false

N-2ASR

0001263994

As soon as practicable after the effective date of this Registration Statement.

Yes

0001263994

2024-09-05

2024-09-05

0001263994

dei:BusinessContactMember

2024-09-05

2024-09-05

0001263994

utg:RisksAssociatedWithOfferingsOfAdditionalCommonSharesMember

2024-09-05

2024-09-05

0001263994

utg:AdditionalRisksOfRightsMember

2024-09-05

2024-09-05

0001263994

utg:InvestmentAndMarketRiskMember

2024-09-05

2024-09-05

0001263994

utg:IssuerRiskMember

2024-09-05

2024-09-05

0001263994

utg:IncomeRiskMember

2024-09-05

2024-09-05

0001263994

utg:LeverageRiskMember

2024-09-05

2024-09-05

0001263994

utg:TaxRiskMember

2024-09-05

2024-09-05

0001263994

utg:SectorIndustryRiskMember

2024-09-05

2024-09-05

0001263994

utg:ConcentrationRiskMember

2024-09-05

2024-09-05

0001263994

utg:CommonStockRiskMember

2024-09-05

2024-09-05

0001263994

utg:ForeignSecuritiesRiskMember

2024-09-05

2024-09-05

0001263994

utg:ForeignCurrencyRiskMember

2024-09-05

2024-09-05

0001263994

utg:SmallAndMidCapStockRiskMember

2024-09-05

2024-09-05

0001263994

utg:NonInvestmentGradeSecuritiesRiskMember

2024-09-05

2024-09-05

0001263994

us-gaap:InterestRateRiskMember

2024-09-05

2024-09-05

0001263994

us-gaap:CreditRiskMember

2024-09-05

2024-09-05

0001263994

utg:DerivativesRiskMember

2024-09-05

2024-09-05

0001263994

utg:PreferredStockRiskMember

2024-09-05

2024-09-05

0001263994

utg:DebtSecuritiesRiskMember

2024-09-05

2024-09-05

0001263994

utg:InflationRiskMember

2024-09-05

2024-09-05

0001263994

utg:IlliquidSecuritiesRiskMember

2024-09-05

2024-09-05

0001263994

utg:MarketPriceOfCommonSharesMember

2024-09-05

2024-09-05

0001263994

utg:ManagementRiskMember

2024-09-05

2024-09-05

0001263994

utg:MarketDisruptionAndGeopoliticalRiskMember

2024-09-05

2024-09-05

0001263994

utg:LegislationPolicyAndRegulatoryRiskMember

2024-09-05

2024-09-05

0001263994

utg:CommonSharesMember

2024-05-01

2024-07-31

0001263994

utg:CommonSharesMember

2024-02-01

2024-04-30

0001263994

utg:CommonSharesMember

2023-11-01

2024-01-31

0001263994

utg:CommonSharesMember

2023-08-01

2023-10-31

0001263994

utg:CommonSharesMember

2023-05-01

2023-07-31

0001263994

utg:CommonSharesMember

2023-02-01

2023-04-30

0001263994

utg:CommonSharesMember

2022-11-01

2023-01-31

0001263994

utg:CommonSharesMember

2022-08-01

2022-10-31

0001263994

utg:CommonSharesMember

2022-05-01

2022-07-31

0001263994

utg:CommonSharesMember

2022-02-01

2022-04-30

0001263994

utg:CommonSharesMember

2021-11-01

2022-01-31

0001263994

utg:CommonSharesMember

2024-09-05

2024-09-05

0001263994

utg:CommonSharesMember

2024-08-28

0001263994

utg:CommonSharesMember

2024-08-28

2024-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on September 5, 2024

Securities

Act File No. 333-[●]

Investment Company Act File No. 811-21432

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-2

(check

appropriate box or boxes)

| REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

|

☒ |

| |

|

|

| Pre-Effective

Amendment No. |

|

☐ |

| |

|

|

| Post-Effective

Amendment No. |

|

☐ |

| |

|

|

| and/or |

|

|

| |

|

|

| REGISTRATION

STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

|

☒ |

| |

|

|

| Amendment

No. 22 |

|

☒ |

Reaves

Utility Income Fund

(Exact name of registrant as specified in charter)

1700

Broadway, Suite

1850

Denver,

Colorado

80290

(Address

of principal executive offices)

(800)

644-5571

(Registrant’s

Telephone Number)

Chris

Moore

Reaves

Utility Income Fund

1700

Broadway, Suite 1850

Denver,

Colorado 80290

(Names

and addresses of agents for service)

Copies

to:

Allison

M. Fumai

Dechert

LLP

1095

Avenue of the Americas

New

York, NY

10036

Approximate

Date of Proposed Public Offering: As soon as practicable after the effective date of the Registration Statement.

If

appropriate, check the following box:

| ☐ | The

only securities being registered on the form are being offered pursuant to a dividend or interest reinvestment plan. |

☒ Any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under

the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan.

| ☐ | This

form is a registration statement or a post-effective amendment thereto. |

☒ This form is a registration statement or a post-effective amendment thereto that will become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act.

☐ This form is a post-effective amendment to a registration statement filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act.

It

is proposed that this filing will become effective (check appropriate box)

| ☐ | when

declared effective pursuant to Section 8(c) of the Securities Act |

If

appropriate, check the following box:

| ☐ | This

[post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| ☐ | This

form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the Securities

Act registration statement number of the earlier effective registration statement for the same offering is ______. |

| ☐ | This

form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is ______. |

Check

each box that appropriately characterizes the Registrant:

| ☒ | Registered

Closed-End Fund (closed-end company that is registered under the Investment Company Act). |

| ☐ | Business

Development Company (closed-end company that intends or has elected to be regulated as a business development company under the

Investment Company Act). |

| ☐ | Interval

Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under

the Investment Company Act). |

| ☒ | Well-Known

Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ☐ | Emerging

Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

| ☐ | New

Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

September

5, 2024

Reaves

Utility Income Fund

$900,000,000

Common

Shares of Beneficial Interest

Subscription

Rights for Common Shares of Beneficial Interest

Follow-on Offerings

The

Reaves Utility Income Fund (the “Fund”) is a diversified, closed-end management investment company registered under

the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to provide

a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation.

The Fund pursues this objective by investing at least 80% of its total assets in the securities of domestic and foreign companies

involved to a significant extent in providing products, services or equipment for (i) the generation or distribution of electricity,

gas or water, (ii) telecommunications activities or (iii) infrastructure operations, such as airports, toll roads and

municipal services (“Utilities” or the “Utility Industry”). A company will be deemed to be involved in

the Utility Industry to a significant extent if at least 50% of its assets, gross income or profits are committed to or derived

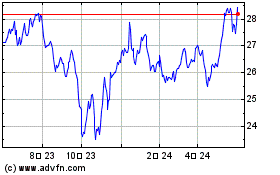

from activities in the areas described above. As of August 28, 2024, the last reported sale price for the Fund’s common

shares was $30.05 per common share, and the last reported net asset value (“NAV”) for the Fund’s common shares

was $29.64 per common share, representing a premium to NAV of 1.38%.

W.H.

Reaves & Co., Inc. (the “Investment Adviser” or “Reaves”) serves as the Fund’s investment

adviser. As of June 30, 2024, Reaves had approximately $3.247 billion of assets under management. The Investment Adviser’s

address is 10 Exchange Place, Jersey City, New Jersey 07302. The Fund’s address is 1700 Broadway, Suite 1850, Denver, Colorado

80290, and its telephone number is 800-644-5571.

The

Fund may offer, from time to time, up to $900,000,000 aggregate initial offering price of common shares of beneficial interest,

no par value (“Common Shares”), subscription rights to purchase Common Shares (“Rights”) and/or any follow-on

offering (“Follow-on Offering” and together with the Common Shares and Rights, “Securities”) in one or

more offerings in amounts, at prices and on terms set forth in one or more supplements to this Prospectus (each a “Prospectus

Supplement”). Follow-on Offerings may include offerings of Common Shares, offerings of Rights, and offerings made in transactions

that are deemed to be “at the market” as defined in Rule 415 under the Securities Act, including sales made directly

on the NYSE American LLC (“NYSE American”) or sales made to or through a market maker other than on an exchange. You

should read this Prospectus and any related Prospectus Supplement carefully before you decide to invest in the Securities.

The

Fund may offer Securities (1) directly to one or more purchasers, (2) through agents that the Fund may designate from time to

time or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering of Securities will

identify any agents or underwriters involved in the sale of Securities, and will set forth any applicable purchase price, fee,

commission or discount arrangement between the Fund and agents or underwriters or among underwriters or the basis upon which such

amount may be calculated. The Fund may not sell Securities through agents, underwriters or dealers without delivery of this Prospectus

and a Prospectus Supplement. See “Plan of Distribution.”

An

investment in the Fund is not appropriate for all investors. No assurances can be given that the Fund will achieve its investment

objective. Further, the Fund’s ability to pursue its investment objective, the value of the Fund’s investments and

the Fund’s NAV may be adversely affected by changes in tax rates and policies. Because the Fund’s investment objective

is to provide a high level of after-tax yield and total return consisting primarily of dividend and interest income and capital

appreciation, the Fund’s ability to invest, and the attractiveness of investing in, equity securities that pay qualified

dividend income in relation to other investment alternatives will be affected by changes in federal income tax laws and regulations,

including changes in the qualified dividend income provisions. Any proposed or actual changes in such rates, therefore, can significantly

and adversely affect the after-tax returns of the Fund’s investments in equity securities. Any such changes also could significantly

and adversely affect the Fund’s NAV, as well as the Fund’s ability to acquire and dispose of equity securities at

desirable returns and price levels and the Fund’s ability to pursue its investment objective. The Fund cannot assure you

as to the portion, if any, of the Fund’s dividends that will be qualified dividend income.

Investing

in the Fund’s Common Shares involves certain risks. See “Risk Factors” beginning on page 27 of this Prospectus.

This

Prospectus sets forth concisely the information about the Fund and the Securities that a prospective investor ought to know before investing

in the Fund and participating in an offer. You should read this Prospectus, which contains important information about the Fund, before

deciding whether to invest in the Fund’s Common Shares and retain it for future reference. A Statement of Additional Information

dated September 5, 2024 (the “SAI”), containing additional information about the Fund, has been filed with the Securities

and Exchange Commission (“SEC”) and is incorporated by reference in its entirety into this Prospectus, which means that it

is part of this Prospectus for legal purposes. You may request a free copy of the SAI, the Fund’s Annual and Semi-Annual Reports,

request other information about the Fund and make shareholder inquiries by calling (800) 644-5571 (toll-free) or by writing to Paralel

Technologies LLC, 1700 Broadway, Suite 1850, Denver, Colorado 80290, or obtain a copy of such documents (and other information regarding

the Fund) by visiting the Fund’s website (www.utilityincomefund.com) or the SEC’s

web site (http://www.sec.gov).

The

amount of distributions that the Fund may pay is not guaranteed. The Fund may pay distributions in a significant part from sources

that may not be available in the future and that are unrelated to the Fund’s performance such as a return of capital.

This

Prospectus is part of a registration statement on Form N-2 that the Fund filed with the SEC using a “shelf” registration

process. Under this process, the Fund may offer, from time to time, up to $900,000,000 aggregate initial offering price of Securities

in one or more offerings in amounts, at prices and on terms set forth in one or more Prospectus Supplements. The Prospectus Supplement

may also add, update or change information contained in this Prospectus. You should carefully read this Prospectus and any accompanying

Prospectus Supplement, together with the additional information described under the heading “Where You Can Find More Information.”

You

should rely only on the information contained or incorporated by reference in this Prospectus and any accompanying Prospectus

Supplement. The Fund has not authorized any other person to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. The Fund is not making an offer to sell these securities in

any jurisdiction where the offer or sale is not permitted. You should assume that the information contained or the representations

made herein are accurate only as of the date on the cover page of this Prospectus. The Fund’s business, financial condition

and prospects may have changed since that date. The Fund will amend this Prospectus and any accompanying Prospectus Supplement

if, during the period that this Prospectus and any accompanying Prospectus Supplement is required to be delivered, there are any

subsequent material changes.

WHERE

YOU CAN FIND MORE INFORMATION

The

Fund is subject to the informational requirements of the Securities Exchange Act of 1934 (the “Exchange Act”) and

the Investment Company Act of 1940 (“1940 Act”) and in accordance therewith files, or will file, reports and other

information with the SEC. Reports, proxy statements and other information filed by the Fund with the SEC pursuant to the informational

requirements of the Exchange Act and the 1940 Act can be inspected and copied at the public reference facilities maintained

by the SEC, 100 F Street, N.E., Washington, D.C. 20549. The SEC maintains a web site at www.sec.gov containing

reports, proxy and information statements and other information regarding registrants, including the Fund, that file electronically

with the SEC

This

Prospectus constitutes part of a Registration Statement filed by the Fund with the SEC under the Securities Act of 1933, as amended

(“Securities Act”) and the 1940 Act. This Prospectus omits certain of the information contained in the Registration

Statement, and reference is hereby made to the Registration Statement and related exhibits for further information with respect

to the Fund and the Common Shares offered hereby. Any statements contained herein concerning the provisions of any document are

not necessarily complete, and, in each instance, reference is made to the copy of such document filed as an exhibit to the Registration

Statement or otherwise filed with the SEC. Each such statement is qualified in its entirety by such reference. The complete Registration

Statement may be obtained from the SEC upon payment of the fee prescribed by its rules and regulations or free of charge through

the SEC’s website (www.sec.gov).

The

Fund will provide without charge to each person, including any beneficial owner, to whom this Prospectus is delivered, upon written or

oral request, a copy of any and all of the information that has been incorporated by reference in this Prospectus or any accompanying

Prospectus Supplement. You may request such information by calling toll-free 1-800-644-5571 or you may obtain a copy (and other information

regarding the Fund) from the SEC’s website (www.sec.gov). Free copies of the Fund’s Prospectus, SAI and any incorporated

information will also be available from the Fund’s website at www.utilityincomefund.com.

Information contained on the Fund’s website is not incorporated by reference into this Prospectus or any Prospectus Supplement

and should not be considered to be part of this Prospectus or any Prospectus Supplement.

INCORPORATION

BY REFERENCE

This

Prospectus is part of a registration statement that the Fund has filed with the SEC. The Fund is permitted

to “incorporate by reference” the information that it files with the SEC, which means that the Fund can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important

part of this Prospectus, and later information that the Fund files with the SEC will automatically update and supersede

this information.

The

documents listed below, and any reports and other documents subsequently filed with the SEC pursuant to Rule 30(b)(2) under the

1940 Act and Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering, are incorporated

by reference into this Prospectus and deemed to be part of this Prospectus from the date of the filing of such reports and documents:

| |

● |

the Fund’s

Statement of Additional Information, dated September 5, 2024, filed with this Prospectus (“SAI”); |

| |

● |

the Fund’s

Annual Report on Form

N-CSR for the fiscal year ended October 31, 2023, filed with the SEC on January 5, 2024 (“Annual Report”); |

| |

● |

the Fund’s

Semi-Annual Report on Form N-CSR

for the period ended April 30, 2024, filed with the SEC on July 3, 2024; |

| |

● |

the Fund’s

definitive proxy statement on Schedule

14A for our 2024 annual meeting of shareholders, filed with the SEC on February 16, 2024 (“Proxy Statement”);

and |

| |

● |

the Fund’s

description of common shares contained in our Registration Statement on Form

8-A (File No. 333-109089) filed with the SEC on February 20, 2004. |

To

obtain copies of these filings, see “Where You Can Find More Information.”

The

Fund’s securities do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other

insured depository institution and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve

Board or any other government agency.

The

Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this Prospectus. The Fund has not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you

should not rely on it. The Fund is not making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should not assume that the information provided by this Prospectus and any related Prospectus Supplement is

accurate as of any date other than the date on the cover page of this Prospectus and any related Prospectus Supplement. The Fund’s

business, financial condition and prospects may have changed since that date.

PROSPECTUS

SUMMARY

The

following summary is qualified in its entirety by reference to the more detailed information appearing elsewhere in this Prospectus.

This summary does not contain all of the information that you should consider before exercising your Rights and investing in the

Fund. You should review the more detailed information contained in this Prospectus and in the Statement of Additional Information,

especially the information set forth under the heading “Risk Factors.”

| The

Fund |

|

Reaves

Utility Income Fund (the “Fund”) is a diversified, closed-end management investment company. The Fund’s

outstanding common shares are listed on the NYSE American LLC (the “NYSE American”) under the symbol “UTG”.

As of August 28, 2024, the net assets of the Fund were $2,566,611,240. As of August 28, 2024, the Fund had outstanding 86,607,381

common shares. The Fund has no other outstanding securities. See “The Fund.” As of August 28, 2024, the last reported

sale price for the Fund’s common shares was $30.05 per common share, and the last reported net asset value (“NAV”)

for the Fund’s common shares was $29.64 per common share, representing a premium to NAV of 1.38%. In connection with

any offering of Rights, the Fund will provide information in the Prospectus Supplement of the expected trading market, if

any, for Rights. |

| |

|

|

| The

Offering |

|

The

Fund may offer, from time to time, up to $900,000,000 aggregate initial offering price

of common shares, no par value (“Common Shares”), subscription rights to

purchase common shares (“Rights”) and/or any follow-on offering (“Follow-on

Offering” and together with the common shares and Rights, “Securities”)

in one or more offerings in amounts, at prices and on terms set forth in one or more

supplements to this Prospectus (each a “Prospectus Supplement”). Follow-on

Offerings may include offerings of common shares, offerings of Rights, and offerings

made in transactions that are deemed to be “at the market” as defined in

Rule 415 under the Securities Act of 1933, as amended (the “1933 Act”), including

sales made directly on the NYSE American or sales made to or through a market maker other

than on an exchange. You should read this Prospectus and any related Prospectus Supplement

carefully before you decide to invest in the Securities.

The

Fund may offer Securities (1) directly to one or more purchasers, (2) through agents that the Fund may designate from time to

time or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering of Securities will

identify any agents or underwriters involved in the sale of Securities, and will set forth any applicable purchase price, fee,

commission or discount arrangement between the Fund and agents or underwriters or among underwriters or the basis upon which such

amount may be calculated. The Fund may not sell Securities through agents, underwriters or dealers without delivery of this Prospectus

and a Prospectus Supplement. See “Plan of Distribution.” |

| |

|

|

| Use

of Proceeds |

|

Unless

otherwise specified in a Prospectus Supplement, W.H. Reaves & Co., Inc. (the “Investment Adviser” or “Reaves”),

the Fund’s investment adviser, anticipates that investment of the proceeds will be made in accordance with the Fund’s

investment objective and policies as appropriate investment opportunities are identified. It is currently anticipated that

the Fund will be able to invest substantially all of the net proceeds of an offering of Securities in accordance with its

investment objective and policies within three months after the completion of such offering. Pending such investment, the

proceeds will be held in high quality short-term debt securities and instruments. A delay in the anticipated use of proceeds

could lower returns and reduce the Fund’s distribution to holders of common shares (“Common Shareholders”). |

| Investment

Objective and Policies |

|

The

Fund’s investment objective is to provide a high level of after-tax income and

total return consisting primarily of tax-advantaged dividend income and capital appreciation.

The Fund pursues this objective by investing at least 80% of its total assets in the

securities of domestic and foreign companies involved to a significant extent in providing

products, services or equipment for (i) the generation or distribution of electricity,

gas or water, (ii) telecommunications activities or (iii) infrastructure operations,

such as airports, toll roads and municipal services (“Utilities” or the “Utility

Industry”).

A

company will be deemed to be involved in the Utility Industry to a significant extent if at least 50% of its assets, gross

income or profits are committed to or derived from activities in the areas described above. The remaining 20% of the Fund’s

total assets may be invested in other securities including stocks, debt obligations and money market instruments, as well

as certain derivative instruments (described below) and other investments.

As

used in this Prospectus and the Statement of Additional Information, the terms “debt securities” and “debt

obligations” refer to bonds, debentures and similar long and intermediate term debt investments and do not include

short-term fixed income securities such as money market instruments in which the Fund may invest temporarily pending investment

of the proceeds of an offering and during periods of abnormal market conditions. The Fund may invest in preferred stocks

and bonds of below investment grade quality (i.e., “junk bonds”).

Under

normal market conditions, the Fund invests at least 80% of its total assets in dividend-paying common and preferred stocks

of companies in the Utility Industry. In pursuing its objective, the Fund invests primarily in common and preferred stocks

that pay dividends that qualify for federal income taxation at rates applicable to long-term capital gains (“tax-advantaged

dividends”).

The

Fund may invest in the securities of both domestic and foreign issuers, including those located in emerging market countries

(i.e., a country not included in the MSCI World Index, a free float-adjusted market capitalization weighted index that

is designed to measure the equity market performance of developed markets).

As

an alternative to holding foreign-traded securities, the Fund may invest in dollar-denominated securities of foreign companies

that trade on U.S. exchanges or in the U.S. over-the-counter market (including depositary receipts, which evidence ownership

in underlying foreign securities).

To

date, the Fund’s derivatives usage has been limited to equity options, including writing covered calls, the purchase of

calls and the sale of puts. Options may be used as both hedges against the value of existing holdings or as speculative trades

as part of the Fund’s overall investment strategy.

In

addition, the Fund may choose to use interest rate swaps (or options thereon) from time to time for hedging purposes.

Although the Fund does not currently use interest rate swaps (or options thereon), the Fund may do so in the future, depending

on the interest rate outlook of the Investment Adviser and other factors. Such usage would be limited to no more than

20% of the Fund’s total assets. The Fund may choose to use other derivatives from time to time, as described in

the Statement of Additional Information.

|

| |

|

There

is no assurance that the Fund will achieve its investment objective. Further, the Fund’s ability to pursue its investment

objective, the value of the Fund’s investments and the Fund’s NAV may be adversely affected by changes in tax rates

and policies. Because the Fund’s investment objective is to provide a high level of after-tax yield and total return consisting

primarily of dividend and interest income and capital appreciation, the Fund’s ability to invest, and the attractiveness

of investing in, equity securities that pay qualified dividend income in relation to other investment alternatives will be affected

by changes in federal income tax laws and regulations, including changes in the qualified dividend income provisions. Any proposed

or actual changes in such rates, therefore, can significantly and adversely affect the after-tax returns of the Fund’s investments

in equity securities. Any such changes also could significantly and adversely affect the Fund’s NAV, as well as the Fund’s

ability to acquire and dispose of equity securities at desirable returns and price levels and the Fund’s ability to pursue

its investment objective. The Fund cannot assure you as to the portion, if any, of the Fund’s dividends that will be qualified

dividend income. |

| |

|

|

| Investment

Adviser |

|

W.H.

Reaves & Co., Inc. serves as the Fund’s investment adviser. Reaves is registered

with the Securities and Exchange Commission (“SEC”) as an investment adviser

under the Investment Advisers Act of 1940, as amended. As of June 30, 2024, Reaves had

approximately $3.247 billion of assets under management. Reaves’ address is 10

Exchange Place, Jersey City, New Jersey 07302.

The

Fund pays Reaves a management fee payable on a monthly basis at the annual rate of 0.575% of the Fund’s average daily total

assets on assets up to and including $2.5 billion and 0.525% of the Fund’s average daily total assets on assets over $2.5

billion. |

| |

|

|

| Administrator |

|

Paralel

Technologies LLC (“Paralel”), located at 1700 Broadway, Suite 1850, Denver, Colorado 80290, serves as administrator

to the Fund. Under an administration and accounting agreement between Paralel and the Fund, Paralel is responsible for providing

the Fund with fund accounting, tax, fund administration, and compliance services, providing the Fund with certain executive

officers, and generally managing the business affairs of the Fund. The administration and accounting agreement provides that,

from its fees earned, Paralel will pay all expenses incurred by the Fund, with the exception of advisory fees; taxes and governmental

fees; expenses related to portfolio transactions and management of the portfolio; expenses associated with secondary offerings

of shares; trustee fees and expenses; expenses associated with tender offers and other share repurchases; and other extraordinary

expenses. Paralel is entitled to receive a monthly fee at the annual rate of 0.15% on the first $2 billion of the average

daily total assets of the Fund and 0.10% on any amount in excess of $2 billion of the average daily total assets of the Fund. |

| |

|

|

| Use

of Leverage |

|

The

Fund currently uses leverage through borrowing. More specifically, the Fund has entered

into a credit agreement (the “Credit Agreement”) with State Street Bank and

Trust Company (the “Bank”). As of April 30, 2024, the Fund had outstanding

$545,000,000 in principal amount of borrowings from the Credit Agreement representing

approximately 25.6% of the Fund’s net assets and 20.3% of the Fund’s total

assets. The Bank has the ability to terminate the Credit Agreement upon 360-days’

notice or following an event of default. |

|

|

The

Fund has no present intention of issuing preferred shares, although it has done so in the past and may choose to do so

in the future.

The

Fund also may borrow money as a temporary measure for extraordinary or emergency purposes.

Leverage

creates risks for common shareholders, including the likelihood of greater volatility of NAV and market price of, and

dividends paid on, the common shares. There is a risk that fluctuations in the dividend rates on any preferred shares

issued by the Fund may adversely affect the return to the common shareholders. If the income from the securities purchased

with such funds is not sufficient to cover the cost of leverage, the return on the Fund will be less than if leverage

had not been used, and therefore the amount available for distribution to common shareholders as dividends and other distributions

will be reduced.

Changes

in the value of the Fund’s portfolio (including investments bought with the proceeds of the leverage program) will

be borne entirely by the common shareholders. If there is a net decrease (or increase) in the value of the Fund’s

investment portfolio, the leverage will decrease (or increase) the NAV per share to a greater extent than if the Fund

were not leveraged.

The

issuance of a class of preferred shares or incurrence of borrowings having priority over the common shares creates an

opportunity for greater return per common share, but at the same time such leveraging is a speculative technique in that

it will increase the Fund’s exposure to capital risk. Unless the income and appreciation, if any, on assets acquired

with leverage proceeds exceed the associated costs of the leverage program (and other Fund expenses), the use of leverage

will diminish the investment performance of the common shares compared with what it would have been without leverage.

The

fees received by Reaves and Paralel are based on the total assets of the Fund, including assets represented by leverage.

During periods in which the Fund is using leverage, the fees paid to Reaves for investment advisory services (and separately,

to Paralel for administrative services) will be higher than if the Fund did not use leverage because the fees paid will

be calculated on the basis of the Fund’s total assets, including proceeds from borrowings and the issuance of any

preferred shares. Therefore, Reaves and Paralel may have a financial incentive to use leverage, which creates a conflict

of interest between Reaves and Paralel and common shareholders. Reaves and Paralel will seek to manage this conflict of

interest by utilizing leverage only when they determine such action is in the best interests of the Fund. The Board of

Trustees of the Fund (the “Board”) reviews the Fund’s leverage on a periodic basis, and the Fund’s

use of leverage may be increased or decreased subject to the Board’s oversight and applicable law.

Under

the Investment Company Act of 1940, as amended, and the rules and regulations thereunder (the “1940 Act”),

the Fund is not permitted to issue preferred shares unless immediately after such issuance the total asset value of the

Fund’s portfolio is at least 200% of the liquidation value of the outstanding preferred shares (i.e., such liquidation

value may not exceed 50% of the Fund’s total assets). In addition, the Fund is not permitted to declare any cash

dividend or other distribution on its common shares unless, at the time of such declaration, the NAV of the Fund’s

portfolio (determined after deducting the amount of such dividend or other distribution) is at least 200% of such liquidation

value.

To

qualify for federal income taxation as a “regulated investment company,” the Fund must satisfy certain requirements

relating to sources of its income and diversification of its assets, and must distribute in each taxable year at least

90% of its net investment income (including net interest income and net short-term gain). The Fund also will be required

to distribute annually substantially all of its income and capital gain, if any, to avoid imposition of a nondeductible

4% federal excise tax.

|

| |

|

The

Fund’s willingness to issue new securities for investment purposes, and the amount the Fund will

issue, depends on many factors, the most important of which are market conditions and interest rates.

There

is no assurance that a leveraging strategy will be successful during any period in which it is employed.

The

Fund may increase the amount of leverage following the completion of an offering, subject to applicable law. |

| |

|

|

| Risk Factors |

|

This

is a summary of only certain of the risks associated with an offering of the Fund’s common shares and with an investment

in the Fund. See “Risk Factors” below.

Risk

is inherent in all investing. Investing in any investment company security involves risk, including the risk that you

may receive little or no return on your investment or even that you may lose part or all of your investment. Therefore,

before investing you should consider carefully the following risks that you assume when you invest in the Fund’s

common shares:

Risks

Associated with Offerings of Additional Common Shares. The voting power of current shareholders will be diluted to

the extent that current shareholders do not purchase shares in any future offerings of shares or do not purchase sufficient shares

to maintain their percentage interest. If the Fund is unable to invest the proceeds of such offering as intended, the Fund’s

per common share distribution may decrease and the Fund may not participate in market advances to the same extent as if such proceeds

were fully invested as planned. If the Fund sells common shares at a price below NAV pursuant to the consent of shareholders,

shareholders will experience a dilution of the aggregate NAV per common share because the sale price will be less than the Fund’s

then-current NAV per common share. Similarly, were the expenses of the offering to exceed the amount by which the sale price exceeded

the Fund’s then current NAV per common share, shareholders would experience a dilution of the aggregate NAV per common share.

This dilution will be experienced by all shareholders, irrespective of whether they purchase common shares in any such offering.

See “Description of the Common Shares–Common Shares.”

|

| |

|

Additional

Risks of Rights. There are additional risks associated with an offering of Rights. Shareholders who do not

exercise their Rights may, at the completion of such an offering, own a smaller proportional interest in the Fund than

if they exercised their Rights. As a result of such an offering, a shareholder may experience dilution in NAV per share

if the subscription price per share is below the NAV per share on the expiration date. If the subscription price per share

is below the NAV per share of the Fund’s common shares on the expiration date, a shareholder will experience an

immediate dilution of the aggregate NAV of such shareholder’s common shares if the shareholder does not participate

in such an offering and the shareholder will experience a reduction in the NAV per share of such shareholder’s common

shares whether or not the shareholder participates in such an offering. Such a reduction in NAV per share may have the

effect of reducing market price of the common shares. The Fund cannot state precisely the extent of this dilution (if

any) if the shareholder does not exercise such shareholder’s Rights because the Fund does not know what the NAV

per share will be when the offer expires or what proportion of the Rights will be exercised. If the subscription price

is substantially less than the then current NAV per common share at the expiration of a rights offering, such dilution

could be substantial. Any such dilution or accretion will depend upon whether (i) such shareholders participate in the

rights offering and (ii) the Fund’s NAV per common share is above or below the subscription price on the expiration

date of the rights offering. In addition to the economic dilution described above, if a Common Shareholder does not exercise

all of their rights, the Common Shareholder will incur voting dilution as a result of this rights offering. This voting

dilution will occur because the Common Shareholder will own a smaller proportionate interest in the Fund after the rights

offering than prior to the rights offering. There is a risk that changes in market conditions may result in the underlying

common shares purchasable upon exercise of the subscription rights being less attractive to investors at the conclusion

of the subscription period. This may reduce or eliminate the value of the subscription rights. If investors exercise only

a portion of the rights, the number of common shares issued may be reduced, and the common shares may trade at less favorable

prices than larger offerings for similar securities. Subscription rights issued by the Fund may be transferable or non-transferable

rights. In a non-transferable rights offering, Common Shareholders who do not wish to exercise their rights will be unable

to sell their rights. In a transferrable rights offering, the Fund will use its best efforts to ensure an adequate trading

market for the rights; however, investors may find that there is no market to sell rights they do not wish to exercise.

Investment

and Market Risk. An investment in common shares is subject to investment risk, including the possible loss

of the entire principal amount invested. An investment in common shares represents an indirect investment in the securities

owned by the Fund, which are generally traded on a securities exchange or in the over-the-counter markets. The value of

these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The Fund anticipates

using leverage, which will magnify the Fund’s investment, market and certain other risks. The common shares at any

point in time may be worth less than the original investment, even after taking into account any reinvestment of dividends

and distributions.

Issuer

Risk. The value of common and preferred stocks may decline for a number of reasons which directly relate

to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods and

services.

Income

Risk. The income that common shareholders receive from the Fund is based primarily on the dividends and interest

it earns from its investments, which can vary widely over the short and long-term. If prevailing market interest rates

drop, distribution rates of the Fund’s holdings and common shareholder’s income from the Fund could drop as

well. The Fund’s income also would likely be affected adversely if prevailing short-term interest rates increase

and the Fund is utilizing leverage.

Leverage

Risk. Described in the “Use of Leverage” section above.

|

| |

|

Tax

Risk. The Fund’s investment program and the tax treatment of Fund distributions may be affected by

Internal Revenue Service (“IRS”) interpretations of the Internal Revenue Code of 1986, as amended (the “Code”),

future changes in tax laws and regulations. There can be no assurance that any portion of the Fund’s income distributions

will not be fully taxable as ordinary income. The Fund’s ability to pursue its investment objective, the value of

the Fund’s investments and the Fund’s NAV may be adversely affected by changes in tax rates and policies.

Because the Fund’s investment objective is to provide a high level of after-tax yield and total return consisting

primarily of dividend and interest income and capital appreciation, the Fund’s ability to invest, and the attractiveness

of investing in, equity securities that pay qualified dividend income in relation to other investment alternatives will

be affected by changes in federal income tax laws and regulations, including changes in the qualified dividend income

provisions. Any proposed or actual changes in such rates, therefore, can significantly and adversely affect the after-tax

returns of the Fund’s investments in equity securities. Any such changes also could significantly and adversely

affect the Fund’s NAV, as well as the Fund’s ability to acquire and dispose of equity securities at desirable

returns and price levels and the Fund’s ability to pursue its investment objective. The Fund cannot assure you as

to the portion, if any, of the Fund’s dividends that will be qualified dividend income. Further, in order to avoid

corporate income tax at the level of the Fund, it must qualify each year as a regulated investment company under the Code.

Sector/Industry

Risk. The “Utility Industry” generally includes companies involved in providing products, services

or equipment for (i) the generation or distribution of electricity, gas or water, (ii) telecommunications activities

or (iii) infrastructure operations, such as airports, toll roads and municipal services. The Fund invests a significant

portion of its total assets in securities of utility companies, which may include companies in the electric, gas, water,

telecommunications sectors, as well as other companies engaged in other infrastructure operations. This may make the Fund

more susceptible to adverse economic, political or regulatory occurrences affecting those sectors. As concentration of

the Fund’s investments in a sector increases, so does the potential for fluctuation in the NAV of common shares.

Risks

that are intrinsic to utility companies include difficulty in obtaining an adequate return on invested capital, difficulty in

financing large construction programs during an inflationary period, restrictions on operations and increased cost and delays

attributable to environmental considerations and regulation, difficulty in raising capital in adequate amounts on reasonable terms

in periods of high inflation and unsettled capital markets, technological innovations that may render existing plants, equipment

or products obsolete, the potential impact of natural or man-made disasters, increased costs and reduced availability of certain

types of fuel, occasional reduced availability and high costs of natural gas and other fuels, the effects of energy conservation,

the effects of a national energy policy and lengthy delays and greatly increased costs and other problems associated with the

design, construction, licensing, regulation and operation of nuclear facilities for electric generation, including, among other

considerations, the problems associated with the use of radioactive materials, the disposal of radioactive wastes, shutdown of

facilities or release of radiation resulting from catastrophic events, disallowance of costs by regulators which may reduce profitability,

and changes in market structure that increase competition. |

| |

|

In

many regions, including the United States, the Utility Industry is experiencing increasing competitive pressures, primarily

in wholesale markets, as a result of consumer demand, technological advances, greater availability of natural gas with

respect to electric utility companies and other factors. For example, the Federal Energy Regulatory Commission (the “FERC”)

has implemented regulatory changes to increase access to the nationwide transmission grid by utility and non-utility purchasers

and sellers of electricity. A number of countries, including the United States, are considering or have implemented methods

to introduce and promote retail competition. Changes in regulation may result in consolidation among domestic utilities

and the disaggregation of many vertically integrated utilities into separate generation, transmission and distribution

businesses. As a result, additional significant competitors could become active in certain parts of the Utility Industry.

Due

to the high costs of developing, constructing, operating and distributing assets and facilities many utility companies

are highly leveraged. As such, movements in the level of interest rates may affect the returns from these assets. See

“Risk Factors—Sector/Industry Risk—Interest Rate Risk.”

Concentration

Risk. The Fund’s investments will be concentrated in the Utility Industry. The focus of the Fund’s

portfolio on this sector may present more risks than if the Fund’s portfolio were broadly spread over numerous sectors

of the economy. A downturn in this sector (or any sub-sectors within it) would have a larger impact on the Fund than on an

investment company that does not concentrate solely in this specific sector (or in specific sub-sectors). At times, the

performance of companies in the Utility Industry (or a specific sub-sector) may lag the performance of other sectors or the

broader market as a whole.

Common

Stock Risk. The Fund will have substantial exposure to common stocks. Although common stocks have historically

generated higher average returns than fixed-income securities over the long-term, common stocks also have experienced

significantly more volatility in returns. An adverse event, such as an unfavorable earnings report, may depress the value

of a particular common stock held by the Fund. Also, the price of common stocks are sensitive to general movements in

the stock market and a drop in the stock market may depress the price of common stocks to which the Fund has exposure.

Common stock prices fluctuate for many reasons, including changes in investors’ perceptions of the financial condition

of an issuer or the general condition of the relevant stock market, or when political or economic events affecting the

issuer occur. Common stock is subordinated to preferred stock and debt in a company’s capital structure with respect

to priority in the right to a share of corporate income, and therefore will be subject to greater dividend risk than preferred

stock or debt instruments. In addition, common stock prices may be sensitive to rising interest rates, as the costs of

capital rise and borrowing costs increase.

Foreign

Securities Risk. Investments in securities of non-U.S. issuers will be subject to risks not usually associated

with owning securities of U.S. issuers. These risks can include fluctuations in foreign currencies, foreign currency exchange

controls, social, political and economic instability, differences in securities regulation and trading, expropriation or nationalization

of assets, and foreign taxation issues. In addition, changes in government administrations or economic or monetary policies in

the United States or abroad could result in appreciation or depreciation of the Fund’s securities. It may also be more difficult

to obtain and enforce a judgment against a non-U.S. issuer. Foreign investments made by the Fund must be made in compliance with

U.S. and foreign currency restrictions and tax laws restricting the amounts and types of foreign investments. The risks of foreign

investing may be magnified for investments in issuers located in emerging market countries. |

| |

|

To

the extent the Fund invests in depositary receipts, the Fund will be subject to many of the same risks as when investing

directly in non-U.S. securities. The holder of an unsponsored depositary receipt may have limited voting rights and may

not receive as much information about the issuer of the underlying securities as would the holder of a sponsored depositary

receipt.

Foreign

Currency Risk. Investments in securities that trade in and receive revenues in foreign currencies are subject

to the risk that those currencies will decline in value relative to the U.S. dollar. Currency rates in foreign countries

may fluctuate significantly over short periods of time. A decline in the value of foreign currencies relative to the U.S.

dollar will reduce the value of securities held by the Fund and denominated in those currencies. Some foreign governments

levy withholding taxes against dividend and interest income. Although in some countries portions of these taxes are recoverable,

any amounts not recovered will reduce the income received by the Fund, and may reduce distributions to common shareholders.

These risks are generally heightened for investments in emerging market countries.

Small

and Mid-Cap Stock Risk. The Fund may invest in companies of any market capitalization. The Fund considers

small companies to be those with a market capitalization up to $2 billion and medium-sized companies to be those with

a market capitalization between $2 billion and $10 billion. Smaller and medium-sized company stocks may be more volatile

than, and perform differently from, larger company stocks. There may be less trading in the stock of a smaller or medium-sized

company, which means that buy and sell transactions in that stock could have a larger impact on the stock’s price

than is the case with larger company stocks. Smaller and medium-sized companies may have fewer business lines; changes

in any one line of business, therefore, may have a greater impact on a smaller or medium-sized company’s stock price

than is the case for a larger company. As a result, the purchase or sale of more than a limited number of shares of a

small or medium-sized company may affect its market price. The Fund may need a considerable amount of time to purchase

or sell its positions in these securities. In addition, smaller or medium-sized company stocks may not be well known to

the investing public and may be held primarily by insiders or institutional investors.

Non-Investment

Grade Securities Risk. Investments in securities of below investment grade quality, if any, are predominantly speculative

because of the credit risk of their issuers. While offering a greater potential opportunity for capital appreciation and higher

yields, preferred stocks and bonds of below investment grade quality (also known as “junk bonds”) entail greater potential

price volatility and may be less liquid than higher-rated securities. Issuers of below investment grade quality preferred stocks

and bonds are more likely to default on their payments of dividends/interest and liquidation value/principal owed to the Fund,

and such defaults will reduce the Fund’s NAV and income distributions.

|

| |

|

Interest

Rate Risk. Interest rate risk is the risk that preferred stocks paying fixed dividend rates and fixed-rate

debt securities will decline in value because of changes in market interest rates. When interest rates rise the market

value of such securities generally will fall. An investment by the Fund in preferred stocks or fixed-rate debt securities

means that the NAV and price of the common shares may decline if market interest rates rise. In typical interest rate

environments, the prices of longer term debt securities generally fluctuate more than the prices of shorter-term debt

securities as interest rates change. These risks may be greater in the current market environment because certain interest

rates are near historically low levels. During periods of declining interest rates, an issuer of preferred stock or fixed-rate

debt securities may exercise its option to redeem securities prior to maturity, forcing the Fund to reinvest in lower

yielding securities. During periods of rising interest rates, the average life of certain types of securities may be extended

because of slower than expected payments. This may lock in a below market yield, increase the security’s duration,

and reduce the value of the security. The value of the Fund’s common stock investments may also be influenced by

changes in interest rates.

Credit

Risk. Credit risk is the risk that an issuer of a preferred or debt security will become unable to meet its

obligation to make dividend, interest and principal payments. In general, lower rated preferred or debt securities carry

a greater degree of credit risk. If rating agencies lower their ratings of preferred or debt securities in the Fund’s

portfolio, the value of those obligations could decline. In addition, the underlying revenue source for a preferred or

debt security may be insufficient to pay dividends, interest or principal in a timely manner.

Derivatives

Risk. Although it may use other derivative instruments from time to time as described in the Statement of Additional

Information, the Fund’s derivatives usage to date has generally been limited to equity options, including writing covered

calls, the purchase of calls and the sale of puts. A decision as to whether, when and how to use options involves the exercise

or skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or

unexpected events. The Fund may also, from time to time, choose to use interest rate swaps (or options thereon). Derivatives transactions

of the types described above subject the Fund to increased risk of principal loss due to imperfect correlation or unexpected price

or interest rate movements. The Fund’s use of derivative instruments involves investments risks and transactions costs to

which the Fund would not be subject absent the use of these instruments and, accordingly, may result in losses greater than if

they had not been used. The Fund also will be subject to credit risk with respect to the counterparties to the over-the-counter

derivatives contracts purchased by the Fund. If a counterparty becomes bankrupt or otherwise fails to perform its obligations

under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery

under the derivative contract in a bankruptcy or other reorganization proceeding. The Fund may obtain only a limited recovery

or may obtain no recovery in such circumstances. As a general matter, dividends received on hedged stock positions are characterized

as ordinary income and are not eligible for favorable tax treatment. In addition, use of derivatives may give rise to short-term

capital gains and other income that would not qualify for payments by the Fund of tax-advantaged dividends.

|

| |

|

Preferred

Stock Risk. The Fund may have exposure to preferred stocks. In addition to credit risk, investments in preferred

stocks involve certain other risks. Certain preferred stocks contain provisions that allow an issuer under certain conditions

to skip distributions (in the case of “noncumulative” preferred stocks) or defer distributions (in the case

of “cumulative” preferred stocks). If the Fund owns a preferred stock that is deferring its distributions,

the Fund may be required to report income for tax purposes while it is not receiving income on this position. Preferred

stocks often contain provisions that allow for redemption in the event of certain tax or legal changes or at the issuers’

call. In the event of redemption, the Fund may not be able to reinvest the proceeds at comparable rates of return. Preferred

stocks typically do not provide any voting rights, except in cases when dividends are in arrears beyond a certain time

period, which varies by issue. Preferred stocks are subordinated to bonds and other debt instruments in a company’s

capital structure in terms of priority to corporate income and liquidation payments, and therefore will be subject to

greater credit risk than those debt instruments. Preferred stocks may be significantly less liquid than many other securities,

such as U.S. government securities, corporate debt or common stock.

Debt

Securities Risk. In addition to credit risk, investments in debt securities carry certain risks including:

redemption risk (debt securities sometimes contain provisions that allow for redemption in the event of tax or security

law changes in addition to call features at the option of the issuer. In the event of a redemption, the Fund may not be

able to reinvest the proceeds at comparable rates of return); limited voting rights (debt securities typically do not

provide any voting rights, except in cases when interest payments have not been made and the issuer is in default; and

liquidity (certain debt securities may be substantially less liquid than many other securities, such as U.S. government

securities or common stocks).

Inflation

Risk. Inflation risk is the risk that the purchasing power of assets or income from investment will be worth

less in the future as inflation decreases the value of money. As inflation increases, the real value of the common shares

and distributions thereon can decline.

Illiquid

Securities Risk. The Fund may invest in securities for which there is no readily available trading market

or which are otherwise illiquid. The Fund may not be able readily to dispose of such securities at prices that approximate

those at which the Fund could sell such securities if they were more widely traded and, as a result of such illiquidity,

the Fund may have to sell other investments or engage in borrowing transactions if necessary to raise cash to meet its

obligations. In addition, the limited liquidity could affect the market price of the securities, thereby adversely affecting

the Fund’s NAV.

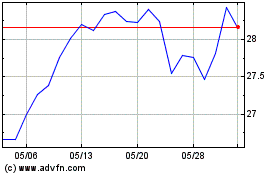

Market

Price of Common Shares. The shares of closed-end management investment companies often trade at a discount

from their NAV, and the Fund’s common shares may likewise trade at a discount from NAV. The trading price of the

Fund’s common shares may be less than the public offering price. The returns earned by common shareholders who sell

their common shares below NAV will be reduced. As of April 30, 2024, the Fund’s common shares are trading at a premium

to NAV.

Management

Risk. The Fund is subject to management risk because it has an actively managed portfolio. Reaves and the individual

portfolio managers apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be

no guarantee that these will produce the desired results.

|

| |

|

Market

Disruption and Geopolitical Risk. The value of your investment in the Fund is based on the values of the

Fund’s investments, which may change due to economic and other events that affect markets generally, as well as

those that affect particular regions, countries, industries, companies or governments. These movements, sometimes called

volatility, may be greater or less depending on the types of securities the Fund owns and the markets in which the securities

trade. The increasing interconnectivity between global economies and financial markets increases the likelihood that events

or conditions in one region or financial market may adversely impact issuers in a different country, region or financial

market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest

rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory

events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years,

such as the escalated conflict in the Middle East and the ongoing Russia-Ukraine conflict, terrorist attacks around the

world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market

volatility and may have long term effects on both the U.S. and global financial markets. The occurrence of such events

may be sudden and unexpected, and it is difficult to predict when similar events affecting the U.S. or global financial

markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have

a significant adverse impact on the value, liquidity and risk profile of the Fund’s portfolio, as well as its ability

to sell securities to meet redemptions. There is a risk that you may lose money by investing in the Fund.

Social,

political, economic and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics),

terrorism, wars, conflicts and social unrest, may occur and could significantly impact issuers, industries, governments and other

systems, including the financial markets. As global systems, economies and financial markets are increasingly interconnected,

events that once had only local impact are now more likely to have regional or even global effects. Events that occur in one country,

region or financial market will, more frequently, adversely impact issuers in other countries, regions or markets. These impacts

can be exacerbated by failures of governments and societies to adequately respond to an emerging event or threat. These types

of events quickly and significantly impact markets in the U.S. and across the globe leading to extreme market volatility and disruption.

The extent and nature of the impact on supply chains or economies and markets from these events is unknown. These events could

reduce consumer demand or economic output, result in market closures, travel restrictions or quarantines, and generally have a

significant impact on the economies and financial markets and the Adviser’s investment advisory activities and services

of other service providers, which in turn could adversely affect the Fund’s investments and other operations. The value

of the Fund’s investments may decrease as a result of such events, particularly if these events adversely impact the operations

and effectiveness of the Adviser or key service providers or if these events disrupt systems and processes necessary or beneficial

to the investment advisory or other activities on behalf the Fund.

|

| |

|

Legislation, Policy and Regulatory Risk. At any time after the date of this Prospectus, legislation or additional regulations may be enacted that could negatively affect the assets of the Fund or the issuers of such assets. Recent changes in the U.S. political landscape and changing approaches to regulation may have a negative impact on the entities and/or securities in which the Fund invests. Legislation or regulation may also change the way in which the Fund itself is regulated. New or amended regulations may be imposed by the Commodity Futures Trading Commission (“CFTC”), the SEC, the Board of Governors of the Federal Reserve System (the “Federal Reserve”) or other financial regulators, other governmental regulatory authorities or self-regulatory organizations that supervise the financial markets that could adversely affect the Fund. In particular, these agencies are empowered to promulgate a variety of new rules pursuant to financial reform legislation in the United States. There can be no assurance that future legislation, regulation or deregulation will not have a material adverse effect on the Fund or will not impair the ability of the Fund to achieve its investment objective. The Fund also may be adversely affected by changes in the enforcement or interpretation of existing statutes and rules by these governmental agencies.

|

| |

|

|

| Anti-Takeover Provisions |

|

The Fund’s

Agreement and Declaration of Trust, dated September 15, 2003 (the “Declaration of Trust”), includes provisions

that could have the effect of inhibiting the Fund’s possible conversion to open-end status and limiting the ability

of other entities or persons to acquire control of the Board. In certain circumstances, these provisions might also inhibit

the ability of shareholders to sell their common shares at a premium over prevailing market prices. See “Description

of Capital Structure — Anti-Takeover Provisions in the Declaration of Trust.” |

| |

|

|

| Distributions |

|

The Fund intends

to make a level dividend distribution each month to common shareholders after payment of interest on any outstanding borrowings.

The level dividend rate is determined, and may be modified by the Board of Trustees, from time to time. Any net capital gains

earned by the Fund are distributed at least annually. Distributions to shareholders are recorded by the Fund on the ex-dividend

date. In August 2009, the SEC issued an order approving exemptive relief for the Fund, from Section 19(b) and Rule 19b-1 under

the 1940 Act (the “Order”). The Order allows the Fund to employ a managed distribution plan (the “Managed

Distribution Plan”) rather than a level distribution plan. The Fund implemented the Managed Distribution Plan for the

fiscal year ended October 31, 2011. The Board’s most recent approval of the Plan was in September 2011. Common shareholders

who elect not to participate in the Fund’s dividend reinvestment plan will receive all distributions in cash paid by

check mailed directly to the shareholder of record (or, if the common shares are held in street or other nominee name, then

to such nominee). See “Distributions.” |

| |

|

|

| Dividend Reinvestment Plan |

|

Common shareholders

may elect automatically to reinvest some or all of their distributions in additional common shares under the Fund’s

dividend reinvestment plan. Whenever the Fund declares a dividend or other distribution payable in cash, participants in the

dividend reinvestment plan will receive the equivalent in common shares. See “Dividend Reinvestment Plan.” |

| |

|

|

| Common Share Purchases and Tenders |

|

From time to time,

the Fund’s Board may consider repurchasing common shares in the open market or in private transactions, or tendering

for shares, in an attempt to reduce or eliminate a market value discount from NAV, if one should occur. |

| |

|

|

| Custodian and Transfer Agent |

|

State Street Bank

and Trust Company (“State Street”) serves as the Fund’s custodian. SS&C Global Investor & Distribution

Solutions, Inc. (“SS&C GIDS”) serves as the Fund’s transfer agent, dividend paying agent and registrar.

See “Custodian, Transfer Agent, Dividend Paying Agent and Registrar.” |

SUMMARY

OF FUND EXPENSES

The

following table is intended to assist investors in understanding the fees and expenses (annualized) that an investor in common

shares of the Fund would bear, directly or indirectly. The table is based on the capital structure of the Fund as of April 30,

2024.

The

table assumes the use of leverage in the form of amounts borrowed by the Fund under a credit agreement in an amount equal to 20.3%

of the Fund’s total assets as of April 30, 2024 (including the amounts of any additional leverage obtained through the use

of borrowed funds) and shows Fund expenses as a percentage as a percentage of net assets attributable to common shares. The following

table should not be considered a representation of the Fund’s future expenses. Actual expenses may be greater or less than

those shown below. Interest payments on borrowings are included in the total annual expenses of the Fund.

| Shareholder

Transaction Expenses (as a percentage of offering price) |

|

|

| Sales

Load1 |

|

— |

| Offering

Expenses Borne by Common Shareholders1 |

|

0.00%6 |

| Dividend

Reinvestment Plan Fees2 |

|

None |

| |

|

|

| Annual Expenses |

|

Percentage of Net Assets

Attributable to Common

Shares1 |

| Investment

Advisory Fees3 |

|

0.72% |

| Interest

Payments on Borrowed Funds4 |

|

1.58% |

| Other

Expenses5 |

|

0.23% |

| Total

Annual Fund Operating Expenses |

|

2.53% |

| (2) | There

will be no brokerage charges with respect to common shares of beneficial interest issued

directly by the Fund under the dividend reinvestment plan. You will pay brokerage charges

in connection with open market purchases or if you direct the plan agent to sell your

common shares held in a dividend reinvestment account. |

| (6) | Amount

represents less than 0.00% of the offering price. |

Example

The

purpose of the following table is to help a holder of common shares understand the fees and expenses that such holder would bear

directly or indirectly. The following example illustrates the expenses that you would pay on a $1,000 investment in common shares

of the Fund assuming (1) that the Fund incurs total annual expenses of 2.53% of its net assets in years 1 through 10 (assuming

borrowing equal to 20.3% of the Fund’s total assets) and (2) a 5% annual return.

| 1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

| |

|

|

|

|

|

|

| $26 |

|

$79 |

|

$134 |

|

$286 |

The

example should not be considered a representation of future expenses or rate of return and includes the expenses of the offering.

Actual expenses may be higher or lower than those shown. The example assumes that the estimated “Other Expenses”

set forth in the Annual Expenses table are accurate and that all dividends and distributions are reinvested at NAV. Moreover,

the Fund’s actual rate of return may be greater or less than the hypothetical 5% annual return shown in the example.

FINANCIAL

HIGHLIGHTS

The

Fund’s audited Financial Highlights for the fiscal years ended October 31, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021,

2022 and 2023 and the unaudited Financial Highlights for the six months ended April 30, 2024 are incorporated by reference from

the Fund’s Semi-Annual Report for the six months ended April 30, 2024 and in the future, will be incorporated by reference

from the Fund’s Form N-CSR filings.

INFORMATION

REGARDING SENIOR SECURITIES

The

following table sets forth certain unaudited information regarding the Fund’s senior securities as of the end of each of

the Fund’s prior ten fiscal years. The Fund’s senior securities during this time period are comprised of outstanding

indebtedness, which constitutes a “senior security” as defined in the 1940 Act, and any then-outstanding auction market

preferred shares.

Senior

Securities Representing Indebtedness

Fiscal Year Ended | |

Principal Amount

Outstanding1 | |

Asset Coverage Per

$1,0002 |

| October 31, 2023 | |

$520,000,000 | |

$4,642 |

| October 31, 2022 | |

$500,000,000 | |

$4,989 |

| October 31, 2021 | |

$450,000,000 | |

$5,796 |

| October 31, 2020 | |

$345,000,000 | |

$5,811 |

| October 31, 2019 | |

$445,000,000 | |

$5,000 |

| October 31, 2018 | |

$445,000,000 | |

$4,472 |

| October 31, 2017 | |

$320,000,000 | |

$6,040 |

| October 31, 2016 | |

$320,000,000 | |

$4,489 |

| October 31, 2015 | |