Bitcoin Falls From $60,000 With US Transfer Of 10,000 BTC: Vital Levels To Monitor

2024年8月15日 - 4:08AM

NEWSBTC

On Wednesday, the crypto market experienced a wave of volatility as

news broke that the US government had transferred a significant

amount of Bitcoin seized from the infamous Silk Road marketplace to

the Coinbase exchange. Massive Silk Road Bitcoin Influx To Coinbase

According to on-chain data tracker Arkham, the US government

recently moved 10,000 Bitcoin worth around $590 million from a

known government wallet to a Coinbase Prime deposit address.

Notably, this transfer sparked a 3.3% dip in the Bitcoin price,

which fell below the key $60,000 support level to trade at around

$59,130 at the time of writing. However, it’s important to note

that the US government’s selection of Coinbase as the custodian for

its seized digital assets may only sometimes lead to immediate

selling. Related Reading: XRP Price Eyes $0.60 Reclaim:

Crucial for a Fresh Upswing As reported by Bitcoinist, Coinbase

announced that the US Department of Justice’s asset forfeiture

division, the US Marshal Service, had chosen Coinbase Prime to

offer custody and advanced trading services for its “Class 1”

digital assets. This partnership is intended to streamline the

custody, management, and disposal processes for cryptocurrency

assets, allowing for diversification in the types of digital assets

that can be handled and disposed of under the government’s

forfeiture programs. Ultimately, this may result in the

exchange holding this large amount of BTC and not affect the

Bitcoin price in the short term or contribute to selling pressure

unless there is a shift from previous movements and the authorities

decide to liquidate the tokens. Critical Resistance Levels

And Support Thresholds In a recent analysis of the current Bitcoin

price action, crypto analyst Daan Crypto Trades recently

highlighted key levels to watch for a potential continuation of

BTC’s recovery over the past seven days after falling towards

$59,000 on August 5th. The analyst first noted that Bitcoin is at a

pivotal point where it needs to break above the 200-day exponential

moving average (EMA) at $59,468 and the 200-day moving average (MA)

at $62,274. Daan Crypto Trades explains that these levels are

key to catalyzing favorable medium-to-long-term dynamics in favor

of the bulls. However, the cryptocurrency has struggled with this

challenge and failed to consolidate above these levels last week.

Related Reading: Maker Sees 7% Upswing As Key Indicators Signal

$2,662 Resistance Test In light of this scenario, the analyst has

identified two significant resistance levels that the BTC price

must uphold if a potential correction looms. Daan Crypto

Trades underscores the importance of vigilance around the $56,530

mark on the BTC/USDT daily chart, emphasizing its role as a

critical floor crucial for preventing a downturn that could mirror

the substantial 20% correction witnessed at the commencement of

August. Moreover, the analyst points to the $52,990 threshold as

the subsequent support level to monitor should Bitcoin falter at

the aforementioned mark, especially if selling pressure

intensifies, exerting downward pressure on its price trajectory.

Featured image from DALL-E, chart from TradingView.com

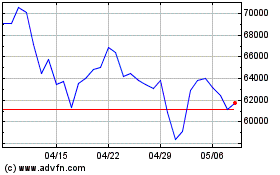

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 7 2024 まで 8 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 8 2023 まで 8 2024