Eton Pharmaceuticals, Inc (“Eton” or “the Company”) (Nasdaq: ETON),

an innovative pharmaceutical company focused on developing and

commercializing treatments for rare diseases, today reported

financial results for the quarter ended June 30, 2024.

“We are pleased to report another quarter of record product

sales as Carglumic Acid and ALKINDI SPRINKLE® continue to deliver

impressive growth. During the quarter we also launched PKU GOLIKE

under our commercial infrastructure and received a favorable

reception from the PKU community. Our five existing commercial

products have the potential to deliver strong organic growth for

many years to come, and we plan to accelerate that growth with our

internal pipeline and business development activities,” said Sean

Brynjelsen, CEO of Eton Pharmaceuticals.

“We have made tremendous recent progress advancing our pipeline,

which we believe will set us up to deliver even greater growth in

2025 and beyond. Our NDA for ET-400 was recently accepted for

review and assigned a target action date in early 2025. Pre-launch

commercialization activities for the product are underway and we

anticipate launching it shortly after the expected approval. In

addition, our ET-600 product candidate is now ready to start its

pivotal study in Q3, after passing a pilot study earlier this year.

This should allow for an early 2025 NDA submission, which would

further boost the Company’s long-term growth prospects” concluded

Brynjelsen.

Second quarter and Recent Business

Highlights

14th straight quarter of sequential growth in product

sales and royalty revenue. Eton reported second quarter

2024 product sales of $9.1 million, representing 40% growth over

the prior year period, and 14% over the first quarter of 2024,

driven primarily by the ongoing growth of ALKINDI SPRINKLE and

Carglumic Acid. The Company expects to continue to see sequential

quarter-over-quarter growth of product sales through the remainder

of 2024 and beyond.

NDA for ET-400 submitted and accepted by the

FDA. During the second quarter of 2024, Eton submitted an

NDA for ET-400, its proprietary patented formulation of

hydrocortisone oral solution. The FDA accepted the NDA and assigned

it a Prescription Drug User Fee Act (PDUFA) target action date of

February 28, 2025. Eton anticipates initiating production of launch

quantities in the fourth quarter of 2024, to allow for a commercial

launch promptly after the expected approval. Eton believes the

introduction of ET-400 will allow the Company to capture a greater

percentage of the oral hydrocortisone market and, together with

ALKINDI SPRINKLE, can achieve combined peak sales of more than $50

million annually.

Acceleration of growth for ALKINDI SPRINKLE.

ALKINDI SPRINKLE reported 63% year over year revenue growth in Q2

2024. Product sales are benefiting from the Company’s internal

sales force, which has now been in place for more than a year and

has seen increased production, as well as recent initiatives

including the launch of the sampling program and the Company’s

strong presence at Endocrinology medical conferences and patient

advocacy events in the first half of 2024.

Continued Carglumic Acid outperformance. Sales

of Carglumic Acid continue to exceed the Company’s expectations.

The product reported strong growth in the second quarter and has

already added additional patients in the third quarter of 2024. The

recent launches of Betaine Anhydrous, Nitisinone, and now PKU

GOLIKE have also helped increase the frequency of the Company’s

interactions with potential Carglumic Acid prescribers.

Launched PKU GOLIKE, a medical formula for patients with

phenylketonuria (PKU). After acquiring PKU GOLIKE in the

first quarter, the Company launched the product under Eton’s

commercial infrastructure in April at the Genetic Metabolic

Dieticians International Conference. The product has been well

received and the Company has already seen an increased number of

patient referrals since the initiation of its promotional

activities.

Anticipated initiation of ET-600 pivotal study.

Eton expects to initiate a pivotal bioequivalence study for ET-600,

the Company’s product candidate for diabetes insipidus, in the

third quarter. Earlier this year, the product passed its pilot

bioequivalence study, and the company anticipates submitting an NDA

for the product in early 2025

Second Quarter Financial Results

Net Revenue: Net sales for the second quarter

of 2024 were $9.1 million compared to $12.0 million in the prior

year period. Net sales in the prior year period included $5.5

million of licensing payments related to the divestment of Eton’s

neurology product royalties.

Product sales and royalty revenue were $9.1 million for the

second quarter of 2024, an increase of 40% compared to $6.5 million

in the prior year period, and an increase of 14% over the first

quarter of 2024. The year-over-year increase in product sales and

royalty revenue was primarily driven by growth in ALKINDI SPRINKLE

and Carglumic Acid.

Gross Profit: Gross profit for the second

quarter of 2024 was $5.6 million compared to $9.7 million in the

prior year period.

Research and Development (R&D) Expenses:

R&D expenses for the second quarter of 2024 were $3.0 million

compared to $1.1 million in the prior year period. The increase was

primarily due to the payment of a $2.0 million NDA filing fee for

ET-400.

General and Administrative (G&A) Expenses:

G&A expenses for the second quarter of 2024 were $5.6 million

compared to $4.7 million in the prior year period, mainly due to

increased sales and marketing expenses, employee-related expenses,

and one-time legal fees related to business development

activities.

Net Income: Net loss for the second quarter of

2024 was $2.9 million or $0.11 per basic and diluted share,

including the $2.0 million ET-400 filing fee. In the prior year

period, net income was $4.6 million, or $0.18 per basic and diluted

share, and included $5.5 million from the sale of Eton’s royalty

interests.

Cash Position: As of June 30, 2024, Eton had

cash and cash equivalents of $17.7 million. The Company generated

$1.3 million of operating cash flow during the quarter, including

the $2.0 million ET-400 filing fee. The company expects to continue

to generate positive operating cash flow for the remainder of

2024.

| Conference Call and Webcast

Information |

| As previously announced, Eton Pharmaceuticals will

host a its second quarter 2024 conference call as follows: |

| Date |

August 8,

2024 |

| Time |

4:30 p.m. ET (3:30 p.m. CT) |

| Dial in* (Audio Only) |

Click Here |

| Webcast: |

Click Here |

| |

|

In addition to taking live questions from participants on the

conference call, management will be answering emailed questions

from investors. Investors can email questions to:

investorrelations@etonpharma.com.

The live webcast can also be accessed on the Investors section

of Eton’s website at https://ir.etonpharma.com/. An archived

webcast will be available on Eton’s website approximately two hours

after the completion of the event and for 30 days thereafter.

*Conference call participants should register to obtain their

dial-in and passcode details. Please be sure to register using a

valid email address.

About Eton

Pharmaceuticals

Eton is an innovative pharmaceutical company focused on

developing and commercializing treatments for rare diseases. The

Company currently has five commercial rare disease products:

ALKINDI SPRINKLE®, PKU GOLIKE®, Carglumic Acid, Betaine Anhydrous,

and Nitisinone. The Company has three additional product candidates

in late-stage development: ET-400, ET-600, and ZENEO®

hydrocortisone autoinjector. For more information, please visit our

website at www.etonpharma.com.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements associated with the expected ability

of Eton to undertake certain activities and accomplish certain

goals and objectives. These statements include but are not limited

to statements regarding Eton’s business strategy, Eton’s plans to

develop and commercialize its product candidates, the safety and

efficacy of Eton’s product candidates, Eton’s plans and expected

timing with respect to regulatory filings and approvals, and the

size and growth potential of the markets for Eton’s product

candidates. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements. Words such

as “believes,” “anticipates,” “plans,” “expects,” “intends,”

“will,” “goal,” “potential” and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are based upon Eton’s current expectations and involve

assumptions that may never materialize or may prove to be

incorrect. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of various risks and uncertainties, which

include, without limitation, risks associated with the process of

discovering, developing and commercializing drugs that are safe and

effective for use as human therapeutics, and in the endeavor of

building a business around such drugs. These and other risks

concerning Eton’s development programs and financial position are

described in additional detail in Eton’s filings with the

Securities and Exchange Commission. All forward-looking statements

contained in this press release speak only as of the date on which

they were made. Eton undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

Investor Relations:Lisa M. Wilson, In-Site

Communications, Inc.T: 212-452-2793E: lwilson@insitecony.com

|

Eton Pharmaceuticals, Inc.Condensed

Statements of Operations(In thousands, except per

share amounts)(Unaudited) |

| |

| |

For the three months ended |

|

|

For the six months ended |

|

| |

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing revenue |

$ |

— |

|

|

$ |

5,500 |

|

|

$ |

— |

|

|

$ |

5,500 |

|

| Product sales and

royalties |

|

9,074 |

|

|

|

6,497 |

|

|

|

17,040 |

|

|

|

11,801 |

|

| Total net

revenues |

|

9,074 |

|

|

|

11,997 |

|

|

|

17,040 |

|

|

|

17,301 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing revenue |

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

| Product sales and

royalties |

|

3,448 |

|

|

|

2,315 |

|

|

|

6,407 |

|

|

|

4,273 |

|

| Total cost of

sales |

|

3,448 |

|

|

|

2,315 |

|

|

|

6,407 |

|

|

|

4,273 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

5,626 |

|

|

|

9,682 |

|

|

|

10,633 |

|

|

|

13,028 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

2,970 |

|

|

|

1,125 |

|

|

|

3,621 |

|

|

|

1,660 |

|

| General and

administrative |

|

5,591 |

|

|

|

4,674 |

|

|

|

10,747 |

|

|

|

10,019 |

|

| Total operating

expenses |

|

8,561 |

|

|

|

5,799 |

|

|

|

14,368 |

|

|

|

11,679 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

(2,935 |

) |

|

|

3,883 |

|

|

|

(3,735 |

) |

|

|

1,349 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

|

— |

|

|

|

800 |

|

|

|

— |

|

|

|

800 |

|

| Interest expense, net |

|

(52 |

) |

|

|

(124 |

) |

|

|

(63 |

) |

|

|

(250 |

) |

| Total other income

(expense) |

|

(52 |

) |

|

|

676 |

|

|

|

(63 |

) |

|

|

550 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before

income tax expense |

|

(2,987 |

) |

|

|

4,559 |

|

|

|

(3,798 |

) |

|

|

1,899 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

54 |

|

|

|

— |

|

|

|

54 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

$ |

(3,041 |

) |

|

$ |

4,559 |

|

|

$ |

(3,852 |

) |

|

$ |

1,899 |

|

| Net income (loss) per

share, basic |

$ |

(0.12 |

) |

|

$ |

0.18 |

|

|

$ |

(0.15 |

) |

|

$ |

0.07 |

|

| Weighted average number of

common shares outstanding, basic |

|

25,778 |

|

|

|

25,593 |

|

|

|

25,771 |

|

|

|

25,560 |

|

| Net income (loss) per

share, diluted |

$ |

(0.12 |

) |

|

$ |

0.18 |

|

|

$ |

(0.15 |

) |

|

$ |

0.07 |

|

| Weighted average number of

common shares outstanding, diluted |

|

25,778 |

|

|

|

25,983 |

|

|

|

25,771 |

|

|

|

25,949 |

|

|

Eton Pharmaceuticals, Inc.Condensed

Balance Sheets(in thousands, except share and per

share amounts) |

| |

| |

June 30, 2024 |

|

|

December 31, 2023 |

|

| |

(Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

17,694 |

|

|

$ |

21,388 |

|

|

Accounts receivable, net |

|

4,873 |

|

|

|

3,411 |

|

|

Inventories |

|

2,068 |

|

|

|

911 |

|

|

Prepaid expenses and other current assets |

|

799 |

|

|

|

1,129 |

|

| Total current

assets |

|

25,434 |

|

|

|

26,839 |

|

| |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

45 |

|

|

|

58 |

|

|

Intangible assets, net |

|

6,122 |

|

|

|

4,739 |

|

|

Operating lease right-of-use assets, net |

|

210 |

|

|

|

92 |

|

|

Other long-term assets, net |

|

12 |

|

|

|

12 |

|

| Total

assets |

$ |

31,823 |

|

|

$ |

31,740 |

|

| |

|

|

|

|

|

|

|

| Liabilities and

stockholders’equity |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,133 |

|

|

$ |

1,848 |

|

|

Debt, net of unamortized discount |

|

4,658 |

|

|

|

5,380 |

|

|

Accrued liabilities |

|

11,425 |

|

|

|

9,013 |

|

| Total current

liabilities |

|

18,216 |

|

|

|

16,241 |

|

| Operating lease liabilities,

net of current portion |

|

145 |

|

|

|

22 |

|

| |

|

|

|

|

|

|

|

| Total

liabilities |

|

18,361 |

|

|

|

16,263 |

|

| |

|

|

|

|

|

|

|

| Commitments and

contingencies (Note 11) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’equity |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

25,745,802 and 25,688,062 shares issued and outstanding at June 30,

2024 and December 31, 2023, respectively |

|

26 |

|

|

|

26 |

|

| Additional paid-in

capital |

|

121,358 |

|

|

|

119,521 |

|

| Accumulated deficit |

|

(107,922 |

) |

|

|

(104,070 |

) |

| Total

stockholders’equity |

|

13,462 |

|

|

|

15,477 |

|

| |

|

|

|

|

|

|

|

| Total liabilities and

stockholders’equity |

$ |

31,823 |

|

|

$ |

31,740 |

|

|

Eton Pharmaceuticals, Inc.Condensed

Statements of Cash Flows(In

thousands)(Unaudited) |

| |

| |

Six months ended |

|

|

Six months ended |

|

| |

June 30, 2024 |

|

|

June 30, 2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Net loss |

$ |

(3,852 |

) |

|

$ |

1,899 |

|

| |

|

|

|

|

|

|

|

| Adjustments to reconcile net

loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

1,661 |

|

|

|

1,657 |

|

|

Depreciation and amortization |

|

513 |

|

|

|

385 |

|

|

Non-cash lease expense |

|

36 |

|

|

|

39 |

|

|

Debt discount amortization |

|

48 |

|

|

|

61 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(1,462 |

) |

|

|

(1,232 |

) |

|

Inventories |

|

(1,157 |

) |

|

|

(259 |

) |

|

Prepaid expenses and other assets |

|

330 |

|

|

|

423 |

|

|

Accounts payable |

|

284 |

|

|

|

537 |

|

|

Accrued liabilities |

|

2,381 |

|

|

|

2,045 |

|

| Net cash (used in)

provided by operating activities |

|

(1,218 |

) |

|

|

5,555 |

|

| |

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

Purchases of product license rights |

|

(1,868 |

) |

|

|

— |

|

|

Purchases of property and equipment |

|

(14 |

) |

|

|

— |

|

| Net cash used in

investing activities |

|

(1,882 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

Repayment of long-term debt |

|

(770 |

) |

|

|

(385 |

) |

|

Proceeds from employee stock purchase plan and stock option

exercises |

|

176 |

|

|

|

272 |

|

|

Payment of tax withholding related to net share settlement of stock

option exercises |

|

— |

|

|

|

(181 |

) |

| Net cash used in

financing activities |

|

(594 |

) |

|

|

(294 |

) |

| |

|

|

|

|

|

|

|

| Change in cash and

cash equivalents |

|

(3,694 |

) |

|

|

5,261 |

|

| Cash and cash equivalents at

beginning of period |

|

21,388 |

|

|

|

16,305 |

|

| Cash and cash equivalents at

end of period |

$ |

17,694 |

|

|

$ |

21,566 |

|

| |

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

Cash paid for interest |

$ |

362 |

|

|

$ |

426 |

|

|

Cash paid for income taxes |

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

| Supplemental

disclosures of non-cash transactions in investing and financing

activities |

|

|

|

|

|

|

|

|

Right-of-use assets and liabilities obtained due to lease

renewal |

$ |

153 |

|

|

$ |

— |

|

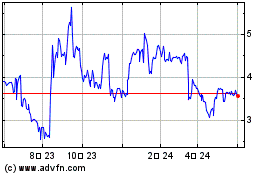

Eton Pharmaceuticals (NASDAQ:ETON)

過去 株価チャート

から 11 2024 まで 12 2024

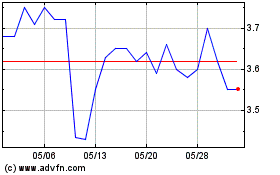

Eton Pharmaceuticals (NASDAQ:ETON)

過去 株価チャート

から 12 2023 まで 12 2024