PGIM Private Capital provided $7.5 billion of senior debt and

junior capital to more than 130 middle-market companies and

projects globally in the first half of 2024. PGIM Private Capital

is a source of private debt for public and private companies and is

the private capital arm of PGIM, the $1.34 trillion global

investment management business of Prudential Financial, Inc. (NYSE:

PRU).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240717591924/en/

“We expect momentum to continue with

companies that have put off financing decisions gradually adjusting

their expectations and cost structures in anticipation of a

higher-for-longer rate environment, and continuing to look for

long-term partners to provide credit solutions.” --Matt Douglass,

Senior Managing Director at PGIM Private Capital (Photo: Business

Wire)

“The first half of 2024 has been more stable for issuance than

the same period last year. This year we’ve seen M&A activity

pick up somewhat, a less uncertain economic environment and greater

acceptance of higher rates which has fed through to a pickup in

financing activity,” said Matt Douglass, senior managing director

and head of PGIM Private Capital. “We expect momentum to continue

with companies that have put off financing decisions gradually

adjusting their expectations and cost structures in anticipation of

a higher-for-longer rate environment, and continuing to look for

long-term partners to provide credit solutions.”

First Half 2024 Highlights:

- $5.5 billion of investment-grade investments, $1.7 billion of

below-investment-grade investments, over $230 million of mezzanine

and private equity investments.

- 56 new issuers across a range of industries added to the

portfolio, and 79 existing borrower companies returned for further

funding.

- $4.0 billion in Global Corporate Finance investments across

North America, the U.K., Europe, Latin America and

Australasia.

- $2.5 billion in real assets sectors, including energy, power,

infrastructure, credit tenant lease financing, and structured

credit.

- Over $230 million of mezzanine investments, across nearly 20

transactions.

- $1.1 billion in Direct Lending transactions, across more than

30 transactions in 9 countries.

In the first half 2024, PGIM Private Capital continued building

long-term relationships across geographies, including over 50

direct Global Corporate Finance transactions. Direct originations

continue to be a core driver of PGIM Private Capital’s diverse

pipeline, offering investors access to differentiated deal flow —

from financing a U.S.-based family-owned agricultural commodity

processor to supporting Mexico’s leading distributor of heavy

machinery and equipment.

PGIM Private Capital’s Real Assets platform originated $1.9

billion in energy and power transactions, over $450 million in

infrastructure investments, and $200 million in credit tenant lease

transactions. Notably, the team closed its first renewable power

transaction in Sweden with Solør Bioenergi AB, a privately owned

Northern European district heating platform, and its first energy

investment in Spain with a holdco debt transaction in Exolum, an

international liquid products logistics company.

As general economic activity stabilizes and steadily increases,

PGIM Private Capital’s Alternatives platform has seen strong

activity, with over $1.3 billion in originations globally. The

platform continues to gain momentum across both direct lending and

mezzanine asset classes internationally, with the team notably

closing several transactions comprising both senior and junior

capital across Europe, Australia and North America.

PGIM Private Capital also launched its first European Long-Term

Investment Fund (ELTIF) in H1 2024 to support its direct lending

strategy. The ELTIF will support PGIM Private Capital’s loan

origination efforts in Europe, providing flexibility to extend

loans across the continent with a more varied mix of borrower

type.

ABOUT PGIM PRIVATE CAPITAL

PGIM Private Capital manages a $102.4 billion portfolio of

private placements, mezzanine, and direct lending investments

through its regional office network (Atlanta; Chicago; Dallas;

Frankfurt, Germany; London; Los Angeles; Madrid; Mexico City1;

Milan; Minneapolis; Newark, New Jersey; New York; Paris; San

Francisco; and Sydney2) and purchases up to $16 billion annually in

predominantly senior debt and junior capital investments. PGIM

Private Capital manages more than $20 billion in outside

non-affiliated assets through its Institutional Asset Management

unit and Alternative Investments unit, comprising Direct Lending,

PGIM Capital Partners and PGIM Energy Partners mezzanine funds. All

data as of March 31, 2024. For more information, please visit

pgimprivatecapital.com.

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 41 offices across 19 countries, our

more than 1,450 investment professionals serve both retail and

institutional clients around the world.

As a leading global asset manager, with $1.34 trillion in assets

under management,3 PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not

affiliated in any manner with Prudential plc, incorporated in the

United Kingdom, or with Prudential Assurance Company, a subsidiary

of M&G plc, incorporated in the United Kingdom. For more

information please visit news.prudential.com.

1 The Mexico City office operates through PGIM Real Estate

Mexico S.C.

2 The Sydney office operates through PGIM (Australia) Pty

Ltd.

3 As of March 31, 2024.

In the United Kingdom, information is issued by PGIM Private

Capital Limited with registered office: Grand Buildings, 1-3

Strand, Trafalgar Square, London, WC2N 5HR. PGIM Private Capital

Limited is authorized and regulated by the Financial Conduct

Authority (“FCA”) of the United Kingdom (Firm Reference Number

172071) and registered in England No. 1331817. In the European

Economic Area (“EEA”), information is issued by PGIM Private

Capital (Ireland) Limited with registered office: Pramerica Drive,

Letterkenny Business and Technology Park, Letterkenny, Co Donegal,

F92 W8CY, Ireland. PGIM Private Capital (Ireland) Limited is

authorized and regulated by the Central Bank of Ireland and

registered in Ireland under company number 635793 operating on the

basis of a European passport. In certain EEA countries, information

is, where permitted, presented by PGIM Private Capital Limited in

reliance of provisions, exemptions or licenses available to PGIM

Private Capital Limited under temporary permission arrangements

following the exit of the United Kingdom from the European Union.

These materials are issued by PGIM Private Capital Limited and/or

PGIM Private Capital (Ireland) Limited to persons who are

professional clients as defined under the rules of the FCA and/or

to persons who are professional clients as defined in the relevant

local implementation of Directive 2014/65/EU (MiFID II).

CONNECT WITH US: Visit pgim.com Follow on LinkedIn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717591924/en/

MEDIA Guy Nicholls +1 973 204 1648

guy.nicholls@pgim.com

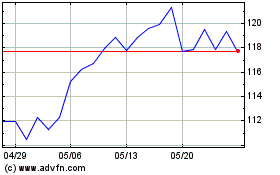

Prudential Financial (NYSE:PRU)

過去 株価チャート

から 6 2024 まで 7 2024

Prudential Financial (NYSE:PRU)

過去 株価チャート

から 7 2023 まで 7 2024