.94

%

Total interest-bearing liabilities

3.32

%

3.29

%

3.25

%

3.04

%

2.74

%

(1) Includes securities available for sale

and securities held to maturity.

(2) Tax-exempt income on industrial

revenue bonds is included in commercial loans on a tax-equivalent

basis.

(3) Includes nonaccruing loan balances and

interest received on such loans.

(4) Includes the basis adjustments of

certain loans included in fair value hedging relationships.

HarborOne Bancorp,

Inc.

Selected Financial

Highlights

(Unaudited)

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

Performance Ratios

(annualized):

2024

2024

2023

2023

2023

(dollars in thousands)

Net income (loss)

$

7,296

$

7,300

$

(7,111)

$

8,411

$

7,450

Less: Goodwill impairment charge

—

—

10,760

—

—

Net income, excluding goodwill impairment

charge(1)

$

7,296

$

7,300

$

3,649

$

8,411

$

7,450

Average Assets

$

5,807,997

$

5,804,738

$

5,646,493

$

5,624,288

$

5,595,576

Average Equity

$

575,321

$

584,405

$

586,705

$

598,811

$

600,258

Return on average assets (ROAA)

0.50

%

0.50

%

(0.50)

%

0.60

%

0.54

%

Return on average assets (ROAA), excluding

goodwill impairment charge(2)

0.50

%

0.50

%

0.26

%

0.60

%

0.54

%

Return on average equity (ROAE)

5.07

%

5.00

%

(4.85)

%

5.62

%

4.98

%

Return on average equity (ROAE), excluding

goodwill impairment charge(3)

5.07

%

5.00

%

2.49

%

5.62

%

4.98

%

Total noninterest expense

$

33,144

$

31,750

$

43,214

$

31,872

$

31,725

Less: Amortization of other intangible

assets

189

189

189

189

189

Total adjusted noninterest expense

32,955

31,561

43,025

31,683

31,536

Less: Goodwill impairment charge

—

—

10,760

—

—

Total adjusted noninterest expense,

excluding goodwill impairment(4)

$

32,955

$

31,561

$

32,265

$

31,683

$

31,536

Net interest and dividend income

$

31,350

$

30,582

$

29,693

$

31,080

$

32,100

Total noninterest income

11,919

10,741

8,904

11,598

12,662

Total revenue

$

43,269

$

41,323

$

38,597

$

42,678

$

44,762

Efficiency ratio (5)

76.16

%

76.38

%

111.47

%

74.24

%

70.45

%

Efficiency ratio, excluding goodwill

impairment charge(6)

76.16

%

76.38

%

83.59

%

74.24

%

70.45

%

(1) This non-GAAP measure represents net

income, excluding goodwill impairment charge

(2) This non-GAAP measure represents net

income, excluding goodwill impairment charge to average assets

(3) This non-GAAP measure represents net

income, excluding goodwill impairment charge to average equity

(4) This non-GAAP measure represents

adjusted noninterest expense, excluding goodwill impairment

charge

(5) This non-GAAP measure represents

adjusted noninterest expense divided by total revenue

(6) This non-GAAP measure represents

adjusted noninterest expense, excluding goodwill impairment divided

by total revenue

At or for the Quarters

Ended

June 30,

March 31,

December 31,

September 30,

June 30,

Asset Quality

2024

2024

2023

2023

2023

(dollars in thousands)

Total nonperforming assets

$

9,766

$

12,201

$

17,582

$

18,795

$

20,234

Nonperforming assets to total assets

0.17

%

0.21

%

0.31

%

0.33

%

0.36

%

Allowance for credit losses on loans to

total loans

1.02

%

1.01

%

1.01

%

1.02

%

1.02

%

Net charge-offs (recoveries)

$

195

$

125

$

1,311

$

(18

)

$

2,671

Annualized net charge-offs

(recoveries)/average loans

0.02

%

0.01

%

0.11

%

—

%

0.23

%

Allowance for credit losses on loans to

nonperforming loans

503.18

%

396.27

%

273.92

%

257.21

%

236.62

%

HarborOne Bancorp,

Inc.

Selected Financial

Highlights

(Unaudited)

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

Capital and Share Related

2024

2024

2023

2023

2023

(dollars in thousands, except share

data)

Common stock outstanding

44,459,490

45,055,006

45,401,224

45,915,364

46,575,478

Book value per share

$

12.99

$

12.82

$

12.86

$

12.73

$

12.79

Tangible common equity:

Total stockholders' equity

$

577,329

$

577,683

$

583,759

$

584,634

$

595,532

Less: Goodwill

59,042

59,042

59,042

69,802

69,802

Less: Other intangible assets (1)

1,136

1,326

1,515

1,704

1,893

Tangible common equity

$

517,151

$

517,315

$

523,202

$

513,128

$

523,837

Tangible book value per share (2)

$

11.63

$

11.48

$

11.52

$

11.18

$

11.25

Tangible assets:

Total assets

$

5,787,035

$

5,862,222

$

5,667,896

$

5,664,387

$

5,659,254

Less: Goodwill

59,042

59,042

59,042

69,802

69,802

Less: Other intangible assets

1,136

1,326

1,515

1,704

1,893

Tangible assets

$

5,726,857

$

5,801,854

$

5,607,339

$

5,592,881

$

5,587,559

Tangible common equity / tangible assets

(3)

9.03

%

8.92

%

9.33

%

9.17

%

9.38

%

(1) Other intangible assets are core

deposit intangibles.

(2) This non-GAAP ratio is total

stockholders' equity less goodwill and intangible assets divided by

common stock outstanding.

(3) This non-GAAP ratio is total

stockholders' equity less goodwill and intangible assets to total

assets less goodwill and intangible assets.

HarborOne Bancorp,

Inc.

Segments Key Financial

Data

(Unaudited)

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

Statements of Net Income for HarborOne

Bank Segment:

2024

2024

2023

2023

2023

(Dollars in thousands)

Net interest and dividend income

$

31,098

$

30,485

$

30,637

$

31,468

$

32,490

Provision (benefit) for credit losses

615

(168

)

644

(113

)

3,283

Net interest and dividend income, after

provision for credit losses

30,483

30,653

29,993

31,581

29,207

Mortgage banking income:

Intersegment loss

(464

)

(236

)

(159

)

(198

)

(358

)

Changes in mortgage servicing rights fair

value

(74

)

(32

)

(257

)

18

29

Other

180

180

185

188

195

Total mortgage banking (loss) income

(358

)

(88

)

(231

)

8

(134

)

Other noninterest income:

Deposit account fees

5,223

4,983

5,178

5,132

5,013

Income on retirement plan annuities

141

145

147

146

128

Gain on sale of asset held for sale

1,809

—

—

—

—

Loss on sale of securities

(1,041

)

—

—

—

—

Bank-owned life insurance income

758

746

1,207

531

511

Other income

624

517

1,405

694

962

Total noninterest income

7,156

6,303

7,706

6,511

6,480

Noninterest expenses:

Compensation and benefits

15,627

15,307

16,535

15,238

15,067

Occupancy and equipment

4,052

4,150

4,038

3,828

3,910

Data processing

2,363

2,470

2,462

2,527

2,355

Loan expense

188

71

153

128

96

Marketing

1,331

783

751

709

787

Professional fees

771

1,056

1,404

914

699

Deposit insurance

992

1,164

794

1,004

1,176

Other expenses

2,467

2,406

2,476

1,924

2,103

Total noninterest expenses

27,791

27,407

28,613

26,272

26,193

Less: Amortization of other intangible

assets

189

189

189

190

189

Total adjusted noninterest expense

27,602

27,218

28,424

26,082

26,004

Income before income taxes

9,848

9,549

9,086

11,820

9,494

Provision for income taxes

2,310

2,386

2,535

2,716

2,193

Net income

$

7,538

$

7,163

$

6,551

$

9,104

$

7,301

Efficiency ratio (1) - QTD

72.15

%

73.99

%

74.13

%

68.67

%

66.73

%

Efficiency ratio (1) - YTD

73.05

%

73.99

%

68.49

%

66.64

%

65.67

%

(1) This non-GAAP measure represents

adjusted noninterest expense divided by total revenue

HarborOne Bancorp,

Inc.

Segments Key Financial

Data

(Unaudited)

Quarters Ended

June 30,

March 31,

December 31,

September 30,

June 30,

Statements of Net Income for HarborOne

Mortgage Segment:

2024

2024

2023

2023

2023

(Dollars in thousands)

Net interest and dividend income

$

240

$

80

$

160

$

199

$

120

Mortgage banking income:

Gain on sale of mortgage loans

3,141

2,013

2,176

2,704

3,300

Intersegment gain

464

308

56

249

90

Changes in mortgage servicing rights fair

value

(1,024

)

86

(3,296

)

107

407

Other

2,177

2,097

2,116

2,082

2,117

Total mortgage banking income

4,758

4,504

1,052

5,142

5,914

Other noninterest income (loss)

4

10

2

(4

)

—

Total noninterest income

4,762

4,514

1,054

5,138

5,914

Noninterest expenses:

Compensation and benefits

3,944

2,919

3,217

4,014

3,700

Occupancy and equipment

547

604

596

567

688

Data processing

11

9

13

21

48

Loan expense

274

304

(470

)

258

321

Marketing

36

33

60

85

138

Professional fees

131

132

120

155

180

Goodwill impairment

—

—

10,760

—

—

Other expenses

326

310

371

390

418

Total noninterest expenses

5,269

4,311

14,667

5,490

5,493

Income (loss) before income taxes

(267

)

283

(13,453

)

(153

)

541

Income tax (benefit) provision

(76

)

60

(596

)

(15

)

232

Net income (loss)

$

(191

)

$

223

$

(12,857

)

$

(138

)

$

309

Closed loan volume

$

172,994

$

102,101

$

124,225

$

157,572

$

172,153

Gain on sale margin

1.82

%

1.97

%

1.75

%

1.72

%

1.92

%

Efficiency ratio (1) - QTD

105.34

%

93.84

%

1,208.15

%

102.87

%

91.03

%

Efficiency ratio, excluding goodwill

impairment (2) - QTD

105.34

%

93.84

%

321.83

%

102.87

%

91.03

%

Efficiency ratio (1) - YTD

99.83

%

93.84

%

192.98

%

109.91

%

113.87

%

Efficiency ratio, excluding goodwill

impairment (2) - YTD

99.83

%

93.84

%

125.94

%

109.91

%

113.87

%

(1) This non-GAAP measure represents

noninterest expense divided by total revenue

(2) This non-GAAP measure represents

noninterest expense, excluding goodwill impairment divided by total

revenue

Category: Earnings Release Source: HarborOne Bancorp, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725061729/en/

Stephen W. Finocchio, Executive Vice President and Chief

Financial Officer (508)-895-1180 sfinocchio@harborone.com

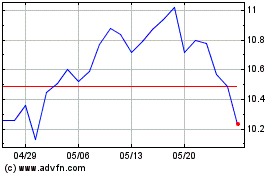

HarborOne Bancorp (NASDAQ:HONE)

過去 株価チャート

から 6 2024 まで 7 2024

HarborOne Bancorp (NASDAQ:HONE)

過去 株価チャート

から 7 2023 まで 7 2024