Ethereum Price In Danger? Metalpha Withdraws 10,000 ETH From Lido To Binance

2024年8月18日 - 5:07PM

NEWSBTC

According to the latest on-chain data, a crypto company has

redeemed and transferred a significant amount of Ether tokens from

the staking platform Lido to the cryptocurrency exchange Binance.

Could this hold a bearish consequence for the Ethereum price? Is

ETH Price Preparing For Further Correction? According to data from

Arkham Intelligence, digital asset management firm Metalpha

redeemed 10,000 ETH (worth about $26 million) from the liquid

staking platform Lido on Saturday, August 17. Following the

withdrawal to the Metalpha-labeled Gnosis Safe Proxy wallet, the

Ether tokens were then sent to Binance, the world’s largest

cryptocurrency exchange. Related Reading: Bitcoin Market Facing A

Persistent Net Sell-Side Bias, Glassnode Reveals It is worth

keeping an eye on this type of asset movement, especially

considering the direction and magnitude of this transfer and the

potential impact on the Ethereum price. Moreover, these fund

movements could provide an insight into the sentiment amongst

institutional and large investors at the moment. As shown on

Arkham’s dashboard, the ETH tokens were transferred from a Gnosis

Safe Proxy wallet to a wallet on the Binance exchange. Gnosis Safe

Proxy wallets are known for their multi-signature feature, which

requires authorization from multiple parties to execute a

transaction. While the multi-sig nature of the sender wallet is

quite interesting, the move of assets to a custodial wallet on a

centralized exchange is an even bigger narrative. Typically, when

investors transfer their digital assets to an exchange, it implies

that they want to utilize one of these centralized platform’s

services, which includes selling. Consequently, the latest flow of

Ether tokens to the Binance platform could carry bearish

consequences for the Ethereum price, if Metalpha does intend to

sell with this move. With the rationale behind this move unknown,

it remains to be seen whether the altcoin will feel downward

pressure off the back of the transaction. Ethereum Price At A

Glance As of this writing, the ETH token has yet to witness any

significant price movement in the last few hours. Instead, the

Ethereum price has continued to consolidate around the $2,600

level, with a mere 0.5% increase in the past day. Nevertheless, the

second-largest cryptocurrency is in a much better position than it

was less than two weeks ago. The Ethereum price has shown good

signs of recovery after falling to a multi-month low of $2,200 in

early August. Related Reading: Cardano Sees Massive 150%

Volume Surge, Yet ADA Price Stalls With 4% Decline On the broader

timeframe, though, the price of ETH seems to have lost the momentum

it displayed earlier in 2024. According to data from CoinGecko, the

price of ETH is still down by nearly 25% in the past month.

Featured image from Shutterstock, chart from TradingView

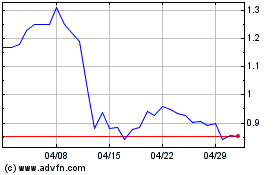

Flow (COIN:FLOWUSD)

過去 株価チャート

から 10 2024 まで 10 2024

Flow (COIN:FLOWUSD)

過去 株価チャート

から 10 2023 まで 10 2024