0001020710false00010207102024-11-072024-11-07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 4, 2024

Commission file number 0-21513

DXP Enterprises, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Texas | 76-0509661 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | | | | | | | |

| 5301 Hollister | | (713) | 996-4700 |

| Houston, | Texas | 77040 | |

| (Address of principal executive offices) | | (Registrant’s telephone number, including area code) |

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on which Registered |

| Common Stock par value $0.01 | DXPE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ⃞

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The following information is furnished pursuant to Regulation FD.

On November 4, 2024, DXP Enterprises, Inc., issued a press release announcing financial results for the third quarter ended September 30, 2024. A copy of the release is furnished herewith as Exhibit 99.1, and incorporated herein by reference. Such exhibit (i) is furnished pursuant to Item 2.02 of Form 8-K, (ii) is not to be considered "filed" under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and (iii) shall not be incorporated by reference into any previous or future filings made by or to be made by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

99.1 Press Release dated November 4, 2024 announcing the earnings results for the third quarter ended September 30, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| DXP ENTERPRISES, INC. | |

| (Registrant) | |

| | |

| By: | /s/ Kent Yee | |

| Kent Yee | |

| Senior Vice President/Finance and Chief Financial Officer |

| | |

| By: | /s/ David Molero Santos | |

| David Molero Santos | |

| Vice President/Finance and Chief Accounting Officer |

| | |

| Dated: | November 7, 2024 | |

INDEX TO EXHIBITS

Introductory Note: The following exhibit is furnished pursuant to Item 2.02 of Form 8-K and is not to be considered “filed” under the Exchange Act and shall not be incorporated by reference into any of the Company’s previous or future filings under the Securities Act or the Exchange Act. | | | | | |

| Exhibit No. | Description |

| 99.1 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

DXP ENTERPRISES, INC. REPORTS THIRD QUARTER 2024 RESULTS

•$35.0 million in cash

•$472.9 million in sales, a 6.1 percent sequential and 12.8 percent year-over-year increase

•GAAP diluted EPS of $1.27

•$52.4 million in earnings before interest, taxes, depreciation & amortization and other non-cash charges ("Adjusted EBITDA")

•Free Cash Flow of $24.4 million for the quarter, and $54.4 million for the nine months ended September 30, 2024

•Completed five acquisitions through Q3; three water, and two industrial rotating equipment companies

Houston, TX – November 4, 2024 – DXP Enterprises, Inc. ("DXP" or the "Company") (NASDAQ: DXPE) today announced financial results for the third quarter ended September 30, 2024. The following are results for the three months ended September 30, 2024, compared to the three months ended September 30, 2023, and June 30, 2024, where appropriate. A reconciliation of the non-GAAP financial measures can be found in the back of this press release.

Third Quarter 2024 Financial Highlights:

•Sales increased 6.1 percent sequentially to $472.9 million, compared to $445.6 million for the second quarter of 2024 and increased 12.8 percent compared to $419.2 million for the third quarter of 2023.

•Net income for the third quarter was $21.1 million, compared to $16.2 million for the third quarter of 2023 and $16.7 million for the second quarter of 2024.

•Earnings per diluted share for the third quarter was $1.27 based upon 16.6 million diluted shares, compared to $0.93 earnings per diluted share in the third quarter of 2023, based on 17.4 million diluted shares. Adjusted diluted earnings per share was $1.43 for the third quarter compared to $0.96 in the third quarter of 2023.

•Adjusted EBITDA for the third quarter was $52.4 million compared to $44.0 million for the third quarter of 2023 and $48.2 million for the second quarter of 2024. Adjusted EBITDA as a percentage of sales, or Adjusted EBITDA margin, was 11.1 percent, 10.5 percent, and 10.8 percent, respectively.

•Free Cash Flow (cash flow from operating activities less capital expenditures) for the third quarter was $24.4 million, compared to $38.3 million for the third quarter of 2023.

David R. Little, Chairman and Chief Executive Officer commented, "The Company posted excellent third quarter financial results in a lessening inflationary and varied spending by end market, delivering solid sales, adjusted EBITDA, earnings per share and free cash flow. Third quarter results reflect the continued execution of our growth strategy and the impact of our acquisition program. We continue to set new high watermarks as DXPeople. We are pleased with our sequential sales growth and strong adjusted EBITDA margins. This resulted in operating leverage that produced earnings per share of $1.27. DXP’s third quarter 2024 sales were $472.9 million, or a 6.1 percent increase over the second quarter of 2024 and a 12.8 percent growth over the same period in 2023. Adjusted EBITDA grew $4.2 million, or 8.7 percent over the second quarter of 2024 to $52.4 million. During the third quarter of 2024, sales were $316.8 million for Service Centers, $89.8 million for Innovative Pumping Solutions, and $66.3 million for Supply Chain Services. Overall, we are very pleased with our performance and the progress DXP continues to make as a growth company."

Kent Yee, Chief Financial Officer and Senior Vice President, remarked, "DXP achieved yet another high watermark quarter with a 6.1 percent sequential sales increase to $472.9 million in sales and 11.1 percent Adjusted EBITDA margins. We have closed five acquisitions through the third quarter, and we have closed two acquisitions during the fourth quarter of 2024. This quarters financial results reflect continued execution of our strategic goals and the impact of our diversification efforts, an overall reduced energy industry exposure, and a strong balance sheet to support our key initiatives. Subsequent to the third quarter, we announced the successful completion of the repricing of our existing debt plus raising an incremental $105 million. DXP is saving one hundred basis points on existing debt, while raising incremental money to further drive anticipated acquisition growth. Total debt outstanding as of September 30, 2024, was $544.5 million. DXP’s secured leverage ratio or net debt to EBITDA ratio was 2.54:1.0 with a covenant EBITDA of $200.7 million for the last twelve months ending September 30, 2024. We expect to finish fiscal year 2024 strong with momentum going into fiscal year 2025."

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

Conference Call Information

DXP Enterprises, Inc. management will host a conference call, November 5, 2024, at 10:30 a.m. Central Time, to discuss the Company’s financial results. The conference call may be accessed by going to https://ir.dxpe.com.

Interested investors and other parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of the Company's website at https://ir.dxpe.com. The online replay will be available on the same website immediately following the call. A slide presentation highlighting the Company’s results and key performance indicators will also be available on the Investor Relations section of the Company’s website.

To learn more about DXP Enterprises, Inc., please visit the Company's website at https://www.dxpe.com

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service distributor that adds value and total cost savings solutions to industrial customers throughout North America and Dubai. DXP provides innovative pumping solutions, supply chain services and maintenance, repair, operating and production ("MROP") services that emphasize and utilize DXP’s vast product knowledge and technical expertise in rotating equipment, bearings, power transmission, metal working, industrial supplies and safety products and services. DXP's breadth of MROP products and service solutions allows DXP to be flexible and customer-driven, creating competitive advantages for our customers. DXP’s business segments include Service Centers, Innovative Pumping Solutions and Supply Chain Services. For more information, go to www.dxpe.com.

Non-GAAP Financial Measures

DXP supplements reporting of net income with certain non-GAAP measurements, including EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, and Free Cash Flow. This supplemental information should not be considered in isolation or as a substitute for the unaudited GAAP measurements. Additional information regarding EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Free Cash Flow and net debt referred to in this press release are included below under "Unaudited Reconciliation of Non-GAAP Financial Information".

The Company believes EBITDA provides additional information about: (i) operating performance, because it assists in comparing the operating performance of the business, as it removes the impact of non-cash depreciation and amortization expense as well as items not directly resulting from core operations such as interest expense and income taxes and (ii) the performance and the effectiveness of operational strategies. Additionally, EBITDA performance is a component of a measure of the Company’s financial covenants under its credit facilities. Furthermore, some investors use EBITDA as a supplemental measure to evaluate the overall operating performance of companies in the industry. Management believes that some investors’ understanding of performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing ongoing results of operations. By providing this non-GAAP financial measure, together with a reconciliation to its most directly comparable GAAP financial measure, the Company believes it is enhancing investors’ understanding of the business and results of operations, as well as assisting investors in evaluating how well the Company is executing strategic initiatives. Free Cash Flow reconciles to the most directly comparable GAAP financial measure of cash flows from operations as provided below. We believe Free Cash Flow is an important liquidity metric because it measures, during a given period, the amount of cash generated that is available to fund acquisitions, make investments, repay debt obligations, repurchase shares of the Company's common stock, and for certain other activities.

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

Information Related to Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe-harbor” for forward-looking statements. Certain information included in this press release (as well as information included in oral statements or other written statements made by or to be made by the Company) contains statements that are forward-looking. These forward-looking statements include, without limitation, those about the Company’s expectations regarding the Company's expectations regarding the filing of the Form 10-Q; the description of the anticipated changes in the Company's consolidated balance sheet and the results of operations and the Company's assessment of the impact of such anticipated changes; the Company’s business, the Company’s future profitability, cash flow, liquidity, and growth. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future; and accordingly, such results may differ from those expressed in any forward-looking statement made by or on behalf of the Company. These risks and uncertainties include, but are not limited to: the effectiveness of management’s strategies and decisions; our ability to implement our internal growth and acquisition growth strategies; general economic and business conditions specific to our primary customers; changes in government regulations; our ability to effectively integrate businesses we may acquire; new or modified statutory or regulatory requirements; availability of materials and labor; inability to obtain or delay in obtaining government or third-party approvals and permits; non-performance by third parties of their contractual obligations; unforeseen hazards such as weather conditions, acts of war or terrorist acts and the governmental or military response thereto; cyber-attacks adversely affecting our operations; other geological, operating and economic considerations and declining prices and market conditions, including supply or demand for maintenance, repair and operating products, equipment and service; inability of the Company or its independent auditors to complete the work necessary in order to file the Form 10-Q in the expected time frame; unanticipated changes to the Company's operating results in the Form 10-Q as filed or in relation to prior periods, including as compared to the anticipated changes stated here; unanticipated impact of such changes and its materiality; ability to obtain needed capital, dependence on existing management, leverage and debt service, domestic or global economic conditions, ability to manage changes and the continued health or availability of management personnel and changes in customer preferences and attitudes. In some cases, you can identify forward-looking statements by terminology such as, but not limited to, “may,” “will,” “should,” “intend,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “goal,” or “continue” or the negative of such terms or other comparable terminology. More information on these risks and other potential factors that could affect the Company’s business and financial results is included in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

DXP ENTERPRISES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

($ thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Sales | $ | 472,935 | | | $ | 419,249 | | | $ | 1,331,126 | | | $ | 1,271,556 | |

| Cost of sales | 326,825 | | | 293,687 | | | 923,341 | | | 889,101 | |

| Gross profit | 146,110 | | | 125,562 | | | 407,785 | | | 382,455 | |

| Selling, general and administrative expenses | 106,502 | | | 89,706 | | | 301,694 | | | 273,720 | |

| Income from operations | 39,608 | | | 35,856 | | | 106,091 | | | 108,735 | |

Interest expense | 15,716 | | | 12,684 | | | 46,644 | | | 36,068 | |

Other expense (income), net | 160 | | | 1,234 | | | (2,844) | | | 522 | |

| | | | | | | |

| Income before income taxes | 23,732 | | | 21,938 | | | 62,291 | | | 72,145 | |

| Provision for income taxes | 2,631 | | | 5,766 | | | 13,165 | | | 19,339 | |

| Net income | 21,101 | | | 16,172 | | | 49,126 | | | 52,806 | |

| | | | | | | |

| | | | | | | |

| Preferred stock dividend | 23 | | | 22 | | | 68 | | | 67 | |

| Net income attributable to common shareholders | $ | 21,078 | | | $ | 16,150 | | | $ | 49,058 | | | $ | 52,739 | |

| | | | | | | |

| Net income | $ | 21,101 | | | $ | 16,172 | | | $ | 49,126 | | | $ | 52,806 | |

| Foreign currency translation adjustments | 380 | | | (844) | | | (141) | | | (87) | |

| Comprehensive income | $ | 21,481 | | | $ | 15,328 | | | $ | 48,985 | | | $ | 52,719 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 1.34 | | | $ | 0.98 | | | $ | 3.08 | | | $ | 3.08 | |

| Diluted | $ | 1.27 | | | $ | 0.93 | | | $ | 2.93 | | | $ | 2.94 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 15,750 | | | 16,516 | | | 15,915 | | | 17,104 | |

| Diluted | 16,590 | | | 17,356 | | | 16,755 | | | 17,944 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

DXP ENTERPRISES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

($ thousands, except share amounts)

| | | | | | | | | | | |

| |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 35,000 | | | $ | 173,120 | |

| Restricted cash | 91 | | | 91 | |

| Accounts receivable, net of allowance of $5,316 and $5,584, respectively | 337,722 | | | 311,171 | |

| Inventories | 109,787 | | | 103,805 | |

| Costs and estimated profits in excess of billings | 49,707 | | | 42,323 | |

| Prepaid expenses and other current assets | 22,274 | | | 18,044 | |

| | | |

| Total current assets | 554,581 | | | 648,554 | |

| Property and equipment, net | 73,050 | | | 61,618 | |

| Goodwill | 448,103 | | | 343,991 | |

| Other intangible assets, net | 89,356 | | | 63,895 | |

| Operating lease right of use assets, net | 48,498 | | | 48,729 | |

| Other long-term assets | 17,857 | | | 10,649 | |

| Total assets | $ | 1,231,445 | | | $ | 1,177,436 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of debt | $ | 5,500 | | | $ | 5,500 | |

| Trade accounts payable | 106,802 | | | 96,469 | |

| Accrued wages and benefits | 41,230 | | | 36,238 | |

| Customer advances | 12,656 | | | 12,160 | |

| Billings in excess of costs and estimated profits | 11,911 | | | 9,506 | |

| | | |

| Short-term operating lease liabilities | 14,928 | | | 15,438 | |

| Other current liabilities | 56,336 | | | 48,854 | |

| Total current liabilities | 249,363 | | | 224,165 | |

| | | |

| Long-term debt, net of unamortized debt issuance costs and discounts | 519,250 | | | 520,697 | |

| Long-term operating lease liabilities | 34,922 | | | 34,336 | |

| Other long-term liabilities | 25,542 | | | 17,359 | |

| | | |

| Total long-term liabilities | 579,714 | | | 572,392 | |

| Total liabilities | 829,077 | | | 796,557 | |

Commitments and Contingencies | | | |

| Shareholders' equity: | | | |

| Series A preferred stock, $1.00 par value; 1,000,000 shares authorized | 1 | | 1 |

| Series B preferred stock, $1.00 par value; 1,000,000 shares authorized | 15 | | | 15 | |

| Common stock, $0.01 par value, 100,000,000 shares authorized; 15,694,883 and 16,177,237 outstanding, respectively | 345 | | | 345 | |

| Additional paid-in capital | 218,062 | | | 216,482 | |

| Retained earnings | 368,329 | | | 319,271 | |

| Accumulated other comprehensive loss | (31,381) | | | (31,240) | |

Treasury stock, at cost 4,707,773 and 4,141,989 shares, respectively | (153,003) | | | (123,995) | |

| Total DXP Enterprises, Inc. equity | 402,368 | | | 380,879 | |

| | | |

| | | |

| Total liabilities and equity | $ | 1,231,445 | | | $ | 1,177,436 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

Business segment financial highlights:

•Service Centers’ revenue for the third quarter was $316.8 million, an increase of 7.6 percent year-over-year, with a 14.6 percent operating income margin.

•Innovative Pumping Solutions’ revenue for the third quarter was $89.8 million, an increase of 52.3 percent year-over-year, with a 20.3 percent operating income margin.

•Supply Chain Services’ revenue for the third quarter was $66.3 million, an increase of 0.7 percent year-over-year, with a 8.4 percent operating income margin.

SEGMENT DATA

($ thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| Sales | 2024 | | 2023 | | 2024 | | 2023 |

| Service Centers | $ | 316,831 | | | $ | 294,459 | | | $ | 911,783 | | | $ | 914,078 | |

| Innovative Pumping Solutions | 89,825 | | | 58,962 | | | 225,417 | | | 158,440 | |

| Supply Chain Services | 66,279 | | | 65,828 | | | 193,926 | | | 199,038 | |

| Total Sales | $ | 472,935 | | | $ | 419,249 | | | $ | 1,331,126 | | | $ | 1,271,556 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| Operating Income | 2024 | | 2023 | | 2024 | | 2023 |

| Service Centers | $ | 46,154 | | | $ | 41,912 | | | $ | 130,329 | | | $ | 134,549 | |

| Innovative Pumping Solutions | 18,207 | | | 10,599 | | | 38,543 | | | 26,555 | |

| Supply Chain Services | 5,568 | | | 5,589 | | | 16,653 | | | 16,519 | |

Total Segments Operating Income | $ | 69,929 | | | $ | 58,100 | | | $ | 185,525 | | | $ | 177,623 | |

RECONCILIATION OF OPERATING INCOME FOR REPORTABLE SEGMENTS

($ thousands, unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income from operations for reportable segments | $ | 69,929 | | | $ | 58,100 | | | $ | 185,525 | | | $ | 177,623 | |

| Adjustment for: | | | | | | | |

Amortization of intangibles | 5,245 | | | 5,866 | | | 14,333 | | | 15,206 | |

| Corporate expenses | 25,076 | | | 16,378 | | | 65,101 | | | 53,682 | |

| Income from operations | $ | 39,608 | | | $ | 35,856 | | | $ | 106,091 | | | $ | 108,735 | |

| Interest expense | 15,716 | | | 12,684 | | | 46,644 | | | 36,068 | |

Other expense (income), net | 160 | | | 1,234 | | | (2,844) | | | 522 | |

| Income before income taxes | $ | 23,732 | | | $ | 21,938 | | | $ | 62,291 | | | $ | 72,145 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION

($ thousands, unaudited)

The following table sets forth the reconciliation of EBITDA, EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin to the most comparable U.S. GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

Income before income taxes | $ | 23,732 | | | $ | 21,938 | | | $ | 62,291 | | | $ | 72,145 | |

Plus: Interest expense | 15,716 | | | 12,684 | | | 46,644 | | | 36,068 | |

Plus: Depreciation and amortization | 8,720 | | | 7,983 | | | 24,385 | | | 21,468 | |

| EBITDA | $ | 48,168 | | | $ | 42,605 | | | $ | 133,320 | | | $ | 129,681 | |

| | | | | | | |

| | | | | | | |

Plus: other non-recurring items(1) | 2,950 | | | 551 | | | 4,292 | | | 551 | |

| Plus: stock compensation expense | 1,322 | | | 864 | | | 3,398 | | | 2,211 | |

| Adjusted EBITDA | $ | 52,440 | | | $ | 44,020 | | | $ | 141,010 | | | $ | 132,443 | |

| | | | | | | |

| Operating Income Margin | 8.4 | % | | 8.6 | % | | 8.0 | % | | 8.6 | % |

| EBITDA Margin | 10.2 | % | | 10.2 | % | | 10.0 | % | | 10.2 | % |

| Adjusted EBITDA Margin | 11.1 | % | | 10.5 | % | | 10.6 | % | | 10.4 | % |

| | | | | | | |

(1) Other non-recurring items includes unique acquisition integration costs and other non-cash, non-recurring costs not related to continuing business operations. |

The following table sets forth the reconciliation of Acquisition Sales, Organic Sales and Organic Sales per Business Day to the most comparable U.S. GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales by Business Segment | | | | | | | |

| Service Centers | $ | 316,831 | | | $ | 294,459 | | | $ | 911,783 | | | $ | 914,078 | |

| Innovative Pumping Solutions | 89,825 | | | 58,962 | | | 225,417 | | | 158,440 | |

| Supply Chain Services | 66,279 | | | 65,828 | | | 193,926 | | | 199,038 | |

| Total DXP Sales | $ | 472,935 | | | $ | 419,249 | | | $ | 1,331,126 | | | $ | 1,271,556 | |

| Acquisition Sales | 28,535 | | | 3,868 | | | 63,713 | | | 30,266 | |

| Organic Sales | $ | 444,400 | | | $ | 415,381 | | | $ | 1,267,413 | | | $ | 1,241,290 | |

| | | | | | | |

| Business Days | 64 | | 63 | | 191 | | 191 |

| Sales per Business Day | $ | 7,390 | | | $ | 6,655 | | | $ | 6,969 | | | $ | 6,657 | |

| Organic Sales per Business Day | $ | 6,944 | | | $ | 6,593 | | | $ | 6,636 | | | $ | 6,499 | |

| | | | | | | | |

| | NEWS RELEASE CONTACT: Kent Yee Senior Vice President, CFO 713-996-4700 www.dxpe.com |

RECONCILIATION OF NON-GAAP FINANCIAL INFORMATION CONTINUED

($ thousands, unaudited)

The following table sets forth the reconciliation of Free Cash Flow to the most comparable GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash from operating activities | $ | 28,344 | | | $ | 39,758 | | | $ | 70,068 | | | $ | 63,775 | |

| Less: purchases of property and equipment | (3,954) | | | (1,486) | | | (15,673) | | | (7,103) | |

| | | | | | | |

| Free Cash Flow | $ | 24,390 | | | $ | 38,272 | | | $ | 54,395 | | | $ | 56,672 | |

The following table is a reconciliation of adjusted net income attributable to DXP Enterprises, Inc., a non-GAAP financial measure, to net income, calculated and reported in accordance with U.S. GAAP (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net Income | $ | 21,101 | | | $ | 16,172 | | | $ | 49,126 | | | $ | 52,806 | |

One-time non-cash items | 2,950 | | | 551 | | | 4,292 | | | 551 | |

| | | | | | | |

| | | | | | | |

Adjustment for taxes | (327) | | | (145) | | | (907) | | | (145) | |

Adjusted Net Income | $ | 23,724 | | | $ | 16,578 | | | $ | 52,511 | | | $ | 53,212 | |

| | | | | | | |

| Weighted average common shares and common equivalent shares outstanding | | | | | | | |

| | | | | | | |

| Diluted | 16,590 | | | 17,356 | | | 16,755 | | | 17,944 | |

| | | | | | | |

| Diluted Earnings per Share | $ | 1.27 | | | $ | 0.93 | | | $ | 2.93 | | | $ | 2.94 | |

| Adjusted Diluted Earnings per Share | $ | 1.43 | | | $ | 0.96 | | | $ | 3.13 | | | $ | 2.97 | |

| | | | | | | |

|

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

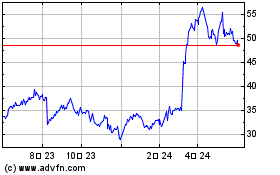

DXP Enterprises (NASDAQ:DXPE)

過去 株価チャート

から 11 2024 まで 12 2024

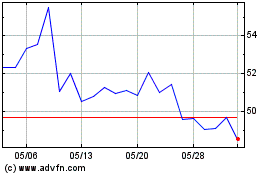

DXP Enterprises (NASDAQ:DXPE)

過去 株価チャート

から 12 2023 まで 12 2024