MARKET WRAPS

Forex:

Danske Bank Research remains positive on the outlook for the

dollar.

"We anticipate the potential for a dollar rally in 1Q, given the

ongoing trend of scaling back rate cut expectations among G10

central banks, which could lead to general risk-off sentiment in

markets."

The dollar has had a strong start to the year, emerging as the

best performer in the G10 space, and negative economic data

surprises outside the U.S., such as the recent weak data from

China, could act as potential catalysts for a dollar rally, it

said.

Danske forecast EUR/USD at around 1.05 on a 12-month

horizon.

The euro rose to a one-week high against the dollar, helped by

improved risk appetite on reports that China is considering a large

stimulus package to support struggling stock markets, ING said.

Whether the euro's gains continue will depend on whether

equities continue to rise, it said.

"The direction of travel today for the pair will mostly be a

consequence of whether Western stock indices will be able to keep

the positive mood shown by Asian equities and FX."

The yen gaine against the dollar after the Bank of Japan left

its policy unchanged , helped by comments from Governor Kazuo Ueda

indicating that the BOJ is moving closer to raising rates, MUFG

said.

However, sustained yen strengthening looks unlikely for now,

MUFG added, noting that Ueda refrained from indicating the exact

timing of an exit from negative rates while uncertainty remains

over how widespread wage hikes will be.

"While we expect the BOJ's exit from negative rates to encourage

a stronger yen...recent price action has highlighted that it is

still likely premature to expect the yen to strengthen on a more

sustained basis."

Energy:

Crude prices edged higher following fresh attacks by the U.S.

and the U.K. against Houthi sites in Yemen and Ukraine's drone

attack on a Russian fuel terminal in the Baltic Sea over the

weekend.

Metals:

Base metals prices rose on improved sentiment following the

Bloomberg report that Chinese authorities are considering a package

of measures to stabilize the stock market.

Top metals consumer China "will remain key in driving the

general trend of the whole complex, most likely resulting in

rangebound moves," Sucden Financial said.

Meanwhile, gold edged higher as the dollar softened while

investors awaited economic data and central bank decisions.

Battery Metals

Wood Mackenzie forecast a glut of lithium, cobalt, nickel and

graphite to continue for several years.

It said automakers are likely sitting on large stockpiles of

battery cells for EV sales that failed to materialize.

Citing the China Automotive Battery Innovation Alliance, Wood

Mackenzie said only 387 GWh of the 747 GWh of power batteries

produced in China in 2023 were installed into products.

"With storing batteries being an expensive business, automakers

may have a more cautious appetite for purchasing cells in

2024."

TODAY'S TOP HEADLINES

Microsoft Balances SEC Disclosure Rules After Email Hack

Microsoft's regulatory disclosure Friday of a cyberattack on

senior executives' email accounts shows the interpretation of

materiality is expanding under new federal cybersecurity rules.

Companies are used to evaluating the financial or operational

blow from situations such a factory shutdown or an executive

departure. Now to satisfy new mandates from the Securities and

Exchange Commission, companies must try to assess the latent

business impact of cybercrime.

Why It Makes Sense for New EV Drivers to Look Beyond Tesla

For consumers, it makes a lot of sense to lease an electric

vehicle instead of buying one. For the companies on the other side

of the trade, not so much.

A full 59% of the EVs sold through U.S. dealerships in December

were leased rather than bought outright, according to the data

provider Edmunds-the highest share in three years. Importantly,

that calculation excludes the market leader Tesla, which sells

directly to consumers. Its leasing share is at the other end of the

spectrum: It fell to 2% of deliveries in the fourth quarter, the

lowest in at least four years.

Desperate Chinese Property Developers Resort to Bizarre

Marketing Tactics

China's real-estate crisis has dragged down the economy, caused

massive layoffs and pushed multibillion-dollar companies to the

point of collapse.

Economists think it's about to get worse.

In New Hampshire, Underdog Haley Tries to Block Trump's Path to

GOP Nomination

CONCORD, N.H.-A Republican primary electorate heavy with

independent voters will deliver a verdict Tuesday on whether Nikki

Haley's long-shot bid to slow Donald Trump's march to the party's

2024 presidential nomination can find any traction in the snow of

New Hampshire.

Haley, a former South Carolina governor and United Nations

ambassador, engaged in a frantic burst of final campaigning Monday

ahead of what is likely her best chance to alter the narrative that

the former president is the inevitable nominee.

Israeli Military Suffers Deadliest Day Since Gaza War Began

TEL AVIV-The Israeli military said at least 21 soldiers were

killed when two buildings rigged for demolition in Gaza collapsed

after militants fired at a nearby tank, by far the deadliest

incident for Israel in the enclave since the start of the war.

The blast from the rocket-propelled grenade on Monday likely

caused the explosives to detonate, collapsing the buildings, the

military said.

Write to ina.kreutz@wsj.com

TODAY IN CANADA

Earnings:

Canadian National Railway 4Q

Economic Indicators (ET):

Nothing scheduled

Stocks to Watch:

Alimentation Couche-Tard Prices C$500M Notes Offering; Notes

Carry 4.603% Coupon, Mature Jan 2029; Intends to Use Proceeds for

Debt Payments; Indebtedness Was Used for Acquisition of European

Retail Assets From TotalEnergies; Notes Being Offered via Syndicate

Consisting of National Bank Financial, Desjardins Securities , RBC

Dominion Securities, Among Others; Notes Given BBB+ Rating by

Standard & Poor's, Baa1 by Moody's; Offering Expected to Close

on or About Jan 25

---

Chesswood Initiated Review of Strategic Alternatives to Maximize

Shareholder Value; to Evaluate Range of Alternatives to Determine

Best Path Forward to Maximize Value for Shareholders; to Consider

Sale of Certain Assets, a Wind Dn of Portfolios, Other Strategic

Options; Dividends to Hldrs Will Be Suspended During Review

---

Farmers Edge Enters Agreement With Fairfax to Take Farmers Edge

Private at C$0.35/Share; Deal Follows Initial Proposal From Fairfax

Offering C$0.25 Per Common Share; Purchase Price Represents 218%

Premium to Closing Level Day Before Initial Proposal; Special

Committee of Board Independent Directors Unanimously Recommended

Deal; Transaction Will Be Financed by Cash on Hand, Not Subject to

Financing Condition; Expects to Be De-Listed From Toronto Stock

Exchange Upon Deal Close

---

West Fraser Timber Sawmill in Fraser Lake, British Columbia, to

Close; Cites Inability to Access Economically Viable Fiber in

Region; About 175 Employees to Be Affected by Closure

Expected Major Events for Tuesday

05:00/JPN: Dec Steel Production

05:00/JPN: Dec Supermarket sales

07:00/UK: Dec Public sector finances

08:59/JPN: Japan Monetary Policy Meeting decision

08:59/JPN: Nov Final Labour Survey - Earnings, Employment &

Hours Worked

13:55/US: 01/20 Johnson Redbook Retail Sales Index

15:00/US: Dec State Employment and Unemployment

15:00/US: Jan Richmond Fed Business Activity Survey

18:00/US: Dec Money Stock Measures

21:30/US: API Weekly Statistical Bulletin

23:50/JPN: Dec Provisional Trade Statistics for the Month

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Tuesday

3M Company (MMM) is expected to report $2.01 for 4Q.

AMCON Distributing Co (DIT) is expected to report for 1Q.

AmeriServ Financial Inc (ASRV) is expected to report for 4Q.

Anixa Biosciences Inc (ANIX) is expected to report for 4Q.

Atlantic Union Bankshares Corp (AUB) is expected to report for

4Q.

Baker Hughes Co (BKR) is expected to report $0.47 for 4Q.

Bassett Furniture Industries Inc (BSET) is expected to report

$-0.06 for 4Q.

Capital City Bank Group (CCBG) is expected to report $0.72 for

4Q.

Citizens Holding Co (CIZN) is expected to report for 4Q.

City Holding Co (CHCO) is expected to report $1.89 for 4Q.

Cohbar Inc (CWBR) is expected to report for 3Q.

Community Bank System (CBU) is expected to report $0.83 for

4Q.

D.R. Horton (DHI) is expected to report $2.87 for 1Q.

Dakota Gold Corp (DC) is expected to report for 4Q.

First Bancorp Inc (FNLC) is expected to report for 4Q.

First Busey (BUSE) is expected to report $0.50 for 4Q.

Forestar Group Inc (FOR) is expected to report $0.55 for 1Q.

Gatx Corp (GATX) is expected to report $1.55 for 4Q.

General Electric Co (GE) is expected to report for 4Q.

Halliburton Co (HAL) is expected to report $0.80 for 4Q.

Intuitive Surgical Inc (ISRG) is expected to report $1.30 for

4Q.

Invesco Ltd (IVZ,IVZ-LN) is expected to report $0.38 for 4Q.

Jewett-Cameron (JCT-T,JCTCF) is expected to report for 1Q.

Johnson & Johnson (JNJ) is expected to report $2.00 for

4Q.

Lockheed Martin Corp (LMT) is expected to report $7.28 for

4Q.

NBT Bancorp (NBTB) is expected to report $0.75 for 4Q.

Netflix Inc (NFLX) is expected to report $2.21 for 4Q.

Nicolet Bankshares Inc (NIC) is expected to report $1.90 for

4Q.

Old National Bancorp (ONB) is expected to report $0.45 for

4Q.

Peoples Bancorp (Ohio) (PEBO) is expected to report $0.96 for

4Q.

Procter & Gamble Co (PG) is expected to report $1.71 for

2Q.

RTX Corp (RTX) is expected to report for 4Q.

Sandy Spring Bancorp Inc (SASR) is expected to report $0.51 for

4Q.

Southern First Bancshares Inc (SFST) is expected to report $0.39

for 4Q.

Summit State Bank (SSBI) is expected to report for 4Q.

Synchrony Financial (SYF) is expected to report $0.96 for

4Q.

Union Bankshares Inc (UNB) is expected to report for 4Q.

Verizon Communications (VZ) is expected to report $1.05 for

4Q.

Webster Financial Corp (WBS) is expected to report $1.34 for

4Q.

Western New England Bancorp Inc (WNEB) is expected to report

$0.15 for 4Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Aclaris Therapeutics Cut to Neutral From Buy by HC Wainwright

& Co.

Advanced Micro Devices Cut to Market Perform From Outperform by

Northland Capital Markets

Agree Realty Raised to Market Outperform From Market Perform by

JMP Securities

Allete Raised to Neutral From Sell by Guggenheim

American Airlines Group Raised to Outperform From Peer Perform

by Wolfe Research

American Electric Power Cut to Neutral From Buy by

Guggenheim

Archer Daniels Midland Cut to Hold From Buy by Stifel

Archer Daniels Midland Cut to Neutral From Buy by Goldman

Sachs

Archer Daniels Midland Cut to Neutral From Buy by Roth MKM

Archer Daniels Midland Cut to Neutral From Outperform by

Baird

Archer Daniels Midland Cut to Underweight From Overweight by

Barclays

Array Technologies Cut to Equal-Weight From Overweight by

Barclays

Avista Raised to Neutral From Sell by Guggenheim

BlackRock Warns Markets Not Appreciating Worsening Geopolitical

Backdrop

Cadre Holdings Cut to Market Perform From Outperform by Raymond

James

Carrols Restaurant Cut to Hold From Buy by Truist Securities

Celanese Cut to Neutral From Overweight by Alembic Global

Comerica Cut to Market Perform From Outperform by Raymond

James

CommScope Holding Cut to Underperform From Neutral by B of A

Securities

Digital Realty Raised to Sector Outperform From Sector Perform

by Scotiabank

DR Horton Cut to Neutral From Buy by Seaport Global

DTE Energy Cut to Neutral From Buy by Guggenheim

Edison International Raised to Buy From Neutral by

Guggenheim

elf Beauty Cut to Equal-Weight From Overweight by Morgan

Stanley

EPR Properties Cut to Market Perform From Market Outperform by

JMP Securities

Evergy Cut to Neutral From Buy by Guggenheim

Eversource Energy Raised to Buy From Neutral by Guggenheim

Fastly Raised to Neutral From Sell by Citigroup

Home Depot Cut to Perform From Outperform by Oppenheimer

Idacorp Cut to Neutral From Buy by Guggenheim

Intl Flavors & Fragrances Raised to Overweight From

Equal-Weight by Morgan Stanley

JB Hunt Raised to Buy From Neutral by UBS

LCI Industries Cut to Underperform From Market Perform by BMO

Capital

McCormick & Co Cut to Equal-Weight From Overweight by

Consumer Edge Research

Meritage Cut to Neutral From Buy by Seaport Global

Norfolk Southern Raised to Outperform From Market Perform by

Bernstein

NorthWestern Raised to Neutral From Sell by Guggenheim

Pinnacle West Capital Raised to Buy From Neutral by

Guggenheim

Plymouth Industrial REIT Raised to Market Outperform From Market

Perform by JMP Securities

Public Service Enterprise Cut to Neutral From Buy by

Guggenheim

Regency Centers Raised to Outperform From In-Line by Evercore

ISI Group

SentinelOne Raised to Buy From Neutral by BTIG

Shoals Technologies Raised to Equal-Weight From Underweight by

Barclays

Taylor Morrison Home Cut to Neutral From Buy by Seaport

Global

Toll Brothers Cut to Neutral From Buy by Seaport Global

Union Pacific Raised to Outperform From Market Perform by

Bernstein

Vita Coco Cut to Market Perform From Outperform by William

Blair

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 23, 2024 06:16 ET (11:16 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

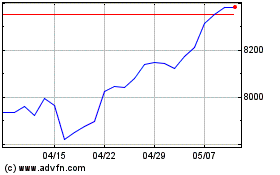

FTSE 100

指数チャート

から 10 2024 まで 11 2024

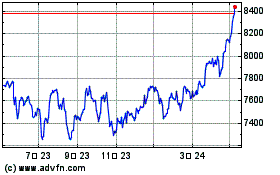

FTSE 100

指数チャート

から 11 2023 まで 11 2024