As filed with the Securities and Exchange Commission on July 24, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CRITEO S.A.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

France (State or other jurisdiction of incorporation or organization) | | Not applicable (I.R.S. Employer Identification No.) |

| | |

32 rue Blanche Paris, France (Address of Principal Executive Offices) | | 75009 (Zip Code) |

Amended 2016 Stock Option Plan

Amended and Restated 2015 Performance-Based Restricted Stock Units Plan

Amended and Restated 2015 Time-Based Restricted Stock Units Plan

(Full title of the plans)

National Registered Agents, Inc.

160 Greentree Dr., Suite 101

Dover, DE 19904

(Name and address of agent for service)

(302) 674-4089

(Telephone number, including area code, of agent for service)

Copies to:

| | | | | | | | |

| Sinead M. Kelly | Agnès Charpenet | Ryan Damon |

| | Chief Legal and Corporate Affairs Officer |

| | |

| Baker & McKenzie LLP | Baker & McKenzie A.A.R.P.I. | Criteo S.A. |

| Two Embarcadero Center, Suite 1100 | 1 rue Paul Baudry | 32 rue Blanche |

| San Francisco, CA 94111 | 75008 Paris, France | 75009 Paris, France |

| Tel: (415) 576-3000 | Tel: +33 1 44 17 53 00 | Tel: +33 1 75 85 09 39 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer x | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 (the “Registration Statement”) is filed by Criteo S.A. (the “Registrant”) for the purpose of registering an additional 7,000,000 Ordinary Shares, and options and rights to acquire such Ordinary Shares of Criteo S.A. reserved for issuance under the Registrant’s Amended 2016 Stock Option Plan, Amended and Restated 2015 Performance-Based Restricted Stock Units Plan and Amended and Restated 2015 Time-Based Restricted Stock Units Plan.

PART I.

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The information required by Item 1 is included in documents sent, given or made available by the Registrant to participants in the plans covered by this Registration Statement pursuant to Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”).

Item 2. Registrant Information and Employee Plan Annual Information.

The written statement required by Item 2 is included in documents sent, given or made available by the Registrant to participants in the plans covered by this Registration Statement pursuant to Rule 428(b)(1) of the Securities Act.

PART II.

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant with the Securities and Exchange Commission (the “Commission”) are incorporated by reference into this Registration Statement:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 23, 2024;

(c) The Registrant’s Current Reports on Form 8-K, filed with the Commission on February 7, 2024 (excluding information furnished pursuant to Item 2.02), February 23, 2024 (excluding information furnished pursuant to Item 7.01), March 4, 2024 (including information furnished pursuant to Item 7.01), April 16, 2024, April 25, 2024, May 2, 2024 (excluding information furnished pursuant to Item 2.02) and June 26, 2024.

(d) The description of the Registrant’s Ordinary Shares and American Depositary Shares contained in Exhibit 4.3 of the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 filed on March 2, 2020 (File No. 001-36153).

All other reports and documents filed, but not furnished, by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered under this Registration Statement have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Except as expressly provided in Item 3(c) hereof, in no event, however, will any of the information, including exhibits, that the Registrant discloses under Item 2.02 and Item 7.01 of any report on Form 8-K that has been or may be, from time to time, furnished to the Commission, be incorporated by reference into or otherwise become a part of this Registration Statement.

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein (or in any other subsequently filed document that also is or is deemed

to be incorporated by reference in this Registration Statement) modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable. The class of securities to be offered is registered under Section 12 of the Exchange Act.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The Registrant is incorporated under the laws of France.

The Registrant maintains liability insurance for its directors and officers, including insurance against liability under the Securities Act, and the Registrant has entered into agreements with its directors and certain of its executive officers to make the provision of such insurance mandatory. With certain exceptions and subject to limitations on indemnification under French law, these agreements provide for insurance coverage, indemnification and advancement of expenses to these individuals for damages and expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by them in any action or proceeding arising out of their actions in their respective capacities as directors and/or executive officers of the Registrant. A shareholder’s investment may be adversely affected to the extent the Registrant may compensate its directors and officers for any indemnifiable claim (including any settlement amount and damage awards) against them pursuant to these agreements, to the extent not covered by the Registrant’s insurance policies.

Certain of the Registrant’s non-employee directors may, through their relationships with their employers or partnerships, be insured and/or indemnified against certain liabilities in their respective capacities as members of the Registrant’s board of directors.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 23.2* | | Consent of Baker & McKenzie A.A.R.P.I. (included in Exhibit 5.1). |

| | |

| 24.1* | | Power of Attorney (included on the signature page to this Registration Statement on Form S-8). |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

* Filed herewith.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act.

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

[THE NEXT PAGE IS THE SIGNATURE PAGE]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Paris, France on July 24, 2024.

| | | | | | | | |

| CRITEO S.A. |

| |

| By: | /s/ Megan Clarken |

| | Megan Clarken |

| | Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Megan Clarken, Sarah Glickman and Ryan Damon as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file or cause to be filed the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact and agent full power and authority to perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, shall do or cause to be done by virtue of this Power of Attorney.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on July 24, 2024.

| | | | | | | | | | | | | | |

| Signature | | Capacity | | Date |

| | | | |

| /s/ Megan Clarken | | Chief Executive Officer and Director | | July 24, 2024 |

| Megan Clarken | | (Principal Executive Officer) | | |

| | | | |

| /s/ Sarah Glickman | | Chief Financial Officer | | July 24, 2024 |

| Sarah Glickman | | (Principal Financial Officer and Principal Accounting Officer) | | |

| | | | |

| /s/ Ryan Damon | | Chief Legal and Corporate Affairs Officer | | July 24, 2024 |

| Ryan Damon | | | |

| | | | |

| /s/ Nathalie Balla | | Director | | July 24, 2024 |

| Nathalie Balla | | | | |

| | | | |

| /s/ Frederik van der Kooi | | Director | | July 24, 2024 |

| Frederik van der Kooi | | | | |

| | | | |

| /s/ Marie Lalleman | | Director | | July 24, 2024 |

| Marie Lalleman | | | | |

| | | | | | | | | | | | | | |

| /s/ Edmond Mesrobian | | Director | | July 24, 2024 |

| Edmond Mesrobian | | | | |

| | | | |

| /s/ Hubert de Pesquidoux | | Director | | July 24, 2024 |

| Hubert de Pesquidoux | | | | |

| | | | |

| /s/ Rachel Picard | | Director | | July 24, 2024 |

| Rachel Picard | | | | |

| | | | |

| /s/ Ernst Teunissen | | Director | | July 24, 2024 |

| Ernst Teunissen | | | | |

| | | | |

AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-8 has been signed by the undersigned as the duly authorized representative in the United States of Criteo S.A. in Paris, France on July 24, 2024.

| | | | | | | | |

| CRITEO S.A. |

| |

| By: | /s/ Megan Clarken |

| | Megan Clarken |

| | Chief Executive Officer |

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Criteo, S.A.

(Exact name of registrant as specified in its charter)

Table 1 – Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Security Type | | Security Class Title | | Fee Calculation Rule | | Amount Registered | | | Proposed Maximum Offering Price Per Unit | | | Maximum Aggregate Offering Price | | | Fee Rate | | | Amount of Registration Fee |

Equity | | Ordinary Shares, €0.025 par value(1) | | Other(3) | | 7,000,000(2) | | | $39.86(3) | | | $279,020,000.00 | | | $147.60 per $1,000,000(2) | | | $ | $41,183.35(2) |

Total Offering Amounts | | | | | | |

| | | | | | | | | | | $ | $41,183.35 |

Total Fee Offsets | | | | | | | | | | | | | | | | | | | – |

Net Fee Due | | | | | | | | | | | | | | | | | | $ | $41,183.35 |

| | | | | | | | |

| (1) | The securities to be registered include ordinary shares, par value €0.025 per share, (“Ordinary Shares”) of Criteo S.A. (the “Registrant”), options to purchase Ordinary Shares issuable under the Registrant’s Amended 2016 Stock Option Plan and rights to acquire Ordinary Shares issuable under the Registrant’s Amended and Restated 2015 Time-Based Restricted Stock Units Plan or under the Registrant’s Amended and Restated 2015 Performance-Based Restricted Stock Units Plan. The Ordinary Shares may be represented by American Depositary Shares (“ADSs”) of the Registrant. Each ADS represents one Ordinary Share. ADSs issuable upon deposit of the Ordinary Shares registered hereby were registered pursuant to a separate Registration Statement on Form F-6 (File No. 333-191715, as amended by post-effective amendment filed with the Securities and Exchange Commission on December 17, 2021). |

| (2) | This Registration Statement covers 7,000,000 Ordinary Shares issuable under the Registrant’s Amended 2016 Stock Option Plan, Amended and Restated 2015 Time-Based Restricted Stock Units Plan, or Amended and Restated 2015 Performance-Based Restricted Stock Units Plan. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”) and also covers an indeterminate amount of additional Ordinary Shares, which may be offered and issued under the Registrant’s Amended 2016 Stock Option Plan, Amended and Restated 2015 Time-Based Restricted Stock Units Plan, or Amended and Restated 2015 Performance-Based Restricted Stock Units Plan as a result of stock splits, stock dividends, or similar transactions increasing the number of the Registrant's outstanding Ordinary Shares without any consideration. |

| (3) | Estimated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the registration fee based upon the average of the high and low prices of the ADSs on the Nasdaq Global Select Market on July 17, 2024. |

Table 2 – Fee Offset Claims and Sources

Not applicable.

Baker & McKenzie – Association d’Avocats à Responsabilité Professionnelle Individuelle – Avocats à la Cour. Membre d'une association agréée, le règlement des honoraires par chèque est accepté. Baker & McKenzie A.A.R.P.I. est membre de Baker & McKenzie International. Baker & McKenzie A.A.R.P.I. Avocats à la Cour 1 rue Paul Baudry 75008 Paris France Tél. : +33 (0) 1 44 17 53 00 Fax : +33 (0) 1 44 17 45 75 www.bakermckenzie.com Asie Pacifique Bangkok Brisbane Hanoï Ho Chi Minh-Ville Hong Kong Jakarta Kuala Lumpur* Manille* Melbourne Pékin Rangoun Séoul Shanghai Singapour Sydney Taipei Tokyo Europe, Moyen-Orient & Afrique Abu Dhabi Almaty Amsterdam Anvers Bahreïn Bakou Barcelone Berlin Bruxelles Budapest Casablanca Djedda* Doha Dubaï Düsseldorf Francfort Genève Istanbul Johannesburg Kiev Le Caire Londres Luxembourg Madrid Milan Moscou Munich Paris Prague Riyad* Rome St Pétersbourg Stockholm Varsovie Vienne Zurich Amérique Bogota Brasilia** Buenos Aires Caracas Chicago Dallas Guadalajara Houston Juarez Lima Mexico Miami Monterrey New York Palo Alto Porto Alegre** Rio de Janeiro** San Francisco Santiago Sao Paulo** Tijuana Toronto Valencia Washington, DC * Cabinet Associé ** En coopération avec Trench, Rossi e Watanabe Advogados Criteo S.A. 32 rue Blanche 75009 Paris Paris, July 24, 2024 Re: Registration Statement on Form S-8 of Criteo S.A. Ladies and Gentlemen: We have acted as French counsel to Criteo S.A., a French société anonyme (the “Company”), in connection with the potential issuance or delivery and sale of an aggregate of up to 7,000,000 ordinary shares of the Company, par value €0.025 per share (the “Shares”), pursuant to the Company’s Amended 2016 Stock Option Plan (the “2016 Stock- Option Plan”), Amended and Restated 2015 Time-Based Restricted Stock Units Plan (the "2015 RSU Plan"), and Amended and Restated 2015 Performance-Based Restricted Stock Units Plan (the "2015 PSU Plan" and, collectively, the “Plans”). In connection with the opinion expressed herein, we have examined (i) a certified copy of an extract of the minutes of the board of directors of the Company held on April 6, 2022 notably to amend the 2016 Stock-Option Plan with the amended 2016 Stock-Option Plan attached thereto, a certified copy of an extract of the minutes of the board of directors of the Company held on April 5, 2023 notably to amend the 2015 RSU Plan with the amended 2015 RSU Plan attached thereto and a certified copy of an extract of the minutes of the board of directors of the Company held on April 15, 2024 notably to amend the 2015 PSU Plan with the amended 2015 PSU Plan attached thereto (collectively, the “Board Meetings”), and (ii) certified copies of the minutes of the resolutions of the combined ordinary and extraordinary general meeting of the shareholders of the Company held, respectively, on June 13, 2023 and June 25, 2024 (collectively, the “Shareholders Meetings”), and such other documents, records and matters of law as we have deemed relevant or necessary for purposes of such opinion. In such examination, we have assumed that (i) the documents reviewed are true and correct copies of the original documents, (ii) the signature on the documents reviewed are genuine, (iii) the persons identified as officers in the documents reviewed are actually serving as such, (iv) the persons executing the documents reviewed have the legal capacity to execute such documents, and (v) the Board Meetings and the Shareholders Meetings have been validly convened and held. We have also assumed that the Company has not, and will not take, action inconsistent with the resolutions authorizing the Company to issue the Shares. We have lastly assumed, for any future awards under the Plans, that (i) the resolutions authorizing the Company to issue the Shares pursuant to the respective Plans and the

2 applicable award agreements will be in full force and effect on the date of such awards, (ii) such future awards will be approved by the board of directors of the Company in accordance with applicable laws and regulations and with the terms of the relevant Plan and (iii) at the time of each issuance of the Shares, there will be a sufficient number of ordinary shares authorized for issuance under the applicable resolutions that have not otherwise been issued or reserved or committed for issuance. Based on the foregoing, and subject to the further limitations, qualifications and assumptions set forth herein, we are of the opinion that the Shares that may be issued or delivered and sold pursuant to the Plans and the authorized forms of award agreements thereunder will be, when issued or delivered and sold in accordance with the respective Plans and applicable award agreements, validly issued, fully paid and non-assessable (which term means that no shareholder shall be obliged to pay or contribute further amounts to the capital of the Company in connection with the issue of such shares), provided that, in respect of the new Shares issuable pursuant to the 2016 Stock-Option Plan, the consideration paid for the Shares is at least equal to the stated par value thereof. The opinion expressed herein is limited to the laws of France, as currently in effect, and we express no opinion as to the effect of the laws of any other jurisdiction. We undertake no obligation to advise you as a result of developments occurring of which we may become aware after the date hereof and that may affect the matters addressed in this opinion. This opinion expressed above is limited to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated. We have not been responsible for investigating or verifying the accuracy of the facts contained in the documents reviewed or for verifying that no material fact have been omitted therefrom. We hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement on Form S-8 filed by the Company to effect registration of the Shares to be issued and sold pursuant to each Plan under the Securities Act of 1933 (the “Act”). In giving such consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission promulgated thereunder. Very truly yours, Agnès Charpenet _______________________ Baker & McKenzie A.A.R.P.I.

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 23, 2024, relating to the financial statements of Criteo S.A. and subsidiaries (the “Company”), and the effectiveness of the Company’s internal control over financial reporting, appearing in the Annual Report on Form 10-K of the Company for the year ended December 31, 2023.

/s/ Deloitte & Associés

Paris – La Défense, France

July 24, 2024

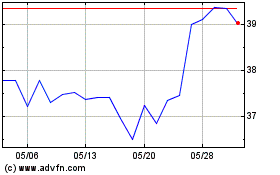

Criteo (NASDAQ:CRTO)

過去 株価チャート

から 6 2024 まで 7 2024

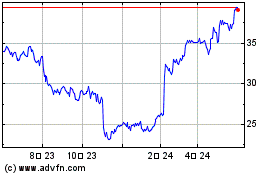

Criteo (NASDAQ:CRTO)

過去 株価チャート

から 7 2023 まで 7 2024