National Australia Bank Profit Hit by Losses on Asset Sales -- Update

2016年10月27日 - 7:51AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--National Australia Bank Ltd. (NAB.AU)

maintained its dividend even as its annual profit was dented by

hefty losses on asset sales and as costs for pockets of soured

loans creep upward.

The bank, one of Australia's "Big Four" lenders, has been

scaling back its overseas presence to focus on its core lending

operations in Australia and New Zealand, and recently concluded a

deal to sell control of its life insurance business. That, and a

dividend cut earlier this year by a rival, had raised questions

about the sustainability of NAB's dividend.

"We now have the business we want...the core business is really

sound," Chief Executive Andrew Thorburn said Thursday.

Net profit sank to 352 Australian dollars (US$269 million) in

the year through September from A$6.34 billion the year before. The

result included a A$4.22 billion loss booked in the first half of

the year for spinning off and listing its British banking

operations and a flagged A$1.34 billion hit for the sale of most of

its life insurance business. Stripping out exited operations, NAB

said its profit was 5.6% lower for the year.

Still, NAB maintained its dividend for a sixth half-year period

running, which Mr. Thorburn said reflected the outlook for the bank

and its capital position even amid some uncertainty over regulatory

pressures for lenders to lift buffers against risks.

Since taking over in August 2014, Mr. Thorburn has accelerated

the bank's efforts to tighten its focus on its higher returning

core franchises. CYBG PLC (CYBG.LN), a U.K. lender housing

Clydesdale and Yorkshire Bank, was listed in February after most of

the shares were handed out to NAB shareholders. An 80% interest in

its life insurance business was sold to Nippon Life Insurance Co.

for A$2.4 billion.

NAB's cash earnings--a measure followed by analysts that

excludes some one-time costs and gains--rose 4.2% on the year

before to A$6.48 billion, ahead of the A$6.39 billion median of

seven broker forecasts compiled by The Wall Street Journal.

Analysts have question the sustainability of the big banks'

dividend payout levels as headwinds build against revenue growth.

Australia & New Zealand Banking Group Ltd. (ANZ.AU) reduced its

interim dividend in May in a bid to return an elevated payout ratio

to its historical range and in the wake of a slump in its

first-half profit, hit by restructuring and impairment charges.

NAB said its revenue on a cash earnings basis rose 2.5% over the

financial year, benefiting from higher lending balances and

stronger markets and treasury income, although expenses were up

2.2%. The bank's net interest margin, a profit measure based on the

difference between the rate at which a bank borrows and lends,

narrowed by 2 basis points on-year to 1.88%.

Competition in the mortgage market remains high as housing

markets in cities such as Sydney and Melbourne remain hot.

Competition has also picked up in other areas of lending, including

the business segment, Mr. Thorburn said.

It comes as Australia's biggest lenders have warned of small

areas of stress in their loan books, much of it tied to the slump

in commodity prices in recent years, and as they face heightened

regulatory scrutiny and demands to increase capital held again the

risk of future crises. Commonwealth Bank of Australia Ltd.

(CBA.AU), which runs on a different financial calendar to its

peers, in August racked up another record annual profit but said

its net interest margin was under pressure and its charge for bad

debts had edged higher.

Mr. Thorburn said the Australian economy remains in "pretty

good" shape. The ratio of impaired assets and loans more than

90-days past due to gross loans and acceptances was 0.85% at the

end of September, up 7 basis points over the last six months, due

mainly to an increased impairment of its exposure to New Zealand's

dairy industry.

The overall charge for bad and doubtful debts rose 7% over the

year to A$800 million, which the bank said mainly reflected a rise

in specific charges on the impairment of a small number of

individual clients in Australia.

The bank said it would pay a final dividend of A$0.99 a share,

for an unchanged full-year payout of A$1.98.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 26, 2016 18:36 ET (22:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

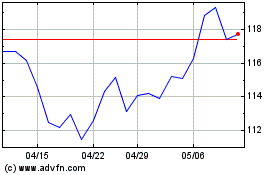

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 10 2024 まで 11 2024

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 11 2023 まで 11 2024