Fed Minutes Suggest Interest Rates To Remain Higher For Longer

2024年5月22日 - 11:25PM

RTTF2

With recent data not increasing confidence inflation is moving

sustainably toward 2 percent, the minutes of the latest Federal

Reserve meeting suggest officials expect to maintain interest rates

at current levels longer than previously thought.

The minutes of the April 30-May 1 meeting, released Wednesday

afternoon, said participants highlighted disappointing readings on

inflation over the first quarter and indicators pointing to strong

economic momentum.

The participants subsequently assessed that it would take longer

than previously anticipated for them to gain "greater confidence"

inflation is moving sustainably toward 2 percent.

With Fed officials repeatedly saying they need "greater

confidence" inflation is slowing before they cut rates, the minutes

said participants discussed maintaining the current restrictive

policy stance for longer.

While officials also discussed reducing policy restraint in the

event of an unexpected weakening in labor market conditions,

various participants also mentioned a willingness to raise rates

further should risks to inflation materialize in a way that such an

action became appropriate.

Meanwhile, the participants reiterated the future path of

interest rates would depend on incoming data, the evolving outlook,

and the balance of risks.

The Fed's next monetary policy meeting is scheduled for June

11-12, with the central bank widely expected to again leave

interest rates unchanged.

While the likelihood rates will be lower by September remains

high, the chances have fallen to 70.6 percent from close to 90

percent last week, according to CME Group's FedWatch Tool.

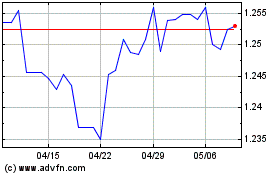

Sterling vs US Dollar (FX:GBPUSD)

FXチャート

から 5 2024 まで 6 2024

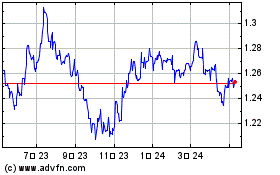

Sterling vs US Dollar (FX:GBPUSD)

FXチャート

から 6 2023 まで 6 2024