UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission file number: 001-39109

Fangdd Network Group Ltd.

Room 1501, Shangmei Technology Building

No. 15 Dachong Road

Nanshan District, Shenzhen, 518072

People’s Republic of China

Phone: +86 755 2699 8968

(Address and Telephone Number of Principal Executive

Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fangdd Network Group Ltd. |

| |

|

| |

By: |

/s/ Xi Zeng |

| |

|

Name: |

Xi Zeng |

| |

|

Title: |

Chief Executive Officer and Chairman of the Board of Directors |

Date: July 31, 2024

2

Exhibit

99.1

FANGDD

ANNOUNCES UPDATES ON ITS SUBSTITUTION LISTING PLAN

SHENZHEN,

China, July 31, 2024 (GLOBE NEWSWIRE) -- Fangdd Network Group Ltd. (Nasdaq: DUO) (“FangDD” or the “Company”)

today announced updates on its substitution listing plan.

As

previously announced on June 3, 2024, the Company intends to terminate the Company’s existing American depositary receipts (the

“ADR”) facility on or about September 4, 2024, and list its Class A ordinary shares for trading on The Nasdaq Stock Market

LLC (“Nasdaq”) in substitution for the American depositary shares (the “ADS”) (the “Substitution Listing”).

The Company expects that, upon the effectiveness of the Substitution Listing, its ADSs will cease to be listed on Nasdaq while the Class

A ordinary shares represented by the ADSs will trade on Nasdaq under the symbol of “DUO.” The Company has appointed VStock

Transfer, LLC as its United States transfer agent (the “U.S. Transfer Agent”) for the Substitution Listing.

To

facilitate the Substitution Listing, the Depositary will call for the surrender of all ADSs to be exchanged into the Company’s

Class A ordinary shares on a mandatory basis (the “Mandatory Exchange”) on or after September 4, 2024 (the actual date of

the Mandatory Exchange, the “Exchange Date”). For ADSs held by participants of The Depository Trust Company (“DTC”),

the Depositary will instruct the U.S. Transfer Agent to register a transfer of the number of deposited shares represented by those ADSs

to DTC for allocation by DTC to the participant accounts entitled to them; and for uncertificated ADSs held by owners other than DTC,

the Depositary will instruct the U.S. Transfer Agent to register transfers of the number of deposited shares represented by uncertificated

ADSs in the names of the respective owners.

ADS

holders do not need to take any action and the Depositary will not charge ADS holders any fees in connection with the Mandatory Exchange.

The Depositary has issued a notice to supersede its prior notice issued to ADS holders on June 4, 2024 regarding the ADS termination,

and to inform ADS holders of the Mandatory Exchange. A copy of this notice is attached to this press release as Exhibit A.

There

remains uncertainty regarding whether and when the Company will be able to obtain clearance from Nasdaq to effectuate the Mandatory Exchange

and the Substitution Listing. Prior to the Exchange Date, Nasdaq may suspend the trading of the Company’s ADSs until such time

as the Mandatory Exchange and the Substitution Listing shall have taken effect or as otherwise determined by Nasdaq.

In

connection with the Substitution Listing, the Company plans to effect, on or about August 12, 2024 (Eastern Time), a share consolidation

to consolidate each 5,625 ordinary shares of a par value US$0.0000001 per share of the Company into one ordinary share of a par

value US$0.0005625 per share (the “Share Consolidation”), followed by a share capital increase and the adoption of the

sixth amended and restated memorandum and articles of association of the Company as set out in the Notice of Extraordinary General Meeting

dated June 3, 2024. The Share Consolidation and related matters were previously approved by the Company’s shareholders at

the extraordinary general meeting held on July 11, 2024. For detailed information about the Share Consolidation, please see the Company’s

current report on Form 6-K furnished to the U.S. Securities and Exchange Commission on July 11, 2024.

The

Share Consolidation will change the ratio of the ADSs to the Company’s Class A ordinary shares from (i) one

(1) ADS representing five thousand six hundred and twenty-five (5,625) Class A ordinary shares of a par value US$0.0000001

per share to (ii) one (1) ADS representing one

(1) Class A ordinary share of a par value US$0.0005625 per share. ADS holders do not

need to take any action in connection with the ADS ratio change.

About

FangDD

Fangdd

Network Group Ltd. (Nasdaq: DUO) is a customer-oriented property technology company in China, focusing on providing real estate transaction

digitalization services. Through innovative use of mobile internet, cloud, big data, artificial intelligence, among others, FangDD has

fundamentally revolutionized the way real estate transaction participants conduct their business through a suite of modular products

and solutions powered by SaaS tools, products and technology. For more information, please visit http://ir.fangdd.com.

Safe

Harbor Statement

This

announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “aim,”

“anticipate,” “believe,” “estimate,” “expect,” “hope,” “going forward,”

“intend,” “ought to,” “plan,” “project,” “potential,” “seek,”

“may,” “might,” “can,” “could,” “will,” “would,” “shall,”

“should,” “is likely to” and the negative form of these words and other similar expressions. Among other things,

statements that are not historical facts, including statements about the Company’s beliefs and expectations are or contain forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement. All information provided in this press release is as of the date of

this press release and is based on assumptions that the Company believes to be reasonable as of this date, and the Company does not undertake

any obligation to update any forward-looking statement, except as required under applicable law.

Investor

Relations Contact

Ms. Linda

Li

Director,

Capital Markets Department

Phone: +86-0755-2699-8968

E-mail: ir@fangdd.com

Exhibit

A

|

|

240 Greenwich

Street, |

| |

|

8th Floor |

| |

|

New York, NY 10286 |

NOTICE

TO HOLDERS OF AMERICAN DEPOSITARY SHARES (ADSs)

REPRESENTING ORDINARY SHARES (ORDs)

OF

FANGDD

NETWORK GROUP LIMITED

Each

American Depositary Share (“ADS”) represents 5,625 deposited FangDD Network shares

CUSIP

30712L307

We,

The Bank of New York Mellon (the “Depositary”) previously notified you on June 4, 2024 that the deposit agreement under which

the ADSs are issued would terminate on September 3, 2024. You are hereby notified that termination will not occur on that date.

FangDD

Network Group Limited (the “Company”) has informed the Depositary that it intends to list its ordinary shares underlying

the ADSs (the “Shares”) directly on the Nasdaq Stock Market (“Nasdaq”), to be effective on or about September

4, 2024 and to suspend trading of the ADSs on Nasdaq on or before that date.

Accordingly,

you are hereby further notified that the Company and the Depositary have agreed that if the direct listing of the Shares occurs,

the Depositary will call for surrender of all ADSs to be exchanged on a mandatory basis into Shares, which will be listed on Nasdaq.

If

you do not wish to receive Shares in exchange for your ADSs, you should arrange to sell your ADSs before trading of ADSs is suspended

on the Nasdaq Stock Market, which is expected to occur after the close of trading on Tuesday, September 3, 2024.

You

do not need to take any action in response to this notice. The Depositary will not charge you any fees in connection with the mandatory

exchange described above.

For

more information regarding your FangDD Network ADSs, please contact the Shareholder Relations Department at The Bank of New York Mellon

at 1-888-BNY-ADRs / 1-888-269-2377.

| Dated: July 30, 2024 |

|

THE BANK OF NEW YORK MELLON, |

| |

|

As Depositary |

PLEASE

SEE INVESTOR DISCLOSURE ON LAST PAGE

This

notice and the information and data provided herein are provided for general informational purposes only. BNY Mellon does not warrant

or guarantee the accuracy, timeliness or completeness of any such information or data. BNY Mellon does not undertake any obligation to

update or amend this notice or any information or data, and may change, update or amend this notice or any information or data at any

time without prior notice.

BNY

Mellon provides no advice, recommendation or endorsement with respect to any company or securities. No information or data is intended

to provide legal, tax, accounting, investment, financial, trading or other advice on any matter, and is not to be used as such. We expressly

disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon this notice or any information or data, including

market value loss on the sale or purchase of securities or other instruments or obligations.

Nothing

herein shall be deemed to constitute an offer to sell or a solicitation of an offer to buy securities.

BNY

Mellon collects fees from DR holders pursuant to the terms and conditions of the DRs and any deposit agreement under which they are issued.

From time to time, BNY Mellon may make payments to an issuer to reimburse and/or share revenue from the fees collected from DR holders,

or waive fees and expenses to an issuer for services provided, generally related to costs and expenses arising out of establishment and

maintenance of the DR program. BNY Mellon may pay a rebate to brokers in connection with unsponsored DR issuances; brokers may or may

not disclose or pass back some or all of such rebate to the DR investor. BNY Mellon may also use brokers, dealers or other service providers

that are affiliates and that may earn or share fees and commissions.

BNY

Mellon may execute DR foreign currency transactions itself or through its affiliates, or the Custodian or the underlying Company may

execute foreign currency transactions and pay US dollars to BNY Mellon. In those instances where it executes DR foreign currency transactions

itself or through its affiliates, BNY Mellon acts as principal counterparty and not as agent, advisor, broker or fiduciary. In such cases,

BNY Mellon has no obligation to obtain the most favorable exchange rate, makes no representation that the rate is a favorable rate and

will not be liable for any direct or indirect losses associated with the rate. BNY Mellon earns and retains revenue on its executed foreign

currency transactions based on, among other things, the difference between the rate it assigns to the transaction and the rate that it

pays and receives for purchases and sales of currencies when buying or selling foreign currency for its own account. The methodology

used by BNY Mellon to determine DR conversion rates is available to registered Owners upon request or can be accessed at https://www.adrbnymellon.com/us/en/news-and-publications/dr-issuers/drs_foreign_exchange_pricing_disclosure.pdf.

In

those instances where BNY Mellon’s Custodian executes DR foreign currency transactions, the Custodian has no obligation to obtain

the most favorable exchange rate or to ensure that the method by which the rate will be determined will be the most favorable rate, and

BNY Mellon makes no representation that the rate is the most favorable rate and will not be liable for any direct or indirect losses

associated with the rate. In certain instances, BNY Mellon may receive dividends and other distributions from an issuer of securities

underlying DRs in U.S. dollars rather than in a foreign currency. In such cases, BNY Mellon will not engage in or be responsible for

any foreign currency transactions and it makes no representation that the rate obtained by an issuer is the most favorable rate and it

will not be liable for any direct or indirect losses associated with the rate.

This

notice or any excerpt of this notice may not be copied or reproduced without the prior express written consent of BNY Mellon.

BNY

Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment

lifecycle. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation (NYSE: BK).

BNY

Mellon’s name, brand and/or trademarks may not be used, copied or reproduced without the prior express written consent of BNY Mellon.

DEPOSITARY

RECEIPTS ARE NOT INSURED BY THE FDIC OR ANY OTHER GOVERNMENT AGENCY, ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF, AND ARE NOT GUARANTEED

BY, BNY MELLON AND ARE SUBJECT TO INVESTMENT RISKS INCLUDING POSSIBLE LOSS OF PRINCIPAL AMOUNT INVESTED.

4

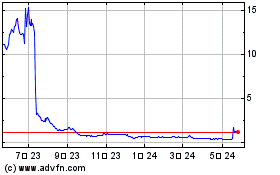

FangDD Network (NASDAQ:DUO)

過去 株価チャート

から 7 2024 まで 7 2024

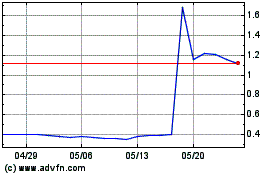

FangDD Network (NASDAQ:DUO)

過去 株価チャート

から 7 2023 まで 7 2024