Solana ETF Approval Could Skyrocket SOL’s Value 9x Higher, Report Finds

2024年6月29日 - 5:00AM

NEWSBTC

Leading asset manager and Bitcoin Exchange Traded Fund (ETF) issuer

VanEck has officially filed a Spot Solana ETF with the US

Securities and Exchange Commission (SEC), fueling bold growth

predictions for the Solana ecosystem. Market-making firm GSR

Markets recently released a report shedding light on the potential

impact of a Solana ETF and highlighting the platform’s emergence as

part of the “Big Three” in the crypto space. Speculation Of A

Solana ETF Approval GSR’s report highlights Solana’s rapid rise

within the cryptocurrency industry, positioning it as a major

player alongside Bitcoin and Ethereum. With the Bitcoin ETF

market already approved and Ethereum about to launch a spot ETF in

the US, GSR predicts that it’s only a matter of time before Solana

follows suit, potentially making the biggest impact. Related

Reading: Bitcoin Miner Selling Cools Off – Is This The Breakout

Moment? GSR’s analysis highlights three key technological

advancements that set Solana apart from its competitors. Firstly,

Solana’s proof-of-history enables validators to produce blocks

efficiently, resulting in remarkable speed and scalability

advantages. Second, Solana’s parallel transaction processing

enables increased throughput and takes advantage of improvements in

computing speed. Finally, the company said Solana’s

architecture positions it to solve the “blockchain trilemma” by

achieving global state synchronization at “unprecedented speeds” as

hardware and bandwidth costs decline. In addition, GSR’s report

addresses the likelihood of Solana securing a spot digital asset

ETF. While the current regulatory framework requires a federally

regulated futures market and a futures-based ETF before a spot

product can be considered, GSR believes that the potential for

change shouldn’t be underestimated. The company also claims

bipartisan support for the crypto industry, and shifting attitudes

among lawmakers indicate a more favorable environment for digital

assets. A Trump administration and a liberal SEC commissioner

could further pave the way for the launch of spot digital asset

ETFs, creating opportunities for Solana and other cryptocurrencies,

the report said. Projected Impact On SOL’s Price GSR emphasizes the

importance of decentralization and potential demand in determining

the next spot digital asset ETF. Factors such as

permissionless participation, developmental control, token

allocation, and stake characteristics contribute to a blockchain’s

level of decentralization. Meanwhile, as indicated by metrics

like market cap, potential demand serves as a crucial factor for

issuers when assessing future inflows. GSR combines

decentralization and demand scores to create an ETF Possibility

score, which highlights Ethereum and Solana as leading contenders

for the next spot in digital asset ETF. Related Reading: Dogecoin

To The Moon? Crypto Analyst Predicts 440% Price Increase Drawing

parallels to the effect of spot Bitcoin ETFs on Bitcoin’s price,

GSR estimates the potential impact of a Solana ETF on SOL.

Adjusting for Solana’s smaller market cap relative to Bitcoin, GSR

predicts a 1.4x to 8.9x increase in SOL’s price under different

scenarios. However, the report acknowledges that the impact

could be even higher, considering SOL’s active usage in staking and

decentralized applications. In the event of a spot ETF approval,

GSR suggests that the potential upside for SOL presents a

significant opportunity in the market. As investor excitement over

the development became apparent, SOL’s price reached a weekly high

of $151 on Thursday, but in the past few hours, SOL has dropped

nearly 4% to a current trading price of $143. Featured image

from DALL-E, chart from TradingView.com

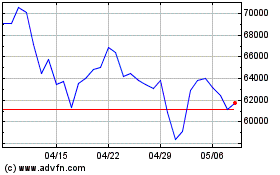

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 11 2023 まで 11 2024