Filed

pursuant to Rule 424(b)(3)

File

No. 333-263572

UNITED

STATES 12 MONTH NATURAL GAS FUND, LP

Supplement

dated August 8, 2023

to

Prospectus

dated April 26, 2023

This

supplement contains information that amends, supplements or modifies certain information contained in the prospectus of United

States 12 Month Natural Gas Fund, LP (“UNL”) dated April 26, 2023 (the “Prospectus”).

You

should carefully read the Prospectus and this supplement before investing. This supplement should be read in conjunction with

the Prospectus. You should also carefully consider the “Risk Factors” beginning on page 8 of the Prospectus before

you decide to invest.

| 1. | ADM

Investor Services, Inc. to Serve as a Futures Commission Merchant for UNL |

On

August 8, 2023, UNL entered into a Customer Account Agreement with ADM Investor Services, Inc. (“ADMIS”) to serve

as an additional futures commission merchant (“FCM”) for UNL.

In

light of the foregoing, the section entitled “Futures Commission Merchants” beginning on page 39 of the Prospectus

is revised to add the following text at the end of the section:

ADM

Investor Services, Inc.

On

August 8, 2023, UNL and ADM Investor Services, Inc. (“ADMIS”) entered into a Customer Account Agreement pursuant to

which ADMIS has agreed to serve as an additional FCM for UNL. The Customer Account Agreement between UNL and ADMIS requires ADMIS to

provide services to UNL in connection with the purchase and sale of futures contracts that may be purchased or sold by or through

ADMIS for UNL’s account. Under this agreement, UNL has agreed to pay ADMIS commissions for executing and clearing trades on behalf of

UNL.

ADMIS’s

primary address is 141 W Jackson Boulevard, Suite 2100a, Chicago, IL 60604. ADMIS is registered in the United States with the

CFTC as an FCM providing futures execution and clearing services covering futures exchanges globally. ADMIS is a member of various

U.S. futures and securities exchanges.

ADMIS

has been named as a defendant in various legal actions, including arbitrations, class actions and other litigation including those

described below, arising in connection with its activities. Certain of the actual or threatened legal actions include claims for

substantial compensatory and/or punitive damages or claims for indeterminate amounts of damages. ADMIS is also involved, in other

reviews, investigations and proceedings (both formal and informal) by governmental and self-regulatory agencies regarding ADMIS’s

business, including among other matters, accounting and operational matters, certain of which may result in adverse judgments,

settlements, fines, penalties, injunctions or other relief.

ADMIS

contests liability and/or the amount of damages as appropriate in each pending matter. In view of the inherent difficulty of predicting

the outcome of such matters, particularly in cases where claimants seek substantial or indeterminate damages or where investigations

and proceedings are in the early stages, ADMIS cannot predict the loss or range of loss, if any, related to such matters; how

or if such matters will be resolved; when they will ultimately be resolved; or what the eventual settlement, fine, penalty or

other relief, if any, might be. Subject to the foregoing, ADMIS believes, based on current knowledge and after consultation with

counsel, that the outcome of such pending matters will not have a material adverse effect on the consolidated financial condition

of ADMIS.

On

September 4, 2019, AOT Holding AG (“AOT”) filed a putative class action under the U.S. Commodities Exchange Act in

federal district court in Urbana, Illinois, alleging that ADMIS sought to manipulate the benchmark price used to price and settle

ethanol derivatives traded on futures exchanges. On March 16, 2021, AOT filed an amended complaint adding a second named plaintiff

Maize Capital Group, LLC (“Maize”). AOT and Maize allege that members of the putative class suffered “hundreds

of millions of dollars in damages” as a result of ADMIS’s alleged actions. On July 14, 2020, Green Plains Inc. and

its related entities (“GP”) filed a putative class action lawsuit, alleging substantially the same operative facts,

in federal court in Nebraska, seeking to represent sellers of ethanol. On July 23, 2020, Midwest Renewable Energy, LLC (“MRE”)

filed a putative class action in federal court in Illinois alleging substantially the same operative facts and asserting claims

under the Sherman Act. On November 11, 2020, United Wisconsin Grain Producers LLC (“UWGP”) and five other ethanol

producers filed a lawsuit in federal court in Illinois alleging substantially the same facts and asserting claims under the Sherman

Act and Illinois, Iowa, and Wisconsin law.

The

court granted ADMIS’s motion to dismiss the MRE and UWGP complaints without prejudice on August 9, 2021 and September 28,

2021, respectively. On August 16, 2021, the court granted ADMIS’s motion to dismiss the GP complaint, dismissing one claim

with prejudice and declining jurisdiction over the remaining state law claim. MRE filed an amended complaint on August 30, 2021,

which ADMIS moved to dismiss on September 27, 2021. UWGP filed an amended complaint on October 19, 2021, which ADMIS moved to

dismiss on December 9, 2021. On October 26, 2021, GP filed a new complaint in Nebraska federal district court, alleging substantially

the same facts and asserting a claim for tortious interference with contractual relations.

ADMIS

denies liability, and is vigorously defending itself in these actions. As these actions are in pretrial proceedings, ADMIS is

unable at this time to predict the final outcome with any reasonable degree of certainty, but believes the outcome will not have

a material adverse effect on its financial condition, results of operations, or cash flows.

ADMIS

will act only as clearing broker for UNL and as such will be paid commissions for executing and clearing trades on behalf of UNL.

ADMIS has not passed upon the adequacy or accuracy of this prospectus. ADMIS will not act in any supervisory capacity with respect

to USCF or participate in the management of USCF or UNL. ADMIS is not affiliated with UNL or USCF. Therefore, neither USCF nor

UNL believes that there are any conflicts of interest with ADMIS or its trading principals arising from its acting as UNL’s

FCM.

| 2. | Marex

North America, LLC Transfers its Futures Clearing Business to Marex Capital Markets,

Inc. |

Marex

North America, LLC (“MNA”) and Marex Capital Markets, Inc. (formerly ED&F Man Capital Markets Inc.) (“MCM”),

which are affiliated entities, serve as futures commission merchants for UNL. On July 28, 2023, MNA and MCM formally advised UNL

that (1) on or about July 14, 2023 MNA transferred its futures clearing business to MCM as part of an internal reorganization

(the “Transfer”), and (2) in connection with the Transfer and to avoid confusion as to which futures customer agreement

governs, the MCM futures customer agreement will be terminated. UNL’s futures trading account with MNA has been consolidated

with UNL’s futures trading account with MCM and the MCM futures trading account is governed by UNL’s futures customer

agreement between UNL and MNA. MCM has agreed to assume the rights and obligations of the futures customer agreement in place

between UNL and MNA from and after the date of the Transfer and, therefore, no material impact on UNL’s operations is anticipated.

In

light of the foregoing:

| · | The

subsection titled “Marex North America, LLC” is deleted from pages

41-42 of the Prospectus, immediately before the subheading “Marex Capital Markets,

Inc., formerly ED&F Man Capital Markets Inc.”; and |

| · | The

first paragraph after the subheading “Marex Capital Markets, Inc., formerly

ED&F Man Capital Markets Inc.” on page 42 of the Prospectus is deleted

in its entirety and replaced with the following: |

On

June 5, 2020, UNL entered into a Customer Account Agreement with ED&F Man Capital Markets Inc. (“MCM”) to serve

as an FCM for UNL. On July 14, 2023, this Customer Account Agreement was terminated and replaced by a Customer Account Agreement

between UNL and Marex North America, LLC (“MNA”) dated May 28, 2020, in respect of which MCM assumed the rights and

obligations of MNA vis-à-vis UNL following the transfer of MNA’s futures clearing business to MCM as part of an internal

reorganization. This agreement requires MCM to provide services to UNL in connection with the purchase and sale of Futures Contracts

and Other Natural Gas-Related Investments that may be purchased or sold by or through MCM for UNL’s account. Under this

agreement, UNL pays MCM commissions for executing and clearing trades on behalf of UNL.

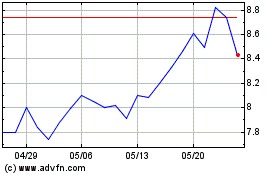

United States 12 Month N... (AMEX:UNL)

過去 株価チャート

から 4 2024 まで 5 2024

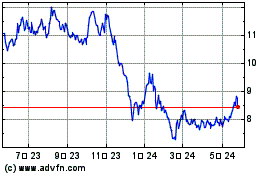

United States 12 Month N... (AMEX:UNL)

過去 株価チャート

から 5 2023 まで 5 2024