0001606698FALSE00016066982023-12-202023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) December 20, 2023

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYER IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into Material Definitive Agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On December 20, 2023, Direct Tech Sales LLC d/b/a RCA Commercial Electronics, an Indiana limited liability company (“DTS”), and DTI Services Limited Liability Company d/b/a RCA Commercial Electronics, an Indiana limited liability company (“DTI” and together with “DTS, individually and collectively, jointly and severally, the “Borrower”), both of which entities are subsidiaries of Alpine 4 Holdings, Inc., a Delaware corporation (“Alpine 4”) entered into a Loan and Security Agreement (“Loan Agreement”) with North Mill Capital LLC, d/b/a SLR Business Credit, a Delaware limited liability company (the “Lender”).

Additionally, and in connection with the Loan Agreement, Alpine 4 entered into a Corporate Guaranty with the Lender, and DTS entered into a Collateral Assignment Agreement with the Lender pursuant to which DTS granted to the Lender a security interest in certain collateral of DTI.

Loan and Security Agreement with North Mill Capital LLC

Under the Loan Agreement, the Lender agreed to provide the Borrower with one or more advances in an amount up to 85% of the aggregate outstanding amount of Eligible Accounts (as defined below) (the “Eligible Accounts Loan Value”); plus the lowest of (i) an amount up to 60% of the aggregate value of Eligible Inventory (as defined below); (ii) $5,000,000; and (iii) an amount not to exceed 100% of the then outstanding Eligible Accounts Loan Value; minus $350,000.

The Loan Agreement defines Eligible Accounts as those accounts created by the Borrower in the ordinary course of business, which are acceptable to the Lender, provided that standards of eligibility may be established and revised from time to time by the Lender in the Lender’s exclusive judgment. The Loan Agreement includes certain criteria on which the Lender may base its determination of eligibility. Under the Loan Agreement, Eligible Accounts does not include any of the following: (i) (A) Accounts with respect to which the Account debtor has failed to pay within ninety (90) days of invoice date, and (B) all Accounts owed by any Account debtor that has failed to pay twenty-five percent (25%) or more of its Accounts owed to Borrower within ninety (90) days of invoice date; (ii) Accounts with respect to which the goods sold are sold on a bill and hold basis, a consignment sale basis, a guaranteed sale basis, a sale or return basis or which contain other terms by reason of which payment by the Account debtor may be conditional; (iii) Accounts with respect to which the Account debtor is not a resident of the United States unless such Accounts are supported by foreign credit insurance or a letter of credit, in both instances satisfactory, in form and substance, to, and assigned to, Lender; (iv) Accounts with respect to which the Account debtor is the United States or any department, agency or instrumentality of the United States, any State of the United States or any city, town, municipality or division thereof unless all filings have been made under the Federal Assignment of Claims Act or comparable state or other statute; (v) Accounts with respect to which the Account debtor is an officer, employee or agent of, or subsidiary of, related to, affiliated with or has common shareholders, officers or directors with Borrower; (vi) Accounts with respect to which Borrower is or may become liable to the Account debtor for goods sold or services rendered by the Account debtor to Borrower or otherwise; (vii) Accounts with respect to an Account debtor whose total obligations to Borrower exceed fifteen percent (15%) of all Accounts or such other percentage as Lender may agree to in writing as to a particular Account debtor (such applicable percentage being, the “Concentration Percentage”), to the extent such obligations exceed the applicable Concentration Percentage, provided, that, with respect to the Account debtor W.W. Grainger, Inc., the Concentration Percentage shall not exceed fifty percent (50%)(rather than 15%); (viii) Accounts with respect to which the Account debtor disputes liability or makes any claim with respect thereto, is subject to any insolvency proceeding, becomes insolvent, fails or goes out of business; (ix) Accounts arising out of a contract or purchase order for which a surety bond was issued on behalf of Borrower; (x) Accounts with respect to which Lender does not have a first priority and exclusive perfected security interest; (xi) Accounts with respect to which the Account debtor is in a jurisdiction for which Borrower is required to file a notice of business activities or similar report and Borrower has not filed such report within the time period required by applicable law; (xii) Accounts with respect as to which an invoice has not been issued to the Account debtor; or (xiii) Accounts which represent a progress or "milestone" billing on a contract that has not been fully completed by Borrower.

The Loan Agreement defines Eligible Inventory as Inventory consisting of first quality finished goods held for sale in the ordinary course of Borrower's business and raw materials for such finished goods which are located at Borrower's premises and acceptable to Lender in all respects, provided that standards of eligibility or acceptability

for Eligible Inventory may be established and revised from time to time by Lender in Lender's exclusive judgment. In determining such acceptability and standards of eligibility, Lender may, but need not, rely on reports and schedules of Inventory furnished to Lender by Borrower, but reliance thereon by Lender from time to time shall not be deemed to limit Lender's right to revise its standards of eligibility and acceptability at any time. In general, except in Lender's sole discretion, Eligible Inventory shall not include the following: (a) obsolete or unsalable or slow moving items; (b) work in process, components which are not part of finished goods, supplies, spare parts, packaging and shipping materials or materials used or consumed in Borrower's business; (c) goods returned to, repossessed by, or stopped in transit by, Borrower; (d) Inventory at the premises of third parties or subject to a security interest or lien in favor of any third party; (e) bill and hold goods, (f) Inventory which is not subject to a perfected security interest in favor of Lender; (g) returned and/or defective goods, or “seconds;” (h) Inventory purchased or sold on a consignment basis; (i) Inventory which contains any labels, trademarks, trade names or other identifying characteristics which are the property of third parties unless the use of same by Borrower is under a valid license, royalty or similar agreement with the owner thereof, in form and substance satisfactory to Lender, and which license, royalty or similar agreement remains in full force and effect, has not been terminated and the owner thereof has issued in favor of Lender an agreement, in form and substance satisfactory to Lender, allowing Lender to dispose of said items of Inventory upon the occurrence of an Event of Default; (j) Inventory produced in violation of the Fair Labor Standards Act and subject to the so-called “hot goods” provision contained in Title 29 U.S.C. Section 215(a)(1); or (k) Inventory located at a leased premises or public or private warehouse unless Lender has received a waiver agreement, in form and content satisfactory to Lender, from the landlord/warehouseman. Eligible Inventory shall for the purposes of the Loan Agreement be valued at the lower of cost or market value.

The maximum aggregate principal amount subject to the Revolver is $10,000,000 (the “Advance Limit”). Interest accrues on the daily balance at the per annum rate of 1.5% above the Prime Rate in effect from time to time, but not less than 9.00% (the “Applicable Rate”). In the Event of a Default, interest may become 6% above the Applicable Rate (the “Default Rate”). All interest payable under the Loan Documents is computed on the basis of a 360-day year for the actual number of days elapsed on the Daily Balance.

In consideration of the Lender’s entering into the Loan Agreement, the Borrower has agreed to pay the Lender an annual facility fee (the “Facility Fee”) of (a) one percent (1.00%) of the Advance Limit, simultaneously with the execution of the Loan Agreement (the “Initial Facility Fee”), and (b) one percent (1.00%) of the Advance Limit on each anniversary of the date hereof (each, an “Annual Facility Fee”); provided, however, as an accommodation to Borrower, (i) the Initial Facility Fee shall be due and payable in twelve (12) equal monthly installments, commencing on the date hereof and continuing thereafter, on the first Business Day of each subsequent month until paid in full and (ii) each Annual Facility Fee shall be payable in twelve (12) equal monthly installments, commencing on the first Business Day of the month immediately following the last installment payment of the Initial Facility Fee and, continuing thereafter, on the first Business Day of each subsequent month. Notwithstanding the foregoing, the unpaid balance of the Facility Fee shall be payable in full on the earlier of (a) the termination of the Loan Agreement and (b) at Lender’s option, upon declaration of an Event of Default. Pursuant to the Purchase Agreement, the Facility Fee is deemed to be fully earned upon the execution of the Purchase Agreement for the entire Initial Term.

The Borrower will also pay the Lender a monthly fee (the “Servicing Fee”) in an amount equal to 0.10% of the average Daily Balance during each month on or before the first day of each calendar month during the Term, including each renewal term, or so long as the obligations are outstanding. Pursuant to the Loan Agreement, in the event that the Borrower breaches its obligations relating to the collection of its accounts, and without constituting a waiver of the Event of Default as a consequence of such breach, at the election of Lender, the Servicing Fee shall be doubled. The Loan Agreement also includes the requirement to pay a field examination fee in an amount equal to One Thousand One Hundred Ninety-Five Dollars ($1,195) per day, per examiner plus out-of- pocket expenses for each examination of Borrower's Books or the other Collateral performed by Lender or its designee, and the payment of a late reporting fee of $50 per document per day for each business day any report, financial statement or schedule required by the Purchase Agreement to be delivered to Lender is past due.

The initial term of the loan is three years. After the initial term and unless otherwise terminated, the loan will be extended in one-year periods at the option of the Lender. If the term is terminated by the Lender upon the occurrence of an Event of Default or is terminated by the Company before the expiration of the initial term or during a renewal term, the Company will owe the Lender a fee in an amount equal to: (a) 3% of the sum of the Advance Limit plus any advances by the Lender to or on behalf of the Borrower other than under the Revolving Credit Facility, if such termination occurs on or prior to the first anniversary of the commencement date of the initial term; (b) 2% of the sum of the Advance Limit plus any advances by the Lender to or on behalf of the Borrower other than under the

Revolving Credit Facility, if such termination occurs after the first anniversary of the commencement date of the initial term and on or prior to the second anniversary of the commencement date of the initial term; or (c) 1% of the sum of the Advance Limit plus any advances by the Lender to or on behalf of the Borrower other than under the Revolving Credit Facility, if such termination occurs after the second anniversary of the commencement date of the initial term and on or prior to the termination of the initial term.

Pursuant to the Loan Agreement, the Borrower granted to the Lender a continuing security interest in the Collateral in order to secure the repayment of the obligations and performance by the Borrower of each and all of its covenants and obligations under the Loan Agreement. The Loan Agreement defines Collateral as all of the following assets, properties, rights and interests in property of the Borrower whether now owned or existing, or hereafter acquired or arising, and wherever located: all accounts, all equipment, all commercial tort claims, all general intangibles, all chattel paper, all inventory, all negotiable collateral, all investment property, all financial assets, all letter-of-credit rights, all supporting obligations, all deposit accounts, all money or assets of borrower, which hereafter come into the possession, custody, or control of lender; all proceeds and products, whether tangible or intangible, of any of the foregoing, including proceeds of insurance covering any or all of the foregoing; any and all tangible or intangible property resulting from the sale, lease, license or other disposition of any of the foregoing, or any portion thereof or interest therein, and all proceeds thereof; and any other assets of borrower or any guarantor which may be subject to a lien in favor of Lender as security for the obligations.

The Loan Agreement also contains both affirmative and negative covenants that are customary in this type of transaction.

Capitalized terms not otherwise defined herein have the meanings set forth in the Loan Agreement.

Corporate Guaranty

In connection with the Loan Agreement, Alpine 4 entered into a Corporate Guaranty (the “Guaranty”) with the Lender, pursuant to which Alpine 4 agreed to jointly and severally guarantee the full, prompt and unconditional payment when due of each and every Liability of Borrower to Lender, existing as of the date of the Loan Agreement or thereafter incurred, whether matured or unmatured, and the full, prompt, and unconditional performance of every term and condition of any transaction to be kept and performed by Borrower to Lender. The Guaranty is a primary obligation of Alpine 4 and will be a continuing inexhaustible Guaranty without limitation as to the amount or duration and may not be revoked except by notice (the “Notice”) in writing to the Lender received at least thirty (30) days prior to the date set for such revocation; provided, however, no Notice shall affect the liability under the Guaranty the Guaranty for any such Liability of Borrower arising prior to the date set for revocation whether made before or after the Notice.

Additionally, the Lender has the right, among other things, to change the manner, place, or terms of payment; exercise or refrain from exercising any of its rights under the Loan Agreement or the Guaranty; release, settle, or compromise any Liability of the Borrower; and take or refrain from taking any action against the Borrower or Alpine 4. Pursuant to the Guaranty, if there is an event of default under the Loan Agreement, the Lender has the right to declare the Liability of the Borrower to be immediately due and payable by Alpine 4.

In the Guaranty, Alpine 4 made certain representations and warranties customary in this type of transaction, and the Guaranty includes standard indemnification provisions and other covenants and terms customary in this type of transaction.

Collateral Assignment

In connection with the Loan Agreement, DTS entered into a Collateral Assignment with the Lender (the “Collateral Assignment”), and agreed to grant to the Lender a security interest in the Collateral (as defined in the Collateral Agreement) and the goodwill and certain other assets with respect to the Collateral.

The Collateral Assignment defines the Collateral as follows:

(a) all state (including common law), federal and foreign trademarks, service marks and tradenames, and application registration of such trademarks, service marks and trade names (but excluding any application to register any trademark, service mark or other mark prior to the filing under applicable law of a verified statement of use (or the equivalent) for such trademark, service mark or other mark to the extent the creation of a security interest

therein or the grant of a mortgage thereon would void or invalidate such trademark, service mark or other mark) (the "Trademarks"), all licenses relating to any of the foregoing and all income and royalties with respect to any licenses (including such marks, names and applications described in Exhibit A attached hereto), whether registered or unregistered and wherever registered, all rights to sue for past, present or future infringement or unconsented use thereof, all rights arising therefrom and pertaining thereto and all reissues, extensions and renewals thereof;

(b) all right of action, claims for damages, profits and costs, all other demands for any sum or sums of money whatsoever which it has or may have either at law or in equity, against any and all persons, firms, corporations and associations by reason of claims of infringement upon said Trademarks;

(c) the entire goodwill of or associated with the business now ore hereafter conducted by Assignor connected with and symbolized by any of the aforementioned properties and assets;

(d) all general intangibles and all intangible intellectual or other similar property of Assignor of any kind or nature, associated with or arising out of any of the aforementioned properties and assets and not otherwise described above;

(e) all proceeds of any or all of the foregoing (including license royalties, rights to payments, accounts and proceeds of infringement suits) and, to the extent not otherwise included, all payments under insurance (whether or not Assignee is the loss payee thereof) or any indemnity warranty or guaranty payable by reason of loss or damage to or otherwise with respect to the foregoing.

Pursuant to the Collateral Agreement, DTS agreed that, notwithstanding the Collateral Assignment, DTS will perform and discharge and remain liable for all its covenants, duties, and obligations arising in connection with the Collateral and any licenses and agreements related thereto. The Lender shall have no obligation or liability in connection with the Collateral or any licenses or agreements relating thereto by reason of the Collateral Assignment or any payment received by the Lender relating to Collateral, nor will the Lender be required to perform any covenant, duty, or obligation of DTS arising in connection with the Collateral or any license or agreement related thereto or to take any other action regarding the Collateral or any such licenses or agreement. Additionally, unless and until an event of default occurs pursuant to the Loan Agreement, DTS will retain the legal and equitable title to the Trademarks and shall have the right to use the Collateral, subject to the terms and covenants of the Loan Agreement, and the Collateral Assignment.

This Current Report contains only a brief description of the material terms of the Loan Agreement, the Corporate Guaranty, and the Collateral Assignment, and does not purport to be a complete description of the rights and obligations of the parties thereunder, and such descriptions are qualified in their entirety by reference to the full text of the Loan Agreement, the Corporate Guaranty, and the Collateral Assignment, which will be included as exhibits filed with the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Thermal Dynamics International Merchant Cash Advance

On December 27, 2023, the Company, and its subsidiary Thermal Dynamics International, Inc. ("TDI", and collectively with the Company, the “Borrowers”) entered into a Standard Merchant Cash Advance Agreement (the “AEC Cash Advance Agreement”) with AEC GAP Capital ("AEC"), an unrelated third-party financial institution, for the purchase and sale of future receipts, pursuant to which the Company sold in the aggregate $745,000 in future receipts of the Company and the Borrowers for gross proceeds to the Borrowers of $500,000.

Under the terms of the AEC Cash Advance Agreement, until the purchase price has been repaid, the Company must pay $6,750 each day for the first 22 days, followed by $8,500 a day for the remaining 15 weeks with the first payment being due December 28, 2023 (the Borrowers made this payment as required). The AEC Cash Advance Agreement includes a pre-payment discount of $105,000 if payoff occurs prior to January 26, 2024, or $70,000 if payoff occurs prior to February 26, 2024. The financing arrangement is secured by an interest in collateral of select subsidiaries that had no other banking encumbrances (the “AEC Collateral”), that is defined as collectively: (a) all accounts, including without limitation, all deposit accounts, accounts-receivable, and other receivables, as those terms are defined by Article 9 of the Uniform Commercial Code (the “UCC”), now or hereafter owned or acquired by any Borrower; and (b) all proceeds, as that term is defined by Article 9 of the UCC. Prior to the entry into the AEC Cash Advance Agreement, there had been no previous relationship between the Company or any of its subsidiaries and AEC. Due to delays in the anticipated closing of the sale of the Company’s shares pursuant to its registration statement, the financing was deemed necessary for working capital purposes.

Guarantee

In connection with the AEC Cash Advance Agreement, the Company entered into a guarantee (the “Guarantee”) pursuant to which the Company agreed to guarantee TDI’s performance of its obligations under the AEC Cash Advance Agreement and any addenda or other agreements executed simultaneously. Under the Guarantee, if there is an event of default under the AEC Cash Advance Agreement, AEC may enforce its rights under the Guarantee without first seeking to obtain payment from TDI.

Direct Tech Sales Addendum

Additionally, in connection with the AEC Cash Advance Agreement, Direct Tech Sales, Inc. (“DTI”), a subsidiary of the Company, entered into an addendum (the “Addendum”) to secure the performance obligations of the Borrowers. Pursuant to the Addendum, DTI granted to AEC a security interest in certain collateral of DTI consisting of (a) all accounts, including without limitation, all deposit accounts, accounts-receivable, and other receivables, chattel paper, documents, and instruments, as those terms are defined by Article 9 of the Uniform Commercial Code (the “UCC”), now or thereafter owned or acquired by DTI; and (b) all proceeds, as that term is defined by Article 9 of the UCC.

Pursuant to the AEC Cash Advance Agreement, if an event of default occurs, AEC agreed to first seek to enforce its rights against the Company, and subsequently (if needed) to seek payment from DTI, in that sequential order.

The foregoing description of the AEC Cash Advance Agreement (and the Guarantee and Addendum) does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified by reference to the full text of such agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: December 29, 2023

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

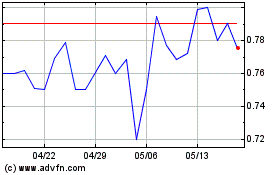

Alpine 4 (NASDAQ:ALPP)

過去 株価チャート

から 3 2024 まで 4 2024

Alpine 4 (NASDAQ:ALPP)

過去 株価チャート

から 4 2023 まで 4 2024