As filed with the Securities and Exchange Commission

on November 30, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ADAPTIMMUNE THERAPEUTICS PLC

(Exact name of registrant as specified in its charter)

| England and Wales |

|

Not Applicable |

| (State or other jurisdiction |

|

(IRS Employer Identification No.) |

| of incorporation or organization) |

|

|

60 Jubilee Avenue, Milton Park

Abingdon, Oxfordshire OX14 4RX

United Kingdom

(44) 1235 430000

(Address of principal executive offices, including

zip code)

Adaptimmune Therapeutics plc Company Share Option

Plan

Adaptimmune Therapeutics plc 2015 Share Option

Scheme

Adaptimmune Therapeutics plc 2016 Employee Share

Option Scheme

(Full title of the plans)

ADAPTIMMUNE LLC

351 Rouse Boulevard, The Navy Yard

Philadelphia, PA 19112

United States of America

(215) 825 9260

(Name, address, telephone number, including area

code, of agent for service)

Copies to:

| David S. Bakst |

Adrian Rawcliffe |

| Mayer Brown LLP |

Chief Executive Officer |

| 1221 Avenue of the Americas |

60 Jubilee Avenue, Milton Park |

| New York, NY 10020 |

Abingdon, Oxfordshire OX14 4RX |

| Telephone: (212) 506 2500 |

United Kingdom |

| |

Telephone: (44) 1235 430000 |

| |

Facsimile: (44) 1235 430001 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer x |

Smaller reporting company x |

| Smaller reporting company ¨ |

Emerging growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

REGISTRATION

OF ADDITIONAL SHARES PURSUANT TO GENERAL INSTRUCTION E

Pursuant

to General Instruction E to Form S-8, Adaptimmune Therapeutics plc (the “Registrant”) is filing this Registration Statement

on Form S-8 (the “S-8 Registration Statement”) with the Securities and Exchange Commission (the “Commission”)

to register 213,932,393 additional ordinary shares, par value £0.001 per share (the “Ordinary Shares”), of the

Registrant under the Adaptimmune Therapeutics plc Company Share Option Plan, the Adaptimmune Therapeutics plc 2015 Share Option

Scheme and the Adaptimmune Therapeutics plc 2016 Employee Share Option Scheme (collectively, the “Plans”). In accordance

with the instructional note to Part I of Form S-8 as promulgated by the Commission, the information specified by Part I of the Form S-8

has been omitted from this Registration Statement.

INCORPORATION BY REFERENCE

OF CONTENTS OF

REGISTRATION

STATEMENTS ON FORM S-8

This

S-8 Registration Statement is being filed for the purpose of increasing the number of securities of the same class as other securities

for which Registration Statements of the Registrant on Form S-8 relating to the same benefit plans are effective. The Registrant previously

registered ordinary shares for issuance under the Plans under a Registration Statement on Form S-8 filed with the Commission on

August 30, 2019 (File No. 333-233558), as amended by post-effective amendment number one filed with the Commission on June 29, 2023 and

a Registration Statement on Form S-8 filed with the Commission on May 7, 2015 (File No. 333-203929), as amended by post-effective amendment

number one filed with the Commission on June 29, 2023. Pursuant to General Instruction E to Form S-8, this S-8 Registration Statement

hereby incorporates by reference the contents of the Registration Statements referenced above.

Item 8. Exhibits.

Exhibit

No. |

|

Description |

| 3.1 |

|

Articles of Association of Adaptimmune Therapeutics plc (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the Commission on June 16, 2016). |

| |

|

|

| 4.1 |

|

Form of certificate evidencing ordinary shares (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form F-1 (file no: 333-203267)). |

| |

|

|

| 4.2 |

|

Form of Deposit Agreement among Adaptimmune Therapeutics plc, Citibank, N.A., as the depositary bank and Holders and Beneficial Owners of ADSs issued thereunder (incorporated by reference to Exhibit 4.2 to the Company’s Registration Statement on Form F-1 (file no: 333-203267)). |

| |

|

|

| 4.3 |

|

Form of American Depositary Receipt (included in Exhibit 4.2)(incorporated by reference

to Exhibit 4.3 to the Company’s Registration Statement on Form F-1 (file no: 333-203267)). |

| |

|

|

| 5.1* |

|

Opinion of Mayer Brown International LLP. |

| |

|

|

| 10.1 |

|

Adaptimmune Therapeutics plc Company Share Option Plan, dated March 16, 2015, as amended on April 15, 2015, as further amended on January 13, 2016 (incorporated by reference to Exhibit 4.32 to the Company’s Transition Report on Form 20-F (file no. 001-37368) filed with the Commission on March 17, 2016). |

| |

|

|

| 10.2 |

|

Adaptimmune Therapeutics plc 2015 Share Option Scheme, dated March 16, 2015, as amended on April 15, 2015, January 13, 2016, December 18, 2017 and June 29, 2023 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Commission on June 29, 2023 (file no. 001-37368)). |

| |

|

|

| 10.3 |

|

Adaptimmune Therapeutics plc 2016 Employee Share Option Scheme, dated January 14, 2016, as amended on December 18, 2017 and June 29, 2023 (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the Commission on June 29, 2023 (file no. 001-37368)). |

| |

|

|

| 23.1* |

|

Consent of KPMG LLP. |

| |

|

|

| 23.2* |

|

Consent of Mayer Brown International LLP (included in Exhibit 5.1). |

| |

|

|

| 24.1* |

|

Power of Attorney (included on the signature page to this Registration Statement). |

| |

|

|

| 107* |

|

Filing fee table. |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for

filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in Oxfordshire, England, on November 30, 2023.

| |

ADAPTIMMUNE THERAPEUTICS PLC |

| |

|

| |

By: |

/s/ Adrian Rawcliffe |

| |

|

Name: Adrian Rawcliffe |

| |

|

Title: Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose

signature appears below constitutes and appoints Adrian Rawcliffe and Gavin Wood, and each of them, as his or her true and lawful attorney-in-fact

and agent, each with the full power of substitution, for him or her and in his or her name, place or stead, in any and all capacities,

to sign any and all amendments to this Registration Statement on Form S-8 (including post-effective amendments), and to file the

same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto

said attorney in fact, proxy and agent full power and authority to do and perform each and every act and thing requisite and necessary

to be done in connection therewith, as fully for all intents and purposes as such person might or could do in person, hereby ratifying

and confirming all that said attorney in fact, proxy and agent, or such person’s substitute, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement on Form S-8 has been signed by the following persons on November 30, 2023 in the capacities

indicated.

| Signature |

|

Position |

| |

|

|

| /s/ Adrian Rawcliffe |

|

Chief Executive Officer and Director (Principal Executive Officer) |

| Adrian

Rawcliffe |

|

|

| |

|

|

| /s/ David M. Mott |

|

Chairman of the Board of Directors and Director |

| David M. Mott |

|

|

| |

|

|

| /s/ Gavin Wood |

|

Chief Financial Officer (Principal Accounting and Financial Officer) |

| Gavin Wood |

|

|

| |

|

|

| /s/ Andrew Allen |

|

Director |

| Andrew Allen |

|

|

| |

|

|

| /s/ Lawrence Alleva |

|

Director |

| Lawrence Alleva |

|

|

| |

|

|

| /s/ Ali Behbahani |

|

Director |

| Ali Behbahani, M.D. |

|

|

| |

|

|

| /s/ John Furey |

|

Director |

| John Furey |

|

|

| |

|

|

| /s/ Priti Hegde |

|

Director |

| Priti Hegde |

|

|

| |

|

|

| /s/ Kristen M. Hege |

|

Director |

| Kristen M. Hege |

|

|

| |

|

|

| /s/ Gary Menzel |

|

Director |

| Gary Menzel |

|

|

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE

OF THE REGISTRANT

Pursuant to the Securities Act, the undersigned, the duly authorized

representative in the U.S. of Adaptimmune Therapeutics plc, has signed this Registration Statement or amendment thereto on November 30,

2023.

| |

Adaptimmune LLC |

| |

|

| |

By: |

/s/ Adrian Rawcliffe |

| |

Name: |

Adrian Rawcliffe |

| |

Title: |

Chief Executive Officer |

Exhibit 5.1

| |

Mayer

Brown International LLP

201 Bishopsgate

London EC2M 3AF

Telephone: +44 20 3130 3000

Fax: +44 20 3130 3001

www.mayerbrown.com

DX 556 London and City

|

| |

|

| Adaptimmune Therapeutics plc |

|

| 60 Jubilee Avenue |

30 November 2023 |

| Milton Park |

|

| Abingdon |

|

| Oxfordshire |

|

| OX14 4RX |

|

Dear Sirs

Registration Statement on Form S-8

We have acted for Adaptimmune Therapeutics

plc, a public limited company incorporated under the laws of England and Wales (the "Company"), as its legal advisers

in England in connection with the registration statement on Form S-8 (the "Registration Statement") to be filed

on or about 30 November 2023 by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended

(the "Securities Act"), and the rules and regulations promulgated thereunder (the "Rules"), relating

to the registration of an aggregate of 213,932,393 ordinary shares of £0.001 each in the Company (the "Shares").

The Shares are issuable under: (a) the Adaptimmune Therapeutics plc 2015 Share Option Scheme (the "ATP 2015 Scheme");

(b) the Adaptimmune Therapeutics plc 2016 Employee Share Option Scheme (the "ATP 2016 Scheme"); and (c) the Adaptimmune

Therapeutics plc Company Share Option Plan (the "ATP CSOP", and, together with the ATP 2015 Scheme and the ATP 2016

Scheme, the "ATP Schemes").

We understand that no Shares are, or

are intended to be, admitted to trading on any market or exchange, or otherwise listed, in the United Kingdom.

In connection with the Registration

Statement, we have been asked to provide an opinion on certain matters, as set out below.

| 2. | Examination

and enquiries |

| (a) | For

the purpose of giving this opinion, we have examined: |

| (i) | a

copy of the Registration Statement (excluding its exhibits and any documents incorporated

by reference into the Registration Statement); and |

This is a legal communication, not a financial

communication. Neither this nor any other communication from this firm is intended to be, or should be construed as, an invitation or

inducement (direct or indirect) to any person to engage in investment activity.

Mayer Brown International LLP is a limited liability

partnership (registered in England and Wales number OC303359) which is authorised and regulated by the Solicitors Regulation Authority.

We operate in combination with other Mayer Brown entities with offices in the United States, Europe and Asia and are associated with

Tauil & Chequer Advogados, a Brazilian law partnership.

We use the term “partner” to refer

to a member of Mayer Brown International LLP, or an employee or consultant who is a lawyer with equivalent standing and qualifications

and to a partner of or lawyer with equivalent status in another Mayer Brown entity. A list of the names of members of Mayer Brown International

LLP and their respective professional qualifications may be inspected at our registered office, 201 Bishopsgate, London EC2M 3AF, England

or on www.mayerbrown.com.

| (ii) | a

certificate dated 30 November 2023 signed by the company secretary of the Company (the "Officer's

Certificate") relating to certain factual matters and having annexed thereto copies

(certified by the company secretary as being true, complete, accurate and up-to-date in each

case) of the following documents: |

| (A) | the

Company's certificate of incorporation, certificate of incorporation on re-registration,

memorandum of association and its articles of association; |

| (B) | the

rules of the ATP 2015 Scheme (as most recently amended as 29 June 2023); |

| (C) | the

rules of the ATP 2016 Scheme (as most recently amended on 29 June 2023); and |

| (D) | the

rules of the ATP CSOP. |

| (b) | For

the purpose of giving this opinion, we have arranged for our agents to make on 30 November

2023 the following searches in respect of the Company: |

| (i) | an

online search of the register kept by the Registrar of Companies in respect of the Company

(the "Company Search"); and |

| (ii) | at

10:16 a.m. (GMT) an online search in respect of the Company of the Central Registry of

Winding Up Petitions (the "Central Registry Enquiry" and, together with

the Company Search, the "Searches"), and reviewed the information we received

from our agents from the Searches (the "Search Results"). |

| (c) | For

the purposes of giving this opinion, we have only examined and relied on those documents

referred to in paragraph 2(a), and arranged or obtained the Searches and reviewed the Search

Results. We have made no further enquiries concerning the Company or any other person or

any other matter in connection with the giving of this opinion. |

| (d) | We

have made no enquiry, and express no opinion, as to any matter of fact. As to matters of

fact which are material to this opinion, we have relied entirely and without further enquiry

on statements made in the documents listed in paragraph 2(a). |

| (a) | In

giving this opinion we have assumed: |

| (i) | the

genuineness of all signatures, seals and stamps; |

| (ii) | that

each of the individuals who signs as, or otherwise claims to be, an officer of the Company

is the individual whom he or she claims to be and holds the office he or she claims to hold; |

| (iii) | the

authenticity and completeness of all documents submitted to us as originals; |

| (iv) | the

conformity with the original documents of all documents reviewed by us as drafts, specimens,

pro formas or copies and the authenticity and completeness of all such original documents; |

| (v) | the

person whose name and electronic signature appears in the signature block of any document

is the person who signed and that signature was applied with the intention to authenticate

that document; |

| (vi) | that

the ATP Schemes were validly adopted by the Company in accordance with all applicable laws

and regulations and the Company's articles of association; and that all amendments to the

ATP Schemes were validly made, in each case in accordance with the rules of the relevant

scheme, all applicable laws and regulations and the Company's articles of association; |

| (vii) | that

all grants of awards made under the ATP Schemes have been, or will be, validly made in accordance

with the rules of the ATP Schemes and in accordance with all applicable laws and regulations

and the Company's articles of association; |

| (viii) | that

there are no provisions of the laws of any jurisdiction outside England and Wales that would

have any implication for the opinion we express and that, insofar as the laws of any jurisdiction

outside England and Wales may be relevant to this opinion letter, such laws have been and

will be complied with; |

| (ix) | that

each consent, licence, approval, authorisation or order of any governmental authority or

other person which is required under any applicable law or regulation in connection with

the transactions contemplated by the ATP Schemes and the Registration Statement, has been

or will have been obtained and is or will be in full force and effect; |

| (x) | that

the Company is and will at all relevant times remain in compliance with all applicable anti-corruption,

anti-money laundering, anti-terrorism, sanctions, exchange control, human rights and national

security laws and regulations of any applicable jurisdiction, and the enforcement of all

transactions contemplated by the ATP Schemes and the Registration Statement are, and will

at all times remain, consistent with such laws and regulations; |

| (xi) | that

no agreement, document or obligation to or by which the Company (or its assets) is a party

or bound and no injunction or other court order against or affecting the Company would be

breached or infringed by the performance of actions to be carried out pursuant to, or any

other aspect of the matters contemplated by, the Registration Statement; |

| (xii) | that

the information included in the Search Results is true, accurate, complete and up-to-date

and that there is no information which, for any reason, should have been included in them

but was not; |

| (xiii) | that

all applicable laws (for the avoidance of doubt, as in force at all relevant times) have

been and will be complied with respect to anything done in relation to the grant of options

under the ATP Schemes and the allotment and issue of any Shares, including without limitation

the Financial Services and Markets Act 2000; |

| (xiv) | that

as at each date on which the Company granted or grants options under the ATP Schemes or allots

and issues any Shares (each an "Allotment Date"), the documents examined,

and the results of the searches and enquiries made, as set out in paragraph 2 (Examination

and enquiries), would not be rendered untrue, inaccurate, incomplete or out-of-date in

any relevant respect by reference to subsequent facts, matters, circumstances or events; |

| (xv) | that

as at each date on which the Company allots and issues any Shares, the Company will have

received the aggregate consideration payable for those Shares as "cash consideration"

(as defined in s583(3) Companies Act 2006), such aggregate consideration being not less than

the nominal value of those Shares; and that s583 Companies Act 2006 will continue in force

unamended at all relevant times; |

| (xvi) | that

the directors of the Company as at each Allotment Date will be duly authorised pursuant to

the articles of association of the Company in force at the Allotment Date, the Companies

Act 2006 and any relevant authority given by the members of the Company in general meeting

to grant such awards and/or to allot and issue the relevant Shares, and that any pre-emption

rights that would otherwise apply in relation to such grant, allotment and issue will have

been validly disapplied (in each case to the extent required); |

| (xvii) | that

as at each date on which the Company allots and issues any Shares, the board of directors

of the Company, a duly authorised committee of the board of directors or a duly authorised

director will have validly resolved to allot and issue the relevant Shares; |

| (xviii) | that

there is and will be no fact or matter (such as bad faith, coercion, duress, undue influence

or a mistake or misrepresentation before or at the time any agreement or instrument is entered

into, a subsequent breach, release, waiver or variation of any right or provision, an entitlement

to rectification or circumstances giving rise to an estoppel) and no additional document

between any relevant parties which in either case would or might affect this opinion and

which was not revealed to us by the documents examined or the searches and enquiries made

by us in connection with the giving of this opinion; |

| (xix) | that

the Company's place of central management and control is not the UK, the Channel Islands

or the Isle of Man for the purposes of the City Code on Takeovers and Mergers; and |

| (xx) | that

resolutions of the board of directors of the Company or a committee of the board of directors

referred to paragraph 3(a)(xvii) will be passed at a meeting duly convened, constituted and

held in accordance with all applicable laws and regulations; that in particular, but without

limitation, a duly qualified quorum of directors will be present throughout the meeting and

vote in favour of the resolutions; that each provision contained in the Companies Act 2006

or the articles of association of the Company relating to the declaration of directors' interests

or the power of interested directors to vote and count in the quorum will be duly observed;

and that in approving those resolutions the directors will act in accordance with ss171 to

174 Companies Act 2006, and actions to be carried out by the Company pursuant to those resolutions

will be in its commercial interests. |

| (b) | In

relation to paragraph 3(a)(xii), it should be noted that this information may not be true,

accurate, complete or up-to-date. In particular, but without limitation: |

| (i) | there

may be matters which should have been registered but which have not been registered or there

may be a delay between the registration of those matters and the relevant entries appearing

on the register of the relevant party; |

| (ii) | there

is no requirement to register with the Registrar of Companies notice of a petition for the

winding-up of, or application for an administration order in respect of, a company. Such

a notice or notice of a winding-up or administration order having been made, a resolution

having been passed for the winding-up of a company or a receiver, manager, administrative

receiver, administrator or liquidator having been appointed may not be filed with the Registrar

of Companies immediately and there may be a delay in any notice appearing on the register

of the relevant party; |

| (iii) | the

results of the Central Registry Enquiry relate only to petitions for the compulsory winding

up of, or applications for an administration order in respect of, any company presented prior

to the enquiry and entered on the records of the Central Registry of Winding Up Petitions.

The presentation of such a petition, or the making of such an application, may not have been

notified to the Central Registry or entered on its records immediately or, if presented to

a County Court or Chancery District Registry, at all; and |

| (iv) | in

each case, further information might have become available on the relevant register after

the Searches were made. |

| (a) | On

the basis of the examination and enquiries referred to in paragraph 2 (Examination and

enquiries) and the assumptions made in paragraph 3 (Assumptions) and subject to

the qualifications set out in paragraph 5 (Qualifications), we are of the opinion

that the Shares allotted and issued pursuant to the ATP Schemes will, when the Company has

received the aggregate issue price in respect of such Shares in accordance with the rules of

the relevant ATP Scheme, and the names of the holders of such Shares are entered in the register

of members of the Company, be validly issued, fully paid and no further amount may be called

thereon. |

| (b) | This

opinion is strictly limited to the matters expressly stated in this paragraph 4 and is not

to be construed as extending by implication to any other matter. |

| (a) | The

opinion set out in paragraph 4 (Opinion) is subject to the qualifications set out

in the remainder of this paragraph 5. |

| (b) | We

express no opinion as to matters of United Kingdom taxation or any liability to tax (including,

without limitation, stamp duty and stamp duty reserve tax) which may arise or be incurred

as a result of or in connection with the Shares, the ATP Schemes or the transactions contemplated

thereby, or as to tax matters generally. |

| (c) | The

opinion set out in paragraph 4(a) (Opinion) relates only to Shares contemplated by

the Registration Statement that are new ordinary shares issued by the Company from time to

time pursuant to the ATP Schemes following the date of the Registration Statement. We express

no opinion in respect of any other securities of the Company. |

| (a) | This

opinion and any non-contractual obligations arising out of or in connection with this opinion

shall be governed by, and construed in accordance with, English law. |

| (b) | This

opinion relates only to English law as applied by the English courts as at today's date ("Applicable

Law"). |

| (c) | By

"English law", we mean (except to the extent we make specific reference to an English

law "conflict of law" (private international law) rule or principle) English domestic

law on the assumption that English domestic law applies to all relevant issues. In construing

any European Union directive or regulation, we have read only the English version. |

| (d) | Except

to the extent, if any, specifically stated in it, this opinion takes no account of any proposed

changes as at today's date in Applicable Law. In particular, no account is taken of the impact

of the Retained EU Law (Revocation and Reform) Act 2023 with effect from 31 December 2023.

Nor do we undertake or accept any obligation to update this opinion to reflect any actual

changes in Applicable Law made or coming into effect after today's date. |

| (e) | We

express no opinion as to, and we have not investigated for the purposes of this opinion,

the laws of any jurisdiction other than England. It is assumed that no foreign law which

may apply to the matters contemplated by the Registration Statement, or any document relating

to, or any party to, any transactions contemplated by the ATP Schemes and the Registration

Statement, would or might affect the opinion set out in paragraph 4 (Opinion). |

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby

admit that we are in the category of persons whose consent is required under section 7 of the Securities Act or the Rules.

Yours faithfully

/s/ Mayer Brown International LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the use of our reports dated March 6, 2023, with respect

to the consolidated financial statements of Adaptimmune Therapeutics plc, and the effectiveness of internal control over financial reporting,

incorporated herein by reference.

| /s/ KPMG LLP |

| Reading, United Kingdom |

| November 30, 2023 |

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

ADAPTIMMUNE THERAPEUTICS PLC

(Exact name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type | |

Security Class

Title | |

Fee

Calculation

Rule | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering

Price Per

Unit | | |

Maximum

Aggregate

Offering Price | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Ordinary shares, £0.001 par value per share (1)(2) | |

Rule 457(c) and Rule 457(h) | |

| 93,932,393 | (3) | |

$ | 0.5116 | (4) | |

$ | 48,055,812.26 | | |

$147.60

per

$1,000,000 | | |

$ | 7,093.04 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| | |

| Equity | |

Ordinary shares, £0.001 par value per share (1)(2) | |

Rule 457(c) and Rule 457(h) | |

| 120,000,000 | (5) | |

$ | 0.0772 | (6) | |

$ | 9,264,000.00 | | |

$147.60

per

$1,000,000 | | |

$ | 1,367.37 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| | |

| | |

Total Offering Amounts | |

| | | |

| | | |

$ | 57,319,812.26 | | |

| | |

$ | 8,460.41 | |

| | |

Total Fee Offsets | |

| | | |

| | | |

| | | |

| | |

$ | — | |

| | |

Net Fee Due | |

| | | |

| | | |

| | | |

| | |

$ | 8,460.41 | |

| (1) | The ordinary shares, par value £0.001 per share (the “Ordinary Shares”) of Adaptimmune

Therapeutics plc (the “Company”) registered hereunder may be represented by the Company’s American Depositary Shares

(“ADSs”), with each ADS representing six Ordinary Shares. The Company’s ADSs issuable upon deposit of the Ordinary Shares

have been registered under separate registration statements on Form F-6 (333-203642, 333-212714 and 333-233560). |

| (2) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”),

this registration statement is deemed to cover an indeterminate number of additional Ordinary Shares that may be offered or issued pursuant

to the Plans to prevent dilution resulting from any share dividend, share split or other similar transaction. |

| (3) | Represents 93,932,393 Ordinary Shares reserved for issuance upon the exercise of options previously granted

pursuant to the Adaptimmune Therapeutics plc Company Share Option Plan, the Adaptimmune Therapeutics plc 2015 Share Option Scheme and

the Adaptimmune Therapeutics plc 2016 Employee Share Option Scheme (collectively, the “Plans”). |

| (4) | Computed solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the

Securities Act on the basis of $0.5116, which is the weighted average exercise price of the options outstanding but not registered under

the Plans as of November 30, 2023. |

| (5) | Represents 120,000,000 Ordinary Shares issuable upon exercise of options to be granted pursuant to and

in accordance with the Plans. |

| (6) | Computed solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and 457(h)

under the Securities Act on the basis of $0.0772, the average high and low sale price of the ADSs on the Nasdaq Global Select Market on

November 27, 2023 divided by six to reflect the Ordinary Share to ADS ratio. |

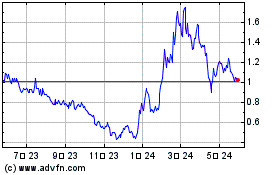

Adaptimmune Therapeutics (NASDAQ:ADAP)

過去 株価チャート

から 10 2024 まで 11 2024

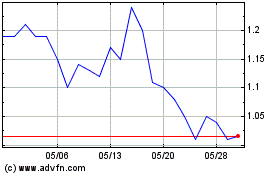

Adaptimmune Therapeutics (NASDAQ:ADAP)

過去 株価チャート

から 11 2023 まで 11 2024